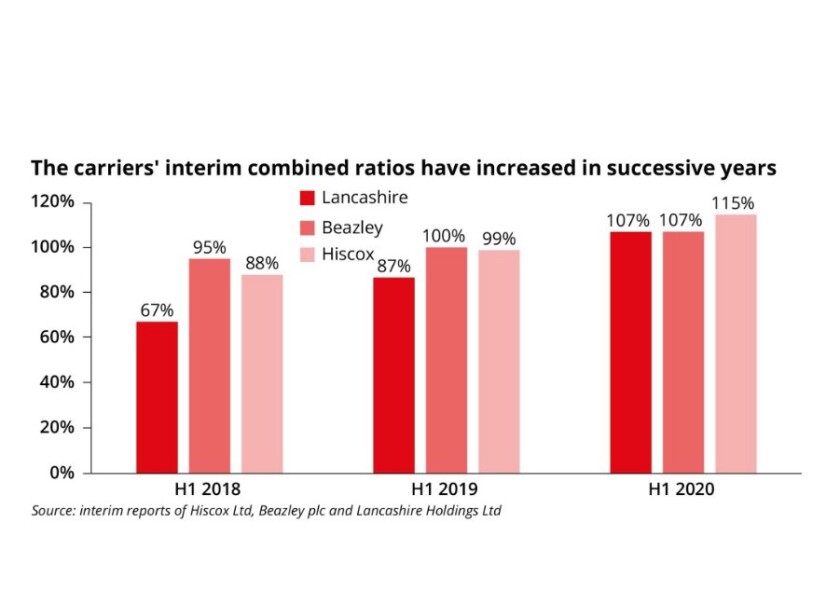

They often move as a group, as is the case at present with their underperforming stock prices – Hiscox and Beazley’s share prices recently hit five-year lows compared with the STOXX Europe 600 Insurance index, while Lancashire’s share price...

Idiosyncratic risks: H1 earnings preview for the London-listed carriers