-

The deal adds a forward-flow, giving Compre the option to reinsure additional future years.

-

Charlotte Pritchard is set to succeed Andrew Creed, effective 5 January.

-

The transaction is subject to regulatory approval.

-

The appointment follows Everest’s $2bn renewal rights sale of its commercial retail business to AIG.

-

This publication revealed Volante was in talks with legacy players last month.

-

-

YTD disclosed run-off deals total 26, with $1.36bn of gross liabilities transferred.

-

The protection covers the US insurance book for the 2024 and prior accident years.

-

Plus, the latest people moves and all the top news of the week.

-

Carriers are rethinking the traditional renewal-rights model.

-

Without flexible mechanisms the Corporation risks suppressing transactions.

-

Volante launched Syndicate 1699 in 2021.

-

Legacy reinsurance deals will be reviewed by the Legacy Review Panel.

-

Plus, the latest people moves and all the top news of the week.

-

The deal marks the latest step in Catalina’s shift from P&C to life run-off.

-

Bill Bouvier has spent more than three years at the legacy firm in this role.

-

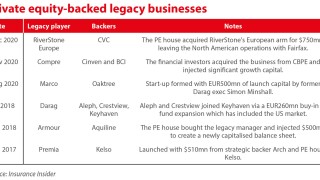

Fleming’s attempt follows those of other legacy carriers that have had recent successes raising capital.

-

A survey from PwC described the sector as “stable”, “evolving” and “dynamic”.

-

The ILS play will make the business more capital efficient under new owner Sixth Street.

-

Peter Vogt will act as a strategic advisor at Axis until the end of 2026.

-

It is targeting low-risk specialty lines where it has a competitive edge.

-

The carrier also benefitted from favourable reserve development in property and A&H.

-

Q2 saw a steady stream of activity in legacy, but volumes dipped slightly from Q1.

-

The legacy player is working to secure its first deal, and could look to expand to US E&S.

-

The agreement is the second service contract the group has taken on.

-

Plus, the latest people moves and all the top news of the week.

-

Andrew Creed has been promoted to group president in addition to his role as group CFO.

-

Luke Tanzer is set to retire after 16 years at the helm of the run-off carrier.

-

Arturo Pelaez will continue in his managing director role at Brookfield Asset Management.

-

Bridges had been at QBE for 17 years.

-

The take-private deal was announced in July 2024.

-

R&Q Gamma’s outstanding liabilities predominantly relate to the UK P&I Club.

-

Rachel Bardon will also join the board of Compre's Bermuda-based reinsurer Pallas Re.

-

Argo shelved the sale of its Bermudian insurance business in mid-2024.

-

Renewable retrospective solutions were a key point during the discussion.

-

The market has broadened its risk appetite and infrastructure over the years.

-

Till Wagner and Felix Rollin have been named executive board members in Germany.

-

The reduction was due to impacts from investments and less favourable PYD.

-

The group reported a 19.1% return on opening adjusted tangible book.

-

The Kelso and Arch-backed run-off player has retained Evercore to advise.

-

The legacy carrier reported an operating loss of $45.3mn for the year.

-

The business will still look at large non-life deals in particular in-the-money ADCs.

-

The process for the legacy book is believed to be in the late stages.

-

Gallagher Re’s global head of retrospective solutions, James Dickerson, recently exited.

-

The Bermudian legacy carrier is seeking a counterparty to manage the claims on the portfolio.

-

Dickerson has spent over three years at the reinsurance broker.

-

Hampden embarked on a new “intelligent follow” strategy in 2023.

-

The reinsurance to close transaction is effective from 1 January 2025.

-

The second half of the year was significantly more active for the legacy market.

-

The restructuring arrangement is designed to protect creditors.

-

Syndicate 609 will cede net loss reserves of approximately $196mn.

-

Augment has been building its staff base after launching with Altamont backing in 2023.

-

The carrier tapped the run-off market in Q4 for a US casualty insurance-focused portfolio.

-

The reinsurance veteran joins from Artex Risk Solutions.

-

The transaction mostly covers casualty portfolios of 2021 and prior underwriting years.

-

The result was impacted by recent adverse development on a liability portfolio.

-

The transaction has received all required regulatory approvals and closed.

-

The carrier’s shares declined over 17% this morning following Q3 earnings and strategic actions.

-

James River also amended the convertible preferred equity held by Gallatin Point and closed its strategic review.

-

The UK and Ireland have also seen “increased activity”, with four deals announced.

-

Nicola Gaisford joined RiverStone from R&Q last year.

-

RiverStone is assuming $1.2bn of a $1.6bn legacy deal.

-

The Corporation’s CUO said managing agents must ensure they manage the future differently to the past.

-

The UK subsidiary of Carrick will acquire BMS International Insurance DAC and Seamair Insurance DAC.

-

Future deal flow in the US could come from more adequately reserved liability lines.

-

The take-private is expected to close by mid-2025.

-

Hundle & Partners will provide capital support for the business, which will focus on acquiring corporate liabilities.

-

Sources said the venture will look to service both US and European corporates and is backed by family office money.

-

The deal covered US and European P&C liabilities for Accelerant's 2020-2021 underwriting years.

-

The James River-Long Tail Re deal is the latest example of deal-specific investor capital.

-

The legacy firm said the deal would strengthen its Bermuda operations.

-

The transactions will de-risk all North America middle-market reserves up to 30 June 2024.

-

This is Carrick’s second transaction this year and Insurance Insider understands it expects to complete others before year end.

-

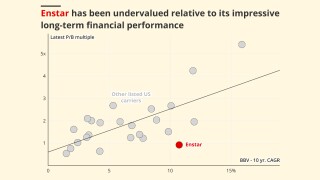

The firm escapes public market distractions and long-term undervaluation, but the low mark will hurt peer companies.

-

The ratings agency said Sixth Street provides flexibility through long-dated capital.

-

She will work on preparations for the take-private deal with Sixth Street before departing.

-

The deal values the business just under its closing price on Friday, at 0.97x book value.

-

The executive replaces interim CEO Paul Brockman, who remains group COO.

-

Acquirers are increasingly discerning around deals, according to a report.

-

Plus the latest people moves and all the top news of the week.

-

Enstar will provide $430mn of excess cover over ~$1.7bn of underlying reserves.

-

-

Some 39% of respondents expect deal volumes to increase in the next 12 months.

-

The transaction is conditional to the completion of the sale of shares in Accredited to Onex.

-

The liquidation will let the company sell its Accredited arm to Onex via an alternative transfer structure.

-

With topco liquidation looming, there are questions for R&Q and the wider market.

-

The Canadian PE house is delaying close and seeking to renegotiate aspects of the deal.

-

The deal will see Darag manage open claims relating to the runoff of Unipol Re.

-

The CEO also discussed the need for portfolio diversification.

-

Major deals include a $1.3bn loss portfolio transfer with SiriusPoint.

-

The former R&Q head of legacy will join as an adviser.

-

The vehicle will give the legacy carrier a US platform.

-

Enstar recorded $280mn of other income in Q1 2023 related to Enhanzed Re.

-

Love joins from Scor, where she was assistant vice president, insurance operations.

-

The legacy deal comes one year after a $1.3bn LPT with Compre covering several lines.

-

The legacy carrier is to buy the captive from a “very large” multinational firm.

-

The agreement from Fleming to honour original terms still leaves it open to long-term damage.

-

Increasingly, deals are being brought to market but not transacted on.

-

R&Q Legacy will book adverse development of ~23% of net reserves for the year.

-

The market is shifting towards capital relief, with fewer, larger deals.

-

The company is still working to get debt holder approval for the Accredited deal.

-

Mitha joined Compre in 2022 as chief actuary, North America.

-

Fleming has claimed breach of contract and is seeking roughly $78mn in “economic concessions”.

-

The company reiterated its commitment to consummating the Accredited sale.

-

The Marco Capital company will target the captives market.

-

Its PE owners have been exploring strategic options since May last year.

-

The newly launched Marco Re will be led by Mark Elliott as CEO.

-

-

CEO Booth said there is “continued interest” in the NA captive market.

-

The transaction would have been one of the largest the market has seen for years.

-

The executive joined the legacy carrier as CIO in 2020.

-

As part of the transaction, Carrick will assume the company’s staff and operations.

-

R&Q is still dealing with a Bermudian regulatory review, personnel turnover and a transitioning business model.

-

Just over half of votes cast were in favour of the $465mn sale to Onex.

-

The legacy carrier has acquired two portfolios of European casualty and motor liabilities from two separate insurance groups.

-

Selling investor Zimmer said the deal was concluded at a premium to book value, but no numbers were disclosed.

-

The regulator has also paused the redemption of the company’s $20mn Tier 2 floating-rate subordinated notes.

-

The R&Q share price has plummeted since the sale of the ~$1.8bn-premium fronting arm was announced 10 days ago.

-

The revised status follows the recent announcement that R&Q Insurance Holdings has agreed a sale of its Accredited program.

-

The bids received did not meet the seller’s reserve price, and it is likely to remarket the unit in two to three years.

-

R&Q expects ongoing operating losses after the sale as transitions its legacy business to a fee-based model.

-

Halfway through a complex restructuring is not the time for a CEO (and CFO) change.

-

R&Q CEO William Spiegel will transfer to the Accredited program management business.

-

Darag’s German outfit completed the transaction to assume expired long-term liability insurance policies from the undisclosed captive.

-

The seller is facing an uphill struggle convincing its legacy rivals that there is strategic value in the merger deal.

-

Although the total deal values for 2022 and 2023 were almost identical, PwC noted that one-third fewer deals were announced in the more recent half-year period.

-

Catalina put its Irish subsidiary up for sale in May as it looks to streamline operations.

-

The insurer has been working to build a reputation for favorable reserve development after past sins.

-

The transactions were written into Darag Bermuda and offer full legal finality for the US workers’ compensation book of the latter and the US workers’ comp and automotive liability books of the former.

-

He will be responsible for driving the use of technology and data across the business.

-

The carrier has agreed to acquire the former Credit Suisse ILS unit, following the acquisition of sister company Humboldt Re in 2021.

-

This publication's legacy survey and roundtable suggest that while inflation and competitive pricing remain challenges, the opportunity is still strong in the run-off space.

-

The legacy carrier reported significant unrealised investment losses.

-

The CEO received $3.9mn in shares alongside his salary and bonus.

-

In the wake of Enstar's $5.1bn go-private deal, here's our prior deep dive on the firm.

-

Accredited and R&Q Legacy will now operate under two separate holding companies within the group.

-

In reality, there are three credible buyers for the ~EUR200mn-book-value Darag – Riverstone, Enstar or Premia.

-

Gallagher Re is looking to increase its presence in the North American large-account space, where it is underweight compared with rivals.

-

Investment bank Macquarie has been retained to advise the legacy firm on the disposals.

-

The executive takes on the role vacated by former Enstar M&A chief Jonathan Zisaruk.

-

The loss portfolio transfer deal was completed in March of this year, covering £200mn of UK motor insurance claims.

-

The deal includes a diversified book of international and NA financial lines, European and NA reinsurance portfolios, and several US discontinued programs.

-

The split of the program and legacy businesses is the most obviously compelling path for R&Q shareholder value creation.

-

The company believes the program management and legacy businesses would work better as standalone operations.

-

As the new board members take their place, long-time members Corver, Everiss and Roberts are to step down.

-

The appointment comes as the legacy and investment banking divisions join under common management.

-

The LPT covers both settled and unsettled claims, taking on “a lot of variability” and potential exposure in terms of the reserve, Marco said.

-

In tandem, the company elevated David Ni as chief strategy officer, Paul Brockman as chief operating officer and Matthew Kirk as chief financial officer.

-

The deal is the latest incidence of bumper transaction size in the legacy space.

-

Following the completion of this transaction, Enhanzed Re became a wholly owned subsidiary of the legacy carrier.

-

2022 represented a period of bumper legacy deal-making for the legacy carrier.

-

After taking a $90mn capital charge relating to the former Ace run-off asbestos book in 2021, the group is looking to liquidate the entity.

-

The business is being advised on the potential transactions by Howden.

-

RACQ will cede net reserves of approximately A$360mn (~$247mn), and Enstar will provide around A$200mn (~$130mn) of cover in excess of the ceded reserves.

-

The coverage supports a series of recent Lloyd’s transactions, including the £1.2bn MS Amlin RITC.

-

The deal regards international and North America financial lines, European and North American reinsurance portfolios, and several US discontinued programs.

-

The number of global, non-life run-off deals dropped to 48 over 2022, compared with 54 in 2021, according to a report from PwC.

-

Dean Dwonczyk established Catalina in 2005 with former UK CEO Chris Fagan, who exited the business in February 2021.

-

Execution of the legacy transaction ticks off another major piece of work for MS Amlin in its turnaround of Syndicate 2001.

-

The legacy acquirer will reweight its portfolio towards life run-off, moving away from P&C deals which it deems less attractive, sources said.

-

CEO Marc Rowan said P&C business is “not that attractive”.

-

The Italian group previously halted writing catastrophe excess-of-loss business.

-

Andrew Lewis has outlined growth plans for Xitus, a niche global legacy firm he has co-founded that will focus on non-life and reinsurance deals of $5mn-$50mn.

-

The R&Q founder had been linked to 777 since its attempted acquisition of the listed firm.

-

The deal represents the first Part VII transfer completed by Marco since launching in 2020.

-

At least $7.8bn in reserves was transferred from the live market to legacy carriers last year, with Enstar the leading acquirer.

-

The executive chairman has sold around half of his holding back to the company.

-

The pair have acquired an MSA subsidiary that holds product liability claims for exposure to harmful substances.

-

Legacy firm Darag has completed a reinsurance agreement with an undisclosed US carrier that carries a transaction value of around $15mn.

-

The CVC-backed legacy player edged out Enstar in the process which was run by Gallagher Re.

-

The transaction covers net reserves for losses and loss expenses of approximately $400mn and provides ground-up cover to a policy limit of $605mn.

-

The pair have permission to undertake a Part VII transfer.

-

The LPT will provide the unnamed California-based pool with reserves related to legacy general liability, employment practices liability and auto liability risks.

-

The increasing frequency of $1bn-plus deals has led to discussion in legacy circles on whether there is a viable case for legacy deal syndication.

-

The tech company contributed $139mn to its asbestos subsidiary companies as part of the deal.

-

The £70mn deal follows a flurry of Lloyd’s legacy activity, with a major MS Amlin transaction also currently in train.

-

The legacy specialist has made its second foray into medical professional liability.

-

The bakery will be able to claim for multiple separate incidences rather than confining its losses to a single £2.5mn ($2.8mn) cap.

-

If transacted successfully and in full, a deal for the state-backed icare could be the largest-ever single legacy transaction in terms of volume of liabilities.

-

Inflation will define priorities such as a focus on safeguarding clauses and pricing transparency, as well as line of business challenges, for underwriters and actuaries in the year ahead.

-

Plus all the top news from the Monte Carlo Rendez-Vous and this week’s exclusive executive moves.

-

Inver Re said the launch was part of its growing inter-disciplinary approach to reinsurance broking.

-

The process provides further evidence of larger deal sizes becoming more frequent in the legacy space.

-

Insurance Insider selects 10 exclusive news stories reported by our team on the frontline at Monte Carlo Rendez-Vous.

-

Activist investors had tabled resolutions to oust William Spiegel as executive chairman and appoint Ken Randall as a director.

-

Around 50% of the $100bn growth in the market emanated from deals struck in North America.

-

The carrier’s programme management business’ GWP rose by 82% to $807.3mn.

-

Jonathan Zisaruk will be based in London and report to group CEO Will Bridger.

-

The transaction will mark Sompo International’s full withdrawal from the Lloyd’s market.

-

The company expects to announce another similarly sized deal soon, and the rest of the year’s pipeline is “beyond expectations”.

-

The deal is split into a ~£1.1bn reinsurance-to-close deal and a ~£100mn loss portfolio transfer.

-

The executive was responsible for all types of legacy transactions, from structured adverse development cover to LPTs.

-

The executive has come under fire from the company’s two largest shareholders, which are calling for his removal.

-

The latest financial condition report for Darag Bermuda shows a $69.0mn loss after tax for 2021.

-

Guy Carp is advising the specialty insurer as it seeks to draw a line under adverse development from its historic program book.

-

The transaction will eliminate Enstar’s direct exposure to cat business and boost its book value.

-

A very public shareholder dispute is taking centre stage at a firm in transition.

-

The investor now has a ~9% holding in the legacy specialist.

-

The transaction would mark a fifth legacy deal struck by Argo as it seeks to clean up its back book amid a strategic review.

-

The portfolio consists mainly of underwriting years 2004 to 2018.

-

The carrier was pushed to a net loss of $493mn by mark-to-market losses in its investment portfolio in Q2.

-

The carrier completed legacy deals within both its Re & ILS and London market segments.

-

The sector saw a variety of deal sizes, with transaction values ranging in H1 from $10mn to $3.1bn.

-

-

The legacy specialist started the fundraise in the wake of a collapsed takeover by Brickell.

-

The outgoing exec will remain as a board member, while chief strategy officer David Ni will lead the company’s M&A strategy going forward.

-

The deal would mark the second time the carrier has come to the legacy market in recent times as the syndicate’s turnaround continues.

-

The redomicile is part of a diversification strategy to broaden the carrier’s focus from Continental Europe to Lloyd’s and North America.

-

The legacy carrier will use the proceeds to refinance existing debt.

-

The legacy acquirer also struck a quota share deal for UK builders warranty insurance in 2021.

-

The biggest challenge with reporting on the legacy market is the lack of publicly available information to track the sector’s performance.

-

The legacy carrier’s GWP of EUR28.5mn was less than half that of the prior year.

-

The legacy and program specialist is pursuing a $100mn rights issue after the collapse of its sale to 777 Partners-owned Brickell.

-

The company confirmed that shareholders voted against a proposed takeover by the 777-owned insurance arm, after its suitor stated its intention to terminate the deal.

-

The existing $770mn adverse development cover between the two parties has been absorbed as part of the deal.

-

Premia and Arch are pursuing AmTrust for costs relating to an RITC deal struck as part of the Canopius merger.

-

A substantial rise in the value of liabilities transacted during Q1 to $4.2bn was driven largely by Aspen’s $3.6bn LPT with Enstar.

-

The legacy specialist has faced a downturn in profits following a bumper run of results through 2020 and 2021.

-

The two companies will operate as standalone subsidiaries within Marco Capital Group.

-

A $90mn capital charge relating to the former Ace run-off asbestos book is a bear signal for the wider legacy market.

-

The legacy market is entering a new era of increased deal competition with intensifying margin pressures, while the number of deals in the market is proliferating.

-

Interim chief Bruce Hemphill has returned to his role as non-executive chairman after 12 months of turnaround work at the legacy carrier.

-

The business will deliver legacy portfolio transactions for other Lloyd’s syndicates and be managed by Capita.

-

As part of the recent LPT deal, the Cinven-backed legacy firm also acquired the team from SiriusPoint’s run-off division as part of its push into the US.

-

The regulator said it does not seek to either “incentivise or disincentivise” legacy transfers.

-

The deal is the largest in Enstar’s history and sets Aspen up either for a sale to a strategic buyer or a return to the public markets.

-

In addition, Fortitude Re’s subsidiary Fortitude Reinsurance Company has obtained approval to operate as a reciprocal jurisdiction reinsurer in the US.

-

The transaction marks the legacy carrier’s first acquisition in Continental Europe.

-

The deal was brokered by Gallagher Re.

-

Legacy acquirer Darag has entered into a Stock Purchase Agreement and received the relevant regulatory approval for the purchase of a Texas-based insurer in run-off.

-

The transaction is expected to close during H1 2022 and reflects Argo’s strategic refocus on US specialty.

-

Brid Reynolds will be responsible for the oversight and development of risk functions globally.

-

Insurance Insider takes a deep dive into the challenges facing the #2 run-off player following a regulatory probe, management turnover and a big 2020 loss.

-

Legacy business RiverStone International has appointed former PartnerRe CEO Costas Miranthis as an independent non-executive director and Neil Taylor as group chief investment officer.

-

Amid three regulatory consultations for the legacy market and the threat of s166 reviews for certain Part VII transfers, the legacy market is reaching a turning point.

-

The portfolio has no active client relationships and was underwritten from 1969 onwards.

-

The executive said a capital-light structure would enable continued investment in underwriting, origination and servicing.

-

The PRA has proposed that where non-life legacy transfer deals involve a carrier in run-off, the acquirer may have to go through a Section 166 review under certain circumstances.

-

Wolf will remain with the company to assist Gregory during a transition period lasting until September 30.

-

The deal follows a $37mn reserve charge taken by Third Point Re just ahead of the closing of its merger with Sirius International in February.

-

The exit follows news earlier this year that founding CEO Chris Fagan was stepping down to be replaced by Bruce Hemphill.

-

The Malta-based start-up buys Isle of Man-based VA Insurance Services from Thomas Cook, which is in liquidation.

-

The operation will be the lead carrier for business Marco writes in the EU.

-

The transfer, which includes most of the Hiscox USA surplus lines broker business, secures coverage of Hiscox reserves valued at $520mn.

-

The deal will cover commercial auto liabilities occurring in the two years ended September 2020.

-

Legacy acquirer Darag has agreed to buy SunPoint Holdings, the legacy business founded by Fosun in 2017.

-

The PE house will inject growth equity capital into Premia after the all-paper deal.

-

The deal comes shortly after the legacy specialist established a $265mn sidecar, Elevation Re.

-

Competition has ramped up over the last two years and now represents a threat to returns.

-

The new launch will be managed under an Apollo turnkey, and looks set to take on run-off liabilities from the Lloyd’s carrier.

-

He has held a seat on the company’s board since 2017.

-

The outgoing chief executive founded the company in 2005, building it into the second--largest legacy-focused business.

-

The impending deal follows recent Lloyd’s legacy transactions with Neon and ArgoGlobal by RiverStone.

-

UK chair Tim Cox will step down in March, as will NED David O’Connor.

-

The Allianz-owned non-life carrier closed to new business in 2015.

-

The new vehicle gives third-party investors access to Premia’s run-off investments.

-

Syndicate 5678 went into run-off in December 2019, and carried net liabilities of £251.1mn as of 30 June.

-

The legacy transaction is the first undertaken by The Carrick Group since it was launched last year.

-

The Karl Wall-run firm will now have a UK platform through which to pursue future deals.

-

The new role for the former head of M&A is a strong signal that plans for a Lloyd’s platform are advancing.

-

The business builds its team after securing more than $600mn of backing from Oaktree Capital Management.

-

The legacy carrier also appoints Tony Cunningham and Fiona Walden following the departures of Aditya Dutt and Jacques Bonneau from the board.

-

The deal on the heels of the purchase of Miller establishes Cinven as a significant non-life insurance-sector investor.

-

The landmark transaction with Sentry requires court clearance after gaining the state insurance commissioner’s nod.

-

Sources said that the carrier’s equity raise was the more efficient path to securing growth capital.

-

Darag will retain run-off operations in the country.

-

The legacy carrier is the first to utilise a recently enacted framework in Oklahoma.

-

The executive will help the broker expand its legacy market presence.

-

The legacy bidder prevails over Enstar, Premia and start-up Marco.

-

Sources said the legacy arm of Axa had lost some investor support for the second of its funds used to back legacy acquisitions.

-

The original cedant is a French P&C, motor and D&O specialist.

-

The private equity house holds a majority stake in the business and invested five years ago.

-

Alan Barlow starts effective immediately and will split his time between London and Malta.

-

Former Allianz CFO Dieter Wemmer joins the run-off acquirer as chairman.

-

Reserves in scope have not been finalised, but sources estimated the figure to be in the low hundreds of millions of dollars.

-

R&Q M&A chief Corver forecasts further transactions in coming days as demand for legacy solutions rises.

-

The deal for Inceptum, Vibe’s UK and European legacy unit, follows the closure of Syndicate 5678.

-

Elliott Goss will become the group’s head of claims from 17 August and be based in London.

-

The deal sets an exit plan for Stone Point from the Bermuda group’s North Bay entity if that business isn’t reorganised by year-end.

-

The LPT could help make the E&S writer a more attractive takeover target.

-

The January agreement remains subject to regulatory approval.

-

The MGA had established the PCC as a way to align underwriting interests with its paper providers.

-

Syndicate 1200 is the second Lloyd’s syndicate after Canopius to explore such a deal.

-

-

The deal, first announced in March, secures Aspen $770mn in cover for losses in excess of $3.8bn, as well as $250mn in excess $4.8bn.

-

The company is targeting more than four-fold growth in program GWP and Ebitda at the unit of over $50mn by 2022/23.

-

PE backer Aquiline is thought most likely to seek a merger partner for the Bermuda-based legacy firm.

-

The executive replaces Chris Fleming, who has been at Catalina since 2005.

-

The purchase is the latest in a string of deals for R&Q, including an agreement with the UK P&I Club last month.

-

The carrier has agreed to reinsure legacy business underwritten by Zurich from 1 October 2015 to 30 September 2018.

-

Its first transaction in the Asian market leaves the run-off group with assets totalling $7.2bn.

-

The book of occupational disease liability is highly volatile and payouts can be significant.

-

Aspen is the latest to pass the risk of unfavourable reserve development on to reinsurers.

-

The move is the latest in a string of deals with companies including BorgWarner, Zurich and Munich Re.

-

CFO John Parry, who joined the firm last year after holding the same role at Lloyd’s, will become interim CEO.

-

The carriers claim in a lawsuit that Maiden wrongfully stopped paying claims in late 2018.

-

The stock-performance-related plan comes as the carrier extends Dominic Silvester's contract, and those of the president and COO, by three years.

-

Legacy specialist continues expansion with first Montana captive.

-

The legacy carrier is understood to be looking for a replacement with public sector experience.

-

The syndicate is being positioned as an entry point to the RITC market at Lloyd’s.

-

The Pine Brook founder (pictured) becomes deputy chairman immediately and will take the chairman's role in about a year's time.

-

The board strengthening follows Catalina's agreement last year to buy Asia Capital Re

-

The deal will result in a $280mn gain for parent Fairfax.

-

The German insurer finally concludes the sale 18 months after it first brought the legacy portfolio to market.

-

The Gibraltar entity's losses are understood to stem primarily from its relationship with collapsed NZ carrier CBL.

-

The live carrier will cease writing business with immediate effect and become a platform for the legacy acquirer's Asian run-off expansion.

-

The legacy carrier is in line to seal RITC deals following the closure of its acquisition of CTMA and Syndicate 1884.

-

The manager will continue part time in an executive role advising on claims and reinsurance for group legacy companies.

-

The ratings agency said the transaction reduced the carrier’s exposure to higher risk legacy products.

-

Staff explore funding for an MBO or merger after management calls time on the syndicate.

-

The deal covers around £150mn of reserves from the 2017 and prior years of account.

-

The pending sale of Asia Capital Re (ACR) to a run-off acquirer – revealed yesterday by this publication – is a painful blow to the Asian reinsurance market.

-

About $190mn of reserves are associated with the transaction.

-

The legacy specialist had acquired AG Insurance’s UK branch business in 2017.

-

Investment income and an improved performance at StarStone lift the group result.

-

Liabilities involved are associated with asbestos and environmental claims.

-

The reinsurer's shares rose more than 9 percent on news of the board rejecting the offer.

-

Discussions are thought to be in the early stages for the venture.

-

The transaction would address the 2017 and prior years of account.

-

The executive is understood to have teamed up with former colleagues Harris and Hernon.

-

Asbestos payments in 2018 declined by 14 percent to $2.1bn, according to the ratings agency.

-

The executive will leave the legacy carrier at the end of the month.

-

The recruit will optimise the structure of the legacy carrier’s acquired run-off assets.

-

The transaction has now received regulatory approval and has closed.

-

John Cashin said the legacy space is too complex to be easily tackled with technology solutions.

-

The executive has investment from private-equity house Partners Group and is already considering transactions.

-

The deal is Axa Liabilities Managers’ 20th run-off purchase.

-

The executive moves to the Hamburg-based company from the position of head of legacy solutions restructuring in North America.

-

Executives from RSA, Enstar, Builders’ Accident Insurance and RiverStone participate in the venture.

-

The sellers say the run-off specialist will develop additional RITC and run-off solutions for the Lloyd's legacy sector.

-

Consultant predicts increased restructuring in the legacy sector and continued growth in deals.

-

The relatively small number of participants has to date constrained the capital supply and pricing for Lloyd’s legacy deals.

-

A rival Compre-Hudson bid group fails to disrupt the Premia offer.

-

The portfolio holds almost $200mn in net reserves.

-

The executive also played down competition in the legacy space.

-

The legacy acquirer will provide complete finality for shareholders.

-

The run-off platform is headed by former Enstar US chief Karl Wall, with Richard Harris holding a non-exec role.

-

The Canadian conglomerate will buy out all of Omers minority stake in Brit.

-

The executive replaces Patrick Manley as CEO of the Swiss carrier’s main EU general insurance arm.

-

The legacy carrier will use the base to acquire insurance entities in run-off.

-

The European legacy specialist, led by CEO Tom Booth, had been considered the frontrunner to take the German book.

-

Discipline will be key as the legacy market enters a period of rapid change.

-

The two firms did not secure approval from Bafin within the allotted nine months.

-

The target is in administration, having entered solvent run-off in 2003.

-

The executive joins after nearly a decade at the Bermuda carrier's legacy peer.

-

The Oslo-based carrier warns it will record a Q2 combined ratio of 107 percent after losing a dispute with Munich Re over Grenfell losses.

-

The legacy carrier has acquired several risk retention groups in recent months.

-

Alan Quilter and Roger Sellek, a former CEO at AM Best, will become joint CEOs.

-

They say good things come to those who wait.

-

The carrier is continuing its European expansion following its purchase of two run-off books from Generali.

-

As live carriers shake off last night’s excesses and vow to turn over a new leaf, the run-off market can be there to provide a reassuring pat on the back and a sympathetic ear.

-

The former RITC syndicate follows a string of other Lloyd’s businesses onto the market.

-

Global specialty insurer StarStone reported $51mn of adverse development

-

The $80.5mn deal - the buyer's largest ever legacy takeover - was originally expected to close in 2018.

-

The unusual development follows the close of five run-off years during 2018.

-

The planned disposal would be the latest in a series of run-off sales at the global insurer.

-

Forging CTMA and the Standard Syndicate into a dedicated Lloyd's run-off player would add useful new capacity.

-

The legacy carrier and ART Bermuda will each assume a 50 percent quota share of construction defect losses incurred by Amerisure.

-

StarStone generates a loss to its majority owner of $159mn after its management team is restructured.

-

The syndicate was unable to abide by the unwritten rules that govern all new Lloyd's businesses.

-

Private equity and in-market consolidators look to profit as Lloyd’s challenges provoke evolution of ownership structure.

-

Enstar assumes reinsurance reserves of £650mn through the transactions.

-

The legacy carrier has issued £100mn in new shares and will offer shareholders an additional £7mn of equity.

-

The insurer’s new £500mn legacy sell-off brings into focus the £55bn reserve pot on Lime Street.

-

The carrier is exploring a deal for around £500mn of reserves, with Enstar considered favourite for this as well as the smaller Doré book.

-

The Milan-based carrier has finalised the agreement, following over a year of exclusive talks.

-

Sometimes corporate announcements look so futuristic that one suspects the planned move is never going to happen.

-

The Vermont deal marks R&Q’s sixth with a self-insurer over the past two years.

-

Simon Hawkins joined the legacy carrier as COO in July last year.

-

The program manager and legacy transactions company forges an alliance with Kitsune.

-

The second legacy transaction for the AmTrust quota share book is still pending approval.

-

The transfer of the pre-2007 UK liabilities will lead to a small business operating loss for Zurich in the fourth quarter.

-

The deal adds four run-off books to the legacy carrier.

-

Enstar partnered with the Stone Point-managed Trident V funds to contribute the additional capital.

-

Some will interpret the planned disposal as a positive sign the continental European legacy market is opening up.

-

The portfolio for sale holds EUR90mn of Irish public liability and employers' liability exposures.

-

Arndt Gossmann has teamed up with Munich Re on the start-up.

-

The Standard Syndicate run-off goes to the very heart of the fundamental question of what Lloyd’s is supposed to be.

-

Lloyd's life syndicates set to dwindle to two amid licensing issues.

-

The additional $700mn in equity committed by Apollo is a huge vote of confidence in Catalina and the legacy market.

-

The broker anticipates increased demand for legacy liability transfers.

-

The extra committed equity provides the run-off acquirer with greater firepower for larger deals.

-

The agreement for the casualty facultative reinsurance business comes after up-for-sale Maiden struck deals with Enstar and TransRe.

-

The first court hearing will take place next month for a transfer the Corporation hopes to complete by the end of 2020, CFO John Parry says.

-

Chairman Ken Randall says size is no obstacle to potential Lloyd's run-off deals.

-

The legacy acquirer is to pay $80.5mn for Global US Holdings.

-

The run-off acquirer spent $5.73mn to increase its stake from 5 percent.

-

The Bermuda reinsurance vehicle is set to co-invest alongside Catalina in major UK legacy deal with Zurich.

-

It is understood the performance management directorate has issued up to five run-off letters to Lloyd's syndicates.

-

The run-off book is said to hold around $500mn in reserves.

-

The spate of Bermudian deals pointed to the quality of the carriers, Duperreault said.

-

Swiss Re makes a cash injection into the parent of the Rhode Island legacy carrier.

-

The two parties are understood to be nearing an agreement on the sale of £1.6bn of Zurich’s legacy UK employers’ liability exposures.

-

The legacy arm of Axa has agreed to acquire a EUR85mn portfolio of Sovag’s inward reinsurance business and direct business.

-

Barbican and AmTrust have now both launched formal processes to secure a reinsurance-to-close transaction.

-

With the recent push from Lloyd’s to remediate the market’s ailing profitability, it’s widely expected that the legacy market will see greater reinsurance-to-close (RITC) deal flow in the months to come.