In the former camp, the market behemoth cannot escape being seen by investors as an “index play” – or worse still, a carrier that lumbers at the wrong time in the market cycle.

But those in the latter camp note the firm’s extraordinary global resourcing and highly scientific image, with a regular churn of Sigma studies on everything from premium volumes to cat loss estimates to economic trends.

Perceptions will always vary of any competitor, but bridging the gap between the two to mobilise its think tanks in effective ways is the task ahead of group CEO Christian Mumenthaler and his new executive line-up.

Can Swiss Re become nimbler despite its giant size and ensure the voice of its technical experts is represented to make its underwriting forward-looking at the right time? This would help to address some of the current challenges that have faced the carrier in the past year, from high turnover to inflation loss charges and peer underperformance, as we explore below.

Although 2022-23 is very far from being a crisis era for the firm – unlike the near-miss of its investment meltdown in 2008 – it suffered outsized mark-to-market write-downs in 2022 and, like other Europeans, was hit by a stronger US dollar alongside last year’s cat losses.

These problems exacerbated its pandemic underperformance versus Continental peers. While Munich Re and Hannover Re began regaining ground on the markets last year, particularly from Q4 onward, Swiss Re stock still lags its pre-pandemic levels. It was trailed only by Scor, which also experienced a difficult 2022 amid outsized losses from Brazil droughts, inflation charges and life losses.

On a total-return basis, accounting for the firm’s higher dividends and offsetting the drag from Swiss franc forex effects, the picture is more complex and more favourable to the carrier. Swiss Re actually had a better 2021 than Munich Re, underperformed in 2022 and had been closely tracking it this year up until a July downturn put it further back.

Personnel rebuild

This year, Swiss Re is in personnel rebuild mode after the abrupt departure of former CUO Thierry Léger, followed by multiple other long-serving executives leaving or announcing an upcoming departure, including Mike Mitchell, Keith Wolfe and Russell McGuire.

Others suggest there could be more fallout ahead on this front. One Zurich executive notes that any time recruitment vacancies open up, “there are an awful lot of Swiss Re resumés coming in”.

This is also coming at a time when the firm has had turnover of its chairman, due to Sergio Ermotti being called on to lead UBS through its Credit Suisse takeover, with vice chair Jacques de Vaucleroy taking over.

As Swiss Re seeks to navigate its way out of the turnover phase, some market participants pointed to the depth of its personnel networks as a saving grace in handling the departures. But other competitors believe the firm may have a harder time in empowering new underwriting talent to make the group nimbler in its approach.

In this deep dive, Insurance Insider delves into some of the challenges the market perceives Swiss Re has ahead of it.

Key challenges:

Swiss Re was heavily hit by investment writedowns in 2022 and took a large inflation loss charge

Share price performance shows analysts rating Munich Re, Hannover Re more strongly

High personnel turnover amid a restructure that needs time to embed

Needs to show it can empower underwriters to push past poor casualty reinsurance track record

Empowering underwriters

A key target for the firm’s new personnel structures is to bring together account management and underwriting functions, although, with only one renewal having passed since the restructures took impact, the results will take time to be proven.

Some peers perceive that the separation of the two functions has historically disenfranchised underwriters and diluted their impact.

“Somehow, that data and insight and thoughtful underwriting never seems to make it to the frontline,” as one competitor described it.

Despite the positioning around empowering and combining expertise, the current reinsurance structure still replicates a split between global clients and the underwriting business units. However, the global client unit is far smaller than in the past and will only serve a true top tier of the largest clients, with underwriting responsibility remaining within the business units.

The line-up implemented after Léger’s departure saw the P&C reinsurance and life and health reinsurance units carved out, along with the creation of a new global clients unit. The roles of regional presidents were discontinued.

Urs Baertschi was named to lead P&C, Paul Murray to oversee L&H and Moses Ojeisekhoba – formerly overall reinsurance CEO – became CEO of global clients and solutions.

The next tier down includes Gianfranco Lot as P&C CUO, previously having been head of global reinsurance, and P&C COO Nicola Parton. Russell Higginbotham, CEO of reinsurance solutions, has joined the global clients and solutions executive committee and retained his title.

One benefit of the restructure is that it should give more visibility to the firm’s life and health business, which, like others, is expected to benefit from a positive earnings impact under IFRS 17 accounting changes.

Underwriters now have a direct reporting line to unit leaders to improve accountability, whereas, under the old structure, the group CUO had no immediate underwriting reports.

Internally, the restructure is seen as something that will drive leader accountability at the market unit level, making underwriting paramount, in contrast to a 2012 restructure that gave more power to client managers and led to a greater focus on growth.

Double-double half fallout and the leadership/lumberer debate

Before Léger’s departure, Swiss Re had most recently been in the headlines for its “double-double half” messaging in the run-up to the 1 January 2023 renewals, through which it signalled it would attempt to double retentions and rates and halve ceding commissions.

Many argued it had misfired in its blunt message, as one broker said, implying that it suggested a “one-size-fits -all” approach to clients, while other rivals described it as being “punitive”.

But with that said, some defended their move, arguing Swiss Re was “damned if they do and damned if they don’t” and that peers were likely to “talk behind their backs”, criticising them “when they don’t take leadership, and being first to take advantage if they do”.

Either way, one of the firm’s strengths is reflected in the fact that even critics of this positioning admit it ultimately doesn’t matter: “They’re so big and so important, people will get over it.”

The “double-double half” kerfuffle reflects on a broader tension in the way market peers portray Swiss Re.

On the one hand, there is the perception it consistently mistimes the market – expanding in what is retrospectively seen as a soft market (such as its growth in US casualty in the mid-2010s) and chasing after harder markets more slowly.

Its overall approach to the non-life market over the past decade – both reinsurance and direct – has notably been more guarded than those of its peers.

One broker, describing the company as “an enigma for 40 years now”, said it had been “in and out of US markets my whole career”.

However, there is also an acknowledgment that, when Swiss Re moves – i.e., by stepping back from US primary casualty business when it began remediation in the Corso business – it helps the broader market, as it is one of the handful of carriers with the true heft to help create a market cycle.

Indeed, internally, it is understood Swiss Re prides itself on its ability to move quickly, when it decides to move. While the firm’s 2013-18 growth in casualty is now openly acknowledged as a mistake in retrospect, it sees this as more of a one-off error influenced by the opacity of casualty risks than a tendency towards delayed reactions.

Casualty – the next frontier to prove itself

Certainly, the firm can point to a quick turnaround achieved over just a couple of years within its Corporate Solutions (CorSo) primary segment, where it now has two years of underwriting profit under its belt after significant prior-year losses.

The remediation included an exit from lead umbrella, excess casualty and energy casualty business in the US in late 2019, and the division’s regional CEO for North America has previously told sister title Inside P&C that though market forces accelerated the unit’s turnaround, it was the result of “true discipline”.

She said the firm would not be opportunistic in chasing the hard primary market for top-line growth.

But this willingness to walk away from business has not yet translated into improved performance on its casualty reinsurance segment, where it has not made a full-year underwriting profit since 2015.

Here, the firm has been also in remedial mode as it was in CorSo – it began management actions as early as 2017, including adding social inflation costing loads into pricing models and cutting appetite for US liability and commercial motor.

Within the P&C reinsurance unit, Swiss Re has cut large corporate liability exposure by 70% since 2019, again with the bulk of reductions being made within a couple of years.

But in the Q2 reporting season, its results included 1.2 points of adverse prior-year development in liability/motor and a 119% combined ratio for casualty reinsurance.

The firm’s CFO John Dacey told analysts the adverse development was a “pretty trivial number” in dollar terms and emphasised that the carrier still retains around $1bn of the $1.2bn in IBNR inflation reserves it gathered over 2022, after moving to incur a portion of that inflation reserve cushion in the half-year.

The 2022 inflation charges were steep, but, to date, they have not caused Swiss Re the kind of pain that it incurred in 2018-19, when, in total, it added $4bn to reserves connected with emerging liability issues. Casualty segment reserve additions have all been funded from excess reserves elsewhere, without having to recognise overall reserving deficiencies.

Cat turnaround

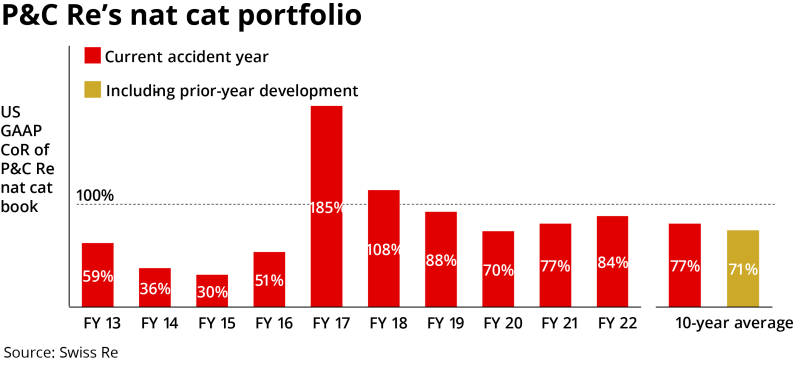

In contrast to its casualty struggles, the firm’s heartland of catastrophe risk has performed much more strongly in the past decade – even amid a high phase of disaster losses.

Like others, Swiss Re has had to reset expectations around catastrophe budgets in response to climate change and the new era of high loss years.

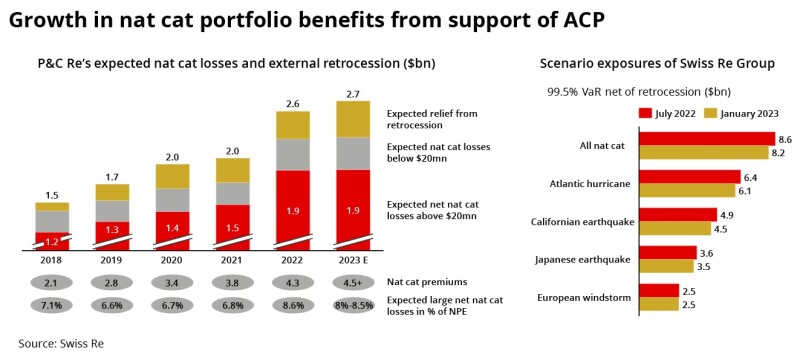

Swiss Re upped its cat budget by $400mn, or 27%, from 2021 to 2022 and kept the budget stable for this year, saying the impact of model updates was offset by rising attachment points and increased retro protection.

It is understood the firm sees itself as having been an early mover in the 2020s cat underwriting cycle, due to early messaging around the danger of secondary perils in 2020, when it began trimming aggregate exposure.

The firm sees nat-cat risk as being “in its DNA” and provides business-level disclosure for the line of business, partly as a way of reassuring equity investors on the ongoing insurability of the segment. Other than the major loss years of 2017-2018, it has made underwriting profits in this line of business over the past decade.

On the retro point, it is notable Swiss Re has gone through a major pivot in its approach to the ILS markets in recent years.

Although Swiss Re has had a longstanding sidecar, Sector Re, it is only within the past couple of years that it has set up multiple investor-friendly access points to its framework, with a funds management framework and cat bond strategies opened up to third-party capital.

This points to a shift in its thinking – no longer giving up premium income to retro providers that are not strictly necessary to a company with such a large equity base, but instead using alternative capital to lift its gross exposure while managing down net risks.

The lower net exposure also reflects the trend towards higher attachments and occurrence covers, which means giving up premium income – although the firm believes its earnings power has increased through moving to better-paid remote risks.

Swiss Re and its European peers are known to be big in international diversifying catastrophe business, where smaller carriers argue that standalone margins are so low that they heavily undercut the value of the diversification.

However, at least in Q2 2023, it appears to have come through a phase of high international losses in fairly good stead. Both Munich Re and Swiss Re said they had lower than expected cat losses in H1, but whereas Munich Re’s combined ratio deteriorated year on year, Swiss Re’s result improved. It posted nat-cat losses worth 5.9 points on the combined ratio for H1, below Munich’s 10.3 points, with EUR600mn taken by the latter on the Turkish quake alone.

Tailwinds and outlook

Analysts are evenly split on Swiss Re at present. Of the 23 analysts covering the carrier, just over half had Swiss Re on a neutral/hold positioning after its mid-year results, with six recommending it as a buy or overweight, and five taking a “sell” stance. This was incrementally better than ahead of H1 results, when the buy/sell group were evenly weighted.

The news in mid-August that S&P had revised its outlook on the carrier to stable, from negative, citing the impact of the improved pricing environment, along with prior corrective actions, may provide a further boost to sentiment.

The hard cat market will be a tailwind for Swiss Re as it addresses all of these issues, but social inflation is clearly a major offset.

Will its personnel restructure be enough to convince its new generation of talent to stay put and to navigate through the next market downturn with more panache? Has it acted boldly enough, early enough, on inflation reserving for its soft-market casualty years to come through this new era of higher inflation strongly versus its peers?

All these questions are ones analysts will be waiting for proof points on – while its peers may also be hoping to see knock-on benefits from its actions, as they did in the 2023 cat renewals.