The rapidly growing offshore wind sector is commonly perceived as one of the most exciting growth opportunities for the energy insurance market, as the insurance industry throws its weight behind the energy transition.

However, this year has seen a succession of bleak financial warnings from some of the world’s leading turbine manufacturers, presenting knock-on implications for insurers.

Companies have been buffeted by supply chain logjams, technological failures, inflation and infrastructure constraints – a painful cocktail of developments that is proving a roadblock in the rapid development of the industry.

Combined with the quick rollout of prototypical technology, the environment is growing increasingly complex from an underwriting perspective, and loss severity is a rising concern.

As the insurance industry looks to play a key role in facilitating the energy transition, carriers are also keen to avoid in effect subsidising the development of prototypical technology through unprofitable underwriting.

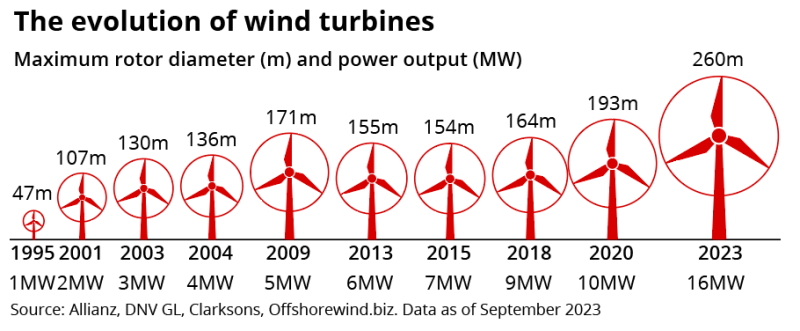

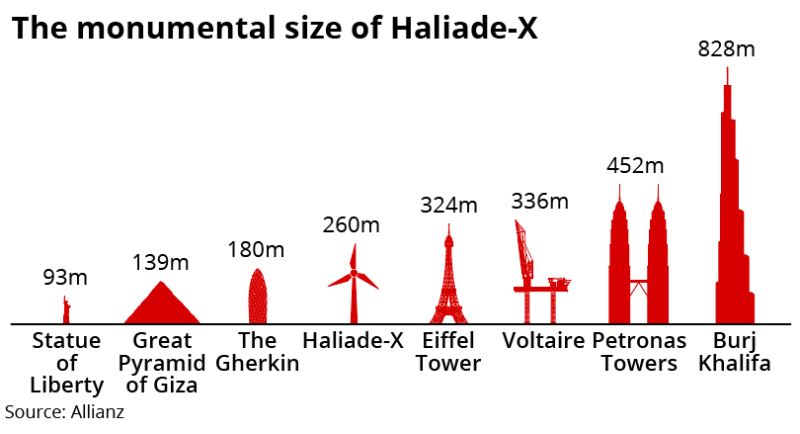

In particular, the massive growth of the size of wind turbines has been flagged as a key concern, which is contributing to rising claims costs.

Nonetheless, capacity continues to redeploy from traditional upstream energy into the offshore wind space.

“Ten years ago, clients asked us who is writing renewable energy, and now it is a case of who is not writing it,” said WTW’s global renewable energy leader, Steven Munday.

Incoming capacity has contributed to competition on rates and made charting a course to profitable underwriting difficult, although the long-term growth potential in the class remains highly attractive.

As a result, underwriters are conceding increasingly broad terms to clients at a time when exposures are growing larger and more complex.

A cocktail of challenges

In the turbine manufacturing industry, this year has been marked by a series of increasingly gloomy updates from some of the sector’s leading players.

Siemens Energy revealed in August that it expects to incur a loss of EUR4.5bn ($4.7bn) this year thanks to problems in its wind turbine business, which has been dogged by inflation and technical problems.

Danish renewables giant Ørsted gave a similarly downbeat update a few weeks later, predicting that its projects off the Atlantic coast will require impairment charges of up to 16bn Danish krone ($2.3bn).

Share prices have taken a pummelling.

The bleak outlook in the offshore wind space was exemplified in early September, when a key UK government auction of offshore wind projects received no bids from developers.

Common issues that companies cited – inflation, supply chain, and technological troubles – are all serious considerations for the insurance market in both the near and long term.

Impact on claims

Of immediate concern is how the emerging trends can contribute to the increasing severity of losses.

The combination of inflationary pressures and supply chain constraints, coupled with the increasing scale of turbines, is inflating claims.

Fraser McLachlan, CEO of Tokio Marine HCC’s renewables division GCube, said: “We are starting to see the severity of claims increasing.

“The frequency has probably ticked up a little bit, but for us it is the severity of the loss that has really ticked up.”

Earlier this year, a GCube report found that the average size of offshore wind claims has increased to more than £7mn in 2021 from £1mn ($1.2mn) in 2012.

Furthermore, increased energy costs in the wake of the Ukraine war have contributed to higher BI exposures for operational risks.

“From an insurance perspective it has a massive impact on the quantum of claim you are going to pay from a BI perspective,” McLachlan said.

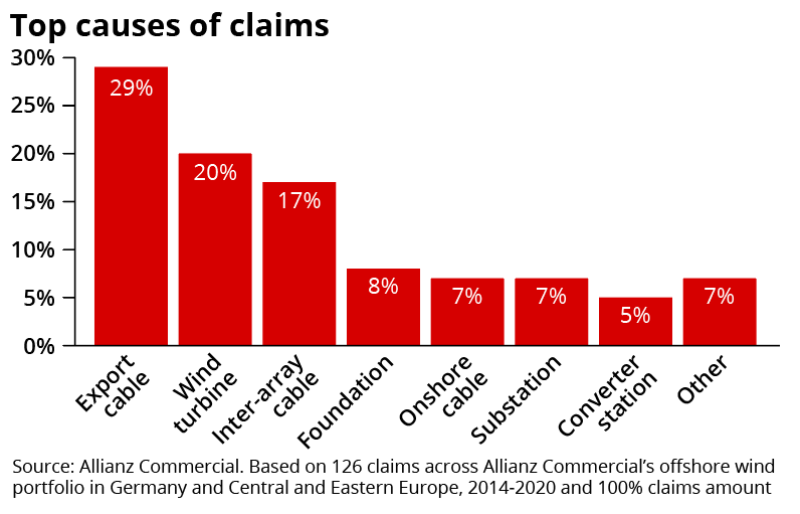

In offshore wind, cable malfunctions remain the driving force of claims, and the growing scale of turbines is only adding to this.

In a recent report, Allianz Commercial found that 53% of offshore wind claims by value in the key geographies of Germany and Central Eastern Europe stemmed from cable damage between 2014-2020.

“With the increasing size of wind farms comes a corresponding increase in cable length and complexity,” the report noted.

Looking ahead

The need for underwriting dynamism and expertise will be substantial to keep pace with changing technology, with brokers continuing to flag a lack of leaders in the class.

“We are seeing lots more capacity come into the market, but it is supportive, follow market capacity,” WTW’s Munday said.

“There have still been limited quality leaders in this sector.”

A common complaint from incumbent renewables underwriters is that new capacity from the upstream space is underwriting with a reliance on its traditional upstream aggregate models, which fail to account for the unique exposure issues around offshore wind.

In particular, sources said newer markets were more willing to give ground on terms and conditions for exposures such as cables, even though they have been a perennial source of claims.

Despite the structural headwinds, the offshore wind sector is still poised for vast growth.

At the end of 2022, global installed offshore wind capacity stood at 64.3GW, and 380GW is expected to be added over the next 10 years, according to the Global Wind Energy Council.

The opportunity for the insurance industry is correspondingly significant, but there are hurdles to overcome from the increasing complexity of risks.

Some of the largest projected offshore wind growth is in the US and Asia, which brings with it increasing exposure to natural catastrophes.

Then, there is the next technological frontier of the widespread deployment of floating turbines.

Floating turbines are anchored to the seabed rather than fixed in place, allowing them to be constructed in far deeper waters and opening new areas of ocean for potential development.

The complex feat of engineering introduces additional risks for underwriters to manage throughout the construction and operational phase.

In such a rapidly developing industry, stumbling blocks for both developers and the insurance industry are inevitable.

But ongoing innovation, research and disciplined capital deployment from the insurance market will be essential to underpin this key plank of the energy transition and ensure its long-term sustainability.