Fuel a smarter strategy with actionable market intelligence

Insurance Insider is the leading source for insurance intelligence, providing in-depth coverage of the London and US insurance markets, ILS, specialty, P&C insurance, Lloyd’s and insurance M&A.

Clarity in a complex, fast-moving market

Insurance Insider delivers independent intelligence that helps senior decision-makers anticipate change, validate strategy and act with confidence.

Our reporting combines speed, depth and authority, covering every facet of the global insurance, (re)insurance and specialty markets.

About usWhy Insurance Insider?

As the leading source of intelligence and analysis for the insurance industry, we empower decision-makers to act with confidence – delivering rapid, accurate insights and exclusive data tools that transform market complexity into strategic clarity.

Three intelligence platforms. One integrated market view.

Coverage across global (re)insurance, the US domestic market and ILS - delivered with speed, depth and authority.

Who we serve

Insurance Insider is built for insurance professionals at every level. We support teams across the insurance ecosystem with the insight they need to operate at the highest level.

-

Carriers, (re)insurers and InsurTechs

Carriers, (re)insurers and InsurTechs

Insurance Insider anticipates market shifts and validates underwriting and growth strategies. This serves to optimise portfolio performance, pricing discipline and long‑term profitability.

-

Brokers, distributors and MGAs

Brokers, distributors and MGAs

Navigate competitive dynamics and uncover emerging opportunities to differentiate offerings, expand placement options and accelerate profitable growth.

-

Finance and investors

Finance and investors

Understand risk, capital flows and market momentum to identify attractive entry points, manage downside exposure and drive superior returns.

-

Service providers

Service providers

Stay ahead of client needs and industry change to refine go‑to‑market strategies, deepen client relationships and unlock new revenue streams.

Carriers, (re)insurers and InsurTechs

Insurance Insider anticipates market shifts and validates underwriting and growth strategies. This serves to optimise portfolio performance, pricing discipline and long‑term profitability.

Brokers, distributors and MGAs

Navigate competitive dynamics and uncover emerging opportunities to differentiate offerings, expand placement options and accelerate profitable growth.

Finance and investors

Understand risk, capital flows and market momentum to identify attractive entry points, manage downside exposure and drive superior returns.

Service providers

Stay ahead of client needs and industry change to refine go‑to‑market strategies, deepen client relationships and unlock new revenue streams.

Trusted by industry leaders worldwide

Proven data-driven solutions for the insurance industry

Intelligence in action

This is intelligence that moves the market. We deliver timely reporting and sharp analysis on the developments shaping global insurance, (re)insurance and the ILS market.

MGAs break free from the market cycle as new forces reshape the model

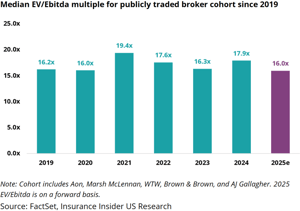

Broker stocks fall from five-year highs and multiples compress as the cycle turns

Twelve Securis launches insurance credit fund focusing on RT1 notes

Trusted by the global insurance community

Get started now

Get the intelligence you need to stay ahead of the market. Request a free trial and experience the depth, speed and insight trusted by leading insurance professionals.

.png?width=2010&height=695&name=Catrin%20video%20still%20(3).png)