-

The six D&I partner networks already derive most of their funding from other sources.

-

Rowan Douglas steps down as Howden climate risk CEO, stays on as senior adviser.

-

The guidance will come into force on 1 September 2026.

-

How do you harmonise distribution strategies in a rapidly evolving marketplace?

-

A look back at the year in (re)insurance, with the aid of some of our visual journalism.

-

Data points to growth in surrogacy and IVF support across the industry.

-

The association has teamed up with Lloyd’s on a women’s underwriting summit.

-

The developments this week thrust culture issues up the agenda for new leadership.

-

Insurers must avoid being a “blocker” in development and financing decisions.

-

The latest guide is the first in a two-phase programme with a practical guide to follow.

-

Liès called for the industry to have a louder voice to promote greater insurance literacy across sectors.

-

The charity said that improved ecosystems could help protect from disasters.

-

An insurability crisis could pose systemic risks that undermine the foundations of finance.

-

Losing senior women creates a knock-on effect as juniors lose role models.

-

More general issues at recruitment level include drawing from too narrow a pool.

-

Organisations were challenged to address systemic DEI failure rather than play “word salad” with labels.

-

Age has not been addressed as much as other areas of diversity, the panel said.

-

Plaintiffs allege that manufacturers and retailers have broken environmental laws.

-

The departure follows an investigation into an “offensive” email sent by Rouse.

-

Surveys show diversity and inclusivity foster a sense of belonging and increase productivity.

-

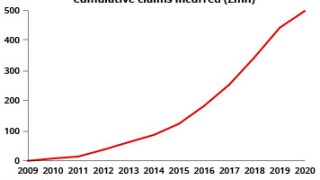

Claims were concentrated in the US, with a significant increase in D&O class actions.

-

Cultural transformation, education, and leadership are also essential to creating safe workplaces.

-

It is the second deliverable of the FIT Transition Plan Project.

-

Green hushing is on the rise as Trump rows back on climate initiatives.

-

The awards will be held on 3 September at The Brewery in London.

-

The carrier is expanding its appetite for sustainable construction of large commercial buildings.

-

The association said privacy should be a key consideration in new requirements.

-

The group said corporations face geopolitical and climate risk.

-

The executive criticised the ongoing underrepresentation of women in senior leadership roles.

-

What does it take to stay profitable as the insurance cycle shifts — and why is leadership diversity still lagging in the London market?

-

The proposals consist of supervisory expectations rather than rules.

-

Sources expect it to be a couple billion-dollar insurable market.

-

Experts at Insider Progress shared tried-and-true methods to get women into boardrooms.

-

The proportion of women in lead underwriting roles still trails other leadership positions.

-

Opportunities for insurance in transition-related activity “incredible”.

-

Good ESG practices are part of good risk management, the company said.

-

Carriers rushing headlong into gen AI without considering its ESG implications could face costly complications down the road.

-

In part two of our 2025 outlook, we explore the drivers of carrier M&A and recreating the ESG agenda.

-

Certain new and old themes will re-emerge this year as the balance of power shifts.

-

The report aims to plug the gap in insurance-specific guidance.

-

Signposting the opportunity is one place to start.

-

The climate protest group is targeting insurance companies during a week of action.

-

Bullying and sexual harassment were the most commonly reported incidents.

-

Risk managers are increasingly concerned about insurability.

-

The hub aims to be a single point of assessment and access to the market.

-

DEI has faced a backlash in the US where companies have pulled back from targets and initiatives.

-

The panellists discussed possible actions to improve racial and ethnic inclusion within organisations.

-

‘We need to track our metrics, we need to hold ourselves accountable,’ said Andrew Corbin-Turner.

-

CFC developed and employed the lenders carbon-credit insurance policy with Standard Chartered Bank.

-

Only 14% of board seats are filled by women, but directors at brokers tend to be younger than at managing agents.

-

A quick roundup of the week’s main stories.

-

The festival will host more than 130 events across 48 countries to promote D&I.

-

Expectations of what “walking the walk” means for leaders have risen.

-

The new product will be led by head of special risks Ed Parker.

-

The facility will provide coverage globally for blue and green hydrogen projects.

-

The placement follows the launch of a carbon capture and storage facility in January.

-

Insurers must take their responsibilities seriously.

-

LMG's latest London Matters report reveals that UK capital has lost ground to the US and Bermuda in some lines.

-

Last week, UNEP launched a multistakeholder forum building on the experience gained from the NZIA.

-

The forum will be an ‘even safer space’ for efforts on climate change action than the NZIA.

-

The Lloyd's CUO warned against "calling victory too early".

-

The US regulator faces litigation from both sides of the climate issue.

-

It plans to deliver other products for parts of the carbon value chain.

-

The companies account for ~70% of GHG emissions in its portfolio.

-

The target was initially set in 2020, with a deadline of December 2023.

-

-

The findings have implications for businesses and D&O.

-

The funding will allow the firm to release Yurty, a digital care app.

-

Managing risks associated with the technology is essential.

-

ECLiC discussed how climate litigation can impact the Lloyd’s market.

-

Changing work practices do not overshadow basic precepts of good employment.

-

The report examines challenges and opportunities for insurers.

-

CarbonPool insures against unexpected carbon-credit shortfalls and reversal events.

-

The facility provides cover for environmental damage and loss of revenue.

-

A new Geneva Association report says the early involvement of (re)insurers is key to supporting the growth of emerging technologies.

-

Speaking to a Treasury committee, Rathi explained that the FCA is not proposing to enforce social policy, but to provide data for firms to evaluate themselves.

-

Nearly 80% of transportation companies surveyed cited a lack of access to insurance solutions and a lack of data to understand supply-chain risks.

-

In the second part of our themes for 2024 outlook, we explore how fear of missing out in cat reinsurance is still contrasting with an upstreaming of risk that is creating fallout for primary insurers, while momentum in facilitisation and ESG continues.

-

In the first section of our two-part outlook for 2024, we explore why macro-economic concerns are taking a step back, though casualty pricing micro-cycles highlight ongoing caution.

-

Insurance Insider takes a look at some of the biggest news and developments of 2023.

-

Lloyd’s may be wary of making disciplinary hearings more public, but it could at least make processes more transparent.

-

Speaking to a Treasury committee, Blanc said she was “inundated” with messages detailing “incredibly sad” stories from women in the insurance industry.

-

Mass construction in remote locations is throwing up challenges around modelling exposures.

-

The renewables insurer flagged a “staggering increase” in hail events, which was driving double-digit rate increases.

-

The summit has been called the most significant for the industry to date, as there is a growing awareness of the value of insurance.

-

The voluntary carbon market reached $2bn in 2021, and is expected to grow to $10bn-$40bn by 2030, according to a report by Shell and the Boston Consulting Group published in January.

-

The survey was conducted by the Nick Kilhams Foundation, founded in memory of the late Chaucer underwriter.

-

The roadmap sets out planned oversight processes and regulatory expectations on climate-related risk management, capital and reserving as well as transition planning.

-

London Market Group CEO Caroline Wagstaff said more firms outside of the Top Three broking businesses had to engage in the process.

-

The product will protect offtake agreements from the risk of under-delivery of projected carbon credits.

-

Panellists at Insurance Insider’s London Market Conference discussed the need for nuance when interpreting emissions data.

-

In addition to the need for new products when insuring the transition, panelists highlighted the need to innovate and adapt.

-

Speaking as a witness on the “Sexism in the City” panel, Braun described sexism in the industry as “completely unacceptable and shocking.”

-

The Corporation’s head of culture Mark Lomas said: “We know we can’t undo the past, but we can do something about the inequalities we see today.”

-

The number of female CEOs, CUOs, CFOs, MDs or board members has hardly changed in the past 12 months.

-

Inflation, supply chain issues and technological failures are complicating the underwriting landscape.

-

The 30-strong segment will combine reinsurance and capital markets with data, analytics and technology.

-

Investors are beginning to push insurers harder to deliver on diversity and inclusion, but the culture around speaking out and recruiting talent suggests new ideas or broader execution is needed.

-

The CMA said it would not take enforcement action on agreements that “genuinely contribute” to addressing climate change.

-

The report also highlighted general liability policies as an area of potential exposure to insurers.

-

At an event that brought together construction insurers, brokers, engineers and developers, delegates discussed an impasse over insuring sustainable development projects.

-

Panellists at the Dive In Festival explored the link between innovation and inclusion and why it's important to them as leaders in their respective fields.

-

Inflation, supply chain bottle necks and issues with emerging technology are all challenges for the sector.

-

The Corporation will collaborate with Moody’s Analytics to develop a solution to quantify greenhouse gas emissions across managing agents’ underwriting and investment portfolios.

-

Our virtual roundtable polled industry leaders on critical questions for the reinsurance market. Today, we explore how the industry can collaborate on net-zero objectives after insurers exited the Net-Zero Insurance Alliance (NZIA) in droves.

-

Insurance Insider explores how insurers can manage the dual, polar-opposite pressures of a litigious anti-ESG movement and net-zero climate activism.

-

The carrier exited the Net Zero Insurance Alliance in May among other insurers.

-

Renew Risk will be hiring cat modellers and climate scientists, as it expands its proposition to help insurers understand the risks of insuring renewable energy infrastructure.

-

Plus the latest people moves and all the top news of the week.

-

WTW has highlighted that global climate change-related litigation cases have doubled to more than 2,000 since 2015.

-

The carrier will provide cover to a wind farm and a solar farm as part of the Aon-brokered deal.

-

The carrier will aim to reduce its emissions by up to 49% by 2030.

-

The fallout from Coutts’ cancellation of Nigel Farage as a client provides useful lessons as companies adopt bolder stances around issues such as social justice and climate change.

-

The carrier announced the launch of the green solutions portfolio in May as it looks to become a market leader for sustainable risks.

-

Beazley’s Smart Tracker Syndicate was granted full syndicate status from the start of this year.

-

If you only read a handful of articles this week, make it the selection below.

-

The Net-Zero Insurance Alliance has said its Target-Setting Protocol will now serve as a “voluntary best-practice guide”.

-

Risk management, reputation risk and regulation were found to be key drivers for insurers of integrating ESG risk factors into underwriting.

-

The guide focuses on how its members can protect homes and businesses they insure from climate risk, as well as protecting their own reputational risk.

-

The company will no longer insure energy companies expanding their coal-based activities.

-

If you only read a handful of articles this week, make it the selection below.

-

The carrier will increase its involvement in renewables, and cut the carbon intensity of its motor and P&C book.

-

A panel of sustainability leaders from Conduit Re, Axa XL, Convex and Vantage Risk discussed the need for a consistent methodology to measure underwriting emissions at the Bermuda Climate Summit.

-

The executive worked for WTW for more than two decades.

-

Plus all the latest executive moves and the top news from the week.

-

Insurers are looking ahead to possible fallout from issues such as cyber risks and the impact of AI on the workforce, while still seeing these new trends as opportunities to capture.

-

In the aftermath of an exodus from the NZIA, brokers are concerned that fragmented methodologies adopted by carriers to measure insurance emissions could be a "disaster" for insureds.

-

The Canadian mutual only announced its membership to the NZIA less than two months ago, joining several high-profile carriers to have exited the alliance.

-

The collapse of the Net-Zero Insurance Alliance means insurers must find new neutral ground to continue ESG engagement, CEOs at the Geneva Association's General Assembly said.

-

The investigation enquires into how the US insurance industry evaluates, invests in or underwrites fossil fuel expansion projects.

-

The decaying oil tanker FSO Safer is holding over a million barrels of oil and is at risk of explosion.

-

The structure envisages bringing in philanthropic capital to provide project funding to mitigate disaster risk as part of ILS deals.

-

Despite leaving the alliance, Beazley said it “remains fully committed” to its transition to net-zero.

-

A string of insurers has abandoned the alliance after Munich Re announced its departure at the end of March.

-

The Corporation’s exit is the latest blow to the alliance and the announcement comes just hours after Sompo and QBE became the eighth and ninth firms to leave the initiative.

-

The Net-Zero Insurance Alliance has been urged to overhaul its objectives as the string of high-profile carrier departures continues.

-

After founder members Axa and Allianz dealt a potentially terminal blow to the Net-Zero Insurance Alliance by withdrawing, the NZIA is exploring limited options to continue.

-

Sompo is the eighth major insurer to leave the NZIA, casting even further doubt on its future as remaining members explore options around whether to continue.

-

Both Axa and Allianz said their own targets on sustainability and reducing emissions remain unchanged.

-

The reinsurer is the fifth major player to leave the organisation, following Swiss Re, Munich Re, Zurich and Hannover Re.

-

Munich Re, Swiss Re, Hannover Re and Zurich have all abandoned the project in the past eight weeks.

-

The future of the NZIA is in the spotlight following several prominent exits from the organisation.

-

The first cohort of insurance professionals will embark on their secondments to cities such as Melaka in Malaysia, Surat in India and The Hague in The Netherlands next month.

-

A report from WTW and the Institute of International Finance has found little correlation between companies’ operation emissions intensity and their climate transition value-at-risk.

-

The Swiss reinsurer follows Munich Re, Hannover Re and Zurich in withdrawing from the alliance.

-

In the latest threat to the NZIA, 23 state AG have warned members that collaboration on decarbonisation targets may not square with federal law.

-

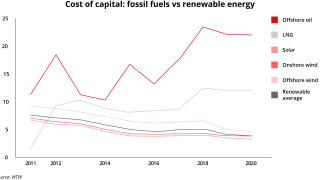

Both oil and gas and renewables insurers are at the sharp end of the insurance industry’s ESG journey.

-

Simon Tighe is taking on the group ESG position in addition to his role as group head of investments and treasury at Chaucer.

-

Signatories of the UN’s PSI must abide by four key principles, including embedding insurance-related ESG issues into decision-making.

-

The guide includes details on aspects of implementing an ESG policy, including carbon management, green offices, investment strategy and local community engagement.

-

At Insurance Insider’s latest Progress event, we discussed various tactics for the London market to change recruitment strategies in order to attract entrants from broader socio-economic groupings.

-

The executive said surging demand for coverage would address the supply-demand mismatch in the renewables space.

-

The business is looking to become a lead presence in green risks in London, following Syndicate 457’s exit from oil and gas business.

-

The group has also developed a multi-stage reduction path for its withdrawal from thermal coal by 2038.

-

Beneva has signed up to net-zero targets as a member of the NZIA, following a period of turbulence in which Munich Re, Zurich and Hannover Re have left the alliance.

-

Aviva has said it is committed to the Net-Zero Insurance Alliance, in the wake of withdrawals from the group by Zurich, Munich Re and Hannover Re.

-

Hannover Re has followed Zurich and Munich Re in announcing its departure from the Net Zero Insurance Alliance, though it offered no explanation for its decision.

-

Shock departures from the Net Zero Insurance Alliance have cast a shadow over the group’s long-term future, as a number of high-profile carriers review developments and consider their ongoing membership.

-

The NGO called out “climate laggards” for “tarnish[ing] the reputation of Lloyd’s and all other Lloyd’s insurers”.

-

Lloyd’s has launched a fund on its new investment platform to enable the market to invest globally in assets themed around climate adaptation, mitigation and social inclusion.

-

The report states that nature-related financial risks need to be better understood, quantified and managed within insurance underwriting portfolios.

-

Zurich’s decision comes less than a week after Munich Re decided to withdraw from the UN-backed initiative.

-

Industry climate alliances have received allegations from conservative politicians and regulators in the US that such commitments are illegal group activities that violate antitrust laws.

-

Reliable ESG information is increasingly important, as an estimated $33.9tn of global assets under management will consider ESG factors within three years.

-

The regulator called the descriptions of data sources used by ratings providers “particularly poor”.

-

The Women in Finance Charter report has shown that 71% of signatories have increased their proportion of women in senior management.

-

The regulator has set out priorities for monitoring climate risks for the financial system and how it will address climate-related gaps in the regulatory regime.

-

Inclusion@Lloyd’s partner network initiative aims to support existing networks that are tied to a specific D&I need.

-

The sub-syndicate will complement Hiscox’s existing portfolio, offering additional capacity to qualifying clients.

-

As it stands, the Insurance Development Forum has hit $2.2bn in expected or offered risk capacity across 22 ongoing country projects.

-

Maria Guercio, Melanie Markwick-Day and Jared Concannon join the unit as executives.

-

In a discussion paper the regulator has highlighted good practices on sustainability-related governance and competence, as it seeks more consistency among financial firms.

-

Human rights groups have issued a complaint to a US mediation body alleging that Marsh has violated OECD guidelines for corporate standards.

-

The association showed strong leadership and innovative thinking to increase the number of women on its panel without sacrificing fairness.

-

The insurance industry must use its extensive risk management expertise to mitigate the risks of climate change, the chair says.

-

Despite improving returns, inflation and the availability of economically priced nat cat capacity remain the biggest challenges facing the sector.

-

The company has made a number of senior appointments to help run the unit.

-

In a review of financial services firms’ D&I policies that highlighted shortcomings, the regulator said policies need to be holistic, and not generic.

-

The government will consult in Q1 2023 on pulling ESG ratings providers into the FCA’s perimeter.

-

Several structural factors, including the pricing cycle, make insurers more insulated from US activist states.

-

The correlation between a good ESG score and low loss ratio is strongest in property insurance, the report shows.

-

The multi-year strategy will target each stage of the employment journey, to encourage inclusive recruitment practices and drive improvement.

-

Announcements and interviews at the UN conference have shed light on the tools emerging to help carriers decarbonise their underwriting portfolios.

-

Richard Dudley, global head of climate strategy at Aon, says existing products such as IP coverage can help insurers take a leading role in opening up investment for new climate transition technology.

-

The Lloyd’s carrier said the strategy will support profitable growth, attract staff and help meet regulatory requirements.

-

The project, funded by Agence Française de Développement, was revealed during the G20 Leaders’ Summit in Bali.

-

The Africa Climate Risk Facility was unveiled at COP27 with aims to underwrite $14bn of cover for 1.4 billion people by 2030.

-

A first look at a new tool to track regional climate risk data was launched by The Global Resilience Index Initiative – part of the Mark Carney-backed Insurance Development Forum.

-

The geo-political groups have launched the Global Shield against Climate Risks, a scheme that will deploy financial support for vulnerable countries during cat events including via insurance provisions.

-

CEO John Neal said a pilot with managing agents is working towards a measurement framework to help syndicates transition underwriting portfolios.

-

Marsh McLennan is mobilising the insurance industry to support the UN’s Race to Resilience initiative, starting by featuring 17 climate adaptation projects.

-

The broker warned that more insurers will restrict or drop oil and gas business in the coming years.

-

Chaucer CEO John Fowle also set out to Insurance Insider the rationale for the carrier’s new ESG scorecard comprising 158 data points.

-

The transport sector has the largest investment gap, needing an estimated $114tn to build greener infrastructure.

-

The tool scores (re)insurers’ books on a scale of one to five on how well they serve communities.

-

London Market Group chair Matthew Moore has set out the aims of a campaign to pro-actively engage with universities and schools to broaden the industry’s talent pool for recruitment.

-

Speaking at the 2022 Dive In Festival, Lloyd’s CEO John Neal, Axis Re CEO Ann Haugh and Marsh Specialty president Lucy Clarke discussed inclusion in Lloyd’s and the wider insurance market.

-

The carrier has put in place further curbs on metallurgical coal, tar sand extraction and fracking.

-

Prior to joining Aon, O’Gorman previously advised central governments and private sector companies in the UK and EU on their ESG strategies.

-

Since its inception in 2019, membership in the Net-Zero Asset Owner Alliance has increased sixfold to 74.

-

The International Underwriting Association’s CEO Dave Matcham believes certain Blueprint Two projects can be vital in attracting more business to the London market.

-

William Bruce will be responsible for building and leading Aon’s global climate risk consulting team.

-

The product protects firms buying carbon credits from third-party negligence and fraud.

-

While the construction market is seeing rate rises slow to single-digit increases, anecdotal evidence shows the cost of construction claims is 20% up on 2021.

-

Yesterday, we published a detailed examination of the barriers preventing women from reaching the executive committees of Lloyd’s managing agencies.

-

A former Swiss Re underwriter, who was told by a former senior manager “I bet you like to be on top in bed” at the carrier, had a number of discrimination claims against the firm upheld.

-

The executive will work to help corporations understand and mitigate the threats posed by climate change.

-

The hydrogen industry is a key pillar of the energy transition, but securing insurance coverage is challenging.

-

The Prince of Wales-backed scheme has the support of the likes of Lloyd’s, Aon, Ascot and Axa XL.

-

The Financial Conduct Authority and Financial Reporting Council have published two reports on findings from a review of listed firms’ climate disclosures.

-

The Corporation’s latest market survey on D&I shows key metrics moving in the right direction but persistent fears remain from individuals around speaking out.

-

The regulator has submitted a formal request to the Treasury for an extended remit to regulate ESG data providers.

-

More public-private partnerships should be a priority for governments and businesses.

-

Bosnia & Herzegovina saw a 246% increase in the amount of land burnt in the past year.

-

Of the companies ShareAction has asked to disclose ethnicity pay gap data, just three financial firms, including Hiscox, have agreed to do so.

-

The appointment comes after a slew of ESG initiatives at Beazley and across the wider London market.

-

The insurer joins 28 other firms signed up to NZIA, representing some 15% of the world’s premium volume.

-

The renewables insurer has also promoted Josh Shimali to the position of head of onshore underwriting.

-

The carrier is the first Japanese company to join the insurance, asset owner and investment manager green alliances.

-

More than 60% of respondents to an ESMA survey believe the level of methodological transparency is still unsatisfactory.

-

The report also found that only 4% of European insurers have people with sustainability experience on their boards.

-

As London market carriers encourage parental leave take-up, Insurance Insider explores whether the HR benefit can be a tool to tackle the industry’s diversity issue.

-

The Japanese carrier joins the likes of Fidelis, Mapfre and QBE in efforts to go net zero by 2050.

-

Arguably the Corporation could find more creative ways to promote its ESG targets, but the reality is that the showy protests are of less relevance than winning boardroom votes.

-

The Glasgow Financial Alliance for Net Zero has published for consultation a framework for insurers and banks to create net-zero transition plans.

-

The watchdog is proposing rules that would require actuaries to consider climate risks in technical work.

-

Competition for business is leading to a rollback in exclusions written into contracts following major loss activity.

-

The committee will also assess the work of the Glasgow Financial Alliance for Net-Zero.

-

As momentum builds for greater transparency on ESG and net-zero transitions across the insurance ecosystem, brokers are entering an evolution.

-

Clients face under-insurance for BI if their coverage is not adjusted to reflect energy price rises.

-

A BDA report found that more than 30% of Bermudian carriers have integrated ESG into underwriting.

-

The carrier has also disclosed carbon emission breakdowns across its underwriting portfolios, as well as D&I figures for its workforce, in an ESG report.

-

The product will provide construction all risk and operational all risk coverage, backed by AI-powered data and analytics.

-

Shareholders approved a second proposal asking for a report detailing how Chubb is addressing greenhouse gas emissions.

-

Lloyd’s chief of markets Patrick Tiernan highlighted priorities for oversight of delegated authority business, ESG and inflation at a media briefing this evening.

-

CEO John Neal and chair Bruce Carnegie-Brown highlighted a continued commitment to "insuring the transition" and D&I.

-

The company will also double its coverage for low-carbon energies by 2025.

-

Ahead of a market message on 2023 business plans, Lloyd’s has set out early expectations on inflation, ESG and management of cat volatility.

-

Capgemini’s report said insurers needed to embed climate strategies into operating models and fundamentally change data strategy.

-

Beazley’s pioneering new Syndicate 4321 uses ESG ratings to provide additional capacity for clients, but it will play a broader, strategic role for the carrier.

-

Axa chairs the alliance, while Allianz, Aviva, Generali, Munich Re, Scor, Swiss Re and Zurich are all founding members.

-

Lucas Dow said coal companies were seeking government support to establish a mutual insurance system.

-

Analysis by the broker trade body estimated the insurance opportunity created by the transition at around $125bn.

-

The insurer added that, from July 2023, it would no longer renew contracts for existing projects.

-

The commitment includes achieving greenhouse gas neutrality across its global underwriting and investment portfolios.

-

The insurer hopes to achieve net-zero in eight countries by 2024 and across the whole group by 2030.

-

The (re)insurer aims to fill a gap in the market by providing ESG data for insurers on the private firms they insure.

-

The task force will develop "rigorous and robust" measures for tackling greenwashing and support companies with their transition plans, according to the Finance Ministry.

-

The rules will apply to listed companies for financial accounting periods starting from 1 April 2022.

-

She was previously an investor relations senior manager at Swiss Re.

-

Through the collaboration, the two companies will work together to help clients with their investment strategy decisions by providing data sets, analytics and insights into ESG portfolio-level exposures.

-

Chubb has also received demands from shareholders for more information on its climate-related policies.

-

The move comes despite the Corporation asking managing agents to develop tailored ESG strategies to transition their businesses to net-zero.

-

Carriers are planning to increase their allocation most significantly to private equity (44%) and green or impact bonds (42%).

-

The governing body has also set out its goals for the next two years, including promoting diversity initiatives within market bodies and raising awareness of its Partner Networks.

-

The carrier has introduced a number of ESG-focused roles, which sees Cathal Carr, SVP, underwriting, appointed as global head of climate and sustainability strategy.

-

To help achieve its goal, Marsh McLennan has selected seven carbon-offset projects across the world.

-

The insurer has teamed up with several carbon-removal suppliers to help it achieve its new goal.

-

The reinsurer will focus on three UN Sustainable Development Goals (SDGs) to help it achieve carbon-neutrality by 2050.

-

Liberty Mutual will provide US and Canadian clients that sign up for Marsh’s tool with ESG risk advisory services.

-

Data chief Anita Fernqvist will replace Keppel as UK COO.

-

The carrier has already withdrawn cover for the top 5% of carbon-intensive oil and gas firms in the past year.

-

Under new ESG policies, the Spanish carrier will no longer invest in coal, gas or oil companies lacking energy-transition plans.

-

Growth plans are common in the market but there are questions about the level of rating adequacy.

-

The global insurer has added a "net-zero emissions" goal of 2050 for investments and underwriting.

-

The group aims to create a legacy for respected underwriter Nick Kilhams, who died in 2021.

-

The IPCC has issued its bleakest warning yet on the impacts of climate change on the environment.

-

The newly created role will see Neil Prior lead BMS’s global environmental and social responsibility initiatives.

-

Lloyd’s said that it had developed appropriate policies to manage the transition towards net zero.

-

Participants have committed to transition underwriting portfolios to net zero by 2050.

-

The scorecard will assess a company’s ESG profile, taking areas such as water management, air pollution, D&I, and local infrastructure into account.

-

The carrier has been targeted by activists whose claims it branded “inaccurate and misleading”.

-

The energy division at Chaucer will now be split into two teams: renewable power and natural resources.

-

The association’s membership highlighted climate change as both an underwriting and an operational issue.

-

The UN’s Principles for Sustainable Insurance is helping to ensure ESG practices are embedded across all aspects of the insurance industry.

-

The recommended range for absolute emissions reductions by 2025 should be 49%-65% or more of members’ portfolios.

-

The broker said terms and pricing were not significantly impacted by new capacity from oil and gas players.

-

Integra Risk Services will offer outsourced risk engineering management to the construction, engineering and energy sectors.

-

Also high on the association’s agenda for 2022 is working with the FCA and HM Treasury on a future regulatory framework.

-

Tokio Marine & Nichido Fire Insurance Co also plans to join the partnership for Carbon Accounting Financials initiative.

-

Insurers need to recognise their role in the race to net-zero, preparing for future political, environmental and economic impacts on climate change in the process, the Corporation said.

-

The association will also focus on initiatives to support digital transformation in the London market.

-

The broker said the last three years of hardening had led to a “substantial technical correction”.

-

Project Leaf will see environmental, social and governance (ESG) information issues woven into Aspen’s decision making for its credit and political risk portfolio.

-

The catastrophe market, inflation and loss-costs and the pandemic unwind are among the trends to shape the news agenda this year.

-

New capital made its presence felt in the market in a year that saw both the completion and collapse of major business combinations.

-

In 2021, the partner networks hosted more than 70 free, virtual events and attracted five new corporate sponsors to help drive change across the industry.

-

A new report sets out how to scale insurance and capital for environmental protection projects, for a sector estimated to reach $50bn in size by 2030.

-

The underwriter will also play a part in upskilling upstream underwriters with knowledge of renewables.

-

He will work closely with Amy Barnes to support clients through the climate transition.

-

The reinsurer said joining the alliance further strengthened its commitment to the preservation of biodiversity.

-

Amir Sethu joins from Lendurance, a boutique ESG-focused commercial lender he co-founded in Singapore.

-

The group’s first event will be held in Los Angeles, with more chapters to follow.

-

Amid an onslaught of announcements on climate disclosure requirements, listed insurers have a limited timeframe to prepare.

-

Charlotte Gerken said Solvency II had proved a constraint to certain investments, with lengthy approval processes.

-

Local officials have warned that the cost of rebuilding in British Columbia could exceed C$1bn ($790m).

-

The carrier said it would no longer support greenfield oil exploration and plans a full phase-out of thermal coal from its underwriting portfolio by 2040.

-

Axa XL’s global sustainability director set out practical considerations for insurers in their net-zero transitions at a conference today.

-

The COP26 climate talks in Glasgow represent progress towards a necessary reduction in carbon emissions “but not victory”, with concerns remaining that pledges do not go far enough, according to Swiss Re.

-

The business is targeting a return on equity of 10% in its industrial lines business.

-

UnipolRe has pulled out of writing property cat excess-of-loss business as it became the first reinsurer to fully exit the class based on the impact of climate change, Insurance Insider can reveal.

-

If you only read a handful of stories this week, make it the selection below.

-

Regulators must be less demanding around data requirements from brokers as intermediaries make the shift towards net-zero, the London & International Insurance Brokers Association (Liiba) says.

-

Sources say the insurance industry will not walk away en masse from existing clients.

-

Male board members still hold more than two thirds of all seats at listed carriers and brokers, analysis shows.

-

The cross-industry Insurance Task Force (ITF) working with Lloyd’s has launched a Disaster Resilience Framework for Climate-Vulnerable Countries, as part of its activities for the Prince of Wales’ Sustainable Markets Initiative (SMI).

-

The broker said that weather-related losses had become more severe in the past decade because of climate change.

-

The insurance industry is uniquely positioned to bolster the transition to net zero and improve resilience to climate shocks, according to Selwin Hart, UN assistant secretary-general for climate change.

-

The renewables underwriter said the sector was suffering from broad terms, high claims and new entrants from the oil and gas sectors.

-

Joachim Wenning said the financial sector would play a crucial role in the “very, very costly” energy transition.

-

Swiss Re’s group CUO Thierry Léger has explained to Insurance Insider the rapid progress insurers need to make in the next decade, adding that “every year counts”.

-

Financial authorities must ‘massively expand’ risk-sharing pools.

-

The UN’s Butch Bucani, speaking on Swiss Re’s COP26 panel, warned that the transition was not just about “putting a thermometer in your insurance portfolio and saying ‘it’s 1.5 degrees’”.

-

The UK’s largest firms including insurers and brokers will be mandated to disclose climate-related financial information from April.

-

The insurance market has the potential to become a “significant influencer” in combatting modern slavery, according to the independent anti-slavery commissioner Dame Sara Thornton.

-

The carrier will stop underwriting and investing in new upstream oil greenfield exploration projects, unless certain conditions are met.

-

The regulator plans to switch its supervisory approach from assessing the implementation of climate-related expectations to “actively supervising against them”.

-

The Corporation said it planned to transition its £3bn ($4.1bn) Central Fund to net zero by 2050 by redirecting capital flows to green investments.

-

The pair have created a ‘carbon risk rating’ for customers that underwriters can use when considering the impact of each policy.

-

Lloyd’s also highlighted its desire not to become the “market of last resort” for carbon-intensive companies.

-

Howden said passing risks onto governments would degrade the value of the insurance industry.

-

The executive is transitioning away from his former responsibilities, with no successor yet named.

-

The carrier will phase out thermal coal business and invest $20mn in a green investment fund.

-

The landmark project will provide renewable solar power to the cities of Darwin and Singapore.