Hosted at EY’s London Bridge offices, we sat down under Chatham House rule for a frank discussion, ranging from talent acquisition to whistleblowing.

It was a fascinating and detailed conversation, which not only underlined the seriousness of getting culture right, but also highlighted the positive and practical aspects of doing so.

Progress has been made – but culture in the industry certainly has not been yet transformed, and there is still a perception insurance is doing worse than other financial services on this front.

Here are three of the talking points which stood out to me during the discussion.

The investors are putting the pressure on – but not so much the regulator

Our roundtable was unanimous that responsibility – and accountability - for culture comes from the C-suite. Which makes it even more important that senior management teams as well as executive committees are diverse in their make up (easier said than done – as we have explored before).

Boards are making improvement in their diversity, and while they are offering good recommendations on culture to executive committees, they are not the ones in the business day to day.

One of the observations at the roundtable was that people who apply for jobs want to see that the company culture in “real life” matches up to the statements of a firm and the pictures on its website. This is particularly true of the younger generation, and of diverse talent (and they will vote with their feet).

However, there are also increased expectations from shareholders and investors on culture – and they also want to see it for themselves.

Roundtable members said it was now on the agenda for all investor meetings and is a frequently-asked question by shareholders.

There are increased expectations from shareholders and investors on culture – and they want to see it for themselves

One said that one of their largest shareholders had requested to come in for a day and spend it with various teams to see how they worked, and how they felt about working there.

On the other hand, the regulator is making slow progress. While Lloyd’s has made strides in setting expectations on culture of its managing agents with its Rio framework, the same cannot be said for the PRA and FCA, despite some strongly worded letters to CEOs.

There is a sense that the regulator’s senior managers and certification regime (SMCR) in practice does not have real teeth in accountability, and is largely a box-ticking exercise.

Further regulatory expectations are being developed, but trying to define what “good” culture looks like across financial services, and then implementing it, will be a hugely difficult task. And will these actions drive real accountability when they come?

The progress on creating a “speaking out” culture seems uneven

There have been high-profile instances of misconduct in the press in recent years, all of which have been the result of people coming forward to call it out.

However, it is hard to track progress on how comfortable people feel in speaking out in this market.

The 2022 Lloyd’s culture survey showed almost eight in 10 respondents said they would feel comfortable raising concerns about behaviour within their own organisation – at 78%, that was three percentage points more than the previous year.

However, only 53% of respondents said they would feel comfortable highlighting problematic behaviour in the wider market.

And, of the 12% of respondents who wanted to raise a concern during the survey period, only 52% did (down one point year on year). Of those who did speak out, only 53% (down four points) felt they were taken seriously in their concerns.

Participants in the roundtable said it can be difficult to get true visibility on this matter. Some companies conduct “speaking out” surveys to try to get a clearer picture within their organisations.

Some said that they set up a hotline but had had no calls. It seems unlikely that the reasons for people to use the hotline have been eradicated, and more likely that is it not an effective mechanism for whistleblowing.

Does the formality of the HR complaints process make it more daunting for employees to speak up? And does hybrid working reduce opportunities for employees to raise concerns with their manager, or a trusted individual, quietly?

The roundtable participants were all in agreement that creating a culture in which employees feel comfortable calling out misconduct was key but, while the market drives towards that goal, there is a question around whether whistleblowing frameworks are as effective as they could be.

There is a willingness to collaborate on bringing in new talent

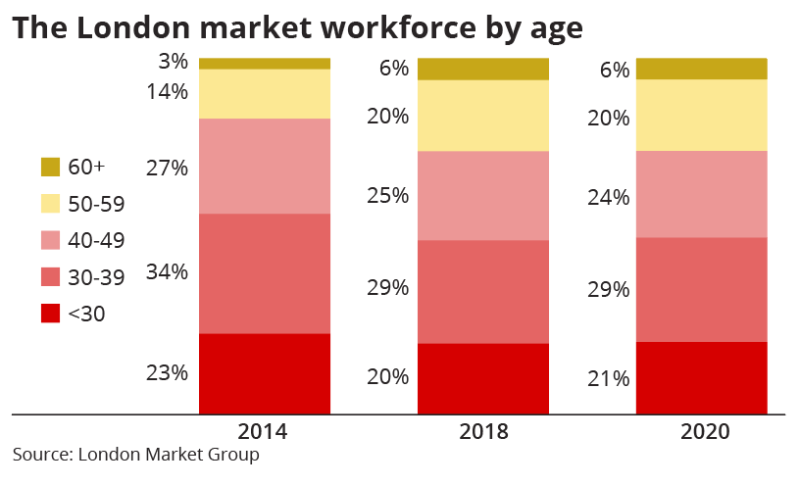

Driving good corporate culture is simply the right thing to do. But it is a huge do-or-die factor in attracting and retaining talent in a market with a fast-ageing workforce.

However, there is a sense that the message that insurance is a great career path is not getting out there.

When it comes to outreach to schools, universities (and frankly outside of the M25) there was an acknowledgement that many of the mid-sized firms cannot execute on the scale the few global market firms can.

There’s also the competition element. No-one wants to commit the time and resource to train recruits, only for them to be snapped up by a rival offering to double their salary.

In fact, outside of the roundtable some executives have previously said that attempts to get firms to commit to market-wide recruitment and training drives have fallen flat for this reason.

The London Market Group has been instrumental in creating a single market voice to reach out to young talent – and most recently brought together 50 market firms and over 100 volunteers to hold its first Futures Academy, offering work experience to 115 sixth-form students in a genuine market first.

But there was a willingness among the participants at our roundtable to do more collaboratively. They suggested that other structures or initiatives could alleviate concerns of wasted time or effort – for example, carriers pairing with brokers on internships for experience on both sides of the transaction.

To which my question to the market would be: what are you waiting for?

Thank you to all of the participants in our C-suite roundtable, and the sponsors of Insider Progress: EY, Arch and Lancashire.