As firms will be transitioning at different speeds, with a vanguard group leading the pack, sources espoused differing views over when most Lloyd’s participants will become data-first – at least in its purest sense.

Some will be trading with data-first processes from the moment Blueprint Two goes live with all new central services late next year.

But many others, depending on their digital maturity, may have to adopt an initial stage where documents such as the MRC v3 contract template, rather than data, determine the approach.

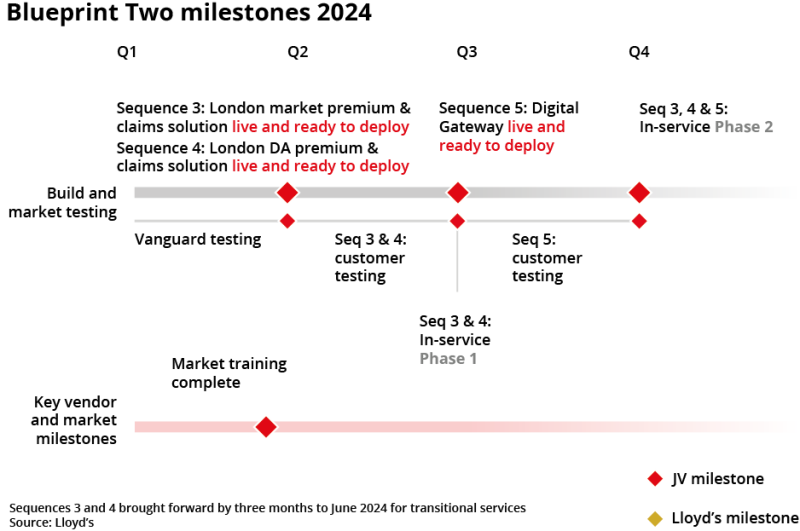

In any case, a major gear shift for the industry will start to take effect around Q3 2024, with the combined utilisation of standardised data, digital messaging and all the new central services for straight-through processing.

Just on its own, the adoption of common data standards, using the core data record (CDR) and incorporating it into Acord's Global Reinsurance and Large Commercial (GRLC) standard for digital messaging, will be a transformational milestone.

But a common query among sources was around the use of documents including the MRC v3.

In essence, their key question was: If data will have to be extracted from the MRC v3 and other documents for processing, will Q3 2024 represent a mass pivot to a data-first approach, or just a first step towards that destination?

Data extraction vs data-first

Data extraction, and where it will be required, was touched on at the Lloyd's and London Market Joint Ventures briefing on Blueprint Two on 19 June.

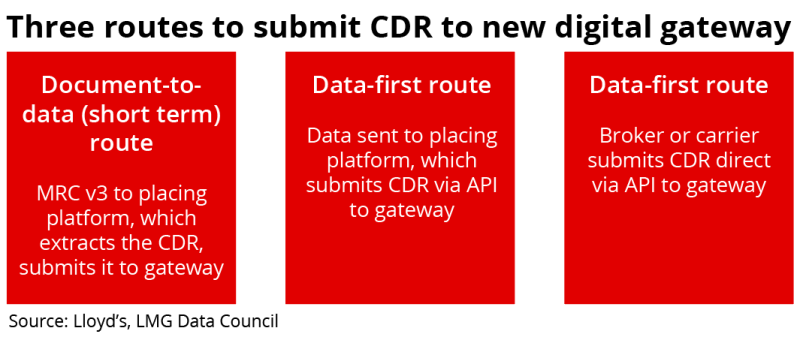

At the briefing, Lloyd's Market Association CEO and LMG Data Council chair Sheila Cameron addressed requirements for firms around data and three options for them to submit the CDR to the new digital gateway – a new central solution designed to enable straight-through processing downstream.

One option, described as a short-term route, will be a “document-to-data” route whereby an MRC v3 is submitted to a placing platform that will then extract the CDR and submit it to the gateway.

Herein lies a concern for sources this publication spoke to: that data extraction can be incredibly complicated, can often require verification after the process and would require a layer of human oversight to check alignment between the document and data (as it sits in another system).

While this concern applies to usage of the MRC v3, two other options that are more data-first will be available to send the CDR to the digital gateway, depending on firms’ capabilities.

One will involve sending the data to a placing platform which will subsequently submit the CDR to the gateway via an API. The third will be a more direct data-first route in which a company submits the CDR directly to the gateway via an API.

Lloyd's explained that extracting data from documents is just one of the three ways to adopt digital processing.

At some point we will look to decommission non-digital routes; though this date is in the future once the digital solutions have been adopted

A spokesperson for the Corporation told this publication: “Our aim is for market participants to move directly to the data-first approach as this is the model that enables the greatest benefits for both brokers and carriers. We recognise that this will be a journey for many participants, who may adopt the data-first approach over time.”

The Corporation said it will not mandate which route firms should take on digital processing and that any of the three pathways can be adopted by September 2024.

The spokesperson added: “At some point we will look to decommission non-digital routes; though this date is in the future once the digital solutions have been adopted.”

Data jacket concept

Lloyd's also explained that the MRC v3 contains around 75% of the CDR information that is required. The rest of this information will sit outside of the MRC v3 within items such as tax schedules and schedules of values.

A Lloyd's spokesperson added: “There is work planned via the LMG Data Council to look at a ‘data jacket’ concept to address this. While this work is underway, platforms will likely approach this in varying ways, from manual keying and extraction from documents to ingestion of this data via APIs.”

The option to use the MRC v3 effectively recognises where the majority of the industry is starting from – which is in the prevalent use of word documents by brokers currently.

The adoption pathways account for the different speeds that Lloyd's participants can move at, while also establishing the foundations that enable automation and innovation to accelerate across the market from September next year.

It is, however, the Data Council's ultimate goal to move the market to computable contracts from the MRC v3.

This publication understands a proof of concept for a binding authority computable contract is underway at the LMA, but it is at an early stage, though timelines to move the market towards computable contracts after the MRC v3 are not expected to emerge until next year.

EDI to Ebot and Ecot

Another consideration for firms this publication spoke to was around the step change between phase one and phase two of Blueprint Two for next year, and how each phase shifts the market to a data-first trading environment.

Digital services under phase one, which will be ready to deploy from June 2024, will involve the use of EDI messaging, which sources described as a step towards fully digital, but will still involve the use of files from which data will need to be “pulled apart”.

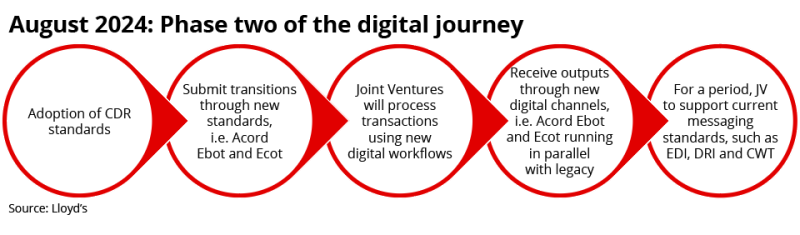

Phase two, described as a bigger step towards data-first and due to take effect towards the end of September next year, will involve the use of electronic back-office transaction (Ebot) and electronic claims office transaction (Ecot) messages.

These refer to Acord standards for digital interactions that will be exchanged between firms and the new central systems.

Lloyd's said its ambition is that the majority of firms will want to migrate from legacy EDI to Acord’s global standards over time, though some sources noted there might be a lag in the move to Ebot and Ecot.

It is difficult to anticipate at this stage when market usage of Ebot and Ecot will reach critical mass, but sources said their use "enables some real wins” in the form of automation and a faster reconciliation process after the risk has been bound.

Implementation guidance

In the immediate term, Lloyd's firms will need to figure out how they will create and consume Ebot and Ecot messages.

They’ll also need to contact Acord to understand how the GRLC standard should be implemented, though a guide that details the structure of the CDR within Acord messaging standards will be delivered in August. A toolkit will be released on adopting the GRLC contract, risk and pre-accounting message.

The Data Council will also publish guidance in Q3 on how different firms' roles around data will change, along with a good practice guide.

The Ruschlikon example

If the industry needed a demonstration of what a data-first infrastructure enables, then the Ruschlikon initiative, which has just marked its 15th anniversary, is a good place to look.

It started out as an initiative between six firms including the major continental reinsurers with an aim to automate post-placement processing using Acord standards.

The group has now grown to well over 60 and its focus areas have since extended from back-office to e-placement. It also has regional implementation groups across the US, UK, France, Italy, Spain and Asia.

The experiences of members also provide a way to measure the benefits of using Acord standards.

Data from an Acord report on Ruschlikon shows that Scor, for example, saw a 60% reduction in manual effort to process claim transactions, an 80% improvement in data quality and a 50% improvement in turnaround time for claims payments.

The same study also shows that Swiss Re observed a 45% improvement in the turnaround time for claims payment approvals, a 69% improvement in the speed of cash allocation and a 67% improvement in the turnaround time for booking treaty accounts.

Foundational steps

Eventually Blueprint Two will be an enabler and an accelerator of a market-wide data-first approach in a full sense, but this will occur in stages.

There is the caveat that it's not yet known how long the MRC v3 will be a temporary measure, or how soon the market can move towards fully computable contracts, and how fast they'll move to Ebot and Ecot messaging.

To state the obvious for a market as old, complex and multifaceted as Lloyd's, firms will be transitioning from different starting points.

For those at an advanced stage of digitalisation, the enablers to operate data-first processes already exist now, particularly in the vendor community and via Acord.

In an era where GPT models are accelerating automation in every industry, and where there's a critical need to relieve the manual burdens of trading at Lloyd's and to cut the expense ratio, there will be an imperative for a swift move to fully data-first trading, after Blueprint Two goes live.

That imperative ultimately speaks to a wider need to deliver faster, better outcomes for insureds.

As was discussed at the June 19 briefing, the change to a data-first market will require a cultural mindset that doesn't just leave the transformation to ops, but secures the support of the C-suite.