Operations/tech

-

Jennings will reunite with Cameron-Williams, who he worked with at BDO.

-

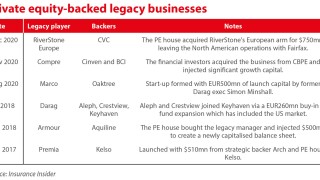

Carriers are rethinking the traditional renewal-rights model.

-

The specialty insurer was recently acquired by Korean carrier DB Insurance.

-

Panellists at Insider Progress shared fixes for bias, confidence and culture.

-

The newly united company has set out ambitions to double in size by 2030.

-

Sources said Marsh Specialty UK growth leader Lizzy Howe will lead the operation.

-

Susan Langley will look to strengthen global business ties and promote UK growth.

-

The executive has been with ASG since it was formed in 2016.

-

Aon’s Enrico Vanin will lead the platform as CEO.

-

This will be Fidelis’ first office in North America and will be led by former Navigators Re head Ivan Vega.

-

The market turn may give some staff pause for thought, but reward remains high.

-

Part four looks at how the talent landscape will shift in response to AI introduction.

-

Organisations were challenged to address systemic DEI failure rather than play “word salad” with labels.

-

This will be the 15th cohort of companies to go through the Lloyd’s Lab.

-

There are concerns that repeated delays could lead to market disengagement with the process.

-

The syndicate will be targeting approximately $50mn of GWP in its first year.

-

Being conservative and stable is the name of the reinsurer’s game.

-

The insurer’s plans for the syndicate were revealed by this publication earlier this year.

-

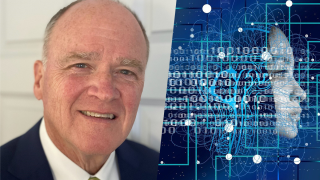

The former Hannover Re CEO said reinsurers must use alternative capital and tech.

-

Anticipation, motivation and inspiration are central to effective implementation.

-

Paul Campbell details how the most profitable insurers act during a soft versus hard market.

-

It is understood that CyberCube has been considering a sale of the business.

-

Lloyd’s will keep heritage systems operationally resilient until at least 2030.

-

The LPPC will offer limits of $127.5mn EAR and DSU coverage in the US and Canada.

-

Plus, the latest people moves and all the top news of the week.

-

A notable uptick in attendance underpins the value still placed on the iconic trading centre.

-

Plus, the latest people moves and all the top news of the week.

-

The update will enable structured data capture early in the placing process.

-

Claude Wade is to step down from his role to address ongoing health issues.

-

Part III of our series looks at where AI is being integrated into underwriting departments.

-

Signature of the exit plan is needed for cutover in 2026.

-

Plus, the latest people moves and all the top news of the week.

-

Stephane Flaquet replaces George Marcotte, who has been interim COO since September 2024.

-

The LMA head also praised Velonetic for transparency on Blueprint 2.

-

CEO David Howden accused rivals of “restricting choice for their own clients”.

-

Plus, the latest people moves and all the top news of the week.

-

A majority of staff not offered jobs at Ryan Re will remain at Markel to manage the run-off.

-

In part II of our series, we look at where AI is being integrated into claims departments.

-

The UK carrier will write business that falls in the scope of the FSCS.

-

Surveys show diversity and inclusivity foster a sense of belonging and increase productivity.

-

Plus, the latest people moves and all the top news of the week.

-

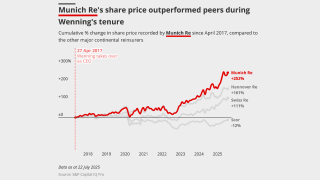

Improved book value, a healthy CoR and disciplined underwriting mark the CEO’s time at the helm.

-

Lloyd’s has confirmed the departure of two senior leaders.

-

A look into how the insurance industry is using AI and where practical gains are arising.

-

Plus, the latest people moves and all the top news of the week.

-

The technology will help analyse growing and emerging risks, especially climate change.

-

Claims chiefs are caught between technological advancement and waiting for phase two

-

A representative from the carrier said Nexus is responding “with urgency”.

-

The MGA is expected to launch a product-recall portfolio in September.

-

Claire Janaway is leaving the carrier after 19 years.

-

The insurer has hired Coface’s Hélène Martin to support its expansion.

-

Volante joins capacity providers Allianz and Tokio Marine Kiln.

-

The executive previously held roles at Capgemini, The Hartford and AIG.

-

Gallagher, Marsh and Aon also faced sizeable outstanding premium payments as at Q4 2024.

-

The new chair said the market must adapt for 2030 and beyond.

-

Lloyd’s executives have suggested ceded reinsurance syndicates could help London compete in treaty.

-

The business currently works with Hamilton Managing Agency.

-

Green hushing is on the rise as Trump rows back on climate initiatives.

-

The awards will be held on 3 September at The Brewery in London.

-

MillerBoost is the latest broker facility to launch in London.

-

The platform will capture and standardise data from all submissions, the broker said.

-

The carrier’s president Andrew McMellin is aiming to double London market share in the next five years.

-

The carrier said the cuts will help it to become a “simpler, digital-led business”.

-

The protection gap is calling into question the relevance of the insurance industry.

-

The deal marks SFMI’s third investment in the group since 2019.

-

Case added that recently acquired broker NFP has “exceeded” expectations.

-

Future claims handlers could be "bionic adjusters” empowered by technology.

-

Ed Short was previously VP, digital partners, at Arch.

-

Corporates buying Lloyd’s syndicates face the culture/integration trade-off.

-

The campaign will run throughout June.

-

Analysts were interested in the potential for fee income from the retail division.

-

The executive set out his vision for the Corporation after assuming leadership.

-

The outgoing CEO said the market had been restored as a leader during his tenure.

-

Frustration is growing around a promised independent operating model and staff reward.

-

Eckert said the reinsurance market is still at historically well priced levels.

-

The Corporation is poised to accelerate its investments in start-ups.

-

The Lord Mayor told the CRO Summit to stop treating risk as a dirty word.

-

The programme will succeed the previous buyback launched in 2023.

-

The platform could help reduce claims-cash holding times by 10 weeks.

-

The exec said if he were a carrier CEO, now is the time he would start looking for deals.

-

The executive said secular heightened risk trends would fuel the carrier’s primary expansion.

-

The group said corporations face geopolitical and climate risk.

-

The executive previously worked at Hiscox and Aviva.

-

Pushing through technological change and maintaining underwriting results are top of agenda.

-

The executive was head of fine art and specie at Miller until February 2025.

-

At his last annual meeting as CEO, Buffett highlighted the importance of Berkshire’s insurance operations.

-

The Nordic operations have capacity provided by Allianz Commercial.

-

Lloyd’s chair Bruce Carnegie-Brown officially hands over to Charles Roxburgh today.

-

Christian Kitchen had been at Travelers since October 2022.

-

Full Vanguard testing is expected to compete by the end of the year.

-

The executive joins from the London Stock Exchange.

-

Risk managers at last week’s Axco summit said interconnected global risks require flexibility.

-

The California wildfires were the only “relevant event” for the period, the carrier said.

-

The business will divide into US wholesale and specialty, and programmes and solutions.

-

Fridays in the office will be the toughest nut to crack.

-

Due diligence is essential to make sure incubators are backing winners.

-

Langley said the London market could benefit from boosting its image at home and abroad.

-

Plus, the latest people moves and all the top news of the week.

-

Technological delays erode credibility, but the market remains strong.

-

CEOs have been told to stand down resources as wider testing won’t start until October.

-

Insurer appetite for facilities is not just about top line, it is also a hedge against disruption.

-

In the first part of this series, we explore how smart-followers are mixing up their strategies.

-

The broker said that businesses not investing in AI capabilities would be left behind.

-

The executive said the market would be updated on progress in late April.

-

The product supports investors of early-stage carbon removal projects.

-

The business offers parametric windstorm coverage.

-

He also joined Everest’s board last week as an independent director.

-

The launch is part of MSI’s strategy to expand the capacity of its UK subsidiaries.

-

The product provides primary and excess coverage limits up to £5mn.

-

Navigating its path to global specialty growth will require operational dexterity.

-

The executive said the firm had to focus time and investment on the most meaningful projects.

-

-

The group will house a segment for specialty and benefits and another for underwriting.

-

The insurer has participated on McGill and Price Forbes facilities, as well as Amwins.

-

The executive said the company’s expanding capacity base would make it “more like a marketplace”.

-

James Shea will lead the new Sompo P&C arm, while Yasuhiro Oba will become Wellbeing CEO.

-

The organisation has released its mission for 2025 and signed a MoU with the ABI.

-

Contour Underwriting is a specialty lines MGA.

-

The business will prioritise growth in the life segment.

-

The board intends to issue a dividend of EUR2.70 per share.

-

Conclusions on possible options will be shared at the end of Q1.

-

The agency cited the group’s increased earnings diversification and improved resilience.

-

The company has simplified its structure following the retirement of Richard Webb.

-

The carrier’s US platform will continue to be led by long-time executive Sal Pollaro.

-

Capacity will be available to 11 open-market lines of business.

-

A combination of mandated days and soft pressure is driving up EC3 attendance.

-

The broker also plans to hire from LSN Re and Aon Re, as part of a build-out of its team in the French capital.

-

The flagship project to digitise the market has been beset by delays and mounting costs.

-

Carriers rushing headlong into gen AI without considering its ESG implications could face costly complications down the road.

-

In part two of our 2025 outlook, we explore the drivers of carrier M&A and recreating the ESG agenda.

-

Certain new and old themes will re-emerge this year as the balance of power shifts.

-

The reinsurer is buying out China Minsheng affiliate at year-end.

-

A recent drive for additional brokerage underscores the shift towards a softer market.

-

The company has added new product and revenue offices.

-

The carrier said its P&C and L&H reserves have been confirmed by independent reviewers.

-

In October, this publication revealed that the carrier had resumed IPO preparations.

-

First-quartile 2023 performers will contract capacity by 5% in aggregate next year, according to our survey analysis.

-

Lower inflation and a softer market outlook tempered aggregate growth expectations.

-

The broker has placed Rethink staff under consultation, sources said.

-

Surging capacity suggests broker facilities are now refined enough to be a long-term feature.

-

Marine and energy were the busiest lines, driven by high competition for talent.

-

The broker facility is led by Beazley’s Smart Tracker Syndicate.

-

The broker will track and rank carriers’ response times.

-

-

The market’s dearth of third-party managing agents is a source of tension among young syndicates.

-

CEO Mario Greco said his future retirement had nothing to do with bringing the plan forward.

-

The company is on track to exceed its targets for 2023-25 one year ahead of schedule.

-

The broker will be using Verisk US agricultural risk models.

-

Greco will likely remain in place in the medium-term, which could mean major M&A and a Lloyd’s platform.

-

The international segment’s net written premium grew 15.8%.

-

In a decade this market could grow from $5bn to $60bn.

-

Parent MS&AD highlighted “strong underwriting fundamentals”.

-

A new report put enhanced underwriting at 7% of Lloyd’s GWP with potential for fast growth.

-

CEO Stef Raftopoulos said the company platform will let the operation reach a suitable scale.

-

The number of Corporation roles potentially impacted remains unknown.

-

Good leaders and embracing data are key, panellists said.

-

Innovation is moving too slowly, experts said at Insurance Insider’s London Market Conference.

-

Insurers should reform underlying data before using AI, according to experts.

-

Growth vs discipline, smart follow and M&A mean 2025 will be a mixed bag for London.

-

The business’s total stamp for both syndicates has hit £1bn for 2025.

-

It is understood the increase is mainly due to a new professional lines team.

-

The QIC-owned carrier has completed extensive remediation in the past two years.

-

The cyber solution is backed by Mosaic, Chubb and Liberty Specialty Markets.

-

-

Over the period, the Spanish carrier’s reinsurance segment expanded profit by almost 10% year on year.

-

CEO of WTW’s Corporate Risk and Broking for North America, discusses the transformation in operations, diversity, and talent strategy.

-

The new proposition will offer £10mn primary cover and £15mn limit for XoL.

-

MIC Global will become Lloyd’s coverholder of Greenlight Re’s Syndicate 3456 for 2025

-

Lloyd’s is to take a 75% stake in PPL Technologies Group.

-

BP Marsh has taken a 25.5% stake in the energy-transition business.

-

The Madrid branch will look to begin underwriting primary specialty insurance in 2025.

-

Increased interest follows ratings agency upgrades of Lloyd’s paper.

-

The market organisation has commissioned Oxbow Partners to discuss implications of the burgeoning segment.

-

Better performance data and clarity around entry are key, report says.

-

The partnership aims to increase investment in developing countries.

-

The process will run until the end of the year.

-

Company market premium grew 10% over 2023, a report finds.

-

The executive worked with Artificial Labs on Chaucer’s underwriting platform.

-

The consultation includes methods for tackling bullying and harassment.

-

Smart-follow is creating a third tier of provider – the “lead follower” – but broader efficiencies must be achieved.

-

The move is the latest phase of the carrier's operational transformation programme, AIG Next.

-

The platform hopes to confirm significant partnerships in the near future.

-

-

The CEO said the broker can now hold its own “with any client, anywhere”.

-

Reinsurers continued to diversify into primary and specialty business.

-

The unit will support Ascot’s third-party capital business.

-

The Blueprint Two build is due to be completed in January 2025.

-

-

Insuring the transition is frequently touted as a major growth opportunity, but when it comes to renewable energy, complications abound. Natural catastrophe, evolving technology, and data scarcity all add to the complexity of underwriting in the class. GCube's Fraser McLachlan has been operating in the renewables sector over several market cycles, and gives his insight on the latest dynamics in the class.

-

Market-wide testing is not expected to start until late Q4 this year or Q1 2025.

-

Insurance COOs predict API and Gen AI most likely to deliver future transformation.

-

Syndicate 5757 will target US programme business.

-

Sources also named Mark Cloutier as a long-shot potential candidate for the position.

-

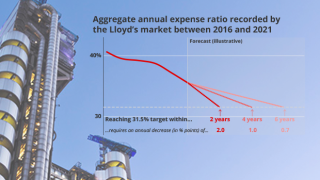

Resulting lowered expenses could feed into Lloyd’s ambitions of building a £100bn premium market.

-

The operation will be led by Stephen Saunders, with Jawad Ghunaim from AIG as CUO.

-

Two-thirds of insurance firms have been challenged about their resilience plans by the regulator.

-

Analysis of directors’ ages shows a shortage when it comes to the next generation of leaders.

-

The move comes after the group delayed a strategic process until 2025.

-

The Oxbow report found that AI use cases span the entire (re)insurance capability model.

-

Syndicate 3123’s opening is “the largest-ever launch of a Names-sponsored syndicate in Lloyd’s”.

-

The model uses machine learning and daily data to forecast hurricane seasons.

-

A new cutover date will only be decided once key activities are completed or near completion.

-

The company will now focus on its better-positioned businesses.

-

With topco liquidation looming, there are questions for R&Q and the wider market.

-

The Cut-over Review Committee will review the readiness of the London market.

-

Self-insurance has taken $25bn more premium out of the market than five years ago.

-

Latin America and the Caribbean accounted for 4.6% of GWP for Lloyd's in 2023.

-

Initial testing ahead of the switch to a cloud-based system is around a month behind.

-

The track record of smart-follow vehicles is still young, but the segment is gaining traction.

-

The shares are being sold by select shareholders in the group.

-

Proposals will be put to the Lloyd’s Council over the coming weeks to take effect from 2025.

-

Current Bermuda CEO Chris Bonard will become president of the unit.

-

The insurer said its Lloyd’s presence underscores its London market commitment.

-

Digital Follow will be launched in the second half of the year.

-

Lloyd’s and Velonetic are still exploring three options for the latter stages of cutover.

-

Some firms are outsourcing their recruitment to tailor for a younger generation.

-

We explore the first stages of incorporation of GenAI into insurance, alongside the longer-term potential.

-

-

The partnership will add more capacity on the platform from April.

-

AI was the hot topic throughout the InsurTech Insights event.

-

The injection will be sufficient to take the platform through its next stage of major development.

-

The start of phase one is now slated for October at the earliest, not 1 July.

-

-

Computable binding authority agreement set for April 2025 launch.

-

Sources believe Lloyd’s may be veering away from central DA systems.

-

The syndicate-in-a-box will target £34.1mn in gross premium for 2024.

-

As the interim CEO prepares to hand on the role, a major restructure is ahead.

-

Impressive results in 2023 will mean big payouts.

-

Brokers face pressure on margins as the market’s firming phase slows

-

Velonetic said the transition would not go ahead if questions over readiness remained.

-

Plus all the latest executive moves and the top news of the week.

-

Pravina Ladva, Swiss Re's group CDTO, sets out experiments the carrier is conducting with generative AI.

-

CEO John Neal has ambitions to pull in more major insurers, E&S players and captives.

-

The broker has used Whitespace since 2019.

-

The company will use MS Amlin to drive international growth.

-

The new licence expands the carrier's P&C capabilities in Europe.

-

Trading on a data-first approach marks a 'new era of innovation', execs said.

-

Price Forbes will become the dominant brand, while international CEO Ferguson will exit the business.

-

Asta-managed Syndicate 1966 will target £75mn GWP for 2024.

-

Changing work practices do not overshadow basic precepts of good employment.

-

The transaction will reduce the firm’s reliance on private debt deals.

-

The broking group aims to release cash and facilities for investment.

-

Putting together two “show me” stories risks investor skepticism.

-

The association will also deliver work around binding authorities as well as engaging with regulators.

-

The company has improved performance and brought in new top management – but its direction under Covéa remains to be seen.

-

The syndicate is expected to complete an RITC process by late 2025.

-

Insurance competition remains vibrant in some of the segments that remain most exposed to persistent risks highlighted by the flagship World Economic Forum report.

-

The platform is adding a contract builder component that would smooth adoption of the new MRC v3 contract.

-

Business will continue as usual, with the PlacingHub platform still expected to go live in January, the technology firm said.

-

The Corporation plans energy efficiency measures and refurbishment of the upper galleries.

-

Any firms that struggle to communicate on the new platform will be charged “translation fees” in the long term.

-

The delayed introduction of phase two changes was at the request of the LMA, to allow more time for phase one implementation.

-

The follow-only algorithmic syndicate has stamp capacity of $925mn for next year.

-

The sectors could see many job roles automated as technology advances.

-

The programme services carrier will serve UK MGAs from 1 January.

-

Delegates at our annual London Market Conference (LMC) described the market as “transforming” and “exciting”.

-

London’s insurance market is booming in some ways yet still has multiple challenges to address.

-

From 16 December, Next Gen will be the only platform available to quote, bind and endorse risks.

-

The new contract will include annual rent increases of 3%-5%.

-

The scheme will begin with support for transport risks before broadening to other lines.

-

The scale of the Cat 221 flood event, as well as labour and materials shortages, contributed to its impact, the ICA said.

-

The 3x3 plan takes the things about the firm over the last decade that have been distinctive and intensifies them.

-

The broker’s share price fell by around 4% after the announcement of its Q3 results and extended restructuring program.

-

The not-for-profit placement platform generated a surplus after tax of £1.48mn for 2022, a substantial drop from an £8.83mn surplus in 2021.

-

Two studies have found that, while almost a third of back-up attempts fail to restore system data after a ransomware attack, cybercriminals are refining their methods.

-

The reinsurer said carriers could face challenges around underwriting profits and solvency levels.

-

The firm announced plans in May to decommission the original PPL v3 platform by the end of 2023.

-

The panel discussed issues around AI including its deployment, ethical concerns, bias minimisation, decision-making and the role of leadership.

-

The 2023 Travelers Risk Index has put concern over cyber threats among the top three worries for small, medium-sized and large businesses for the ninth straight year.

-

Lloyd's has set out what London market firms will need to do to transition from decades-old systems to new central services in July next year, in a crucial step of several modernisation milestones to come in 2024.

-

PPL has confirmed a previously announced deadline that London firms must switch over to its Next Gen placement by 1 October.

-

CFO Jan Wicke called the move a "positive step for our stock’s future performance" in laying the foundations for future liquidity.

-

The executive will drive the carrier’s new change programme, ‘How We Work’.

-

The two-month refurbishment project included a reallocation of ground floor box space and IT upgrades.

-

A Reverse Mentoring programme from the people behind the Dive In festival aims to give new generations in insurance a chance to ensure their voices are heard.

-

The reinsurer has announced a detailed plan to diversify its P&C reinsurance book as part of a new strategic plan.

-

A webinar and report from the Geneva Association has explored the barriers and prospects for the growth of blockchain insurance.

-

Carriers benefited from improved rate adequacy and the impact of interest rate rises on investment returns.

-

Aurora plans to add cyber, property and BI, professional indemnity and other business lines to its algorithmic trading proposition in the coming months.

-

After Apollo announced a collaboration marking the latest milestone for algorithmic underwriting-led follow capacity in the London market, Insurance Insider explores how such partnerships can proliferate.

-

The collaboration will involve the algorithmic underwriting of risks with a human in the loop for decision verification and portfolio steering.

-

PPL said release 2.0 of the Next Gen placing platform contains more than 100 changes including a new quote functionality.

-

The auctions will take place in October-November this year.

-

PPL is managing a market migration from the v3 platform, which is being phased out for new placements by October 1, to Next Gen.

-

PPL has set out how it is resolving various functionality problems raised by sources to Insurance Insider.

-

Gallagher Re's latest Global InsurTech report has shown that Q2 funding dropped below $1bn to the lowest quarterly investment level in three years.

-

Issues with faked letters of credit are not limited to one banking provider, sources said.

-

This publication examined how London market firms are managing post-Covid-19 working practices and found a reluctance to impose mandated office days, but increasing soft pressure to return to the City.

-

The Data Council has allocated roles for London market firms around data assembly and approval for open-market placement and endorsements that will underpin the Lloyd's modernisation programme.

-

WTW exploring reinsurance exec recruitment comes at a time of competitive tension in the market.

-

-

Letters from PPL's legal representatives had been issued to Ebix Europe, over the timing for the launch of Ebix Europe's new PlacingHub platform.

-

The firm said it will use the results of an analysis being conducted by experienced investigators to "take appropriate measures”.

-

Over half of respondents said that the technology currently available to them is not allowing them to make the most of the data at hand or make better pricing and portfolio decisions.

-

The firm said it had identified two specific transactions in which “collateral inconsistencies” were in question.

-

A study by digital payments platform Diesta has unearthed time lags for insurers to receive premiums, as well as frictional costs created by inefficient premium processing.

-

The Corporation has had to navigate challenging trade-offs around its succession planning.

-

Over 90% of carriers and 40 brokers are using the electronic trading platform.

-

While Blueprint Two was expected to move the market to a data-first approach, firms have different views on when the industry will reach this new destination and rid itself of document-led processes.

-

The Corporation has also created separate codes for pandemic event cancellation and active assailant risk, among others.

-

The platform will connect MGAs with capacity from a wide range of providers.

-

The broker, led by Ed Gaze, who previously ran the Lloyd's Lab, helps develop and launch InsurTechs based in the UK and globally.

-

Miller is now using Whitespace for casualty business in a move to leverage the e-trading platform's data-capture functionality.

-

Lloyd's said early adopters could be operating in a fully digital framework by September 2024, with market testing set to accelerate this year with a vanguard group.

-

In this second of a two-part analysis on the proliferation of ChatGPT and similar generative AI tools, Insurance Insider explores the risks inherent in using them.

-

Amid a wide spectrum of views on the proliferation of ChatGPT in insurance, this first of a two-part analysis explores the use cases of automation, data extraction, fraud detection and more.

-

Verisk said the deal will expand its data and technology solutions for straight-through processing and distribution to a growing market of SME brokers, coverholders and MGAs.

-

Guy Carpenter was the sole placing broker sourcing capacity for the tie-up.

-

Joe Gordon also reiterated plans to switch off PPL’s older Ebix Europe platform later this year, claiming some participants see friction with brokers “when it’s not there”.

-

The integration launched by Eigen Technologies, a provider of AI-driven document processing and data extraction services, marks another advance of large language-model technology in the London market.

-

Egan will receive an annual base salary of $1.1mn and an annual target bonus equal to 140% of his salary.

-

Artificial Labs is developing a pilot with several carriers and brokers that integrates a generative AI model, including the use of ChatGPT, into its algorithmic underwriting platform.

-

PPL has avoided having to renew with Ebix Europe again for 2024 – a move that would have cost the placement platform around £8mn-£10mn.

-

The Corporation appointed two barristers to examine the behaviour of five employees within the underwriting directorate.

-

The go-live has started with more than 450 colleagues in Aon UK’s commercial risk teams covering marine financial and professional services, natural resources and construction.

-

The technology company has completed a major step in moving London market systems to the cloud, in a project that lays some of the groundwork for the Blueprint Two reforms.

-

The group’s recent gear shift on growth has elevated the group’s risk profile across areas including M&A, financing, integration and liquidity.

-

PPL is looking to enhance its capabilities around generating a CDR in a pilot that could also demonstrate how a CDR validation process could work for many firms under the Lloyd’s Blueprint Two programme.

-

The broker described Neuron as an end-to-end trading solution that connects multiple broker and insurer systems together, enabling risks to flow at scale and with common data standards.

-

Nick Williams-Walker, COO of Gallagher’s Specialty division, will chair the group as it looks to advance the market’s adoption of foundational elements of the Lloyd’s Blueprint Two programme.

-

Insurance Insider analysis shows which managing agents stand to gain – or lose – the most ground floor space.

-

The insurer is progressing talks to establish a partnership to combine Artificial Labs’ algorithmic trading capabilities with Apollo’s underwriting expertise within Lloyd’s.

-

Capitola operates as a digital market that connects brokers with carriers using AI for risk-appetite matching.

-

Apollo plans to deploy meaningful lead capacity through the consortium which will be led by Syndicate 1971, as revealed by Insurance Insider.

-

The facility would largely involve Lloyd’s companies but Apollo confirmed it could potentially include London company market firms on a reinsurance or sidecar basis.

-

The wholesaler had already paid out a cumulative $2.1bn of dividends to investors since 2018.

-

The Next Gen platform has opened to placements for the entire market after four weeks of limited access, as firms completed training on the new solution.

-

Brokers must begin producing MRC v3 compliant contracts by 30 September.

-

The London-listed carrier has made several changes to its remuneration policy.

-

CEO John Neal and CFO Burkhard Keese retained their salary levels from 2021 during 2022, though their performance bonuses increased significantly, as Lloyd’s made one-off payments to staff to reflect cost-of-living pressures.

-

The Canadian pension fund will retain 9.4% of the carrier’s voting shares.

-

Lloyd’s has confirmed a combined ratio of 91.9% in its full-year results for 2022, following preliminary numbers that also showed an improvement in the attritional loss ratio to 48.4%.

-

Ground floor boxes are set to be reallocated based on recent footfall.

-

Analysts find carriers have few investments in bank debt after Credit Suisse rescue.

-

The French carrier is exposed to the troubled bank via various bonds.

-

With chairman Bruce Carnegie-Brown’s third term expiring in June 2025, the organisation needs to start laying the ground for broader changes.

-

Pay for NEDs has increased by 70% since 2018 due to inflation and more contracted days, according to research.

-

In the Spring Budget, chancellor Jeremy Hunt said he would also look to help the AI sector prosper in the next decade.

-

Market transformation director Bob James has been given a broader remit as COO at Lloyd’s, while deputy CFO Alex Cliff has joined the executive committee.

-

The collapse of Silicon Valley Bank is creating investor fear across the global financial services sector.

-

CEO Adrian Cox and CFO Sally Lake are set to lose more than £100k each in long-term share awards after the accounting error.

-

With brokers shifting to new providers to place certain classes, and competition among e-trading firms intensifying, the placement platform landscape has reached a crucial turning point.

-

Argo’s first bids included an implied firm value of $49.71 per Argo common share and $40 per share in cash, among others.

-

The launch date for PPL’s Next Gen platform was pushed back as the team fixed final defects.

-

At the InsurTech Insights Europe event last week, experts explored how AI is on the brink of being commoditised in underwriting.

-

Broker benefits include the ability to get a quote within seconds and to manage clients’ policies fully, Hiscox said.

-

The pair will depart as Ron Hayes arrives to drive an acceleration of the specialty unit’s placement strategy.

-

AdvantageGo has secured agreements with Acord, Verisk, Vipr and Zywave to establish a collaborative ecosystem of London market data and technology vendors, which will help carriers modernise and prepare for the Lloyd’s Blueprint Two programme.

-

The broker’s London market specialty unit is on the brink of closing a deal with Whitespace to place North American casualty risks on the e-placement platform.

-

The broker is looking to embrace forms of data integration ahead of the Blueprint Two reforms at Lloyd’s.

-

The launch date for PPL’s Next Gen platform has been delayed to 6 March, as the team at Deloitte fix some final defects.

-

The Lloyd’s carrier’s CEO said the market must now ‘climb out of the rehabilitation phase’.

-

The member joined the board in August 2022, two and a half years after ending his activist campaign against the carrier’s management.

-

With PPL just two weeks from launching its twice-delayed Next Gen placing platform, new CEO Joe Gordon has stressed the importance of a migration this year to a completely rebuilt system and its potential as a rich data hub for the market.

-

It is understood that Lyons has been set to retire from the company in the summer of 2023.

-

CEO Sheila Cameron has called for “sharp focus” on market transformation.

-

The French carrier has replaced Laurent Rousseau with Swiss Re’s Thierry Léger - midway through a remedial journey. Can a third CEO in two years resolve the carrier’s issues?

-

The charges spanned workforce actions, rationalizing technology and reducing the overall real estate footprint.

-

The association showed strong leadership and innovative thinking to increase the number of women on its panel without sacrificing fairness.

-

The non-profit initiative will broaden to include cyber and casualty after successful tests on property reinsurance placements.

-

As a decline in InsurTech investment continues and risk capacity providers reconsider their support, sources expect many InsurTech MGAs will have to review and potentially pivot their business models.

-

After two delays, the placement platform will be launched on 20 February.

-

The new market participant will operate under the syndicate-in-a-box scheme.

-

Ian Summers has set out AdvantageGo’s plans to manage clients’ eco-systems of technology suppliers on their behalf, and to collaborate with competitors on the Blueprint Two programme.

-

The business is lead by former Barbican group CEO David Reeves.

-

In a review of financial services firms’ D&I policies that highlighted shortcomings, the regulator said policies need to be holistic, and not generic.

-

DXC Assure Broking is an integrated, modular solution for commercial insurance brokers built on the DXC Assure Digital Platform.

-

After an annual update from Lloyd’s CEO John Neal on the progress of Blueprint Two, Insurance Insider delves into the delays and what was actually delivered.

-

The new MRC v3, renamed from the iMRC, will be ready by Q1 next year along with the latest version of the core data record.

-

The tech partners have agreed to make at least transitional changes to their software to interact with the Corporation’s new digital services.

-

London carriers were bullish on the opportunity ahead and suggested new ways of working will continue to evolve.

-

The activist investor’s statement comes as a reaction to Argo’s message to investors last Friday ahead of the carrier’s annual shareholder meeting.

-

Ian Summers has joined the commercial (re)insurance software provider after being CEO of Verisk Specialty Business Solutions.

-

Artur Niemczewski has held leadership roles at WTW, Marsh, Asta and DXC.

-

The platform will automate a range of processes across risk submission, risk appetite evaluation, underwriting and pricing for quotation, using a lead algorithm.

-

The carrier is urging shareholders to appoint all seven of its nominees to the board in an annual meeting next month, amid activist investor pressure.

-

In addition, the executive will be eligible to participate in the company's long-term incentive program with a target grant date value of $11.1mn.

-

The move comes after Antares Syndicate 1274 secured a 16% stamp capacity increase for 2023.

-

The Bermudian claimed Ron Bobman and David Michelson’s directorship would ‘diminish’ the board’s capabilities and expertise.

-

The follow-only syndicate is one of the fastest growing entities in the market’s history.

-

In an interview, the CEO also addressed the carrier’s international expansion and portfolio remediation.

-

The latest Gallagher Re InsurTech study shows that, beyond the biggest funding rounds in Q3, investment fell to its lowest level since early 2020.

-

Argo is set to hold its annual meeting with shareholders on December 15, when seven nominees will be elected to the board.

-

The Chartered Insurance Institute has confirmed that data including names, addresses and dates of birth were obtained in the cyber security incident.

-

The entrepreneur will help shape and execute the strategic direction for the algorithmic underwriting specialist.

-

Anthony Siggers previously held a number of senior positions at WTW, including global head of broking operations, technology and analytics.

-

Often regarded as the destination for tech start-ups, IPOs no longer have the same attraction for UK InsurTechs, due to market volatility and the performance of their listed US counterparts.

-

Chaucer CEO John Fowle also set out to Insurance Insider the rationale for the carrier’s new ESG scorecard comprising 158 data points.

-

Reid Stanway will support and influence London market firms’ digital transformation strategies.

-

In the last two days of a consultation on the new iMRC template, the volume of responses surged by more than 2,500, leading to a revised timeline for its launch.

-

After a widespread drop in InsurTech funding, all signs point to a period of M&A among InsurTechs either struggling to raise funding or seeking a partnership with an incumbent.

-

Sources told Insurance Insider that unusual activity was the result of an update to some of Lloyd’s systems, however the Corporation declined to comment on speculation.

-

UK insurers have now paid out £1.2bn in final settlements for claims relating to pandemic closures.

-

London Market Group chair Matthew Moore has set out the aims of a campaign to pro-actively engage with universities and schools to broaden the industry’s talent pool for recruitment.

-

Adoption of the core data record and intelligent market reform contract (iMRC) will be fundamental to the success of the Blueprint Two modernisation programme.

-

Lloyd’s has postponed milestones against work on specifications for a new digital gateway and the build of a proportional treaty system.

-

LIMOSS and Vitesse will deliver the claims service, which is part of the Blueprint Two reforms, and are offering discounts to syndicates signing up in H1 2023.

-

Cohort 9 of the start-up accelerator programme includes a provider of a parametric loan default product, a parametric BI offering and an embedded insurance specialist.

-

The Corporation is giving some employees a bonus to help tackle rising energy and food prices.

-

The team will offer strategic consulting and technology solutions, starting with clients in property, casualty, life and reinsurance.

-

The International Underwriting Association’s CEO Dave Matcham believes certain Blueprint Two projects can be vital in attracting more business to the London market.

-

Novidea will provide a platform for every stage of the broking lifecycle and help Gallagher adopt digital solutions being developed for the Lloyd’s Blueprint Two programme.

-

The sale is part of the firm’s strategy to improve its capital structure and optimize operating expenses.

-

Yesterday, we published a detailed examination of the barriers preventing women from reaching the executive committees of Lloyd’s managing agencies.

-

In the first part of a two-piece investigation, Insurance Insider explores the pernicious barriers to women reaching the executive committees of Lloyd’s managing agencies.

-

After PPL announced a second delay to the NextGen platform in May, Insurance Insider examines lingering questions over a beleaguered modernisation project.

-

A very public shareholder dispute is taking centre stage at a firm in transition.

-

A team within the Lloyd’s, DXC and IUA joint venture is working on the gateway – a pivotal element of the digital solutions for BP2.

-

The Corporation has resequenced a key Blueprint workstream for delegated authority business, as it looks to create a data strategy for DA in Q4.

-

Investors are beginning to pull back from writing $50mn+ funding cheques for InsurTechs, according to Zach Powell, general partner at Eos Ventures.

-

The industry initiative around blockchain has filed for insolvency under Swiss law and ceased trading.

-

The Corporation’s latest market survey on D&I shows key metrics moving in the right direction but persistent fears remain from individuals around speaking out.

-

The MGA will write cyber for both SMEs and larger corporations via the German base.

-

The new DA-X platform aims to bring the entire delegated authority value chain under one roof for its end-to-end solution.

-

The company becomes the latest InsurTech to cull staff as a result of financial challenges.

-

After a half-year update on the Blueprint Two programme, Insurance Insider explores what has been delivered, but also the questions on how adoption will play out.

-

As London market carriers encourage parental leave take-up, Insurance Insider explores whether the HR benefit can be a tool to tackle the industry’s diversity issue.

-

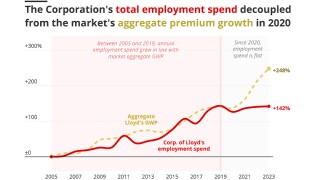

While aggregate premiums grew by 1.5x between 2012 and 2021, annual expenditure at Lloyd’s on salaries and other employment costs has doubled.

-

If you believe that the Lloyd's market has turned around its fortunes, it’s a buyers’ market on Lime Street.

-

The Financial Conduct Authority is facing a perfect storm of a backlog of approvals, striking staff and an urgent need to transform operations.

-

The Australian carrier is pursuing a strategic buildout of its operations on the continent.

-

More scrutiny on the remuneration of delegated authority business is well overdue.

-

Ahead of a market message on 2023 business plans, Lloyd’s has set out early expectations on inflation, ESG and management of cat volatility.

-

A second setback to the delivery of PPL’s Next Gen’s platform has triggered questions among firms about confidence in any new timeline.

-

Hansen’s appointment is in support of the company’s decision to separate the roles of chairman of the board and CEO.

-

London market businesses must increase supply if they can’t keep up with demand for talent.

-

“We like where we are positioned right now in terms of the performance of some of that strategic hiring,” Glaser told analysts.

-

Berkshire’s board opposed the proposal and recommended that the shareholders vote against it.

-

The FCA has proposed performance-related pay and new salary ranges.

-

The two companies have collaborated on the submission of a purely data-driven contract that complies with the core data record.

-

The US firm is looking at expanding across Australia, Canada and the UK after securing new investment.

-

Lloyd’s annual report shows a rise in fees paid to consultants and overall staff costs.

-

The plan outlines an aggressive M&A strategy, as well as increased InsurTech investment, expansion plans and a target to lift earnings by more than 14% annually until 2024.

-

The investment firm said that pivoting to a pure-play insurance data business would unlock up to $20bn of value.

-

Rethink will join Dual, while Howden Analytics will join the reinsurance division.

-

As part of the revamp, Michael Chang has been named global head of customer and distribution.

-

The theme of yesterday’s market briefing is that Lloyd’s is now moving into a period of growth, having completed remediation, but it wants smarter, sustainable growth.

-

Who will lead Italy’s 191-year-old insurer over the next three years? Analysts have their say.

-

A hardening market, competition from start-ups and macro conditions have combined to drive up staff costs.

-

With an abundance of detail on delivery, the Corporation can now be held to account.

-

Discussing tomorrow’s publication of the Blueprint Two interactive guide, the Lloyd’s CEO said market reforms will slash servicing costs by 40%.

-

With government guidance lifted, there is a growing pressure for an in-person presence in the London market.

-

Lloyd’s will have no further wiggle room to delay the delivery of Blueprint Two elements this year, but it will depend largely on technology partners.

-

The carrier said the move reinforces the importance of Lloyd’s as a platform.

-

Datum Consulting has been set up to support commercial insurers, coverholders and brokers on data usage and digitisation.

-

The Corporation is granting more flexibility but will keep a closer eye on cat, cyber and delegated authority next year.

-

Gallagher has pushed retention and equity awards unusually far down the organisation as it looks to keep the team intact.

-

In an interview, group CEO David Walsh and CEO Graeme Newman discussed securing growth, technology and the importance of capital optionality following CFC’s most recent PE buy in.

-

To walk away from One Lime Street at this juncture would certainly be a very bold statement on how Lloyd’s is embracing modernisation and its future.

-

The Corporation said it will consider using digital platforms as it evolves its thinking on the future of the Lloyd’s underwriting room.

-

The CEO is signalling to the market, investors and the rating agencies that Lloyd’s has turned a corner.

-

The start-up CEO said the carrier was now “categorically” ready to pursue Names backing as it looks for “significant growth” next year.

-

The body said the standards will allow further modernisation of the industry.

-

Increasing cat losses, combined with social inflation, put ESG and climate change at top of the mind even as the market sees strong growth, says Guy Carpenter’s John Trace.

-

The PPL board has finally chosen a partner to deliver the NextGen platform, opting for a build option with Deloitte Digital.

-

This publication has reported extensively on the ups and downs of the PPL saga, as the company seeks to push ahead on the development of its NextGen platform – a major component of the market-wide push on modernisation.

-

How well has Howden future-proofed itself against key issues around the group’s culture, shape, ownership and succession plan?

-

After Willis Towers Watson’s attrition rate rose 22% amid the Aon merger uncertainty, executives are seeking to dial back a talent drain.

-

The move is part of a new package of climate-related measures.

-

Most survey respondents want to travel no more than once every two months for work.

-

Major increase in incentive pool represents an early step from management to shore up its staff base.

-

The number two broker must now refocus on rebuilding internal divisions.

-

The disruption of the Aon-Willis deal breakdown could arguably create almost as much of a shake-up of the competitive landscape amongst the second-tier challenger brokers as it will for the two would-be merger partners themselves.

-

The division will employ 60 data scientist and analysis employees to serve the group’s global customer base.

-

Accenture Ventures’ backing of Imburse will drive the platform’s expansion – nurtured by Generali’s innovation hub – of partnerships with global insurers.

-

The Lloyd’s Market Association has finished a six-month project to create a digitally enabled, data-driven and cheaper model for delegated authority partnerships.

-

UK-based Flock has been working on a partnership with the Japanese carrier’s UK arm to create insurance products that reward fleet drivers for safer driving.

-

Kessler and Derez will each get something they want from the deal, which will also clean the slate for incoming CEO Rousseau.

-

Lloyd’s CEO John Neal has said the prospects of climate change could present the industry with its greatest “underwriting and investment opportunity” in a generation, but cautioned that it would require a commitment by the industry to be both “smart and brave”.

-

A settlement allows the mutual an “orderly exit” from the reinsurer’s share capital and removes a major distraction from incoming Scor CEO Laurent Rousseau.

-

The reinsurer warned of some of the associated risks arising from Covid-19, such as the "unintended consequences" of government interventions.

-

Many of the individual causes championed by CEOs are positive, but there are good reasons to separate the political and business spheres.

-

Axa has been amongst the insurers pushing for financial institutions to assess emerging nature-related risks and opportunities.

-

The recruit has spent 16 years at AGCS in senior roles.

-

The covered agreement provisions will ease the flow of US business into London.

-

The new logo and slogan follow a year of progress in the carrier’s turnaround plan.

-

The French reinsurer unveiled a surprise change to its succession plan yesterday, with Denis Kessler set to stand down as executive leader early.

-

Downstream uses of oil and gas pose challenges for the (re)insurance industry, he says.

-

The former Zurich Ireland CUO will take on the role from July and report to UK & Lloyd’s market CUO Luis Prato.

-

The Bermudian booked a $4.6mn loss from Winter Storm Uri.

-

The former UK CUO will move to Zurich in a reshuffle that follows Signorelli’s promotion to commercial insurance CEO.

-

More than half of survey respondents expect to work from home two or three days a week, with only limited sojourns to the office.

-

The new head held various government positions and advised Christine Lagarde when she was finance minister.

-

The former Willis executive is to work with Corant Bermuda CEO Chris Bonard and Ed Broking’s Bermuda chairman John Turner.

-

The group has a ‘multi-million-pound’ M&A war chest to tackle the ‘next leg of our journey’.

-

The legacy specialist advises shareholders to approve the “best practice” board change at the AGM in June.

-

Bowline Underwriters will operate in partnership with Facet Underwriting, with capacity from Clear Spring Property and Casualty Company.

-

Blank check vehicle Pegasus Europe is targeting financial services businesses with either digital models, or those benefiting from economic tailwinds.

-

Lack of scale prompts the retreat from a line the carrier began writing in 2017.

-

Senior executives at Aon, AIG, Aston Lark and Pool Re join the initiative.

-

Sacha Sadan joins the regulator after more than 25 years at Legal and General.

-

The broker aims to cut emissions by at least half by 2030.

-

The insurer has been expanding its marine presence in London.

-

The work from home model has proved the sector’s resilience, but there are opportunities to flourish for companies that return to the office.

-

Underwriters look to avoid the costly option of setting up an EEA service company to use the platform.

-

After years of poor performance and talent flight, Insurance Insider examines the challenges faced by Axa XL and the strengths it holds to forge a new start.

-

-

The promotion follows yesterday’s news that the outgoing active underwriter is moving to a role with Liberty Mutual Re.

-

Credit Agricole served as the debt arranger, with Sompo Japan and Aioi Nissay Dowa Insurance acting as insurers.

-

The mid-market PE firm turns its attention to niche insurance distribution after increasing the valuation of insurance services company Davies Group by a reported 13-fold in four years.

-

The appointment comes after the departure of its Netherlands-based team and Sophie Irvine in the UK.

-

The carrier has been replenishing its team following departures last year.

-

Gerald McDowell will step down from his role after nearly 16 years with the business.

-

Masaki Maeda, a claims director at JV partner Tokio Marine & Nichido Fire, will lead the operation.

-

The global natural resources director said “walking away” from risks was unhelpful and a “policy of engagement” was needed.

-

The MGA launched in the A&H market last year amid a buildout into specialty classes.

-

The resignation comes as Willis moves towards completion of the mega merger with rival Aon.

-

The acquisitive broker looks to compete with PE houses through its new platform.

-

Richard Foster previously worked at Agile Risk Partners and Zurich.

-

The Syndicate 2791 founder pins wording issues on the “nefarious activities of the broking houses”.

-

Maxine Goddard and Rachael Dobie will be senior vice president and assistant vice president respectively.

-

Lloyd’s has completed its initial consultation with brokers and underwriters about the future of the room following the end of lockdown.

-

The four-strong team writes a book of business with a US-domiciled focus.

-

Senior executives Michael Owen and Hussain Ahmad will jointly lead the new venture.

-

The German carrier is reportedly wary of Chubb’s bidding firepower because of the lack of synergies any takeover would yield.

-

The London company will use the funding to expand into new territories, develop new products and improve distribution.

-

The potential disposal may help to alleviate competition concerns within the French market.

-

The pair will depart after around a decade with the carrier.

-

The sale concludes Aviva’s plan to divest from non-core geographies and focus on the UK, Ireland and Canada.

-

The broker will focus on sustainable sourcing, energy efficiency, curbing business travel and switching to renewable energy.

-

The Toby Esser-led broker said it would fulfil responsibilities to clients and partners.

-

The trade body set out its principles about how the industry should learn from a year of remote working.

-

The Corporation’s CEO emphasises the (re)insurance industry’s role in dealing with pandemic risk.

-

The new recruit will be head of international war and terror underwriting and work alongside Quentin Prebble.

-

The insurer said the attack impacted certain CNA systems, including corporate email.

-

The funding will be used to develop and improve risk models.

-

The move counters the assumption London market carriers will shrink their real estate footprint after a year of home working.

-

The FinTech specialist will take on the role from April and joins Andreas Roth and Sebastiaan Bongers on the leadership team.

-

US carriers lag European peers, but the country is rising from its slumber under Biden.

-

The pre-eminent reinsurance event is cancelled for the second year running over Covid-19 concerns.

-

The former Corporation chief technology officer will report to Thibaud Hervy.

-

The Luther Pendragon director will be seconded to the role on a part-time basis from 1 April until the end of 2021.

-

The Financial Conduct Authority (FCA) is looking at the feasibility of mandating diversity targets in its premium listing framework to improve diversity and inclusion, according to the FCA’s chief executive Nikhil Rathi.

-

Existing investors HGGC and Aimco will retain minority holdings after a deal which reportedly values the insurance services provider at £1.2bn.

-

The MGA aims to improve its cyber claims and incident response abilities through the deal.

-

Written comments should be submitted by email by 3 May and the draft methodology is available online.

-

The board says each business should be individually responsible for managing the associated risks and opportunities.

-

The reinsurer accelerates its retreat as part of a new set of targets to achieve net-zero emissions by 2050.

-

The insurers is to sever all ties with the German utility this year due to the size of its coal operation.

-

Steve O’Gorman, former Argo international energy and marine head, will lead the unit.

-

Marsh & McLennan Companies (MMC) has changed its name to Marsh McLennan.

-

Numbers will be limited at first, but the Corporation aims to relax these rules further from 21 June.

-

Beazley has launched a digital business unit headed by COO Ian Fantozzi as it seeks to accelerate the digitalisation of the business.

-

The Corporation used Acord standards to build this early iteration.

-

Isha Patel has worked at the carrier since 2013 and was previously area director of the south.

-

The insurer is expanding its programme in line with underlying growth.

-

HIA International and Luker Rowe are the latest addition to the intermediary.

-

The company has also acknowledged that former Ironshore CEO Kevin Kelley is set to join as non-executive chairman.

-

The agreement, the second with the Norwegian carrier, covers its workers’ compensation book.

-

ERS has secured a $350mn injection of new equity with experienced sector investor Abry Partners buying into the firm to support its strategic pivot to specialty lines insurance and reinsurance, Insurance Insider understands.

-

The division will have a maximum capacity of $50mn for any one risk, with up to $250mn of syndicated capacity via the US.

-

IGI is set to launch into the contingency market and has appointed underwriter Emily Clapham to lead the entry into the class, Insurance Insider can reveal.

-

Senior CorSo executive Ashley Hirst will take over innovation and transformation responsibilities at the primary unit.

-

Nicolas Masjuan and Christian Müller are joining the management board as Camillo Khadjavi departs.

-

The Lloyd’s investment company has raised $53mn to finance more LLV acquisitions.

-

The business signals expansion into complementary lines after its 2018 reset bears fruit.

-

The deputy CEO said businesses are often too focused on the short term, as he outlines his ambitions for Convex.

-

In a second hire within the broker’s offshore wind team, Sarah Burston returns.

-

The deal will transfer legacy Pembroke business that still sat with Liberty Mutual Group for the 2018 and prior years of account.

-

Simon Moore has joined Lockton Re as a senior broker in the company’s non-marine retro and property specialty team, based in London.

-

The former RSA CFO has been UK and international CEO since 2019.

-

The division had been led by group CEO Kevin O’Donnell on an interim basis following Aditya Dutt’s departure.

-

As Adrian Cox prepares to take the helm at Beazley, what challenges does the CEO-in-waiting face?

-

The move follows the departure of two senior PV specialists to ERS.

-

The segment returned to underwriting profit despite the group reporting a significant pre-tax loss.

-

The carrier is one of a number of players to have entered the D&O market as pricing continues to grow.

-

Peel Hunt and Jefferies analysts are reassured by calibre of the outgoing CEO’s internal replacement.

-

The interim chief will stay on in an advisory role for an initial period before retiring.

-

The move follows Jess Pryor’s promotion to executive chairman of Brit’s US business.

-

CEO Richard Harries and active underwriter Toby Drysdale outline the carrier’s ambitions as it leans into the pricing cycle.

-

The former Arch managing agency director will focus on legacy business, M&A and alternative capital.

-

The EU surety and guarantee operations is now one entity and rebranded to Liberty Mutual Surety.

-

The association’s members have also identified digital platforms as a prime concern.

-

Brian Dusek will develop and grow the start-ups North America cyber portfolio and report to Yosha DeLong.

-

Miller CEO Greg Collins has pledged to expand the business internationally as its takeover by private equity firm Cinven and Singapore sovereign wealth fund GIC completes.

-

The lawyer moves up after five years at the carrier.

-

CEO Amanda Blanc claims a world first with a plan that includes underwriting curbs on companies making more than 5% of their revenue from coal from the end of this year.

-

The new recruit will take on the role of head of Europe for the growing M&A team.

-

The CEO says rate momentum provides a “great opportunity” to focus on profitability.

-

The venture plans to target auto cover before using M&A to expand into other lines.

-

The 2020 Lloyd’s culture survey showed improvements, but serious questions remain on whether London is striding towards an inclusive culture.

-

The 2020 Lloyd’s culture survey showed improvements, but serious questions remain on whether London is striding towards an inclusive culture.

-

Yosha DeLong will be cyber underwriting head, whilst James Tuplin will be international head of cyber underwriting.

-

The news follows the sale of Aviva’s French operation as the insurer refocuses on core UK, Ireland and Canadian businesses.

-

The sector is trying to secure better underwriting terms amid a financially challenging period for shipowners.

-

Mathias Neumann was chief underwriter of casualty and specialty at the Japanese company.

-

In other appointments David Govrin becomes global CUO and Americas reinsurance president, and Monica Cramér Manhem international reinsurance president.

-

The PE house will inject growth equity capital into Premia after the all-paper deal.

-

The deal comes shortly after the legacy specialist established a $265mn sidecar, Elevation Re.

-

The appointment follows the expected departure of Phil Furlong to expansive insurer ERS.

-

The Corporation’s survey suggests an improved perception of the marketplace among women.

-

The internal promotion comes as LMG chief Lebecq prepares to join the PE-backed consolidator as COO.

-

Regional per occurrence deals were also down compared to last year, but Validus lifted its retro cover by $75mn.

-

The Norwegian mutual says pricing achieved a balance between owners’ needs and underwriting profitability.

-

Wayne Page will report to CRO Shane Kingston.

-

This publication outlines five takeaways from Swiss Re’s 2020 results, which revealed a 11% cut in premium at 1 January.

-

CEO Matt Crane and AmWins chief Scott Purviance outline a “call to arms” revamp as the unit seeks talent and international growth.

-

The association’s chief will leave at the end of April to become COO at the HGGC-backed consolidator.

-

Plus an update on European (re)insurer results and all this week’s top news.

-

The carrier reported “significant claims provisions” following the judgement in the FCA BI test case.

-

The CEO lays part of the blame for the UK’s Covid-19 BI woes at brokers’ door.

-

We assess the hurdles facing the marquee specialty insurance franchise, including staff retention and the fallout from the UK BI saga.

-

The A$14bn pool will switch brokers on 1 April.

-

The new board member has worked for the Agnelli family for over 20 years.

-

Insiders Mark Appleton and Thomas Stamm take new roles as the carrier expands management of the line beyond Hanover.

-

The executive committee will meet next Thursday to discuss the UK government’s Monday update.

-

The deal will lift GWP handled by the broker-aggregator by more than three quarters to £1.6bn.

-

The local underwriting head steps up to run the Irish operation.

-

The continued expansion comes amid tough competition for talent in the hard D&O marketplace.

-

The new recruit led casualty at Neon before the operation was shuttered last year.

-

A decision is likely in the next month over whether to proceed with the London Stock Exchange listing.

-

The risk modeller pledges to review the offer but says its $6bn agreement with the PE firm still stands.

-

Tim Wakeman has worked across the space and aviation sector at Aon, Willis and UIB.

-

The Asta-managed syndicate is understood to have failed to attract sufficient capital and is still searching for backing.

-

The executive joins after a decade at PartnerRe and will have a dual focus at the broker.

-

Competition has ramped up over the last two years and now represents a threat to returns.

-

The Ardonagh-owned broker has drawn from Ed, Marsh and KM Dastur.

-

The buyer will use the acquisition to expand Arena beyond Belgium and into other European markets.

-

Our highest priority remains protecting the health, safety and wellbeing of our colleagues, said CEO Case.

-

The CEO said pricing was going up by 10%-30% and that terms were being tightened globally.

-

He joins fellow Marsh alumni Naresh Dade and former McGill exec Andrew Harrison-Sleap.

-

The firm’s mean pay differential also shrank 10 points to 29.6%.

-

Insurers are taking a “cautious approach”, especially with new risks, but overall capacity is at an all-time high.

-

The pandemic has reinforced gender stereotypes and virtual working has created barriers to sharing issues.

-

Shaw was the first ever D&I chief for an NBA team and earlier worked at the NFL.

-

The central bank governor says Brussels is wrong to insist UK rules shouldn’t change independently of the EU.

-

The takeover last year was a significant piece of InsurTech M&A.

-

The CFO said that commercial lines business was improving faster than retail, reversing previous trends.

-

The move follows Fidelis’ decision to hand back $275mn it had raised for a retro vehicle.

-

The reinsurance unit of the Spanish group takes a near-EUR80mn full-year hit on the pandemic.

-

Robertson will join as deputy group CEO before taking the CEO job, with Michael Watson staying on as chairman.

-

The supervisor says the regulator is neither vying to hike nor slash requirements on the back of a Solvency II review.

-

The reinsurer completes its EUR453mn deal for 29.5% stake in French trade credit carrier.

-

The appointments follow the promotion of Jeremiah Konz to chief reinsurance officer.

-

The broker association’s CEO says Brexit speaks to the need for a lighter rulebook.

-

The start-up changes its business model to selling data structuring and analytics services.

-

The investor’s largest portfolio company Nexus plans further acquisitions in 2021.

-

The brokers’ association flags severe under-insurance in some pockets of the market.

-

The division will service large corporate energy companies in EMEA, Asia Pacific and Latin America.

-

He replaces Tim Mardon, who recently moved to Third Point Re as global head of property.

-

Futureset aims to bring together specialists to promote risk awareness and resilience.

-

The new recruit also served as head of group distribution and broker relationships at Hiscox.

-

Executives reiterate the mid-single expansion guidance announced in March, despite growing organically by 1% in 2020.

-

The WR Berkley subsidiary was founded in 2009 and writes upstream energy, marine and energy liability.

-

Plus key takeaways from Q4 results and all the week’s top news.

-

The London market is believed to have a maximum $70mn exposure written through Japanese treaties.

-

Sea Traders’ Ioanna Procopiou becomes vice-chair.

-

The former Ironshore COO said that the business will not be Pembroke 2.0, with the model set to be new.

-

Michael Yeats will oversee the carrier’s reinsurance offices in Bogota, Buenos Aires, Miami and Sao Paulo.

-

The newcomer joins as independent director.

-

The EU’s lead insurance watchdog has internationally active (re)insurers in his sights.

-

The executive will focus on streamlining the carrier’s operating model in the newly created position.

-

The fourth-quarter charge will take group full-year pandemic losses to EUR1.2bn.

-

The newcomer was previously CEO for client and country management at Axa XL.

-

-

The new managing partner will work in Gallagher’s property practice with Asia-Pacific and South African clients.

-

The carrier will continue to write Chinese business through its Singapore unit.

-

Former Securis' executive Neil Strong joins arrivals including Lancashire’s Chris Wilkinson as a second head of specialty and Talbot PV specialist Dan Callow.

-

The former senior AJ Gallagher and IAG executive will take up the role in August, reporting to interim group CEO Richard Pryce.

-

The political violence specialist leaves after almost three years.

-

The broker is building up its Bermuda presence following last month’s rebrand.

-

Stephen Bertolla joined Guy Carpenter in 2016 and has held roles at JLT, Marketform and Benfield.

-

The government removes a previous cap of 49% in its budget.

-

The outgoing chief executive founded the company in 2005, building it into the second--largest legacy-focused business.

-

The executive will move to London from Sydney as part of her new role.

-

The investment will help finance hires and expansion into other jurisdictions.

-

The executive moves up from the deputy chairman role.

-

The CEO said there is still some way to go on pricing as he revealed $2.4bn premium expectations for the group in 2021.

-

The organisation also says that the specialty sector is not immune to tech disruption from Lemonade-style companies.

-

The executive takes over from Megan Thomas, who left to become the CEO at Hamilton Re in September.

-

The appointment follows the departure of a team of marine brokers to BMS to work on a US wholesale buildout.

-

The Australian carrier centralises its inwards reinsurance operation within the international segment.

-

He will start in the role on Monday and replace Sandy Warne, who left the business to join Inigo.

-

Hessing joined the company in September to replace David Atkins, who had been with Enstar since 2003.

-

Aon’s decision on its post-deal reinsurance leadership shows it has moved past tactics of its Benfield-era integration.

-

General manager Frédéric de Courtois and group chief investment Timothy Ryan will leave the business.

-

An all-staff memo obtained by this publication stresses Case and Haley’s emphasis on a ‘one firm’ approach.

-

The UK’s biggest MGA will use the investment to pursue growth following the recent completion of its Co-op deal.

-

The legacy company announces three recent appointments to its management team.

-

Gebauer, Kent, Pullum and Garrard are among the Willis execs named to big jobs.

-

Group CEO David Howden said the A-Plan acquisition brings further retail M&A opportunities.

-

The automated follow-only syndicate aims for integration with broker platforms this summer.

-

His predecessor left the business following his conviction for assaulting his then-partner.

-

The intermediary recorded revenue of £777mn, with 6% Ebitda growth taking earnings to £223mn.

-

The Vantage CEO said that the carrier had a ‘successful’ 1.1 launch and foresaw sustained hardening conditions in the insurance market.

-

The impending deal follows recent Lloyd’s legacy transactions with Neon and ArgoGlobal by RiverStone.

-

The Convex CEO reiterates his prediction of a potential $200bn casualty-reserving deficit and anticipates a similar amount of Covid claims.

-