-

The London MGA is considering various options, including a minority investor.

-

The Jay Rittberg-led program manager kicked off a strategic process in August.

-

Christopher Reynolds and AJ Jones have been hired as business development directors.

-

The executive is charged with defrauding investors out of nearly $500mn.

-

A Lloyd’s consortium led by Beat Syndicate 4242 backs the MGA.

-

The executive has run the MGA platform since its 2017 inception.

-

Neil Ross was also appointed CUO for the broker’s MGA.

-

The MGA is also looking to build out its US mid-market professional liability expertise.

-

Carriers are rethinking the traditional renewal-rights model.

-

The Ryan Specialty renewables MGA launched an international arm last year.

-

Pryor-White founded Tarian Underwriting, which was sold to Corvus in 2022.

-

It comes as the MGA expects to write more than $1bn of premium in 2026.

-

The underwriter has worked for Markel in Singapore since 2020.

-

The carrier has renewed and extended its capacity arrangement with the MGA.

-

Seller White Mountains will retain a roughly 15% fully diluted equity stake.

-

West Hill Capital is the main investor in the capital raise.

-

The business has been ~70% owned by White Mountains since January 2024.

-

The firm offered W&I cover with capacity of up to £16mn per transaction.

-

The MGA secured a “significant strategic investment” from Zurich earlier this year.

-

Kantara now holds a majority stake in the MGA, with the rest held by employees.

-

The vehicle will now cover an E&S program jointly launched with Accredited.

-

The company will continue its capacity partnership with the MGA until 2030.

-

The BP Marsh-backed MGA launched earlier this year, led by Adam Kembrooke.

-

This will be Fidelis’ first office in North America and will be led by former Navigators Re head Ivan Vega.

-

MGA Amiga Specialty launched in May, with backing from investor BP Marsh.

-

The market turn may give some staff pause for thought, but reward remains high.

-

The change in reinsurance intermediary follows an RFP for the account.

-

It said the loss did not reflect the underlying economic performance of the business.

-

The measures also seek to encourage greater wildfire mitigation efforts.

-

The sidecar will support five programs providing specialty frequency coverages.

-

-

The business has ramped up its underwriting volume since launching in Lloyd’s last July.

-

Insurance Insider reported earlier today of the asset manager’s foray into the MGA space.

-

The MGA is backed by three Lloyd’s syndicates, offering capacity limits of up to $10mn.

-

The business said it was experiencing strong momentum on the Island.

-

The deal represents a first entry into the US MGA market for the $1.1tn asset manager.

-

The Howden MGA established its marine presence in the Netherlands in 2023.

-

The deal is expected to result in $700mn in combined GWP in Florida upon completion.

-

The MGA has set a "new market benchmark" for non-US primary tax risk, it said.

-

The vehicle will provide a streamlined route for capital to its client MGAs.

-

Pine Walk has grown substantially and is on course to write $1.2bn of premium this year.

-

The Argenta-backed MGA is already active in the cargo and property classes of business.

-

The departure follows an investigation into an “offensive” email sent by Rouse.

-

The treaty underwriter is set to run an MGA within the group.

-

Former Hannover Re CEO Jean-Jacques Henchoz received the Lifetime Achievement award.

-

Jane Poole will succeed Michael Grist, who exits after nearly 16 years.

-

The deal ends Livingbridge’s two-year attempt to sell the UK broking/MGA platform.

-

Sources said that the NY-based TL underwriter has retained Piper Sandler to run the process.

-

Submission volume is up 10%-20%, according to sources.

-

Property MGA Arden Insurance Services specialises in multi-family habitations.

-

The executive has worked for JLT Re, Lockton Re, Willis Re and US Re.

-

Ex-Tysers chairperson Dan Lott heads the consultancy as CEO.

-

This publication revealed two years ago that EQT could lodge a $1bn claim.

-

He joins from MS Amlin, where he was lead underwriter for US casualty.

-

The family-owned group is embarking on a major international expansion.

-

Arch will continue to provide long-term capacity for the MGA.

-

The company has also expanded its relationships with US and UK MGAs.

-

Verita leadership and staff will remain intact and “seamlessly functional”.

-

The underwriter was head of financial institutions at LSM for six years.

-

Nadia Beckert was promoted to Bermuda CUO in March.

-

The MGA will initially focus on credit, energy and construction.

-

The transaction is expected to have a price-to-earnings multiple of 11x.

-

The firm will target mid-market risks with TIVs of $25mn-$1bn.

-

In part II of our series, we look at where AI is being integrated into claims departments.

-

The legacy player is working to secure its first deal, and could look to expand to US E&S.

-

Insight into the state of the insurance M&A market, powered by this publication's deal database.

-

Demian Smith joins from Guy Carpenter.

-

The fronting insurer will be able to support MGAs across the 27 EU states.

-

Sources said MarshBerry is advising the underwriter.

-

The MGA no longer has an FCA licence and was wound up in May.

-

The medical professional liability firm is targeting further healthcare opportunities.

-

The medical liability carrier said the deal marks a strategic shift.

-

In March 2024, Cowen was appointed to lead Chubb’s new international transactional liability platform.

-

The MGA has also appointed Probitas alumnus Kiran Wignall.

-

The MGA has recently added casualty and specialty reinsurance divisions.

-

The MGA has secured Lloyd’s paper to write crypto theft insurance.

-

A representative from the carrier said Nexus is responding “with urgency”.

-

Patel has run the MGA platform since its launch in 2017.

-

Dan Prince said the firm will work with brokers’ existing relationships.

-

Plus, the latest people moves and all the top news of the week.

-

The executive said there was an ‘active cross-sell culture’ across The Fidelis Partnership.

-

How is The Fidelis Partnership choosing to launch into new insurance classes as it rapidly expands?

-

BP Marsh announced its backing of Amiga, which is led by Adam Kembrooke, last month.

-

The start-up aims to bind its first risk in Q4 2025.

-

The MGA will write natural resources professional liability business.

-

Volante joins capacity providers Allianz and Tokio Marine Kiln.

-

Syndicate 1947 is gearing up to expand its marine reinsurance portfolio.

-

The business is one of the first to sell in this round of Lloyd’s M&A.

-

The Bermudian investor already owned a 1% interest in the NY-based MGA platform.

-

The challenge now is balancing top-line growth with underwriting discipline amid falling rates.

-

Carriers expect a rise in the severity and frequency of claims over the next two years.

-

The MGA has been through a remedial exercise under Acrisure’s ownership.

-

The executive told this publication he will have more time “to propel” embedded auto MGA In The Car.

-

There has been an uptick in UK retail firms buying cyber after a string of attacks.

-

The awards will be held on 3 September at The Brewery in London.

-

Last month, Combarro announced his exit on LinkedIn after 17 years at Lockton.

-

The underwriter has worked for RiverStone, Advent, Lloyd’s and AIG.

-

Holschneider co-founded the firm and is currently executive chairman.

-

Volante’s syndicate may still support select transactional liability risks, but it will not have an in-house team.

-

Peter Montanaro retired from his role as market oversight director at Lloyd’s in May.

-

Nick Line has spent 28 years at Markel, where he has been CUO since 2018.

-

The executive said the MGA model is here to stay and offers an “immense value”.

-

Is the huge growth experienced by the MGA sector run out of steam?

-

The pair is looking to provide investment and strategic advice to early-stage firms.

-

Logue replaces Richard Barke, who is moving to a senior leadership role at Asta owner Davies.

-

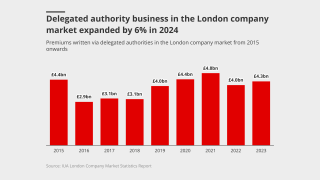

In 2024, MGA GWP reached approximately $20bn in Europe.

-

BP Marsh has subscribed for a 49% shareholding in the start-up MGA.

-

The MGA has built out a suite of products, including a planned launch into political violence.

-

The purchase aims to bolster Markel’s marine product line in the Asia-Pacific region and EU.

-

Jack Kenneally will take on the role of class underwriter at the MGA.

-

Sam Wylie has been appointed portfolio manager.

-

Bredahl has been appointed CEO and Bonneau as chairman.

-

Starr and Axon also are among those exposed to the Marsh USA-placed $40mn line.

-

There have been several personnel moves in the fast-growing tax insurance space recently.

-

He will also invest in the company.

-

In January, 32 Acquinex employees resigned, with 22 moving to Howden’s underwriting arm.

-

Motion Specialty will initially focus on high value home and flood insurance in the US.

-

Delegates welcomed the FCA’s red-tape cut, but said more is yet to come.

-

Sources said MarshBerry was retained earlier this year to run the sale.

-

The executive previously worked at Hiscox and Aviva.

-

The MGA is building out its product base from its latent defects and surety offering.

-

The group has hired Hines Associates to advise on the process.

-

Jacqui Ferrier speaks with Insurance Insider in her first interview since taking the reins.

-

The executive was head of fine art and specie at Miller until February 2025.

-

The appointment follows the recent exits of CUO Chatterjee and SVP Dharma-Wardana.

-

The Nordic operations have capacity provided by Allianz Commercial.

-

These resignations come as many former Acquinex employees begin their new roles at Dual this week.

-

Co-founder and CUO Jacqui Ferrier has been appointed his successor.

-

The firm acted as the front for Trouvaille Re, the E&S property sidecar for MGA AmRisc.

-

Alongside Chatterjee, SVP Dharma-Wardana has also exited the team.

-

Giles Hussey is set to join from Guy Carpenter.

-

Meco's 2024 gross written premiums totaled $63mn.

-

Methven joined the MGA in 2002.

-

Due diligence is essential to make sure incubators are backing winners.

-

Alex Amezquita will fill Cahill’s previous position as CFO.

-

In January, 32 Acquinex transactional liability employees resigned for Howden’s underwriting arm, Dual.

-

The move was influenced by fierce competition in the domestic US D&O market.

-

Trouvaille II raised $580mn for 2025, compared to $325mn in 2024.

-

The specialty MGA has been pursuing an M&A strategy in recent months.

-

The group is expecting to announce more M&A deals this year.

-

The coverholder’s deal with SiriusPoint expired at 1.4.

-

Chris Jones, Will Shepherd-Barron and David Clark will join the start-up.

-

Allianz has previously entered several capacity arrangements with the MGA.

-

The strategic investment supports Icen’s international ambitions.

-

The Paragon-owned coverholder is known as a specialist in film insurance.

-

The MGA will be Pine Walk’s 13th start-up.

-

Personnel movement has been high in the PVT class as new capacity enters the market.

-

PartnerRe's $5mn commitment will enable the MGA to expand its D&O line size.

-

The product offering is led by Rob Earrey and James Harris.

-

The MGA will operate as an appointed representative of Davies.

-

Sources said Insurance Advisory Partners is advising the fac MGA on the strategic process.

-

CEO Rinku Patel said the move marked a “clear step change” in Pine Walk’s MGA strategy.

-

Evercore has reached out to a combination of strategics and private equity houses.

-

The binder will provide capacity for international fac property, power and onshore energy.

-

The business offers parametric windstorm coverage.

-

The property and specialty insurer reported underwriting profits of $131mn ($170mn).

-

The company’s syndicate has booked an 87.4% combined ratio for 2024.

-

The MGA is offering lines of $25mn, up from the $10mn limit it was providing until late last year.

-

The transactional liability-focused MGA's Lloyd’s line is up from £37.5mn to £40mn.

-

Staff who left SRG’s MX Underwriting will begin working for Canopy this year.

-

The offering includes GA, aviation GL and airport and product manufacturers liability.

-

The product provides primary and excess coverage limits up to £5mn.

-

The executive said MGA and broking start-up activity looked set to continue.

-

Is the MGA start-up boom here to stay?

-

The MGA will be trying to replace the transactional liability capacity in the coming weeks.

-

The group joined Velocity in December and includes James Robertson.

-

The distribution firm has accused the MGA platform of illegally recruiting staff.

-

The executive also spent nine years at Ace.

-

The niche auto underwriting cell was the first to launch on the MGA platform.

-

Last month, MGA Acquinex’s 20+ transactional risk team resigned for roles at Howden-owned MGA Dual.

-

The MGA launched last October with a B.P. Marsh investment.

-

The MGA will have a broad casualty-focused appetite with Lloyd’s capacity backing.

-

This was Ryan’s second-largest 2024 deal, after its $1.4bn Assure purchase.

-

The broker is understood to be seeking a consideration of £3.75bn+.

-

The investors are led by PE firm NMS Capital Group.

-

The MGA’s US clients will now have access to London market capacity.

-

The traditional R&W product is seeing an increasing number of large losses.

-

The business has so far invested in ProMarine and Killara Cyber.

-

The specialty MGA is being watched closely by PE houses for signs of movement on a sale.

-

Talbir Bains founded the Acrisure-owned MGA in 2018.

-

The organisation has released its mission for 2025 and signed a MoU with the ABI.

-

CUO responsibilities will now be split out across senior underwriting leadership.

-

Gary Head led the schemes & delegated authority, FL and specialty teams at Axa.

-

The facility is backed by a $10mn Lloyd’s binder.

-

The MGA and 49% owner SiriusPoint could bring in a new investor.

-

He succeeds James Potter, who is set to become chairman at Rokstone.

-

The MGA has faced high claims activity on its energy liability book, fuelled by social inflation.

-

VUW.ai rebranded from Vi Digital last March.

-

-

The unit will write business from Australia, Canada, the UK and Europe.

-

The executive said that the fragmentation of the European market has proved a barrier to entry in the past.

-

CEO McManus vows broker “will not be silent” over “unlawful” competitor behaviour.

-

The insurer has renewed separate three and five-year arrangements.

-

Sources said that the new paper is replacing PartnerRe capacity that was backing the MGA.

-

The new European A&H business will be led by Samia Baliad, who joins the company from Axa.

-

Transactional risk head Smith has spent the last six years at Acquinex in various senior roles.

-

Charlton joins specialist construction MGA from Consort Technical Underwriting Managers.

-

The pair have joined from Ryan Specialty Group’s Castel.

-

The MGA can now put down $200mn lines in the niche aviation war class.

-

The programme was developed in collaboration with Allianz Commercial.

-

This publication revealed on Friday that Reith was joining the firm, having departed from Helios in June.

-

The executive will play a key role in capital arrangements for Acrisure’s suite of underwriting units.

-

The executive will look to develop the MGA’s specialty underwriting portfolio.

-

David Hughes has a line size of A$10mn with a global mandate.

-

-

The underwriter most recently worked as head of hull and war for Travelers Syndicate 5000.

-

The firm said the UK hub demonstrates its commitment to expanding in Europe.

-

The MGU also announced a string of promotions to leadership, including RWI CUOs and a new head of Europe.

-

-

Jamie Cann, previous head of aviation and space at the Fidelis Partnership, also joined Axa XL.

-

Castel founder Mark Birrell will take the role of executive chairman.

-

-

The Pen Underwriting MGA is expanding from its marine war specialism.

-

The hybrid fronting carrier was launched last year and is led by Talbot alumnus Sam Reeder.

-

The deal follows Bishop Street’s acquisition of Ethos’ TL operations from Ascot.

-

Amwins is working to build out its London underwriting business.

-

The marine MGA is continuing to build out its staff base and product offering.

-

The underwriter will manage and develop the MGA’s professional indemnity portfolio.

-

Several businesses are set to launch new marine offerings in 2025.

-

The partnership is Fidelis Insurance Group’s first third-party capacity deal.

-

The business will trade via London, the US and Canada.

-

The wholesaler also paid $11.7mn in cash to Alera for the acquisition of Greenhill Underwriting.

-

A significant amount of new capacity has flowed into the political violence and terror market in recent months.

-

Former PWC partner Tom Brown has been named interim CFO.

-

The marine underwriter said the business had grown through taking “very big positions” on programmes.

-

How do you build a $400mn MGA? Navium Marine CEO Clive Washbourn told Behind the Headlines that his business is a "fighter jet" out hunting for deals. Navium has built scale by taking on risk "in a fairly aggressive way" with large line sizes available to deploy. Whilst the marine market is now coming under pressure, Washbourn still thinks there is "robustness" in rating, although making money in the volatile Red Sea war market is challenging.

-

Craig Miller most recently held the role of UK commercial director at Dual Oliva.

-

He will be responsible for originating European acquisitions as part of the MGA’s global expansion plans.

-

Matt Foster joins Coalition following an eight-year tenure at Munich Re.

-

The Canadian pension plan put its Lloyd’s portfolio under review earlier this year.

-

The raise includes minority investments from Nationwide, Enstar and others.

-

The announcement comes a week after the launch of international property MGA Seraphina.

-

-

The transaction will be one of the largest involving two strategics in broking history.

-

Kelly Sanders has returned to the Fidelis group to lead the unit.

-

The MGU said the refinancing allowed it to address a low leverage ratio and reward staff.

-

The firm will specialise in professional liability insurance for SMEs.

-

The build-out of the new vehicle will bring capacity to the constrained aviation war class.

-

The MGA aims to capitalise on the growth and maturation of the continental MGA sector.

-

Brics UW will allow emerging-market reinsurers to tap into London’s distribution.

-

The business is formed out of the existing Thomas Miller Specialty Offshore team.

-

It will offer additional capacity to WTW US property clients with a limit up to $25mn.

-

Ascot will evaluate other options for its ~$140mn-premium transactional liability unit.

-

The executive will report to London-based BMS director Alex Shephard.

-

The investment will be used to scale operations and extend its presence in key international markets.

-

-

Lloyd’s capital has several attractions to the MGA segment if it can manage the operational hurdles.

-

The syndicate will focus on writing non-cat delegated authority business.

-

Markel executive Alan Rodrigues will lead the unit.

-

Stuart Rouse, Kentro’s CFO, will step into the role of group CEO with immediate effect.

-

The operation will be led by Stephen Saunders, with Jawad Ghunaim from AIG as CUO.

-

The firm has hired from Probitas, Tamesis Dual and Aegis for the cells.

-

K2 plans to put $10mn-$20mn into the new syndicate, with third-party investors teeing up to fund the rest.

-

-

The multiline MGA was co-founded by Lea's fellow Vantage alum Farhan Shah.

-

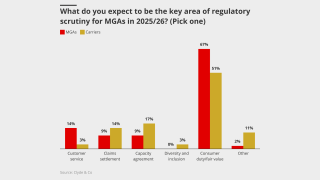

MGAs are looking hard at capacity arrangements for fear of regulatory action.

-

Dan Walsh has led Aon Client Treaty for the past six years.

-

The acquisition allows AM Specialty to expand its E&S offerings.

-

The carrier said the office in Belgium “doubled down” on its commitment to Europe.

-

The MGA has added Scor and Argenta’s syndicates to its panel.

-

The chairman said PE ownership can be “sub-optimal” in softer market conditions.

-

Ambac also announced it was selling its financial lines book to Oaktree for $420mn.

-

The terrorism product, led by Chaucer, will offer an initial line size of $100mn.

-

The Howden-owned MGA lost ~$250mn in cat capacity in September.

-

The former Everest executive will look to roll out a range of new product lines at the heavyweight MGA.

-

The hard market has not burst the MGA bubble – and now interest is on the rise again.

-

Polo MGA will provide services to both start-ups and established MGAs.

-

O’Shea outlined growth ambitions and managing leadership transitions at the MGA in a wide-ranging interview.

-

The consideration in this deal will also include $2.2mn of Ryan Specialty Class A common stock.

-

This publication revealed that the firm is working with Jefferies on the sale of its A&H MGA Armada.

-

-

Accusations levelled at the firm include verbal abuse, unwanted physical contact and bullying.

-

The carrier's UK portfolio will no longer be written with an in-house team.

-

Its first UK MGA partner signing is expected by the end of this quarter.

-

Hunt has previously held the role of CUO for the commercial business at RSA.

-

The MGA was founded by Natasha Attray, James Dodd, James Fletcher and Charles Turnham.

-

Rokstone has taken box 335 on gallery three and will write several specialty lines from the box.

-

Blue Signing Re CEO Velasquez will be XS Global's head of casualty motor, L&H and benefits.

-

The MGA platform has been under auction since last year.

-

Colin Addy and Greg Conroy, former Vale and Chubb executives, co-head the new operation.

-

Sources said the Bermuda carrier has been working with Jefferies on the sale.

-

The announcement confirms earlier reports from this publication.

-

The business will leverage technology from Clearwater Dynamics.

-

Sources believe Lloyd’s may be veering away from central DA systems.

-

The facility will target operators across the US, onshore and offshore.

-

-

The growth was spread across all classes of business, sources said.

-

The executive left OdysseyRe last August, as this publication revealed at the time.

-

The MGA previously hired Sara Valentine from Brit to launch in energy.

-

The team will be led by Alejandra Hernandez Irizarry and Courtney Alonzo.

-

Sources said the initiative includes former Ambridge executive MD Jeff Doran.

-

The binder has a line size of $2mn and will enable the MGA to write international property risks in a number of international territories.

-

Tom Fulford-Smith and Charles D’Alton previously founded and led marine intermediary Latitude Brokers in Hong Kong in 2014.

-

The deal follows this publication’s report that the Bank of America-run sale process of Castel was drawing robust interest.

-

It is understood that AUB’s investment in Mexbrit includes the broker’s marine-focused MGA subsidiary Forte Underwriters.

-

The MGA writes business including forestry, surety and financial lines, and was granted Lloyd’s coverholder status in July.

-

The MGA was without backing since March 2023, after Markel and Chaucer pulled their PVT paper.

-

There are clear strategic advantages to the company’s London launch – but demand may not be as high as in the US.

-

The question is whether the inherent value in CFC was in fact concentrated in departing executives David Walsh and Graeme Newman, or if the business can trade forward as it did.

-

The agency cited the segment’s sustained growth and performance on a global basis but noted tight capacity for certain risks and uncertainty looming over the fronting market as offsetting factors.

-

Allianz Trade recently announced that Stennett's role is being taken on by Peter Evola.

-

The product will protect offtake agreements from the risk of under-delivery of projected carbon credits.

-

The five-person underwriting team will be led by Ian Lewis, who has been named head of intangible assets.

-

It is understood the MGA will run a restricted process, but owners are open-minded on counterparties.

-

The specialist MGA was launched in February 2019 by former Aspen active underwriter Ed Beckwith in collaboration with former Pembroke head of tax Tom Cartwright.

-

Tokio Marine Kiln, Chaucer and Liberty Specialty Markets are among the Lloyd’s carriers understood to have joined the new venture.

-

BP Marsh will receive a £51.5mn cash consideration from the sale of its 18.7% shareholding in in the company.

-

Sources said the Houston, Texas-headquartered program manager is now writing business on Sutton National paper.

-

The fac-focused underwriter launched in South Florida earlier this year, providing general liability and PV coverage in Latin American markets.

-

Syndicate 1856 is looking to back diversified coverholders for the project.

-

Stability Risk will be supported by Lloyd’s and London-market capacity.

-

The MGA platform was launched by former Barbican executives in late 2021.

-

Demex said its RCR Re platform enables cedants to buy reinsurance for secondary peril risks that aggregate over time.

-

Prior-year legacy deals and higher reinsurance costs are just some of the issues that brokers, MGAs and other cedants are confronting in clearing up after the debacle over allegations regarding faked letters of credit.

-

-

Sources suggest that, based on a multiple of 15x-17x Ebitda, the business could be valued at £300mn-£375mn.

-

The deal adds a further £14mn of GWP to the business, following the recent purchase of Tay River Holdings.

-

The MGA has also appointed Protean Risk’s Charlie Cooper for FI, fintech and cyber underwriting.

-

Brown & Brown was ranked as the largest MGA Group in the world as the first to generate more than $1bn in annual revenue.

-

Ebitda multiples for MGAs are undented by rising interest rates, report claims.

-

The US retailer’s acquisition of the UK MGA and broking group will be mutually beneficial, according to executives.

-

Based in Miami, the executive joins BUA as partner, working alongside managing director and CUO Juan Calvache.

-

Lloyd’s has asked all syndicates to outline their delegated authority (DA) portfolio at a whole account level for syndicate business discussions (SBDs), as the 2024 business plan cycle kicks off.

-

The transaction, which was announced in early January, included Ambridge’s operations in the US, UK and Germany.

-

Jackson is likely to be charged with a build-out beyond the three lines currently underwritten in London.

-

Bermudian carrier SiriusPoint’s equity stake in D&O MGA Banyan Risk has been reduced to 49% from 100%, filings show.

-

The funding from BP Marsh has enabled a management buyout from Castel Underwriting Agencies, with the management owning the remaining 65% of Verve.

-

Bastion Risk Partners will operate autonomously as a provider of specialist (re)insurance solutions for a wide range of commercial entities.

-

Details of the bids are being closely guarded, but sources said they expected a valuation of $400mn or above if a deal is consummated.

-

The new programme marks Core Specialty’s first offering in the tech E&O and cyber market and offers up to $5mn of coverage.

-

The firm is led by the former executive team of MGA Medici Facultative, headed by Henrik Webster.

-

The MGA provides coverage to SMEs in the food, hospitality, leisure and hotel sectors.

-

The business has hired former AGCS aviation underwriter Alistair Blundy as CEO.

-

The hires will support the MGA’s recently launched cyber product in partnership with Travelers.

-

The MGA has $15mn of capacity to underwrite UK public corporations and plans to expand into the US market.

-

James Kench has over 14 years’ experience in global (re)insurance broking, climate risk and portfolio management.

-

Nirvana Risk Partners was founded by Rob Jones in 2017 as a division of Castel Underwriting Agencies’ MGA formation platform.

-

Reinsurance renewals were more orderly than feared and business plan resubmissions have a positive weighting.

-

The MGA’s international platform hopes to bring in MGA underwriters looking for US expansion.

-

The executive didn’t provide a target for the number of investments it expects to keep, but said SiriusPoint will not be an active acquirer in the near term.

-

Argenta will be a cornerstone capacity provider to new MGA Casper, which will write $100mn in year one.

-

The insurer has previously attempted a range of different options to manage down cat losses from the book.

-

Barry Marren, who leads Arcadian’s property team, will focus on acquiring worldwide industrial and commercial property business.

-

It is understood that the Miami-based underwriter will continue operating with capacity from Bermudian carrier PartnerRe and Mexican reinsurer Patria Re.

-

As a decline in InsurTech investment continues and risk capacity providers reconsider their support, sources expect many InsurTech MGAs will have to review and potentially pivot their business models.

-

Francesca Giurato will take on a leadership role for both Dual Europe and Dual Italia, with the aim of building a European hub for the fine art business.

-

The business marks the latest launch into a financial lines market that has attracted substantial amounts of capacity.

-

The business is predicted to write $1.4bn this year.

-

Authorities in the UK, Ireland, Belgium and Bermuda have rubberstamped the ambitious restructure.

-

M&A multiples might also come under pressure in a tighter debt market, experts said during a panel debate at Insurance Insider’s London Market Conference.

-

The MGA plans to build up its presence within the Lloyd’s market.

-

Spectrum Risk Management will rebrand as Nexus as part of the transaction.

-

The investors have also purchased MGA service company Precision Partnership, and the firms’ leaderships will be combined.

-

The executive joined the carrier last year as underwriting manager for US delegated authority.

-

Peter Rossell, Dan Watson and Anthony Palmer, all senior engineering underwriters at Globe Underwriting, have joined Rokstone.

-

LIMOSS and Vitesse will deliver the claims service, which is part of the Blueprint Two reforms, and are offering discounts to syndicates signing up in H1 2023.

-

The former Aspen and Willis Re Specialty executive laid out the five-year vision for his start-up business.

-

Bowood managing director Stephen Greener will chair the entity, which is to place $6bn in GWP.

-

Research from this publication exposed a dearth of female leadership in the Lloyd’s market.

-

Meaningful capacity is returning to the marine market, increasingly via delegated authority underwriting.

-

Helena Kazi is set to launch an InsurTech MGA later this year that will provide “hyper-personalised” insurance to the gig economy.

-

The product recall underwriting unit BluNiche is led by former Talbot senior class underwriter Neil Evans.

-

For the immediate future, Origin UW will function as a standalone brand within Jensten’s wholesale division.

-

The coverage is provided in partnership with Beazley.

-

The MGA will write cyber for both SMEs and larger corporations via the German base.

-

The MGA has added cyber underwriting and claims professionals as well as a security expert.

-

The unit led by Dan Kumpf will offer miscellaneous professional liability cover.

-

The two carriers have injected a further $100mn into the underwriting project.

-

The MGA writes management liability, professional indemnity, crime and cyber risk.

-

The carrier has appointed Fidelis’ Arif Rahman the head up the facility.

-

The MGA will offer coverage to trustees administering assets of more than $5mn.

-

The DUA service is aiming for $1.5bn GWP within three years.

-

Fusion Specialty UK will provide access to the company’s M&A insurance online (Mio) product.

-

The move is part of a wider Ascot strategy that will see the imminent launch of an MGA platform headed up by David Leathem.

-

In terms of revenues, the highest ranked MGA in Insuramore’s survey was Brown & Brown, closely followed by Gallagher, Ryan Specialty, Amwins and Truist.

-

SiriusPoint has announced a strategic partnership with home rental insurance MGA Garentii, providing paper, balance sheet and risk advisory services to the InsurTech.

-

The appointment comes after the MGA brought new capacity to the cargo market last year with a $18mn facility.

-

Managing partner Brian Hayes will lead the unit that aims to serve SMEs.

-

The MGA’s gross written premium now surpasses $650mn.

-

The ratings agency has undertaken its first performance assessment of a UK MGA, after launching a methodology for the new process in February.

-

The MGA has had a major impact on the marine market since its launch, writing a substantial amount of business.

-

The MGA was launched in 2017 and wrote $350mn of premium in 2021, the same year it announced the approval for a Lloyd’s syndicate.

-

CEO John Boylan expects "material" increase in premium in 2022.

-

The contract is the first property binder signed by Zavarovalnica Triglav with an international MGA.

-

The former head of international financial lines will report to executive chairman Matthew Fosh.

-

The moves build out the MGA's W&I capabilities following the acquisition of W&I-focused MGA Brockwell Capital earlier this month.

-

Sources described the deal as a collegiate agreement, and long term the carrier is still understood to be committed to the US property market.

-

Sources told this publication Tom Draper would become head of insurance at the expansive MGA’s European operation.

-

The US practice will be led by Themis partner Naomi Collins, who has previously worked for CFC Underwriting and Allied World.

-

The law firm said some firms might accelerate deal plans because of changing insurance market dynamics and rising interest rates.

-

As a Lloyd’s-registered coverholder, ARTes will initially focus on underwriting a US inland marine specialty book with an estimated $20mn capacity.

-

The appointment comes in the wake of a major private equity deal for CFC, and the launch of a Lloyd’s syndicate.

-

The MGA can now offer limits of up to £10mn on either primary or excess layers for UK PI business.

-

The supply-chain InsurTech is also broadening the scope of its Lloyd’s syndicate.

-

Howden’s latest purchase boasts expertise in the jewellery and financial institutions insurance sectors.

-

The deal makes SiriusPoint the lead underwriting capacity provider for Honeycomb.

-

Samphire Risk is being incubated by Davies, which has supported the launch and hosting of more than 40 MGAs.

-

International CUO Kyle Bryant declined to specify when the company would be up and running but said it was in advanced discussions and “quite confident” of landing a deal soon.

-

Over the cycle, the MGA model has proved to be more resilient than initially expected by the market and its observers.

-

The placement is the first delegated underwriting authority consortium as well as the first consortium supporting SIAB.

-

Increased capacity has been secured for the three underwriting teams, K2 Financial, K2 Property D&F and K2 Cat.

-

In his new role at the specialist D&O MGA, Densham will report to Banyan founder and CEO Tim Usher-Jones.

-

It is understood that Ascent is currently in negotiations with a number of new potential lead markets.

-

BP Marsh has had a return on equity eight times higher than when it first invested in Walsingham Motor Insurance Limited.

-

The contingency book was skewed towards prize indemnity and over redemption, representing less than 1% of CFC’s business.

-

Under the deal, Tierra will be able to focus on underwriting activities for Argo Syndicate 1200 and Ascot 1414, while Pro oversees operational services.

-

Sources said there are already four cells in line to join the platform in early 2022.

-

MX Underwriting will at first operate on top of SRG’s existing brands before merging into one brand by the end of 2022.

-

Spring Partners said the new underwriting capacity and product launch were part of its London market growth plans.

-

Toby Gorman will be responsible for managing a portfolio of North American property binder business.

-

The former Dual CEO will run a unit in the same stable as the private equity firm’s broker, Oneglobal.

-

The underwriter will also play a part in upskilling upstream underwriters with knowledge of renewables.

-

The appointment of Nicholas Stevens follows Occam’s acquisition of terrorism-focused MGA Beech Underwriting, an approved Lloyd’s coverholder.

-

The fundraise will support collateralised reinsurance deals with the firm initially targeting Californian wildfires.

-

The confirmation comes after the intermediary agreed to buy two books of business from Parker Norfolk.

-

OPEnergy will be the second MGA to launch on the platform this year, after Navium Marine was founded in April.

-

The insurance product is set to launch in Jamaica, the US Virgin Islands, the Bahamas and St Lucia in 2021, with further expansion planned for 2022.

-

People movement is picking up in the sector, which is experiencing broadly stable rating thanks to ample capacity.

-

David Robinson will work in a senior business management role and report to CEO Matthew Fosh.

-

Experienced underwriters Patrick Comerford and Clive Moore left Pioneer after it failed to secure PL paper for 2020.

-

ICEYE’s fleet of satellites will offer data insights into areas where coverage is impeded by data limitations.

-

The business will write casualty lines including PI, D&O, medmal and cyber.

-

The insurance product provided by Armd and OneAdvent is underwritten by RSA.

-

The property and liability coverholder joins the trade body as part of an initiative to expand into the Republic of Ireland.

-

After the acquisition, the Beech team will continue to be led by Geoff Stilwell, Andrew Woodhams and Matt Gates.

-

The Colin Thompson-led MGA has secured a £70mn banking facility from Barings.

-

The MGA has appointed Rebecca Steel to run the new offering.

-

Former Barbican CFO Lloyd Howson is also part of the MGA’s top team.

-

Barry Marren joins the new D&F property team, Aoife O’Donovan joins as CFO and Paul Connor joins as chief risk officer.

-

The Bermudian carrier acquired the Middle Eastern agency in 2019 as part of its purchase of Ironshore.

-

The managing agency will also house SPA 6131.

-

Clyde & Co’s survey shows that more than two-thirds of MGAs are expecting to expand carrier partnerships next year.

-

Appropriate scale and differentiated products are vital for securing paper in current challenging conditions.

-

The Series B funding was led by SoftBank Vision Fund 2 and will fund expansion beyond the core cyber class.

-

This publication revealed in April that Evercore had been retained to run a process for the cyber-focused MGA.

-

Ian Anson joined Rokstone last year as portfolio manager.

-

Angus Pinner joins from Deloitte, with the carrier hoping the appointment will bolster its tax insurance offering.

-

The two brokers have also agreed to non-solicitation clauses in their new deal.

-

In an interview alongside Align’s founder Kieran Sweeney, the legendary London market entrepreneur also disclosed his company paid $800mn for the US MGA.

-

Align’s founder Kieran Sweeney will run the merged business in the US, become executive chairman of Dual Group globally, and is joining Howden’s executive committee.

-

Insurance Insider first reported in March that Asta had been put up for sale by its backers.

-

The expansive MGA has launched into a number of lines of business in the past year.

-

Hoxton Insurance Services will target mid- and high-net-worth personal lines customers.

-

The new CEO identified cyber reinsurance as an area where the carrier could look to grow in a core class.

-

Ensurance has also launched three new underwriting lines: SME casualty, mid-market casualty and risk managed casualty.

-

The management change follows a period of major expansion for the business, which has launched its own syndicate.

-

The MGA’s new venture will offer latent defect cover for mixed use and tenure developments around the UK.

-

Head of crisis management Mark LeBlanc will lead the team.

-

The SiriusPoint-backed business will focus on complex risks, such as IPOs, life science and SPACs.

-

International speciality (re)insurance MGA Rokstone has secured an insurance agent licence from the Financial Services Commission in Mauritius and is now fully authorised to underwrite business directly in Africa.

-

The deal marks JenCap’s second takeover this year and the 13th since it was founded in 2016.

-

The business will be headed up by Tim Usher-Jones, a former Chubb D&O executive in the Canadian market.

-

GC Access was launched last year to match carriers and MGAs and help them plan new ventures.

-

Ex-Dual CEO Doyle has teamed up with former Willis Re Specialty COO in a bid to launch a hybrid underwriting vehicle.

-

There has been an influx of capacity in the cargo market after several years of improved pricing conditions.

-

The unit is the fourth MGA sold from the underwriting platform.

-

The chairman role was changed over at the group’s AGM, where annual results for 2020 were shared with staff.

-

The Gary Burke-led business has appointed KBW to advise on the transaction.

-

The Lloyd’s Market Association has finished a six-month project to create a digitally enabled, data-driven and cheaper model for delegated authority partnerships.

-

The investor projects GWP at its largest portfolio company to rise by almost a third this year.

-

Falcon Risk Holdings will initially focus on financial and cyber lines in the US.

-

CUO Mike Duffy predicts MGA will become “the future of Lloyd’s”.

-

Brokers were informed on the final working day before the 1 June renewal that the MGA would not be able to honour renewal quotes for cyber clients.

-

The ILS vehicle has support from four key providers and will be launched alongside a broader offering including K&R, fine art and other specialty risks.

-

The veteran marine underwriter highlighted “strong” cargo rates but acknowledged the structural challenges facing hull pricing.

-

The Gallagher MGA said current market conditions made it an ‘ideal time’ to invest in D&O.

-

Two former Axa XL financial lines underwriters join the start-up.

-

The platform plans to launch an Abu Dhabi operation, as well as a London marine MGA.

-

The recruitment comes amid expansion on the wider MGA platform.

-

The London MGA is launching a Lloyd’s vehicle to take on a share of the business that it writes.

-

The former Beazley marine chief launched the MGA through Fidelis’s Pine Walk platform with $100mn of capacity.

-

Through five promotions, the carrier has introduced a new layer of management to support its growth plans.

-

Derrick Potton and Alex Fell will work on business development and management liability respectively.

-

The move follows Jess Pryor’s promotion to executive chairman of Brit’s US business.

-

Rising Edge will provide D&O cover for companies ranging from US-listed entities to private entities.

-

However, 2021 could be a turning point for the profitability of delegated authority books, according to the broker.

-

Huge uncertainty reigns over the ultimate size of the loss, the full extent of which will take months to play out.

-

Axa will be the MGA’s main capacity provider from February for construction and engineering products.

-

Arch Managing Agency was launched last year to bring together Arch and Barbican’s Lloyd’s operations.

-

The agreement will initially focus on political risk and trade credit, energy and property business, with up to $25mn of capacity per risk.

-

The investor’s largest portfolio company Nexus plans further acquisitions in 2021.

-

The InsurTech could be merged into Reinvent Technology Partners, as Metromile prepares to go public in a similar transaction, Bloomberg reports.

-

The WR Berkley subsidiary was founded in 2009 and writes upstream energy, marine and energy liability.

-

The senior executive previously oversaw Lloyd’s Brexit planning and its China platform.

-

Bryte has also granted an underwriting binder for its entire corporate property book to Sapphire Risk Transfer.

-

The former Novae CEO calls the delegated authority platform planned under Blueprint Two the “holy grail” for MGAs.

-

Group CEO David Howden said the A-Plan acquisition brings further retail M&A opportunities.

-

The intermediary recorded revenue of £777mn, with 6% Ebitda growth taking earnings to £223mn.

-

The London-based investor says its 20% stake in the Australian MGA is now worth $10.5mn.

-

William Alderton becomes head of the new worldwide unit.

-

The Marsh JLT-owned business specialises in cover for floating power and desalination operations.

-

Pressure is growing from Lloyd’s underwriters on A&H coverholders, which often attract high commissions.

-

The capital supports the MGA’s excess retro portfolio.

-

This publication looks at 10 issues that will shape the industry in the year ahead, from rate sustainability to start-up progress to the post-Covid recovery.

-

The move follows the recruitment of former Novae CEO Matthew Fosh.

-

AmWins also highlighted the continued availability of “cheap” excess capacity from London cyber MGAs.

-

The executive was an EVP at the Innovisk-hosted MGA, which will enter run-off for 2021.

-

The executive will work as a business development manager, raising awareness of the need for coverage.

-

A “change of control” clause also gives hosted MGAs the opportunity to find new platforms if they wish.

-

CEO Danny Maleary also highlights ambitions for his firm to pioneer a packaged incubation/risk-bearing platform approach for MGAs.

-

The new entity will begin accepting risks on 1 November.

-

A recent Clyde & Co survey shows carriers are more bearish than MGAs on capital provision, and their demands are changing.

-

The yacht operation is led by experienced underwriter Paul Miller and both the team and book of business will move across.

-

The division brings together carriers and MGAs, while providing capital advisory, analysis and modelling support.

-

The venture is led by Guillermo Eslava, a former Swiss Re and Brit underwriter who briefly joined Argo in 2019 as head of LatAm casualty.

-

The listed investor aims high for the growing MGA despite Covid-19 challenges.

-

The 50:50 joint venture will sell automotive and mobility insurance products, starting in France next year.

-

The Lloyd’s coverholder writes a variety of professional liability business.

-

The executive was previously active underwriter for Everest Syndicate 2786.

-

The Hyperion CEO says backing from three institutions plus employee ownership creates “a new financial model”.

-

Arch Underwriting at Lloyd’s and Barbican Managing Agency have been brought together.

-

The executive will manage the MGA’s new all-risks account, while former Chubb loss adjuster David Adcock becomes aviation claims head.

-

The creation of the vehicle reflects the hedge fund reinsurer's respositioning as a specialty carrier.

-

The former Verto CEO is fundraising to begin writing as an MGA in 2021.

-

The partnership will provide cover for clinical trials to university life sciences and medical departments.

-

The expansion comes in anticipation of uptick in Asian M&A activity.

-

Delegated authority brokers are braced for the 1 January property binders renewal.

-

The MGA’s underwriting firepower rises by 15%.

-

The executive joins as head of offshore renewable energy following the MGA’s takeover by Tokio Marine HCC.

-

The construction, leisure and commercial sector MGA will join the group’s Geo Specialty business.

-

AGCS is one of four capacity suppliers alongside Swiss Re Corporate Solutions, Aspen and Scor.

-

Alcor Group will operate out of Bermuda and London, with initial capacity of $10mn per programme.

-

Move comes amid double-digit rate hardening in the US commercial auto market.

-

The Accredited program partner has plans to expand into new lines of business.

-

Beazley-backed vehicle hires Safeonline’s David Dickson, Protean Risk’s Luke Chesworth and Culture Trip’s Anthony Anderson.

-

Sources told this publication that the carrier could be mulling an open market entry.

-

The program administrator expanded into the business line at the beginning of the year.

-

Covid-19 has accelerated dynamics in the MGA space, and now a tough 1 January renewal looms.

-

Will Curtis will lead the new unit as property risk partner, as the MGA separately increases its energy capacity.

-

The MGA is offering limits for between $1mn and $100mn of cover, with the intention of serving both the SME and large corporate market.

-

The MGA platform has acquired the renewal rights for a book of cargo, hull and liability policies.

-

The carrier began providing capacity to the MGA’s construction business through a consortium in 2014.

-

The AJG-owned MGA currently writes £600mn of business and is looking to expand into new niche lines.

-

The MGA had established the PCC as a way to align underwriting interests with its paper providers.

-

Wayne Murphy joins from Trust Re to lead the new division.

-

Mike Keating will start on 8 September and replaces Peter Staddon, who retires in August.

-

The carrier’s decision to withdraw comes just over a year after the partnership was announced.

-

Tim Smyth, former CEO of Primary Group portfolio company RCHL, takes the helm of the MGA.

-

The marine cyber MGA and risk manager was launched last year by ex-Standard Syndicate 1884 active underwriter Robert Dorey.

-

In the post-Covid market, it looks likely that MGAs with scale, expertise and access to capital will win.

-

The listed investor’s shares rise almost 17 percent in early trading.

-

The pandemic means the MGA will hit the £500mn GWP trigger for a review faster than anticipated.

-

She joined the broker after 16 years at Zurich, where she was senior vice president and regional sales director.

-

The raise was led by Alpha Intelligence Capital, and was its first major InsurTech investment.

-

Lewis joined Aon from TMK in September to set up the managing general agency.

-

The target writes premium of about $12mn.

-

The Carbon and Brit syndicate approvals are big test cases in two major Future at Lloyd’s initiatives.

-

The launch would mark the first MGA entry into Lloyd’s via the new framework.

-

She is set to lead the company’s US growth strategy as it expands into the admitted lines cyber market.

-

Tracy Wade reports to programs senior vice president Tim Chesson.

-

The underwriter’s four remaining units will become part of the expansive US MGA platform, in K2’s first non-US acquisition.

-

The transaction will be part-financed through a recently announced debt facility.

-

The partnership will initially offer traditional crop insurance products and then expand.

-

A memo seen by this publication says the Dubai-based MGA plans to relaunch its energy operation.

-

The expansive MGA platform bolsters its senior team with the hire of Mark Smith from the Marsh-owned business.

-

James Dover takes the Adeptive CEO role, with Jeff Bright CUO and Chilton non-executive partner.

-

The transaction is Brown & Brown’s eighth of the year.

-

Brian Hanuschak was previously president of the MGU’s North America business.

-

Munich Re's move to pull back capacity to Hippo comes as reinsurers are looking more cautiously at InsurTechs.

-

The deal comes as renewable energy rates continue to harden.

-

The broker is seeing an increase in demand for coverholder and binder services.

-

The selling shareholder is Bermuda’s Primary Group.

-

The division is led by Stacy Paquet, with capacity provided by Professional Solutions Insurance.

-

John Keen leads the project to revive a previous framework for hosting captives at Lloyd’s.

-

The managing director has been in post since 2013 and overseen a growth in membership.

-

Pioneer's troubles will have made it even tougher for the harder-pressed MGAs to prove their worth

-

The in-principle transaction will see the US MGA take on Pioneer’s four remaining underwriting teams.

-

Insider London panellists said access to capital was a draw but SIAB performance measures were dissuasive.

-

The program includes coverage for trailer parks, which house about 20 million Americans.

-

The cyber and emerging risks specialist makes its second acquisition in six months.

-

This publication looks at the 10 most prevalent industry trends for the year ahead.

-

Raoul Carlos will lead the specialty “centre of excellence”, with the MGA platform also creating two other dedicated hubs.

-

The coverholder is the first multi-line, independent MGA to be incorporated in Bermuda.

-

Confirmed lines of business for 2020 have capacity of more than £150mn.

-

The Japanese-owned carrier teams up with Hiscox to provide capacity to former chief equine underwriter David Ashby.

-

The executive, who joined the firm in 2016, is looking for opportunities in the dedicated MGA and underwriting sector.

-

The Bermuda-based start-up run by Lefebvre, Lucking and Weston receives regulatory approval.

-

The fundraising brings its total backing to around $45.8mn, according to Crunchbase.

-

LMA and Lloyd’s say the exercise will begin around March or April this year.

-

Former Generali UK manager and head of financial lines hired.

-

Newbridge founders Kirby and Buchanan are to move with immediate effect.

-

The rebrand comes as the MGA enters 2020 with an increased line of £100mn.

-

Group underwriting director Graeme Rayner, CFO David Foster and COO Simon Gaffney are all to leave the firm.

-

Matthew Edgette will take a ‘leading role’ in Concord’s tax practice Ryan Specialty.

-

Active underwriter Jill Frances says the MGU will leverage Lloyd’s licensing for international growth.

-

The MGA will initially write mid-market cyber and professional liability business.

-

In an interview with sister publication Insider Quarterly, CEO David Walsh said growth would be achieved organically rather than via M&A.

-

It’s the countdown to Christmas and for the many in the (re)insurance market, that means the focus is on the January renewals.