Swiss Re, Munich Re, Hannover Re and Scor have all given hints of their 1 January strategies during third-quarter results reporting as the industry debates whether cat models are fit for purpose, pricing is broadly adequate, and the full impact of climate change is properly understood.

Within the quartet, Scor is in the midst of the most drastic action, having announced an extensive portfolio shift, while Hannover is holding its cat appetite level next year, Munich is pushing for rate increases on some business and Swiss Re is seemingly ahead of the pack after nine months of exposure reduction.

Increasing noise from the retro market also suggests that capacity here will not be as plentiful as in previous years, putting further pressure on reinsurers to demand higher prices from cedants or cut their cat appetites.

Each of the four European reinsurers has communicated differently on cat in the past fortnight. Their pronouncements come after Bermudian reinsurers signalled a cooling on cat business, with Axis vowing to take on no further cat exposure at any price and Everest Re communicating a move away from cat.

RenaissanceRe, meanwhile called this year’s cat losses “a body blow” to the ILS market, noting that around 75% of losses from Bernd will land in the reinsurance market and from there spill into retro.

Although each of the Big Four are taking subtly different approaches, the indication is that the upcoming January renewal will present a challenge for cedants as carriers tighten up cat underwriting.

The retro picture

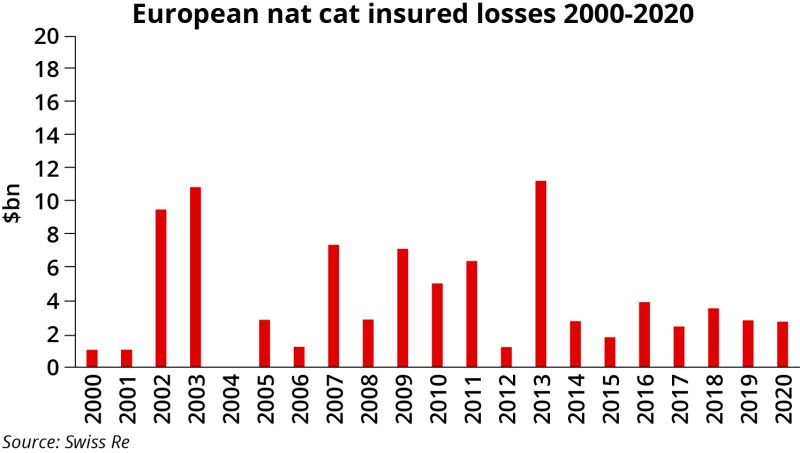

Swiss Re has estimated industry insured losses from Winter Storm Uri will reach $15bn, while Storm Bernd will cost $12bn. Industry loss estimates for Hurricane Ida vary, with Swiss Re pegging its estimate at $28bn-$30bn, and Munich Re a more severe $35bn.

The early indications are that these losses have led to a significant amount of lost or trapped capital in the retro market, with a dearth of new capital flowing into the sector.

As sister title Trading Risk has explored here, the move by reinsurers to wean themselves off earnings protection retro covers started when Markel Catco shut up shop in mid-2019, but this year, they are likely to face a more drastic withdrawal.

The market already expects to see a further shift away from aggregate cover and towards the occurrence market, with attachment points set to rise, as well as an increasing reluctance to write quota-share retro covers.

All of this points to difficulty for reinsurers in securing the retro cover they have enjoyed in the past, which in turn can affect their appetite for inwards cat business. Scor, for instance, has already revealed that it will be forced to restructure its retro programme due to a lack of aggregate and proportional cover available.

Although it has made no comment on the retro market in broad terms, Hannover Re has also made significant recoveries on its retro programme this year.

The carrier reported a net Bernd loss of EUR643mn ($742.7mn) but a gross loss of EUR214.2mn. Board member for P&C Sven Althoff confirmed that Hannover Re had made recoveries on both its K-Cessions sidecar and its whole-account excess-of-loss (XoL) layer for Bernd.

Swiss Re, meanwhile, acknowledged the challenges in the retro market due to trapped capital and a lack of new investors. CFO John Dacey, however, said Swiss Re funds the majority of its growth with its own capital, and so is less affected by any retro shortages.

Swiss Re: $2bn of exposure culled

Despite Q3 losses of $750mn from Ida and $520mn from Bernd, and a total of $1.7bn in large P&C losses for the first nine months of the year, Swiss Re reported a nine-month combined ratio of 97.5%, a marked improvement from last year’s 110.3%, when the book was hit by Covid-19 losses and greater-than-expected Q3 cat losses.

This progress, Swiss Re said, was a direct result of remedial work to improve the quality of its P&C portfolio over the course of 2021 – although it also benefited from an improvement in its investment result.

CFO Dacey said the P&C segment’s return to profit, from a $201mn nine-month loss in 2020, was achieved through work since January to move away from lower layers on reinsurance programmes that had been continually hit by mid-sized cat events to protect its earnings.

“We removed ourselves from approximately $2bn of notional exposure coming into 2021,” he said on a Q3 conference call.

At 1 January this year, for instance, Swiss Re’s exposure reduction was clear, with its top line growth of 5.7% falling short of achieved price increases of 6.5%.

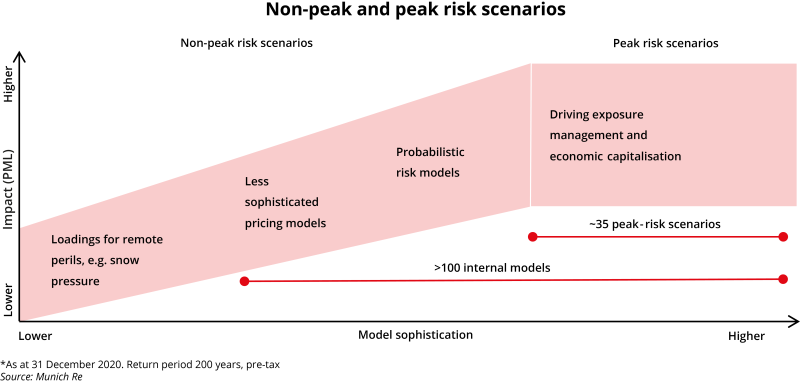

Dacey added that while Swiss Re had updated its own models concerning cat risk late last year, he expects other carriers to re-evaluate “risk and appropriate pricing” along the same lines following this year’s cat losses.

Munich Re: Reaffirming the cat commitment – at a price

Munich Re’s P&C segment also swung from a EUR23mn loss to a consolidated result of EUR138mn profit for Q3, despite its combined EUR1.8bn loss from Ida and Bernd.

The carrier achieved a 30% increase in investment returns for the quarter compared to the prior-year period, which helped boost the result.

However, the P&C unit reported a 0.6-point deterioration in its combined ratio, which remained greater than 100% at 112.8%.

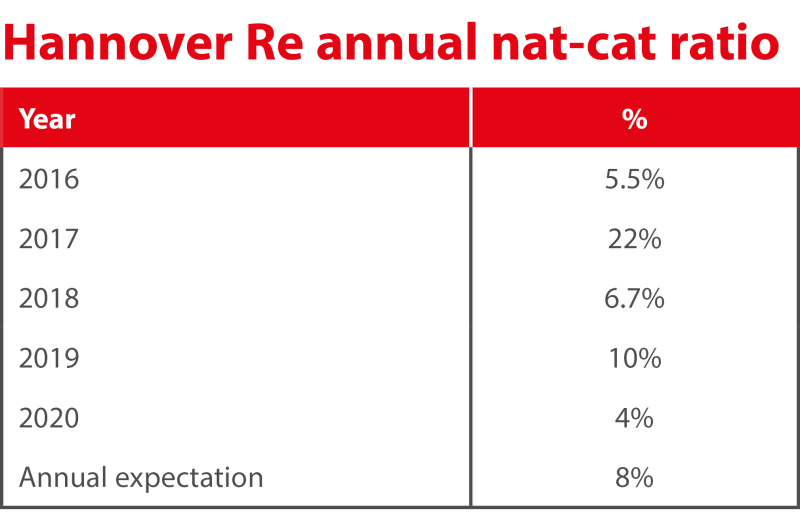

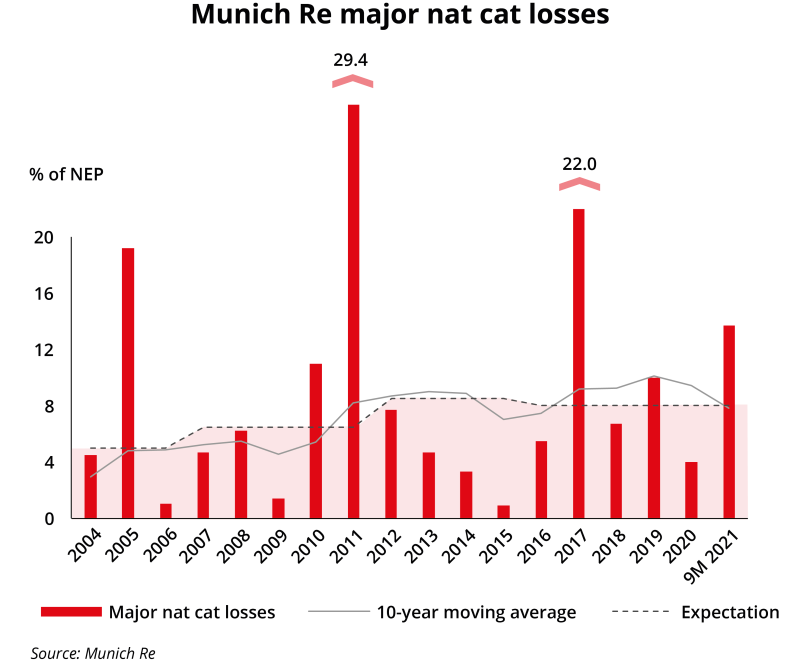

Despite this year’s cat losses, Munich Re’s CFO Christoph Jurecka affirmed the company’s commitment to cat business and defended the maintenance of its budgeted 8% cat ratio, when analysts questioned whether this is still realistic.

Munich Re’s expected annual nat-cat ratio has been 8% since 2016, a figure it exceeded in 2017 and 2019.

“Cat business is a volatile business, but it is a profitable business long-term,” said Jurecka.

He added that Munich Re has maintained its focus on the impact of climate change on the frequency and severity of events.

While Jurecka explained that Munich Re regularly updates its models to take account of climate change, the carrier’s Q3 presentation illustrated that frequency and severity of events “remains largely random” in any given year, and argued the only defence against this was portfolio diversification.

Jurecka added that the carrier is continuing to push for rate adequacy in cat as it recalibrates its models.

In particular, Jurecka said that while there had been rate increases in cat-prone areas, other geographies where there have not been major disasters in recent years are still lagging behind on pricing.

Scor: Portfolio shift

While Swiss Re telegraphs that it is ahead of the game on pricing, Munich Re vows to keep cat as core to its offering, and Hannover holds its appetite steady, Scor is an outlier in its shift away from cat business.

The French carrier reported an operating loss of EUR56mn for Q3, compared to a EUR119mn profit last year, as it booked EUR343mn losses from Ida and Bernd.

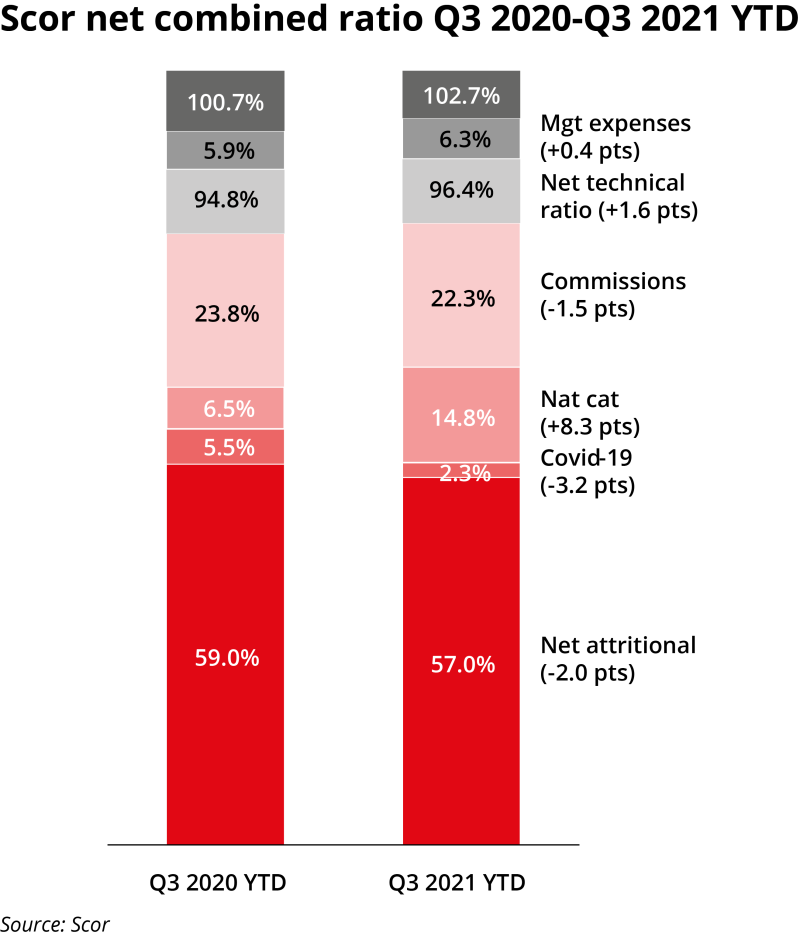

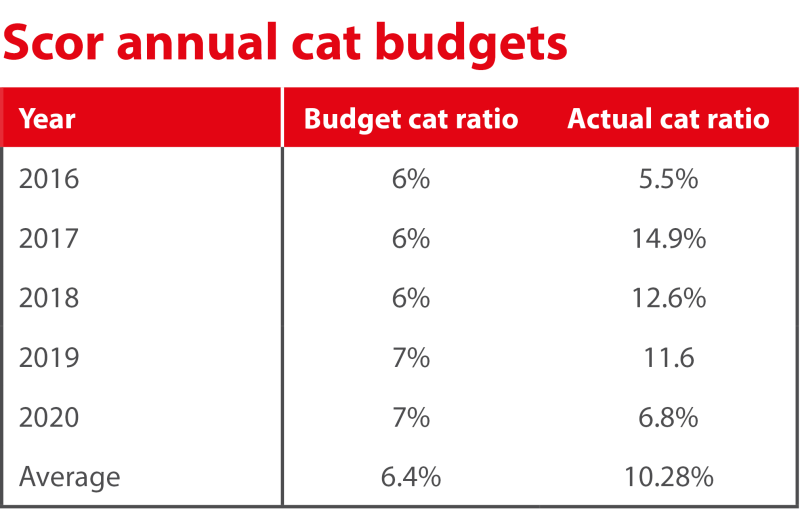

Scor booked a 23.4% cat ratio for the quarter and has repeatedly exceeded its annual budgeted cat ratio, as shown below.

At the same time the carrier, led since this summer by new CEO Laurent Rousseau, announced that it had already begun a portfolio rebalancing exercise in which it will shift towards a 60:40 P&C and life split (reversing the current position), as well as moving away from cat and towards non-cat property and specialty reinsurance.

The shift is not confined to reinsurance; Scor has also pulled away from providing capacity for MGAs that are focused on US excess and surplus primary business that is exposed to North Atlantic hurricanes, as well as cutting back capacity for proportional US treaties.

Scor group CEO Laurent Rousseau said the actions on MGAs alone had reduced probable maximum loss by $200mn.

Hannover Re: Steady as she goes

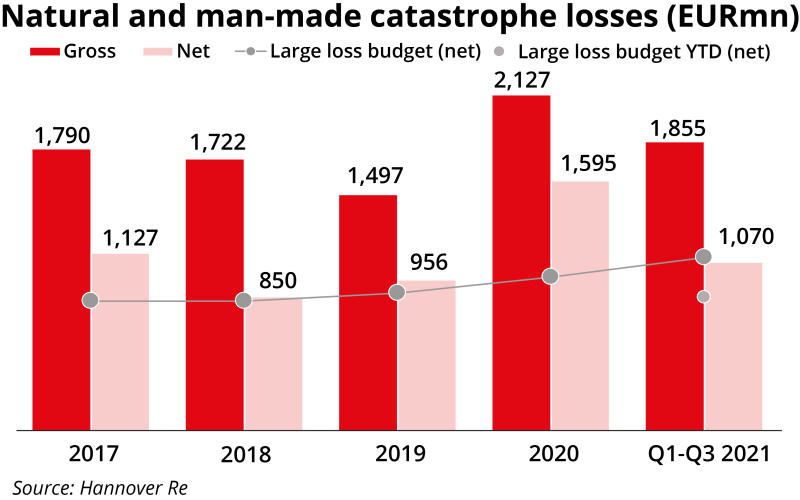

Hannover Re’s P&C unit reported operating profit of EUR283mn for Q3, down 5.2% year on year, as it exceeded both its budget for nat-cat and man-made losses and booked a Q3 combined ratio of 101.5%.

As noted previously, Hannover Re’s Sven Althoff said it had passed a sizeable proportion of its Q3 losses on to its retro programme.

He added, however, that the increase in its large loss budget for 2022 to EUR1.3bn, up from this year’s EUR1.1bn, should not be read as a proxy for dramatic premium growth or a desire for more cat business.

The executive said the increased large loss budget for 2022 – of which EUR1.05bn is earmarked for nat-cat – was partly the product of 2021 growth earning through, as well as model changes and a small degree of 2022 premium expansion.

“The last two rounds of rate increases certainly helped to get [the nat-cat] portfolio to a better level of profitability,” said Althoff on a conference call, adding: “We expect further rate increases on the loss-impacted business into 2022.”

“We are OK with our profitability on the nat-cat side, but…we will keep our relative risk appetite for nat-cat stable.

“We are not seeing rates yet which would make us fundamentally change our risk appetite.”