-

The carrier anticipates a “favourable” retro renewal at 1.1.

-

The federation, FASE, aims to connect all participants to provide a voice for European MGAs.

-

Both the primary and reinsurance segments benefitted from a light cat year.

-

While attritional losses were up for the quarter, those in the carrier’s core business declined.

-

The French reinsurer improved its P&C combined ratio by 7.4 points to 80.9%.

-

The company reported no cat losses but saw a jump in attritional losses.

-

CEO Brand said he expected to deliver double-digit growth, if “marginally” lower in 2026.

-

CFO Vogt added that the vehicle’s impact from earned premiums should ramp up from 2026 through 2029.

-

The fundraising structure for the deal includes a $600mn Convex debt raise.

-

The revised outlooks reflect the difficult moment as Everest moves away from retail.

-

In insurance, premium growth came from all lines of business except cyber.

-

Sources said that the businesses in Canada and LatAm were part of Everest’s original plans to sell its retail book.

-

AIG has agreed to pay Everest $10mn per month for nine months for transition services.

-

The company’s stock fell nearly 9% as the market digested news of an ADC, renewal rights deal and reserve charge.

-

Consolidated NWP reduction was driven by the reinsurance segment, partly attributable to two transactions in Q3 2024.

-

The appointments are aimed at offering a clearer team structure.

-

AWS suffered a large-scale service disruption originating in northern Virginia.

-

The company noted tougher market conditions and higher large losses during the year.

-

The protection covers the US insurance book for the 2024 and prior accident years.

-

Brian Church has spent 20 years at Chubb.

-

The MGA is also looking to build out its US mid-market professional liability expertise.

-

Carriers are rethinking the traditional renewal-rights model.

-

As both carriers and reinsurers deal with softening markets, all eyes are on hurricane-prone areas.

-

The carrier has renewed and extended its capacity arrangement with the MGA.

-

Improved performance and growing investment returns played a role in the upgrade.

-

The executive was most recently serving as CRO – insurance.

-

The protection gap must be closed before a public cyber reinsurance scheme is possible.

-

The Bermuda-based executive joined the Ardonagh Group’s reinsurance broking arm in March 2023.

-

Winds have strengthened to 80 mph, and the hurricane is expected to intensify further over the next 48 hours.

-

Tom Potter was global casualty underwriting manager for UK & Lloyd’s at Axa XL.

-

The tropical cyclone is expected to be named Imelda.

-

This will be Fidelis’ first office in North America and will be led by former Navigators Re head Ivan Vega.

-

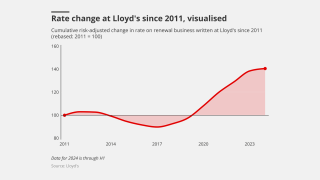

The Corporation’s chair reiterated its aim to reduce the cost of doing business.

-

The market turn may give some staff pause for thought, but reward remains high.

-

Despite formation of Gabrielle, there is "a very high probability" of a below-average season.

-

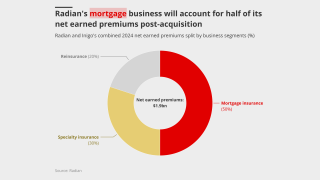

The low degree of overlap between the combining portfolios benefits both parties.

-

How does Lloyd’s plan to secure its future as a leading global marketplace?

-

More general issues at recruitment level include drawing from too narrow a pool.

-

Age has not been addressed as much as other areas of diversity, the panel said.

-

Vantage Group Holdings received a BBB- long-term issuer credit rating.

-

The practice group will enhance the company’s existing offerings in E&S.

-

The affirmations reflect Everest’s strong underwriting diversification.

-

Plus, the latest people moves and all the top news of the week.

-

The tech firm is building a joint stock company with insurers and investors.

-

The new recruit will report to group CUO Ian Houston.

-

Chilton founded Capsicum Re, which was acquired by Gallagher in 2020.

-

Models anticipate a busier second half, particularly in the next few weeks.

-

The carrier’s US and Europe claims teams will report to Clayden.

-

The platform aims to “bend the loss curve”.

-

A roundup of the breaking news, C-suite interviews and exclusive insights.

-

The deal is expected to result in $700mn in combined GWP in Florida upon completion.

-

Blackstone-style capital seeking to get closer to source is a net negative for reinsurers.

-

Geopolitical turbulence brings new challenges that primary specialty lines carriers urgently need to address.

-

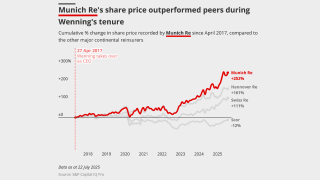

Being conservative and stable is the name of the reinsurer’s game.

-

The aviation market may prove an outlier following a disastrous year of loss activity.

-

Reinsurers and their cedants are feeling their books are in better shape, although the market is still uneven.

-

Reinsurers are ready to draw a line under a worsening claim outlook across the casualty market.

-

The carrier M&A cycle has started and reinsurance is a segment where acquisitions work better.

-

Anticipation, motivation and inspiration are central to effective implementation.

-

Swiss Re forecasts more risk transferring to reinsurance and retro markets in the future.

-

The post-disaster reinsurance start-up model is changing.

-

Excess capacity will sustain softer rates, as organic growth challenges lead to more M&A chatter.

-

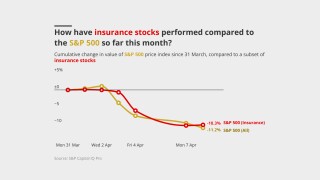

Agency reactions ranged from Fitch revising down its sector outlook to AM Best keeping a positive outlook.

-

Terms are expected to hold, underpinning the stronger recent performance of reinsurers.

-

The reinsurer’s new CEO said he sees no need for a radical shift in strategy.

-

Supply for property outstrips demand, but the casualty market is “bifurcated”.

-

Former Hannover Re CEO Jean-Jacques Henchoz received the Lifetime Achievement award.

-

The executive said claims can be a differentiator in a softening market.

-

The action follows Sompo’s $3.5bn all-cash acquisition of Aspen Insurance.

-

The ratings agency warned negative PYD on US casualty will likely continue.

-

Ratings agency said the Sompo deal could have positive financial and operational benefits for the Bermudian.

-

Plus, the latest people moves and all the top news of the week.

-

Sources see Aspen as the right fit for Sompo, with Apollo getting a full cash exit.

-

The Japanese company announced the $3.5bn deal today, three months after the Bermudian completed its IPO.

-

The all-cash deal values the Bermudian’s stock at a 36% premium.

-

Lawmakers are seeking input on risk evaluation, limits and other concerns.

-

He succeeds Felix Cassau, who is joining Hannover Re.

-

Aspen would give Sompo more reinsurance scale, more US premium and a Lloyd’s presence.

-

This publication revealed yesterday that the two were in detailed takeover talks.

-

She was most recently claims manager at QBE France.

-

Sources said that detailed discussions have taken place, with a clear path to a deal.

-

Besides Russia-Ukraine losses, the Air India crash losses totaled $26mn.

-

Nat-cat events triggered A$1.36bn of losses during the year.

-

The London carrier missed consensus on gross and net premiums for H1.

-

The Hannover Re CEO said rate adequacy remains “attractive” overall.

-

The carrier is the first Fortune 500 company to take a stake in a League Two club.

-

In trying to solve multiple needs, specialty reinsurance opens up complexities.

-

California wildfires were the reinsurer’s largest H1 loss, at EUR615.1mn.

-

Rachel Sabbarton has been promoted to CEO at Lancashire Syndicates.

-

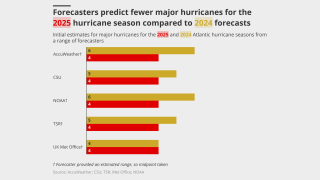

Both organisations still predict an above-average hurricane season.

-

The carrier cited elevated cat and large-loss activity, including the LA wildfires.

-

The company bolstered casualty reserves by $18mn, mostly from discontinued lines.

-

The move will impact around $50mn of gross written premiums in total.

-

The carrier’s overall P&C combined ratio improved 1.8 points to 91.2%.

-

The Swiss carrier improved its P&C combined ratio by 1.2 points to 92.4%.

-

Cat losses of $1.5mn, net of reinsurance, were primarily due to severe convective storms.

-

This publication reported yesterday that Talanx was closing in on the sale.

-

The loss was driven by nat cats and reserve adjustments in US casualty.

-

Emerging lawsuits and expanding loss triggers are giving rise to potential claims under a range of policies.

-

Prior-year reserve development moved to a $6.3mn charge in Q2 from a $19.3mn release a year ago.

-

With roughly 200 employees, the South American operations generated over EUR130mn in 2024 GWP.

-

The executive has spent more than three decades in insurance.

-

The company has also expanded its relationships with US and UK MGAs.

-

The new team will be headed by Brown & Brown’s Ed Byrns.

-

The underwriter was head of financial institutions at LSM for six years.

-

Matthew Doherty joined the reinsurer in 2018 as SVP, property portfolio manager.

-

Cat portfolios generally grew, but casualty approaches varied.

-

The reinsurance CoR decreased 2.3 points to 79.5% while the primary CoR rose 4.7 points to 98.7%.

-

The executive joined Navigators in 2010 after eight years at White Mountains Capital.

-

A majority of staff not offered jobs at Ryan Re will remain at Markel to manage the run-off.

-

The Miami-based executive assumes the role left vacant by April McLaughlin.

-

Specialty casualty now accounts for around 22.2% of its insurance business mix.

-

The vehicle will support Ascot’s casualty business in the US and Bermuda.

-

Everest booked $98mn of aviation losses related to the war, which contributed 2.5 points to the consolidated CoR.

-

The Bermudian said its pursuit of SMEs through M&A will provide sustainable improvements to its bottom line.

-

Pricing was “virtually flat” in the second quarter.

-

The CEO said business remains adequately priced in most classes.

-

The carrier is reducing its exposure to quota shares and shifting to XoL.

-

The loss ratio rose 1.9 points to 53.1%, while the expense ratio ticked up 0.6 points to 28.1%.

-

The carrier had $20mn in reserve releases in the quarter, compared to nil in Q2 2024.

-

This brings the carrier’s total limit on the program to $1.8bn.

-

The reduced fine reflected the PRA view that the breaches weren’t deliberate.

-

North American carriers completed the most transactions in the first half of 2025.

-

Surveys show diversity and inclusivity foster a sense of belonging and increase productivity.

-

The reinsurance unit’s combined ratio for the quarter was 94.2%.

-

Improved book value, a healthy CoR and disciplined underwriting mark the CEO’s time at the helm.

-

Bridges joins from QBE, where he spent over 17 years.

-

CFO Christoph Jurecka will succeed as management board chair.

-

The medical professional liability firm is targeting further healthcare opportunities.

-

-

The suit claims billions of dollars are being illegally withheld.

-

Airmic has been lobbying the government to introduce a captives framework for years.

-

The US accounted for 92% of all global insured losses for the period.

-

The outcome of the consultation includes a detailed timetable for delivery.

-

In the US, the index fell 6.7% year on year.

-

Despite predicting fewer hurricanes, the numbers are still above average.

-

The Cathal Carr-led carrier has been building its team since launching this year.

-

Demand and growth opportunities remain ample despite competitive pressures.

-

Arturo Pelaez will continue in his managing director role at Brookfield Asset Management.

-

It is the second deliverable of the FIT Transition Plan Project.

-

The managing agency is offering 62p per £1 for 2026 YoA capacity.

-

The awards will be held on 3 September at The Brewery in London.

-

The cost comes in at $530.6bn, roughly $20mn lower than budgeted.

-

SRCC exposures are being studied more closely but fixing aggregation issues is a challenge.

-

The carrier said the cuts will help it to become a “simpler, digital-led business”.

-

The investment comes amid expectations of a new cycle of deals.

-

Phil Furlong has been made head of underwriting and oversight, a newly created role.

-

Rachel Bardon will also join the board of Compre's Bermuda-based reinsurer Pallas Re.

-

In April, the loss modeller pegged losses at A$2.57bn.

-

Who will buy the swathe of PE-backed Lloyd’s firms coming to market over 2025-26?

-

The firm's near-term global strategy includes operations in the UK, US, parts of Europe and Asia.

-

The reinsurer has also appointed Mehdi Benleulmi as global head of credit.

-

This year is predicted to be an above-average season, like 2024.

-

Markel International has also hired senior underwriter Keely Madden.

-

The hire is the latest in the newly formed carrier’s buildout.

-

The carrier benefited from top-line growth and lower adverse PYD.

-

Large natural catastrophe losses totalled $570mn in Q1, driven by the LA wildfires.

-

The company has settled, or is in the settlement stage, for 80% of the exposure.

-

Specialty reinsurance has experienced high competition for talent.

-

The revision is significantly lower than the $4.5bn October estimate.

-

The reinsurer said the LA wildfires would have a “dampening effect” on mid-year renewals.

-

The carrier will focus on mid-market business outside of Lloyd’s.

-

The reinsurer's group operating income fell by 14% to EUR480.5mn.

-

More players are looking to the class in a bid for top-line growth.

-

Former Aviva and AIA CEO Mark Wilson will lead the new initiative.

-

The company’s upsized public offering priced at $30 per ordinary share.

-

The (re)insurer used alternative capital in the reinsurance coverage.

-

Hamilton also expects rising demand and stable supply for 1 June renewals.

-

The IPO was announced at the end of April, targeting ~$2.6bn-$2.9bn.

-

Hamilton reported $150.5mn of net cat losses, partially offset by $9.2mn favourable prior year development.

-

IGI saw opportunities in energy, ports and terminals and marine cargo but remains cautious in long-tail lines.

-

The specialty carrier is braving volatile macroeconomic conditions in a second effort to list.

-

Gallagher Re said rates had softened in 2025 versus the prior two years.

-

Till Wagner and Felix Rollin have been named executive board members in Germany.

-

The CEO expects overall P&C pricing to be “stable” through 2025.

-

The carrier booked LA wildfire losses of EUR148mn.

-

Cat losses included $17.5mn from the CA wildfires and other events.

-

The carrier reported a below-budget cat experience, despite the California wildfires.

-

Space pricing experienced double-digit increases after the 2023 capacity retreat.

-

At his last annual meeting as CEO, Buffett highlighted the importance of Berkshire’s insurance operations.

-

Meanwhile, gross written premiums grew 8.6% year on year to $985mn.

-

The primary and reinsurance unit CoRs were 103.1% and 98.7%, respectively.

-

We assess the Bermudian’s standing amid waning investor sentiment and economic uncertainty.

-

The remediation process is on track for completion in the fourth quarter.

-

The CUO described the pricing dynamics in the line as “strong and good”.

-

The executive also addressed the impact of the US tariffs.

-

Its 2025 programme exhausts at $9.5bn excess $1bn.

-

The carrier estimated its California wildfire loss at $145mn-$165mn.

-

The days of 30%+ growth are probably behind the firm, he said.

-

The group reported a 19.1% return on opening adjusted tangible book.

-

Overall, the company’s underwriting income fell 43% to $417mn in the first quarter.

-

The carrier is targeting an IPO valuation between $2.6bn and $2.9bn.

-

The carrier is offering shares priced at $29-$31.

-

The California wildfires were the only “relevant event” for the period, the carrier said.

-

The business, which has ~EUR300mn of book value, is expected to launch a process.

-

Insolvencies caused by the tariffs could also cause increased losses

-

The storm made landfall in Queensland, Australia at the beginning of March.

-

The firm acted as the front for Trouvaille Re, the E&S property sidecar for MGA AmRisc.

-

From where to prioritise investing to managing slower growth, there are tough balancing acts ahead.

-

The investment recovery will be welcome but Chinese tariffs will contribute to loss-cost inflation.

-

Storms in the UK and Ireland drove losses in the commercial segment.

-

Trade credit and marine are among the lines facing direct impacts amid a broader inflationary challenge.

-

Swiss Re and Talanx led the gains among listed European carriers.

-

The ratings agency said underwriting-cycle management would be key going forward.

-

The tariffs could expose insurers to the risk of recession and shrinking income.

-

Markets have taken a battering across the globe following the “Liberation Day” announcement.

-

Large losses and attrition put pressure on aviation underwriters.

-

The combined ratio improved by 1.9 points to 94.7%.

-

Jonny Strickle became the group chief actuarial officer for the carrier in 2023.

-

The event has caused widespread damage in Bangkok, Thailand.

-

The executive has managed both casualty and personal lines reinsurance books.

-

The combined ratio improved 1.5 points to 90%.

-

The executive, Everest CEO from 1994 to 2013, has served as board chair since 1994.

-

The syndicate expects £5.8mn-£8.6mn in California wildfire claims.

-

The executive said the market would be updated on progress in late April.

-

The MGA’s GWP hit $4.6bn as the CEO labelled aviation all-risks rates “woefully inadequate”.

-

The segment’s underwriting results halved to $532mn in 2024 from $1.07bn in the prior year.

-

The insurance industry has experienced mounting losses from severe convective storms.

-

These events can also no longer be considered secondary perils, executives said.

-

Almost 300,000 people have been left without power from the storm.

-

CEO Alex Maloney said the LA fires might prompt some carriers to go more “risk-off”.

-

Changes in business mix towards specialty and improved reserve development offset higher Q4 cat losses.

-

The estimate is based on industry losses in the range of $35bn-$45bn.

-

CEO Andreas Berger addressed Swiss Re’s primary aviation exit.

-

The carrier’s CoR improved across P&C, including at commercial lines-focused Axa XL.

-

Conditions in the London market remain attractive according to CEO Aki Hussain.

-

Katie McGrath is appointed CorSo CUO amid a restructure of the unit.

-

The carrier announced a $175mn share buyback.

-

The carrier has paid $1.75bn on around 9,500 claims filed from the wildfires.

-

Cedants could choose to retain more as cross-share sell-offs boost their capital.

-

Retention levels for reinsurance fell across the different geographies the carrier operates in.

-

Social inflation and larger vessels are making multi-billion losses more likely.

-

Good ESG practices are part of good risk management, the company said.

-

The carrier expects to book $100mn-$140mn from the California wildfires.

-

James Shea will lead the new Sompo P&C arm, while Yasuhiro Oba will become Wellbeing CEO.

-

More than 33,000 claims had been filed as of 5 February.

-

Genna Biddell will report to Brad Melvin, president and CEO, BMS Re US.

-

Annual report pegged data and cyber security risks as most cited business challenges.

-

The Dana floods in Valencia resulted in a EUR34mn net impact at group level.

-

The executive has also worked for Guy Carpenter during her 20-year career.

-

The government’s consultation ended on Friday (7 February).

-

Iumi expressed concern about the escalation of trade wars.

-

Over 2024, four hurricanes added 13 points of cat-loss impact to the combined ratio.

-

The board intends to issue a dividend of EUR2.70 per share.

-

Reinsurers on portfolios with longer-tail liabilities may withdraw.

-

Andy Houston will be based in London, reporting to Mark Roberts, division president UKISA.

-

The French credit insurer has Apollo lined up as its managing agent.

-

Non-proportional business accounted for 34% of its total.

-

A combination of mandated days and soft pressure is driving up EC3 attendance.

-

The nationwide carrier ranked sixth for multi-peril California homeowners' insurance in 2023.

-

The carrier is restructuring the business into three segments.

-

Anthony Norfolk joins from Swiss Re, where he was a senior engineering underwriter.

-

Compared with its initial figure, CatIQ’s latest estimate has increased by 40%.

-

Disclosures show the insurer has roughly 4,300 homeowners’ policies in effect in fire-impacted zip codes.

-

In the food and beverage market, rates are falling by an average of 3%-4%.

-

The carrier can claim separately for the Palisades and Eaton fires if necessary.

-

The reinsurance attaches at $7bn, unchanged for the past two years.

-

Market softening means exploiting hardening niches is the name of the game.

-

Philip Ryan and Sir Paul Tucker will not stand for re-election.

-

High-net-worth binders and treaty exposures will bring significant claims to Lloyd’s writers.

-

This could see it surpass the 2017 Camp Fire, which cost around $12.2bn.

-

Moody’s also expects losses in the billions of dollars.

-

Six fires now cover more than 27,000 acres across Southern California.

-

Julia Willberg joins from Hannover Re, where she has held several senior roles.

-

Tim Watson most recently served as a senior credit and political risk underwriter.

-

In part two of our 2025 outlook, we explore the drivers of carrier M&A and recreating the ESG agenda.

-

An 11th-hour softening has driven discounts into double-digit territory on some deals.

-

The reinsurer is buying out China Minsheng affiliate at year-end.

-

Axa XL leads the aviation all-risks reinsurance coverage for the destroyed Jeju Air Boeing 737-800 craft.

-

A quick roundup of the top stories of the week.

-

The storms struck Victoria, New South Wales and Queensland.

-

Insight into the insurance M&A market, powered by Insurance Insider’s deal database.

-

Reinsurer appetite for aggregates begins to creep back in.

-

Overall, reinsurers accepted that rate cuts were still leaving them with strong margins.

-

Aggregates that are featuring in the reinsurance market are not the low-attaching ones of prior years, he added.

-

The result was impacted by recent adverse development on a liability portfolio.

-

The P&C re unit will target a combined ratio below 85%.

-

The P&C re unit will aim for a 79% combined ratio next year.

-

The carrier said its P&C and L&H reserves have been confirmed by independent reviewers.

-

The firm will maintain a close partnership with Brit as a nominated lead across all classes.

-

The appointment is a “major part” of Zurich’s global strategy, the company said.

-

The state insurer is budgeting for an extra 43% of overall coverage in 2025-26.

-

TSR anticipates that next year will see an ACE value of 129 compared with the 30-year norm of 122.

-

The state reinsurer of last resort discussed options for 2025 reinsurance buying strategy.

-

James Irvine will report to Cathal Carr, CEO and active underwriter of Oak syndicate 2843.

-

Hannah Brooke joins the UK and Ireland team from HDI’s Belgium business.

-

Aviva increases its offer to 275p per Direct Line share.

-

The executive said that capital, tech and algorithmic capabilities would help the structures endure.

-

The cargo market has recently seen a string of moves as new carriers launch into the market.

-

The carrier has also promoted James Glynn and James Thomas.

-

The carrier is seen as a likely target of Lloyd’s ‘Big Game Hunting’ strategy.

-

The sale of the business was confirmed in June.

-

The 2025 target would be ~25% larger than the $3.56bn it placed for 2024.

-

Jamie Cann, previous head of aviation and space at the Fidelis Partnership, also joined Axa XL.

-

Alex Nelson will work as head of power and renewable energy at the carrier.

-

The carrier has undertaken work to give it “optionality” for a public listing, but has no plans to list in the short term.

-

The transaction has received all required regulatory approvals and closed.

-

Tillett succeeds Michela Moro who is returning to Italy, according to Allianz.

-

Oak Re confirmed Bain as an investor, with further capital through Hampden clients and Alpha.

-

Other capacity supporting the syndicate is mostly individual Names, sources have said.

-

Staff movement in the class of business is high as new carriers launch into the space.

-

CEO Mario Greco said his future retirement had nothing to do with bringing the plan forward.

-

Davide Pressman was a marine cargo underwriter at Aegis for under two years.

-

Sources agreed that to achieve growth, the focus is shifting from the US to SMEs in Europe.

-

The agency’s outlook for global reinsurance remains at Positive.

-

Greco will likely remain in place in the medium-term, which could mean major M&A and a Lloyd’s platform.

-

This year’s top-line growth will be a decade-high.

-

The deterioration was driven by increased operating expenses.

-

Harriet James was previously head of sustainability at RenaissanceRe

-

The market grew at a rate of 32% annually from 2017 to 2022.

-

Helene losses were spread wider than initially suggested, in contrast to Milton claims.

-

The recruitment comes amid a spate of hiring for Westfield.

-

James Cox succeeds James Lee, who is set to retire at the end of 2024.

-

O’Brien was previously head of cyber centre of excellence for international at Guy Carpenter.

-

Under his leadership SiriusPoint has established partnerships with several marine MGAs.

-

Swiss Re reported some $743mn in catastrophe losses for Q3 alone.

-

Improved underwriting results thanks to pricing action were offset by nat cat activity in Canada.

-

The carrier has also completed a review of its L&H unit.

-

The company said it is still on target to achieve $3bn net income for the full year.

-

Innovation is moving too slowly, experts said at Insurance Insider’s London Market Conference.

-

The CEO was responding to comments made by Chubb’s Evan Greenberg.

-

-

Rates are continuing to soften in D&O and cyber, according to CFO Paul Cooper.

-

Major-loss expenditure doubled to EUR1.6bn for the quarter

-

The CEO said the property market was in a “super-good place”, and increased competition was inevitable.

-

Rob Lusardi and Michael Dawson are to step down after eight years as directors.

-

The A&H market had improved performance between 2020 and 2023.

-

The business is being marketed off around £15mn Ebitda, sources said.

-

The carrier reported total cat losses of $48.9mn during Q1-Q3 2024, versus $20.2mn in 2023.

-

The acquisition will expand Allianz Direct further into the B2B2C segment.

-

Most of the losses derive from France.

-

The firm will provide an update on 22 November to avoid holiday season.

-

The figures imply first-layer reinsurance recoveries for Helene.

-

The ratings agency said higher attachment points would make 2024 hurricane claims “manageable”.

-

The LMA report focused on first-party property damage from a coverage perspective and on eight key sectors.

-

Axa XL Re has hired former Swiss Re executive Greg Schiffer as its North America CEO, effective from 11 November.

-

Elaine Casaprima will serve as CEO of the combined entity.

-

How is the market positioned to withstand Hurricane Milton?

-

The hurricane has destroyed hundreds of homes and left more than 2.7 million homes without power in Florida.

-

It also reported that severity increased by 17% in the same period.

-

Hurricane Milton strengthened from a tropical storm on Sunday to a Category 5 storm yesterday.

-

Most sources noted expectations of a $50bn+ event, but the range of outcomes is huge.

-

Milton is expected to move north of the Yucatan Peninsula today and cross the eastern Gulf of Mexico by Wednesday.

-

Based in Peru, the executive will oversee marine and aviation lines.

-

SCS caused global insured losses worth at least $8bn in the first quarter of 2024.

-

Forecasters have warned that a number of meteorological factors could make this year the most active on record.

-

Recurring loss patterns have led to squeezed coverage, leaving clients exposed.

-

We explore the first stages of incorporation of GenAI into insurance, alongside the longer-term potential.

-

This publication revealed the appointment in November last year.

-

-

Rates have fallen on the back of reduced deal flow in 2023.

-

-

Gulf insurers have borne the brunt of reinsurance rate corrections in the past couple of years, but a different, albeit similar market segment is emerging as a focus for concern ahead of this year’s 1 January renewal.

-

AI development is creating new risks for insurers to assess as multiple key trends suggest it will evolve into a standalone insurance product like cyber-risk.

-

Earlier this afternoon, San Diego County issued a tropical storm warning related to Hilary – the first in its history.

-

Over half of respondents said that the technology currently available to them is not allowing them to make the most of the data at hand or make better pricing and portfolio decisions.

-

Plus all the latest executive moves and the top news of the week.

-

24 February marks the point when blocking and trapping claims can be lodged against war risk insurers, against ships stuck waters around Ukraine.

-

The club argued that proposed rules on transporting crude through the Turkish Straits would have been punitive to members.

-

The carrier aims to achieve an energy underwriting portfolio that is 75% low-carbon in seven years’ time.

-

Loh Wei-Lyn has been promoted to CEO of Asia, while Luann Petrellis has joined as US CEO.

-

As the Aegis London CEO retires this week, he revealed his key lessons from over three decades in Lloyds – and what has to change if the market is to survive.

-

The executive has worked for the company in London, New York and Dublin.

-

The French reinsurer faces a number of hurdles as it looks to set its new corporate strategy. We outline the challenges ahead.

-

A reduction in incidents linked to better resilience and the Ukraine war may temper cyber price increases, the broker said.

-

The forecast range of hurricanes is slightly wider than in 2021, but in line with 2020.

-

Plus latest people moves and all the top news of the week.

-

According to a joint Marsh-Microsoft report, 75% of 660 companies surveyed said they have suffered a cyber attack of some form.

-

Aon’s report covering multiple classes and geographies highlighted improving conditions in D&O for the UK, and a moderation of rate rises in property.

-

Plus the lowdown on the potential Howden-TigerRisk tie-up and all the top news of the week.

-

Premiums are forecast to grow buy 2.3% rather than 2.7%, according to the CEO of the German Insurance Association.

-

Plus the latest company results, people moves and all the top news of the week.

-

CFO George Quinn said he did not foresee any classical inflation scenario impacting the carrier’s P&C book.

-

The broker’s political risk report has highlighted the competing interests between countries for ownership of untapped natural resources and space exploration.

-

Prince Charles’ speech to open the next parliamentary session referred to a new bill that will introduce a competitiveness objective for the financial regulators.

-

Clarity is growing over how the Ukraine war loss may eventually play out, although the picture is still uncertain.

-

Plus this week’s Q1 results and all the top news of the week.

-

The conflict is a live cat that could last months and crucially, has straddled a significant reinsurance renewal date.

-

ExposureHub has been designed to help underwriters make more informed decisions on risk selection and general exposure management.

-

Plus the latest executive moves and all the top stories from this week.

-

Business leaders surveyed by Beazley said they were increasingly worried about war risk in particular, prior to the Ukraine conflict.

-

The carrier announced its entry into the London marine hull and machinery market in November 2021.

-

The carrier launched a dedicated renewable power offering at the start of 2022, led by Lyndsey Picton.

-

The appointment comes after the carrier’s previous head of cyber Neil Arklie left the business for Lloyd’s.

-

The Zurich chairman previously spent over four decades at Swiss Re, including as CEO between 2012 and 2016.

-

A report from the Bermuda Monetary Authority shows how the island’s carriers have raised their worst-case estimate of cyber losses in recent years.

-

Alli MacLean will take on the expanded role following the exit of contingency chief Yael Mimran.

-

The executive said the Ukraine conflict was an example of how the industry had come to over-optimise models.

-

The hire follows the appointment of Keith Mather to head up financial lines for the international business.

-

The executive will oversee management liability, healthcare and casualty/specialty reinsurance.

-

The carrier strengthened reserves by $41mn due to uncertainty around financial and professional lines claims development.

-

The carrier said it will examine the impact of the ruling on other claims under non-damage denial-of-access wordings.

-

The company will withdraw all of its outstanding ratings on Russian firms before 15 April, having already announced the suspension of its Russian operations.

-

Lancashire has direct exposure to Ukraine through aviation, marine and political risk lines, according to a Jefferies report that said the carrier will likely incur “immaterial losses” from the conflict in its aviation war business.

-

BMS’s Andrew Siffert said losses from US winter-related storms and thunderstorms are likely to arrive at a below-average figure for Q1.

-

Plus more on the market’s exposure to aircraft leasing firm Aercap and the lowdown on the US 1.4 renewals.

-

It is understood that the policy is written via the Aon Alpha facility and is led by Liberty Specialty Markets.

-

The executive will work to accelerate commercial insurance revenue and develop new channels and geographies.

-

A further £40mn of claims were fully settled in the month to 7 March, according to the regulator’s latest data release.

-

The first of a two-part series on innovation examines the barriers blocking product innovation in the P&C market.

-

Courts in Bermuda and the US approved the move, which had earlier been subject to investor litigation.

-

The company reported a pre-tax, pre-divide income of $5.3mn and combined ratio of 105.6%.

-

The executive said that, in many cases, reinsurance contract wordings had not been tested for Covid recoveries.

-

In an open letter to Insurance Europe, insurance trade bodies from Ukraine have urged western insurers to pull out of Russia completely.

-

Interim active underwriter David Message will assume the position of energy lead underwriter.

-

Claims from New South Wales are expected to increase in the coming days, given the flooding emergency in Sydney.

-

Plus the evolution of the broker consolidator model, this week’s results and all the top news of the week.

-

The ratings agency said that the reinsurance arm of MS Amlin was expected to make a “significant” loss after tax in 2021.

-

The acquisition of Willis Re last year transformed Gallagher into a top-three reinsurance player.

-

A conclusion to the Evercore-run restricted sale process is expected this quarter.

-

At the ABI conference this morning, carriers were warned about crime syndicates’ use of automation to deploy cyber attacks.

-

Axa XL underwriters will be available for in-person meetings across all product lines every day of the week.

-

The Norwegian insurer added 14 million gross tonnes to its total tonnage and retained 99.6% of existing business.

-

Plus our take on London market financials a all of this week’s full-year results.

-

The CEO said the business unit was focused on bottom-line profits rather than top-line growth.

-

HDI Global Specialty, Verto Syndicate 2689 and IQUW Syndicate 1856 are among the new trade capital partners.

-

A further £39mn of claims were fully settled in the month to 5 February, per the latest release of data by the FCA.

-

S&P’s proposal to disallow senior debt as a form of available capital is thought to be among the most impactful of a slew of detailed changes by the rating agency.

-

Improved underwriting performance and double-digit top line growth at most carriers has characterised results reported so far.

-

Atrium Underwriters has posted a combined ratio of 88% for 2021, with a strong underwriting performance driving profits up 24% to £68mn ($92mn).

-

The appointment comes after Allison Wilkinson departed Chubb to join Convex.

-

The carrier’s reinsurance unit upped profits by 53%, with reduced expenses benefiting the combined ratio.

-

The investor has been calling on the board to explore strategic alternatives for the business since September last year.

-

Hiring levels at Ardonagh Group saw the fastest growth out of the Top 20 insurance companies, with an increase of 482%.

-

Convex was one of the carriers to enter the contingency market following the major Covid-19 loss event.

-

Tim Pembroke will retire at the end of March after more than 24 years with QBE.

-

The appointment comes after marine liability underwriter Ellie Barr resigned to join Convex.

-

The firm has promoted Huw Owens to CUO and Sam Wilde to head of London markets in its financial risk solutions division.

-

Rates rocketed in the two most challenged areas of the market, while price deceleration continued in P&C, the broker’s index showed.

-

The carrier has been targeted by activists whose claims it branded “inaccurate and misleading”.

-

The ratings company said it considered Scor's earnings performance, which has been below the agency's expectations for the past five years.

-

Two legal academics, giving evidence to the House of Lords inquiry into London market regulation, highlighted the need for a climate-focused duty for regulators.

-

Graeme Young is relocating from Eliot’s New York office to his native Australia to run the executive search firm’s new unit.

-

The carrier has bought out positions in Future Generali India Insurance and Future Generali India Life.

-

The year broke a number of records in terms of insured losses.

-

Fidelis joined the contingency market in 2020 amid massive dislocation caused by Covid-19.

-

The ratings agency is allowing more time for feedback on proposed changes to assessing insurers’ capital adequacy levels.

-

Tokio Marine & Nichido Fire Insurance Co also plans to join the partnership for Carbon Accounting Financials initiative.

-

A further £51mn of claims were fully settled in the month to 5 January, per the latest release of data.

-

The association will also focus on initiatives to support digital transformation in the London market.

-

Two of the carrier’s underwriters were hired by new entrant IQUW to build its book of business.

-

Southgate worked at the likes of Canopius, Swiss Re, Aon and Sturge Syndicate during his career.

-

The carrier has been rebuilding its D&O team after a number of staff left to launch new books of business.

-

James Allchorne and Laura Wells will work in the team headed up by Neil Russell.

-

Bilge Mert will work on delivering a data-driven platform for underwriting, claims and operations.

-

The executive, who joined Fidelis in 2017, will continue in her role as group head of contract wordings.

-

Extreme flooding combined with hailstorms led to Germany’s worst loss year since records began in 1970.

-

The broker has acquired the share previously owned by the Rampart Trust.

-

The UK’s biggest insurance firms saw the tax that HMRC investigated jump by over £260mn between 31 March 2020 and 31 March 2021.

-

In a raft of promotions, Andrew Rippert will become reinsurance CUO and Beatrice Morley head of international reinsurance.

-

The transaction is expected to close during H1 2022 and reflects Argo’s strategic refocus on US specialty.

-

The European authority’s stress test on 43 carriers found that a section of the market still relies heavily on transitional measures.

-

Jefferies’ report shows that cat losses have been spread across a broader range of perils and regions this year.

-

Plus, the latest executive moves in the sector and all the top news of the week.

-

The rating agency has also given the Australian carrier a stable outlook.

-

The UK National Cyber Security Centre has described the flaw as potentially “the most severe computer vulnerability in years”.