Hiscox

-

Cyber, mortgage and crop were identified as attractive growth areas.

-

The carrier’s retail division saw premiums increase by 7.3% to $2bn.

-

The underwriter has worked at Hiscox, Lloyd’s, Chubb and Zurich.

-

Marlon Williams will focus on the placement of reinsurance and retro business.

-

The LPPC will offer limits of $127.5mn EAR and DSU coverage in the US and Canada.

-

Top line grew across all carriers even as pre-tax profits dipped.

-

Matthew Budd has over 30 years’ claims experience and previously worked for Talbot and XL.

-

The carrier posted its H1 results earlier today, beating analyst consensus.

-

The carrier also announced an increased share-buyback programme.

-

Stephane Flaquet replaces George Marcotte, who has been interim COO since September 2024.

-

The executive previously held roles at Capgemini, The Hartford and AIG.

-

Plus, the latest people moves and all the top news of the week.

-

The broker has been building out its Bermuda reinsurance presence.

-

Analysts were interested in the potential for fee income from the retail division.

-

-

The majority of the savings are expected to be realised in the retail division.

-

The hire is the latest in the newly formed carrier’s buildout.

-

Motion Specialty will initially focus on high value home and flood insurance in the US.

-

Beazley, Hiscox and Lancashire all grew in Q1 despite widespread rate decreases.

-

Plus, the latest people moves and all the top news of the week.

-

The executive also addressed the impact of the US tariffs.

-

The carrier reported a 3% price reduction across London market business.

-

The executive joins from the London Stock Exchange.

-

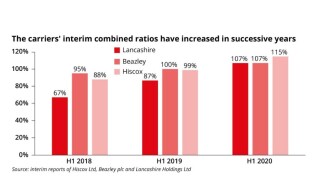

Hiscox, Beazley and Lancashire all reported top line growth, but ROEs dipped in an active wind season.

-

-

Several underwriters left Hiscox’s property D&F team last year to join MGA Velocity.

-

The result is 1.1 points ahead of the midrange of a 6.4%-16.4% forecast.

-

Conditions in the London market remain attractive according to CEO Aki Hussain.

-

Lloyd’s CEO pay is lowest compared to major LSE-traded specialty insurers by a considerable margin.

-

The carrier announced a $175mn share buyback.

-

Newer swing products offer an alternative way to deal with escalating awards.

-

The offering will provide D&O, professional indemnity/errors and omissions, crime and cyber cover.

-

Amie Townsend will be responsible for developing Beat’s UK and Europe platform.

-

The MGA can now put down $200mn lines in the niche aviation war class.

-

In 2019, Shali Vasudeva left her COO role at Hiscox to join Axa UK & Ireland as COO.

-

The movers include former line underwriter for major property D&F, James Robertson.

-

A resurgence in IPO activity may help provide new business for underwriters and reduce competition.

-

Rates are continuing to soften in D&O and cyber, according to CFO Paul Cooper.

-

The carrier’s retail division saw the largest growth at 4.7%.

-

Nick Orton said the market is now pricing for non-peak perils, amid some surprise losses.

-

We may be in the midst of US hurricane season, but international catastrophe losses can emerge at any moment.

-

The carrier noted that the board has commenced the search for a permanent chair.

-

The ex-Prudential CEO was aboard the yacht with tech entrepreneur Mike Lynch.

-

Hiscox has gone live with its AI-enhanced lead underwriting model for sabotage and terrorism business.

-

Lancashire was the only carrier to see double-digit growth in insurance revenue for H1.

-

Plus the latest people moves and all the top news of the week.

-

Hiscox posted a H1 London market combined ratio that worsened by 3.7 points to 86.9%.

-

Hussain said the firm’s exposure to the CrowdStrike losses was “immaterial”.

-

Hiscox said in its big-ticket businesses, “positive market conditions have persisted”.

-

Hales will switch to underwriting after a career specialising in marine claims.

-

The City grandee has experience on the Catlin, Convex and Miller boards.

-

Arch, Axa XL, Beazley, Chubb, Hiscox, Howden, MS Amlin and TMK are participating.

-

With Hiscox’s founders no longer at the helm, deal-making may be more achievable.

-

This publication reported that parties including Sompo and Generali were circling the carrier.

-

A round-up of all the news you need today, including the possible sale of Hiscox and a new CFO at BMS.

-

Sources said that Japanese big-three carrier Sompo and Italian insurance giant Generali are circling.

-

Curtis Dickinson will help to oversee the strategy and vision of Hiscox Re & ILS.

-

The executive said Lloyd’s was the “best place” to underwrite emerging risks.

-

In this episode, Hiscox London Market CEO Kate Markham discusses the carrier's AI lead underwriting project with Google Cloud, and the opportunity the insurer sees underwriting energy transition business in the Lloyd's marketplace.

-

The carrier said rating in the London market came in ahead of expectations.

-

The short-term disruption of relisting may be justified by the long-term benefits.

-

The consortium will offer up to $50mn of per-program capacity.

-

Leigh Hellrung joins from Farmers Insurance, where she worked for 11 years.

-

Hiscox, Beazley and Lancashire all delivered one-off capital returns while swerving casualty issues.

-

Syndicate 6104 closed its 2021 year of account with a profit of 4.1%.

-

The deals cover 42% of the carrier’s casualty reserves.

-

Continued geopolitical and climate uncertainty will hold up pricing.

-

The London-listed carrier announced a $150mn share buyback.

-

Gareth Wharton announced his exit after nearly 18 years with the company in a post on LinkedIn.

-

The carrier said the model will enable underwriters to offer lead quotes in just three minutes.

-

Ratings could be lowered by one notch depending on regulatory restrictions on cash flow from Bermuda operating entities to non-operating holding companies, the ratings agency said.

-

Cat losses were within budgets despite high levels of minor events.

-

CFO Paul Cooper said rates would be increasing “steadily to modestly” come 1 January.

-

The carrier said that aggregate nat cat losses year to date are within budget despite an "active" third quarter.

-

The proposals, published in July, would have placed additional reporting burdens on large UK firms.

-

DirectAsia is a direct-to-consumer business operating in Singapore and Thailand that predominantly sells motor insurance.

-

London’s major carriers have projected bullish messages on a prolonged hard market for property, while acknowledging other classes are in very different cycles.

-

The executive said new capital would require more data points to prove the long-term profitability of reinsurance underwriting.

-

The carrier is “leaning into” the hard reinsurance market, while the London market segment has returned to growth.

-

The carrier will provide cover to a wind farm and a solar farm as part of the Aon-brokered deal.

-

The former Vibe CEO has also worked for Axis Capital and Ace.

-

The carrier announced in March that Robert Childs was retiring after more than three decades at the company.

-

Emily Taylor joined Hiscox as a senior underwriter in 2020.

-

Most carriers were keen to talk about how they are taking on the ongoing hard market in Q1, but some complexities partly offset their good news.

-

Beth Boucher is non-executive director, audit committee member and chair of the nomination and remuneration committee at Coforge.

-

Reforms to the UK listing regime may enhance prospects of an insurance firm opting to IPO in London in future, but several broader problems, including liquidity issues, will also affect such a decision, according to industry sources.

-

Martindale will be responsible for bringing together the capital management and actuarial reserving teams.

-

The executive said the company was applying a “gentle brake” in the D&O class as rates fall.

-

The carrier hailed positive rating momentum in both the London market and the Re & ILS division.

-

He joins the division during a period of growth, with GWP surpassing $1bn for the first time in 2022.

-

Syndicate 33 also reported unrealised investment losses of $69.3mn in 2022, taking its total investment loss for the year to $43.2mn.

-

The London-listed carrier has made several changes to its remuneration policy.

-

The carrier said the initiative accelerates obtaining an entry-level underwriting licence by two-thirds.

-

The collapse of Silicon Valley Bank is creating investor fear across the global financial services sector.

-

The property underwriter has also worked for Beazley and Liberty Mutual.

-

The executive said the carrier had sufficient “dry powder” to expand in hard market conditions.

-

The sub-syndicate will complement Hiscox’s existing portfolio, offering additional capacity to qualifying clients.

-

The executive has worked at Hiscox since 1986, in roles including group CUO.

-

The carrier reported a combined ratio of 90.6% despite losses from Hurricane Ian and Ukraine.

-

The ILS expert had joined as a portfolio manager in 2018 from Ontario Teachers’ Pension Plan.

-

Broker benefits include the ability to get a quote within seconds and to manage clients’ policies fully, Hiscox said.

-

The appointment comes after it emerged that Malcolm Smart is leaving the business to join Ark.

-

The figure has been consistently narrowing since reporting began in 2017.

-

Talbot hull underwriters Edward Carpenter and Benjamin Ewen recently resigned to join Everest Re.

-

The carrier is ready to deploy capital if rate rises prove attractive, Hiscox’s CEO said.

-

The carrier reported substantial expansion in its Re & ILS division, with GWP up by more than 32%.

-

The carrier focuses on risk and treaty catastrophe A&H coverage through its NOA Syndicate.

-

The loss portfolio transfer reinsures around $116mn of the group’s share of Syndicate 33 reserves from between 1993 and 2018.

-

The carrier completed legacy deals within both its Re & ILS and London market segments.

-

The carrier is in growth mode in reinsurance following a period of caution, owing to pricing concerns.

-

The carrier posted $48mn of losses relating to Ukraine and said that rates were keeping pace with inflation.

-

Of the companies ShareAction has asked to disclose ethnicity pay gap data, just three financial firms, including Hiscox, have agreed to do so.

-

The appointment of Pushpa Sriwignarajah comes amid change within the Hiscox cyber team.

-

Craig Dunn’s exit follows a flurry of movement in the cyber market.

-

His departure comes after several years of extensive remedial work on the Hiscox London Market property portfolio to strip out volatility.

-

-

The revised estimates come after Hiscox reported its results for the first quarter last week.

-

The appointment of Granger follows other recent cyber market moves, including the entry of Starr to the market.

-

Swiss Re goes against the tide in expanding in cat, while specialty rates appear to be holding up better than expected.

-

Shares in the carrier were down 3% as it disclosed $40mn of estimated losses from the Ukraine war.

-

The carrier also announced a $116mn LPT for a casualty reinsurance run-off book its Re & ILS business.

-

The new lead underwriter has almost 30 years’ experience including stints at Chubb, Faraday and Howden.

-

Plus the latest executive moves and all the top stories from this week.

-

CEO Kate Markham and CUO Paul Lawrence discuss the biggest changes to the business, including a near 40% reduction in binders exposure and a push to lead more business.

-

The underwriter had worked at Hiscox since 2019 following a long stint at Ariel Re and predecessor entities.

-

The carrier predicted an improved performance for Syndicate 33 in 2021 and a narrower 2020 loss for 6104.

-

Despite the limited exposure overall, Hiscox said that it has some exposure on its terror and political violence book.

-

The CEO said that Hiscox had ‘negligible’ exposure in Russia and property exposures in Ukraine were heavily reinsured.

-

The positive set of results came after 2020 figures were heavily impacted by Covid-19 claims.

-

Hiscox’s non-executive chairman Robert Childs has told a House of Lords London market inquiry how a new competitiveness objective could be measured.

-

The acquisition of Willis Re last year transformed Gallagher into a top-three reinsurance player.

-

Hiscox has appointed Allianz’s Jon Dye as its new UK CEO, effective September 2022, when he will assume responsibility for leading Hiscox’s retail business in the UK.

-

Over the last 12 months, three of the four London-listed companies have drastically underperformed their US-listed and Continental European peers.

-

Southgate worked at the likes of Canopius, Swiss Re, Aon and Sturge Syndicate during his career.

-

The carrier has been rebuilding its D&O team after a number of staff left to launch new books of business.

-

The former MS Amlin head of reinsurance takes up the CUO role next week.

-

In his new role, Paul Cooper will join the Hiscox board, subject to regulatory approval.

-

The Hiscox London Market CEO said better digital access to EC3 would go a long way to securing the market’s relevance on the global stage.

-

The carrier has been rebuilding its team after losing key underwriting staff earlier in 2021.

-

The outgoing Hiscox CEO picked climate risk, D&I, systemic risks and digital trends as the key drivers of change.

-

Current chair Caroline Foulger will retire as a non-executive director following the 2022 annual general meeting.

-

In his new role, Colin Buchanan will manage a team of 14 underwriters writing cyber, D&O and general liability.

-

Hiscox has appointed Liz Breeze as interim group CFO while the company searches for a permanent hire for the role, following the promotion of Aki Hussain to CEO designate.

-

MS Amlin’s head of reinsurance Matthew Wilken is to leave the business for a role at Hiscox Re & ILS in Bermuda, this publication understands.

-

The incoming CEO flagged cyber and property cat as areas requiring further pricing attention.

-

The carrier continued to benefit from rate increases across its segments during the first nine months of 2021.

-

The executive continues in his PPL role to oversee a crucial period of build and delivery for the e-trading platform.

-

Simon Wilson will join Beazley from Hiscox in mid-January and be based in London.

-

The cyber market will interpret Lewis’s hire as a signal IQUW is looking to grow the book proactively.

-

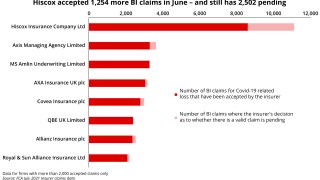

Insurers have now shelled out just over £968mn to BI policyholders in interim and final settlements.

-

Despite a somewhat mixed outlook, UK listed carriers London players say they are still leaning into growth.

-

Helen Rose will start in February 2022, reporting to Hiscox London Market CEO Kate Markham.

-

The executive said excess profits in the London market and reinsurance could be used to invest in retail opportunities.

-

Analysts noted that large losses were benign but rates were earning through and should continue to improve.

-

The carrier had a strong underwriting performance in the London market and reinsurance as Covid-19’s impact receded.

-

After 10 years, the senior executive is departing – just one week after his colleague Aki Hussain was confirmed as successor to CEO Bronek Masojada.

-

The firm has lost some of its sheen, and its CEO-elect has key challenges to address, including how to balance its twin-engine retail and big-ticket businesses.

-

Some observers questioned whether Hiscox would have benefitted from the bigger shake-up of an external hire.

-

Masojada will retire at the end of this year after 21 years and be replaced by Hussain at the beginning of 2022.

-

Analysts believe 2021 will be a “transition year” for Hiscox, Beazley and Lancashire.

-

The company finds itself at a crossroads as it considers its choice of new leadership.

-

Leisure broker NDML said the settlement was an ‘initial figure’, with more claims yet to be finalised.

-

A departure in the spring now seems likely, with Hiscox Global Retail CEO Walter and CFO Hussain internal candidates for the top job.

-

The Financial Conduct Authority’s latest release on UK claims data for Covid-related BI losses shows an acceleration of acceptances during June.

-

Markel, Beazley, Hiscox, Chaucer, Brit and Liberty Specialty Markets are all participants in the product development.

-

He worked for eight years at the French firm, where he oversaw the strategic direction of its ILS business.

-

The London-listed carrier has paid 384 claims of £49,000 each on average.

-

Staff displacement has been high in the D&O market after a period of dramatic rating adjustment in 2020.

-

Hiscox has reached a settlement with the Hiscox Action Group (HAG) following a private arbitration process over Covid-19 BI claims.

-

Illingworth was CUO at MS Amlin, while Hayes spent more than a decade at Zurich, and Cliff hails from Avid.

-

The analyst says Hiscox must convince investors of a retail bounce-back, while Lancashire’s attritional loss ratio is key to better trading.

-

Small business insurer Hiscox Insurance Co and Cox Radio reached a settlement on a long-term legal battle on Monday connected to the leaking of a sex tape involving the famed wrestler Hulk Hogan.

-

The underwriting executive will oversee lines including cyber, D&O and casualty.

-

The transfer, which includes most of the Hiscox USA surplus lines broker business, secures coverage of Hiscox reserves valued at $520mn.

-

The US-based hire has held senior D&I and transformation roles at Accenture.

-

Hiscox, a lead market for D&O in London, takes its peer’s head of London market financial lines.

-

The pandemic has underscored the strength of Lloyd’s trading resilience and shown the market’s ability to thrive in a digital environment, according to Hiscox CEO Bronek Masojada.

-

The carrier reserves $47mn for Storm Uri but says the overall claims experience was positive.

-

The recruitment comes after several exits from Hiscox’s liability team.

-

Kevin Kerridge takes over from Steve Langan, who will retire later this year.

-

Mary Margaret von Herberstein will work on relationships with quota-share capacity providers.

-

Both have worked at Hiscox cumulatively for nearly a decade and are the latest Hiscox executives to join the business.

-

The executive replaces Stéphane Flaquet in the role.

-

The carrier has been replenishing its team following departures last year.

-

The equity research firm cuts its EPS forecasts for the carrier but lifts the share price target.

-

A direct P&C turnaround and a narrowing of the loss in the scaled-back reinsurance division are eclipsed by hefty contingency losses within the specialty division.

-

Hiscox’s decision to adjust its exposure in US casualty retail classes has been welcomed by analysts, who nevertheless warned that it will slow the carrier’s recovery.

-

Isha Patel has worked at the carrier since 2013 and was previously area director of the south.

-

The carrier has admitted to errors in select cases but stressed that its $475mn loss figure remains unchanged.

-

An entrepreneur running an escape room business wins the sum after media intervention.

-

The segment returned to underwriting profit despite the group reporting a significant pre-tax loss.

-

Pandemic claim reserves remained unchanged at $475mn, as CEO Bronek Masojada promised a switch from “resilience to opportunities” in 2021.

-

Derrick Potton and Alex Fell will work on business development and management liability respectively.

-

The appointment follows the expected departure of Phil Furlong to expansive insurer ERS.

-

We assess the hurdles facing the marquee specialty insurance franchise, including staff retention and the fallout from the UK BI saga.

-

Competition has ramped up over the last two years and now represents a threat to returns.

-

The executive will focus on streamlining the carrier’s operating model in the newly created position.

-

The appointment follows the departure of Richard Golder and Jack Bryan to set up a cargo book at Tokio Marine HCC.

-

The bank trims earnings estimates and says consensus expectations are too high.

-

The analyst says the judgment removes an overhang that had weighed on the carrier’s stock.

-

Typical cat loss events trigger XoL reinsurance recoveries. It is not certain that this will.

-

Plus a mixed week for Lloyd’s, the asbestos potential of Covid-19 claims and a round-up of our most-read stories from the week.

-

But Barclays warns the judgment could result in more substantial loss creep for major European reinsurers.

-

The upcoming Supreme Court ruling could result in increased losses for the carrier.

-

The mixed ruling delivered by the High Court meant insurers escaped from worst-case loss scenarios.

-

The start-up makes its first appointment directly from Hiscox, where Inigo founder Richard Watson worked as CUO.

-

The goods-focused pact includes a joint declaration on financial services, though crunch issues have yet to be resolved.

-

Major consolidation laid the ground for current new launches, the Conduit chairman suggested.

-

The carrier said there were plans to grow the team further and its US and non-US sides would be merged.

-

Women at the firm earn 10% less than men in bonus pay, marking an improvement of 21 percentage points compared with last year.

-

There will be significant movements in the ranks of the top 10 syndicates in 2021, with Brit moving into second place and Axa XL tumbling to 7th.

-

Tom Shewry will take on the role on a permanent basis, after having been appointed interim CFO in September.

-

The local Organising Committee expects to receive around 50bn yen ($481mn) for the initial delay.

-

Sandy Warne will report to former Lexington chief George Stratts at the Lloyd’s start-up.

-

The appointment follows the hire Canopius’ Aimee Nolan and the departure of the carrier’s previous cargo team.

-

The appointment follows the departure of Richard Golder and Jack Bryan, who are joining Tokio Marine HCC.

-

The court said that it would work quickly to produce a judgment but it could not guarantee publication this year.

-

The insurer said that stripping out the effects of Covid-19 from counterfactuals would over-indemnify policyholders.

-

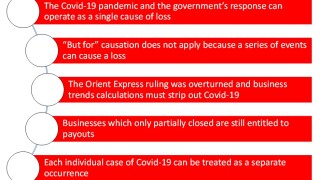

The fundamental issue of causation, as well as trends clauses and the Orient Express judgment, will be under scrutiny.

-

The move comes as Markel Re closes down its independent cat reinsurance underwriting.

-

The CEO reports “forward momentum” after recording strong rate and GWP growth.

-

News of strong premium and rate expansion, along with stable Covid-19 reserving estimates, push the stock higher.

-

-

The former Hamilton Re leader replaces Mike Krefta, who announced he was stepping down in August.

-

The yacht operation is led by experienced underwriter Paul Miller and both the team and book of business will move across.

-

The Bronek Masojada-led carrier says it has yet to decide whether to challenge the High Court ruling.

-

Sources said the flagship syndicate failed to meet top-performer requirements.

-

A trade body and broker said payouts would be the “ethical approach” to support financially stressed businesses.

-

The likelihood of a heavy loss rises, but some elements including requirements around mandatory shutdowns are a silver lining.

-

Lloyd's welcomes the ruling, while the ABI claims it "divides equally" between policyholders and insureds.

-

The carrier predicts fewer than one third of its 34,000 UK BI policies could be impacted by the judgment.

-

The bulk of premiums will be assigned to property, followed by reinsurance and casualty.

-

The hotly anticipated judgment will be a milestone in the ongoing dispute about how carriers respond to Covid lockdown-related losses.

-

The unit combines kidnap and ransom, security incident response, terrorism, product recall and personal accident lines.

-

Policyholders advised by Mishcon club together for an expedited dispute resolution process on Covid-19 claims.

-

Other rival parties are understood to remain in talks about buying the shuttered entity's assets.

-

Hiscox’s 90% projected CoR should prompt further thought at Lloyd’s on moving to a growth paradigm.

-

The carrier cut its exposure significantly in the first half of the year as the firm reassesses its view of risk

-

The carrier increased its claims estimate for Covid-19 by $82mn to $232mn and reported a loss of $139mn.

-

The group reserved $232mn for Covid-19 related claims and cut back on its Re & ILS GWP.

-

The insurer said that the lockdown measures were “unprecedented” and were not covered in policies.

-

The latest Insider Progress virtual event reveals practical tools for companies to support black professionals.

-

Insurers involved in the Financial Conduct Authority (FCA)’s test case for BI disputes have contested the regulator’s assertion that the Covid-19 outbreak was the proximate cause of insureds’ losses.

-

The Hiscox Action Group (HAG) has been given permission to take part in the Financial Conduct Authority (FCA)’s test case on Covid-19 business interruption (BI) claims.

-

It will have a maximum line of over $20mn and allow members to adjust lines on a risk-by-risk basis.

-

The campaign group wins the right to intervene in the key BI Covid-19 action.

-

The group claims policyholders are not represented in the regulator’s legal action.

-

The alternative risks MGA was set up in 2019 by fellow Hiscox alumnus Adam Holberry.

-

The success of remote working is prompting businesses to rethink how the London market will operate post lockdown.

-

Carriers must “stop the clock” on claim time limits from today until the court outcome.

-

Christian Nielsen has been with Hiscox since 2015 and was most recently CFO for Hiscox UK.

-

Law firm Mishcon de Reya also targets additional compensation due to pay-out “delays”.

-

The litigants warn the regulator’s case could delay a final decision by months.

-

The late July High Court hearing will also involve Arch, Argenta and QBE.

-

The executive switches to broking after working at Hiscox for nearly 12 years.

-

Early offers of recompense spark customer demands for phone records.

-

Law firm Edwin Coe rallies more policyholders seeking claims for BI losses.

-

Beazley stock rises more than 9 percent following its issue.

-

-

Clients could be offered a proportion of their agreed limit in exchange for dropping their claims.

-

The policyholders’ law firm may draw on the Enterprise Act to seek redress for the late payment of claims.

-

Hiscox policyholders’ law firm Mishcon de Reya urges insureds to continue to pursue their own claims.

-

Investors give seal of approval after share issue.

-

Jefferies upgrades its recommendation on the stock to “buy” as the carrier raises £375mn at a 6.1 percent discount.

-

Shares in the carrier rise close to 8 percent in early trading after it prices the placing at a modest 6.1 percent discount.

-

The carrier reiterates its view that SME policies do not cover Covid-19 but sets out an "illustrative" analysis.

-

The company says additional capital will help fund expansion in wholesale and reinsurance.

-

The equity research firm lifts its recommendation on the carrier to “add” from “reduce”.

-

The Hiscox Action Group and the Night Time Industries Association says the 500 policyholders have BI cover worth up to £100,000 each.

-

The petition to the UK Chancellor of the Exchequer comes as insurers and clients continue to dispute coronavirus BI pay-outs.

-

The ratings agency says that it expects the company to retain capital adequacy even assuming Covid-19 litigation.

-

The Hospitality Insurance Group Action is the latest collection of firms to fight against denied claims.

-

UBS and Peel Hunt note uncertainties around the (re)insurer’s BI exposure.

-

The carrier insists its capital position remains robust and it is well-placed to pay expected Covid-19-related claims.

-

If lawyers can establish enough facts to support the case then Harbour will provide the backing to take it to court.

-

Hiscox’s Olly Durell, MS Amlin’s Daniel Black and Sarah Reeve all join the company.

-

Uncertainty about future mass gatherings has reduced the number of clients coming to the market.

-

The group has attracted more than 200 policyholders in dispute over BI cover.

-

The Night Time Industries Association becomes the third business group to fight the carrier over denied claims.

-

In an earlier-than-expected trading update, Beazley estimates net $170mn exposure to the pandemic, excluding liability lines.

-

The carrier predicts the pandemic and associated capacity contraction will lift rates.

-

The request for data by 27 April comes amid escalating market concerns around the breadth of BI coverage.

-

The action emanates from a declined BI claim for losses at 37 pubs and restaurants.

-

Hiscox, Willis and Lloyd's were among the companies that faced up to the Covid-19 crisis, while US lawmakers also had their say.

-

The calculation is based on carrier guidance to the market about potential exposures.

-

Precise wordings could trump underwriters’ intentions, or the fact Covid-19 losses were unforeseen and unprecedented.

-

Beazley and Lancashire also fall amid worries about Covid-19 exposure.

-

The carrier notes that only 10,000 of UK SME clients with BI cover have been hit by the Covid-19 lockdown.

-

Shares in peers Lancashire and Beazley also registered losses during trading.

-

Embattled business owners have written to Business Secretary Alok Sharma to complain about the carrier's stance.

-

Multiple broking sources believe the breadth of the Hiscox wording means all BI claims are covered.

-

The dispute centres on wordings around non-damage denial of access and public authority shutdown mandates.

-

Sources suggest the insurer has broader policy wording than that typically used for small business clients.

-

First-quartile syndicates grow while wider market remains constrained.

-

The regulator reiterates call for prudence after Hiscox, Aviva, RSA and Direct Line pull payouts.

-

The proportion of loss-makers falls 4 points from 2018 but is three times as high as 2014.

-

The carrier withdraws financial guidance for 2020, but sticks to its 2022 combined ratio target for Hiscox Retail.

-

Kate Markham takes over from Aon’s Richard Dudley, who was recently appointed Liiba chair.

-

AIG marked a third straight day of stock price losses, ending at $18.78 per share.

-

The biggest hit would come from the IOC’s $800mn event cancellation contract.

-

The CEO said the company was only prepared to deploy capital if increases were sufficient.

-

The carrier’s shares earlier surged after higher than expected reserve disclosures.

-

The carrier reports 11 percent London market rate growth.

-

The experienced underwriter left Canopius last year on the eve of the AmTrust merger.

-

Michael Jordan worked at the London-listed carrier for more than 14 years.

-

The equity research firm said Beazley and Hiscox would be challenged by their casualty exposure.

-

The Japanese-owned carrier teams up with Hiscox to provide capacity to former chief equine underwriter David Ashby.

-

Women employed by Hiscox also earn 31 percent less than men in bonus pay.

-

Hiscox outpaces the FTSE 100, while Lancashire and Beazley fail to match the FTSE 250 growth.

-

A-grade students lose momentum, world-class soccer teams have bad runs and every ship must occasionally navigate through stormy weather.

-

The stock falls further on Monday after losing almost a fifth of its value in the past year.

-

The executive will join alongside Ageas’ Joel Markham as Axa builds its UK delegated authority business.

-

The move is a coup for the InsurTech, given Hiscox’s position at the forefront of digital distribution in the US commercial insurance market.

-

Executives who have been upfront about the need to batten down the hatches ahead of the impending casualty storm must be feeling a little put upon.

-

The index grew for the second consecutive week, recouping the entire 1.6 percent loss made in October.

-

The carrier insists forecast combined ratios given to analysts yesterday weren’t “inside information”.

-

A worsening near-term outlook for the retail unit prompts downgrades and price target revisions.

-

At Syndicate 33 Dolphin is joint active underwriter alongside Paul Lawrence.

-

AIG’s AlphaCat-managed ILS funds grew AuM by $200mn in Q3, while assets at Nephila, Hiscox ILS and Mt Logan dipped in the quarter.

-

Analysts are concerned that the company’s risk profile is higher than the market assumes.

-

The CEO added that the company will reduce its exposure if pricing does not change.

-

The carrier reserves $165mn for claims from Dorian, Faxai and Hagibis.

-

As a “light-touch” syndicate, Hiscox will have its plan automatically approved by Lloyd’s.

-

Aramco does not buy standalone political violence cover, but some energy policies may have contingent business interruption losses.