-

The carrier is consolidating its venture capital activity into asset manager MEAG.

-

The upcoming Lloyd’s Lab cohort 16 will include a dedicated Irish theme.

-

The company will continue its capacity partnership with the MGA until 2030.

-

This will be the 15th cohort of companies to go through the Lloyd’s Lab.

-

The insurer has been under review with positive implications since March.

-

Part III of our series looks at where AI is being integrated into underwriting departments.

-

The lawsuit is the latest development in the multi-billion dollar reinsurance scandal.

-

More investment in early stage firms is an indicator of bullish market, says Gallagher’s Johnston.

-

In part II of our series, we look at where AI is being integrated into claims departments.

-

Plus, the latest people moves and all the top news of the week.

-

The cyber business will continue to operate as a standalone entity.

-

The $2.6bn deal provides Ergo with an entry point to the US SME market.

-

The company said the reduction was due to years of steady improvements.

-

This is up from last year’s $1bn protection for its Florida treaty.

-

The man is alleged to have conspired with others to falsify LOCs and collateral letters.

-

The Corporation is poised to accelerate its investments in start-ups.

-

He will also invest in the company.

-

The Nordic operations have capacity provided by Allianz Commercial.

-

The sale price represents Elephant’s approximate net asset value.

-

The InsurTech was part of the fourth cohort at Lloyd’s lab.

-

Ki cut its top line by 8.7%, while Beazley’s smart-tracker expanded to $481mn.

-

Ahead of the deal, Ergo owned a 29% stake in Next, which generated top line of $548mn last year.

-

Followers will automatically support primary or excess Inigo quotes.

-

Hickman has previously held roles at RSA, LV and Axa.

-

The broker attributed the drop to smaller average deal sizes over the quarter.

-

-

-

The InsurTech is disposing of some non-core business units.

-

The 2024 event saw 80 speakers address an audience of over 350.

-

The minister highlighted London’s critical mass of expertise and tech innovation.

-

Funding has reached $3.2bn over the first three quarters, 7% less than in 2023.

-

PPL plans for iterative releases and a production environment by end of Q1 2025.

-

The streamlined group consists of four brokers and four underwriters.

-

Mark Hartigan will move to chair following a spell as interim CEO.

-

The investment will be used to expand its product portfolio and continue global expansion.

-

Coalition Re to offer active cyber reinsurance via two products supported by Aspen-led capacity.

-

The deal covered US and European P&C liabilities for Accelerant's 2020-2021 underwriting years.

-

The market is warned to think about overall ecosystem interactions rather than “digitalising by stealth”.

-

Annual InsurTech funding volume for H1 was $2.2bn, just below $2.3bn for H1 2023.

-

A roundup of all the news you need today, including Lloyd’s chairman candidates.

-

InsurX has grown its capacity beyond £100mn after adding D&F to its existing contingency business.

-

The company’s investors have also provided EUR 25mn in fresh capital.

-

Mark Hartigan reportedly backed a proposal to sell parts of the InsurTech to Ardonagh.

-

The multiline MGA was co-founded by Lea's fellow Vantage alum Farhan Shah.

-

AI is one of three ingredients needed for evolution in the industry, according to McKinsey senior partner.

-

Since its launch, Bondaval has been operating exclusively as an MGA.

-

AI-centred InsurTechs in Q1 accounted for 28% of all deals in the Global InsurTech report.

-

The carrier's UK portfolio will no longer be written with an in-house team.

-

-

Processing and product innovation companies are also in the cohort.

-

The deal adds to Aspen’s existing support of the InsurTech in the UK and Canada.

-

The funding will allow the firm to release Yurty, a digital care app.

-

Pravina Ladva, Swiss Re's group CDTO, sets out experiments the carrier is conducting with generative AI.

-

Artificial Labs undertook the Lloyd’s Lab accelerator programme in 2020.

-

The investment comes in exchange for a $49mn surplus note from HOA and the acquisition of HOA’s rights to potential claims stemming from the Vesttoo fraud.

-

The motion was filed by Chaucer Insurance Company and Chaucer Syndicates, as managing agent of Lloyd’s Syndicate 1084.

-

Business will continue as usual, with the PlacingHub platform still expected to go live in January, the technology firm said.

-

The new trade organization seeks to promote responsible use of technology, collaborate with regulators on consumer protection and make insurance more available, affordable and accessible.

-

Oliver Bäte joins Bret Johnson, CFO of SpaceX, and Coalition co-founders John Herring and Joshua Motta on the board of directors.

-

Panellists said that key benefits from AI could be in interpreting documents and even helping to mitigate softening market conditions.

-

This is Burton’s last earnings call as the reinsurer’s CEO, as the firm recently appointed TransRe’s Greg Richardson to succeed him effective January 1.

-

Under the agreement, reached late on Monday, Vesttoo would sell its assets in a transaction that would close by December 1, 2023.

-

Increased private investments by (re)insurers have been a “theme of the year” according to Johnston, who described the year as “one of consistency.”

-

In a motion filed Friday, the trustee requested to convert Vesttoo’s Chapter 11 case to Chapter 7 so that “an independent fiduciary can wind down the debtor’s affairs and avoid significant administrative costs”.

-

Earlier today, in a bid to accelerate liquidation, the company’s unsecured creditors requested early termination of the exclusivity period granted Vesttoo to develop a reorganization plan.

-

Doing so would save “at least $8.5mn in cash” based on the firm’s monthly operational expenditures, according to a recent motion.

-

The company said Ki is the first algorithmic underwriter to offer capacity from multiple syndicates.

-

The additional investment makes this the largest ever Series B round for an InsurTech, according to the firm.

-

The capacity deal is slated for deals with 10/1 effective dates and beyond.

-

A Delaware judge has ruled in favour of Vesttoo’s automatic stay in the bankruptcy case.

-

Ola Jacob's role at Descartes will focus on expanding the firm's parametric insurance offering in the London market to corporates exposed to climate risks across the globe.

-

The company also said that it has secured the replacement of all reinsurance on its ongoing portfolio of business through third-party reinsurers and an affiliated reinsurer.

-

Melissa Collett served as executive director for professional standards at the CII, where she spearheaded the Digital Ethics Companion.

-

Renew Risk will be hiring cat modellers and climate scientists, as it expands its proposition to help insurers understand the risks of insuring renewable energy infrastructure.

-

The Aon unit noted 37 LOCs “purportedly procured by China Construction Bank (CCB), Banco Santander and Standard Chartered Bank US”.

-

Digital transformation top of boardroom agenda, according to Cytora CEO Richard Hartley.

-

The company's Ebitda for 2022 was estimated at $60mn compared to $20mn in 2021.

-

Both organizations have agreed for the appointment of a liquidator for Vesttoo transaction structures at the Supreme Court of Bermuda.

-

Issues with faked letters of credit are not limited to one banking provider, sources said.

-

The broker said it believes it has meritorious defenses and intends to vigorously fight the claims and seek recourse against third parties where appropriate.

-

The scale of the coverage offered by the firm means buyers in the emerging line of business face a challenge to swap out their capacity.

-

The firm said it will use the results of an analysis being conducted by experienced investigators to "take appropriate measures”.

-

The London market businesses face potential fallout as Vesttoo investigates collateral inconsistencies.

-

The company’s targeted Vescor cat bond would have provided collateral to meet auto and other obligations, but there were multiple structural points of risk for investors.

-

The fronting company said impairment to Vesttoo’s LoC collateral will be "immaterial".

-

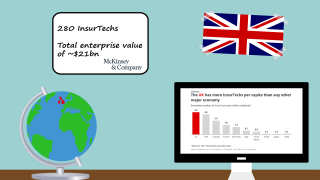

The UK has the highest number of InsurTechs per capita among all major world economies, a new report from McKinsey has found.

-

Fronting companies typically hold premiums in reserve meaning that credit exposure to letters of credit on Vesttoo transactions should only be required in the event of deteriorating losses.

-

The firm said it had identified two specific transactions in which “collateral inconsistencies” were in question.

-

It emerged last week that Steve Hearn was leaving Ardonagh, which he joined through its acquisition of Corant Global.

-

The platform will connect MGAs with capacity from a wide range of providers.

-

Insurers are looking ahead to possible fallout from issues such as cyber risks and the impact of AI on the workforce, while still seeing these new trends as opportunities to capture.

-

The company’s platform allows for the sharing of high quality, standardised data across the insurance value chain.

-

The partnership will give Lloyd’s Lab members access to expand operations in Dubai.

-

Costin left Piiq Risk Partners in November 2022 after nearly three years at the aviation broker.

-

The round was led by Tokio Marine and included MetLife Next Gen Ventures, Malaysia's sovereign wealth fund Khazanah Nasional and new and existing shareholders.

-

The cyber MGA reported that claims severity increased by 7% to an average loss of nearly $169,000, fueled by business email compromise and other types of attacks.

-

Mega-round funding accounted for the smallest percentage of total funding since Q1 2020, according to Gallagher Re’s latest Global InsurTech Report.

-

The business will have insurance management and reinsurance transformer subsidiaries.

-

Capitola operates as a digital market that connects brokers with carriers using AI for risk-appetite matching.

-

Four of 13 companies selected for the 10th cohort of the Lloyd’s Lab incubator programme will focus on European digital and climate solutions.

-

In the aftermath of Silicon Valley Bank’s 11th-hour rescue, InsurTech investors have ramped up systemic risk controls across their portfolios amid a tightening funding landscape

-

Not only could raising venture debt become increasingly difficult for the sector, but InsurTech companies could also struggle to access their credit lines.

-

In the Spring Budget, chancellor Jeremy Hunt said he would also look to help the AI sector prosper in the next decade.

-

At the InsurTech Insights Europe event last week, experts explored how AI is on the brink of being commoditised in underwriting.

-

The insurance technology provider is expanding across the UK, DACH and France, after it reported a 71% increase in revenue in 2022.

-

She will be responsible for providing strategic guidance for the organisation.

-

For InsurTechs, the most significant feature of 2022 is that the narrative around ‘disruption’ seems to be “truly over”, Gallagher Re said.

-

The funding round was led by Bling Capital, and included angel investors such as Vantage Risk CEO Greg Hendrick and CRC Insurance president Garret Koehn

-

The InsurTech said it had raised its per occurrence limit by 32%.

-

The InsurTech Corridor helps UK InsurTechs to prepare for entry into the US market.

-

A regional focus has been adopted for the first time, with Lloyd’s Europe sponsoring efforts to tackle cyber and climate underinsurance.

-

London carriers were bullish on the opportunity ahead and suggested new ways of working will continue to evolve.

-

Artur Niemczewski has held leadership roles at WTW, Marsh, Asta and DXC.

-

Cover Genius has grown GWP to nearly $1.1mn a day since its last funding round in September 2021.

-

The latest Gallagher Re InsurTech study shows that, beyond the biggest funding rounds in Q3, investment fell to its lowest level since early 2020.

-

The homeowners’ InsurTech reported that it has received approximately 6,800 claims associated with Hurricane Ian to date.

-

Often regarded as the destination for tech start-ups, IPOs no longer have the same attraction for UK InsurTechs, due to market volatility and the performance of their listed US counterparts.

-

The fundraise comes after the company raised $180mn of Series A funding last year.

-

Ferian Re will be capitalized by an investor group led by BDT Capital Partners

-

After a widespread drop in InsurTech funding, all signs point to a period of M&A among InsurTechs either struggling to raise funding or seeking a partnership with an incumbent.

-

Innovation Group specialises in business process and claims management solutions and will continue to operate independently.

-

The executive, who had worked at the AI-driven platform for over four years, announced his departure on social media.

-

The digital investments arm of Allianz Group has been a strategic investor in the Berlin-based InsurTech since 2016.

-

It is understood that the company is being advised by boutique investment bank Stonybrook.

-

Personal lines InsurTech Lemonade’s net loss rose by 22% to $67.9mn during Q2 from a $55.6mn loss in the same period last year, as its net loss ratio jumped 10 points to 90%, fueled by the strains of inflation.

-

InsurTechs with diversified teams and deep-rooted technology are more likely to survive the current funding drought, according to MS&AD Ventures’ Jon Soberg.

-

As partner at major InsurTech investor Anthemis, Ruth Foxe Blader explained to Insurance Insider why venture capitalists are pumping the brakes on InsurTech funding.

-

The company becomes the latest InsurTech to cull staff as a result of financial challenges.

-

The newly created role is part of Corvus’ efforts to expand internationally.

-

The funding round has increased the InsurTech’s post-money valuation to $4.5bn.

-

Metromile’s Preston and Lemonade co-CEOs Wininger and Schreiber all joined industry stalwarts in this year’s top 10.

-

Allianz will back Coalition’s US and UK cyber programs.

-

A report from Mapfre and other stakeholders including Mundi Ventures said there remains a $6tn opportunity to unlock in the sector.

-

The InsurTech has tapped talent from Aon, McGill and Talbot as it expands.

-

The funding round led by Force Over Mass Capital will trigger a hiring spree at Artificial Labs and fuel the development of its automated underwriting platform.

-

More than 10% of the largest 200 carriers are “digital laggards”, a study shows.

-

The funding will be used to expand its team and support the development of new and existing products.

-

The Bermuda-based InsurTech will deploy a combination of its own and rated paper capital.

-

Openly completed its first significant catastrophe excess of loss placement, with a diverse panel of reinsurers across London, Bermuda and the US.

-

Amid concerns around increased digitalisation in the insurance sector, the PRA will soon publish a discussion paper on new measures.

-

Lloyd’s announced back in March that it had appointed Schroders Solutions as a partner for its new investment platform.

-

The InsurTech (pronounced Signus) provides clients with the ability to securely connect and collaborate with brokers, insurers, vendors and policyholders.

-

The product will provide construction all risk and operational all risk coverage, backed by AI-powered data and analytics.

-

Marine and energy-focused MGA Thomas Miller Specialty has partnered with Send Technology Solutions to streamline and automate its operations using the InsurTech’s software.

-

Gallagher Re’s Global InsurTech report showed that more capital is being channelled into earlier-stage funding rounds.

-

Mulsanne must pay £1mn to Marshmallow in the next two weeks, with the remaining balance subject to a cost assessment process.

-

With the Lloyd’s Lab in its fourth year and poised to welcome cohort eight to its incubator, Insurance Insider examines its impact so far.

-

The incoming UK and Europe head, with more than 20 years' experience, was most recently was head of M&A at Canopius.

-

The US firm is looking at expanding across Australia, Canada and the UK after securing new investment.

-

Neosurance will use the investment to advance product development and accelerate international growth plans.

-

After listing on the London Stock Exchange, Ondo is looking to expand its water-leak detection technology in the UK and Scandinavia and across more US states.

-

The incoming regional MD will be responsible for growing Duck Creek’s presence both in EMEA and on a global scale.

-

The insurance investment fund’s Brandon Baron will join Layr’s board of directors.

-

New treaty placement elements on the Adept platform will provide structured data exchange functions throughout the placement process.

-

A panel of underwriters and parametric experts explored the product’s scope for expansion during an InsurTech Insight panel.

-

The embedded insurance specialist for the cargo market now plans to accelerate the development of its proprietary smart technology.

-

Brian Kirwan, Douglas Min and Omar Ali have been appointed as general managers of Europe, Korea and the UAE, respectively.

-

The acquisition includes AIS’s flagship BAIL, which provides automated assessment and analysis of motor accident liability.

-

It has also appointed Tim Spencer as head of sales for the UK and Ireland.

-

Co-founder and current CEO Niels Thone will become chief growth officer as Amir steps into his new role.

-

The insurer will now seek an investigation into the impact of the information misuse.

-

Seyna has now raised EUR47mn to date and will deploy the funding to launch the InsurTech’s platform across Europe.

-

The company said that it was creating a new product for customers underserved by traditional insurers.

-

The firm will now accelerate plans to expand in the US, its major target market, as well as Germany, Australia and Japan.

-

The addition of Martyn Holman comes after several substantial appointments to the company's leadership team last year.

-

Syndicate 3456 is the second Lloyd’s launch announced this year, following MIC Global last week.

-

The company will use the funding to invest in new software hires and expansion in Hong Kong and Madrid.

-

The raise would come after an oversubscribed $210mn Series A in 2021.

-

The supply-chain InsurTech is also broadening the scope of its Lloyd’s syndicate.

-

Oliver Delvos will lead Corvus’s office in Frankfurt, Germany, which is slated to open later in 2022.

-

The cyber insurance CEO said his company wrote $55mn in premiums in 2021.

-

In his new role, David Marock will support Previsico’s executive team grow the UK business.

-

The total funding more than doubled, with InsurTechs raking in $15.8bn across 563 deals compared with $7.1bn across 377 deals the year previous.

-

The round was led by global technology giant Tencent and saw participation from SV Angel and Hawktail.

-

International CUO Kyle Bryant declined to specify when the company would be up and running but said it was in advanced discussions and “quite confident” of landing a deal soon.

-

The new platform was developed in collaboration with the London market and Ecliptic’s recently launched Inov8ionLab.

-

The InsurTech will now broaden its data, analytics and risk exchange services to new partners in lines beyond the SME space.

-

With this deal, Corvus said it becomes the first cyber InsurTech to acquire a London underwriting platform.

-

The Series A funding round was led by Mercia Asset Management.

-

Sources said there are already four cells in line to join the platform in early 2022.

-

The start-up can now expand operations in new territories to help farmers recover from extreme climate events.

-

The fund will focus on later-stage investment in companies already known to Eos.

-

The system is designed to streamline connections through APIs between brokers and carriers.

-

The InsurTech has extended its $210mn once more, adding an undisclosed amount to its record-breaking Series A.

-

The significant increase in planned premium will be interpreted as a vote of confidence in the low-cost, follow-only model from Lloyd’s.

-

Inov8ionLab will be a collaborative space offering expertise to help the London market achieve technological change.

-

After its record Series A funding round in the summer, the InsurTech platform has hired AIG’s UK CFO.

-

As a result of the deal, EY, through its wholly owned subsidiary Shackleton, becomes a minority shareholder in IncubEx.

-

Greenlight CEO Simon Burton described title insurance as the perfect example of an inefficient marketplace with high expense ratios.

-

Shah will be based out of Bermuda, where the firm has incorporated Kettle Re and is preparing to fundraise for a balance sheet carrier.

-

The insurance marketplace aims to bridge the gap between insurance and capital markets.

-

Willis’ latest InsurTech briefing shows how a small group of InsurTechs are securing the lion’s share of investment via $100mn-plus mega-rounds.

-

New funding could address long-standing industry challenges and help the market’s move to digitisation, according to a letter from six trade bodies to the UK Treasury.

-

The aim of the new “digital factory” technology is to improve typical processes such as claims audit and management.

-

The insurance product provided by Armd and OneAdvent is underwritten by RSA.

-

The investment will be used to develop Humn’s data capabilities, grow commercial teams and drive European expansion.

-

Munich Re’s venture capital arm Munich Re Ventures has closed a $500mn Munich Re Fund II to invest in early-stage companies.

-

The partnership will open up Verisk’s data and analytics services to Hug Hub’s clients.

-

InsurTech UK has signed an agreement that will open up access for start-ups to Gibraltan officials.

-

Trade body Insurance Europe has warned the Prudential Regulation Authority (PRA) that the temporary regime enabling EU reinsurers to trade in the UK will close before they know which of the Solvency II reforms will be taken forward.

-

The specialist political and credit risk broker BPL collaborated with Euler using an API provided by Whitespace.

-

Plus the winners of the Insider Honours and all the top news from the week.

-

The firm is also planning a windstorm version for Florida hurricanes.

-

The growing trend of InsurTech MGAs looking to transition to balance sheet companies has exposed the shortcomings of the MGA InsurTech model, TigerRisk president Rob Bredahl has said.

-

Increasing cat losses, combined with social inflation, put ESG and climate change at top of the mind even as the market sees strong growth, says Guy Carpenter’s John Trace.

-

With more than 20 years in the industry, Mat Maddocks has worked for a variety of companies including Chubb, Aon and Convex.

-

The InsurTech secured A$68mn from Sompo Asia, with more from existing investors.

-

InsurTech Superscript has partnered with Amazon to offer a monthly subscription insurance service for Amazon Business members.

-

A total of 33 managing agencies have entered into agreements directly on the Tremor market.

-

Singapore-based EDBI and Madrid-based Mundi Ventures are the latest investors in the unicorn InsurTech.

-

The algorithm uses ultra-high-resolution aerial images and data that pinpoints, color-codes and displays properties by damage classification.

-

The investment is jointly funded by the Midlands Engine Investment Fund and Foresight Williams Technology.

-

A report from the company said the pandemic had exposed dissatisfaction with the convenience of existing coverage.

-

The new platform will use the internet of things to embed various functions, from underwriting to claims.

-

More than 95% of global reinsurance capacity can now be accessed by placing business on the platform.

-

A (Re)Connect panel of 2020 start-up leaders said the Covid lockdowns made for challenges in the build-out.

-

The Insurtech employs AI to build a more diverse set of customers and thereby provide more competitive rates.

-

Sequel will add the company to its ‘digital ecosystem’ and said its investment would speed up the expansion of Ignite’s platform.

-

The feature will allow insurers to explore in real time the most competitive prices for a variety of structures and perils.

-

He will also sit on its executive committee and will be responsible for leading Ki’s technology strategy and execution.

-

China’s insurance and banking regulator is stepping up its scrutiny of online insurance companies, its most recent move to maintain control over the country's fintech sector, according to a report by Reuters.

-

Eigen Technologies, which helps insurers and brokers extract and digitise data from various sources, hopes to accelerate growth with new investment in the London market.

-

Willis’s Quarterly InsurTech Briefing shows investments raised more in H1 this year than the whole of 2020.

-

The latest funding round was co-led by Icon Ventures and Lightspeed Venture Partners.

-

The deal follows Bolttech’s $180mn Series A funding round this month.

-

A subsidiary of MS&AD Insurance Group has invested in the US small business insurer, not long after a funding round hiked its valuation to $4bn.

-

The companies say the aim of the partnership is to operate a trade credit insurance market via the Walbing platform.

-

In his first consultancy role since leaving MRDP, Mark Dennis will be advising for an investor whose only current insurance investment, according to its website, is in Bought By Many.