Scor

-

The facility provides solvency support via a fresh equity injection under various scenarios.

-

The underwriter has spent 30 years in fine art insurance.

-

Plus, the latest people moves and all the top news of the week.

-

Carriers posted weaker top-line results but delivered improved combined ratios.

-

Citi and Berenberg believe the carrier is more resilient than in the past.

-

Plus, the latest people moves and all the top news of the week.

-

Opportunities for profitable growth in cat will be hard to predict, the executive said.

-

The French reinsurer improved its P&C combined ratio by 7.4 points to 80.9%.

-

Continental composite carriers aim to smooth volatility with new initiatives.

-

CEO Thierry Léger also stressed his intention to repair the carrier’s relations with Covea.

-

The mid-year renewals point to mounting pressure on reinsurance pricing.

-

Covea had requested a stay in the proceedings.

-

The underwriter left Navium Marine last year and before that worked at Atrium.

-

Scor's CEO said the P&C market had experienced a “competitive” first half.

-

The P&C segment posted an 82.5% combined ratio for the quarter.

-

Hannover Re’s CEO is lowest paid among peers, despite their pay growing 77% since 2015.

-

P&C combined ratios were higher than Q1 2024, and wildfires impacted Hannover Re most.

-

Plus, the latest people moves and all the top news of the week.

-

The CEO expects overall P&C pricing to be “stable” through 2025.

-

The carrier booked LA wildfire losses of EUR148mn.

-

The carrier announced a major writedown in its L&H book last year.

-

London-based US excess casualty writers are increasingly looking to attach lower in the tower.

-

The reinsurer said the probe concerns the alleged involvement of its former chairman.

-

Chapman exited from Scor following a 13-year tenure with the carrier.

-

Plus, the latest people moves and all the top news of the week.

-

Sources warned some property XoL books are already running 50% loss ratios.

-

Some of the Big Four are slowing growth as the market softens.

-

Tim Chapman also holds the role of EMEA head of construction at Scor.

-

Plus, the latest people moves and all the top news of the week.

-

The reinsurer pegged the market loss at $40bn.

-

The carrier pegged its LA wildfire losses at EUR140mn.

-

EGPI growth at the carrier’s Alternative Solutions unit jumped 29.6%.

-

Arta Nasradini joins from AIG, where she led the DACH aerospace team.

-

The reinsurer has made improvements to its life and health segment, it said.

-

The executive has also been made Syndicate 2015 active underwriter.

-

The political violence market is in a competitive stage thanks to an influx of capacity.

-

Julia Willberg joins from Hannover Re, where she has held several senior roles.

-

Adrian Poxon also had oversight of engineering, aviation and space at Scor.

-

The carrier said its P&C and L&H reserves have been confirmed by independent reviewers.

-

Nat cat pricing is expected to be more or less flat, with rises on loss-affected programmes.

-

The carrier has also completed a review of its L&H unit.

-

The denial followed this publication’s report that Covéa had renewed its intentions to buy the reinsurer.

-

This publication reported earlier that French mutual Covéa has engaged Scor in M&A talks.

-

The mutual’s approach comes as Scor continues efforts to fight back from performance issues including a flare-up in L&H.

-

CEO Thierry Léger claims the “insurability” of global risk is becoming “challenged”.

-

Scor is also limiting its exposure in political risk and cyber.

-

Plus the latest people moves and all the top news of the week.

-

Scor disclosed L&H troubles while Swiss Re continued reserving for US casualty.

-

Léger confirmed that his move to lead the L&H unit will not be permanent.

-

The P&C segment posted an 86.9% combined ratio for the quarter.

-

Scor guided to a EUR400mn insurance result loss earlier this month.

-

A selection of the top stories from the week.

-

A roundup of all the news you need today, including Enstar EU’s new CEO.

-

Work to revitalise the French reinsurer just got harder as problems in its life book crashed the share price.

-

A roundup of all the news you need today, including Lloyd’s chairman candidates.

-

The negative L&H result was driven by reserve updates.

-

The negative L&H result was driven by reserve updates.

-

Riots erupted in the Pacific Island territory last month over electoral reforms.

-

Léger will work as chair and Neal as vice-chair of the reinsurance advisory board.

-

Combined ratios improved all around thanks to better pricing and a benign cat quarter.

-

The CEO said Scor is still on track to hit a full-year 87% combined ratio.

-

The carrier reported 1 April price increases of 3.2%.

-

The executive will also serve as a member of Scor’s executive committee.

-

Hard-won profitability has given carriers room to salt away reserves.

-

Five regional leaders have been appointed for P&C and life and health.

-

The firm reallocated from short-tail lines amid social inflation concerns.

-

The company proposed a dividend of EUR1.8 per share for 2023.

-

Dejung spent 13 years at Scor, most recently as cyber CUO.

-

-

Opportunities for profitable growth remain in 2024, the agency said.

-

The executive has over two decades’ experience in the market.

-

The carrier also set out detail on its alternative solutions offering.

-

EGPI growth at the firm’s Alternative Solutions unit soared 191%.

-

Scor partnered with Acrisure Re to build the consortium.

-

Anderson first joined Scor in 2017 as a senior cyber and technology underwriter.

-

The segment has bounced back from its mid-2022 nadir, but its current zenith is not that much to shout home about.

-

Tokio Marine HCC restructured its marine, energy and renewables division earlier this year.

-

Cat losses were within budgets despite high levels of minor events.

-

Global P&C CEO Jean-Paul Conoscente, acknowledging a "heavy" quarter for attritional losses, said the carrier had taken action that should lead to ratio improvements over time.

-

The French carrier's operating result was EUR257mn, an increase of more than 130% on the prior-year period.

-

With new leadership at some of the largest continentals, there will be close attention to how their tactics in changing lines of business will evolve.

-

Speakers at the Guy Carpenter Baden-Baden symposium said the industry must improve its prospects as an investment opportunity.

-

The transaction was a partial exercise of an agreement signed by the companies in June 2021.

-

Our virtual roundtable polled industry leaders on critical questions for the reinsurance market. Today, we explore how the industry can collaborate on net-zero objectives after insurers exited the Net-Zero Insurance Alliance (NZIA) in droves.

-

Our virtual roundtable polled senior industry figures on the biggest questions facing the reinsurance industry. Today, we look ahead to the influences steering M&A market conditions.

-

The reinsurer’s new CEO said demand is to outstrip supply as cedants grow and exposures expand.

-

The French reinsurer said continued price increases, particularly on cat and US casualty, remain necessary.

-

The reinsurer has announced a detailed plan to diversify its P&C reinsurance book as part of a new strategic plan.

-

This is the first multi-year plan led by the new CEO.

-

Downstream underwriters have been pushing for rate this year following high claims activity in 2022.

-

Swiss, Munich, Hannover and Scor all delivered optimistic messages on pricing for next year.

-

The new CEO said the carrier must remain focused on pricing for geopolitical uncertainty.

-

The carrier also reported 9% rate increases at the summer renewals.

-

The underwriter has worked at Swiss Re, Ironshore and Alize during his insurance career.

-

After three years as a company director, Brégier received a unanimous recommendation from the nomination committee.

-

The executive has worked for the French carrier for almost four decades in various roles in Toronto, Paris and Milan.

-

The underwriter joined Scor in 2020 having previously led the cargo and specie operation at Starstone.

-

The long-serving executive turned around the fortunes of the French reinsurer in a two-decade stint as leader.

-

Varenne was previously interim CEO and group COO of Scor.

-

After founder members Axa and Allianz dealt a potentially terminal blow to the Net-Zero Insurance Alliance by withdrawing, the NZIA is exploring limited options to continue.

-

The reinsurer is the fifth major player to leave the organisation, following Swiss Re, Munich Re, Zurich and Hannover Re.

-

Most carriers were keen to talk about how they are taking on the ongoing hard market in Q1, but some complexities partly offset their good news.

-

The global P&C CEO said the carrier will deploy roughly the same capacity in the state as last year.

-

The carrier continued to rebalance its portfolio towards specialty at 1.1 and 1.4.

-

The reinsurer achieved rate increases of 7% across its portfolio.

-

Scor’s P&C reinsurance business is expecting insurance revenue growth of up to 2% in 2023.

-

Analysts find carriers have few investments in bank debt after Credit Suisse rescue.

-

Kayley Stewart joins from Fidelis, and Yvonne Ledger and Kate Carrett are joining the environmental liability team.

-

S&P Global Ratings has affirmed Scor’s financial strength ratings (FSR) at A+, while the French carrier’s outlook remained stable.

-

The release of Swiss Re, Munich Re, Hannover Re and Scor’s year-end reports provides an update on market conditions.

-

The rating downgrades reflect the deterioration in Scor’s operating performance.

-

CFO Ian Kelly said the EUR0.40 reduction reflects 2022 as a loss-making year.

-

Analysts question a 24% Q4 earnings miss as the company cuts its dividend.

-

It is understood that industry veteran James Grieve will retire this summer after over 16 years at the French reinsurer.

-

The carrier is confident the positive cycle will continue as it prepares for April, June and July renewals.

-

The ratings agency said the weakening of the group’s performance in the first part of the year continued into the third quarter.

-

Plus all the top news and latest people moves of the week.

-

The French carrier has replaced Laurent Rousseau with Swiss Re’s Thierry Léger - midway through a remedial journey. Can a third CEO in two years resolve the carrier’s issues?

-

The decisive move to replace Laurent Rousseau early in his CEO tenure was about “timely decisions”, the Scor chairman said.

-

The deal protects the carrier’s capital in the event of large nat-cat or mortality losses.

-

The agency has also cut the carrier’s long-term issuer default rating to A-.

-

In response, Scor said it is taking all possible steps to improve its profitability.

-

Carriers reassured analysts that unrealised investment losses will not seriously affect solvency while sounding a bullish note on renewals.

-

The underwriter will be based in London and report to Marie Biggas and Daniel Carreras.

-

The French reinsurer’s Q3 update details its extensive remedial efforts – but with the impact yet to be felt, it is still vulnerable to takeover.

-

The French carrier has vowed to continue its “selective” reinsurance underwriting strategy.

-

Martine Gerow’s mandate will last for the remainder of Kory Sorenson’s term, which comes to a close at the end of the general meeting in 2023.

-

The group vows to continue remedial work to restore profitability.

-

Inflation, heightened cat activity and years of poor reinsurance returns are fuelling demands for wholesale change in the European market.

-

David Guest’s appointment comes shortly after Christianna Vandoorne, head of terrorism and PV, left the syndicate.

-

Christianna Vandoorne has been head of terrorism and PV at the syndicate since June 2020.

-

Further rating action is likely if underlying performance does not improve in the short to medium term.

-

The scheme aims to fill the gap left when private sector carriers exited the market following the Grenfell disaster.

-

This publication’s review of H1 disclosures shows how listed (re)insurers’ nat cat losses have tallied with aggregate projections.

-

Insurance Insider selects 10 exclusive news stories reported by our team on the frontline at Monte Carlo Rendez-Vous.

-

In their messages at the Rendez-vous de Septembre, Munich Re, Hannover Re, Swiss Re and Scor signalled a ripe environment to hike prices and adjust terms.

-

Chris Beazley stepped down from his CEO position at MS Amlin’s reinsurance arm at the end of August.

-

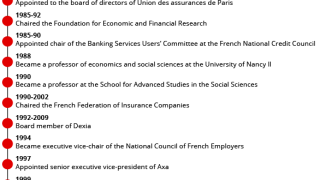

Generali France chairman Claude Tendil has served for 13 years.

-

The CEO likened reinsurance market conditions to those seen in large commercial primary lines post-HIM.

-

The carrier said the move will accelerate deal-making in its early-stage investment arm.

-

Swiss Re, Munich Re, Hannover Re and Scor have set out their strategies on inflation, pricing and Ukraine.

-

The carrier’s management emphasised further underwriting actions.

-

The carrier cut its GWP by 9.8% during the summer renewals, including a 24% reduction in exposure to the US.

-

After serving as a director on Scor’s board for many years, Kory Sorenson has decided to resign due to personal reasons.

-

Adrian Poxon will take on the role of aviation CUO following Sommerlad’s retirement on 1 September.

-

Colleagues William Campbell and David Barr have also handed in their notice, although their destination is not yet known.

-

The reinsurer named climate change as a key driver of the increase in the frequency and severity of droughts.

-

Regulatory burdens mean that restarting the Freeport refinery could take longer than first hoped.

-

The scheme, due to be officially launched in September, will run for five years.

-

The French reinsurer faces a number of hurdles as it looks to set its new corporate strategy. We outline the challenges ahead.

-

The outgoing reinsurance CEO will be succeeded by Stuart McMurdo, current CEO of Scor UK, the Scor syndicate and regional CEO of EMEA.

-

The company will also double its coverage for low-carbon energies by 2025.

-

Ukraine uncertainties remain despite some loss estimates emerging in Q1 earnings across the Big Four European carriers, while inflation looms on the horizon.

-

The agency affirmed the carrier’s Insurer Financial Strength rating at AA-.

-

The carrier also took heavy Covid-19 losses in its L&H division, leading to an operating loss at group level.

-

The carrier said lines including political risk, credit and surety and aviation were facing claims.

-

The executive said the Ukraine conflict was an example of how the industry had come to over-optimise models.

-

The incoming active underwriter and CUO was deputy active underwriter at Arch Syndicate 2012 and head of terrorism, aviation, war and space for Arch Insurance International.

-

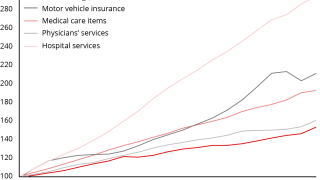

A 1% increase in inflation could lead to a five-point increase in combined ratio for a longer-tail risk such as medical professional liability, the Scor chairman said.

-

Scor’s Malcolm Newman, Axa XL’s Sean McGovern and Aon’s Richard Dudley gave evidence to the Lords committee on regulation.

-

The day, originally planned for 29 March, will be moved to the end of July.

-

The syndicate has doubled its underwriting profit and improved its combined ratio as its turnaround work bears fruit.

-

Earnings reports from Swiss Re, Munich Re and Scor have revealed increased cat budgets and highlighted continued shifts away from frequency coverage.

-

Future large catastrophe events and new Covid-19 variants remain risk factors for 2022’s earnings.

-

CEO Laurent Rousseau told employees face-to-face contact is “essential” to the business.

-

The carrier booked EUR838mn of cat losses for 2021, equal to 12.8% of premium.

-

Scor’s renewals update denotes a continued push to control volatility while Hannover Re is focused on growth.

-

The carrier also said its new retro purchase will provide first-dollar protection.

-

The ratings company said it considered Scor's earnings performance, which has been below the agency's expectations for the past five years.

-

The carrier said InsurTech investment was driven by specialty and commercial solutions during the year.

-

Yves Cormier brings more than 15 years' experience in the insurance sector across capital markets transactions, M&A, investor analytics and balance-sheet management to the role.

-

The executive replaces Kade Spears in the role.

-

The likes of Swiss Re and Scor are supporting the sector-specific methodology linked to broader decarbonisation efforts.

-

The reinsurer said joining the alliance further strengthened its commitment to the preservation of biodiversity.

-

Swiss Re, Munich Re, Hannover Re and Scor have set out divergent strategies on cat as volatility increases and the retro market seizes up.

-

Scor is to shift its portfolio to increase the proportion of P&C to 60% and reduce life and health (L&H) to 40%, according to CEO Laurent Rousseau.

-

Plus the latest impact of cat activity on reinsurer results and all the top news from the week.

-

The carrier has also exited US MGAs exposed to North Atlantic cat risk.

-

The carrier launched a share buyback and announced portfolio rebalancing actions.

-

People movement is picking up in the sector, which is experiencing broadly stable rating thanks to ample capacity.

-

The Scor chairman takes over from Swiss Re CEO Christian Mumenthaler, who steps down after two and a half years in the role.

-

The climate-transition pathway solution helps insurers identify clients with robust climate-transition plans.

-

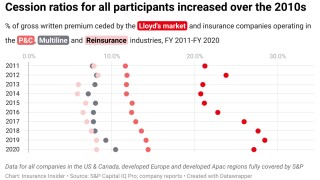

Analysis of financial data shows that the last decade has seen a marked increase in the proportion of premiums ceded by carriers in all sectors.

-

Plus the winners of the Insider Honours and all the top news from the week.

-

The well-known underwriter has held similar positions at Sompo International and Partner Re.

-

Scor Global P&C CEO Jean Paul Conoscente said on a briefing that rate hikes were barely keeping up with inflation.

-

From ESG to social inflation, systemic risk to cat risk, we highlight some of the top discussions from this year’s four-day virtual conference.

-

The Scor CEO said that (re)insurers risked being hounded by regulators for selling inadequate products.

-

The targets are part of the “quantum leap” strategy set to be unveiled by new CEO Laurent Rousseau at an investor day today.

-

Van Viet was head of underwriting management and retrocession at Scor for 13 years before taking on her current position.

-

The reshuffling of the leadership team marks the first big management decisions made by new CEO Laurent Rousseau.

-

Despite some rate tapering, the two German reinsurers are expanding premium, as all four carriers enjoyed North American rate increases.

-

The carrier may also take the opportunity to re-risk its ‘prudent’ investment portfolio.

-

Experts also welcomed the impact of the Covea life transaction on first-half earnings.

-

The carrier increased reserves for P&C Covid-19 losses by EUR109mn in the quarter after UK and France court decisions.

-

He worked for eight years at the French firm, where he oversaw the strategic direction of its ILS business.

-

The new CEO will work with colleagues across the company to write a “new page of history” for the French reinsurer.

-

The reinsurer’s new CEO Laurent Rousseau secured 99.54% of shareholders’ votes for the role at a general meeting, while 91.27% backed Denis Kessler as chairman.

-

The reinsurer’s analysis of 20 research groups’ predictions points to a busier season than usual.

-

The reinsurer was suing Barclays over its role as adviser to Covea during its failed Scor takeover.

-

The deal removes the overhang risk associated with the Covea’s nearly 8.5% stake in the reinsurer.

-

Kessler and Derez will each get something they want from the deal, which will also clean the slate for incoming CEO Rousseau.

-

A settlement allows the mutual an “orderly exit” from the reinsurer’s share capital and removes a major distraction from incoming Scor CEO Laurent Rousseau.

-

State-backed carrier GIC Re faces competition as the European Big Four press into the subcontinent.

-

He will continue to serve in his current position as CUO.

-

The activist has made public a letter sent to the chair of Scor’s nomination and remuneration committee as it follows through on a threat to vote down key AGM proposals.

-

In a statement on Thursday, Scor said it “acknowledges and welcomes” the findings from the French authority, calling the original allegations “a groundless move”.

-

The French carrier’s newly announced successor to Denis Kessler will be charged with taking growth to the next phase.

-

Denis Kessler will cease to be CEO from the end of June this year for personal reasons, a year earlier than planned.

-

Rate increases are tailing off, but the carriers’ reports reveal divergent growth strategies.

-

The carrier racks up losses from Uri and Filomena as well as deterioration on Laura and Sally.

-

The French carrier grew its top line by 14.3% at the April renewals.

-

Reinsurers still have concerns over rate adequacy as views of typhoon risk evolve.

-

The reinsurer argues the action was lodged to divert attention from alleged misconduct by the mutual’s CEO.

-

Covéa said it has filed a complaint against Scor chairman and CEO Denis Kessler with the Parquet National Financier financial crime office alleging “market manipulation and misuse of corporate assets”. Scor denounced the action as "deceitful and groundless".

-

The reinsurance chief sees no role for the ILS market, as pandemics are "badly defined", with no clear end point.

-

Hannover Re has emerged as an outlier by reducing its overall 2020 dividend, but its growth plans may alleviate disappointment about the policy.

-

The investor will focus on late seed and Series A funding rounds as it widens its geographical remit.

-

The business signals expansion into complementary lines after its 2018 reset bears fruit.

-

The carrier is one of a number of players to have entered the D&O market as pricing continues to grow.

-

The lawyer moves up after five years at the carrier.

-

Analysts note the carrier’s forecast 2021 life technical margin is lower than expected.

-

The reinsurer lifts the division's Covid-19 loss assessment by EUR28mn in the fourth quarter within a set of results that beat expectations.

-

The two European carriers are bullish after achieving the best overall rate increases since 2018 at 1 January.

-

The carrier predicts Covid’s reinsurance impact will drive market hardening.

-

The CEO said the French reinsurer will avoid court cases where possible in pandemic coverage disputes.

-

The Principles for Responsible Investment were launched in 2006, with Hannover Re, Liberty and Everest Re among other signatories.

-

The additional raise takes the carrier’s committed capital to $3.2bn.

-

The start-up makes its first appointment directly from Hiscox, where Inigo founder Richard Watson worked as CUO.

-

The management liability market underwent huge hardening last year as major carriers withdrew.

-

Fellow founder Will Thorne will take over the leadership responsibilities and manage its second fund.

-

Kessler will continue as chairman after the handover, while the incoming chief will start out as deputy CEO.

-

The current chief says the governance structure will evolve in a “new phase” for the reinsurer.

-

Emmanuel Clarke, Frédéric de Courtois and Benoît Ribadeau-Dumas reportedly compete with insiders including Laurent Rousseau.

-

The French mutual and its CEO say they will contest the ruling issued on Tuesday by a Paris court.

-

Separate criminal proceedings brought by the French reinsurer against the mutual and its chief have yet to be heard.

-

AIG shares climbed 13% to $37.52, compared with a 1.2% increase in the overall S&P 500 index.

-

The 1 January renewal will be a battle for the biggest slice of post-Covid upside.

-

Denis Kessler argued that solvent companies should be able to manage their capital base freely.

-

A stable Covid-19 claims assessment within P&C and a better-than-forecast trajectory in life buoy the stock.

-

The carrier adds just EUR8mn to its running Covid-19 claims tally, which now stands at EUR256mn.

-

The new capacity will be welcomed by brokers and clients as conditions continue to harden.

-

The changes move away from a management structure built around types of business.

-

The new hires join as CFO and COO under recently arrived CEO Juan Andrade.

-

The (re)insurer would, however, consider a culturally compatible merger if the opportunity arose, the chairman and CEO said.

-

The carrier said it was benefitting from “exceptional market conditions in a low yield environment”.

-

The executive says a time lag for start-ups to achieve profitability would favour incumbents.

-

Deputy CEO Laurent Rousseau tells investors the “pruning is over” as the shares rise 11%.

-

The carrier reports lower-than-expected life claims linked to the pandemic.

-

First-half executive commentary also reveals Hannover Re is allocating capital for growth as Scor continues portfolio review.

-

The French reinsurer guides away from an equity raise as it predicts further rate hardening.

-

The carrier's P&C unit swings EUR111mn into the black in Q2 as the combined ratio deteriorates 17 points.

-

The ACPR edict adds pressure on Scor and Covea.

-

Carrier says it will propose new CEO well in advance of 2021 AGM.

-

The activist investor has called on the Scor board to consider a merger.

-

Christian Stanley will be its underwriting insight head and Christian Vandoorne its terrorism and political violence head.

-

The activist investor and 0.4% Scor shareholder demands the chief’s dual role is split and a strategic review is undertaken.

-

Analyst Jonny Urwin estimates a $20bn shortfall between available (re)insurance capital and demand.

-

The carrier said advice given by European regulators on carriers’ response in the crisis was a key factor in the decision.

-

The mutual’s retreat reduces the prospect of a sale of its Scor stake.

-

The four continental European reinsurers expect Covid-19 to accelerate price momentum despite divergent approaches at 1.4.

-

The executive led the carrier through key 1980s expansion.

-

The ratings agency affirms the reinsurer’s existing ratings.

-

The reinsurer’s P&C chief says primary carriers are looking to protect capital because of the pandemic.

-

Citigroup and RBC note the reinsurer’s strong solvency position.

-

The reinsurer beats earnings forecasts and says Covid-19-exposed lines account for a small slice of premium.

-

The carrier achieves 5.4 percent growth in Japan as it moves up programme layers.

-

The topic's absence from the Davos agenda highlights a collective failure, the CEO notes.

-

Rescheduling comes after pressure from CIAM over timing.

-

The activist investor revives its campaign for a separation of the CEO and chair roles.

-

Disparate attitudes between European reinsurers could temper aggressive rate increases at the key 1 April renewal.

-

Munich Re's move to pull back capacity to Hippo comes as reinsurers are looking more cautiously at InsurTechs.

-

Global P&C CEO Conoscente offers reassurance on US casualty exposure.

-

Japanese catastrophe losses keep P&C in the red as the group result beats forecasts.

-

The appointment is still awaiting regulatory approval.

-

The French (re)insurer said the deal was in line with its “quantum leap” strategy to expand into profitable business lines and reinforce technical expertise.

-

The mutual has no restrictions governing the potential sell-down of its 8.4 percent stake in the French reinsurer.

-

The carrier’s specialty division recorded a 14 percent rate increase at 1 January.

-

RBC and Jefferies cut growth expectations after carrier reveals cat losses and reinsurance premium reduction.

-

Significant rate growth continues to elude reinsurers, while PartnerRe hunts for a new home.

-

No early indication that reinsurance pricing is catching up with insurance rate acceleration.

-

Global P&C CEO Jean-Paul Conoscente says recent Japanese losses triggered a rethink.

-

The shares dip as large loss numbers exceed expectations.

-

Barclays fails in a High Court bid to get legal action against it postponed.

-

The Paris-based carrier has a history of using innovative capital tools to manage risks to the company’s balance sheet.

-

The four European carriers have significantly outpaced Bermudian reinsurers in GWP growth so far this year.

-

About $190mn of reserves are associated with the transaction.

-

The reinsurer’s shares rise sharply on above-forecast results, though Citigroup and RBC suggest its underlying performance was poor.

-

The business unit's underwriting performance deteriorated slightly, while investment income surged.

-

The Scor Global P&C deputy CEO said the firm would deploy more capital into specialty insurance.

-

There are questions on whether the four European reinsurers will continue to expand their top line as conditions improve

-

The transaction would address the 2017 and prior years of account.

-

The French investor resumes its campaign after failing to overturn resolutions at a June shareholder meeting.

-

The French reinsurer is providing paper to support bundled homeowners and auto policies underwritten by the InsurTech.

-

Just months into the job, Scor’s new head of reinsurance sits down with The Insurance Insider to share his assessment of rates and where they’re headed

-

The reinsurer is considering creating a separate balance sheet that could write risks on behalf of third-party investors, akin to the Vermeer Re vehicle managed by RenaissanceRe.

-

Scor will place increasing emphasis on third-party capital, the CEO says.

-

The reinsurer maintains existing combined ratio and RoE targets and keeps mum on a buyback.

-

Swiss Re leads the charge on US exposure as reinsurers prepare for North American hurricane season.

-

Global P&C chief Conoscente notes the carrier “very positive” on casualty.

-

The global reinsurer’s group result comes in ahead of expectations as cat losses are less severe than forecast.

-

The company will use the grant to launch invoice insurance and a trade credit scoring product in France and Germany.

-

The firm’s 2015 Atlas cat bond has triggered, following loss creep from the 2017 hurricanes.

-

The Spanish insurer signs a memorandum of understanding to insure the multi-billion dollar project.

-

The Philadelphia programme also has big lines from Munich Re and Scor.

-

The French reinsurer garnered about 55 percent of shareholder support for its CEO’s pay in April.

-

Further M&A activity in the ILS market points to the likelihood that no single ownership model will prevail.

-

ACPR vice president Bernard Delas said there was no “interest in letting that row last eternally”.

-

The deal would bolster the reinsurer’s ILS assets under management by more than 60 percent to $2.1bn.

-

Carriers must not sacrifice product simplicity for tech innovation, the Scor P&C deputy CEO says.

-

The promotion fills a role that was previously held by Jean Paul Conoscente.

-

Scor “remains open to discussion” about participating in an alternative reinsurance scheme.

-

The Unfriend Coal organisation called on the (re)insurers to fully phase out exposure to coal by 2040.

-

The activist investor noted that more than 45 percent of Scor shareholders oppose Denis Kessler’s compensation.

-

The activist pledges to continue its campaign, claiming success in garnering 45 percent backing for its remuneration motions.

-

P&C CEO Jean-Paul Conoscente discloses the change after $40mn loss creep in Q1 from typhoons Jebi and Trami.

-

The combined ratio deteriorates by 2.8 points as typhoons Jebi and Trami pushes up the loss ratio.

-

The comments come during a long-running dispute about the mutual’s unsuccessful bid to take over Scor.

-

The reinsurer grew gross written premiums to EUR548mn ($619.2mn) at 1 April renewals.

-

Both proxy advisory firms recommend voting down the Scor chairman and CEO's compensation package.

-

Nine broking houses made it to the ranking this year versus 54 underwriting firms.

-

The second edition of the survey generated a ranking of 227 reinsurance professionals

-

The company is partnering with Scor to provide capacity for its credit insurance policy.

-

The Scor-owned Lloyd’s operation pins its woes on property and professional liability lines.

-

Trading partnerships with South East Asia, LatAm and the Mena region are also being targeted.

-

The French investor fires a new round in its long-running battle with the reinsurer.

-

After Hurricane Katrina, a slew of big composite insurers including Axa and Chubb spun off their reinsurance arms, citing their excessive volatility.

-

The reinsurer is urging shareholders to reject CIAM’s proposal to split the chairman and CEO roles.

-

The investor demands the CEO and chairman role be split and pledges to vote the lead director off the board.

-

While large European reinsurers achieved “significant growth” at 1.1, rates tended to be flat to up 1 percent.

-

Spichtig, McMurdo and Pinho are also promoted in a number of changes to be made following Peignet’s retirement.

-

In a comparison that you should only attempt if you have a French accent, Scor chairman and CEO Denis Kessler once quipped that traditional reinsurance was the wife of the insurance world, while ILS was the mistress.

-

With US activist investors now settled in Europe and native species such as Scor nemesis CIAM also flourishing, what should the (re)insurer CEO or chair do when that unsolicited phone call comes?

-

The reinsurer is also suing Covea entities, the mutual’s CEO and Rothschild in France.

-

The Austrian carrier reserves the right to insure coal risks in exceptional cases in countries where the economy and employment depend on the sector.

-

Catastrophes weigh in on the carrier’s fourth-quarter results, inflating the combined ratio more than expected.

-

At the midpoint of disclosures, this publication summarises the key trends identified by industry leaders so far.

-

The Scor chief also tells Les Echos that the Credit Suisse CEO personally intervened to abandon the bank’s advisory mandate for Covea.

-

David Reed is set to take on the advisory leadership role.

-

The carrier predicts double-digit rate increases in both Japan and the US later this year.

-

Current active underwriter Tom Corfield continues as CUO of Scor UK.

-

The fund manager’s CEO suggests Kessler is acting in his own interests and against those of shareholders.

-

People say there is no smoke without fire, but we journalists know that it is a lot more complicated than that.

-

The French mutual’s board said it would “take all action in order to defend its interests”.

-

Court documentation reveals deliberations at Scor about a hypothetical fusion with PartnerRe.

-

I think the smart money coming into this year was on Covéa to grind down Scor and buy the company.

-

Scor CEO said reinsurer has filed a 584-page citation on Covea boss with Paris courts.

-

Simeon Seamer joins from Scor Business Solutions to lead the division.

-

Expectations of rate rises and outsized catastrophe losses resulted in a subdued annual performance for the composite index.

-

If you are reading this from the UK or Europe, it is likely that your political attention the last few weeks has homed-in on certain rumblings in that peculiar part of central London where reality recently seems to have become a relative concept.

-

The Hong Kong insurance regulator marshals the sector to respond to the Chinese government’s infrastructure investment programme.

-

The exit comes ahead of Lloyd’s closure of Special Purpose Arrangement 6129.

-

Paul Lucas reports to Argo group chief actuary Bob Katzman.

-

Solvency capital requirements are increased by as much as 20 percent for some syndicates’ plans.

-

Market sources described a frenetic dynamic between underwriting leaders and followers in the verticalised market.

-

The move will cost the carrier almost $114mn in gross written premiums.

-

The company will take on new and renewed EEA business that can no longer be written by Scor UK.

-

Above-average cat losses dominate discussions during the P&C earnings season.

-

In September, Derez stepped down temporarily from the Scor board.

-

The former Scor executive becomes a senior underwriter.