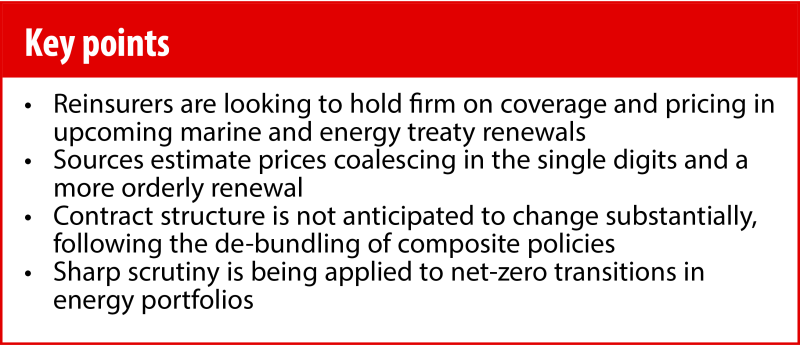

Sources said they are anticipating more orderly negotiations than those during a hectic run-up to 1 January 2023, when reinsurers achieved a radical overhaul in contract structure and pricing, which left brokers scrambling to confirm coverage in the run up to the new year.

Sources said that just as much focus will be directed to terms and coverage for the 1 January 2024 renewals.

Meanwhile, brokers are optimistic that in a more orderly market, they will be able to achieve clearer and more aligned coverage for cedants, with reinsurers approaching the renewal without the fear of unquantifiable losses relating to the war in Ukraine.

“Broadly speaking, it is about making sure that the achievements reinsurers made last year are not lost and that we are not imminently moving back towards a 2022 or 2021 market,” said Christian Silies, head of global aviation, marine and energy reinsurance at Sompo International.

“The point that reinsurers made over 1.1 was that coverage needs to be paid for, and the terms and conditions and the wordings should be tight rather than broad.”

In particular, reinsurers want to ensure all aspects of reinsurance coverage have appropriate, more specific levels of premium attached, and any re-bundling of contracts that were restructured last year is unlikely.

“The days when one plus one equals one and a half in terms of pricing are over,” Silies said. “Nowadays it is probably two.”

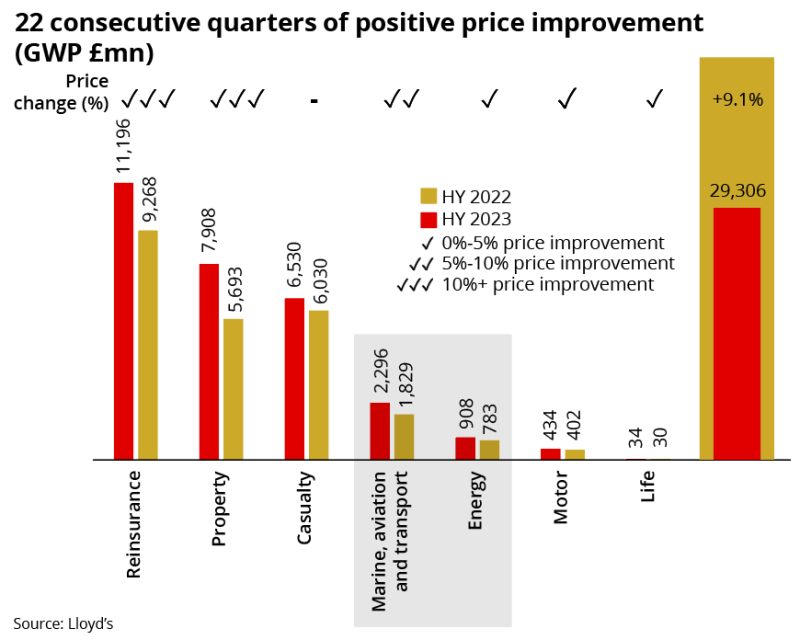

With Ukraine exposures more clearly understood than last year – despite ongoing uncertainty around potentially vast aviation claims – brokers said that there is an increased appetite from reinsurers to write marine and energy business.

Nick Croxford, global head of marine and energy at Gallagher Re, said that at this point last year, reinsurers were “fearful”, but that the atmosphere had now changed.

“They didn’t know what losses from Ukraine would materialise,” Croxford said.

“I think they were comfortable at 1.1 with the pricing and standards they achieved, and now it is a green light to write business.”

Inflation also remains a key point of discussion, while retention increases implemented last year are expected to be broadly unchanged.

In addition, the market is paying closer scrutiny to underwriting plans relating to the energy transition, with ESG increasingly incorporated into reinsurance underwriting decisions.

The ramifications of Ukraine

Russia’s February 2022 invasion of Ukraine sent shockwaves through the (re)insurance market, but it only became clear in the final weeks of the year how dramatically specialty reinsurers would react.

Composite deals had previously been commonplace in the specialty market – bundling in lines including marine, energy, aviation and political violence – but in many (but not all) instances, these structures were drastically reshaped.

In particular, reinsurers were keen to generate additional premium income for political violence business, which sources said had been incorporated into contracts for negligible premium in soft market years.

Furthermore, a series of exclusionary wordings were introduced, largely relating to war coverage.

Reinsurers adopted a defensive stance, producing their own wordings, creating significant concerns about potential gaps in coverage and leaving many carriers running marine war risks on a net basis in Ukraine following the renewal.

Hannover Re – amongst the largest players in the specialty market – caused particular commotion with its exclusionary wording and its move to exclude indirect losses from the war.

Key to the reinsurer attitude was a huge unknown about the eventual scale and impact of claims stemming from Ukraine, with the majority of marine claims only crystallising from February 2023, a year after the invasion was launched.

“One of the key challenges at 1 January 2023 was that you had unquantifiable losses coming out of Ukraine,” said Jim Summers, global head of marine and energy specialty at Guy Carpenter.

“That lack of clarity led to a defensive position being taken by reinsurers in terms of pricing, terms and conditions, and event definitions around terrorism.”

While deals ultimately got home, the situation was chaotic.

Aspirations for standardisation

Approaching this renewal, brokers are pushing hard to deliver aligned coverage that meets the demands of clients, which were effectively operating as forced buyers last year.

“What we want to ensure this year is that clients are able to purchase the types of cover that best meet their risk and capital needs,” said Summers.

“We want to get to a place where we can have one structure and one set of terms, and one set of event definitions.”

Reinsurers also said there was a willingness to push for more uniformity of coverage.

“I completely agree that is desirable,” said Silies of Sompo International.

“This is where the reinsurance market has not delivered. Unified clauses would have been desirable.”

Nuanced approaches

In a market that looks set to be more favourable for buyers, brokers are optimistic that more attractive deals can be achieved for cedants with strongly performing books.

Gallagher Re’s Croxford said that reinsurers adopted a “blanket approach” last year, but this looked set to change.

“We want to differentiate our clients,” Croxford said.

“Last year there was a blanket approach but now there is appetite to partner with well-performing cedants.”

Another major change in last year’s renewals was increasing retentions, which has made some marine and energy losses this year painful for the direct market, with insurers swallowing higher net claims costs.

However, it is not anticipated that there will be significant changes to retention levels at upcoming renewals, especially given the positive dynamics in primary market pricing.

“Generally, in a harder market if your underlying book is sound then taking a higher retention can be a healthy thing to do,” Summers said.

Reinsuring the transition

While war coverage is set to be the key talking point of 1 January, there is an increasing focus on ESG in underwriting decisions, with reinsurers wanting to see tangible energy transition plans within energy portfolios.

There is increased demand for renewable products, but traditional fossil fuel risks are still the mainstay.

“Supporting energy majors who are themselves going through a transition seems a wise strategy,” Sompo International’s Silies said.

“We are going to be a partner in that transition as well. We are giving our clients time, but that transition is happening.”