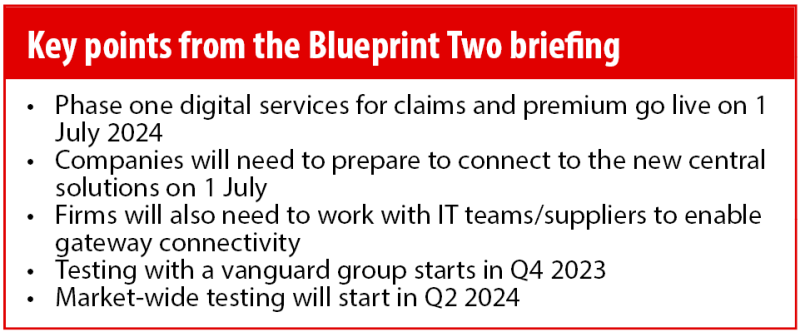

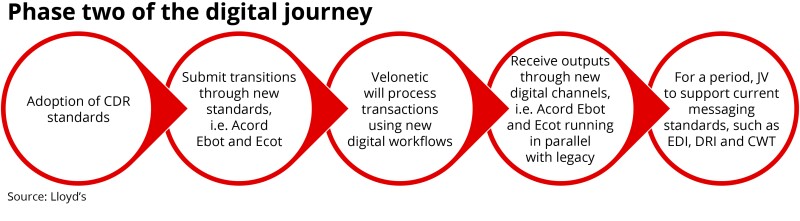

In the latest Blueprint Two briefing yesterday, delivered to hundreds of delegates, Lloyd's set out upcoming milestones and what London market firms will need to do to transition from systems using nearly 30-year-old technology to the new solutions.

At this point, the build programmes are still on track, and the positioning from Lloyd's and DXC has moved onto what's involved in “phase one” and “phase two” of adoption next year. A key aspect of this latest briefing was that target dates have not moved out or been delayed, given the scale of the tech build.

Phase one involves the cutover on 1 July to the two new solutions for processing of both London market premium and claims, and London market premium and claims for delegated authority (DA) business.

To help firms gear up for the switch, Lloyd's and Velonetic (the rebranded London Market Joint Ventures), will assist with training and support on adoption of messaging changes and how to connect to the new central services.

Velonetic CEO Chris Halbard told Insurance Insider: “The market cutover needs to happen so that we're not trying to run a marketplace on two different systems, which is untenable, both from a cost and data synchronisation standpoint.

“The ability to process new business in the old system stops on July 1, but we'll retain a capability for a ‘look back’ into the old systems.”

Phase two will involve the adoption, firm by firm, of the new digital gateway, and ensuring brokers and carriers are enabled to use the full digital services once they're all ready.

The gateway, due to be ready for deployment towards the end of Q2 next year, will act as a mechanism to ensure placement and/or claims data is sufficient and complete for digital processing. It will ensure the core data record (CDR) is complete and can be passed on to the new solutions for back-office processing.

Velonetic will work closely with the placement platforms Whitespace and PPL to enable them to connect to the gateway.

With the solutions still on track for their sequenced release dates next year, the point at which all the digital services will be ready in their entirety will be around the start of October 2024.

The messaging from Lloyd's and Velonetic to the industry now centres more around options for adoption, connectivity, specifications and how fast firms want to move.

Market momentum

The Lloyd's briefing provided an indication of the extent of cross-market preparations for Blueprint Two adoption.

A survey of London market firms conducted by Lloyd's and Velonetic found that 57% of carriers and 77% of brokers have line items dedicated to the programme in current budgets, or plan to, for 2024 to cover costs of the changes.

The study also found, though, that 14% of respondents had concerns around the clarity of timelines, while 37% had gaps in their understanding of the technical details, such as requirements around systems, messaging and customisations.

With these findings in mind, Lloyd's said an adoption plan will signpost key timelines, and a technical repository with training materials will provide the detail for adoption. A central hub featuring the training materials will be available from November.

The Corporation also said the adoption guide will help firms identify changes required to estimate costs for the transition.

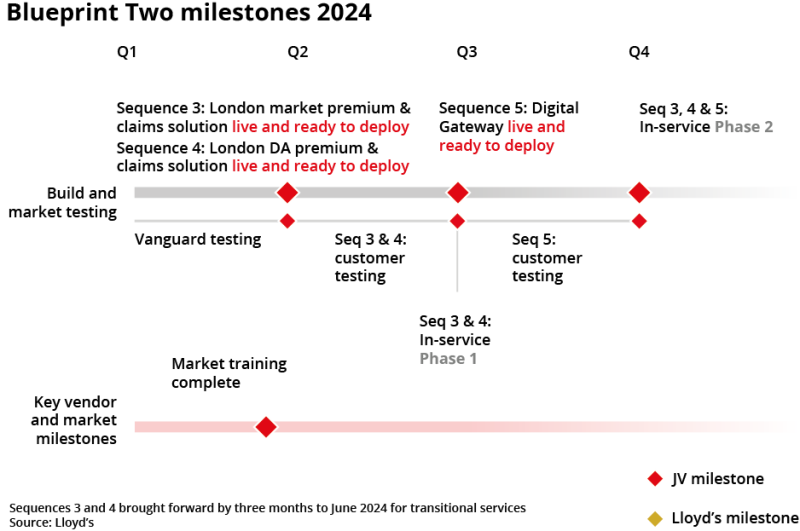

EDI vs Ebot and Ecot messaging

Lloyd's acknowledged the complications that could emerge, as adoption unfolds, when London market firms use different forms of messaging on syndicated risks.

The eventual plan is for all London market firms to move to Acord messaging – which involves the use of electronic back-office transaction (Ebot) and electronic claims office transaction (Ecot) messages.

These refer to Acord standards for digital interactions that will be exchanged between firms and the new central systems. They are also described as enabling a true, data-first approach.

While the hope is that most firms will want to migrate from legacy EDI messaging to Acord messaging relatively quickly, there might be a lag among some firms in the move to Ebot and Ecot.

During this lag, there's a prospect of firms using different forms of messaging around the same syndicated risk, as the market moves into phase two.

When asked about this, Halbard said: “The (central solutions') ability to receive all existing formats today of messages coming in and to respond out with all existing formats, doesn't change at phase one.

“As we move into phase two, if one early adopter wants to go through phase two quickly, including for syndicated risks, then the Velonetic platform has the ability to relay messages out in different formats.”

Halbard emphasised the importance of moving the market to standardised messaging, adding that where it gets to specific requests from firms on messaging capabilities, there will be "trade-offs" between the economics of lots of bespoke functionality being retained, as opposed to “moving the majority of the market” to standardised messaging formats.

Another point that remains unknown is when the majority of the market will move off EDI messaging to the data-first approach of standardised Ebot and Ecot messaging. There was no sign from Lloyd's on when it might try to phase out EDI messaging entirely.

Lloyd's COO Bob James explained: “If we turned on the gateway on September 1 next year and expected to reach a market tipping point in December, that might be too ambitious.

“But there's a lot of factors that will work in favour of adoption. First of all, the tech providers will use the new [Acord] data standards so that they can feed data into the gateway from their platforms. It would become more expensive for the joint venture to process business in two fashions. So at some point, the underwriter is going to start having conversations, asking why they're having to pay more for some submissions compared to the others.”

James added that this and other market forces will help create a tipping point for adoption.

DA workstreams

The Blueprint Two workstreams on data standards and the CDR have focussed on open market business, but the equivalent work for DA business will need to be undertaken.

James explained that there is work to be done on harmonising data standards for DA, a process that is complicated by the number of stakeholders involved in the DA space.

Once this foundational work on DA data standards is completed, he said, APIs can be developed to submit a CDR for data risks into the central solutions.

The more detailed work on modernising processes and data standards in the DA space will be on a different timeline to those already announced for the open market for 2023 and 2024.

James and Halbard confirmed that once there's a clear path for industry adoption of all the digital solutions going live next year, other sequences will follow for developments in the DA space towards the end of 2024/early 2025.

The vanguard

In the shorter term, as testing begins towards the end of this year with a vanguard group on the solutions already in development, this will provide insight into functionality before market-wide testing unfolds in Q2 2024.

The over-arching emphasis for the wider market, for now, is on preparation for the July 1 cutover next year.

James added: “The messaging is: here's the technical data and support that's available, here's the market engagement team that's available and here are the facilities available for firms to sit down and plan this out.”