Axa XL

-

Insurers must avoid being a “blocker” in development and financing decisions.

-

The power market is experiencing double-digit rate reductions.

-

Beazley is one of the key leaders in the London marine marketplace.

-

The carrier has been exploring launching into P&C organically or via acquisition.

-

The carrier is planning a limited relaunch into the UK D&O market.

-

Tom Potter was global casualty underwriting manager for UK & Lloyd’s at Axa XL.

-

The pair hail from Dale Underwriting and Axa XL, respectively.

-

He was appointed CUO of casualty, Americas, in July last year.

-

One of the options being explored is setting up a dedicated company for the wholesale vertical.

-

The LPPC will offer limits of $127.5mn EAR and DSU coverage in the US and Canada.

-

Donna Swillman is currently a senior underwriter at Axa XL.

-

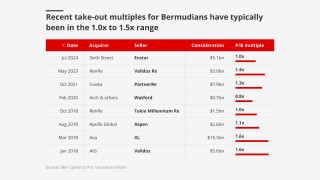

Aspen would give Sompo more reinsurance scale, more US premium and a Lloyd’s presence.

-

This publication revealed yesterday that Sompo is currently in negotiations with Aspen.

-

There has already been an influx of new capacity from MGAs into the power market.

-

The company has recently made several senior changes to its UK and Lloyd’s leadership.

-

AIG leads the all-risks cover and Axa XL is the hull war lead.

-

The claim could add pressure to the hull war market after a recent High Court ruling.

-

The exec said if he were a carrier CEO, now is the time he would start looking for deals.

-

The carrier will focus on mid-market business outside of Lloyd’s.

-

The carrier reported a below-budget cat experience, despite the California wildfires.

-

The Paragon-owned coverholder is known as a specialist in film insurance.

-

Results were impacted by prior year reserving and an unwind of intragroup reinsurance recoveries.

-

Earlier this week, we revealed that Louise Nevill was joining Axa XL as specialty CUO.

-

Nevill has extensive experience in underwriting at Talbot, WR Berkley and Markel.

-

Several underwriters left Hiscox’s property D&F team last year to join MGA Velocity.

-

The reserve includes hull, liabilities and legal expenses.

-

The portfolio tracker facility is led by Canopius.

-

Behind Axa XL, Convex wrote a 9.5% line on the all-risks reinsurance programme.

-

The move comes amid a restructure of Axa XL’s specialty leadership.

-

The executive has also worked for AIG and Ace.

-

Axa XL leads the aviation all-risks reinsurance coverage for the destroyed Jeju Air Boeing 737-800 craft.

-

Axa XL is understood to be the lead carrier, with Gallagher the broker on the account.

-

Jamie Cann, previous head of aviation and space at the Fidelis Partnership, also joined Axa XL.

-

Alex Nelson will work as head of power and renewable energy at the carrier.

-

The carrier is believed to be restructuring the leadership of its London specialty business.

-

Underwriters are broadly pricing on the basis of a $1.5bn Baltimore claim, but there is uncertainty.

-

Axa XL Re has hired former Swiss Re executive Greg Schiffer as its North America CEO, effective from 11 November.

-

The underwriter has worked for JLT and FM Global.

-

Chris Caponigro will be responsible for expanding Axa XL’s product offering and investor base.

-

At group level, Axa’s underlying earnings improved by 4% to EUR4.2bn.

-

The appointment is part of a reorganization of the Americas business.

-

The marine expert has worked for Axa XL and Catlin for most of his career.

-

Axa XL has also added Fidelis’ Jamie Cann to its aviation team.

-

The underwriter will head up casualty reinsurance for the US and elsewhere.

-

Michael Yeats will now lead the automatic reinsurance facilities division in the US.

-

-

He was previously head of underwriting management and deputy CUO for Axa XL’s marine segment.

-

Kelly was recently appointed to head up the product recall book at Axa XL.

-

-

The LMG chair also discussed the need for tailored regulations.

-

Paul Thomas was also appointed head of sports, media and entertainment.

-

The P&C segment reported a 71% increase in underlying earnings.

-

The company provides reinsurance to insurers in LatAm and the Caribbean.

-

Duties will include setting strategic direction in marine, aerospace, and specialty niche lines.

-

The appointment follows the resignations of Shaun Russ and Ian Davidson.

-

The resignations will see Russ and Davidson reunited with fellow Axa XL alumnus Mark Hutton, who joined Tokio Marine HCC as head of crisis management last year.

-

Ashwell is widely regarded as one of the architects of the standalone terrorism market that emerged after 9/11.

-

The carrier is targeting the line of business as part of a wider strategic push in international insurance.

-

Mike Gosselin steps into the role vacated by Luis Prato, who left the carrier earlier this year to join LSM.

-

Canopius will write a 2.5% line on the multi-class facility, while Axa XL will write 1%.

-

It is understood that Hutton has resigned from his previous role as global product head of product recall at Axa XL after six years with the carrier.

-

Sources voiced some disappointment in the rate reduction but acknowledged the improved loss record of the contract.

-

Adias Gerbaud will be responsible for developing underwriting strategies, optimising product offerings and driving profitability for Axa XL in Europe, Asia and Australia.

-

At an event that brought together construction insurers, brokers, engineers and developers, delegates discussed an impasse over insuring sustainable development projects.

-

Based in New York, the executive will report to Axa XL CUO Libby Benet.

-

Demand for specialty commercial insurance in Australia has been increasing, driven in part by the growth of the digital economy alongside traditional industries.

-

Hayzelden has been charged with leading the firm's upstream energy team, covering both offshore oil and gas and offshore renewable wind risks.

-

It was reported last month that Axa was believed to be preparing for a sale of Axa XL Re.

-

Axa’s lack of success in selling its more volatile XL Re segment has led the insurer to cut back on those lines, but the current rate environment makes this a good time to revisit a sale.

-

It didn’t take long after the Validus-RenRe deal for the next possible reinsurance consolidation target to emerge.

-

The carrier will increase its involvement in renewables, and cut the carbon intensity of its motor and P&C book.

-

At this week's Bermuda Climate Summit, speakers heralded the Island's future as a centre of excellence for climate-related innovation and risk transfer.

-

A panel of sustainability leaders from Conduit Re, Axa XL, Convex and Vantage Risk discussed the need for a consistent methodology to measure underwriting emissions at the Bermuda Climate Summit.

-

-

The decaying oil tanker FSO Safer is holding over a million barrels of oil and is at risk of explosion.

-

The carrier has announced several changes to its management committee before revealing its new strategic plan early next year.

-

The carrier has been recruiting for the position following Steven Farr’s move to Tokio Marine HCC.

-

Sean McGovern said the appointment was part of an “important strategic initiative” for the company.

-

The carrier reported group revenue of EUR31.8n, 2.1% higher than in the prior-year quarter.

-

The underwriter has worked at various Axa entities for 13 years, holding a string of increasingly senior positions.

-

Sean McGovern, chair of the London Market Group, outlined why it is critical for the trade body’s outreach programme to build the market’s talent pipeline and attract data science expertise.

-

The underwriter has over a decade of cyber experience and has worked at Axa XL since 2020.

-

The appointment comes after a slew of cyber reinsurance brokers left Aon to join Howden.

-

Hannah Hosking will join from Chubb to lead the strategy across the business, focusing on growth at the higher end of the market segment.

-

Adam Lait is joining as senior underwriter, marine liability & ports, UK & Lloyd’s after a near-10-year tenure at Marsh.

-

The syndicate booked a comprehensive loss of £103.7mn for the year as its underwriting profit fell by 90%.

-

The MGA has $15mn of capacity to underwrite UK public corporations and plans to expand into the US market.

-

The biggest increases came from North American hurricane and earthquake coverage, where retentions rose from $350mn to $600mn.

-

The carrier also reported a drop in reinsurance revenue, with Axa XL Re reporting revenues of EUR3.2bn, a 27% fall from the year prior.

-

Stephanie Coxall joined the business in 2012 and progressed to hold several key roles, most recently leading Axa XL’s global learning academy.

-

According to sources, Daniel O’Connell will join Fidelis MGU as head of bespoke.

-

Felix Winzap will join the Swiss leadership team following the resignation of Peter Schmidt.

-

Tristan Abend has been with the Axa XL Reinsurance team for 10 years.

-

Francesca Giurato will take on a leadership role for both Dual Europe and Dual Italia, with the aim of building a European hub for the fine art business.

-

Prior to her promotion, Laura Casby was a senior underwriter in the UK and Lloyd’s upstream energy team.

-

Prior to her promotion, Kareen Richardson was a vice president, senior underwriter, in Axa XL’s excess casualty team.

-

The cyber specialist joins a company in growth mode, with acquisitions and new offices in London and Europe.

-

The executive joins from Aon where she spent 19 years in cyber roles including chief operating officer, chief commercial officer and chief broking officer.

-

A harder retro market will have a knock-on effect for London reinsurers, a panel of executives said at today’s London Market Conference hosted by Insurance Insider.

-

Some expressed disappointment at the rate change, but it came off the back of a major correction last year.

-

The French carrier’s P&C unit has been reducing exposure to nat cat during 2022.

-

The conflict has prompted a potential mismatch between insurer and client transition speeds.

-

Steven Farr has worked at Axa XL since 2007, then the Catlin business, holding a string of increasingly senior energy underwriting positions.

-

Last month, Axa XL appointed Mark Twite as CEO for its Bermuda reinsurance operations.

-

Mike Gazzard joined Axa XL in 2019 and was most recently vice president and senior underwriter of the carrier’s E&O portfolio strategy.

-

Prior to his new role, Mark Twite served as global head of reinsurance finance at Axa XL.

-

Insurance Insider selects 10 exclusive news stories reported by our team on the frontline at Monte Carlo Rendez-Vous.

-

Nigel Hinshelwood will succeed Claire Ighodaro on 1 January 2023, subject to regulatory approval.

-

The carrier will “hold the line” on property exposure with its key renewal clients, the executive explained.

-

Bertrand Romange will retain his current position of CEO for Europe and CUO of P&C International Re alongside his new duties.

-

Sabrina Lahrmann will be responsible for growing Axa XL’s international property portfolio.

-

Axa also announced the launch of a group EUR1bn share buy-back scheme.

-

In his new role, Adrian Burgess will be responsible for developing and managing underwriting strategies within Axa XL’s UK construction book.

-

Sarah White joins from HDI Specialty, where she spent more than 12 years, most recently as a senior underwriter and product lead for SME lawyers.

-

The market is concerned about potential claims from the Hellenic War Risks mutual, which has ships worth around $350mn stuck in the Black Sea.

-

The underwriter will focus on underwriting and marketing strategy in the region.

-

The underwriters are tasked with implementing “ambitious growth plans” across the lines of business.

-

Peter Kiernan replaces Simon Penney, who is moving to an analytics role.

-

The executive previously led financial lines in Iberia for the carrier.

-

Ian Sawyer worked at XL Catlin from 2006 to 2018, when he left to take up the global head of casualty role at SiriusPoint.

-

The incoming cyber head will step into the role left by Laura Hunt, who joined AIG last month.

-

The executive replaces Nancy Bewlay, who has moved to run the reinsurance division.

-

The new hire joins from Axa XL, with a background at Hiscox.

-

The underwriter has held the role on an interim basis since September last year.

-

The reorganisation is one of the first major changes to the reinsurance arm since Nancy Bewlay became CEO of the division.

-

A Q1 results update shows total revenues at Axa XL increased 4% to EUR6.2bn ($6.5bn) as top-line growth was offset by drop in revenue at Axa XL Re.

-

In a string of appointments, the carrier has also promoted Enrique López Torrents to country manager Iberia.

-

Conditions for SPAC D&O are likely to remain turbulent, amid the heightened SEC scrutiny and uncertainty concerning claims resolution.

-

The 2021 result is the first time Syndicate 2003 has turned an underwriting profit in four years.

-

Scor’s Malcolm Newman, Axa XL’s Sean McGovern and Aon’s Richard Dudley gave evidence to the Lords committee on regulation.

-

The new chief joined XL Catlin in 2017 and previously worked for Swiss Re and CV Starr.

-

The transaction will see Catlin redomiciled in Oklahoma, moving it from Delaware, to make use of the Oklahoma Insurance Business Transfer Act.

-

Axa XL has worked to trim volatility, reducing nat-cat reinsurance exposure by 40% and restructuring its reinsurance retentions.

-

Axa XL underwriters will be available for in-person meetings across all product lines every day of the week.

-

In her new role, De Rosa will oversee Axa’s construction and engineering treaty and facultative portfolio and strategy for clients in both the US and international markets.

-

Prior to securing the top A&H job, Andrew Maynard was global product lead for wholesale life and A&H.

-

The Axa XL executive said a parliament inquiry into London market regulation provides a platform to raise issues around the absence of UK captives and domestic reinsurers.

-

Prior to joining Sompo International, Patrick Corbett was life and A&H CUO at Axa XL for three years.

-

A total of 12 managing agents control £1bn or more of capacity, analysis shows.

-

Lindsay Astor’s appointment to the new role is effective immediately.

-

Speaking at an Insurance Insider panel event on the future of the market, Axa XL CEO Sean McGovern said the industry should focus less on “recycling” existing talent.

-

Axa XL’s global sustainability director set out practical considerations for insurers in their net-zero transitions at a conference today.

-

Allianz Global Corporate & Specialty (AGCS) hull underwriter Matthew Wells has resigned to join Axa XL, Insurance Insider can reveal.

-

Axa XL has promoted Olivia Shing to head of underwriting management, UK and Lloyd’s, in a role where she will execute the regional strategy to ensure sustainable profitability.

-

Axa XL anticipates booking losses of EUR400mn ($462mn) before tax and net of reinsurance from Hurricane Ida, the carrier has disclosed, as it reported total revenue growth of 3% in the first three quarters of 2021.

-

The executive and other ESG experts at the Airmic conference stressed the importance of insuring the transition to net-zero.

-

Nick Pascall becomes the latest senior member of staff to leave the business after a string of recent departures.

-

Despite the appointment of Alain Burguiere, it is understood that Elseco’s current head of aviation, Antoine Lamy, has not left the company.

-

The business has seen a number of senior staff in specialty lines exit recently.

-

Specialty (re)insurer Chaucer has appointed Xamira Groves as its new head of insurance, where she will work closely with the group’s syndicates to expand global market share across multiple P&C lines.

-

Plus the winners of the Insider Honours and all the top news from the week.

-

The inability to strike a deal sends both buyer and seller back to square one.

-

The carrier said the move is part of its plan to simply group reinsurance operations.

-

In his new role, Andy MacFarlane will be in charge of developing Axa’s climate strategy.

-

Stephen Clark will also keep his responsibilities as North America hull and liabilities practice leader, a role he has held since 2017.

-

As part of his promotion, Andrew Innes will also join the division’s global aerospace leadership team.

-

Nine (re)insurance firms in London took part in the programme for career-break women, organised by diversity and inclusion firm Inclusivity and supported by the Insurance Families Network.

-

Dane Mahoney, who has been with Axa XL since 2013, will lead a team of global risk analysts and develop the global underwriting strategy.

-

The hull market has seen multiple years of positive rating momentum following a period of prolonged soft conditions.

-

The executive said the carrier would continue with its underwriting approach and benefit from pricing tailwinds.

-

Axa almost doubled its profits at a group level, and the business expects claims of EUR400mn from recent European floods.

-

The carrier’s global head of hull Mike MacColl resigned from the business earlier this year to join Atrium.

-

Any transaction would be predicated on a major reorganisation of the acquisition target, slowing deal progress.

-

The executive spoke exclusively to Insurance Insider about his role leading the London Market Group’s five-point plan to lobby for UK regulatory reforms.

-

The new hire joins from Axis’ capital risk solutions team.

-

Ress will lead Axa XL’s underwriting strategy for general liability, motor and environmental insurance in Europe and the APAC region.

-

The carrier has reshaped its hull leadership team since the departure of global head of hull Mike MacColl.

-

Although superficially a good match, Axa would run significant risks in pursuing a sale of its reinsurance arm to the French mutual.

-

If Covea agrees a sale price in this range for the operations, parent Axa could book a EUR1bn gain, Berenberg claimed.

-

The French mutual has been looking to expand, with recent unsuccessful attempts to acquire Scor and PartnerRe.

-

The carrier has also promoted internally for a new leader of its US political risk, credit and bond team as it continues to staff up the division.

-

The former underwriter will take up the newly created role on 9 August.

-

The research body said that both businesses had reported poor underwriting results.

-

The CEO said he had “no regrets” in taking the radical actions needed to stem losses at the unit.

-

The ILS vehicle has support from four key providers and will be launched alongside a broader offering including K&R, fine art and other specialty risks.

-

Sources say the pipeline operator has at least $15mn in cyber insurance cover.

-

The former Zurich Ireland CUO will take on the role from July and report to UK & Lloyd’s market CUO Luis Prato.

-

Axa France says it will continue to reimburse policyholders for breach response costs.

-

Piers Tuggey has served as interim head since December and worked at both predecessor entities Catlin and XL Catlin.

-

Parent Axa says the unit is on track to achieve a full-year earnings target of EUR1.2bn ($1.4bn).

-

The former financial lines CUO will start at the end of the month and be based in Switzerland.

-

Trade association research found that women make up only 27% of directors at 31 member companies surveyed.

-

The MGA will cover power, mining, chemical processing industries and public and private building sectors and civil infrastructure risks.

-

After years of poor performance and talent flight, Insurance Insider examines the challenges faced by Axa XL and the strengths it holds to forge a new start.

-

Binding insurers include Chubb and AIG, with reinsurance from Munich Re.

-

The former Asia Pacific head of marine will relocate to London.

-

The creation of a single Bermuda reinsurance company removes a key structural impediment to a sale.

-

Gallagher is the broker for Indonesian state oil firm Pertamina, with AIG and Axa XL understood to participate.

-

The new Axa XL Reinsurance Limited consolidates the carrier’s reinsurance operations.

-

Axa XL’s flagship Syndicate 2003 reported a loss of £334mn ($459mn) for the year as its combined ratio deteriorated by 23.8 points to 133.8% on Covid-19 losses and adverse development on long-tail lines.

-

The Week in 90 Seconds: Biometric data and cyber; Greensill collapse; Guy Carpenter’s Priebe on pandemic risk; Texas storm; Marsh McLennan’s Glaser

-

The new recruit will be head of international war and terror underwriting and work alongside Quentin Prebble.

-

The marine hull and war underwriter will rejoin former colleague Chris Goddard, who launched the start-up last year.

-

In securing the Enstar ADC, Axa XL has drawn a line in the sand and signalled a fresh start to investors.

-

The four major developments of the week include:

-

The carrier is one of a number of players to have entered the D&O market as pricing continues to grow.

-

The team of around 30 staff will manage the run-off of Axa XL’s existing book and launch a product with Aviva.

-

Pressed for time? This selection of articles will bring you up to speed fast:

-

The new recruit will take on the role of head of Europe for the growing M&A team.

-

The two-layer arrangement includes a 10% retention and involves a premium of just under $1.4bn.

-

Yosha DeLong will be cyber underwriting head, whilst James Tuplin will be international head of cyber underwriting.

-

The broker said that the carrier’s decision had forced some clients to rebuild policies from scratch.

-

The firm’s mean pay differential also shrank 10 points to 29.6%.

-

Robertson will join as deputy group CEO before taking the CEO job, with Michael Watson staying on as chairman.

-

Michael Yeats will oversee the carrier’s reinsurance offices in Bogota, Buenos Aires, Miami and Sao Paulo.

-

He reports to the carrier’s global chief underwriting officer for financial lines, Libby Benet.

-

Ashok Krishnan moves into the London-based role from Axa Hong Kong.

-

It is understood the book will be reinsured to close into Compre’s new legacy syndicate once the launch is approved.

-

Scully fills a gap left by the departure of Steve Hartwig to Ark last year.

-

The carrier’s former energy, property and construction claims lead exits for consultancy position.

-

The management liability market underwent huge hardening last year as major carriers withdrew.

-

The deal, pitched at a multiple of 12.2x 2019 earnings, follows disposal agreements for Axa in the Gulf, central and eastern Europe and India.

-

Major consolidation laid the ground for current new launches, the Conduit chairman suggested.

-

David Gallagher has left his role, after more than 26 years with the business.

-

The appointment confirms the carrier’s prospective involvement in the rapidly hardening market.

-

The executive replaces Urs Uhlmann, who left the company in October.

-

There will be significant movements in the ranks of the top 10 syndicates in 2021, with Brit moving into second place and Axa XL tumbling to 7th.

-

The new Syndicate 1796 is the conduit for the initiative and is backed by 14 global (re)insurers.

-

The local Organising Committee expects to receive around 50bn yen ($481mn) for the initial delay.

-

The underwriter’s resignation marks the latest in a string of senior departures at the carrier.

-

The US carrier has offloaded a tranche of liability business written out of London.

-

The Axa CEO has “very high confidence” that Scott Gunter and his team will achieve EUR1.2bn in underlying earnings by 2021.

-

The insurance regulator suggests Solvency II reforms should include a provision to ban shareholder handouts in times of crisis.

-

What really moves the needle at Lloyd’s is when the biggest beasts start to draw in their horns.

-

The executive takes over from Peter Welton, who was made UK & Lloyd’s CUO for marine, energy and aerospace earlier this year.

-

James Tuplin has worked at the carrier for nearly four years and has taken redundancy as the business continues its restructure.

-

The executive has worked at Axa XL and legacy XL Catlin since 2011.

-

AIG shares climbed 13% to $37.52, compared with a 1.2% increase in the overall S&P 500 index.

-

The Axa XL UK and Lloyd's chief says the outlook influenced its decision to put its UK and Lloyd’s executive liability and financial institutions book into run-off.

-

CFO Bouas-Laurent reassures analysts that the cash injection will not harm solvency.

-

Parent Axa leaves its EUR1.5bn estimate for Covid-19 losses unchanged at the nine-month mark.

-

The insurance industry should use the wake of the pandemic to “build back better” says the Axa CEO.

-

The industry group highlights Swiss, US, Asian and Middle Eastern outreach.

-

The carrier’s Polish, Czech and Slovakian operations are now owned by Uniqa.

-

The decision follows an earlier move to shrink the book and the departure of CUO of international financial lines Tim Powell.

-

The carrier has implemented a new operating model designed to empower leadership in its regions.

-

The CEO said future uncertainty and the “enormity” of corporate debt posed a significant challenge for the insurance sector.

-

The changes are part of the carrier’s move to a more regional operating model.

-

The carrier unveils a carbon management strategy to tackle climate change.

-

As rating soars and income dries up, clients are forced to cut limits and take on higher deductibles.

-

D&O is a major focus of the remediation work, with new business halted and a number of accounts expected to be non-renewed.

-

Analyst Philip Kett said that the move could lift the company’s valuation.

-

Jonathan Salter replaces Corinne Vitrac, who will become head of group P&C risk management.

-

Future trading arrangements and the need to make London more competitive will top the new business environment sponsor’s agenda.

-

Sources said the legacy arm of Axa had lost some investor support for the second of its funds used to back legacy acquisitions.

-

April McLaughlin will manage and expand its multi-line reinsurance offering within the region.

-

The potential disposal coincides with sale processes in locations including Singapore, Belgium and Central and Eastern Europe.

-

Liability losses on the Willis Re-brokered policy will take the claims tally above the expected total $50mn hull loss.

-

Ahead of the Dive In festival, the Axa XL UK and Lloyd’s CEO said better data collection for D&I was imperative to achieve progress.

-

Investors react after the carriers’ group earnings almost halve year on year.

-

Reinsurance, crisis management and art and specie are areas of opportunity, according to the Axa XL chief.

-

Axa estimated its total 2020 impact from Covid-19 for the group at EUR1.5bn, which it booked in the first half.

-

Three senior executives take on new roles after the appointment of Sean McGovern as permanent chief of the regional unit.

-

McGovern was named as permanent CEO for UK and Lloyd’s at Axa XL earlier this week.

-

The former Lloyd’s exec takes the helm as the carrier pivots towards a new structure with more regional autonomy.

-

The pull back of a key lead market comes at a time of significant hardening in the D&O space.

-

The licence makes it the first Shanghai-based reinsurance subsidiary and the first foreign-owned reinsurance subsidiary in China.

-

Concerns over crew liability claims have led carriers to change wordings and tighten underwriting criteria.

-

Munich Re Syndicate has appointed Rob McAdams as its new head of marine, replacing Simon Parnell, who is retiring after 21 years at the company.

-

The experienced underwriter replaces Simon Parnell, who is retiring after a long career at the firm.

-

Willis Towers Watson’s Michael Clarke and Generali’s Robyn Warke are to join the carrier.

-

The former Axa China CEO and Middle Eastern healthcare architect steps up.

-

The carrier will have to compensate a Parisian restaurateur for two months’ lost earnings.

-

Analyst Michael Huttner predicts that rising rates could allow Zurich to recover pandemic losses in just a year.

-

Analyst Michael Huttner forecasts lower pandemic-related losses for the Axa unit than for Allianz.

-

Coronavirus’ unwanted record; John Neal speaks out; structured credit freezes up.

-

The carrier positions itself to take advantage of rising rates following Covid-19 losses.

-

Nancy Bewlay takes on the role of global CUO while Sean McGovern becomes interim CEO for the UK and Lloyd’s market.

-

Philip Kett said Axa’s likely loss for the outright cancellation of the games would be EUR60mn.

-

The syndicate narrowed its underwriting loss year on year with a combined ratio of 110 percent.

-

The cancellation comes amid market-wide pressure on broker facilities.

-

The position at the carrier was vacant following the elevation of Peter Welton to UK head of energy.

-

Chris Williams previously spent 12 years as class underwriter for bloodstock at the Fairfax-owned company.

-

The carrier looks to capitalise on a pricing correction in the class.

-

Coronavirus and the contingency market, the future of Axa XL, and more.

-

The move is the latest in a string of deals with companies including BorgWarner, Zurich and Munich Re.

-

The appointment of Scott Gunter as Axa XL CEO has surprised the market.

-

The unit also cuts its property cat appetite and reduces line sizes in casualty lines.

-

Cat losses and large man-made claims weigh on the division's earnings.

-

The surprise move reflects a desire to bolster profitability at the specialty business, group CEO Buberl says.

-

The International Group originally notified reinsurers of a $115mn loss.

-

Carriers led by Axa XL are accused of “not acting in good faith” and acting “miserly”.

-

The combined vehicle will write P&C cover for amusement parks, arcades and carnivals.

-

Elizabeth Benet has a long career in specialty lines underwriting.

-

Hancock’s shock departure, Pioneer for sale, AJG’s Matson on record and more loss updates.

-

Katy Bradica returns to the carrier after nine months as AIG’s chief actuary for North America, while Mary Latham joins from Beazley.

-

The case exemplifies the complications historic opioid claims are causing in the market.

-

Odette Novoa and Erica Delaney join the insurer’s New York office.

-

The issues lag the size of expiring ILS cover for both carriers.

-

The flagship facility retains QBE and Axa XL for 2020 participation.

-

The firm provides real estate investors and developers across Europe, India and the Americas with cover.

-

Sheri Wilbanks was at AIG for more than 14 years, most recently as its global innovation lead for its Client Risk Solutions division.

-

The Fleet UK product is distributed around 600 brokers and combines risk management services, with telematics and fleet analysis.

-

The latest Galileo cat bond has five tranches and will cover various natural catastrophe risks in the US, Canada, Puerto Rico and the US Virgin Islands, Europe and Australia.

-

Nine-month revenues were up 11 percent year on year, driven by growth in P&C insurance.

-

Mark Campbell and David Walker will be wholesale A&H underwriting manager and class underwriter, respectively.

-

Great American replaces Axa-XL as a paper provider for the AJ Gallagher-owned marine managing general agent.

-

Peter Welton becomes UK energy head to replace Luis Prato, who was promoted to CUO of Axa XL UK legal entities.

-

Size of payout will depend on whether CBI sub-limit of $100mn holds, with insured seeking $450mn.

-

Tokio Marine is likely to retain a significant portion of Pure’s $666mn of 2018 ceded premium net.

-

The hire helps to replenish a team depleted by appointments at Convex.

-

Matt Lucas joins as managing director of business development, while Dvorit Mausner will be director of execution.

-

Michelle Jensen and Pietro Tarone will take up the respective roles of senior underwriter and underwriter.

-

Saverio Longo will take on the role from Simona Fumagalli following her move to a European financial lines leadership role.

-

The deal is Axa Liabilities Managers’ 20th run-off purchase.

-

The appointments come after the company named a new head of UK coverholder management.

-

The executive becomes a permanent replacement for Paul Greensmith, who took the CEO role at the UK businesses last year.

-

The carrier would consider a vehicle if it allowed the matching of the right capital to risk, the Axa XL CEO said.

-

The CEO said in three years the third-party capital platform could support risk from across the parent group.

-

John Welsh will become international markets chief at the start of next year.

-

The promotion of Paul Howard is part of a wider investment push in the delegated authorities segment.

-

The internal promotion comes after Steve Hawkins left the firm for Convex.

-

Axa XL leads the Arkansas-headquartered food company’s property programme, according to market sources.

-

Arezes joins the carrier’s Toronto-based property operation from Zurich.

-

The new recruit joins after a 19-year international career with Axa XL.

-

Further details of the cyber placement show the risk is fairly evenly spread across the US, Bermuda and London markets.

-

The Pennsylvania-based grocer has been named in multiple lawsuits by plaintiffs seeking to recover billions of dollars over opioids.

-

The Axa veteran joins the European team from the Indonesian arm of the business.

-

Anne Middleton spent almost seven years at Catlin and successor entities after moving into the sector from PwC.

-

The Insurance Insider ran an analysis into syndicate administrative costs after Lloyd’s found no correlation between the size of a syndicate and its admin expense ratio.

-

The former RMS CEO spoke Wednesday at a marine industry conference.

-

Tom Houston will work with upstream specialist Steve Hawkins at the new carrier.

-

Sometimes, something sounds like such a simple idea that you write it off as unimportant.

-

Paul Newton is understood to have parted ways with the global carrier.

-

Group deputy CEO and CFO Gérald Harlin shrugs off senior Axa XL underwriting departures to Convex.

-

Up to 125 claims-handling positions in Axa UK’s offices could be eliminated.

-

Start-up hires Pagram as part of talent acquisition spree.

-

Sometimes start-up carriers are formed when it is an obviously good time to do so.

-

The promotion of Charlotte Wilson follows a series of leadership changes since the September merger.

-

The executive took an advisory role when Axa XL bought out minority investors in the funds platform last year.

-

Reserve strengthening eclipses an improvement in the underwriting result.

-

The MGA aims for US expansion with the appointment of the executive as country CEO

-

The hires complete the Bermuda-headquartered (re)insurer’s top team as it gears up to launch.

-

People keep asking me how I think Steve McGill and John Lloyd’s start-up will do.

-

The restructuring is expected to save close to EUR100mn($113.3mn) in reinsurance costs.

-

Axa XL was in the headlines yesterday for making up to 7.5 percent of its workforce redundant.

-

The carrier received in-principle approval to move XL Insurance Company to Ireland late last year.

-

The company market association hires a consultant to help members maximise value from the DXC deal.

-

Settle in for The Insurance Insider’s 12 days of Insurancemas.

-

Chokshi takes over leading the binding authority and brokerage business from Karl Fischbach.

-

The four-strong team has moved to the London-based start-up.

-

The departure follows the exit of another co-founder last year.

-

Market sources described a frenetic dynamic between underwriting leaders and followers in the verticalised market.

-

Move is a sign of Axa XL’s commitment to the ILS space.

-

Following new investment, Akinova has brought in the experienced Paul Jardine.

-

The underwriting team will write Africa-focused risks on Catlin Syndicate 2003 paper.

-

The 502-room resort hotel on St. Thomas sustained extensive damage during the September 2017 hurricanes.

-

Executives are working with Evercore to raise $3bn for the start-up.

-

I remember having a conversation with a (re)insurance executive when they had hired a team to enter a horribly priced line of business.

-

The executive was responsible for a ceded reinsurance portfolio of more than $4bn

-

The Lloyd’s market veterans will join a third-party managing agent responsible for 10 syndicates and two special-purpose arrangements.

-

Ireland's central bank has given the go-ahead for the insurance group to move its XL Insurance subsidiary to Dublin.

-

Michael losses are likely to fall on the reinsurance market due to the low attachment points of the Floridian homeowners’ insurers.

-

Dan Curran forged a career as a casualty underwriter at Catlin, after joining the company in 2000.

-

More involvement on co-investment and co-participation will be key for reinsurers in the future, says AXA XL’s Daniel Brookman.

-

The class underwriter for accident and health had worked at the carrier since 2009.

-

The US will be the MGA’s expansion focal point, with two teams likely to be added annually.

-

Slice Labs aims to use the cash to respond to robust demand for its cloud services.

-

Axa XL promoted Vivienne Moniz and Elaine Scully to country excess casualty heads.

-

Catherine Duffy will join the US giant at an undetermined future date.

-

The spate of Bermudian deals pointed to the quality of the carriers, Duperreault said.

-

The London market hire comes after the analytics company raised a further $16.5mn in a funding round led by XL Innovate.

-

David Watson gets wider role while Bertrand Romagne is promoted.

-

Axa’s $15.3bn XL deal took a step closer to getting done with New York’s approval.

-

Reinsurers will keep trying to build scale but dealmaking won’t solve difficulties.

-

Kopser will begin as North American division chief on 8 October, based in New York.

-

The carrier has hired Naveed Khalidi and Michelle Jensen.

-

InsurTechs among the first to embrace the robot revolution.

-

Weaker reserve development and accident-year results undercut investment gains and other positives.

-

Senior underwriter Fergus Fergusson will take over following the departure of Donnacha Smyth to XL Catlin.

-

The market curtailed its projections as carriers failed to secure sought-after rate rises.

-

Richard Slater joins from XL Catlin as underwriting director, while Adam Champion leaves MS Amlin to take the role of senior vice president, portfolio manager and operations.

-

There were positive share price changes over the quarter from only 13 companies in the index.

-

Stefan Homberger named international casualty head as Arielle Moody moves to team lead.

-

The head of A&H at Everest Re’s syndicate business has resigned, this publication can reveal.

-

They have taken over the lead of the US facility from Beazley and XL Catlin, this publication can reveal.

-

Bruce Carman’s new venture has named Will Gaunt as class underwriter.

-

Bob Eells will be COO of Validus Specialty, Western World and Crop Risk Services.

-

Conservatism in The Hanover board could yet delay the outflow of Chinese money into the insurance sector.

-

Our analysis looked at the total compensation received by named executive officers.

-

Ranzetta works at Vibe while De Vido works at XL Catlin.

-

Underwriting opportunities become the focus in Q4 2017 and Q1 2018.

-

The InsurTech becomes another program administrator the carrier will work with.

-

The insurer-owned blockchain start-up B3i is to build its systems on a blockchain platform developed by banking sector technology consortium R3.

-

The Liberty Mutual unit has added ex-bankers and lawyers to Swan’s new M&A team.

-

Coutts spent 10 years at Brit and 19 at CNA.

-

It is still unclear where the product-market fit is for blockchain in insurance, according to a speaker at the InsiderTech London conference.

-

Accelerate CEO says failure is a natural part of experimentation.

-

Auto Terror Protect arrives as the insurance sector rethinks liability for such attacks.

-

Buyer Allianz would probably offer shares for its Swiss peer, the analysts say.

-

The insurance sector is making strides towards better D&I and that is to be applauded.

-

Smyth returns to XL from Aspen, which he joined in 2016.

-

The P&I and marine carrier now leads Maersk’s hull insurance policy.

-

The former XL Catlin president will join the board of Envelop Risk.

-

Benjamin will become the head of management solutions at Zurich North America.

-

The insurer will extend its global capacity in the line by 20 percent.