Allianz

-

The carrier is looking to achieve sustainable growth across its personal lines business.

-

White will join from Allianz trade, and Summers from Talbot.

-

Stephen Ridgers is leaving his current role as head of construction midcorp at Allianz Commercial.

-

The report highlighted the gap between insured and uninsured attacks is widening.

-

The toll of risk losses sustained by the PVT market this year is mounting.

-

Plus, the latest people moves and all the top news of the week.

-

The platform aims to “bend the loss curve”.

-

The insurer’s plans for the syndicate were revealed by this publication earlier this year.

-

Rates are bottoming out, but ample capacity is still preventing a hardening market.

-

A number of staff will be leaving the D&O team as a result of the restructuring.

-

The carrier’s overall P&C combined ratio improved 1.8 points to 91.2%.

-

Doan Nguyen-Huu also succeeds Claudia Valencia Lascar as unit head.

-

Incumbent Oskar Buchauer is stepping down after 27 years.

-

Liberty Mutual, Allianz and Aviva previously had their appeals dismissed.

-

Plus the latest people moves and all the top news of the week.

-

Lloyd’s executives have suggested ceded reinsurance syndicates could help London compete in treaty.

-

The carrier said the cuts will help it to become a “simpler, digital-led business”.

-

The executive previously spent 15 years in a variety of roles at Zurich.

-

Working out ROI on sponsorship deals is difficult, but the sport is beloved by insurance brands.

-

Politically related exposures are growing for the marine market.

-

While M&S had a cyber policy in place, Co-op and Harrods did not, Insurance Insider revealed.

-

Plus the latest people moves and all the top news of the week.

-

The carrier’s overall P&C combined ratio improved 0.1 points to 91.8%.

-

Insurance Insider revealed earlier this week that the underwriter had resigned from Allianz.

-

-

The Willis-brokered coverage also includes the Willis CyXS facility.

-

New capacity continues to enter the hull market, and rates are falling.

-

Insolvencies caused by the tariffs could also cause increased losses

-

Newly appointed CEO Chris Jones also joins the board.

-

Charles De Bar leaves Allianz after four years with the carrier.

-

A positive outcome could significantly curb insurers’ exposure to the loss.

-

A survey from the carrier looked at the political risk and violence concerns of companies.

-

Allianz has previously entered several capacity arrangements with the MGA.

-

des Cressonnières has worked for the carrier for 28 years.

-

Of the 178 passengers and crew on board, no serious injuries have been reported.

-

A collision earlier today caused a cargo of jet fuel to burst into flames.

-

The company also announced a EUR2bn share buyback.

-

The crash is the latest of several losses for aviation insurers in recent months.

-

A new UK CEO for the trade credit insurer will be announced at a later date.

-

The executive will report to Colm Holmes and Dick Volger in his new position.

-

The biggest riser in this year’s Allianz Risk Barometer was climate change.

-

The executive will look to develop the MGA’s specialty underwriting portfolio.

-

The move follows objections from the Singapore government.

-

The carrier revealed new group financial targets at its Capital Markets Day.

-

Tillett succeeds Michela Moro who is returning to Italy, according to Allianz.

-

Allianz’s P&C unit booked natural catastrophe claims of EUR646mn over Q3.

-

Palestine Action alleges Allianz is involved in insuring the Israeli arms trade.

-

Construction rates remain stable with some talk of potential softening.

-

Mark Hartigan will move to chair following a spell as interim CEO.

-

The former Aspen executive has resigned from AIG and will fill the vacant CEO role at the large corporate unit of the German carrier.

-

The firm will split its global combined cat program into two layers.

-

QBE has “effectively stopped writing new business” in response to its New Caledonia loss.

-

The executive has spent fewer than 12 months in post.

-

Plus the latest people moves and all the top news of the week.

-

Allianz’s group profits were up on stronger investment results.

-

Crashes and collisions accounted for 63% of aviation insurance claims between 2019 and 2024.

-

Both parties expect to close the transaction on 1 August 2024.

-

A roundup of all the news you need today, including Enstar EU’s new CEO.

-

The transaction will make Allianz the fourth-largest composite insurer in Asia.

-

Vanessa Maxwell will remain global head of financial lines.

-

The agreement provides £10mn of capacity in several marine lines of business.

-

Scott Sayce will join on 1 September and report to David Harries, group director of underwriting.

-

Browne joins from Allianz Global Corporate & Specialty, where he was head of specialty.

-

Jason Howes has also been promoted to chief transformation officer.

-

Premium income was down due to lower volume in financial lines and alternative risk transfer.

-

The news follows an announcement from the MGA last week that it has taken a Lloyd’s box.

-

Ulrich Kadow will become global head of product management and underwriting transformation.

-

Environmental activism and terrorist activity are also set to rise.

-

The deal includes an LPT of ~$2bn loss reserves for 2016-2023 years with Arch Re.

-

The marine hull market is looking to retain rating robustness in 2024.

-

Mo joins from Chubb, where she was country manager for Sweden.

-

All three carriers also announced increased dividends.

-

-

The carrier has also hired Henry Henderson from Liberty.

-

The appointment comes following the appointment of Ahad Khalid as head of power.

-

It emerged in November that the carrier’s construction head Daniel Abramson was leaving the business.

-

Political violence rose up the agenda, with conflict raging globally, and key elections due this year.

-

Directors and officers face an increased risk of litigation next year, according to a report.

-

The incoming AGCS CEO joined the carrier in 1998 and was most recently CEO of Central Europe.

-

The carrier has made several senior hires in energy and construction this year.

-

Allianz Trade recently announced that Stennett's role is being taken on by Peter Evola.

-

Profits were down 14.6% at group level to EUR3.46bn, which Allianz attributed to the P&C business segment, where nat cats had a 7.3-point impact on the combined ratio, the highest reported in a decade.

-

Reports show that the combined use of supply chain exploitation and data exfiltration is causing double-digit million-dollar losses for cyber insurers.

-

Valencia will drive the carrier’s strategy for portfolios including panels, facilities, MGAs, bancassurance and other forms of delegated authority.

-

The business was absorbed into AGCS from the former Fireman’s Fund portfolio.

-

The top five insurers on the continent maintained their ‘clear dominance’ in terms of scale.

-

Talanx, Groupama and Itas had shown interest in the P&C business.

-

Elke Vagenende will lead the newly established region, completing Allianz’s leadership team across 11 regions.

-

The capacity, provided by Allianz, will allow Hive to deepen its exposure in the class.

-

In the new role, Giulio Terzariol will take on responsibility for the firm's insurance business units.

-

The carrier is rebuilding its financial lines team following a number of staff exits from the division.

-

Inflation, supply chain bottle necks and issues with emerging technology are all challenges for the sector.

-

Haagen leaves after a 15-year tenure at Allianz, having been a board member of AGCS since early 2020.

-

The underwriter is returning to the company after stints at TransRe and Liberty Specialty Markets.

-

The carrier exited the Net Zero Insurance Alliance in May among other insurers.

-

Downstream underwriters have been pushing for rate this year following high claims activity in 2022.

-

AGCS confirmed that hull underwriter Ashley Hammond is staying with the business.

-

The commercial lines unit increased premiums by 7%, with rate rises up 7% year to date.

-

The liquidity will come from institutional capital, banks and credit funds, facilitated by Trade Finance Global and its partners, including Allianz Trade.

-

Other bidders included France's Groupama and Italy's Itas.

-

Staffing turmoil is ongoing in the marine market as companies vie to secure talent.

-

Under Allianz’s Integrated Commercial strategy, each region will be led by a commercial managing director.

-

Anthony Vassallo will focus on developing AGCS’s natural resources proposition, reporting to global head of specialty Gordon Browne.

-

Simon McGinn joined Allianz in 2004 and was made CEO of Allianz Commercial in 2021.

-

A variety of challenges remain, including the operation of Russia’s ‘shadow fleet’ for oil transport.

-

After founder members Axa and Allianz dealt a potentially terminal blow to the Net-Zero Insurance Alliance by withdrawing, the NZIA is exploring limited options to continue.

-

Sompo is the eighth major insurer to leave the NZIA, casting even further doubt on its future as remaining members explore options around whether to continue.

-

Both Axa and Allianz said their own targets on sustainability and reducing emissions remain unchanged.

-

De la Cuerda will oversee Allianz’s commercial unit in Spain and Portugal, reporting to both Allianz Spain CEO Veit Stutz and AGCS chief regions officer Henning Haagen.

-

AGCS reported an 11% improvement to operating profit, reaching EUR202mn.

-

The carrier made the statement following a news report which said it was renewing the policy.

-

The carrier has confirmed single leaders for each of its four largest P&C commercial markets in the UK, France, Germany and Australia.

-

Sang Hun Park previously spent nine years at Allianz before joining Munich Re as a senior origination manager in August 2021.

-

The MGA provides coverage to SMEs in the food, hospitality, leisure and hotel sectors.

-

Ross Taylor headed the Liberty Specialty Markets marine liability book, which was placed into run-off earlier this year.

-

Analysts find carriers have few investments in bank debt after Credit Suisse rescue.

-

Chris Townsend said streamlining the AGCS business would allow it to attract recruits and open progression opportunities.

-

Gordon Browne will head up lines including marine, aviation and energy, representing 30% of AGCS premium.

-

The collapse of Silicon Valley Bank is creating investor fear across the global financial services sector.

-

Allianz said this approach will close internal structural gaps in market reach and extend its product offering and delivery at a local level.

-

Dr Renate Strasser and Shanil Williams will take on the expanded responsibilities as chief technical and chief underwriting officers, respectively.

-

Karen Pickersgill joined Allianz in 1999 following roles at Aviva and Cigna.

-

The cost of living, government distrust, polarisation, activism and climate all pose heightened risk.

-

Despite 2022 being a “horror year”, the group reported record revenues and operating profit.

-

Group profit improved by 5.7%, as the P&C segment benefited from improved underwriting and investment results.

-

Anna Sampson will be responsible for expanding and diversifying the portfolio of delegated authority and facilities business.

-

It emerged in August that Philip Graham was leaving Chaucer after more than two decades at the company.

-

The deal represents the first Part VII transfer completed by Marco since launching in 2020.

-

The energy crisis came in as a top-four concern, with 44% of respondents expressing worries over fuel costs, supply disruptions, inflation and the effects of Russia’s invasion of Ukraine.

-

The company has made a number of senior appointments to help run the unit.

-

Companies will also face claims relating to cyber security and problems with ESG disclosures.

-

The German carrier will increase the attachment point on its US coverage by 50% to $300mn.

-

The executive replaces Paul Schiavone, who is leaving the company.

-

The unit will aim to grow captive solutions and structured solutions.

-

She succeeds William Mills, who left his role as group head of ceded re and third-party capital for Allianz.

-

AGCS said fire and explosion incidents have caused the most expensive insurance claims in the marine industry, while cargo damage is the most frequent cause of loss.

-

William Mills was most recently group head of ceded reinsurance and third-party capital at Allianz.

-

Thorsten Fromhold has been appointed to the new role of chief group reinsurance buyer.

-

Lack of exposure and extensive reinsurance protection meant Hurricane Ian was “not a big event”.

-

The business unit has posted strong profits following a period of underwriting remediation.

-

The carrier also appointed Sam Bartram as regional head of marine, and Trent Cannings as regional head of energy and construction.

-

The company has promoted Mark Whayling, who has worked for AGCS for five years.

-

After a widespread drop in InsurTech funding, all signs point to a period of M&A among InsurTechs either struggling to raise funding or seeking a partnership with an incumbent.

-

Innovation Group specialises in business process and claims management solutions and will continue to operate independently.

-

The third-party business brings in around EUR1.8bn ($2bn) of Allianz Re’s portfolio.

-

The digital investments arm of Allianz Group has been a strategic investor in the Berlin-based InsurTech since 2016.

-

Charles Tinworth and Abigail Paterson are set to join the property team as senior underwriter and underwriter, respectively.

-

Inflation will define priorities such as a focus on safeguarding clauses and pricing transparency, as well as line of business challenges, for underwriters and actuaries in the year ahead.

-

The carrier is launching into the downstream energy market as part of an international primary lines expansion.

-

Clubs including Arsenal, Aston Villa and Leicester City are claiming against insurers.

-

The transaction will eliminate Enstar’s direct exposure to cat business and boost its book value.

-

The business unit continued its run of post-remediation profitability, posting a combined ratio of 95%.

-

The carrier has posted healthy returns following a period of extensive remediation of its portfolio.

-

The loss comes hard on the heels of a large BI claim stemming from the Freeport LNG refinery.

-

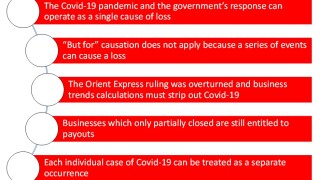

A case against Fireman’s Fund reversed an earlier decision that Covid-19 cannot cause physical damage.

-

The insurer also found that fire and explosion remained the most costly source of claims, defying efforts to improve risk management.

-

Guy Money, global head of product at AGCS, has been appointed global head of multinational business.

-

The suit is the latest in a series of Covid-19 BI legal actions hinging on aggregation brought against insurers.

-

The recruit will report to recently appointed Europe CEO Olaf Jonda.

-

The varying treatment of the flood losses raises questions over how the industry should define flood events.

-

The insurer will take a EUR400mn hit by selling the stake in its Russian outfit.

-

The executive has worked for Beazley for almost 16 years.

-

Climate risk and demographic change will continue to drive expansion over the next decade, according to a report.

-

Together with its parent company, Allianz Global Investors has agreed to pay more than $5bn in restitution to victims and $1bn to US authorities.

-

Plus the latest company results, people moves and all the top news of the week.

-

Profits slipped by 3% at the carrier in Q1, driven by floods in Australia, which added to the highest Q1 cat claims in over a decade.

-

AGCS continued its run of improved profits, posting a combined ratio of 95% for the quarter.

-

The carrier has also promoted Srdjan Todorovic to lead its global political violence operation.

-

The carrier has already set aside EUR3.7bn to cover the cost of the investigation and any litigation costs.

-

The insurer warned that claims could arise beyond the immediate war threat in the Black Sea.

-

The pair will be present in 29 countries, and the chairmanship will rotate between the two firms every two years.

-

The insurer added that, from July 2023, it would no longer renew contracts for existing projects.

-

Alli MacLean will take on the expanded role following the exit of contingency chief Yael Mimran.

-

The carriers have placed a legally binding cat excess-of-loss reinsurance contract using B3i’s platform.

-

Vanessa Maxwell will succeed, and subsequently report to, Shanil Williams, who was promoted to the board in January.

-

Trade credit insurer Euler Hermes has become Allianz Trade in a company rebrand – a move Allianz described as “natural”, given that the former had been a full part of Allianz Group since 2018.

-

Linda Daly will join the company’s D&O division led by Michael Chu.

-

The trio join WTW, Aon, Marsh McLennan, Hannover Re and Generali in shunning Russia over the Ukraine invasion.

-

The appointment comes after underwriter Matthew Wells left AGCS to join Axa XL.

-

Allianz looks the most exposed to the conflict, with roughly EUR2bn of its EUR809bn of investment assets at risk, according to the analyst.

-

The program, specifically for SMEs, covers a range of products within management and professional liability.

-

The carrier has increased the capacity of its aggregate layer from EUR300mn to EUR500mn.

-

The CEO said the business unit was focused on bottom-line profits rather than top-line growth.

-

A turnaround in the fortunes of AGCS saw the combined ratio at the business unit drop by 18 points to 97.5%.

-

Snabe stepped down following concerns he sat on the boards of too many organisations including Siemens, AP Moller-Maersk and the World Economic Forum.

-

Another pandemic outbreak came in fourth place, with 22% of respondents saying they were worried about further health and workforce issues and movement restrictions in 2022.

-

Shanil Williams joined Allianz in 2016 and has worked in a variety of senior roles across its financial lines business.

-

Insolvencies are a key source of claims but have been prevented by government support measures during the pandemic.

-

For the carrier’s P&C business, the company said it would focus on annual revenue growth of 3%-4% between 2022 and 2024.

-

European regulation on dividends is a “disaster” for the insurance industry and “shouldn’t repeat itself”, according to Allianz CEO Oliver Bäte, speaking during the S&P Global Ratings European insurance conference.

-

Allianz Global Corporate & Specialty (AGCS) hull underwriter Matthew Wells has resigned to join Axa XL, Insurance Insider can reveal.

-

Allianz Global Corporate & Specialty (AGCS) has reshuffled its market-facing leadership team with the announcement of a series of regional and global executive appointments.

-

The remediation work at Allianz Global Corporate & Specialty (AGCS) has been “accomplished”, and the business unit is now targeting profitable growth, according to Allianz CFO Giulio Terzariol.

-

Anusha Thavarajah has been appointed regional CEO of Allianz Asia-Pacific (APAC), effective 1 December, while Philipp Kroetz has been appointed CEO of Allianz Direct, effective 1 January, subject to regulatory approval.

-

The insurer pegged its updated gross claims figure higher than the Elbe flood of 2002.

-

The carrier aims to push suppliers to develop better ESG practices.

-

The executive explained the carrier was ready to pivot to growth after exiting some EUR700mn of business as part of its extensive turnaround programme.

-

The deal marks the first legacy risk transaction for the start-up.

-

Allianz Global Corporate and Specialty (AGCS) received over 1,000 cyber claims in 2020 and has warned of no abatement in the frequency and severity of ransomware losses flooding the market.

-

The executive will be succeeded by Allianz Leben chief Andreas Wimmer.

-

The AIG-owned business has seen a major transformation in its senior leadership.

-

The Wall Street Journal reported that top asset management executive Jaqueline Hunt was in talks to leave the business.

-

The policy covers topics from name changes to dress codes and has the support of the charity Stonewall.

-

An investigation by Germany’s financial watchdog BaFin is looking across multiple departments of Allianz’s business, according to Reuters.

-

Berenberg believes EUR3.5bn would be a manageable loss for the insurer and estimates that it would be earned back in well under a year, but a EUR6.8bn loss would be more challenging.

-

Insurers have now shelled out just over £968mn to BI policyholders in interim and final settlements.

-

The carrier returned to profit in Q2, with premium income down as a result of portfolio remediation.

-

Hannover Re has estimated that the floods could end up costing the industry as much as EUR7.5bn.

-

AGCS posted profits of EUR98mn after making a loss in Q2 2020 when it suffered heavy Covid-19 claims.

-

The insurer said that the benefits of scale from large vessels may soon be outweighed by the risks of disruption they pose.

-

The carrier said its board had concluded the probe could “materially impact future financial results”.

-

The carrier is expecting 30,000 property claims, as well as 5,000 vehicle claims.

-

The new division is structured into three business units: a chief underwriting office led by Rasmus Nygård, business transformation led by Jörg Hipp and global MidCorp, headed up by Ole Ohlmeyer.

-

The changes are designed to simplify the business and streamline operations.

-

The information-gathering exercise for large insurers and banks won’t dictate capital requirements.

-

The recruit has spent 16 years at AGCS in senior roles.

-

The central bank governor said such a move would require ‘robust data.

-

The outgoing chief has led the German carrier’s UK business for eight years.

-

The executive says that AGCS is ready to pursue growth after renewal rates rose 22% in the first quarter, following 26% expansion for 2020 as a whole.

-

The combined ratio for AGCS improves by over 19 points as the division swings EUR81mn into the black.

-

Maria Grace had been with Everest since 2016, and was previously an executive within AIG’s Lexington unit.

-

The carrier has widened the scope for businesses linked to coal that it will not insure.

-

The four-year agreement covers professional indemnity, D&O liability, crime and pension-trustee liability.

-

Trade association research found that women make up only 27% of directors at 31 member companies surveyed.

-

The executive will be replaced by CFO Holger Tewes-Kampelmann.

-

QBE is said to be a fourth potential bidder.

-

$600mn round values Stripe at $95bn making the company one of the world’s most valuable private companies.

-

CNP Assurances acquires the UK carrier’s life business in the market.

-

Elizaveta Krieg will lead global property on an interim basis.

-

The product will initially be available in the US, with scope to expand internationally at a later date.

-

Kevin Hegel replaces Ayleen Frete, who becomes global head of practice management.

-

The underwriter has led the unit on an interim basis since late 2020 following the departure of Lauren Bailey.

-

Performance at AGCS deteriorated, with the unit reporting an operating loss of EUR482mn.

-

The legacy company announces three recent appointments to its management team.

-

Insider Hannah Tindal will move from Chicago to London to take the role of D&O head within the London regional unit and Nordic team.

-

Benjamin Telling worked at AGCS since 2009 and has been an airline underwriter since 2017.

-

Typical cat loss events trigger XoL reinsurance recoveries. It is not certain that this will.

-

The carrier says it will back “climate-positive” technologies at the expense of carbon-intensive businesses.

-

Costs outpaced the European benchmark rate change, but Covid loss negotiations have been deferred.

-

The return to the office and perceived slow business recovery could also lead to claims.

-

The German carrier and Apollo-backed bid partner Athora reportedly met resistance from unions during the $3.6bn auction.

-

The latest recruit is returning to Swiss Re after five years.

-

The report said that the volume of cyber insurance claims had gone up more than nine times in the past five years.

-

Soaring rates in the D&O market have prompted a string of underwriting people moves in London.

-

The carrier expects its total losses to reach EUR700mn-EUR900mn, as Covid claims reports begin to flow to reinsurers.

-

AIG shares climbed 13% to $37.52, compared with a 1.2% increase in the overall S&P 500 index.

-

The CFO says the carrier will first focus on bringing its combined ratio below 100%.

-

Operating profit was down 40% in AGCS as the carrier pruned its portfolio in North America and investment income fell.

-

The Allianz unit says the experience of the Sars epidemic suggests general liability claims are likely to remain benign.

-

The deal with Jubilee Insurance supports Allianz’s ambition to gain market leadership in key African territories.

-

The German carrier and the Apollo-backed life insurer team up for a bid which could be worth an estimated $2.3bn-$3.5bn.

-

The expansion comes in anticipation of uptick in Asian M&A activity.

-

The CFO said that the unit was focused on building a profitable book and that growth would come later.

-

The carrier said Covid-19 had a EUR800mn negative impact on the P&C division in the first half.

-

The program administrator expanded into the business line at the beginning of the year.

-

The executive’s interim role as head of the ART unit becomes permanent.

-

Frank Amandi moves to the new post in Cologne after more than six years with the Allianz unit.

-

Carlo Bewersdorf joins from Hannoversche Lebensversicherung as the white-label digital insurer prepares to become a standalone business.

-

S&P Global Ratings has revised its ratings outlook on Allianz Global Corporate & Specialty (AGCS) from stable to negative, citing Covid-19-related profitability concerns.

-

The directors’ and officers’ (D&O) insurance market is bracing for a total loss of around $600mn for claims against American-Israeli drug manufacturer Teva Pharmaceuticals.

-

Allianz Global Corporate & Specialty (AGCS) CEO Joachim Müller has unveiled a turnaround plan that will make the carrier “more efficient, leaner and faster”.

-

The carrier hires from Axa XL and NewRe and consolidates regional leadership as CEO Joachim Müller stamps his mark on the company.

-

Allianz Global Corporate & Specialty (AGCS) has launched a new cyber insurance product, supported by recent new appointments to its UK cyber team.

-

Former Zurich underwriter Michela Moro and CFC’s Lewis Bennett join the team.

-

Allianz, Chubb and WRB are among the carriers that oppose the centralisation of BI claims.

-

Jonathan Milford-Cottam replaces Tom Fadden, who remains global aviation head.

-

Thomas Kang joins Allianz from Willis Towers Watson.

-

The business unit was established in 2018 to monitor the company’s group-wide cyber exposure.

-

Analyst Michael Huttner predicts that rising rates could allow Zurich to recover pandemic losses in just a year.

-

Analyst Michael Huttner forecasts lower pandemic-related losses for the Axa unit than for Allianz.

-

Giulio Terzariol said underwriting losses from the virus would mean P&C operating profit would come in up to 20 percent below target this year.

-

AGCS swings to a EUR141mn loss, while the pandemic impact across the whole P&C unit totals EUR400mn.

-

The Judicial Panel on Multidistrict Litigation will determine whether federal BI lawsuits should be consolidated.

-

The company wants to remove coal-based companies from its investment and insurance portfolios by 2040.

-

The carrier joins a growing number of peers withdrawing targets because of Covid-19 uncertainty.

-

BBVA will contribute insurance operations with GWP of about $325mn last year to a new joint venture.

-

The deal was subject to speculation in October but has come in below the expected EUR1bn value.

-

Oliver Baete tells Bloomberg that the pandemic was like a “meteorite” for the insurance industry.

-

The former AGCS specialty CUO replaces Stuart Beatty, who will lead the reinsurance broking unit in the region.

-

Ali Shahkarami will take on the newly created role and report to COO Bettina Dietsche.

-

The executive will be North American reinsurance head for Allianz’s risk transfer division.

-

The portfolio is understood to give Continental access to over $50mn of new business.

-

Loeiz Limon-Duparcmeur replaces Chantal Schumacher, who moves to a role at parent Allianz.

-

Current business is expected to go to London or Asia, with 23 local employees affected by the closure.

-

Executives cite strong rate growth as they predict a 2021 AGCS combined ratio of 97 percent.

-

Nine cedants including Allianz and Generali were involved in the pilot.

-

The former AGCS marine chief will be managing director of Willis Re’s international customised reinsurance practice.

-

Adam Lantrip, Sam Levine and Laura Burke have joined the new division.

-

US liability claims deterioration is one of the reasons Allianz has not been more specific on its full-year profit guidance, the CFO said.

-

Profits at AGCS grew 57 percent, while pricing momentum pushed up revenues at the unit up by 13 percent.

-

Decision taken to renew separate LV cover at 1 December, with an integrated purchase likely in the future.

-

The drone insurance start-up will initially insure flights for the UK, Belgium and Sweden and Finland.

-

The machine learning company counts Chubb and RenaissanceRe among its customers.

-

Size of payout will depend on whether CBI sub-limit of $100mn holds, with insured seeking $450mn.

-

The CEO says the institution is politicised and encouraging reckless consumer spending.

-

Hyeji Kang was formerly head of actuarial function and replaces Bernhard Arbogast, who retires after 25 years with the carrier.

-

Swiss Re, Allianz and Zurich are among those backing the UN initiative.

-

Singaporean and Vietnamese businesses are reportedly in scope for disposal.

-

The action reflects Mexico’s foreign currency sovereign rating.

-

The deal makes Allianz one of the top three insurers in the country.

-

The CFO tells analysts the US MidCorp business will come under particular scrutiny.

-

The CEO promises not to “sit on” excess capital, opening the door to additional capital management.

-

AGCS records an underwriting loss despite booking no cat losses in the quarter.

-

The financing round in the ESG data provider comes as companies’ regulatory obligations to prioritise sustainability as an investment-criteria increase.

-

The executive will head up the unit following Angelo Colombo’s departure to Swiss Re.

-

Former head of global crisis management Christof Bentele will take on a new ART role, with Björn Reusswig and Stewart Eaton sharing his prior role.

-

The lawsuit against carriers including Chubb, Allianz and Markel follows the passage of NY’s Child Victims Act.

-

The Brazilian company says it has entered bilateral talks with its German peer.

-

The carrier also installs James Stack as Pacific region CEO.

-

The move underlines John Neal’s drive to embrace the wider London market.

-

The executive was the first woman to join the German carrier’s board, and was previously head of group M&A.

-

The German carrier unwinds an eight-year-old alliance originally forged with Banco Popular.