Aon

-

-

Zaffino will become executive chair of AIG and retire as CEO by mid-year.

-

Reinsurers’ average RoE was 16% as of September 2025.

-

The president and CEO will also be eligible for up to $50mn in shares.

-

The influx of capital, combined with a quiet wind season, led to favorable conditions for cedants during 1.1 renewals.

-

Former Aon employees are barred from using Aon’s confidential information.

-

Insurance Insider reflects on the themes that shaped 2025 for the London market.

-

From 2026, the facility will also offer longer maximum construction periods.

-

The packages contained client lists and records saved as “TOP SECRET” on a former employee’s computer.

-

The argument for buyers to purchase cyber has never been stronger, yet growth is still lagging.

-

This publication revealed Jeroen van de Grampel and Nicholas Moore’s departures in August.

-

The class of business has shouldered claims totalling over $4bn this year.

-

Rob Sage joined Aon in 2022 as an executive director.

-

The platform will debut in Germany before an accelerated global rollout in 2026-27.

-

James Kelly joins from Besso, having held senior positions at JLT, Lockton and Gallagher.

-

Rate decreases are often in double digits, but high loss trends and systemic risk persist.

-

CEO Greg Case said data centre demand could generate over $10bn in new premium volume in 2026.

-

The broker grew earnings per share by 12.1% during the quarter.

-

The broker will join Ron Borys’ financial lines team.

-

Ben Hanback joins from Aon, where he spent almost a decade.

-

Part five in our series looks at how AI can empower brokers to add value as well as speed.

-

Rachel Turk was speaking on an Aon Reinsurance Renewal Season panel.

-

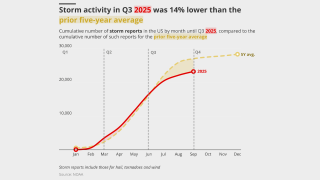

Nine-month insured losses still exceeded $100bn due to California wildfires.

-

The London-based pair will report to commercial risk UK CEO Rob Kemp.

-

Clear Blue originally filed the suit in late 2023, alleging reckless conduct and misrepresentation.

-

The recruits will join from Nephila, Aon and Malaysian Re.

-

Despite a rocky H1, 2025 insured losses from nat cat events may not surpass 2024 levels.

-

The executive has worked at Aon for almost two decades.

-

Cyberattack/data breach remains in the top slot.

-

According to McKinsey, the projected spending on data centers is expected to hit $6.7tn by 2030.

-

The toll of risk losses sustained by the PVT market this year is mounting.

-

The broker said insurers were facing increasing pressure to improve financial performance in claims.

-

This publication revealed in February the incident was expected to lead to a major claim.

-

Reinsurer executives stressed that the industry worked hard on setting the right structure.

-

Nick Fallon is the latest in a string of retro-broker moves in the market.

-

The platform aims to “bend the loss curve”.

-

Cat bonds have outperformed private ILS strategies in the YTD, according to ILS Advisers.

-

Bazan Group’s refinery near Haifa was badly damaged by Iranian bombardment in June.

-

Scale is increasingly becoming a differentiator for reinsurance carriers, the broker noted.

-

Paul Campbell details how the most profitable insurers act during a soft versus hard market.

-

Supply for property outstrips demand, but the casualty market is “bifurcated”.

-

The California wildfires showed reinsurers can absorb major cats and remain profitable.

-

What’s next for the reinsurance market as Monte Carlo approaches?

-

Aon acquired NFP from Madison Dearborn in April last year in a $13.4bn deal.

-

The broker is in hiring mode in specialty after numerous brokers departed for Willis Re.

-

After spending 20 years at Aon, Goodman will start a senior executive position with Guy Carpenter.

-

The reinsurance veteran joined Aon nearly 20 years ago from Cooper Gay.

-

Paul Jeroen van de Grampel drove Aon's M&A and litigation solutions proposition.

-

The lawsuit is the latest development in the multi-billion dollar reinsurance scandal.

-

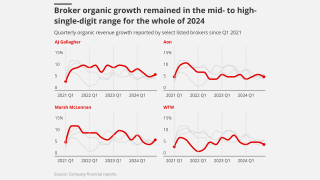

However, group organic growth among public brokers has slowed to pre-pandemic levels.

-

Price decreases became lower throughout Q2, however, averaging 3% in April, 2.3% in May and 1.6% in June.

-

Andrew Laing succeeds Rupert Moore, who will become reinsurance CEO for Asia Pacific.

-

The broker has noted that double-digit reductions are increasingly available in property.

-

In part II of our series, we look at where AI is being integrated into claims departments.

-

The facility was previously for commercial risk clients.

-

The NFP acquisition was a “tailwind for organic growth, not a key driver”, said CFO Edmund Reese.

-

The broker’s EPS beat consensus at $3.49 for the quarter.

-

The broker has nearly 20 years of experience in the reinsurance and retro markets.

-

The impact on the (re)insurance market has been muted due to its strong capital position.

-

The former Lloyd’s CEO is also eligible for a target $5mn annual equity award.

-

A look into how the insurance industry is using AI and where practical gains are arising.

-

Plus, the latest people moves and all the top news of the week.

-

The broker said the appointments are designed to drive growth.

-

John Neal was due to start at Aon as global reinsurance CEO in September.

-

The former Lloyd’s CEO will not make his planned move to Aon.

-

US events accounted for more than 90% of global insured losses.

-

Rates continue to drop as capacity is ample, the broker said.

-

Gallagher, Marsh and Aon also faced sizeable outstanding premium payments as at Q4 2024.

-

He was most recently Marsh’s US manufacturing and automotive practice head.

-

The executive brings more than 25 years of insurance experience.

-

The broker has expanded the number of global industry verticals to seven from four.

-

The broker noted a “significant variation” in renewal outcomes.

-

The platform will capture and standardise data from all submissions, the broker said.

-

Coverage has broadened while limits have increased, the broker said.

-

The executive was formerly the head of cyber solutions, North America.

-

The documents figure in a potential criminal case against a CCB employee.

-

Case added that recently acquired broker NFP has “exceeded” expectations.

-

Muñoz was also Aon Re chairman for the Latin American region.

-

The executive will remain CEO of reinsurance until 1 September.

-

Most of the losses are attributable to a supercell storm in Texas.

-

The executive will also continue as MD overseeing Caribbean fac.

-

Two large storms hit the Midwest and Ohio Valley regions on 14-17 May and 18-20 May.

-

The executive will be global reinsurance CEO and climate solutions chair.

-

The exec will lead key initiatives including Aon United, and work closely with NFP.

-

Hussey will take over the role left vacant when Luis Sonville moved to AJ Gallagher late last year.

-

He was appointed executive chairman for international in 2021.

-

New broker vehicles are setting up amid accelerated softening in D&F.

-

The executive was previously a top US casualty broker.

-

Ann Field, Matt Moore and David Griffiths have also had promotions.

-

The broker's share price dipped 11% in morning trading after its Q1 earnings missed expectations.

-

The commercial risk and reinsurance units delivered mid-single-digit growth.

-

Marsh alleges Aon also went after its clients as well as its employees.

-

Insured losses were the second highest on record for the first quarter.

-

The broker has also hired fellow Aon broker Barry Gordon in a role trading ILWs.

-

The 1 April renewals are the key date for Japanese treaty.

-

Total reinsurer capital grew by $45bn in 2024 to $715bn.

-

Sources said extending coverage to Gen AI may be difficult and unnecessary.

-

Plus, the latest people moves and all the top news of the week.

-

The broker has promoted Oriol Gaspa Rebull to global head of analytics strategy.

-

Earlier today, Aon confirmed president Eric Andersen had stepped down from his role.

-

The executive will remain with the firm as a senior adviser to the CEO until mid-2026.

-

-

Eric Paire was head of capital advisory at Aon for nearly seven years.

-

The steep reduction in quantum stands to benefit specialty excess of loss reinsurers.

-

Sources said the claim is likely to be a multi-hundred-million-dollar event.

-

Plus, the latest people moves and all the top news of the week.

-

Single-digit organic growth, robust casualty pricing and tapering margins were all key trends.

-

The event now includes a casualty portion and has officially been re-branded as the Property and Casualty Symposium.

-

The average change for primary policies with the same limit and deductible was a 3.5% decrease.

-

-

Aon saw lower rates in reinsurance as capacity outstripped demand.

-

President Andersen said he was optimistic about the 2025 reinsurance market.

-

The broker introduced 2025 guidance for mid-single-digit or greater organic growth.

-

Secondary perils accounted for 65% of global insured losses in 2024.

-

The Moss Landing facility has previously faced major claims.

-

The associate director is exiting the broker’s product recall team after 10 years.

-

Aon is in hiring mode following the departure of several senior brokers to Howden Re.

-

The Palisades fire is estimated at $9bn-$12bn, while Eaton is $6bn-$8bn.

-

Total economic and insured losses are “virtually certain” to reach into the billions.

-

The Corporation’s CEO will run Aon Reinsurance Solutions.

-

The move means Lloyd’s will have a new chairman and a new CEO in the same year.

-

The multi-day weather outbreak caused widespread damage from Texas to the Carolinas.

-

In property, Canada, Central and Eastern Europe and UAE renewals were impacted by losses.

-

The executive said the market would soften during 2025 but would not drop through the floor.

-

The facility was launched in partnership with the EBRD.

-

Barry Stiff is expected to join Aon in May.

-

Jon Thacker has been at WTW for 20 years, specialising in construction.

-

The former CEO will also serve as executive managing director within Aon’s reinsurance solutions business.

-

The commercial chief said Aon will avoid disrupting clients’ insurer relationships.

-

The executive is currently Asia Pacific CEO.

-

Cyber is more in the one- or two-year loss development camp, the Lloyd’s CUO said.

-

The Indonesian flag carrier moves during the busy Q4 airline renewals.

-

The long-serving Aon broker specialises in the placement of cruise portfolios and Norwegian accounts.

-

The executive has worked for LSM and Brit.

-

-

The global broker has beaten off competition from AJ Gallagher, and a number of other strategics.

-

Insured losses for 9M 2024 have hit $102bn, according to a report.

-

Ball will succeed Jeff Poliseno, who is set to retire.

-

The broker said Europeans are pushing hard for rate or attachment point relief.

-

The broker expanded margins and grew earnings per share by 17% during the quarter.

-

The broker is discussing the potential for "smart frequency solutions" with reinsurers.

-

Continental cedants are looking for support for third and fourth events.

-

Underwriters are broadly pricing on the basis of a $1.5bn Baltimore claim, but there is uncertainty.

-

An estimated $6bn to $9bn will be ceded to the FHCF, and $6bn to $10bn to traditional reinsurance markets.

-

She most recently led the broker’s UK insurance vertical.

-

The “exceptionally large and powerful” Category 4 storm made landfall in Florida last month.

-

Richard Pennay will become CEO of Aon Securities.

-

Third-party litigation funding has been linked to rising casualty insurance prices.

-

Aon estimated losses for the Czech Republic at EUR775mn, Austria EUR555mn, Poland EUR285mn and Slovakia EUR33mn.

-

Padilla has also held senior regional roles at Cooper Gay and Swiss Re.

-

Better performance data and clarity around entry are key, report says.

-

The move follows the recent appointment of Aon’s Brad Melvin as US president and CEO.

-

The brokers called on the industry to “catalyse” the country’ growth by removing blanket exclusions.

-

Italy is seeking to address an insurance protection gap that is much higher than in other European countries.

-

The expanded team aims to increase capability across global specialty lines and property specialty retrocession.

-

The change comes as negotiations start to kick off for 2025 renewals.

-

The US carrier abandoned the project due to high price expectations.

-

Yen Chu Choo has been appointed Asia Pacific capital advisory head.

-

Rob Kemp leads the EMEA central broking team as strategic broking director.

-

Portfolios of clients of varying size in the same region aggregate more risk.

-

Clients are taking advantage of market conditions to restore coverage limits.

-

Sources said LSM head of third party in Miami Humberto Pozo will serve as interim head of distribution.

-

The executive will end her career at Aon Bermuda effective 1 October.

-

-

This is a new role for the broker.

-

He joins the firm following the departure of Edward Morgan and Guy Tyler, who have launched an MGA.

-

Current head of marine hull Helen Costin is set to retire from the business.

-

He will focus on the London and US markets, including the placement of consortia and binders.

-

Q2 was the ninth consecutive quarter of year-over-year price decreases.

-

President Eric Andersen said non-malicious cyber risk was “front of mind” for clients.

-

Organic growth was in line with WTW and Marsh McLennan, which both posted 6% underlying expansion.

-

The move comes amid elevated personnel movement in the energy sector.

-

Moore will oversee Aon Bermuda’s commercial risk solutions broking operations, leading a team of 85 executives.

-

The airlines, healthcare and financial services industries were some of the sectors affected by the outage.

-

The executive has worked for Aon, Steadfast and Argenta.

-

The figure is well above the historical average of $39bn for this century.

-

Trade, technology, weather and workforce were identified as the main mega trends.

-

The new hire spent two years as head of member services at Lloyd’s.

-

Farah Nelson will report to recently appointed group CFO Charlie Rozes.

-

A round-up of all the news you need today, including an updated forecast for Atlantic hurricane season.

-

Hurricane Beryl is expected to strengthen again after hitting the Yucatan Peninsula.

-

The executive was head of wholesale and specialty at Aon’s Global Broking Centre.

-

Paul Davies has been with the broker for more than 36 years.

-

Reinsurers were more willing to support lower layers ahead of 1 July, the broker said.

-

The facility will provide coverage globally for blue and green hydrogen projects.

-

The Mexican state oil company delivered the upstream market its largest claim in 2023.

-

The broker said US insurers purchased around $5bn of additional cat limit.

-

Evercore is leading the capital raise process and Aon is assisting with the Lloyd’s application process.

-

Mark Parker has been leading the GBC on an interim basis and will retire in the coming weeks.

-

SCS caused global insured losses worth at least $8bn in the first quarter of 2024.

-

Interest is growing in third-party capital, captives and private debt.

-

Dan Walsh has led Aon Client Treaty for the past six years.

-

The $357mn programme consists of four transactions, including a $50mn facility brokered by Aon.

-

The broker has more than 30 years’ experience in the London motor market.

-

-

-

The broker noted a shift towards alternative risk solutions in the MENA region.

-

An EF-4 tornado devastated Greenfield Iowa, adding to the expected multi-billion-dollar toll.

-

The most common breach type was law compliance, followed by financial statements.

-

He will report to Cynthia Beveridge, global chief broking officer for commercial risk.

-

He will report to Kelly Superczynski, Aon’s global head of capital advisory.

-

Prices for programs that renewed in both Q1 2023 and Q1 2024 decreased 15%.

-

Aon’s CEO said the business was formerly “very underweight” in the middle market.

-

The broker announced yesterday it had completed its $13bn acquisition of NFP.

-

James Platt has previously held group COO and chief digital officer roles at Aon.

-

The most extensive damage was caused by rainfall in Texas, Louisiana, Mississippi and Florida.

-

Eric Paire has been at Aon since 2018, having joined from Guy Carpenter.

-

-

The broker said 1 April Japanese renewals reinforced positive trends in the US at 1 January.

-

Sources cited numerous issues with how collateral protection insurance was designed.

-

Natural-cat-exposed business saw significant price increases.

-

The pair hail from Miller and Aon respectively.

-

The exit follows the broker moving its Climate Risk Advisory function into its Risk Capital segment this year.

-

He was executive managing director in Aon’s wholesale treaty team.

-

Mike Smith will step down from his role on 31 March.

-

The end of the waiting period effectively clears the path to close in the US.

-

-

The executive will lead strategic initiatives and hire talent.

-

The broker has been adding to its capabilities in the region.

-

The pace of price decreases has eased since Q2 last year.

-

The broker wants to “draw a line under the issue” and trade forward.

-

Growth driven by 14% expansion in reinsurance solutions division.

-

Convective storms cost more than ever, but activity was not exceptional.

-

The committee claims Chaucer waited until it had ‘maximum leverage’ over other debtors.

-

The investment comes in exchange for a $49mn surplus note from HOA and the acquisition of HOA’s rights to potential claims stemming from the Vesttoo fraud.

-

Jose Antonio Álvarez served as group CEO of Santander from 2015 to 2022

-

The transaction would have been one of the largest the market has seen for years.

-

The broker’s latest climate report tallied global insured cat losses at $118bn.

-

The executive will lead for the EMEA region in its strategy and development business segment.

-

High staff turnover in the cargo market is continuing this year, following elevated movement in 2023.

-

Ron Gardenier, the current chief MGA at Aon, will be appointed CEO of the newly formed entity.

-

The LatAm telecoms company buys a sizeable protection triggered by windspeeds.

-

Wind and tornado in the US may already have led to losses in the hundreds of millions, according to Aon’s report.

-

The former WTW and Ardonagh executive joined Aon two months ago.

-

The broker has seen several changes to its senior UK leadership in recent months.

-

While it is too early to determine the total financial loss, the US Geological Survey believes there is a 64% likelihood it will reach into the billions of US dollars.

-

The broker’s report also hailed the best risk-adjusted margins for ILS investors in a decade.

-

Separately, sources said Swiss Re Miami-based head of auto overseeing the motor portfolio for the LatAm region Carlos Ricci has also left the reinsurer.

-

The CEO also disclosed that the break fee on the takeover is $250mn.

-

The deal is expected to close in mid-2024 and will be funded by $7bn of cash and $6.4bn of Aon stock.

-

In one deal, JC Flowers-backed broker Oneglobal and Insuterch Floodbase announced a partnership to develop parametric flood insurance across Asia.

-

Woolley joined Aon in 2019 as an associate director and has previously worked as head of broker distribution for First Title Insurance.

-

All existing carriers on the panel renewed in 2024, with QBE remaining leader.

-

Yesterday, this publication reported that James Mackay was set to depart from his previous role at Aon Reinsurance Solutions.

-

The 2023 Global Risk Management Survey showed that the UK is the only region to put climate change in its top 10 risks.

-

Head of Lloyd’s relationships James Mackay joined Aon in 2019 after a 25-year stint at Argenta.

-

Last year, the B2B credit InsurTech raised $15mn in Series A fundraising as it looks to continue building its team and expand globally.

-

The lawsuit, filed Thursday on behalf of Clear Blue and its subsidiaries, alleges that Aon conducted insufficient due diligence on the ILS InsurTech.

-

The CEO anticipates reinsurers to continue focusing on attachment levels and that appetite for specialty classes will be higher.

-

-

As part of the changes, former Andean CEO Alejandro Gregory will take over as LatAm chief commercial officer.

-

Sources voiced some disappointment in the rate reduction but acknowledged the improved loss record of the contract.

-

There is an increasing focus in the casualty reinsurance space on social inflation and litigation funding trends.

-

Aon’s Global Risk Management Survey also places failure to attract or retain top talent in the fourth spot.

-

Aon’s three-year plan will allow the firm to go “further faster” in serving clients with increasingly complicated needs, as well as creating additional operating leverage that will create the opportunity for Aon to deploy capital more broadly, CEO Greg Case told this publication.

-

The decline marked the sixth consecutive quarter of double-digit pricing declines.

-

Current EMEA CEO Eduardo Dávila is to leave the firm to “pursue the next chapter” of his career.

-

The 3x3 plan takes the things about the firm over the last decade that have been distinctive and intensifies them.

-

The plan is projected to deliver savings of $100mn in 2024, $250mn in 2025 and $350mn in 2026.

-

Aon’s three-year plan will allow the firm to go “further faster” in serving clients with increasingly complicated needs, as well as creating additional operating leverage that will create the opportunity for Aon to deploy capital more broadly, CEO Greg Case told this publication.

-

The broker’s share price fell by around 4% after the announcement of its Q3 results and extended restructuring program.

-

The group will look to deliver more integrated solutions to clients through increased tech spend, and will look to scale back headcount.

-

The executive’s career to date includes key claims roles at Chubb and Swiss Re.

-

Podmore joins from Swiss Re, where he held the role of lead cyber underwriter.

-

Creditors already have authorisation to access Vesttoo’s data as part of their investigation.

-

Caccamese spent nearly six years at rival broker Guy Carpenter prior to joining Aon.

-

The motion seeks discovery of information and documents about the structure and operation of White Rock’s cells.

-

Mallen previously spent over 10 years at Chaucer, most recently as a US casualty reinsurance underwriter.

-

Aon Re Brazil CEO Antonio Jorge Rodrigues and four other executives have left the firm and are expected to join rival broker Howden, this publication has learned.

-

The business has engaged with the AssuredPartners process, and has also met with a range of other private brokers including Galway and NFP.

-

Nichols joins from Aeolus Capital Management, where he’d served as a portfolio manager after previously spending nearly a decade at Guy Carpenter.

-

He rejoins Aon after 15 years at Guy Carpenter.

-

A Delaware judge has ruled in favour of Vesttoo’s automatic stay in the bankruptcy case.

-

In the initial court documents, Aon alleged its rival broker and former head of PFI “conspired unlawfully” to recruit key members of the team.

-

As the curtain comes down on the millionth Monte Carlo Rendez-Vous, and the prices in the cafes and restaurants are presumably reset to their customary levels, the conference has again done its main job.

-

Insurance Insider has compiled a bite-sized wrap-up of the exclusive news stories and CEO interviews from this year's Monte Carlo Rendez-Vous.

-

Data from the broker indicated that around 70% of global losses were driven by SCS, with events in the US causing $35bn of insured losses over H1.

-

The executive also recommitted Aon to its mission around creating net new markets – including growing IP – in the wake of the Vesttoo issues.

-

Our virtual roundtable polled senior industry figures on the biggest questions facing the reinsurance industry. Today, we look ahead to the influences steering M&A market conditions.

-

Nick Frankland was appointed chairman of the group, which he was instrumental in forming.

-

Investigations have revealed more damage than first thought from the July explosion.

-

The Aon transformer is seeking information on the origins of alleged fraudulent letters of credit.

-

The Aon unit noted 37 LOCs “purportedly procured by China Construction Bank (CCB), Banco Santander and Standard Chartered Bank US”.

-

Carriers continue to adapt their appetite, capacity deployment, coverage language, attachment points and pricing to manage portfolio performance.

-

Sources said Baron is joining Price Forbes after nearly seven years at Aon, where he was managing director based in South Florida.

-

The firm’s interim CEO Ami Barlev has argued that, with Vesttoo’s weekly expenses being $360,000, freezing assets above $1m would be “catastrophic for the company”.

-

The broker has also appointed Paul Shedden as head of advanced risk analytics for its Risk Capital business.

-

The ILS transformer platform claims Vesttoo is in breach of shareholder agreements.

-

Green will be responsible for servicing companies across both Howden’s specialty and retail divisions.

-

The recruitment continues a period of expansive hiring for the intermediary.

-

Aon’s report found that ransomware attacks on average have a 12% lower impact than data breaches.

-

The carrier will provide cover to a wind farm and a solar farm as part of the Aon-brokered deal.

-

The executive left Ardonagh in March as the group restructured its specialty broking operations.

-

Aon report marks the fifth consecutive quarter of year-over-year pricing decreases in the D&O space.

-

The broker said it believes it has meritorious defenses and intends to vigorously fight the claims and seek recourse against third parties where appropriate.

-

Depressed M&A activity is a headwind likely to impact Aon for the remainder of the year.

-

The growth figure represented a 1-point deceleration from the previous quarter.

-

The scale of the coverage offered by the firm means buyers in the emerging line of business face a challenge to swap out their capacity.

-

Areas of focus should include hiring external talent, securing capital for M&A, speeding up US growth, and answering the reinsurance question.

-

The firm said it had identified two specific transactions in which “collateral inconsistencies” were in question.

-

This follows the appointment of Aon's Foord-Kelcey, who is set to head Howden Tiger's cyber re team.

-

The Mexican state-owned oil company has been the source of several large energy claims.

-

Skilton will be chair of the team with Wheeler and Murray heading up the global re specialty unit.

-

Howden Tiger has focused on marine reinsurance for its latest hiring spree.

-

The coverage is designed to reduce the island’s obligation to the US Federal Emergency Management Agency.

-

The broker estimated there was a 7% uplift in alternative capital and a 5% recovery in traditional equity.

-

The broker’s latest report finds stability but continued price discipline in most lines and regions.

-

At this week's Bermuda Climate Summit, speakers heralded the Island's future as a centre of excellence for climate-related innovation and risk transfer.

-

The broker has also announced several internal promotions, including Jack Snowden’s to lead the GRC London team.

-

Howden Tiger, which has been hiring aggressively from rivals, currently has only limited involvement in marine reinsurance.

-

The broker has published research identifying transformative trends in the insurance industry.

-

The initiative aims to fast-track (re)insurance capacity to Ukraine to support reconstruction.

-

The broker said the risk from wildfire is also set to increase substantially.

-

The broker will report directly to Greg Case and move away from day-to-day client responsibilities.

-

Other appointments in the team include Nick Ayres as chairman of global credit and Doug Espenson named as head of US mortgage.

-

The Big Three reinsurance brokers face a number of factors that could challenge their supremacy.

-

Mayer will manage a global centre of excellence for parametric products and report to Paul Schultz, CEO of Aon Securities.

-

According to the latest cyber and E&O report from Aon, premium rates in 2023 are expected to be more competitive than the last 24 months.

-

Sean McGovern said the appointment was part of an “important strategic initiative” for the company.

-

The broker said there is a significant protection gap for flood coverage in the affected areas.

-

The broker said it intends to vigorously defend itself against Aon’s allegations concerning the departure of fac re employees.

-

Aon claims that Alliant has poached around 32% of Aon’s facultative reinsurance group, including 18 of the 25 Aon employees in the casualty fac team at all levels.

-

Securities filings show the conglomerate’s ownership of Markel holdings was valued at over $600mn at the end of March.

-

Thomas Uzzo brings more than a decade of industry experience to his new role.

-

The go-live has started with more than 450 colleagues in Aon UK’s commercial risk teams covering marine financial and professional services, natural resources and construction.

-

Risk capital comprises commercial risk and reinsurance, with human capital covering health, wealth and talent.

-

The scale of reductions is increasing as the class of business experiences its fourth consecutive quarter of rate falls.

-

The broker also said it grew in fac, as well as in its strategy and technology group.

-

Aon’s results continue a trend of accelerated organic growth among brokers in the first quarter.

-

The broker has spent around 15 years working for Aon’s reinsurance unit.

-

-

The appointment comes after a slew of cyber reinsurance brokers left Aon to join Howden.

-

Aon expects depleted shareholder equity to be restored over time via higher retained earnings and the ‘pull-to-par’ effect of bonds approaching maturity.

-

Total economic losses came in well above average, driven by the earthquake in Turkey.

-

The latest round of hires marks a continuation of the broker’s expansive and rapid talent acquisition.

-

Based in London, Artunduaga has served as Aon’s LatAm network leader. In addition, Chile-based Jose Necochea, Victor Padilla and Andres Claro will move to WTW.

-

Pachlatko joins from Kessler where he was the practice leader for cyber and crime risks as well as team leader.

-

Aon said it was “optimistic” that the market is now on a more stable footing following a turbulent 1.1.

-

Reinsurers achieved an average ROE for 2022 of 5.2% – far below the cost of capital – in what Aon described as a “poor year for reinsurance sector earnings”.

-

Finlay joined Aon last year from Guy Carpenter.

-

The executive joins Lockton Re after almost 11 years at Aon Benfield, where he was treaty broker based in Chile.

-

Reserving has increased substantially, inflicting another major claim on the loss-hit class.

-

M&G investments has committed the capital through its Catalyst private assets strategy.

-

Tony Day and Julia Dickinson, who both joined Aon in 2013, have previously held a number of senior roles within the political violence and terror team.

-

The market has quickly moved away from dramatic hardening in 2020 and 2021 following an influx of capacity.

-

The executive will join Aon’s UK leadership team and takes over from Jane Kielty.

-

The broker’s president also noted a stabilisation in primary pricing outside of property.

-

Commercial risk solutions’ Q4 organic growth dropped 8 points year on year to 4%.

-

WTW has appointed Pieter Van Ede as global head of trade credit, in a move the broker said demonstrated its commitment to growth in the class of business.

-

It is understood that Axis and Canopius lead the facility, which considers clients from any industry sector in providing excess capacity.

-

Before the move, the executive spent 12 years at Aon working as a reinsurance broker based in London.

-

The broker found that the insured-loss figure for 2022 was nearly 60% higher than the annual average over the 21st century.

-

The broker’s head of wholesale and specialty said London faces a great opportunity in 2023.

-

The broker also predicted elevated demand for all forms of ILS capital throughout 2023.

-

Under the terms of the renewal, the brokers made several concessions to underwriters, including making PV and SRCC risks prior submit, rather than automatic delegation.

-

Agostino Fulciniti will help deliver Aon’s EMEA commercial risk solutions strategy across broking, claims, specialties and risk consulting.

-

The senior broker joined the firm in 2018 after a long career at Willis Re.

-

The broker said that the event was unlikely to produce losses on a similar scale to the 2021 Texas freeze.

-

Progress around placements undercuts the case for an unravelling of the facilities that dominate the market.

-

Aon Reinsurance Solutions has appointed fac strategic growth leader Muñoz to take over Tassarotti’s position as deputy CEO of global fac.

-

James Buchanan spent 28 years at Aon, serving most recently as CEO of the global reinsurance clients team.

-

The broker has been on Biba’s board since 2020, when she became chair of the standards committee.

-

Marshall Bailey replaces Simon Jeffreys, whose seven-year stint as chair is coming to an end.

-

John Carroll has been promoted to reinsurance solutions CEO for Australia and New Zealand.

-

The broker said clients can move fast in a harder market but need time to review quotes.

-

Announcements and interviews at the UN conference have shed light on the tools emerging to help carriers decarbonise their underwriting portfolios.

-

Richard Dudley, global head of climate strategy at Aon, says existing products such as IP coverage can help insurers take a leading role in opening up investment for new climate transition technology.

-

The transaction will add Latin American hurricane and earthquake modelling capabilities to Aon’s product suite.

-

Some expressed disappointment at the rate change, but it came off the back of a major correction last year.

-

In Q3, 46% of primary policies renewing with the same limit and deductible received a price decrease, while 16% received a price increase, according to Aon.

-

CEO Greg Case said dislocation in the reinsurance market created “tremendous opportunities” for the firm.

-

The organic growth figure came in below that of major rivals Marsh McLennan, WTW and Gallagher.

-

Preliminary total economic losses this year through Q3, including an initial view of Hurricane Ian based on publicly available estimates, were $227bn.

-

The conflict has prompted a potential mismatch between insurer and client transition speeds.

-

A ballot date of 9 December has been set to replace Dominic Christian on the Council of Lloyd’s, as his term of office is set to expire on 31 January 2023.

-

Lloyd’s CEO John Neal said the challenges thrown up by the conflict could lead to difficult decisions in the short term.

-

The broker is working to drive retail and wholesale alignment to deliver better results for clients accessing the London market.

-

Paul Shedden joins from Sompo International, where he was head of portfolio design, pricing and analytics – global insurance.

-

Doreen Tan will be based in Singapore and have responsibility for helping to service Howden Re’s treaty clients across Asia.

-

The executive joins Aon after three years at IT security company vArmour, where she served as SVP and adviser to the CEO.

-

Some reinsurers are in “business as usual” mode after Hurricane Ian, while others are pausing to assess the event, as it is too early to tell how cat risk appetite will change, the broker said.

-

The scheme aims to fill the gap left when private sector carriers exited the market following the Grenfell disaster.

-

The brokers are working on finalizing the terms in a written settlement agreement, which could be filed within two weeks.

-

Prior to joining Aon, O’Gorman previously advised central governments and private sector companies in the UK and EU on their ESG strategies.

-

This publication’s review of H1 disclosures shows how listed (re)insurers’ nat cat losses have tallied with aggregate projections.

-

The process provides further evidence of larger deal sizes becoming more frequent in the legacy space.

-

Jeremy Goodman will relocate from Singapore to London and replace Nick Frankland, who remains in the business as chairman of Aon’s Strategy and Technology Group.

-

The CEO said the (re)insurance industry is not doing enough to meet the climate challenge ahead.

-

The broker said 2022 cat bond issuance was likely to match the record levels of 2021.

-

Aon’s reinsurance solutions CEO, Andy Marcell, said the loss ratios of treaties managed by the brokerage firm performed “pretty well” in the past 10 years.

-

The team will offer strategic consulting and technology solutions, starting with clients in property, casualty, life and reinsurance.

-

The board expects to appoint Karaboutis to the audit committee.

-

The executive joins Aon after 16 years at European reinsurer Scor, where he served as Caribbean market manager.

-

It is understood Markel is the lead insurer and Aon’s Risk Solutions is the broker on the $200mn policy.

-

In its ILS annual report, the broker noted that demand for capacity now exceeded supply of capital.

-

William Bruce will be responsible for building and leading Aon’s global climate risk consulting team.

-

The executive brings more than 15 years of industry experience, having worked for Neon and Validus Reinsurance.

-

Growing competition for UK property business kept price increases in check during the quarter.

-

CFO Christa Davies will also take responsibility for Aon Business Services as Simon transitions to the industry.

-

Becky Allison will work to help clients optimise value through more resilient enterprise structures.

-

While still too early to assess the damage fully, Aon believes the impact on property, infrastructure and agriculture will be significant.

-

The broker said inflation should positively impact its ability to navigate another recession.

-

The broker reported organic expansion slightly below rivals Marsh McLennan and AJ Gallagher.

-

Initial loss estimates from convective storms and flash flooding place the economic impact in the hundreds of millions, although Aon warned losses may rise further.

-

The first six months of the year also saw more billion-dollar loss events than average.

-

Before joining Aon, Rob Sage took a step back from the market after spending more than 20 years at AIG.

-

Leonique van Houwelingen will also join the EMEA executive team.

-

Reinsurer capital fell 8% in Q1 to $645bn on the back of mark-to-market losses, as nat-cat capacity contracted materially for the first time since the 2004-2005 hurricane season.

-

It is understood that he will work on large global client accounts and staff mentoring.

-

Storms from 16-23 June added to a “very active” quarter for the peril.

-

Pietro Toffanello will be based in Milan and report to reinsurance solutions' EMEA co-CEOs Tomas Novotny and Alfonso Valera.

-

Sources have pointed to a deal multiple in excess of £360mn for the UK retailer.

-

Aon claims PFI head Paul Tubb unlawfully recruited five colleagues for Howden’s construction unit.

-

The industry veteran replaces Melissa Thomas, who took over the Cayman business a year ago.

-

The move follows a restructure of the broker’s London reinsurance unit last year.

-

Market dislocation and macroeconomic disruption were listed as the second and third most prominent risks, with the economic environment as a key concern.

-

The intermediary’s reinsurance solutions business has appointed Joanna Parsons as it looks to expand its capital advisory unit.

-

The broker leads a team specialising in the placement of various subsea technology risks.

-

Global reinsurance capital grew by 3.8% last year, according to Aon’s analysis of 22 reinsurers.

-

The broker promoted Eduardo Hussey to succeed Gregory as part of the leadership changes in Miami.

-

It is understood that the Marsh and Aon Alpha facilities are those with the most exposure to the war in the Ukraine.

-

The broker said it planned to ramp up investment for hiring talent, as well as developing employees with improved analytical and technological tools.

-

Plus this week’s Q1 results and all the top news of the week.

-

The broker posted earnings per share ahead of analyst expectations and expanded margins.

-

Countries such as Russia, Ukraine and Belarus and other select geographies are excluded in the renewal terms, as is expropriation.

-

The figure made 2022 the sixth consecutive year in which Q1 losses topped $10bn.

-

Through the collaboration, the two companies will work together to help clients with their investment strategy decisions by providing data sets, analytics and insights into ESG portfolio-level exposures.

-

The brokers asked the judge to delay some pre-trial conferences by two weeks as they could obstruct the settlement negotiations.

-

Aon’s E&O and Cyber Market Review found that between Q1 2019 and Q4 2021, ransomware attacks surged 323%.

-

Muñoz will also take over the role Aon Latin American reinsurance solutions chairman, reporting to global reinsurance CEO Andy Marcell.

-

The new hire joins as a senior broker in the non-life treaty department.

-

The senior broker has worked at Guy Carpenter for more than 25 years and specialises in life, A&H and crisis management.

-

Matt Helm worked at CFC until the end of last year when the MGA opted to place the book into run-off following a review.

-

Damage from windstorms that swept across the central and eastern United States from 21 to 23 March could cause hundreds of millions of dollars in economic and insured losses, according to the Aon Impact Forecasting weekly cat report.

-

He will lead strategy and development for the team, which provides consulting and software.

-

The second of Insurance Insider’s deep-dive analysis pieces on innovation examines the internal structures and opportunities that can accelerate innovation.

-

In his new role, Merlo will be primary contact for claims officers handling difficult claims.

-

The earthquake on Wednesday night caused power cuts for more than 2.2 million homes.

-

The first of a two-part series on innovation examines the barriers blocking product innovation in the P&C market.

-

The firm made the announcement soon after Marsh McLennan took a similar decision earlier today.

-

Aon took a top five spot in the independent magazine’s list of the top 10 most innovative finance companies.

-

The broker’s appointment of Jim Fiore follows his decision last year to leave QBE after nearly 30 years at the carrier.

-

Following the cyber incident, the broker launched an investigation with the support of third-party advisers, incident response professionals and counsel.

-

The broker will also sit with Marsh McLennan/Guy Carpenter, WTW and Lockton Re on ABIR’s broker advisory cabinet.

-

Ntsoaki Ramabulana and Hayley Clarke have been added to the executive committee, while Idelia Hoberg has been appointed to run the new life and health reinsurance programme.

-

The broker’s report highlighted that trade credit underwriting is considered “flexible”, with limits increasing and coverages broadening in this class.

-

The broker has reported successive slowdowns since price increases climbed to a peak in Q1 2020.

-

The broker said there was increased demand for coverage from international clients.

-

Shares in the broker are up by 4% after it comfortably beat analyst earning expectations.

-

The broker grew organically in all divisions and comfortably beat analyst earning expectations by 11%.

-

Dennerståhl will be based in Stockholm and lead a team of over 80 staff when she joins later this year.

-

The broker joins after a brief spell at Aon, where he was head of EMEA business development.

-

The executive said the pandemic had ratcheted up the level of volatility faced by clients.

-

Katy Whelan joins from Deutsche Bank, where she was COO of its corporate finance division, while Charles Stuart joins from WTW, where he was strategy head for WTW GB.

-

Stefan Weda will also take on the role of head of CRB for WTW Netherlands.

-

The brokers will have until early 2023 to settle the case via private mediation or the case will move forward to a jury trial that could last between seven and 10 days.

-

The executive has more than 25 years’ experience working in banking and asset management.

-

A judge for the Miami-Dade County Court has ordered Aon and individual defendants in the Miami facultative team poaching case to avoid doing reinsurance brokerage business with the defendants’ former Willis Towers Watson clients.

-

The long-serving Aon executive led a team placing a variety of contingency coverage in Lloyd’s and London.

-

The flooding had ‘catastrophic’ impacts on the province including damage to homes and agriculture.

-

She will work alongside James Baum in the new position.

-

Competition for staff remains fierce in the D&O market, where there has been substantial rating remediation.

-

A total of 87% of survey respondents are looking to grow their stamp.

-

Berkshire Hathaway reduced its shareholding in Marsh McLennan by 35% during the third quarter, as the Warren Buffet-led business continued to sell down across its portfolio, an analyst note from Morgan Stanley shows.

-

The broker will report to head of Credit Solutions Stuart Lawson.

-

Insured losses from severe weather events in the US are on course to exceed $20bn, following the second highest October tornado tally on record, according to a report from Aon.

-

The report also noted that global reinsurer capital totalled $660bn as of June 30 2021, a $10bn rise from the end of 2020.

-

The broker said that weather-related losses had become more severe in the past decade because of climate change.

-

Based in London, Graham Bristow, Barrie Watson and Ian Leslie all held senior roles at Aon's credit solutions.

-

Amanda Lyons will lead growth for US casualty, with Paul Anderson taking the same role in property.

-

The Texas Windstorm Insurance Association (Twia) has recommend hiring Willis Re as broker and Aon to provide catastrophe modelling services, following a review of its arrangements which were previously with Guy Carpenter.

-

The broker has reported successive slowdowns since rate increases hit a high in Q1 o 2020.

-

The appointments come after the shock departure by former president of North America for reinsurance Tim Ronda, who left late last month to become president of rival intermediary TigerRisk.

-

Brokers have reported strong earnings in Q3, with Aon growing by 12% and Marsh McLennan 13%.

-

Aon is the latest of the major brokers to report rising growth levels this quarter.

-

The appointment comes soon after the collapse of the merger agreement between the two brokers.

-

The broking giant has spent the past eight weeks executing on the strategy it developed for the combined firm.

-

Through the plan, employees of all levels will get stock options or cash-settled units based on the company’s performance.

-

GWP rose by 17% to $177bn for Aon’s peer group of reinsurers, while their average combined ratio stood at 94.0% – down from 104.4% for the prior-year period.

-

Aon made internal announcements on a rebrand last week, as the broker forges a new path after ending plans to merge with Willis.

-

Nine (re)insurance firms in London took part in the programme for career-break women, organised by diversity and inclusion firm Inclusivity and supported by the Insurance Families Network.

-

Hundreds from the insurance business were among those killed on 9/11, making it one of the hardest-hit industries.

-

The firm’s head of business intelligence Mike Van Slooten said strong capital levels contrasted with cat loss activity running above budgets.

-

The CEO said large US retailers and wholesalers may look to enter reinsurance.

-

Plus a look at reinsurers’ cat budgets and all the top news from the week.

-

New chiefs announced for Asia-Pac, Emea, Canada and the Caribbean.

-

Arsonists attacked a chemical warehouse owned by Indian manufacturer UPL last month, amid social unrest in the country.

-

UK CEO Nick Frankland moves to a chairman role of a new consultancy unit.

-

The move comes after major defections to rivals from the firm’s retail broking and reinsurance operations earlier in the year.

-

Willis’s sale of its reinsurance arm was the best option it had left – but the loss will have implications for the wider business.

-

The executive is leaving his role as global head of broking at Willis to take on a major role at Aon, in the aftermath of the mega-merger collapse.

-

Christophe Bonneville, Cristina Chaparro and Joyce Koch join in Paris, Madrid and Amsterdam.

-

The number two broker must now refocus on rebuilding internal divisions.

-

Adjusted for large renewals and IPOs, the pricing index rose 7.7% in the second quarter.

-

Executives addressed analysts following strong Q2 results and the earlier collapse of the Willis integration.

-

Willis Towers Watson will not pay staff bonuses that were contingent on the completion of the Aon merger.

-

Plus this week’s company results and all the top news from the week.

-

The Q2 results update came at the end of a week in which an agreement to acquire Willis Towers Watson collapsed.

-

The disruption of the Aon-Willis deal breakdown could arguably create almost as much of a shake-up of the competitive landscape amongst the second-tier challenger brokers as it will for the two would-be merger partners themselves.

-

The committee will be responsible for seeing through the broker’s four-pronged Aon United Blueprint.

-

A White House press spokesperson said the deal would have led to higher costs for businesses and consumers.

-

CEO Case reiterated the message that the merger was pulled because of poor timing and "misunderstanding" from the DoJ.

-

Willis Towers Watson must act quickly and decisively to either salvage the sale of Willis Re or lock down staff.

-

Wells Fargo insurance analyst Elyse Greenspan said Willis Towers Watson stock “seems very inexpensive” in a note to investors on Monday.

-

The Illinois-based broker said it would also redeem $650mn in 10-year notes that it issued in May.

-

In a statement, Garland argued that the decision will help preserve competition in the insurance brokerage sector in the US.

-

Greg Case said the regulator had a "fundamental misunderstanding" of the industry, and that timing prevented the brokers from going to trial.

-

Shares in rival broker AJ Gallagher, whose plans to buy several Willis assets at a knock-down price are now highly uncertain, were down by 2.3% at $139.

-

The companies disclosed that Aon will pay Willis the $1bn break fee.

-

The Week in 90 Seconds: Aon and DoJ return to the table; German flooding latest; Aki Hussain profilePlus the latest on UK BI legal wrangling and all the top news from this week.

-

Details of potential additional divestitures are closely guarded, but they would likely include P&C broking assets.

-

The Texas Big Freeze plus an active hurricane season could see losses balloon in 2021.

-

The expansive broker has poached a number of senior staff from Aon as it builds its team.

-

The Madrid-based executive, who has worked for Aon for 15 years, has been given a broader remit amid a reshuffle of senior EMEA roles at the broker.

-

The DoJ was given a deadline to provide Aon’s lawyers with pertinent evidence collected from third parties during its investigation into the $30bn mega-merger.

-

The merged entity must divest its corporate and commercial short-term insurance broking in the country, as well as offload several global businesses.