Swiss Re

-

This was the second issuance completed by Farmers via its Bermuda reinsurance vehicle Topanga Re.

-

Los Angeles wildfires and SCS pushed US losses to $89bn.

-

The CEO conceded some might see Swiss Re’s dividend targets for 2026 as “underwhelming”.

-

The reinsurer’s “refreshed” strategy to focus on AI and a new share-buyback programme.

-

Plus, the latest people moves and all the top news of the week.

-

After a challenging period, the industry is now earning above its cost of capital.

-

Oliver Dlugosch spent 20 years at Swiss Re before it exited aviation this year.

-

Carriers posted weaker top-line results but delivered improved combined ratios.

-

The reinsurer said discipline was now “equally important as price”.

-

The reinsurer is “well on track” to achieve $4.4bn in net income for the full year.

-

Munich Re is among the insurers with a stake in the German carrier.

-

Class actions and third-party litigation funding will drive up losses.

-

In July, he took the role on interim basis from Laure Forgeron.

-

Continental composite carriers aim to smooth volatility with new initiatives.

-

The ILS manager has $6.8bn in assets and will be led by MariaGiovanna Guatteri.

-

Plaintiffs allege that manufacturers and retailers have broken environmental laws.

-

The Berkshire subsidiary is seeking coverage for a $22mn antitrust loss.

-

Litigation funders are promoting “aggressive” tactics in the UK, Holland and Israel.

-

Anticipation, motivation and inspiration are central to effective implementation.

-

Swiss Re forecasts more risk transferring to reinsurance and retro markets in the future.

-

Growth in the SME sector could help stabilize the market, however.

-

The underwriter has over 20 years' experience in the construction insurance sector.

-

The mid-year renewals point to mounting pressure on reinsurance pricing.

-

Plus, the latest people moves and all the top news of the week.

-

The CEO said the carrier will prioritise margin over top-line growth.

-

The P&C division booked a combined ratio of 81.1% for the first half of 2025.

-

California wildfires account for $40bn of the insured loss tally in H1.

-

Laure Forgeron has worked at the Swiss carrier since 2009 in numerous senior positions.

-

The reinsurer said US president Donald Trump’s policy was already impacting investment.

-

Separately, Caribbean market head Janine Seifert is leaving the reinsurer for BMS Re.

-

Hannover Re’s CEO is lowest paid among peers, despite their pay growing 77% since 2015.

-

P&C combined ratios were higher than Q1 2024, and wildfires impacted Hannover Re most.

-

The reinsurer’s CFO cited a 1.5% net price reduction year to date.

-

Large natural catastrophe losses totalled $570mn in Q1, driven by the LA wildfires.

-

Specialty reinsurance has experienced high competition for talent.

-

The carrier has also added AIG’s Alice Hawkins to its aviation unit.

-

Growing economic and population exposures are driving potentially larger insured losses.

-

The tariffs could expose insurers to the risk of recession and shrinking income.

-

The asset manager has hired Rom Aviv as head of ILS.

-

Plus, the latest people moves and all the top news of the week.

-

Some of the Big Four are slowing growth as the market softens.

-

This follows the firm’s exit from primary aviation.

-

Plus, the latest people moves and all the top news of the week.

-

CEO Andreas Berger addressed Swiss Re’s primary aviation exit.

-

Katie McGrath is appointed CorSo CUO amid a restructure of the unit.

-

The carrier increased premium by 7% at the January renewals.

-

Sources said that the firm was already preparing to drop the book before the spate of losses.

-

The executive has also worked for Guy Carpenter during her 20-year career.

-

Anthony Norfolk joins from Swiss Re, where he was a senior engineering underwriter.

-

Philip Ryan and Sir Paul Tucker will not stand for re-election.

-

The executive has been with the firm for 27 years.

-

Aggregates that are featuring in the reinsurance market are not the low-attaching ones of prior years, he added.

-

The P&C re unit will target a combined ratio below 85%.

-

It estimated insured losses from nat cats on track to exceed $135bn in 2024.

-

This year’s top-line growth will be a decade-high.

-

The market grew at a rate of 32% annually from 2017 to 2022.

-

The additions included significant reserve bolstering for recent year portfolios 2021-2023.

-

The stock price rose as analysts declared the L&H reserving review better than feared.

-

The market reacted to the $2.4bn charge in a positive light.

-

The company said it is still on target to achieve $3bn net income for the full year.

-

The carrier’s Q3 net income will be around $100mn, far below consensus.

-

More public-private partnerships are needed to keep cat risk affordable.

-

The executive also highlighted SRCC in property treaties as a concern.

-

The carrier highlighted Italian and French hail events in recent years.

-

Pockets in the business are still experiencing significant stress, she added.

-

The new CEO has owned past challenges and charted a better course, but will need to be relentless in driving change.

-

The company is currently “underweight” in that line of business, he added.

-

The reinsurer constructed a “social inflation index” for a new study.

-

In his first interview as Swiss Re CEO, Andreas Berger acknowledged the mistiming of casualty growth, a purist approach on reserving and organisational complexity.

-

Plus the latest people moves and all the top news of the week.

-

The ratings agency said comparing companies was complicated by the adoption of IFRS 17 accounting.

-

Scor disclosed L&H troubles while Swiss Re continued reserving for US casualty.

-

Positive cat experience impact of $600mn was offset by $500mn in property and specialty reserves.

-

The P&C Re CoR came in at 84.5%, a 10.2-point YoY improvement.

-

Plus the latest people moves and all the top news of the week.

-

John Dacey will retire at the end of March 2025 after 12 years with the firm.

-

A roundup of all the news you need today, including Lloyd’s chairman candidates.

-

The insurance sector’s RoE is expected to exceed 10% next year.

-

SCS caused global insured losses worth at least $8bn in the first quarter of 2024.

-

The Italian hailstorm event in the summer 2023 saw estimated losses nearly triple.

-

Combined ratios improved all around thanks to better pricing and a benign cat quarter.

-

CFO John Dacey said the carrier had concluded it was not the “best owner” for iptiQ after a strategic review.

-

The carrier also announced that Moses Ojeisekhoba, CEO of Global Clients and Solutions, has resigned.

-

P&C re and CorSo reported improved net profits and combined ratios for the quarter.

-

Swiss Re is among reinsurers to have the right to limit coverage if conflict widened.

-

Insurance Insider revealed this deal in January.

-

The new CEO needs to fix the underwriting, but should also ask the bigger questions.

-

We take a look at the outgoing CEO’s performance as he prepares to handover to CorSo CEO Andreas Berger.

-

Andreas Berger will step down as CEO of Swiss Re CorSo on 1 July.

-

Severe convective storms were the biggest driver of last year’s losses.

-

Hard-won profitability has given carriers room to salt away reserves.

-

The recruit will run E+S Rück and part of European reinsurance.

-

The carrier is also nominating Geraldine Matchett to its board.

-

Opportunities for profitable growth remain in 2024, the agency said.

-

The US tallies $97bn in economic losses from major perils each year.

-

Pravina Ladva, Swiss Re's group CDTO, sets out experiments the carrier is conducting with generative AI.

-

The carrier added casualty reserves of more than $500mn during Q4.

-

The group’s net profit leapt six-fold to $3.2bn for the year.

-

The reinsurer took a harder line than peers on casualty treaty at the latest renewal.

-

Swiss Re will transfer its Genoa-based hull business to Dual Europe and provide the MGA with underwriting capacity.

-

The segment has bounced back from its mid-2022 nadir, but its current zenith is not that much to shout home about.

-

Effective immediately, Wolfe will help drive growth strategies across the region. He will also lead Guy Carpenter’s US facultative business alongside Frank Guerriero, chairman of Guy Carpenter Facultative.

-

Prior to his resignation, Stubbs held the role of deputy class underwriter at Chaucer Group.

-

The downgrade was driven by a change in the Swiss Insurance Supervision Act, which came into effect 1 January and is unrelated to the rating fundamentals of Swiss Re, according to the agency.

-

Separately, sources said Swiss Re Miami-based head of auto overseeing the motor portfolio for the LatAm region Carlos Ricci has also left the reinsurer.

-

George Quinn has worked at Zurich for a decade and will oversee the completion of Zurich’s 2023 annual results.

-

Global cat-bond capacity has grown by about 4% annually over the last six years, according to a report by the Swiss Re Institute.

-

Losses from severe thunderstorms have increased by 7% annually in the last 30 years, according to the Swiss Re Institute.

-

The P&C Re CEO discussed Swiss Re’s P&C appetite and nat cat exposure in the investor presentation.

-

It is expected to have a negative impact on profit after tax in 2024 of approximately $500mn.

-

The revision reflects Swiss Re's "strongly improved financial performance and better capitalisation and leverage”, the ratings agency said.

-

Swiss Re says economic growth slowdown and elevated geopolitical uncertainty dampen the outlook for the primary insurance industry.

-

Howden Tiger advised the reinsurer on the deal, which involves a portfolio of US commercial multi-peril and workers’ comp business.

-

Cat losses were within budgets despite high levels of minor events.

-

Variations between the casualty and cat markets mean 2024 cat outcomes may be far less uniform than they were this year.

-

The reserve bolstering is due to a “more pessimistic view” of casualty loss trends.

-

The carrier reported a Q3 combined ratio of 138.8% for casualty within the P&C re unit.

-

Mitchell confirmed the launch of consultancy firm Squared – The Power of Two in a LinkedIn post.

-

Rory Morison was hired last month to lead the Australian business.

-

The executive’s career to date includes key claims roles at Chubb and Swiss Re.

-

With new leadership at some of the largest continentals, there will be close attention to how their tactics in changing lines of business will evolve.

-

Podmore joins from Swiss Re, where he held the role of lead cyber underwriter.

-

The reinsurer said hardening of property reinsurance conditions must continue.

-

Swiss Re has underperformed its reinsurance peers over the past 12 months, an analyst said.

-

Rising counterparty risk from economic slowdown will support prices and growth.

-

The report also stated that digital technology could generate savings of 10%- 20% in other processes in the value chain.

-

The reinsurer said carriers could face challenges around underwriting profits and solvency levels.

-

The decision to align across business units had removed the need for the regional presidents' roles, the company said.

-

As the curtain comes down on the millionth Monte Carlo Rendez-Vous, and the prices in the cafes and restaurants are presumably reset to their customary levels, the conference has again done its main job.

-

Hurricane Idalia is a reminder of the new normal cat environment and that reinsurers must continue to ensure they do not pick up attritional losses, the company’s P&C head said.

-

Our virtual roundtable polled industry leaders on critical questions for the reinsurance market. Today, we explore how the industry can collaborate on net-zero objectives after insurers exited the Net-Zero Insurance Alliance (NZIA) in droves.

-

The carrier said there was still “room for improvement” in the property cat market.

-

Plus this week’s executive moves and all the latest exclusives of the week.

-

Warehouse or science lab? Those tend to be two of the diverging views on Swiss Re, the oldest reinsurer, with a 160-year history.

-

Following the initial decision in the case, Julia Sommer sought £5.1mn in compensation for the claims she made against her former employer.

-

AM Best said market hardening was likely to continue through 2024, given global market conditions.

-

The ratings agency also affirmed Swiss Re’s ‘AA-’ rating, with the carrier expected to maintain an ‘AA-’ rating through 2024.

-

Swiss, Munich, Hannover and Scor all delivered optimistic messages on pricing for next year.

-

A total of 10 events caused more than $1bn in losses each.

-

CFO John Dacey said the carrier remains underweight in Florida due to concerns around underlying economics.

-

The carrier achieved treaty price increases of 21% at 1.7, against increased loss assumptions of 16%.

-

The current vice chair will lead the (re)insurer’s board until he can be officially nominated for election at the next AGM in April 2024.

-

The executive will report to reinsurance solutions CEO Russell Higginbotham.

-

Reserves eased slightly from 2020 through 2022, driven by motor and general liability sectors in the US and UK.

-

The global natural catastrophe protection gap stood at $368bn, with protection gaps being largest in emerging markets.

-

The report outlined 17 recurring and emerging risks (re)insurers should be aware of.

-

The comment comes after major US carriers pulled back from new business in wildfire-prone California.

-

The collapse of the Net-Zero Insurance Alliance means insurers must find new neutral ground to continue ESG engagement, CEOs at the Geneva Association's General Assembly said.

-

Mayer will manage a global centre of excellence for parametric products and report to Paul Schultz, CEO of Aon Securities.

-

In this second of a two-part analysis on the proliferation of ChatGPT and similar generative AI tools, Insurance Insider explores the risks inherent in using them.

-

Christoph Oehy will replace Luzi Hitz in November 2023.

-

After founder members Axa and Allianz dealt a potentially terminal blow to the Net-Zero Insurance Alliance by withdrawing, the NZIA is exploring limited options to continue.

-

The Swiss reinsurer follows Munich Re, Hannover Re and Zurich in withdrawing from the alliance.

-

The executive will report to CEO James Shea and is based in Florham Park, New Jersey, United States.

-

Most carriers were keen to talk about how they are taking on the ongoing hard market in Q1, but some complexities partly offset their good news.

-

Reinsurers are starting to see increased demand from personal lines, where valuations are being updated to match inflation.

-

He will succeed Melanie Slack, who will be retiring after more than 20 years with the firm.

-

The CFO said cedants ‘recognise the new supply-demand reality’ as it benefitted from an early release of Hurricane Ian reserves.

-

The carrier’s P&C re and CorSo units benefited from price increases at 1 April, as well as the receding impact of Ukraine.

-

The executive returned to Swiss Re after a stint as a management consultant.

-

The news comes after it emerged last week that RSA was launching into the superyacht class of business.

-

It was announced last month that Ermotti will step down after the AGM and a short handover period.

-

Russell Higginbotham, CEO of Swiss Re’s reinsurance solutions, has also been added to the firm’s Global Clients & Solutions executive committee.

-

Julia Sommer won her tribunal last year after she claimed to have been consistently discriminated against for her sex and was unfairly dismissed after her maternity leave.

-

Jacques de Vaucleroy has been appointed vice chairman as the carrier seeks a new chairman.

-

The reinsurer said cat reinsurance rates hit a 20-year high, driven by losses, inflation and financial markets.

-

Swiss Re estimates that inflation has peaked but is likely to remain persistent in 2023.

-

The collapse of Silicon Valley Bank is creating investor fear across the global financial services sector.

-

The release of Swiss Re, Munich Re, Hannover Re and Scor’s year-end reports provides an update on market conditions.

-

The transaction builds on a $1.15bn first-of-its-kind hybrid bank and ILS capital deal in April last year.

-

Marcus Pollak and Stefan Behr will be based in Zurich.

-

The appointments will be effective July 1, subject to regulatory approvals.

-

The carrier said 18% nominal price increases are mitigated by a 13% rise in loss assumptions.

-

The carrier has reported a P&C re combined ratio of 102.4% for the year.

-

The head of property and specialty underwriting reinsurance posted on LinkedIn that he had brought forward his planned departure from the firm after 35 years.

-

Under the new structure, Urs Baertschi will run P&C Re, while Paul Murray will lead L&H Re.

-

Chairman Kessler remains in place until the 2024 General Meeting when he will stand down on hitting the age limit of 72.

-

Fred Kleiterp worked at Swiss Re for more than 20 years but has joined Beazley as European general manager.

-

Fred Kleiterp will leave his current role as CEO for EMEA at Swiss Re Corporate Solutions to join Beazley in June.

-

The executive was previously head of casualty underwriting for EMEA.

-

Cedants are grappling with rising rates while coverage narrows.

-

Vanessa Lau and Pia Tischhauser will stand for election in April as Renato Fassbind and Susan Wagner retire from the board.

-

The reinsurer emphasised the need for improved secondary peril models including predictive capabilities.

-

Announcements and interviews at the UN conference have shed light on the tools emerging to help carriers decarbonise their underwriting portfolios.

-

Real non-life premiums are forecast to grow by 1.8% in 2023 and 2.8% in 2024.

-

Carriers reassured analysts that unrealised investment losses will not seriously affect solvency while sounding a bullish note on renewals.

-

The reinsurers will provide a parametric solution to ensure a fast payout.

-

Global cyber premiums are expected to reach $23bn by 2025 but, with predicted global annual losses of around $945bn, roughly 90% of the risk remains uninsured.

-

The carrier said inflation and losses were to blame for its likely miss on the P&C re full-year target combined ratio of 94%.

-

The group booked a net loss of $285mn and negative return on equity due to cat losses, prior-year reserve charges and falling investment yields.

-

Inflation, heightened cat activity and years of poor reinsurance returns are fuelling demands for wholesale change in the European market.

-

The reinsurer is pushing for higher retentions on property cat and lower ceding commissions on proportional casualty.

-

The carrier is likely to book a Q3 net loss of $500mn for the storm.

-

The reinsurer said it will look to double rates and retentions and halve the amount of override on casualty quota shares.

-

The transport sector has the largest investment gap, needing an estimated $114tn to build greener infrastructure.

-

The CII also appointed Ian Callaghan as deputy president for 2023.

-

The storm is not expected to be a threat to the order of Jebi or Hagibis.

-

Roman Hohl is rejoining the reinsurer after a decade, having previously worked there as head of agriculture Asia Pacific, director, for four years.

-

Inflation will define priorities such as a focus on safeguarding clauses and pricing transparency, as well as line of business challenges, for underwriters and actuaries in the year ahead.

-

This publication’s review of H1 disclosures shows how listed (re)insurers’ nat cat losses have tallied with aggregate projections.

-

Insurance Insider selects 10 exclusive news stories reported by our team on the frontline at Monte Carlo Rendez-Vous.

-

In their messages at the Rendez-vous de Septembre, Munich Re, Hannover Re, Swiss Re and Scor signalled a ripe environment to hike prices and adjust terms.

-

Economic inflation is having a “minor” impact on reserving practices and is unlikely to result in negative reserve developments, said Swiss Re’s CUO Thierry Leger.

-

Guido Fürer will step back effective 31 March 2023 to spend more time with his family and dedicate himself to his charitable endeavours.

-

Gallagher Re has been appointed as the broker for the programme following an RFP.

-

The carrier said geopolitical factors had given “new urgency” to the green transition.

-

Insured losses in 2021 alone hit $20bn.

-

A former Swiss Re underwriter, who was told by a former senior manager “I bet you like to be on top in bed” at the carrier, had a number of discrimination claims against the firm upheld.

-

The executive will work to help corporations understand and mitigate the threats posed by climate change.

-

Swiss Re, Munich Re, Hannover Re and Scor have set out their strategies on inflation, pricing and Ukraine.

-

Insured nat cat losses amounted to $35bn globally in H1, while manmade events triggered an additional $3bn, according to Swiss Re Insititute.

-

The carrier’s 6% rate increases over 2022 YTD are “subsumed” by larger loss expectations, including rising inflation.

-

The P&C re segment secured 12% rate increases at the 1 July renewals.

-

The recruit joins from Verisk.

-

The forecast for real-term premium growth was depressed by anticipated claims inflation.

-

Insurance resilience is still lower than prior to the Covid-19 shock, according to Swiss Re’s sigma research.

-

The carrier mapped out the future threat landscape for insurers as part of its annual Sonar report.

-

Ukraine uncertainties remain despite some loss estimates emerging in Q1 earnings across the Big Four European carriers, while inflation looms on the horizon.

-

Swiss Re goes against the tide in expanding in cat, while specialty rates appear to be holding up better than expected.

-

The reinsurer also flagged that it is not banking on many reinsurance recoverables from its CorSo exposure to war claims.

-

Market volatility also eroded investment income, with a $283mn Ukraine loss.

-

The (re)insurer aims to fill a gap in the market by providing ESG data for insurers on the private firms they insure.

-

She was previously an investor relations senior manager at Swiss Re.

-

The first-of-its-kind deal blends bank financing with ILS funding.

-

The CUO of the world’s largest reinsurer explains the company’s enduring commitment to cat risk despite advancing climate change.

-

In this newly created position, Claudia Cordioli will report to group CFO John Dacey.

-

David Presley joins Compre while the legacy carrier is targeting expansion in the US.

-

The broker said there was still a “big unknown” around the potential global economic impact of the conflict.

-

The Russian invasion of Ukraine is likely to result in a “mid-sized” cat loss, according to Swiss Re CEO Christian Mumenthaler.

-

The carriers have placed a legally binding cat excess-of-loss reinsurance contract using B3i’s platform.

-

Continuing a trend of several years, secondary perils caused most insured losses at $81bn, or 73% of the total.

-

The second of Insurance Insider’s deep-dive analysis pieces on innovation examines the internal structures and opportunities that can accelerate innovation.

-

Katie McGrath replaces Ivan Gonzalez who has been appointed CEO reinsurance China and China country president.

-

The carrier has already withdrawn cover for the top 5% of carbon-intensive oil and gas firms in the past year.

-

In his new role, Jeffrey Pan will also be a member of the Corporate Solutions APAC executive team.

-

The trio join WTW, Aon, Marsh McLennan, Hannover Re and Generali in shunning Russia over the Ukraine invasion.

-

Earnings reports from Swiss Re, Munich Re and Scor have revealed increased cat budgets and highlighted continued shifts away from frequency coverage.

-

The carrier’s CFO said there will be continued opportunities to grow top line in P&C, CorSo and L&H over 2022.

-

CEO Mumenthaler emphasised cat as a “core competence” for the carrier.

-

CorSo also returned to profit as its CoR improved 24.9 points to 90.6%.

-

The Hartford’s customers will have access to Swiss Re’s globally standardised property wordings and online platform.

-

Cedric Wong has also been promoted to lead the UK engineering and construction wholesale team.

-

The reinsurer said it planned to name a permanent replacement on receiving all regulatory approvals in the coming months.

-

Group operations will be reorganised, with all technology responsibilities falling under Ladva’s remit.

-

Hurricane Ida was the main loss-making event, but once again secondary perils generated more than half of global losses, according to the latest Sigma report.

-

The reinsurer and the tech firm will collaborate on driverless vehicle products.

-

Two thirds of natural catastrophe losses are currently unprotected globally, but this is expected to decrease in the future.

-

The COP26 climate talks in Glasgow represent progress towards a necessary reduction in carbon emissions “but not victory”, with concerns remaining that pledges do not go far enough, according to Swiss Re.

-

Swiss Re, Munich Re, Hannover Re and Scor have set out divergent strategies on cat as volatility increases and the retro market seizes up.

-

Swiss Re’s group CUO Thierry Léger has explained to Insurance Insider the rapid progress insurers need to make in the next decade, adding that “every year counts”.

-

The UN’s Butch Bucani, speaking on Swiss Re’s COP26 panel, warned that the transition was not just about “putting a thermometer in your insurance portfolio and saying ‘it’s 1.5 degrees’”.

-

Maya Bundt referred to cyber security threats as the “dark side” of proliferating digitalisation.

-

The CFO said today’s favourable nine-month numbers were due to a sustained effort to improve P&C underwriting discipline.

-

The carrier’s primary unit CorSo also bettered its combined ratio by 24.9 points on last year’s figures.

-

The insurance marketplace aims to bridge the gap between insurance and capital markets.

-

In a virtual Baden Baden conference, the reinsurer emphasised a push on addressing secondary perils after a high flood loss year.

-

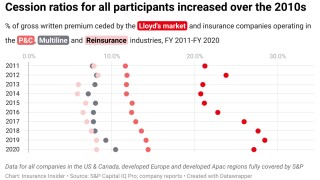

Analysis of financial data shows that the last decade has seen a marked increase in the proportion of premiums ceded by carriers in all sectors.

-

The carrier also estimated its European flooding burden will be $520mn.

-

Staff movement is high in the D&O market as carriers look to capitalise on buoyant market conditions.

-

An increase in the frequency and severity of nat cats and cyber incidents is pushing up protection demand.

-

The property & specialty leader described the phenomena as a “systemic trend”, separate from a pandemic-led cycle of economic inflation.

-

The reinsurer warns that climate risks could increase average weather-related property cat losses in advanced markets by more than 60%.

-

Plus the latest senior executive moves and all the top news from the week.

-

The executive spoke candidly about past management issues at the firm and expressed confidence about the long-term health of the business.

-

Coletti takes the role previously held by Anthony Cordonnier, who recently joined reinsurance broker Guy Carpenter.

-

The offering uses highest wind speeds at set locations as triggers for payouts.

-

It is part of the firm’s commitment to reach net-zero emissions in its own operations by 2030.

-

The carrier has hired also CNA’s Julie Stephenson as global head of casualty.

-

Overall figure was driven by a deep winter freeze, hailstorms and wildfires and marked the second highest first-half figure behind 2011.

-

Despite some rate tapering, the two German reinsurers are expanding premium, as all four carriers enjoyed North American rate increases.

-

Marilyn Blattner-Hoyle will be based in Zurich and report to Andreas Hillebrand, global head of credit & surety.

-

CFO John Dacey also urged primary carriers to be “realistic” on rising extreme-weather costs.

-

The carrier reported price improvements of 4% at the summer renewals.

-

The five reinsurers with the largest shares of the 2020 programme were Swiss Re, Scor, Munich Re, Hannover Re and Lloyd’s carriers.

-

Head of crisis management Mark LeBlanc will lead the team.

-

The product uses Swiss Re's flood model for rating purposes and links it with policy forms developed by Flood Services Corporation.

-

The executive replaces Emmanuel Thommen, who has announced his retirement.

-

Swiss Re acquired its Phoenix stake in 2020 following the sale of closed life business ReAssure.

-

The revelation came with the release of the institute's 2021 Resilience Index.

-

The leadership position in the region was vacant after the promotion of Melanie Slack, who has relocated to London.

-

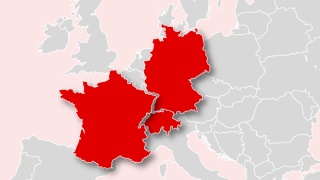

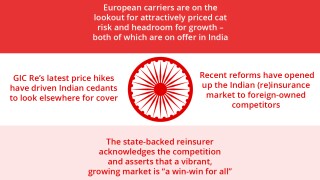

State-backed carrier GIC Re faces competition as the European Big Four press into the subcontinent.

-

Rate increases are tailing off, but the carriers’ reports reveal divergent growth strategies.

-

Aon-Willis, CFC's new Lloyd's syndicate, Talbot's contingency retreat and more.

-

The carrier increased premium volume by 20% at 1 April as Japanese cedants lifted limits.

-

The primary unit swings back to profit, while P&C re earnings expand seven-fold.

-

Reinsurers, corporations and states must redouble efforts towards net-zero emissions, the carrier says.

-

The solvency remains well within the targeted 200%-250% range.

-

The new recruit will be head of power at the UK global broking centre.

-

Reinsurers still have concerns over rate adequacy as views of typhoon risk evolve.

-

The reinsurer finds secondary perils accounted for over 70% of natural catastrophe claims.

-

Hannover Re has emerged as an outlier by reducing its overall 2020 dividend, but its growth plans may alleviate disappointment about the policy.

-

The reinsurer accelerates its retreat as part of a new set of targets to achieve net-zero emissions by 2050.

-

The reinsurer adds $300mn to the unit’s pandemic reserving in Q4 and slashes premium volumes by 11% at the renewals.

-

Maya Bundt says insurers can do more to advise insureds to treat cyber like they would ESG concerns.

-

The Marsh JLT-owned business specialises in cover for floating power and desalination operations.

-

The Principles for Responsible Investment were launched in 2006, with Hannover Re, Liberty and Everest Re among other signatories.

-

The executive will be replaced by Peter Elliott on an interim basis.

-

The entity has had a presence in South Africa since 2015 via a binder agreement with Guardrisk Insurance.

-

Natural catastrophe losses were up 40% year-on-year to $76bn, 7% above the 10-year average.

-

The Swiss carrier’s digital white-label arm becomes the German InsurTech’s main investor.

-

By setting up an asset manager, the reinsurer is competing with ILS firms on their turf.

-

The company has expanded its sidecar in recent years but this will allow it to tap into a different investor base.

-

The latest recruit is returning to Swiss Re after five years.

-

Tina Baacke will join the business from 1 January and succeed Martin Schürz, who retires in February.

-

Suncorp, IAG and QBE reinsurers could face significant recoveries after a landmark court ruling.

-

Mr Justice Henshaw says current liabilities are incompatible with the UK Human Rights Act.

-

Agis Kitsikis succeeds Stefan Behr, who has become head of business development for EMEA.

-

China is expected to lead the upswing in business, with non-life premium growth of 10%.

-

Guido Benz will join the business next spring and report to Lee Meyrick

-

The 1 January renewal will be a battle for the biggest slice of post-Covid upside.

-

The experienced broker had been freelancing for almost two years.

-

CFO Dacey also highlights P&C re reserve strengthening after significant aviation loss deterioration.