AJ Gallagher

-

Sources said he will join the reinsurance brokerage next year, after his garden leave expires.

-

The facility provides coverage for property, terrorism, energy, construction and utilities risks.

-

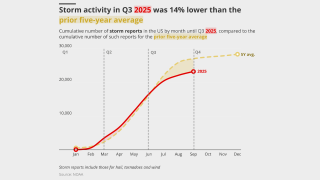

Though wildfire losses are up, total losses are the lowest since 2015.

-

Insurer results and 1.1 reinsurance renewals will shape the trajectory of 2026.

-

Despite a rocky H1, 2025 insured losses from nat cat events may not surpass 2024 levels.

-

As both carriers and reinsurers deal with softening markets, all eyes are on hurricane-prone areas.

-

Susan Langley will look to strengthen global business ties and promote UK growth.

-

Plus, the latest people moves and all the top news of the week.

-

The change in reinsurance intermediary follows an RFP for the account.

-

Lockton Re has predicted major growth in the global cyber insurance market.

-

The practice group will enhance the company’s existing offerings in E&S.

-

Reinsurance CEO Wakefield said reinsurance structures may evolve for prolonged growth.

-

CEO Tom Wakefield said property cat supply is “materially outpacing demand”.

-

The deal is part of Gallagher’s ongoing Asia-Pacific investment strategy.

-

Strong CoRs and investment returns supported profitability in H1 2025.

-

The broker said it was achievable to place a $2bn vertical limit in the London market.

-

Bartlett is the latest in a series of talent moves in the construction market.

-

The broker approved a grant of $316mn in equity awards payable in staggered amounts over the coming five years.

-

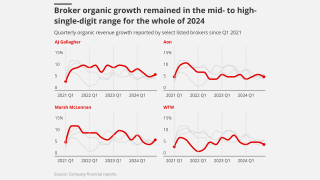

However, group organic growth among public brokers has slowed to pre-pandemic levels.

-

More investment in early stage firms is an indicator of bullish market, says Gallagher’s Johnston.

-

AIG leads the all-risks cover and Axa XL is the hull war lead.

-

The broker said that there could be a flattening of rate decreases in the hull market in 2026.

-

Alistair Lester joins from Aon, where he has worked for the past eight years.

-

AJ Gallagher has responded to a request for additional information under the HSR filing.

-

The broker has nearly 20 years of experience in the reinsurance and retro markets.

-

The impact on the (re)insurance market has been muted due to its strong capital position.

-

Atradius Syndicate 1864 is expected to begin underwriting next year.

-

Coface Lloyd’s Syndicate 2546 is expected to commence underwriting in 2025.

-

The US accounted for 92% of all global insured losses for the period.

-

Continued Apax and Carlyle support will give PIB time to differentiate its business.

-

Apax and Carlyle will continue to back the broker consolidator.

-

The availability of capacity remains the market’s key driver, the broker said.

-

Gallagher, Marsh and Aon also faced sizeable outstanding premium payments as at Q4 2024.

-

The broker’s fac reinsurance division will encompass around 70 staff, it is understood.

-

The soft market continued through H1 2025, especially on shared programs.

-

Gallagher Re’s Lara Mowery said mid-year renewals marked the “beginnings of capacity” emerging.

-

Cedants were able to “challenge the status quo” with aggregates back on the table, the broker said.

-

The broker built out Lockton Re’s US casualty and professional lines treaty book.

-

This publication revealed his exit from MS Re last month.

-

Henk Bijl joins from Aon, where he has worked for the last 25 years.

-

Working out ROI on sponsorship deals is difficult, but the sport is beloved by insurance brands.

-

The merger is on track to close in H2 2025, CEO Pat Gallagher said.

-

SCS can no longer be considered a "secondary" peril for the US insurance market, Steve Bowen said.

-

Renewable retrospective solutions were a key point during the discussion.

-

Their next destination remains unknown.

-

Sources suggested that the multiple could be as low as the 13x range as valuations reset.

-

AJG still has $2bn of M&A capacity after the AP and Woodruff Sawyer deals.

-

The broker will be based in Oslo and drive expansion in the Nordic region.

-

SCS losses were also above average in Q1 due to “lingering” La Niña conditions.

-

Technical pricing is insufficient in some areas and inflation is biting into margins.

-

The book of business comprises both personal and commercial lines.

-

Despite wildfires, reinsurers are “well positioned to maintain strong profitability in 2025”.

-

Large losses and attrition put pressure on aviation underwriters.

-

Langley said the London market could benefit from boosting its image at home and abroad.

-

The Gallagher Re executive called on the market to “prepare to grow sustainably together”.

-

Gallagher Re’s global head of retrospective solutions, James Dickerson, recently exited.

-

The 1 April renewals are the key date for Japanese treaty.

-

Overall market capacity increased by 5.3% year-on-year, the broker reported.

-

Michael Pickel retired from Hannover Re last year after 25 years with the reinsurer.

-

The March 13-16 storms would mark the first billion-dollar US SCS event of the year.

-

Dickerson has spent over three years at the reinsurance broker.

-

The company said it now expects the transaction to close in H2 2025.

-

Competition for specialty reinsurance talent remains high.

-

The California broker’s pro forma revenue for full year 2024 was $268mn.

-

The broker’s current Australia and Asia CEO starts her new role on 1 July.

-

The broker attributed the drop to smaller average deal sizes over the quarter.

-

Plus, the latest people moves and all the top news of the week.

-

Bolding will focus on aligning Gallagher Securities with Gallagher Re.

-

Single-digit organic growth, robust casualty pricing and tapering margins were all key trends.

-

The portfolio tracker facility is led by Canopius.

-

The executive spent 43 years with WTW before joining Gallagher through the Willis Re sale.

-

Parker has worked at Ardonagh-owned Paragon since 2012.

-

The broker added reinsurers remain cautious on US casualty risk.

-

Secondary perils accounted for 65% of global insured losses in 2024.

-

Bradley was construction team leader for US casualty at WTW.

-

Mathieu Loisel joins the reinsurance broker from New Re.

-

The anticipated portion ceded to reinsurance may reach the mid-to-high single-digit billions, it added.

-

The broker said the market had entered a ‘new normal’ after $2bn+ losses

-

The broker cautioned unresolved Russia-Ukraine claims remain a ‘Black Swan’

-

Supply generally exceeded demand and trading relationships were ‘strong’, CEO Tom Wakefield said.

-

The reinsurance market is now in a healthy, stable condition, according to Gallagher Re.

-

Axa XL leads the aviation all-risks reinsurance coverage for the destroyed Jeju Air Boeing 737-800 craft.

-

Axa XL is understood to be the lead carrier, with Gallagher the broker on the account.

-

The pair will lead crisis management and financial lines, respectively.

-

The executive said the combined entity could execute 100-110 tuck-in M&A deals a year.

-

The deal represents a 14.3x Ebitda multiple and strengthens Gallagher’s mid-market position.

-

If the deal is finalised, it will represent the largest in the acquirer’s history.

-

The executive will also serve as an independent non-executive director of Gallagher in the UK.

-

The Pen Underwriting MGA is expanding from its marine war specialism.

-

The exits include several senior brokers who were previously with JLT and Hayward Aviation.

-

Earlier this month this publication revealed that the brokerages were in advanced talks to secure a deal.

-

Samer Ahmad was with Marsh for more than seven years.

-

The broker said that pricing dynamics would require careful management, but adequacy remains

-

Sources said the brokers are in the final stages and could seal a deal in the next couple of weeks.

-

The pair will report to Imea CEO Julian Samengo-Turner.

-

More broadly, the firm is looking at over 100 potential mergers in its pipeline, with ~$1.5bn acquired revenue.

-

The above-average tally was driven by a high frequency of mid-sized events.

-

The cost to the NFIP is likely to be a “mid to high single-digit-billion impact”.

-

Paul spent five years at Gallagher Re in addition to 10 years at Guy Carpenter.

-

The broker confirmed Darren Jones and Ian Curtin were also joining the firm.

-

The Plane Talking report said the longevity of the ‘buyers’ market’ is in question.

-

Simon Collings will join Gallagher’s UK executive team, reporting to UK CEO Michael Rae.

-

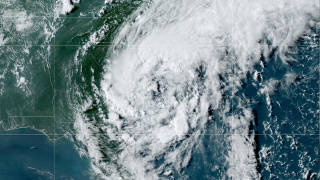

An unexpected shift east towards Tampa could push losses beyond $10bn.

-

Construction rates remain stable with some talk of potential softening.

-

Former Artex managing director Jasmine DeSilva will run the segment.

-

Francine is expected to make landfall in Louisiana tomorrow.

-

Current head of specialty Paul Upton will move to become chairman of the division.

-

-

Sources said Guy Carpenter has promoted Jennifer Paretchan to succeed Mowery.

-

Debby should be a “very manageable” storm for the (re)insurance market, it said.

-

This is a new role for the broker.

-

W&I premium rates have fallen as low as 0.4% in the UK.

-

Annual InsurTech funding volume for H1 was $2.2bn, just below $2.3bn for H1 2023.

-

The broker said rising reinsurance costs after the Baltimore Bridge collapse could put a brake on softening in 2025.

-

Most recently, Richard Harries was CEO at Atrium Underwriters.

-

David Ritchie had worked at the broker for 15 years and ran the D&O and FI teams.

-

A roundup of all the news you need today, including Lloyd’s chairman candidates.

-

Based in Peru, the executive will oversee marine and aviation lines.

-

Chief science officer Steve Bowen said it was still too early to provide precise insured-loss estimates.

-

The broker will work to support US client retention and business growth.

-

The company said insurers’ capacity and appetite had spurred competition over Q2.

-

-

The broker said another strong year would drive pressure for “reasonably significant rate reductions” next year.

-

The broker said it did not anticipate a slew of new entrants, with the possible exception of casualty start-ups.

-

Richard Rudden left Fidelis MGU as head of energy transition in March.

-

Some 39% of respondents expect deal volumes to increase in the next 12 months.

-

A deal would mark Amwins’ second LatAm sale, after Lockton acquired THB Brazil last May.

-

SCS caused global insured losses worth at least $8bn in the first quarter of 2024.

-

Torrential rain caused flash floods in the Gulf States in the middle of April.

-

His promotion to CEO was announced in March.

-

The MGA boosted its capacity by 40% earlier this year, amid heightened activity in marine war.

-

Jessica Cullen is relocating to London from New York to take up the new role.

-

The broker will sponsor a fellowship for a researcher working at the university.

-

The broker had been vying with Marsh McLennan and AJ Gallagher.

-

The MGA can also offer cargo war risk coverage of up to $100mn.

-

The former Nephila director joined the broker last year.

-

Insured loss for Q1 was 10% higher than the decadal average of $18bn.

-

Curtin has spent almost 50 years in the market with stints at Marsh and Sedgwick.

-

The broker attributed increased capacity to improving profitability.

-

The market remains “delicately balanced” amid global conflicts and claims deterioration.

-

Reinsurers have a "strong desire" for growth, but not at the expense of underwriting.

-

Negotiations around US casualty and financial lines were more stressed.

-

Rates continue to trend downwards in the D&O class of business.

-

A total of 30 carriers entered the US public company D&O space in 2023.

-

There is more capacity in the market for long-term risks.

-

The talks are advanced, and the process is likely to move rapidly.

-

-

The findings have implications for businesses and D&O.

-

The 1 January treaty renewal was “far more orderly”.

-

Tim Bluck joins as a partner, covering UK clients.

-

The recruits join from Ardonagh, Guy Carpenter, Howden and Miller.

-

According to its 2023 10-K, Gallagher spent $3.74bn on M&A activity.

-

The probe concluded in Q4 last year, according to Gallagher’s 10-K.

-

Ditte Deschars will be moving into the chairperson role for EMEA.

-

The broker made a number of energy hires from Price Forbes and Miller last year.

-

Funding dropped from $8bn in 2022 to $4.5bn in 2023, a 43.7% decrease.

-

Convective storms cost more than ever, but activity was not exceptional.

-

Spenner will succeed Tony Melia, who is retiring later this year.

-

Total brokerage revenue was up 20.4% year on year.

-

A deal would mark Amwins’ second LatAm sale, after this publication revealed that Lockton acquired THB Brazil last May.

-

2023 was the fourth consecutive year insured cat losses surpassed $100bn.

-

Siemens Gamesa is one of the world’s leading renewable energy manufacturing companies.

-

-

This follows a challenging period for business last year.

-

The executive has spent 20 years in the industry.

-

The new team is one of several the broker has set up in the past 18 months.

-

The incoming executive previously spent 17 years at AIG, most recently as head of financial lines for MENA.

-

In its Plane Talking report, the broker notes a “distinct differentiation” between the hull and liability and the hull war/third-party liability markets in 2023.

-

Some reinsurers could be heading into 2024 with spare capacity, the reinsurance leader said.

-

The broker said over-placement on some deals was a positive sign for brokers, though reinsurance capacity is still very tight in some areas.

-

The executive joined Gallagher in 2015 as COO of its international division.

-

The most effective route for insurers to engage with their clients on emissions reductions will require “fresh thinking and product innovation”, according to the reinsurer.

-

Other early users include Amwins, Aon, BMS Group, Consilium and Costero.

-

Business lines offered include P&C, marine, construction, cyber, trade credit, financial lines, and energy plus employee benefits services.

-

Hansen’s role will be effective after a transition period with departing COO Chris Brook.

-

The box is expected to be manned by Pen's team of specialist marine underwriters.

-

Martin Ford joins the broker following a 26-year-stint at Gallagher Re, formerly Willis Re.

-

The new product is backed by Tokio Marine Kiln and initially aimed at UK businesses, with plans to expand internationally.

-

The broker said dynamics were dependent on full-year results, after years of poor returns.

-

The senior retro/specialty broker spent 26 years at Willis Re, which was acquired by Gallagher in 2021.

-

Alexander will join after his competitive restrictions are up.

-

Increased private investments by (re)insurers have been a “theme of the year” according to Johnston, who described the year as “one of consistency.”

-

The economic losses from the event are expected to exceed $10bn, the report added.

-

The unit almost doubled its organic growth rate from 11% in Q2, while in Q1 the division posted 12% organic growth.

-

Climate change is causing an upward trend in losses, but it should not be conflated with the impact of seasonal variability, according to Gallagher Re.

-

The broker said that $100bn+ loss years have become the “new normal”.

-

A report from the firm warns that the market needs to upskill on cyber.

-

Mark Jenkins becomes chairman of the global credit and political risk team.

-

Looking to the key Q4 renewal period, Gallagher said there is “little to suggest a drastic shift in conditions”.

-

The report also highlighted general liability policies as an area of potential exposure to insurers.

-

At an event that brought together construction insurers, brokers, engineers and developers, delegates discussed an impasse over insuring sustainable development projects.

-

He will be responsible for oversight of all aspects of the practice and leading the firm's growth in the market.

-

Most of the broker’s clients have incurred losses below or about equal to ceded premiums and only one with losses exceeding ceded premiums.

-

The executive will move to the (re)insurer after almost two years at Gallagher Re, a company he joined after the acquisition of Willis Re in late 2021.

-

Carriers benefited from improved rate adequacy and the impact of interest rate rises on investment returns.

-

The repercussions of the war between Russia and Ukraine continue to affect several countries, including Egypt and Somalia, as a result of grain-supply interruptions.

-

The broker said that the Big Bend region towards which the storm is heading has a low exposure density.

-

The role was originally slated to be taken on by now retired James Kent, former CEO of Gallagher Re.

-

The executive will work out a long notice period at his current employer before joining the independent broker next year.

-

Gallagher Re's latest Global InsurTech report has shown that Q2 funding dropped below $1bn to the lowest quarterly investment level in three years.

-

WTW is quietly sounding out market executives for a potential relaunch into reinsurance once its two-year non-compete agreement with Gallagher Re ends in December, this publication can reveal.

-

-

Gallagher Re posted 11% organic growth in Q2, down from 12% in Q1, while RPS recorded 10%, up from 8% the previous quarter.

-

Double-digit rate decreases are common in the class of business despite macroeconomic headwinds.

-

Eduardo Molinari served most recently as general manager of Iberia at Hannover Re.

-

The loss tally comes in 39% above the average for the 21st century.

-

The broker said that rates were largely flat thanks to insurer appetite and competition.

-

Insurers are turning to developing markets, where premiums are higher, as deals dry up.

-

The deal adds a further £14mn of GWP to the business, following the recent purchase of Tay River Holdings.

-

The aviation war segment is also proving ‘treacherous’ to buyers, according to the latest Plane Talking report.

-

As part of the deal, 12 Piiq employees will join Gallagher bringing with them a handful of US-focused clients.

-

Pen’s marine war MGA Vessel Protect has hired maritime security expert Munro Anderson.

-

A “little flurry” of new capacity helped the mid-year renewals as reinsurers pushed to deploy at the last chance for 2023.

-

Reinsurers began relaxing limits on US property exclusions, but the lack of new start-ups points towards stability amid a more orderly market, the broker forecast.

-

The broker said increased reinsurance costs had not been passed onto customers.

-

Langley received the nod for her services to the financial services industry and public service.

-

Three key reports have unearthed issues around capital and lower return period loss figures that may need to be addressed for the cyber market’s maturation, as a pivotal 1 July renewal date approaches.

-

The broker said clients could save money, increase limits and buy extra coverage.

-

The Big Three reinsurance brokers face a number of factors that could challenge their supremacy.

-

Gallagher Re brings together its teams across EMEA to create a unified business unit ideally positioned for future growth and platform expansion.

-

Capital markets are "likely to become a key ingredient of a healthier and sustainable (re)insurance market".

-

Gallagher Re is looking to increase its presence in the North American large-account space, where it is underweight compared with rivals.

-

Kerton steps into the role vacated by Tom Wakefield, who is set to become global CEO of Gallagher Re in the coming weeks.

-

The outgoing CEO will now retire from the company rather than taking up a group carrier relationship role.

-

Tom Wakefield will formally become CEO of Gallagher’s reinsurance broking unit on 1 June, reporting to EMEA CEO Simon Matson.

-

Mega-round funding accounted for the smallest percentage of total funding since Q1 2020, according to Gallagher Re’s latest Global InsurTech Report.

-

The funding triples Novidea’s value in less than two years and will be used to develop its insurance platform and drive international growth.

-

Nick Williams-Walker, COO of Gallagher’s Specialty division, will chair the group as it looks to advance the market’s adoption of foundational elements of the Lloyd’s Blueprint Two programme.

-

The CEO also said Gallagher Re posted a 12% organic revenue growth in Q1 amid the current hardening of the reinsurance market.

-

Gallagher’s operating earnings per share soared 9.8% to $3.03 – beating analyst consensus of $2.99 earnings per share – in Q1.

-

The appointment comes as rates continue to decline in the D&O market.

-

Sources said the executive had a minority ownership interest believed to be around 20%-30% of the operation.

-

GC’s Steve Housse and AJG’s James Elliott have resigned to join the challenger reinsurance broker.

-

Takuya Aibe and Tetsuro Nakazawa have joined the broker from Marsh to lead the business, based in Tokyo.

-

In the first quarter of the year, the total global economic loss for all natural hazards was estimated at $77bn.

-

The two have been at Gallagher since 2019, when the firm clinched the acquisition of JLT Aerospace.

-

EMEA CEO Simon Matson said the company will announce “the optimum structure for this part of Gallagher” once it is finalized.

-

The broker’s Plane Talking report highlighted the excess hull war and liability market as a key area of hardening within the aviation market, as capacity has been restricted and reinsurers take harder lines.

-

The move is the latest indication of talent turmoil in the marine cargo class.

-

Gallagher Re is now lead and sole broker for ARC, the Caribbean Catastrophe Risk Insurance Facility SPC (CCRIF SPC) and the Pacific Catastrophe Risk Insurance Company (PCRIC).

-

Bart Zanelli will work within Gallagher Securities, specialising in capital raising and M&A.

-

Global reinsurance capital fell by 12% in 2022 to $638bn, Gallagher Re estimated.

-

McMillan joins from Siemens, where he spent 16 years, most recently as global head of product safety and risk.

-

The Gallagher-owned MGA is slightly ahead of target as it looks to hit £1bn GWP by 2025.

-

The broker’s international chairman said that without an influx of new capacity, the market will remain disciplined.

-

Renewals in established markets were more orderly than at 1 January, but smaller markets were under pressure.

-

This follows the integration and rebranding of the firm’s three Swedish businesses, Brim, Nordic and Proinova.

-

Incoming Gallagher Re CEO Tom Wakefield will also report to EMEA CEO Matson, who gets an expanded role.

-

Global reinsurers also reported a slight deterioration of their combined ratios in 2022, with the average for the year being 95.7% compared with 94.7% in 2021.

-

The specialty leader had worked at recent acquisition Willis Re since 1998.

-

The AJ Gallagher-owned MGA is looking to hit £1bn in gross written premiums.

-

The executive will be charged with unifying carrier engagement and bringing together Gallagher’s offerings.

-

WTW only gained majority ownership of the India operation last year, meaning it did not transfer in the wider Gallagher acquisition.

-

The appointments aim to provide clients with a product-agnostic view on accessing capital in a capacity-constrained market.

-

Capacity stands at near-record levels for structured credit and political risk, despite key risks such as China’s zero-Covid policy, the Russia-Ukraine conflict and a difficult month of reinsurance renewals.

-

For InsurTechs, the most significant feature of 2022 is that the narrative around ‘disruption’ seems to be “truly over”, Gallagher Re said.

-

The intermediary tallied $360bn in economic losses worldwide.

-

The CEO also heralded the group’s “best full-year brokerage segment organic performance in decades”, with a figure of 9.7%.

-

Louise Piper joins from Aviva, where she was international broker director, and she has previously held senior roles at Axa XL, WTW and Marsh.

-

She had served as director of underwriting at Nephila since mid-2018.

-

Paolo Cuomo joined last year from Brit, where he worked as director of operations, having joined the company in 2019 as head of strategy.

-

The fac heavyweight spent less than 12 months with the company.

-

Aviation insurers are still facing uncertainty moving into 2023, with a slew of legal cases, and large losses from the previous quarters looming above them.

-

Beazley’s $45mn first-time cyber cat bond offered all-perils coverage, though some expected early deals to start with limited scope.

-

As a decline in InsurTech investment continues and risk capacity providers reconsider their support, sources expect many InsurTech MGAs will have to review and potentially pivot their business models.

-

The appointment comes after it emerged that Malcolm Smart is leaving the business to join Ark.

-

Claims were widespread in the class of business during 2022, with almost all areas warranted claimed against.

-

The executive said many reinsurers have secured the pricing and terms necessary to cover their cost of capital.

-

Political violence renewals have been especially demanding, the broker said.

-

Alex Burton Brown’s appointment comes at a time of elevated personnel movement in the financial institutions space.

-

The Gallagher non-executive chair secured 230 of the 259 votes.

-

The broker said a dearth of IPOs had created a “buoyant environment”, with both start-ups and incumbents competing.

-

The increase in premium growth was largely attributed to strong pricing trends for commercial lines and reinsurance business.

-

Inflation, rising reinsurance costs and rebounding shipping activity all pose challenges for the market.

-

Personnel movement in the contingency market has been elevated following Covid-19 upheaval.

-

The broker said rate rises on IG reinsurance could be up to 10% following the impact of Hurricane Ian.

-

The latest Gallagher Re InsurTech study shows that, beyond the biggest funding rounds in Q3, investment fell to its lowest level since early 2020.

-

The broker has worked for Marsh and JLT during his 25 years in energy insurance.

-

Ron Hayes has also held senior placement roles at JLT and Marsh.

-

The hull war market is also looking to target premiums in excess of $500mn, up from the $180mn it achieved in 2021.

-

The unit is led by marine veteran Ricardo Castro, who joined the firm from Marsh and has over four decades of experience in the industry.

-

Inflation will define priorities such as a focus on safeguarding clauses and pricing transparency, as well as line of business challenges, for underwriters and actuaries in the year ahead.

-

How much capacity is available to meet rising cat reinsurance demands was a key theme throughout this year’s Rendez-Vous.

-

The Gallagher Research Centre will be led by Tina Thomson as global head of research.

-

The executive will relocate from London to head the North America team of cyber brokers and actuaries.

-

The broker found reinsurers’ underlying RoE had improved during the period but still fell short of the cost of capital.

-

The executive will report to head of global clients centre of excellence Nick Forti.

-

Novidea will provide a platform for every stage of the broking lifecycle and help Gallagher adopt digital solutions being developed for the Lloyd’s Blueprint Two programme.

-

Alexandre Delacroix will focus on a range of capital market activities, including ILS and collateralised reinsurance.

-

The broker is the latest in a stream of exits from Marsh’s construction team over the past 18 months.

-

The broker said EPS estimates for 2023 were broadly flat due to inflation fears.

-

The broker said Ukraine will fall into a deep recession this year following Russia’s invasion.

-

AnotherDay advises on complex threats and crisis management.

-

Deal flow for InsurTech funding dropped by 7.7% in the quarter, while the average deal size rose by 18% to $22mn.

-

Turner will report to executive partner Gavin Tidman and work closely with head of renewables Duncan Gordon.

-

The broker said clients could achieve broader terms and higher limits in D&O, although there was frustration over pricing fluctuation.

-

Gupta moves from Axis Capital where he served for four years in the New York team.

-

Gallagher is continuing its hiring splurge within its construction practice, as Marsh’s Stuart Freeman looks set to become the latest addition to the team, Insurance Insider can reveal.

-

John Forder will focus on major international contractors, while Daniel Busuttil will be tasked with supporting global infrastructure clients.

-

Its total risk transfer programme is sized at just over $9bn, down $400mn from year-end 2021.

-

Christian Kreutzer joins from Swiss Re, where he was most recently head of the Nordic, Baltic, Russian and Dutch region.

-

Plus, an in-depth look a pressure on the FCA and PRA and all the top news from the week.

-

Rate increases are now universal in the property cat markets, the Gallagher Re executive said.

-

Australian pricing ‘approaching distressed levels’ after successive floods.

-

The new recruit has worked for Argo, Allianz and the European Space Agency.

-

Matthew Solley’s departure brings an end to his 21-year spell at the company.

-

Innovu’s leadership will report to Gallagher’s Michael Rea.

-

An abundance of capacity is leading to price reductions in the downstream sector.

-

Paul Thorburn becomes the latest construction broker to switch between the two companies.

-

The move follows a restructure of the broker’s London reinsurance unit last year.

-

The appointments come just a few months after the company appointed Heather Bone as its Australian CEO.

-

Pressure to grow portfolios may ‘put the brakes’ on premium growth, despite pricing adequacy concerns.

-

The broker’s analysis found rate increases and lower cat experience contributed to strong underwriting results.

-

The account consists of 16 airlines and has a total fleet value of $29.7bn.

-

The renewal also includes an expropriation aggregate limit, which is understood to be less than half of what it was pre-renewal.

-

Rising investment yields may not keep pace with increasing claims costs, the broker said.

-

Madeleine Larke’s departure from Aon’s follows the news that the intermediary has hired long-serving Guy Carpenter broker David Finlay.

-

Plus this week’s Q1 results and all the top news of the week.

-

Gallagher Re’s Global InsurTech report showed that more capital is being channelled into earlier-stage funding rounds.

-

The broker completed five tuck-in brokerage mergers in Q1, the same number as the previous year, but totaling $32.2mn, down from $89.7mn in Q1 2021.

-

The firm suspended relationships with Russia-based clients and estimated those actions will affect its 2022 brokerage unit revenues by up to $10mn.

-

Just a few losses in aviation war have the potential to “wipe out one if not multiple” years of income, the broker said in its Plane Talking report.

-

Alternative capital increased by 4.4% after two years of stagnation.

-

Inflation is now a key concern in every line of business, the broker said.