Attracting new talent to the insurance workforce, and broadening the talent pool in which the insurance industry fishes, is a perennial source of discussion in the sector.

And as the industry sets its sights on the future, one key priority for recruiting managers is selling a career in risk to the next generation.

The so-called Generation Z – those born between 1997-2012 – are now entering the workforce, and employers are looking to rework their hiring practices and refresh HR policies to cater for the first generation of true digital natives.

The theme was the focus of discussion at a recent Insider Progress event, where hiring managers, and Gen Z insurance employees themselves, engaged in discussion about the evolution of a career in the London market.

While such conversations about the future of the workforce can descend into fevered speculation and hyperbole, an overriding takeaway from the morning was that integrating the next generation will be a process of evolution, not revolution.

In fact, while there are undoubted changes in how younger people engage in their careers, some priorities remain little changed.

A desire for job security, clearly visible pathways for progression, decent pay and a welcoming company culture are just as important now as they ever were.

However, embracing the evolving preferences of younger people, be it around remote work or work/life balance, is a clear opportunity for companies looking to attract and retain top staff.

The flexible workplace

The days of five-day commuting have changed forever following the pandemic, an upheaval clear to see for anyone willing to descend on the near-empty City on a Friday.

And while it is true that Gen Z is accustomed to working digitally like no other generation, that doesn’t mean the desire for personal interaction is gone.

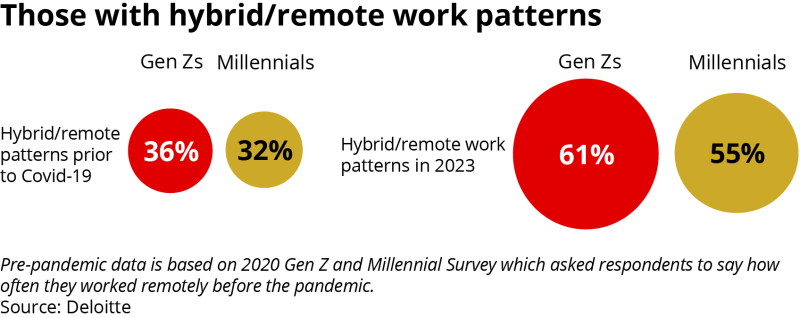

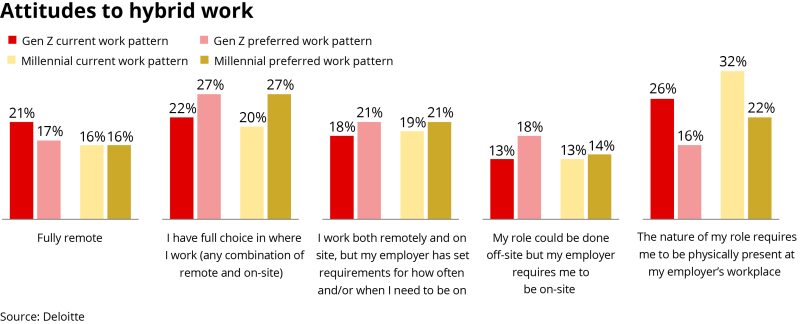

In its 2023 Gen Z and Millennial Survey, consultancy Deloitte found that only 17% of Gen Z favoured a fully remote work set-up.

That compared to 27% who preferred a full choice between remote and on-site.

And hybrid work is by no means a preoccupation of Gen Z alone.

In fact, on several markers surveyed by Deloitte, millennials prove to be more wedded to the hybrid model.

A total of 59% of millennials said hybrid working was positive for their mental health, compared to 54% of Gen Z.

And 22% of Gen Z said hybrid or remote work may have a negative impact on mental health, compared to only 15% of millennials.

What seems essential is for office attendance to be a compelling opportunity from the point of view of collaboration and career development, rather than a compulsion forced on employees by overbearing management.

Nobody wants to commute to the office, only to spend all day on Teams.

And likewise, hybrid working should be an opportunity for flexibility, rather than a cost-saving exercise depriving employees of valuable in-person time with their colleagues.

In addition to trumpeting flexible working policies, savvy marketing can also serve to promote what can often be an obscure industry.

Insurance-themed TikTok has proved a surprising success and is a potential means of attracting new people to a market that has relied heavily on word of mouth to bring in recruits.

The impact of social responsibility

Corporate responsibility, and particularly attitudes to the environment and ESG, undoubtedly seem to be higher on the agenda of younger generations.

A total of 50% of Gen Zs say they and their colleagues are pressuring businesses to act on climate change, although only 19% strongly agreed that large companies are acting to protect the environment.

The insurance industry’s drive to become a central pillar of the energy transition could prove a strong selling point to those considering the sector.

And in a corporate world where every company out there is looking to burnish its ethical credentials, distinguishing which companies are generally ahead of the pack on this front can prove challenging for industry outsiders.

But action can still speak louder than words.

One clear red flag which came up in discussion was if a company had been involved in a major scandal – as this was seen to speak volumes about corporate culture.

Salary still counts

Despite all the aforementioned considerations, it is worth noting that people do not spend their days buying and selling insurance from the good of their own hearts.

Salary matters, and its importance has been underlined by the well-documented cost of living crisis.

Deloitte’s polling showed that cost of living was the leading concern for Gen Z, ranked first by 35% of respondents.

This was followed by unemployment at 22%, then climate change at 21%.

This is a significant conundrum for the London market, as it looks to recruit from beyond its traditional heartlands.

While it may be desirable, for example, to recruit an apprentice from the North East, consider the practicalities.

London is in the midst of a rental crisis – a room in a shared flat can easily cost over £1,000 per month, plus bills and deposits.

The feasibility of moving to the capital on a typical starting salary is increasingly challenging, and a problem with no easy solutions.

Thus, while views evolve, there are still enduring practical realities, be they salary expenses or real estate expenses.

That the world of work is changing fast and generational attitudes differ is indisputable, but this should not mean companies take their eyes off the traditional fundamentals of good employment and sound management.