Legal

-

The broker said WTW hasn’t shown it was irreparably harmed by the defection.

-

The executive is charged with defrauding investors out of nearly $500mn.

-

Clear Blue originally filed the suit in late 2023, alleging reckless conduct and misrepresentation.

-

Willis claims at least two $1mn accounts were also unfairly lost to Howden.

-

Jonathan Rinderknecht was arrested Tuesday on destruction of property charges.

-

After losing in the High Court, insurers pin their hopes on the Court of Appeal.

-

IAG completed its takeover of RACQ last month.

-

Plus, the latest people moves and all the top news of the week.

-

A decision in relation to who bears which legal costs will be reached at a later date.

-

Ex-Western Europe CRB head Alberto Gallego and colleagues left for a Marsh joint venture.

-

The Berkshire subsidiary is seeking coverage for a $22mn antitrust loss.

-

Litigation funders are promoting “aggressive” tactics in the UK, Holland and Israel.

-

The carrier notified California regulators that it would stop renewing plans starting last month.

-

James River said the court was right to dismiss the fraud case.

-

Company said defendant ‘distraction’ can’t make up for flimsy arguments.

-

The violations included not using propertly appointed adjusters and failing to pay claims.

-

The lawsuit has been filed as sales talks with Sompo yielded a deal.

-

Paul Jeroen van de Grampel drove Aon's M&A and litigation solutions proposition.

-

Parrish, now Howden US CEO, and his colleagues said they didn’t violate contracts.

-

A key hearing in the poaching case is set for 4 September in New York.

-

The company was hit with a data breach on July 16.

-

The lawsuit is the latest development in the multi-billion dollar reinsurance scandal.

-

The plaintiffs seek a declaration that part of Marsh recruits’ restrictive covenants are unenforceable.

-

The suit asserts the raid will cause “incalculable harm” to the broker.

-

The lawsuit claims more than 100 employees left with Parrish and his three reports.

-

The broker has recruited from its rival as it looks to launch Willis Re 2.0.

-

The insurer denies it is responsible for the actor’s legal fees.

-

Liberty Mutual, Allianz and Aviva previously had their appeals dismissed.

-

Fidelis, Liberty and Hive are among the insurers with the greatest exposure.

-

The suit claims billions of dollars are being illegally withheld.

-

Ian Roberts joined the law firm in 2013.

-

The ruling comes as insurers face growing legal pressures following the January blazes.

-

There is a growing disconnect between risk and pricing in the class.

-

Jim Williamson said litigation funding had evolved into an investment class.

-

There is the prospect of fragmented appeals and uncertainties around reinsurance recoveries.

-

The carrier said it is disappointed with the English High Court’s decision.

-

The UK High Court has ruled in favour of lessors in the multi-billion-dollar dispute.

-

The documents figure in a potential criminal case against a CCB employee.

-

Burford’s CEO said Chubb is inappropriately using its corporate power.

-

In January, 32 Acquinex employees resigned, with 22 moving to Howden’s underwriting arm.

-

The aircraft lessor has booked $654mn in settlements from insurers over the past year.

-

AIG, HDI Global and others have settled. Chubb’s fight continues.

-

Marsh alleges Aon also went after its clients as well as its employees.

-

In January, 32 Acquinex transactional liability employees resigned for Howden’s underwriting arm, Dual.

-

The tariffs could expose insurers to the risk of recession and shrinking income.

-

The reinsurer said the probe concerns the alleged involvement of its former chairman.

-

Integro’s debt outweighed Tysers’ earn-out plus proceeds from 9 million AUB shares.

-

An issue has emerged in diligence, and Howden has a complex consortium to align.

-

After a two-year delay, more than 100 staff investors will be out of pocket.

-

Settlements relate to aircraft that were blocked from leaving Russia since 2022.

-

Staff who left SRG’s MX Underwriting will begin working for Canopy this year.

-

The distribution firm has accused the MGA platform of illegally recruiting staff.

-

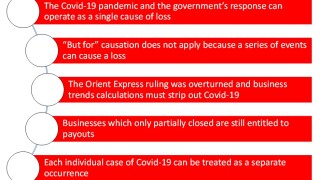

The appeals court has ruled that composite policies provide multiple limits.

-

The aircraft lessor said it did not expect additional recoveries.

-

Financial details will not be revealed until the publication of Avolon’s full-year results.

-

Brokers and insurers must obtain informed consent from clients for the commissions.

-

The restructuring arrangement is designed to protect creditors.

-

This follows a ruling to declass the representative proceeding filed against IAL.

-

CEO McManus vows broker “will not be silent” over “unlawful” competitor behaviour.

-

The court will consider appeals against initial judgments that found in policyholders’ favour.

-

A California ruling could set an important precedent as other courts consider similar cases.

-

The regulator alleges customers were promised discounts they did not receive.

-

Current efforts to battle third-party litigation funding are focused on disclosure.

-

Starr is understood to be one of several carriers to reach an in-principle agreement with AerCap.

-

The settlement was announced by DAE’s lawyer Alistair Schaff on day one of the aviation ‘mega trial’.

-

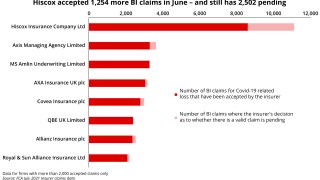

The ruling is the latest in a series of ongoing legal wranglings over Covid-19 BI losses.

-

The 12-week trial is set to commence in the Commercial Court in London tomorrow.

-

The Court of Appeal ruled that ‘at the premises’ wordings provide coverage for Covid-19 losses.

-

James River will also oppose a Fleming motion to uncover additional documents.

-

The judge relied heavily on a previous UK court decision.

-

NatGen allegedly collected $500mn associated with the fraud.

-

Beazley has two days to amend its complaint, correcting jurisdictional deficiencies.

-

The Bermuda courts will assess Onex’s lower, revised offer for the fronting unit.

-

MGAs are looking hard at capacity arrangements for fear of regulatory action.

-

Crystal Palace, Aston Villa, Brighton & Hove Albion and West Ham have reached a settlement.

-

The funding practice has led to a dramatic increase in claims amount, which in turn pushes up rates.

-

BOC is believed to be the first lessor to publicly disclose a settlement with its (re)insurers.

-

-

Insurers claim that damage from the “detonation of an explosive” is also excluded.

-

The agreement from Fleming to honour original terms still leaves it open to long-term damage.

-

Fleming had attempted to land ~$78mn in ‘economic concessions’ on the deal.

-

The six execs left Acrisure for rival broker Woodruff Sawyer in March.

-

The judge said the lessors “are very unlikely to obtain a fair trial in Russia”.

-

The narrative of competition between the two hubs can hold space for benefits.

-

The agency will track the potential impact of the lawsuit on James River’s ratings.

-

Nord Stream has named Lloyd’s Insurance Company and Arch among the defendants.

-

James River sued Fleming yesterday to enforce the $277mn sale of its casualty re unit.

-

Fleming has claimed breach of contract and is seeking roughly $78mn in “economic concessions”.

-

Procedural expenses in the case have been as high as $100,000 per day.

-

Vesttoo is unable to make a similar request again.

-

The firms say no “single aggregating event” caused the contingency losses.

-

The carriers were in arbitration with UnipolRe and Gen Re.

-

The probe concluded in Q4 last year, according to Gallagher’s 10-K.

-

There remain 22 defendants still challenging the venue for claims hearings.

-

The committee claims Chaucer waited until it had ‘maximum leverage’ over other debtors.

-

The court gave a mixed ruling on subjects including coverage, aggregation and furlough.

-

The investment comes in exchange for a $49mn surplus note from HOA and the acquisition of HOA’s rights to potential claims stemming from the Vesttoo fraud.

-

The syndicate is suing its reinsurers to cover Covid-19-related claims in California, Colorado, Florida, Illinois, Nevada, New York and the UK.

-

In total, insurers paid indemnity of $11bn and loss adjustment expenses of $1.5bn for claims closed in 2022.

-

Thursday’s announcement means that the Russian insurer is off the hook for claims proceedings.

-

Aircraft lessors have now received nearly $2.4bn in insurance settlements from Russian airlines.

-

The “convenience claims” route to payout will be limited to claims up to $200,000.

-

The lawsuit, filed Thursday on behalf of Clear Blue and its subsidiaries, alleges that Aon conducted insufficient due diligence on the ILS InsurTech.

-

The company’s litigation was one of the most high-profile cases relating to Covid-19 business interruption.

-

The DoJ also hit rival reinsurance broker Tysers with a $36mn penalty and administrative forfeiture of around $10.5mn.

-

Chief of IRS Criminal Investigation said Tysers had "eroded the process of fair and open competition".

-

Chubb declared at the last minute that it would not contest the English court’s jurisdiction, in contrast to every other reinsurer being sued by aircraft lessors.

-

The Trustee had sought to accelerate the liquidation process while avoiding significant admin costs.

-

Under the agreement, reached late on Monday, Vesttoo would sell its assets in a transaction that would close by December 1, 2023.

-

The former employees are accused of co-ordinating an “unlawful” team move and conspiring to steal clients.

-

The beleaguered firm claims its creditors are unsympathetic around delays due to the Israel-Hamas conflict.

-

In a motion filed Friday, the trustee requested to convert Vesttoo’s Chapter 11 case to Chapter 7 so that “an independent fiduciary can wind down the debtor’s affairs and avoid significant administrative costs”.

-

Celestial Aviation Services received $501.5mn relating to 14 aircraft that were stranded in Russia as a result of the ongoing conflict with Ukraine.

-

The eight-day trial will look at prevention of access wordings, policy limits and furlough payments.

-

Earlier today, in a bid to accelerate liquidation, the company’s unsecured creditors requested early termination of the exclusivity period granted Vesttoo to develop a reorganization plan.

-

Doing so would save “at least $8.5mn in cash” based on the firm’s monthly operational expenditures, according to a recent motion.

-

Creditors already have authorisation to access Vesttoo’s data as part of their investigation.

-

Last week, this publication revealed that Howden agreed to pay Guy Carpenter in excess of £50mn ($61mn) to settle the poaching suit related to Massimo Reina and a defecting European team.

-

The motion seeks discovery of information and documents about the structure and operation of White Rock’s cells.

-

The payment represents the largest ever made in a team lift case in the London market.

-

An internal missive, seen by Insurance Insider, also revealed Howden has agreed to a ‘set of demands to make amends’ in the wake of poaching settlement.

-

The two rival brokers have reached an out-of-court settlement over the poaching of 38 Guy Carpenter staff by Howden.

-

Avenue Capital-backed Greylag claimed that insurers denied coverage of the two lost aircraft, which have a value of nearly $110mn and $120mn, respectively.

-

A worldwide freezing injunction was issued to Alex and Robert Finch, the former directors of AFL Insurance Brokers, after they were found to have committed fraud.

-

The former owners of AFL Insurance Brokers have been ordered to pay damages totalling £6.1mn after being found guilty of fraud and of breaching director duties.

-

In total, 242 claimants have launched legal action against a group of eight insurers.

-

The InsurTech claims five former staff, including the CEO and CFO, forged signatures and impersonated bank staff.

-

A Delaware judge has ruled in favour of Vesttoo’s automatic stay in the bankruptcy case.

-

The football club initially sued the broker for £10mn in a claim connected with the death of the footballer in a 2019 plane crash.

-

In the initial court documents, Aon alleged its rival broker and former head of PFI “conspired unlawfully” to recruit key members of the team.

-

Court filings indicate use of “phony phone numbers” and creation of a “wholly fictitious person” in the letters of credit fraud that has engulfed Vesttoo.

-

The landmark settlement was approved by the US Department of Commerce and the US Department of the Treasury and was not in breach of any sanction regimes, AerCap said.

-

A committee of unsecured debtors was appointed, including Markel, Clear Blue, Porch’s HOA, United Automobile Insurance and Proventus.

-

The Aon transformer is seeking information on the origins of alleged fraudulent letters of credit.

-

The Aon unit noted 37 LOCs “purportedly procured by China Construction Bank (CCB), Banco Santander and Standard Chartered Bank US”.

-

The company’s Monday statement is the latest development in a debacle that could potentially lead to a major loss event for the utility company’s casualty insurers.

-

Following the initial decision in the case, Julia Sommer sought £5.1mn in compensation for the claims she made against her former employer.

-

Vesttoo has filed documents at the Bankruptcy Court for the District of Delaware that seek an automatic stay against White Rock and its putative liquidators.

-

The company's Ebitda for 2022 was estimated at $60mn compared to $20mn in 2021.

-

Recent filings show that 25 new cases regarding Ukraine aviation losses from plane lessors have been lodged against insurers in the UK High Court.

-

The broker argued that it was not “reasonable” to overstep its position as broker to Greensill, the failed supply chain finance firm, and provide certain information to White Oak.

-

The firm’s interim CEO Ami Barlev has argued that, with Vesttoo’s weekly expenses being $360,000, freezing assets above $1m would be “catastrophic for the company”.

-

The ILS transformer platform claims Vesttoo is in breach of shareholder agreements.

-

Guy Carpenter has succeeded in bringing Ronda into the suit, while Baotic and Nicosia will not be added.

-

The co-founders will be on paid leave until a final decision is taken.

-

The legal action follows the resignation of 38 of Guy Carpenter’s European staff to join Howden Tiger.

-

The broker said it believes it has meritorious defenses and intends to vigorously fight the claims and seek recourse against third parties where appropriate.

-

The fronting company said impairment to Vesttoo’s LoC collateral will be "immaterial".

-

The case is the latest in a steady flow of legal disputes relating to business closures during the pandemic.

-

The judge rejected all the buyer’s claims for breaches of the warranty under its buy-side W&I policy.

-

The original verdict could lead to increased payouts for the insurance industry from Covid BI claims.

-

Former Cooper Gay CEO Toby Esser is seeking £9.38mn damages claim in the fraud case.

-

The supply-chain finance firm dramatically collapsed in 2021 after its trade credit insurance was pulled.

-

ExCeL is seeking an indemnity of £16mn ($20.5mn) for losses arising from Covid-19-related business interruption.

-

The case is the latest in a series of BI disputes that focuses on the issue of claims aggregation.

-

The claims resolution company said policyholders are more likely to have to sue to secure payouts.

-

Collectively, the claimants are seeking more than $17mn in damages over a range of allegations over fraud and false financial statements.

-

The broker said it intends to vigorously defend itself against Aon’s allegations concerning the departure of fac re employees.

-

Aon claims that Alliant has poached around 32% of Aon’s facultative reinsurance group, including 18 of the 25 Aon employees in the casualty fac team at all levels.

-

The Marsh McLennan reinsurance unit alleges Massimo Reina was working on the move as early as late 2022.

-

The three lawsuits take the total number of cases filed against insurers from Carlyle in the UK High Court to seven.

-

Montgomery Aviation and Rise Aviation Limited, along with EOS Aviation, have launched fresh legal battles against Convex and Lancashire.

-

Lawsuits from lessors KDAC and Merx will be included in the ‘mega trial’ to be heard next year.

-

Rise Aviation has named the two insurers as the representatives for its all-risk and hull-war reinsurance policies, respectively.

-

The lessor was awarded $355.4mn for the total loss of two aircraft and more than $55mn for costs relating to the recovery of another plane and its engines.

-

The carrier cited a “huge” spread of possible outcomes from various lawsuits relating to aviation claims from the conflict.

-

Legal precedents are being set which could lead to crippling liabilities for US businesses as well as longer term data management implications.

-

Julia Sommer won her tribunal last year after she claimed to have been consistently discriminated against for her sex and was unfairly dismissed after her maternity leave.

-

Mactavish research has found that commercial policyholders are now more than three times as likely to sue their insurers to get their claims paid.

-

The Lloyd’s syndicates named in the trial include Tokio Marine Kiln’s Syndicate 510 and Syndicate 1880, Liberty Managing Agency, MS Amlin and Munich Re.

-

Insurers including AIG, Fidelis, Swiss Re and Chubb along with several lessors were in favour of merging the aviation war cases, while lessor AerCap wanted a separate, standalone trial for its lawsuit.

-

The companies did not disclose whether any money exchange hands as part of the agreement.

-

The lawsuit argues that one engine that was leased out in Ukraine and 16 engines that were leased out in Russia have suffered physical loss or damages.

-

The claim, worth $43.8mn, takes the total amount claimed in the courts by Carlyle Aviation Partners to upwards of $832mn.

-

Falcon 2019-1 Aircraft 3, an entity managed by Dubai Aerospace Enterprise, is suing its contingent war insurers for $43.4mn but, if that fails, is also suing its all-risk insurers for the same amount.

-

The aircraft lessor has outlined its response in a $750mn lawsuit against its contingent war insurers.

-

In addition, Lloyd's syndicates Atrium and Syndicate 1183 asked the judge to dismiss the case against them in its entirety.

-

The carrier argued that, because the sum it was being sued for was significant – $95mn in the all-risk case and $240mn in the war risk case – it should be allowed to represent itself.

-

Bowling chain Hollywood Bowl is also suing Liberty Mutual for Covid-19 BI losses.

-

The pub group and bakery chain will dispute elements of judgements issued in October in UK Covid-related BI lawsuits.

-

The action is being taken by a securitisation entity managed and serviced by Dubai Aerospace Enterprise.

-

A steady stream of legal actions are being filed against insurers over billions of dollars’ worth of stranded aircraft.

-

The lessor is looking to recoup $750mn from its war insurers or over $875mn from its all-risk insurers, in the event that its war claim fails.

-

The amount Aircastle is looking for in the suit is, however, lower than the $350mn insurance claim that for equipment stranded in Russia.

-

Some multi-national cedants are using US addresses to source cover from US carriers, risking issues in the event of claims, amid a desperation for growth on both sides of the Atlantic.

-

Mondelez had filed a $100mn lawsuit against the insurer over payment denial.

-

Court documents also revealed that 101 of AerCap’s 116 planes in Russia have been re-registered.

-

Argo Group has been sued by investors, who claim the company has engaged in inadequate underwriting and misrepresentation of facts which resulted in a 60% drop in the specialty carrier’s common stock value this year.

-

Stonegate’s case is seen in the market as a key precedent for the aggregation of BI claims.

-

The High Court of Australia refused leave to appeal a case that had gone in favour of insurers in February.

-

The Insurance Council of Australia welcomed the news, with CEO Andrew Hall describing it as a “significant milestone”.

-

The brokers are working on finalizing the terms in a written settlement agreement, which could be filed within two weeks.

-

The carrier argued it paid the executive the first installment of a $400,000 retention award in March 2020 and the second half in March 2021.

-

The motion comes a month after Carpenter sued the rival reinsurance broker over the "orchestrated” exit of 12 executives from its Dallas-based practice.

-

The indictment mentions two unnamed UK reinsurance brokers and an executive who took part in the corruption scheme.

-

Clubs including Arsenal, Aston Villa and Leicester City are claiming against insurers.

-

The reinsurance broker also sued five former GC Access leaders who now work at Howden as managing directors.

-

Hayden Tennant also allegedly sought to launch a rival company, in breach of contractual obligations.

-

A steady flow of litigation relating to Covid-19 BI is hitting the courts, despite the completion of the FCA test case last year.

-

The carrier said that it intends to defend the proceeding.

-

If the lessor’s $3.5bn all-risk claim proves unsuccessful, it plans to pursue a claim on its contingent war policy worth $1.2bn.

-

The parties gave their final submissions following a legal hearing that has lasted over two weeks.

-

Louisiana appeals court decision that allows property damage claim for Covid shutdowns is contrary to every other appellate ruling on the issue.

-

The pub company is looking for a payout at every one of its 760 premises, whilst insurers claim it is entitled to a single limit.

-

Aon claims PFI head Paul Tubb unlawfully recruited five colleagues for Howden’s construction unit.

-

In a 3-2 split decision issued last week, Louisiana’s Fourth Circuit Court of Appeal ruled that the policy language is “ambiguous”.

-

The bakery chain is suing Zurich over losses during the lockdown, one of several high-profile BI legal disputes to have emerged.

-

The Spanish government has been locked in a dispute with the London P&I Club over a 2002 oil spill.

-

The pub chain has claimed in court that it is entitled to separate payouts for each of its 760 venues.

-

Aggregation is the main issue in the landmark case brought against MS Amlin, Zurich and Liberty Mutual.

-

The case is linked to losses associated with asbestos-related injuries and claims filed over two decades ago in Montana.

-

Together with its parent company, Allianz Global Investors has agreed to pay more than $5bn in restitution to victims and $1bn to US authorities.

-

The Supreme Court ruling over BI coverage early last year has not put a stop to BI litigation over Covid losses.

-

The Peruvian government is suing Spanish oil company Repsol over the January incident which affected 700,000 residents.

-

“We like where we are positioned right now in terms of the performance of some of that strategic hiring,” Glaser told analysts.

-

Mulsanne must pay £1mn to Marshmallow in the next two weeks, with the remaining balance subject to a cost assessment process.

-

The brokers asked the judge to delay some pre-trial conferences by two weeks as they could obstruct the settlement negotiations.

-

A New Jersey judge writes a scathing decision criticizing hospitality firms for attempting to claim physical damage from virus and misinterpreting policy language.

-

Current Generali CEO Philippe Donnet said the rebel plan puts the firm’s dividend targets at risk.

-

The withdrawal of insurance coverage provided by subsidiary The Bond & Credit Co was linked to the collapse of the supply-chain finance firm.

-

The carrier said it will examine the impact of the ruling on other claims under non-damage denial-of-access wordings.

-

The majority of BLM’s lawyers will join Clyde & Co’s casualty insurance practice as part of the deal.

-

Axa has been granted permission to appeal certain aspects of the ruling of a case successfully brought against it by Wolseley owner Corbin & King over Covid-19 BI cover.

-

The firm says that, without change, firms will be downgraded in the coming weeks.

-

The insurer predicts there will be some release from its provision, but it will happen over time and is subject to court proceedings.

-

Policy holders The Taphouse Townsville and LCA Marrickville, and insurer IAG have each filed applications for special leave to appeal to the Australian High Court.

-

The findings of the Corbin & King case could have both widened coverage and increased the aggregate businesses can claim.

-

Colombian authorities said that Carpenter Marsh collaborated throughout the investigation and received a 50% discount on the fine.

-

The executive said that, in many cases, reinsurance contract wordings had not been tested for Covid recoveries.

-

Multiple interlocking dependencies will determine whether huge potential claims from leasing companies are ultimately paid.

-

The start-up said its survey shows that SPAC and de-SPAC claims would drive increasing litigation throughout 2022.

-

The 30-person team move represented the latest raid from the UK-headquartered broker on Marsh McLennan.

-

The court upheld decisions made in October, although it reversed some elements of the case between IAG and Meridian Travel.

-

The insurer will now seek an investigation into the impact of the information misuse.

-

With a Bermuda court ruling still pending over the firm’s proposed buy-out, Markel has negotiated a deal to counter US litigation.

-

The ruling means the insurer will experience a significant favourable impact on previously booked reserves.

-

In a press statement, the company decried lawsuits filed by QBE against four Applied employees, and against Applied itself for hiring them.

-

The New Jersey Superior Court rejected insurers’ attempts to apply a war exclusion to prevent paying out for BI losses.

-

The brokers will have until early 2023 to settle the case via private mediation or the case will move forward to a jury trial that could last between seven and 10 days.

-

Ashley Bowell was found guilty of defrauding his former employer, and its insurer Aspen, after falsely claiming to have been injured at work.

-

A judge for the Miami-Dade County Court has ordered Aon and individual defendants in the Miami facultative team poaching case to avoid doing reinsurance brokerage business with the defendants’ former Willis Towers Watson clients.

-

The Markel Catco Reinsurance Fund and Markel Catco Reinsurance Opportunities Fund have already had provisional liquidators appointed for restructuring purposes.

-

Beazley tried to recover $6.5mn in claim costs from Prime on a policy which it led.

-

Chubb’s Vigilant, Lloyd’s syndicates and Travelers were turned away in Bear Stearns case over payment fund for investors in 2003 SEC probe.

-

The agreement ends non-solicitation action against the team of brokers, led by Cameron Roe and chairman Tony Phillips.

-

IAG said it was still reviewing the judgment to determine whether to appeal any aspects of the ruling.

-

The carrier said its $110mn net claims burden will be unaffected.

-

The judgment ruled that clauses in insurers’ BI policies covering infectious diseases meant cover was only present for closures relating to an outbreak on assureds’ premises specially.

-

Markel reported that investigations by the DoJ and SEC have concluded with no penalties or action taken against the company.

-

The ICA welcomed the step closer to clarity, after insurers lost the first BI test case over the interpretation of the Quarantine Act.

-

Berenberg believes EUR3.5bn would be a manageable loss for the insurer and estimates that it would be earned back in well under a year, but a EUR6.8bn loss would be more challenging.

-

The broker also filed a lawsuit against Goode, Honeycutt, Forst, Rice, Lee and Keenan as individual defendants.

-

A judge found no evidence Mike Harden unlawfully solicited colleagues who “did not want to work for an Aon-controlled organisation”.

-

The insurer has agreed to indemnify physios who closed their premises in order to comply with Covid-19 guidance from medical bodies.

-

Huge disputes over aggregation of claims and ongoing coverage disputes point to uncertain overall exposures.

-

The DoJ was given a deadline to provide Aon’s lawyers with pertinent evidence collected from third parties during its investigation into the $30bn mega-merger.

-

Leisure broker NDML said the settlement was an ‘initial figure’, with more claims yet to be finalised.

-

Judge orders Marsh to stop poaching; prevents 3 top execs from working for Marsh for months amid the hiring dispute.

-

Aon will have to wait until November at the earliest to argue the case in Federal Court for its $30bn merger with Willis Towers Watson.

-

The London-listed carrier has paid 384 claims of £49,000 each on average.

-

Miami-Dade Circuit Judge Michael Hanzman warned of an "allocation issue" between those who have lost loved ones, and those "lucky enough" to have only lost property.

-

Marsh claimed Aon is trying to ‘flip the narrative’ from its poor management decisions and uncertain future in its response to the suit.

-

Aon’s legal team said it was concerned that the proposed timetable could kill off the deal before the trial begins.

-

The CCCS has identified competition concerns around executive pay consulting services.

-

The lawsuit accuses Michael Parrish of masterminding the raid, despite still being a paid Aon employee.

-

Hiscox has reached a settlement with the Hiscox Action Group (HAG) following a private arbitration process over Covid-19 BI claims.

-

Australian insurers are now pursuing a second test case for further clarity on BI policy wording.

-

“We are not about to let [the] delay…compromise the deal”, says Latham & Watkins lawyer Dan Wall.

-

Lawyers argue the hotel’s claim is similar to that of four pubs against FBD, in which the courts found against the insurer.

-

The Suez Canal Authority has received a new compensation offer from the ship’s owners and insurers.

-

Aon and Willis were taken by surprise by the lawsuit, a CTFN report claims.

-

The broking houses also said they "remain fully committed to the benefits of [their] proposed combination".

-

Small business insurer Hiscox Insurance Co and Cox Radio reached a settlement on a long-term legal battle on Monday connected to the leaking of a sex tape involving the famed wrestler Hulk Hogan.

-

Kessler and Derez will each get something they want from the deal, which will also clean the slate for incoming CEO Rousseau.

-

A settlement allows the mutual an “orderly exit” from the reinsurer’s share capital and removes a major distraction from incoming Scor CEO Laurent Rousseau.

-

Hotel firms are fighting to reclaim $10mn in ‘inflated’ fees charged by a former broker nicknamed ‘the pirate of the Caribbean’.

-

The Suez Canal Authority has asserted the March grounding was entirely the fault of the ship’s captain.

-

The company is accused of “brazenly cheating” Andrew Kudera of his own money and of owed compensation, the lawsuit states.

-

In a statement on Thursday, Scor said it “acknowledges and welcomes” the findings from the French authority, calling the original allegations “a groundless move”.

-

The proposals aim to cut the cost of insurer collapses and provide greater protection to policyholders.

-

The Prestige oil spill caused major damage to the Spanish and French coasts in 2002 and has been subject to long-running litigation.

-

Axis and Covea have so far paid the greatest number of final settlements.

-

The establishment of the National Recovery and Resilience Agency follows news of a new A$10bn state reinsurance backstop for cyclones.

-

The pool, which will cover cyclone and related flood damage from July 2022, is expected to bring down the cost of insurance.

-

The Senate has signed off an insurance reform bill which eliminated earlier proposals on cash roof settlements and fee multipliers, but reduced the statue of limitations and made other pro-industry changes.

-

The next hearing in the case will be after 21 May.

-

Gary Boss is based in New York, and Ashley Prebble works at the law firm’s London office.

-

The reinsurance broker is looking to recover over £10mn and impose an injunction to ensure the return of confidential information.

-

The Suez Canal Authority has detained the ship as parties discuss a disputed $916mn claim.

-

The former LatAm and Caribbean chair, who moved to Guy Carpenter, has failed to nullify non-solicitation clauses.

-

The larger broker says it lost more than $6.5mn in revenue after leaders “solicited” colleagues and clients.

-

The law firm has already this year seen a lot of PE support for startups and scale-ups both through equity and debt.

-

The penalty comes after a Section 166 review into the Lloyd’s broker’s activities.

-

The move follows the brokers’ submission of a remedies package last week to allay competition concerns.

-

Senator Jeff Brandes and local insurance law experts tell this publication that the state’s insurance market will be hugely vulnerable without reform.

-

A New York court has ruled that the names of two clients who are friends with a broker who has left Willis Re to join rivals TigerRisk can be published.

-

The Swiss carrier denies signing off dangerous new-builds without full inspections.

-

The regulator raps the UK division for failure to disclose insurance giant’s holdings in Powergrid and Munich Re.

-

The potential for a wave of class actions as a result of biometric data privacy laws has the cyber market on alert.

-

The reinsurer argues the action was lodged to divert attention from alleged misconduct by the mutual’s CEO.

-

Covéa said it has filed a complaint against Scor chairman and CEO Denis Kessler with the Parquet National Financier financial crime office alleging “market manipulation and misuse of corporate assets”. Scor denounced the action as "deceitful and groundless".

-

The Swiss Bank said that the broker did not disclose issues around the supply chain financier’s insurance coverage.

-

The nonprofit entity remains isolated from liability claims for now.

-

According to the Capitol Forum, antitrust regulators will consider the deal's impact on the world’s fourth largest insurance broker AJ Gallagher

-

The carrier has admitted to errors in select cases but stressed that its $475mn loss figure remains unchanged.

-

An entrepreneur running an escape room business wins the sum after media intervention.

-

The $7.5bn bid requires more certainty of value and a higher cash consideration, according to CoreLogic's CEO.

-

The CEO says an examination of the unlimited guarantee could result in a split of conventional cover from events such as biological or nuclear attacks.

-

Some had argued that the definition of occurrence used by judges could make it harder for insurers to aggregate treaty claims.

-

The government releases further detail about the new claims portal for low-value road traffic accidents.

-

Allianz, IAG, Chubb and Swiss Re Corporate Solutions have filed pleadings in the Federal Court.

-

Changes to the matching adjustment and risk margin would unleash funds that could be invested in renewables, the organisation says.

-

The organisation charts record progress in meeting its seven key principles.

-

The ratings agency downplays concerns centered on probable UK changes to the risk margin.

-

The decision removes the risk of a “cliff edge” when temporary leeway according in the Brexit trade deal expires later this year.

-

The central bank governor says Brussels is wrong to insist UK rules shouldn’t change independently of the EU.

-

The broker association’s CEO says Brexit speaks to the need for a lighter rulebook.

-

The Australian carrier has also modestly increased its reserves for Covid-19 BI claims.

-

The government removes a previous cap of 49% in its budget.

-

The ratings agency foresees no “material effect” on the capital or earnings of UK commercial property insurers following the Supreme Court ruling.

-

Fenchurch Law partner suggests "aggressive" initial claims adjustments will be unwound and the reinsurance context will need specific consideration.

-

The CEO said the French reinsurer will avoid court cases where possible in pandemic coverage disputes.

-

The regulator plans to publish data on the size of claims settlements and scale of reserving.

-

After a management meeting, the analysts rule the carrier well placed to capitalise on the hardening market.

-

Howard Burnell’s sentence also includes court and compensation costs, a restraining order against his former partner and a tagged curfew.

-

Bloomberg Law reports that a settlement would bring litigation in Virginia and Delaware to a close.

-

The Principles for Responsible Investment were launched in 2006, with Hannover Re, Liberty and Everest Re among other signatories.

-

The Bermuda Monetary Authority had granted the InsurTech start-up a “sandbox” licence in 2019.

-

The analyst says the judgment removes an overhang that had weighed on the carrier’s stock.

-

Typical cat loss events trigger XoL reinsurance recoveries. It is not certain that this will.

-

The carrier's 2020 net loss estimate remains intact after the buffer for potential Australian BI losses.

-

The carrier still expects net losses from Covid-19 to cost about £62mn.

-

The ruling broadens the coverage available and alters the operation of trends clauses.

-

Shares in the carrier recover from initial losses following a ruling by the Supreme Court that came down largely in favour of insureds.

-

Judges dismiss insurers’ appeals and overturn the famous Orient Express ruling.

-

But Barclays warns the judgment could result in more substantial loss creep for major European reinsurers.

-

Rising professional indemnity and D&O rates are deterring companies from tendering for public contracts, the organisation said.

-

The mixed ruling delivered by the High Court meant insurers escaped from worst-case loss scenarios.

-

The CFO said the new access point for investors would not be used to inflate Lloyd’s capacity and dampen returns in the market.

-

The finding could have a material impact on the scale of BI losses stemming from the pandemic.

-

Justice Secretary Robert Buckland says the one-month hold-up is a response to stakeholder lobbying.

-

The start-up joins Azur, Paragon and Nuclear Risk among the brokers that gained the pre-Christmas go-ahead from the Irish central bank.

-

Intermediaries surveyed were split on whether the pandemic had a negative or neutral effect on business.

-

Willis has succeeded in winning an injunction that prevents eight brokers from having any contact with their former clients.

-

The relative amicability of the breakaway is probably more significant for the insurance sector than the content of the 1,264-page agreement itself.

-

Guardrisk argued that its policy did not respond to a general government response to the pandemic.

-

The transfer of business to its Irish subsidiary will allow any state within the European Economic Area to carry on the business.

-

The insurer said its reserving was still adequate after the court supported its overall approach, but said biosecurity exclusions were not sufficient to decline claims.

-

The ruling in favour of Spire Healthcare reaffirms legal principles relating to the aggregation of claims.

-

The InsurTech was locked in a dispute with Deutsche Telekom over whether it owns the copyright to the use of magenta.

-

The regulator found that Watson and Argo failed to disclose $5.3mn in personal benefits.

-

The highest court dashes lingering hopes of pre-Christmas certainty in the BI debacle.

-

The firm says the appointment helps to position itself as a “challenger” in the segment.

-

The regulator says it wants a clear position on the issue as soon as possible after the Supreme Court ruling on the BI test case.

-

Howard Burnell was reportedly convicted at Wimbledon Magistrates Court of assaulting his then-partner.

-

The outcome of the appeal and a planned new BI test case will be significant for reinsurers.

-

Wrangling over the award of Petroecuador’s 2021 cover has left reinsurers unsure of which primary carrier and broker to back.

-

The regulator ordered potential rebates in June after deciding lockdown measures meant some contracts offered little value for money.

-

An employment tribunal finds that Liam Vaughan’s claim for constructive unfair dismissal is “well founded”.

-

The clauses are widely used in the insurance sector and have led to some high-profile legal battles.

-

Patchwork provisions for entities without EU authorisations have largely fallen away during the UK’s protracted divorce.

-

The CII, Liiba and others are lobbying hard to have awards such as the ACII recognised in Europe.

-

The outcome of the legal battle is hotly anticipated as a litmus test of the viability of the W&I product.

-

The court finds no “justifiable doubts” around the arbitrator’s impartiality after the US oilfield services company alleged bias.

-

The landmark transaction with Sentry requires court clearance after gaining the state insurance commissioner’s nod.

-

The clearance sets Lloyd's on track to complete the mammoth transfer by year end.

-

Mr Justice Henshaw says current liabilities are incompatible with the UK Human Rights Act.

-

The ruling will follow a final, uncontested court hearing on Wednesday.

-

The insurer was ordered to pay out for policies by the Western Cape High Court earlier this week.

-

The Australian carrier takes a A$865mn provision for BI losses following the unfavourable court ruling.

-

Both Suncorp and QBE said multiple tests applied to trigger BI coverage, with QBE saying aggregate reinsurance should mitigate net exposure.

-

The court said that it would work quickly to produce a judgment but it could not guarantee publication this year.

-

The regulator said in the Supreme Court appeal that carriers ran the risk of a large accumulation of losses when they sold their BI policies.

-

Court rules policy exclusions referring to outdated law not valid.

-

Counsel representing carriers argued it was not reasonable to find cover in respect of a national pandemic on the first day of the FCA BI test case appeal.

-

Australian carrier ups coronavirus BI provision to A$195mn.

-

The regulator also suggests Covid-19 loss assumptions in casualty classes may be over-optimistic.

-

The sanctions will further complicate the delayed construction of the 2,460 km pipeline between Russia and Germany.

-

Justice Grossman ruled that the former AIG CEO could not prove that the defendant “acted with actual malice”.

-

The fundamental issue of causation, as well as trends clauses and the Orient Express judgment, will be under scrutiny.

-

The French mutual and its CEO say they will contest the ruling issued on Tuesday by a Paris court.

-

Separate criminal proceedings brought by the French reinsurer against the mutual and its chief have yet to be heard.

-

Chancellor of the Exchequer Sunak says the government will take a “technical, outcomes-based approach” to the assessments.

-

Amanda Lewis will lead a specialty disruption offering, including contingency, agri-contingency and legal indemnity lines.

-

Wording construction, the use of counterfactuals and the notorious Orient Express ruling will all be under the spotlight.

-

The CEO reports “forward momentum” after recording strong rate and GWP growth.

-

Carriers expect only marginal gains and remain concerned that the UK overhaul will jeopardise equivalence.

-

The regulator found that an initial statement about preference shares was “reasonably capable” of misinterpretation.

-

Legal developments and the growth of litigation funding create challenges for the industry.

-

The outcome of the dispute between Lixil and 20 insurers led by AIG is being seen as a major test of the W&I market.

-

The industry group highlights Swiss, US, Asian and Middle Eastern outreach.

-

New civil case filings in federal court were up 43% as of the end of June.

-

The work always faced obstacles to rapid progression, with the second wave insurmountable.

-

The call for evidence forms part of a five-year review of the pool’s remit.

-

The settlement will have a net impact of less than $36mn on the carrier in the six months to year end.

-

Mini-MDLs will be established for some lawsuits brought against Arch, United Specialty and Society Insurance.

-

The carrier said it did not intervene earlier so that it didn’t “clutter up the procedure”.

-

The case was launched after thousands of businesses attempted to claim on their insurance for Covid-19 related BI.

-

The scheme currently expires at year end.

-

The case started in Sydney today, with the Insurance Council of Australia arguing that the intention of pandemic exclusions in commercial property policies is clear.

-

The scheme’s operational independence was thrown into doubt earlier this year when the mutual was reclassified as a public sector entity.

-

Insurers argue that the judgment shows that downturns prior to the occurrence of the insured peril can be accounted for.

-

The regulator, the Hiscox Action Group and seven carriers will seek leave on Friday to appeal the High Court judgment directly to the Supreme Court.

-

The Bronek Masojada-led carrier says it has yet to decide whether to challenge the High Court ruling.

-

Hiscox Action Group lawyers demand the regulator uses powers to speed up interim payments.

-

Lloyd’s CEO points to the likelihood of a drawn-out dispute in comments on an Airmic panel.

-

A trade body and broker said payouts would be the “ethical approach” to support financially stressed businesses.

-

The regulator anticipates a flood of post-Brexit applications from companies that have availed themselves of the temporary permissions regime.

-

Almost 25% of brokers polled by Liiba opted to set up in Belgium.

-

The proposals would bar carriers from making existing customers pay more than newcomers if they purchase cover through the same channel.

-

The law firm claims the widely used “resilience” wording should respond to government-ordered lockdowns.

-

The regulator orders carriers to consider how they can “progress claims” now, irrespective of an appeals process due to kick off on 2 October.

-

The carrier claims the Paris court decision runs counter to judgments in Toulouse and Bourg-en-Bresse.

-

Financial Services Director General John Berrigan wants to establish a new working group which will report back with proposals in the first quarter.

-

The Swiss carrier says any increase in P&C claims arising from the ruling won’t materially impact its earlier assessment of $750mn in Covid-19 claims.

-

The verdict has been hailed as a victory for the regulator and policyholders but many individual decisions on wordings favour insurers.

-

Lloyd's welcomes the ruling, while the ABI claims it "divides equally" between policyholders and insureds.

-

Reinsurance recoveries and a drop in overall claims will offset the BI loss hike.

-

In a major blow to insurers the court found that the pandemic and the government’s response could be treated as a single cause of loss.

-

The carrier predicts fewer than one third of its 34,000 UK BI policies could be impacted by the judgment.

-

Tomorrow’s decision, including the important precedents it sets, will be appealed.

-

The regulator received more than 1,150 whistleblowing reports and took “significant action” in eight cases.

-

CEO John Neal gave the estimate ahead of the FCA test case judgment next week.

-

The hotly anticipated judgment will be a milestone in the ongoing dispute about how carriers respond to Covid lockdown-related losses.

-

A New South Wales Supreme Court judge gives the go-ahead for the hearing to start on 2 October.

-

Property investor Aubrey Weis accuses the broker of falsifying documents in connection with cover placed with Axa.

-

The beleaguered carrier raises $380mn through the sale of new stock.

-

Parkdean’s legal arguments bear a close resemblance to those in the FCA test case.

-

Policyholders advised by Mishcon club together for an expedited dispute resolution process on Covid-19 claims.

-

The case is being heard on an expedited basis, with policies from Hollard and HDI Global Specialty used as exemplars.

-

The ruling is due in mid-September, but the possibility of an expedited appeal is highly likely.

-

Adam Grossman offers an update and lessons for risk management from the glyphosate, opioid and talc litigations.

-

The cost of straying into “greenwashing” could be very high for businesses that misrepresent their environmental credentials – as well as those who insure them, warns Simon Konsta.

-

The regulator said insurers should work on a case-by-case basis on government support deductions, otherwise it could step in.

-

The establishment of “shared resilience solutions” to BI losses would require unprecedented policy coordination.

-

The law firm representing customer action groups claims brokers discouraged policyholders from lodging Covid-19 claims.

-

FCA BI case hearing closes; Covid crushes carrier results; Convex and Whitespace fundraises.

-

The settlement will be paid in the third quarter.

-

The judges will now consider their verdicts, with an ambition to produce a draft judgement in mid-September.

-

An unspecified superior court will hear the ICA-funded case, with the outcomes used by the Australian financial ombudsman.

-

Director general Huw Evans calls for a "relationship reset" between the watchdog and insurers after the court hearing.

-

The insurer said the regulator was “reverse engineering” to arrive at the conclusions it wanted in the BI test case.

-

Euler Hermes, Coface and Atradius are also participating in the scheme, which has had formal approval from the European Commission.

-

The regulator has argued that businesses that were never required to close during the pandemic still had their access restricted.

-

The (re)insurance supervisor calls for “skin in the game” from all risk owners to reduce the risk of moral hazard arising from any state backstop.

-

The insurer said that the lockdown measures were “unprecedented” and were not covered in policies.

-

Data harnessed from a new litigation tracking product suggests the cruise and care home industry are prime targets.

-

This week the team looks at the final throes of lawsuit activity connected to Irma claims and new entries into the A&H sector.

-

The legacy carrier opens for business after a regulatory rubber stamp.

-

The FCA maintains that losses should be compared to a normal trading environment.

-

The first day of High Court proceedings saw the regulator lay out its arguments on behalf of policyholders.

-

The Irish entity created for Brexit seeks authorisation on the island.

-

The conduct regulator plans to align the deadlines with that for the “fit and proper” assessments.

-

The archipelago has largely escaped the virus but has been subject to all the same lockdown measures.

-

The ACPR edict adds pressure on Scor and Covea.

-

In a joint defence, eight carriers in the High Court case reject FCA’s interpretation of proximate cause.

-

Lloyd’s brush with aviation asphyxia highlights how its elaborate ecosystem, including an extensive use of outsourced suppliers, can make it vulnerable to sanctions clampdowns.

-

The regulator says that the losses were caused by a “jigsaw” of events that should be considered as a whole.

-

The FCA said in its skeleton argument that the government’s instructions amounted to an imposition or order.

-

DXC’s Xchanging backs down from rules that appeared to put the kibosh on any placement that had Cuban or Iranian exposure.

-

Insurers involved in the Financial Conduct Authority (FCA)’s test case for BI disputes have contested the regulator’s assertion that the Covid-19 outbreak was the proximate cause of insureds’ losses.

-

The settlement prevents insurers from pegging claims developed over years of exposure to a reinsurance policy year of their choosing.

-

The regulator says it is reasonable to rely on Imperial and Cambridge models as a form of evidence.

-

The insurance industry's early victory could set a precedent for the many pandemic-related disputes in train.

-

Expert testimony will be needed on vicinity point if FCA opts not to amend its original argument by Friday.

-

Assessments of how closely UK rules mirror those of the bloc look set to remain mired in politics.

-

The latest damaging D&O loss comes as the market hardening continues to accelerate.

-

The campaign group wins the right to intervene in the key BI Covid-19 action.

-

The PRA and the FCA will have to pay heed to the cumulative effect of regulation on business as part of upcoming changes.

-

In robust arguments carriers dispute the causation of losses and the nature of specific wordings.

-

The group claims policyholders are not represented in the regulator’s legal action.

-

The dispute stems from a massive oil spill when the Bahamas-registered vessel sank in 2002.

-

The Irish central bank finds Rory O'Connor "knowingly and actively" under-reserved and gave false information to the supervisor.

-

The value of accounting adjustments made by Ronald Pipoly are said to have exceeded $300mn by the end of 2015.

-

Charles Russell Speechlys is advising is the customers of various UK insurers.

-

The claims resolution firm suggested Herbert Smith Freehills may have worked on some of the policy wordings under scrutiny in the High Court test case.

-

The Corporation looks set to complete the mammoth transaction comfortably within the transition period.

-

China’s one-time top insurance supervisor was sentenced for accepting bribes.

-

Carriers must “stop the clock” on claim time limits from today until the court outcome.

-

Far Horizons Capital is also suing JP Morgan for misrepresenting the reinsurer’s prospects when it was founded.

-

The regulator’s interim chief says 90 percent of cover is for basic property damage.

-

Allianz, Chubb and WRB are among the carriers that oppose the centralisation of BI claims.

-

The industry must address the legacy of “redlining”, the executive says.

-

The action opens up a new front in the war between disgruntled BI policy holders and carriers.

-

Law firm Mishcon de Reya also targets additional compensation due to pay-out “delays”.

-

Argo has consented to a cease-and-desist order and will pay a $900,000 civil penalty.

-

A bill circulating in Congress would make the industry retain the first $250mn of pandemic risk, a proposal that has split industry opinion.

-

A presidential ambition to designate Antifa as a terrorist organisation faces hurdles.

-

Campaigners say ‘Totus Re’ model based on pools for terror and flood could close protection gap.

-

CEO Buberl says the carrier has struck deals with 200 customers but will appeal a ruling about a Parisian restaurant payout.

-

In court documents, the defence company says Aon failed to provide sufficient claims notification advice.

-

The litigants warn the regulator’s case could delay a final decision by months.

-

The regulator sets out the process agreed with eight insurers.

-

The late July High Court hearing will also involve Arch, Argenta and QBE.

-

The insurer wrote an excess casualty policy for the ride-share company in 2014.

-

Early offers of recompense spark customer demands for phone records.

-

Iconic billboards will go blank briefly at 21:00 on Wednesday to focus on the issue of coronavirus-related insurance claims.

-

The measure is supported by over 30 companies and trade organisations from across different sectors.

-

At least 20 states in the US have so far moved to limit the liability of care home operators.

-

The Financial Conduct Authority began seeking submissions from intermediaries last week.

-

Generali, SIAT, Swiss Re, India International and PICC argued that the policies had an exclusive English jurisdiction clause.

-

Claims were initially feared to soar as high as $34bn, according to a state regulatory agency.

-

Following a recent court ruling ordering the payment of BI losses for a restaurateur, Axa will now pay others with similar wordings.

-

Law firm Edwin Coe rallies more policyholders seeking claims for BI losses.

-

The carrier will have to compensate a Parisian restaurateur for two months’ lost earnings.

-

The lawsuit builds on prior findings by the state’s Supreme Court that coronavirus is a natural disaster.

-

Company management is prepared to lose local court battles but believes it will win appeals, analyst Larry Greenberg noted.

-

The broker is accused of failing to disclose material financial information about the deal.

-

Daiichi secures an anti-suit injunction against the insurer regarding a claim for damage to cargo of iron ore in 2014.

-

The decision comes after a review of more than 500 policies by law firm Mishcon de Reya.

-

The latest version of Congresswoman Maloney’s bill would increase the scheme’s ceiling by $250mn.

-

Senator Ward told this publication the amended legislation would protect both carriers and policyholders.

-

The economic damage wrought by Covid-19 may dull considerations of fairness and the sanctity of contracts.

-

The policyholders’ law firm may draw on the Enterprise Act to seek redress for the late payment of claims.

-

Ifeanyi Okoh had filed a complaint against the firm alleging harassment and discrimination.

-

Hiscox policyholders’ law firm Mishcon de Reya urges insureds to continue to pursue their own claims.

-

The regulator is to enforce measures to help customers in financial distress from 18 May.

-

Insurers say the policy at issue has a $15mn sub-limit for windstorm damage.

-

The multi-billion pound plan would make the state an insurer of last resort, and ensure coverage is maintained during the Covid-19 pandemic.

-

The Judicial Panel on Multidistrict Litigation will determine whether federal BI lawsuits should be consolidated.

-

The executive says carriers have not underwritten or priced for statutory developments.

-

The project is one of a number of initiatives stalled or postponed because of Covid-19 pressures.

-

The Financial Ombudsman works within parameters that pay limited heed to legal contracts. ‘Fairness’ versus the law in Covid-19 BI disputes

-

The “pragmatic" move is contingent on the gastronomy companies involved agreeing to exclusions on existing policies.

-

The amendment would have forced insurers to cover claims, even where cover does not exist.

-

The potential reduction in care requirements for disabled people could lead to legal challenges.

-

The proposed legislation would mandate the payment of claims for businesses with fewer than 100 employees.

-

The Hiscox Action Group and the Night Time Industries Association says the 500 policyholders have BI cover worth up to £100,000 each.

-

The bill has bipartisan support but is expected to be subjected to substantial committee scrutiny.

-

The Simon Wiesenthal Center teams with a litigant group established by four high-profile American chefs.

-

The ABI welcomes the move, which comes as disputes over liability for pandemic-related losses at UK SMEs mushroom.

-

The petition to the UK Chancellor of the Exchequer comes as insurers and clients continue to dispute coronavirus BI pay-outs.

-

The Hospitality Insurance Group Action is the latest collection of firms to fight against denied claims.

-

If lawyers can establish enough facts to support the case then Harbour will provide the backing to take it to court.

-

The trade association is pushing back against the forward-looking legislation.

-

The carrier underwrites the policy on behalf of Gallagher and has around 2,000 customers.

-

The discussions may ease industry fears of cavalier rulings by case handlers in favour of complainants.

-

Albert Benchimol says the job of insurers is to mutualise risk, not subsidise it.

-

The group has attracted more than 200 policyholders in dispute over BI cover.

-

The country’s finance ministry says a working group will examine the issue.

-

A New York judge dismissed a class action by investors, closing a long running legal chapter for the Stone Point Capital-owned company.

-

The Night Time Industries Association becomes the third business group to fight the carrier over denied claims.

-

Laws to nullify exclusions on BI cover would “destroy” the insurance industry, the Starr CEO said.

-

The new compensation system will begin next April instead of August.

-

The state department of insurance said it has received complaints from policyholders about changes to coverage.

-

The insurer files a counterclaim insisting the law firm’s policies do not cover its Covid-19 BI claims.

-

Small businesses from the hospitality sector sued the insurers in six states.

-

The action emanates from a declined BI claim for losses at 37 pubs and restaurants.

-

Process servers showed up at some employees’ homes on Thursday evening to deliver documents, according to sources.

-

Felipe Moncaleano Botero is one of three men named in a criminal complaint.

-

The Chubb CEO calls on Congress to shield corporate America from Covid-19-related litigation as the US begins to re-open.

-

The Hartford, CNA, Arch and The Hanover all dropped more than 6 percent on Wednesday, performing worse than the broader market.

-

The state regulator wants insurers to work with their customers as risk exposures change.

-

CEO Bruce Hepburn said insurers should have “feet held to fire” over claims payment.

-

The carrier notes that only 10,000 of UK SME clients with BI cover have been hit by the Covid-19 lockdown.

-

The start-up has filed a countersuit against the brokerage giant after it accused founders of trade secrets misappropriation.

-

The groups sent a letter of opposition yesterday to the California congressman.

-

The move comes after Republican lawmakers asked President Trump to intervene on the industry’s behalf.

-

Multiple broking sources believe the breadth of the Hiscox wording means all BI claims are covered.

-

The dispute centres on wordings around non-damage denial of access and public authority shutdown mandates.

-

Mandating carrier payouts for uncovered claims would undermine contract law and jeopardise the sector’s solvency, the lawmakers warn.

-

The comments come as AM Best earlier today warned over the impact of regulatory creep on BI claims.

-

The ratings agency discussed impacts from the pandemic and noted that it is still awaiting responses to a “stress test” questionnaire.

-

Montemayor also sits on the board of the insurance-focused private equity fund Black Diamond.

-

SCGM says that the policy provides coverage because Covid-19 is a variant of SARS.

-

The conduct regulator will review data collection and authorisation processes, assuming Covid-19 work allows it the time.

-

The state has joined New York, Ohio and Massachusetts in considering the bill.

-

Prime Time Sports Grill says its insurance claim was denied on 23 March.

-

Trade credit sources welcomed plans for backstops but warned of reduced premium levels.

-

The agency also asked carriers to be conservative on executive pay as the Covid-19 crisis continues.

-

The order also forbids insurers operating in the state from charging fees for late payment.

-

The entities allege that Wisconsin-based Society Insurance should provide coverage for "necessary suspension" of business.

-

Under the plans, insurers would nominate themselves to help distribute aid.

-

The trade association urges talks on a tie-up between the government and the insurance industry.

-

The Ohio and Massachusetts proposals come as the APCIA estimates small business losses due to Covid-19 at up to $383bn a month.

-

The bill will provide $350mn in loans for small businesses hit by the crisis.

-

Mel Stride warns that insureds want “flexibility and assurance” from their carriers.

-

The regulatory leeway gives companies until six months of their year ends to publish accounts.

-

The Chickasaw and Choctaw nations say they their properties sustained direct physical loss, meriting coverage.

-

Eiopa has extended reporting deadlines for insurers.

-

The case is likely the first over alleged misrepresentations to investors about the virus.

-

The Dubai-based carrier will target surplus specialty lines including energy, property and political violence.

-

The government will examine the interplay of watchdogs with politicians in the next phrase of its financial services framework review.

-

The broking giant is seeking compensation of at least $200mn, according to Reuters.

-

A further one-year delay to the new accounting framework would mark a victory for industry groups.

-

The law would make it harder for attorneys to use contingency risk multiplier fees.

-

Investors filed the proposed securities class action last March following the delisting of $1.2bn in preferred shares.

-

Insurers have since April 2018 been expected to have a board diversity policy.

-

Incumbent Joe Gunset will take an advisory role at McGlinchey Stafford after leaving the Corporation at the end of March.

-

-

Bruce Lucas said the decline was “pretty material”.

-

The deal boosts Fema’s total reinsurance cover to $2.53bn.

-

The resort’s owner said it had settled its dispute with XL, Lloyd’s underwriters and US Fire over a Hurricane Irma claim.

-

Ricardo Lara is accused of withholding information concerning his meetings with industry executives.

-

The carriers claim in a lawsuit that Maiden wrongfully stopped paying claims in late 2018.

-

In an unrelated incident, another Erie employee was dismissed over criminal charges involving invasion of privacy.

-

Current rules allow lawyers in some insurance cases to collect up to 30 times what an insured is awarded for a claim.

-

At 11pm local time the UK will leave the EU.

-

IGI will become a listed carrier on completion of the deal.

-

Barclays fails in a High Court bid to get legal action against it postponed.