-

The hire follows the departure of David Martin to GIC Re Syndicate.

-

The CEO said that IGI’s action within its PI book showed it was ready to walk away from unprofitable business.

-

The Ryan Specialty renewables MGA launched an international arm last year.

-

The underwriter has worked for Markel in Singapore since 2020.

-

Jo Smart has worked for Torus and Aegis during his two decades in the market.

-

High capacity is adding to competition in the upstream energy space.

-

New sources of capacity lack the expertise to service rapidly developing clients.

-

According to McKinsey, the projected spending on data centers is expected to hit $6.7tn by 2030.

-

Small modular reactors are increasingly viewed as a means of meeting surging energy demand.

-

The London broker has also recently hired Michael Lohan from Lockton.

-

Dale Underwriting recently pulled out of standalone offshore energy business.

-

Plus, the latest people moves and all the top news of the week.

-

This publication revealed in February the incident was expected to lead to a major claim.

-

The aviation market may prove an outlier following a disastrous year of loss activity.

-

Rönesans covers lines including aviation, energy, engineering and liability.

-

The carrier said the decision reflected its commitment to portfolio discipline.

-

The LPPC will offer limits of $127.5mn EAR and DSU coverage in the US and Canada.

-

Donna Swillman is currently a senior underwriter at Axa XL.

-

The underwriter has over 20 years' experience in the construction insurance sector.

-

The carrier is looking to take a lead position in energy-transition risks.

-

The broker has a longstanding trading relationship with US retailer Alliant.

-

A notable uptick in attendance underpins the value still placed on the iconic trading centre.

-

There has already been an influx of new capacity from MGAs into the power market.

-

The NFP acquisition was a “tailwind for organic growth, not a key driver”, said CFO Edmund Reese.

-

Staff targeted include producers that channel business through Howden’s London wholesale arm.

-

Sources said MarshBerry is advising the underwriter.

-

Tokio Marine GX was launched in May to offer coverage for companies looking to decarbonise.

-

The carrier has appointed Roberts Proskovics as renewable energy risk management head.

-

The latest hires follow Rob Hale’s move to Willis.

-

The broker made several senior energy hires from Marsh last year.

-

The executive has spent 13 years in the broker’s marine division.

-

Plus, the latest people moves and all the top news of the week.

-

The MGA will write natural resources professional liability business.

-

Renewable energy premium written in London and international markets amounts to $2bn.

-

Sources said the downstream energy market is unlikely to turn a profit in 2025.

-

Plus the latest people moves and all the top news of the week.

-

Clients are increasingly using captives because of uncertainty around long-term capacity commitments.

-

The carrier has entered several new classes recently, including specie and reinsurance.

-

The claim hits the downstream market following a loss-hit start to the year.

-

It is the second deliverable of the FIT Transition Plan Project.

-

The aerospace, energy and marine markets all sustained multiple significant losses in H1.

-

Although US pricing is improving there is pressure in other geographies.

-

The underwriter joined MS Amlin in 2020 after more than 24 years with Markel.

-

-

There has been significant talent displacement in the specialty reinsurance market.

-

TMGX is designed to help insure the green transition.

-

The CUO described the pricing dynamics in the line as “strong and good”.

-

The worsening of extreme weather is becoming a global problem, presenting data challenges.

-

Softening in the upstream market has also accelerated beyond expectations.

-

The carrier laid out its business mix for the newly launched reinsurance syndicate.

-

Willis said rising energy demand is creating a revival in the nuclear industry.

-

Argenta will also manage the run-off and renewal of the previous White Bear binder.

-

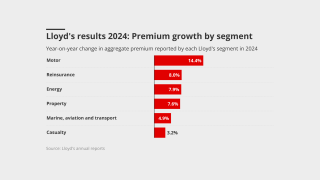

Reinsurance and property remained the primary drivers of premium growth.

-

The product supports investors of early-stage carbon removal projects.

-

The broker has also named Andrew Herring chair of the division from next year.

-

The binder will provide capacity for international fac property, power and onshore energy.

-

The Corporation said pricing within aviation was “almost certainly inadequate”.

-

The broker said the list of perceived obstacles was “fairly damning” for insurers.

-

Earlier this week, we revealed that Louise Nevill was joining Axa XL as specialty CUO.

-

Competition for specialty reinsurance talent remains high.

-

Camilla Gower joined TMHCCI in 2020 from StarStone.

-

Two major claims have prompted underwriters to question the sustainability of double-digit rate decreases.

-

The broker joined the Ardonagh Group from Gallagher’s Alesco in 2017.

-

The MGA launched last October with a B.P. Marsh investment.

-

Good ESG practices are part of good risk management, the company said.

-

Seven team members are set to exit, including team lead Cooke.

-

Plus, the latest people moves and all the top news of the week.

-

Sources said the claim is likely to be a multi-hundred-million-dollar event.

-

The upstream market has undergone a period of high personnel movement.

-

Auton Green will offer up to 40% capacity on onshore renewable energy lines.

-

Claims in recent months have brought a period of benign loss activity to an end in the class.

-

Coverage restrictions in renewables are increasing risk for investors.

-

The MGA has faced high claims activity on its energy liability book, fuelled by social inflation.

-

The renewables market has seen perils such as hail deliver repeated claims.

-

Michael O’Neill has been promoted to onshore power and renewables underwriting manager.

-

Former Chaucer natural resources head James Brown joins as an advisor.

-

The Moss Landing facility has previously faced major claims.

-

Robin Hamilton has been appointed head of energy and marine liability.

-

Several Marsh energy staff have defected to WTW over the past 18 months.

-

It is understood that supporters include Munich Re and Brit.

-

The upstream market is now in softening territory, with capacity still abundant.

-

Energy has been one of the busiest lines across the market for staff turnover this year.

-

It is understood that Lectio is now at ~$160mn of premium and could rise to $270mn next year.

-

Jack Palmer and Toby Hanington are also joining the firm, as previously reported by Insurance Insider.

-

Marine and energy were the busiest lines, driven by high competition for talent.

-

The broker will track and rank carriers’ response times.

-

Alex Nelson will work as head of power and renewable energy at the carrier.

-

Andrew Draycott is to stay on "for the foreseeable future".

-

Samer Ahmad was with Marsh for more than seven years.

-

The carrier is believed to be restructuring the leadership of its London specialty business.

-

The recruitment comes amid a spate of hiring for Westfield.

-

The report aims to plug the gap in insurance-specific guidance.

-

Panellists at Insurance Insider’s LMC also noted a lack of C-suite engagement in renewables.

-

The underwriter resigned last year and had been due to launch a renewables book at Globe Underwriting.

-

The LMA report focused on first-party property damage from a coverage perspective and on eight key sectors.

-

The appointment follows the departure of upstream head Chris Touhey.

-

The carrier is looking to grow its specialty offering across Europe and APAC.

-

How is the market positioned to withstand Hurricane Milton?

-

The MGA said insurers competing on price was “not sustainable”.

-

Benign claims activity and increased capacity are contributing to “competitive pressures”.

-

The broker confirmed Darren Jones and Ian Curtin were also joining the firm.

-

The appointment comes following several resignations in Travelers power and renewables division this year.

-

The business is formed out of the existing Thomas Miller Specialty Offshore team.

-

Pine Walk MGA Kersey Specialty pivoted to renewables at the start of this year.

-

The promoted employees have all been with BHSI’s Singapore offices for years.

-

The downstream market is expected to soften in the second half of the year.

-

The executive said losses in the Middle East had “sent shockwaves” through the market.

-

Insuring the transition is frequently touted as a major growth opportunity, but when it comes to renewable energy, complications abound. Natural catastrophe, evolving technology, and data scarcity all add to the complexity of underwriting in the class. GCube's Fraser McLachlan has been operating in the renewables sector over several market cycles, and gives his insight on the latest dynamics in the class.

-

Smith joins from QBE Insurance, where he spent over 13 years.

-

The downstream market is also starting to soften after a “massive influx” of premium income.

-

The broker said achieving profitability “remains challenging” for insurers.

-

Staff movement in energy has been more active than any other class of business this year.

-

WTW has also recruited Marsh’s Thomas Burrows and Rupert Mackenzie recently.

-

The move comes amid elevated personnel movement in the energy sector.

-

The growing scale of projects is contributing to the need for more capacity.

-

The new product will be led by head of special risks Ed Parker.

-

The moves are the latest in a period of personnel upheaval in the energy market.

-

The broker’s energy division has welcomed a string of hires in the past year.

-

The energy liability market has seen a number of new entrants in recent months.

-

Although talent movement in Q1 2024 was above Q1 2023 levels, personnel movement slowed in Q2 2024.

-

The facility will provide coverage globally for blue and green hydrogen projects.

-

The Mexican state oil company delivered the upstream market its largest claim in 2023.

-

Richard Rudden left Fidelis MGU as head of energy transition in March.

-

This publication reported in April that Alexandra Barnes had resigned from Beazley.

-

The lineslip will be available alongside the MGA’s existing capacity.

-

Burrows is the latest former JLT energy broker to join the team at WTW.

-

The carrier has also hired Victoria Burnell from Tokio Marine Kiln to join the energy team.

-

Renewable energy assets have been plagued by severe weather losses.

-

The broker has worked for Aon, Ed, Willis Re and Tysers.

-

In this episode, Hiscox London Market CEO Kate Markham discusses the carrier's AI lead underwriting project with Google Cloud, and the opportunity the insurer sees underwriting energy transition business in the Lloyd's marketplace.

-

The carrier launched the consortium last year in a bid to support the clean energy sector.

-

A claims dispute between the US Coast Guard and insurers has sparked fear about aggregations.

-

Staff movement has been elevated in the energy market since the beginning of the year.

-

-

Staff turnover has been elevated in the energy market this year.

-

Insurers claim that damage from the “detonation of an explosive” is also excluded.

-

WTW predicted that ‘meaningful softening’ could creep into energy markets during the year.

-

Increased reinsurance retentions left some insurers with their worst net results in a decade.

-

Recurring loss patterns have led to squeezed coverage, leaving clients exposed.

-

Graham Knight will become chairman of natural resources.

-

The broker has made a string of hires in its upstream energy division.

-

Copenhagen Infrastructure Partner’s policy is subject to a sub-limit for hail damage.

-

-

Miller also appointed three other WTW brokers to its onshore energy team.

-

-

The facility will target operators across the US, onshore and offshore.

-

Nord Stream has named Lloyd’s Insurance Company and Arch among the defendants.

-

The underwriter was overseeing MGA Kersey Specialty’s pivot to renewables.

-

The pair hail from Miller and Aon respectively.

-

It will begin underwriting from April 2024.

-

The business will be led by Alex Kirkby, new head of marine and energy.

-

Managing risks associated with the technology is essential.

-

Plus all the latest executive moves and the top news of the week.

-

The MGA previously hired Sara Valentine from Brit to launch in energy.

-

The senior energy underwriter exited amid a strategic pivot at the MGA.

-

Underwriters are pushing for rate rises, but competition is increasing.

-

Kennedy previously worked as an energy broker at Aon and Marsh.

-

The agreement will cover onshore windfarms, primarily in Sweden.

-

Fragile supply chains are driving up costs.

-

The carrier has also hired Henry Henderson from Liberty.

-

The broker made a number of energy hires from Price Forbes and Miller last year.

-

Scor partnered with Acrisure Re to build the consortium.

-

The appointment comes following the appointment of Ahad Khalid as head of power.

-

He will report jointly to Melanie O’Neill and Ronald Bolaños.

-

The carrier is rebuilding its energy underwriting team after a number of staff departures.

-

The senior upstream energy broker departed Marsh last autumn.

-

Siemens Gamesa is one of the world’s leading renewable energy manufacturing companies.

-

A trio of underwriters from GCube will lead the business.

-

The carrier has been expanding its team since launching into the energy market last year.

-

Gaughan took over the leadership of SiriusPoint’s energy underwriting operation last year.

-

The carrier has made numerous energy and power appointments in recent months.

-

The global segment leader for power generation moves to Tokio Marine HCC soon after his colleague Nicola Hannay.

-

IGI writes a worldwide upstream energy book, with a lead underwriting capability and maximum line size of $75mn.

-

The Syndicate 2050 will provide capacity for new energy projects that support the transition to net zero.

-

The carrier has made several senior hires in energy and construction this year.

-

Mass construction in remote locations is throwing up challenges around modelling exposures.

-

The renewables insurer flagged a “staggering increase” in hail events, which was driving double-digit rate increases.

-

The broker is hiring in energy following the departure of several downstream brokers for Price Forbes.

-

Tokio Marine HCC restructured its marine, energy and renewables division earlier this year.

-

The downstream brokers will join Price Forbes alongside former colleague Dan Nicholls, who left Miller last month.

-

The line of business entry will be via its AdA SPA 2024, which will begin underwriting in 2024.

-

The broker said it anticipated new entrants in the downstream class following a profitable 2023.

-

Delegates at our annual London Market Conference (LMC) described the market as “transforming” and “exciting”.

-

The class underwriter has spent more than two decades with Brit.

-

The onshore energy broker has more than 15 years’ experience in the sector.

-

Inflation, supply chain issues and technological failures are complicating the underwriting landscape.

-

Plus this week’s people moves and all the top news from this week.

-

The appointment follows the recent hire of Pascal Carrer as head of casualty in Switzerland, and David Corrigan as head of property.

-

The carrier launched its offshore wind proposition at the beginning of the year.

-

Upstream energy broker David Patten has also left Marsh.

-

The carrier is looking to grow its direct underwriting capabilities, focussing on the offshore wind market.

-

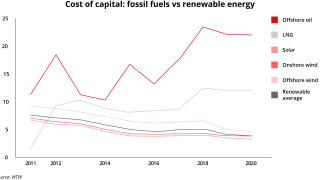

Carriers achieved sweeping changes in pricing, terms and coverage in a hectic renewal at 1 January 2023, in a reset that sources hope isn’t reversed.

-

ESG targets and the growth trajectory of renewables is attracting capacity to the class of business.

-

Inflation, supply chain bottle necks and issues with emerging technology are all challenges for the sector.

-

Tomais Gaughan has been promoted to lead the energy offering at SiriusPoint International.

-

Investigations have revealed more damage than first thought from the July explosion.

-

Sompo International said it saw growing demand for expertise and capacity in the region.

-

The carrier is hiring in its energy team following the resignation of natural resources head James Brown.

-

Downstream underwriters have been pushing for rate this year following high claims activity in 2022.

-

Ardonagh is consolidating the broking operations of Ed Broking, Besso and Bishopsgate under the Price Forbes brand.

-

The community solar binder is led by Canopius, targeting $2mn-$20mn solar projects.

-

The carrier announced the launch of the green solutions portfolio in May as it looks to become a market leader for sustainable risks.

-

The Mexican state-owned oil company has been the source of several large energy claims.

-

There is stiff competition in the renewables space as carriers look to establish positions in a growth market.

-

Howden Tiger, which has been hiring aggressively from rivals, currently has only limited involvement in marine reinsurance.

-

Price Forbes now houses Ardonagh Specialty’s energy operations, absorbing teams from Ed Broking, Besso and Bishopsgate.

-

The BI loss is set to stretch into the hundreds of millions of dollars, with some anticipating a $500mn+ loss.

-

Plus the latest executive moves and all the top news of the week.

-

The carrier has been recruiting for the position following Steven Farr’s move to Tokio Marine HCC.

-

Capacity and competition are limiting underwriters’ ability to continue pushing for double-digit rises.

-

Emily Taylor joined Hiscox as a senior underwriter in 2020.

-

Sean McGovern said the appointment was part of an “important strategic initiative” for the company.

-

Both oil and gas and renewables insurers are at the sharp end of the insurance industry’s ESG journey.

-

The executive passed away last week after suffering from motor neurone disease.

-

The underwriter will work out his notice period at Chaucer, which remains active in the natural resources class.

-

It emerged in March that Tim Welsh was leaving MS Amlin after almost three decades at the business.

-

The news follows months of speculation in the energy market about James Grainger’s plans after his resignation from Munich Re.

-

The pair will be responsible for managing underwriting activity across their respective lines.

-

Ben Kinder, the recently appointed CUO of marine, energy and renewables, will lead the consolidated team.

-

Larger wind turbines are driving up the cost of claims in the renewables sector.

-

The executive said surging demand for coverage would address the supply-demand mismatch in the renewables space.

-

The business is looking to become a lead presence in green risks in London, following Syndicate 457’s exit from oil and gas business.

-

The move marks a return to growth in fac for the broker after heavy talent attrition during Aon’s attempted takeover.

-

The loss hits a market grappling with social and economic inflation, plus increased reinsurance costs.

-

The carrier made the statement following a news report which said it was renewing the policy.

-

The offshore construction market was identified by the broker as being “inherently unprofitable”.

-

Hardening has recommenced in the market, although conditions vary depending on client, according to WTW.

-

The underwriter will focus exclusively on onshore and offshore energy insurance worldwide outside the US, focusing on clients transitioning to a net zero environment.

-

Reserving has increased substantially, inflicting another major claim on the loss-hit class.

-

Sources said they were seeing more verticalisation of placements in the energy market, particularly in the downstream segment.

-

The broker focused on African, North Sea and Latin American business at Primassure and has 30 years’ experience.

-

Energy underwriter Tim Welsh has held a string of increasingly senior positions at the carrier since 1994.

-

Highlander has $300mn of insurance coverage, placed by Ed Broking and led by Munich Re Syndicate.

-

Ex-Miller broker Andrew Vertigan will also join BMS’ energy team as it looks to strengthen its service offering.

-

Underwriters are responding to onshore losses in 2022, but offshore continues to attract new capacity.

-

The recruit has also worked for Arch, Swiss Re, QBE and others.

-

The carrier has launched into downstream energy, marine and aviation in the past year.

-

Human rights groups have issued a complaint to a US mediation body alleging that Marsh has violated OECD guidelines for corporate standards.

-

The losses result from incidents throughout construction of the Sakarya gas field, including damage to a subsea pipeline from an earthquake.

-

Former SSL chairman Andrew Sturdy’s MGA has hired staff from AGCS, Qatar Re and Trust Re.

-

The book of business was performing poorly, and was exposed to major claims from the 2021 Huntington Beach oil spill in California.

-

The broker joined McGill around a year ago as part of the renewables, power and energy division.

-

Will Morgan was part of the original broking team when Inver Re launched in 2021.

-

The settlement is welcome news for the loss-hit downstream market, where there were fears of a claim as high as $1.3bn.

-

Prior to her promotion, Laura Casby was a senior underwriter in the UK and Lloyd’s upstream energy team.

-

Rates began falling at the mid-year but loss activity has changed the mindset of underwriters.

-

Last month there were several unusual drone sightings over North Sea oil fields, sparking security concerns.

-

Mike Gosselin has spent 21 years at Liberty Specialty Markets, most recently as CUO for specialty lines.

-

Former renewables head Hamish Roberts has moved to work as growth leader for the broker in the UK and Ireland.

-

The broker warned that more insurers will restrict or drop oil and gas business in the coming years.

-

The broker has worked for Marsh and JLT during his 25 years in energy insurance.

-

The claim will add pressure to an already stressed downstream market facing resurgent loss activity.

-

Chaucer CEO John Fowle also set out to Insurance Insider the rationale for the carrier’s new ESG scorecard comprising 158 data points.

-

The hail which hit Texas in early summer 2022 alone resulted in solar losses estimated to exceed $300mn.

-

The broker’s sustained hiring has driven it to hit revenues of £250mn in 2022.

-

Simon Lazarus, Andrew Vertigan and Oleg Grigorovich were part of the international team in Miller’s upstream business.

-

The conflict has prompted a potential mismatch between insurer and client transition speeds.

-

There has recently been a string of major claims in the downstream market, making underwriters question rating trajectory.

-

The carrier has merged its marine and energy units as it looks to improve service and achieve growth.

-

Steven Farr has worked at Axa XL since 2007, then the Catlin business, holding a string of increasingly senior energy underwriting positions.

-

Overcapacity in upstream energy means the immediate impact of the move will be limited.

-

The carrier will no longer invest or insure contracts and projects directly relating to new oil and gas fields, new midstream oil infrastructure and new oil-fired power plants.

-

The syndicate will now pivot “in a very robust and determined fashion” into renewables and green tech, according to CUO Dominick Hoare.

-

The executive replaces Jonathan Smith, who is due to retire.

-

Loss activity is escalating in the class of business, leading underwriters to question rate softening.

-

The broker also hired Will Fremlin-Key as global head of mining and metals, and appointed Ahmed Abdel-Gawad as head of natural resources for the CEEMEA region.

-

The underwriter is one of the most respected in the market and leads a substantial amount of Gulf of Mexico business.

-

Offshore energy chairman Frank Streidl said margins are tight and upstream had not hardened like other insurance lines.

-

The broker said the fallout from the Russia-Ukraine conflict was increasing competition for business.

-

The carrier is launching into the downstream energy market as part of an international primary lines expansion.

-

The hydrogen industry is a key pillar of the energy transition, but securing insurance coverage is challenging.

-

The downstream market has been stung by an uptick in claims following two years of healthy profits.

-

Turner will report to executive partner Gavin Tidman and work closely with head of renewables Duncan Gordon.

-

The loss at the OMV Schwechat refinery adds to a string of BI claims landing on the energy sub-sector in recent months.

-

The market has recently been stung by several large anticipated claims, with cat season looming.

-

The loss comes hard on the heels of a large BI claim stemming from the Freeport LNG refinery.

-

The underwriters are tasked with implementing “ambitious growth plans” across the lines of business.

-

Regulatory burdens mean that restarting the Freeport refinery could take longer than first hoped.

-

Hiscox is understood to have led the policy, while Aon is said to be the broker.

-

Under the scheme, insurance services would only be available if the price ceiling was observed by the importer.

-

An abundance of capacity is leading to price reductions in the downstream sector.

-

The watchdog is proposing rules that would require actuaries to consider climate risks in technical work.

-

Plus people moves and all the top news of the week.

-

Increased competition in the upstream space, driven by a capacity surplus, is turning conditions in the favour of clients.

-

The Lloyd’s business recently launched into the energy class under the leadership of Richard Pursey.

-

The latest round of sanctions against the rogue state banned the insurance of ships carrying Russian oil.

-

Challenging loss activity for battery storage projects has led to a capacity contraction in the sub-sector.

-

It is understood that the account includes oil platforms, crude barrels and 12 vessels, and is one of the largest accounts in the South American country.

-

Competition for business is leading to a rollback in exclusions written into contracts following major loss activity.

-

Clients face under-insurance for BI if their coverage is not adjusted to reflect energy price rises.

-

The product will provide construction all risk and operational all risk coverage, backed by AI-powered data and analytics.

-

The hires come amid a personnel expansion at Lockton, which brought in 1,200 new staff last year.

-

The Peruvian government is suing Spanish oil company Repsol over the January incident which affected 700,000 residents.

-

Marine and energy-focused MGA Thomas Miller Specialty has partnered with Send Technology Solutions to streamline and automate its operations using the InsurTech’s software.

-

Plus the latest company results, people moves and all the top news of the week.

-

The scale of the claim deals a substantial blow to the subsection of the energy market, but is not as large as first feared.

-

The broker said there was “genuine pressure” for downstream rate reductions, whilst renewable rate rises were single digit.

-

The carrier launched a dedicated renewable power offering at the start of 2022, led by Lyndsey Picton.

-

Large energy property damage losses in 2020-21 saw a significant reduction, accounting for a total of $500mn across the two years.

-

The executive said the Ukraine conflict was an example of how the industry had come to over-optimise models.

-

The Association of British Insurers director or regulation said that insurance providers have an important role to play in helping to provide capital to fund green infrastructure projects.

-

The escalation of conflict in Ukraine has led to global energy uncertainty and underpinned high asset prices.

-

The intermediary said capacity for downstream energy has now returned to 2017 levels.

-

The potential for major deterioration on a 2019 loss could yet prove “devastating” for the market.

-

The carrier has already withdrawn cover for the top 5% of carbon-intensive oil and gas firms in the past year.

-

It is understood that the Hartford led the EUR85mn policy, with Tysers the broker.

-

It is understood that MS Amlin leads the placement, which is brokered by Marsh.

-

Chris Van Gend joined the company from AGCS earlier this year to lead the buildout in the class.

-

Growth plans are common in the market but there are questions about the level of rating adequacy.

-

Plus the evolution of the broker consolidator model, this week’s results and all the top news of the week.

-

The situation remains ‘business as usual’ for Russian energy contracts, but a worst-case scenario could result in hundreds of millions of premium at risk.

-

The withdrawal of the major lead market will substantially reduce available capacity at 1 April renewals.

-

Cedric Wong has also been promoted to lead the UK engineering and construction wholesale team.

-

The carrier has promoted Sebastian Weaver to head of sustainable energies to run the new unit.

-

The Richard Watson-led carrier will enter a class that has undergone a period of substantial rate rises.

-

The broker said terms and pricing were not significantly impacted by new capacity from oil and gas players.

-

In the upstream market, benign conditions are expected in 2022 as commodity prices increase.

-

Integra Risk Services will offer outsourced risk engineering management to the construction, engineering and energy sectors.

-

The broker said the last three years of hardening had led to a “substantial technical correction”.

-

Gardner was previously at Marsh for nearly three decades, holding a variety of leadership roles.

-

The consortium has been developed by Chaucer, Markel and Munich Re Syndicate, and has a maximum working capacity of $100m per project.

-

The underwriter will also play a part in upskilling upstream underwriters with knowledge of renewables.

-

The move follows another recent energy-related departure from Willis, with news that McGill and Partners had hired former upstream energy broker Ian Elwell.

-

Account wins include Swedish steel manufacturer SSAB and iron ore producer LKAB, both won from Aon.

-

Charlie Richardson will work as head of renewable energy underwriting, as previously reported by this publication.

-

Sources say the insurance industry will not walk away en masse from existing clients.

-

The renewables underwriter said the sector was suffering from broad terms, high claims and new entrants from the oil and gas sectors.

-

OPEnergy will be the second MGA to launch on the platform this year, after Navium Marine was founded in April.

-

Flat rates are expected in upstream whilst insurer appetite is picking up in the downstream market.

-

People movement is picking up in the sector, which is experiencing broadly stable rating thanks to ample capacity.

-

The broker places energy business across upstream, downstream and renewables with a team led by Tim Fillingham.

-

The landmark project will provide renewable solar power to the cities of Darwin and Singapore.

-

Marsh has bolstered its upstream energy division with the appointment of Thomas Burrows from Convex, Insurance Insider has learned.

-

If rising prices are not addressed in insurance policies, gaps could leave energy sector players uninsured as asset values exceed insurance limits.

-

Demand is growing for insurance capacity to cover less carbon-intensive energy sources.

-

The AIG-owned business has seen a major transformation in its senior leadership.

-

The well-known underwriter has held similar positions at Sompo International and Partner Re.

-

The Willis solution is designed to help companies access insurance as they transition to a low-carbon business model.

-

The energy market is being watched closely due to its potential to produce large risk losses.

-

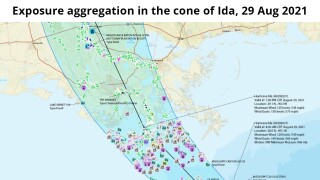

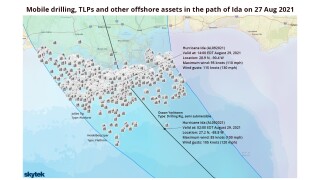

Damage to crucial power infrastructure caused by the storm left over one million Louisiana residents without power.

-

Market sources said there had been no reports of major incidents, but damage assessments would begin in earnest today.

-

Platforms are the most at risk offshore energy asset, with 1,651 exposed to the current trajectory of Ida, while bulk carriers are the most exposed marine asset, with 100 currently exposed.

-

An increase in participants in the class of business could risk derailing underwriting remediation efforts.

-

The broker said ESG pressure was attracting capacity away from fossil fuels to renewables.

-

The hire previously worked for BMS and Price Forbes.

-

The London-based MGA is pivoting to the renewables market and away from supporting fossil fuel energy.

-

Underwriters warned of a need to sustain profits and the risk of losses as plants are reactivated.

-

Meanwhile, capacity is entering the renewable energy market, where loss activity has driven up pricing.

-

The broker said there were signs the downstream market was “topping out” after several years of major hardening.

-

It is understood that the firm serves a number of major oil and gas clients.

-

The insurance trade body has set out an ambitious climate change roadmap that would see members contribute one third of the total investment needed to help meet the UK’s net-zero target.

-

The appointment follows the departure of energy line underwriter Charles Rawlins last year.

-

The Mexican state oil company has been a source of major claims in the past.

-

The rebrand follows a last-minute acquisition of the firm by Aquiline-owned Lloyd’s syndicate ERS, in December of last year.

-

The Italian carrier pledges action in investment and underwriting and the group's core businesses, and commits to a low-climate-impact future.

-

Japanese carrier MS&AD Insurance Group Holdings has become the latest insurer to limit its coal underwriting appetite, saying it will no longer insure new coal-fired power plants.

-

Covid concerns are still high, while natural catastrophe concerns and capacity reduction are driving premium increases.

-

Both brokers join the specialty energy unit from Ed Broking.

-

Plus the lowdown on CFC’s syndicate capacity and all the top news from the week.

-

He said Lloyd’s was a “broad church” and the market would work together gradually to reduce fossil fuel exposure.

-

Executives including AIG CEO Peter Zaffino, Aon CEO Greg Case and Munich Re CEO Joachim Wenning have joined the task force, chaired by Lloyd’s.

-

Oliver Brown, Penny Wang, James Emson and Jack Erritt form the team.

-

Jenner has more than 30 years' experience in the energy market and was formerly an executive director at Howden Specialty.

-

The aspiring carrier is already providing risk-transfer deals for carbon offset buyers but plans for its initial underwriting to be focussed in more traditional areas.

-

The appointment follows the decision of the Dubai MGA to restructure its energy portfolio last year.

-

Severin Hegelbach is to take a new Brazil-based divisional director role.

-

The Insure Our Future network is due to hold “physical and digital actions” in Japan, South Korea, the UK and the US.

-

The Corporation has been repeatedly targeted by the likes of Extinction Rebellion over its involvement in fossil fuel insurance.

-

Efforts to curb covers for the most carbon-heavy assets are gaining pace and the infrastructure that allows for Paris alignment on the liabilities side of the balance sheet is improving.

-

Downstream uses of oil and gas pose challenges for the (re)insurance industry, he says.

-

Lancashire’s upstream income was broadly stable in 2020 as the carrier registered modest rate increases.

-

Wreck removal, if required, would generate a separate $50mn-$100mn claims bill for the P&I market.

-

The total cost of repairs could be as much as $490mn, although the ultimate size of the claim remains unclear.

-

Jones specialises in international upstream business and is experienced in offshore platforms.

-

The MGA, which has capacity from Berkley Offshore and Munich Re Syndicate, is to start underwriting in June.

-

The carrier aims to make its entire global operations climate neutral by 2030 and has set new investment targets.

-

His arrival comes in the wake of a series of departures from Validus Re’s specialty reinsurance team.

-

The newly created Insurance Rebellion dumps fake coal on the doorstep of One Lime Street.

-

Most of the loss comes from BI, with the remainder split between physical damage and extra expenses.

-

In the downstream energy insurance market, 2021 has begun relatively quietly in terms of loss activity.

-

The partnership will focus on onshore wind and solar projects in the US and Canada with a line size of up to $50mn per location.

-

The appointment comes after the departure of its Netherlands-based team and Sophie Irvine in the UK.

-

The global natural resources director said “walking away” from risks was unhelpful and a “policy of engagement” was needed.

-

Capacity above a certain limit remains unavailable, with coal and oil sands industries affected especially.

-

Rating is now bifurcated, with clean risks securing 12.5%-20% increases and more loss-impacted risks seeing 25% -40% hikes.

-

Offshore construction business can attract rates of up to 75%, compared with 5% rises in exploration and production.

-

Gallagher is the broker for Indonesian state oil firm Pertamina, with AIG and Axa XL understood to participate.

-

The Nuclear Electric Insurance Limited subsidiary is targeting US E&S and looking to write business from April.

-

Covid-19 losses materially impact the property market, but the marine, aviation and transport segment returns to profit.

-

The reinsurer accelerates its retreat as part of a new set of targets to achieve net-zero emissions by 2050.

-

More customers and investees are in dialogue with the carrier over sustainable energy concerns.

-

Nat cat and extreme weather claims have become more frequent and severe with hail, heavy rain and wildfires leading to significant losses.

-

The need to secure rate increases will be countered by the financial pressures faced by policyholders.

-

In a second hire within the broker’s offshore wind team, Sarah Burston returns.

-

CEO Amanda Blanc claims a world first with a plan that includes underwriting curbs on companies making more than 5% of their revenue from coal from the end of this year.

-

The P&I club says it increased its market share across all other lines, including hull and energy.

-

The move is a response to US sanctions which previously brought construction on the Russia to Europe project to a halt.

-

The move is a response to US sanctions which previously brought construction on the Russia to Europe project to a halt.

-

The appointment follows the expected departure of Phil Furlong to expansive insurer ERS.

-

The large number of “unwinterised” assets in the north of the state could lead to a slew of claims.

-

The organisation charts record progress in meeting its seven key principles.

-

The agreement will initially focus on political risk and trade credit, energy and property business, with up to $25mn of capacity per risk.

-

The newcomer had joined Lancashire as an underwriter only in October.

-

The division will service large corporate energy companies in EMEA, Asia Pacific and Latin America.

-

The WR Berkley subsidiary was founded in 2009 and writes upstream energy, marine and energy liability.

-

Tom Harries and Robert Bates join from Bloomberg and Miros, respectively.

-

His predecessor left the business following his conviction for assaulting his then-partner.

-

Contractor negligence and poor vegetation management are also increasing sources of claims.

-

Aon’s Nicholas Boswell Brown and Aviva’s Claire Whelan join the business in April to support the expansion into Spanish-speaking markets.

-

The step is the latest in a flurry of initiatives companies in the insurance sector are taking to combat climate change.

-

The broker says the London and European renewables markets achieved profitability in 2020.

-

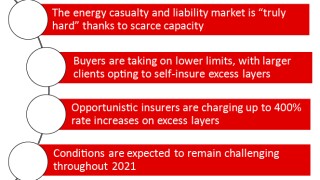

Opportunistic insurers are charging rate rises of up to 400% on excess layers amid a shortage of capacity.

-

Message will write lines including upstream energy as the motor syndicate expands into specialty classes.

-

Sophie Irvine was the only renewable energy underwriter left after Canopius’ Netherlands-based team left the business last year.

-

Losses are “within expected tolerance levels”.

-

Available capacity has shrunk by around $200mn in the loss-hit class of business.

-

Hardening trends in other classes and ESG concerns will test insurer confidence in the sector.

-

They are the latest in a spate of renewable energy hires, which the broker has been growing over the past year.

-

Sources told this publication that former Pioneer colleagues may join the MGA’s new recruit.

-

The partnership will aid the MGU’s international expansion with Generali GC&C UK leading a consortium to back its growth.

-

The losses stem from the Barzan gas plant in Qatar and a Tullow facility off the coast of Ghana.

-

The Lloyd’s CEO said it was not for business to set the tone on climate, as the Corporation laid out its first ESG report.

-

Prior to her time at the oil giant, Harding led the captive practice at Willis Towers Watson.

-

The executive was an EVP at the Innovisk-hosted MGA, which will enter run-off for 2021.

-

The team from the Climate Policy Initiative advises organisations on market exposure to low-carbon transitions.

-

The executive joins the start-up after working at Axa XL since 2007.

-

Howard Burnell was reportedly convicted at Wimbledon Magistrates Court of assaulting his then-partner.

-

Shazia Aslam Rafique has worked at LSM since 2003 and has over 21 years’ experience in the industry.

-

The latest hire follows the appointment of fellow Guy Carpenter marine and energy broker Andy Massingham last month.

-

The experienced underwriter, a former global head of energy at AIG, will be based in London.

-

The court finds no “justifiable doubts” around the arbitrator’s impartiality after the US oilfield services company alleged bias.

-

The former global head of marine, aviation, transport and offshore energy will be a partner and starts on 19 November.

-

The sanctions will further complicate the delayed construction of the 2,460 km pipeline between Russia and Germany.

-

The business segment, which includes HDI Global Specialty, has already exceeded its full-year large loss budget.

-

The Hammerfest loss is thought to be ~$500mn and well spread around the market.

-

Guido Benz will join the business next spring and report to Lee Meyrick

-

Peter Draper was AFL’s international property and energy director, and before that worked at UIB for 13 years.

-

The executive will lead the marine and energy mutual, agency and captive reinsurance solutions practices.

-

Matthew Holmes and colleagues move to the Lloyd’s operation after Dubai-based MGA Elseco restructured its energy portfolio.

-

The executive leaves Aon after 13 years

-

This is just 26% of theoretical capacity of $3bn and has led to major clients self-insuring parts of their programmes, according to Willis.

-

Carriers are imposing 7.5%-10% rate rises on accounts with less than $1mn premium, the broker finds.

-

The Tokio Marine HCC MGA takes Zoe Massie from AGCS and confirms the hire of Talbot’s Joshua Cantwell.

-

The loss record for the class has dramatically improved this year, with a worst-case loss scenario of around $2.5bn for 2020.

-

Jonathan Ibbott, David Watts and Urs Uhlmann have also left the business.

-

Maarten Mulder, Martijn Meijboom, Bart Leijssen and Arnout Bijl have left the carrier to join the MGA.

-

The Aon Global Energy chief commercial officer’s move reflects continued strong interest in the broking sector among financial investors.

-

One source predicted a loss tally as low as $200mn.

-

Early reports from the Gulf of Mexico suggest that damage could be less than the $1bn-$2bn range.

-

The executive resigns after more than three years as energy chief to pursue other opportunities.

-

Insurers forecast rate acceleration, along with damage below that seen in 2005 and 2008.

-

Stinging energy losses could be added to a slew of painful marine and aviation losses in August.

-

The executive joins as head of offshore renewable energy following the MGA’s takeover by Tokio Marine HCC.

-

The JC Flowers-backed broker continues its hiring spree following a rebrand.

-

Gavin Tidman will become an executive partner for the energy practice and expand its presence in international markets.

-

Will Curtis will lead the new unit as property risk partner, as the MGA separately increases its energy capacity.

-

The exit of Aspen and Liberty along with a “challenging claims environment” has put pressure on the class.

-

The broker has made a number of recent hires, including in the energy division in London.

-

Tom Baker will become the carrier’s first ever global head to be based in Asia.

-

Pacific Gas and Electric Company (PG&E) has received approval from the California bankruptcy court for an $11bn settlement with insurers related to wildfire losses in 2017 and 2018.

-

The loss from a March explosion at a South Korean petrochemical plant has expanded from about $200mn to around $600mn after business interruption (BI) claims pushed up the initial loss estimate.

-

The upstream energy market is unlikely to face a claim for the hijacking of a floating production, storage and offloading (FPSO) vessel off the coast of Nigeria earlier this month.

-

Insurers for BW Offshore’s Sendje Berge FPSO may have dodged a bullet following a pirate attack on the vessel, but the ordeal may only be beginning for the nine crew members kidnapped in the raid.

-

Insurers’ ambitions cannot be sustained in a prolonged soft rating environment, the broker says.

-

A spell of damaging losses has led to sustained positive rate movement in the sector.

-

Dominican Republic firm Refidomsa ran a request for proposal process earlier this year.

-

Warren Diogo will head up the London-based team and focus on wind and solar risks.

-

The loss from a March explosion at a South Korean petrochemical plant has expanded from about $200mn to around $600mn after business interruption (BI) claims pushed up the initial loss estimate.

-

BI losses increase the claims tally on the Aon-brokered policy.

-

Willis Towers Watson’s global head of broking for natural resources, facultative, James Goodwin is to join Guy Carpenter’s facultative reinsurance division (GC Fac).

-

Peter O’Neill and Lorena Gallagher join the energy team, while Richard Tomlin heads up marine property and war.

-

Joanne Silberberg will be Canadian renewable energy leader and Dan Gumsley will be a UK account manager.

-

The broker notes a swift transition after years of soft conditions.

-

Underwriters were unable to push through rate rises of more than 5 percent at 1.6 as the oil price crash impacted available spend

-

Former RK Harrison broker Russell Williams will join the Bermuda office.

-

The expansive broker adds another former JLT Re executive, intercepting Martin Stephenson’s move to Aon.

-

Brett Hatton will start in September and report to downstream energy head Jon Parker.

-

A public insurance certificate unearthed by Reuters shows that the insurers are involved despite pledges to fight climate change.

-

The broker has the biggest book in the offshore wind market, according to sources.

-

The broker called on the industry to address the issue of ageing infrastructure.

-

Upstream energy is unaffected by the pullback.

-

The company wants to remove coal-based companies from its investment and insurance portfolios by 2040.

-

The broker has made sweeping changes to its global green energy broking set-up.

-

City comptroller Scott Stringer said AIG, BHSI and Liberty Mutual should stop underwriting and investing in coal.

-

The downstream market is expected to be less impacted although there is some BI exposure.

-

A memo seen by this publication says the Dubai-based MGA plans to relaunch its energy operation.

-

Rates have risen by more than 20 percent, and will be impacted by Covid-19 and the oil price war.

-

Rate growth in the sector stands at 20 percent and in some cases even higher.

-

The broker predicts a “period of turmoil” among energy companies and their insurers.

-

The falling oil price could shrink premiums and curtail rate rises in the recovering class.

-

The worst performing Lloyd’s syndicate suffered from adverse development on prior years for both classes in 2019.

-

Remedial actions start to bear fruit in primary property.

-

Sources said the retreat of Liberty and Aspen from the class has made placements challenging for brokers

-

The Dubai-headquartered company will list on the Nasdaq today, giving it additional access to capital markets.

-

The position at the carrier was vacant following the elevation of Peter Welton to UK head of energy.

-

The deal comes as renewable energy rates continue to harden.

-

The experienced underwriter left Canopius last year on the eve of the AmTrust merger.

-

Market sources said the carrier was no longer accepting submissions across those classes of insurance.

-

Marc Sullivan will be a downstream energy class underwriter at IGI and report to Graham Hensman.

-

The carrier may also expand in power and niche aviation as conditions improve, CUO Paul Gregory told analysts.

-

Hardening market conditions are providing opportunities, the broker says.

-

Gordon Browne will take over as interim head of global specialty following the executive’s departure.

-

The move comes amid rate hardening across both energy and marine insurance.

-

The AIG executive urged carriers to be "part of the solution" and help customers transition to cleaner energy.