In an interview with this publication, Léger, who took the reins at the French reinsurer earlier this year, laid out Scor’s evolving underwriting philosophy and its key messages to the market ahead as the renewal season kicks off.

The executive’s comments come after the publication of his first three-year strategic plan as CEO, which set out Scor’s continued caution on climate-exposed business and its desire to increase its participation on lines such as engineering, marine and international casualty.

In a wide-ranging interview, the executive covered:

Scor’s appetite for business following a period of underwriting remediation

The availability of capacity and the alternative solutions to traditional treaty products to which clients are turning

The impact of the difficult 1 January 2023 renewals and how reinsurers and cedants can recover their working relationships.

Market messaging

Scor has been through a turbulent few years following an attempted takeover by Covea and rapid changes to its leadership, but Léger used the interview to telegraph to cedants that the ship’s course has been righted.

“Scor is very positive about the environment and our positioning,” he said.

“Scor is ready. We will support our clients, we have capacity and we have the expertise.”

He warned though that market conditions are unlikely to soften very far at this renewal or the next.

“Capacity continues to be scarce,” said Léger.

“We have been through many difficult years. We need to replenish our balance sheets after these difficult years to build the capacity that is required to cover cedants’ needs because there's a huge gap today between the demand and the offer.

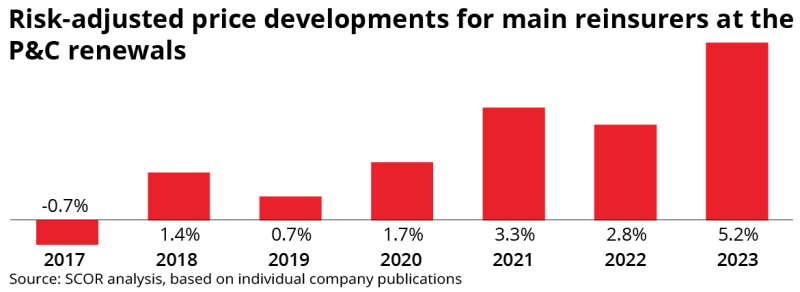

“To fill that gap, we will need to make profits to replenish our capital, which really means that the prices need to go up further.”

He added that Scor has shifted towards a more disciplined underwriting model.

“Technical underwriting has been at the core of Scor and, with this new strategic plan, what we do at group level is capital steering,” Léger explained.

“So capital steering is something we will invest much more in on a group level.

“What we do there is define the lines of business where we want to grow more or less to get to the best possible portfolio in any given time, and that evolves.

“This much refined capital steering is a real change and will be a steer to the teams on the ground. At a group level, we are becoming more technical.”

The CEO added that the desire to make coverages clearer is a reaction to recent losses.

“It started with Covid on the P&C side,” said Léger.

“It triggered certain coverages that in our view should not ever have been triggered. There is a desire to make very clear what we mean when we sign a contract.

“We are in a phase where we are rather restricted and that is an ongoing trend.”

Léger highlighted cyber as a particular example of a line of business where clarity is crucial.

“Cyber is an incredible opportunity for the insurers and reinsurers,” he said.

“Premium in cyber will be multiplied many times. What's really important is to learn from losses and constantly clarify the wording.”

He added that the presence – or otherwise – of coverage for strikes, riots and civil commotion (SRCC) in property treaties is another area of focus.

“Due to the polarisation of the world, we have seen huge civil unrest in Chile, in South Africa, in France – just those three were massive and led to really large losses,” he said.

“This is going to get worse before it gets better. I expect the insurers to have a very strong focus on SRCC.”

Controlling cat exposures

As outlined in its new three-year plan, Scor is continuing to take what it calls a “prudent” approach to climate risk.

This follows a major remedial programme undertaken over the past few years, in which the carrier has reduced its participation on lower layers of programmes in a bid to avoid frequent secondary-peril losses.

Léger stressed that Scor’s approach to climate-change exposure does not equate to a wholesale retrenchment from cat business.

“Climate change does not equal nat-cat,” he said.

It’s going to be more difficult to find solutions to reduce volatility. It's going to be easier if it's a capital-oriented solution

“What we mean by the most climate-change-exposed risks are risks such as flood, avalanches, extreme heat, extreme drought. Those are directly climate change impacts but there are nat-cat elements that are not at all or only to a small extent impacted by climate change.”

He added that climate-change-exposed lines are “not the big bulk of our business”.

“They became more of our business over the last five, six years, as suddenly we saw climate change impacting the whole world,” said Léger.

“At 1.1 2023, we removed ourselves from these risks – not the big risks, the smaller, more frequent events.”

The impact of this, the executive said, has been that clients have retained a far larger proportion of this year’s nat-cat bill than they would have done in previous years.

Recovering from 2023

Léger acknowledged that cedants had been through a bruising renewal at 1 January this year, in a process beset by delays, confusion and sudden price increases.

“Reinsurers and insurers have a business-to-business relationship,” he said.

“The quality of a relationship is measured by how we go through difficult moments. In many instances, the relationship can actually be better after the crisis than before the crisis.”

The difficulty in the run-up to the January 2023 renewals, which Léger termed a “dislocation crisis”, has had a lasting impact.

“It is not going to last forever but it's still there: the shock, the disappointment, the frustration, all these feelings,” he said.

“We will face some of that in the expectations of our clients of the next renewal.”

Nevertheless, Léger said he anticipates a “much more orderly” renewal at 1 January 2024 “because the capacity gap is now very clear to everyone and everyone is working on it”.

That capacity gap, Scor estimates, is around $50bn per year.

“My expectation is that the [supply] will increase relatively slowly,” said Léger.

“Every year this market needs at least $50bn in new capacity, because that's about the growth that we expect. The high volatility this world is facing will increase reinsurance demand.”

Reinsurers will not be able to supply increased capacity in line with demand, Léger said, meaning cedants must face the reality of holding more risk net.

This in turn is to drive demand for alternative reinsurance solutions, which Scor has named as a priority growth area.

As part of its new strategic plan, the carrier has committed to doubling premium from alternative solutions – such as solvency relief quota shares, multi-year stop-loss, combined adverse development covers and contingent reinsurance – in the next three years.

“Structured solutions are by nature tailored to you,” said Léger.

“It’s going to be more difficult to find solutions to reduce volatility. It's going to be easier if it's a capital-oriented solution.”