-

The business has not initiated a sale process, with the wheels not yet actively turning on an exit for Apiary.

-

Prices were 37.4p per £1 of capacity, according to Argenta.

-

Plus, the latest people moves and all the top news of the week.

-

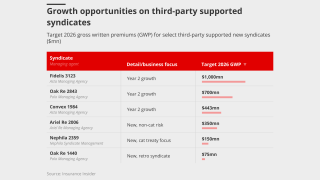

The syndicate is expected to write ~$300mn of business in 2026.

-

Starr’s reinsurance ambitions and embrace of Lloyd’s will be watched closely.

-

How do struggling governments across the globe tackle stagnating economic growth?

-

This publication revealed that Starr was zeroing in on the deal earlier today.

-

The parties could announce the transaction soon, according to sources.

-

The start-up has struggled to build scale since its 2024 launch and has cut back its 2026 stamp.

-

Brokers may encourage clients to capitalise on falling rates by boosting coverage.

-

The MGU’s second syndicate launch was delayed from January 2025.

-

Private capital providers are being signed down as two strong years have piqued interest.

-

The number of syndicates traded at auction was the highest for a decade.

-

Lloyd’s investment vehicles have been shelved in past years but a strong run of returns is creating interest.

-

Sam Geddes will join Syndicate 1918 next year in an executive leadership role.

-

The company noted tougher market conditions and higher large losses during the year.

-

The traditionally lucrative class has faced a series of challenges in the latest geopolitical crisis.

-

The hire follows the departure of David Martin to GIC Re Syndicate.

-

Christopher Reynolds and AJ Jones have been hired as business development directors.

-

The syndicate says it will not set any top-line targets on digital follow strategies.

-

The two lines will add £11mn in planned premium.

-

As two working member vacancies are arising on the Council, a ballot will be held.

-

Plus, the latest people moves and all the top news of the week.

-

IGI’s premium income has almost doubled since it listed in 2020, but how can growth still be achieved in a soft market?

-

Rachel Turk was speaking on an Aon Reinsurance Renewal Season panel.

-

Ark has been adding new product lines across its three Lloyd’s syndicates.

-

Differentiating Lloyd’s claims performance could help drive business to the market.

-

Plus, the latest people moves and all the top news of the week.

-

Incumbent Jane Warren will retire at the end of the year.

-

Without flexible mechanisms the Corporation risks suppressing transactions.

-

The specialty insurer was recently acquired by Korean carrier DB Insurance.

-

It comes as the MGA expects to write more than $1bn of premium in 2026.

-

The former civil servant joined the Corporation in October 2021.

-

Jo Smart has worked for Torus and Aegis during his two decades in the market.

-

Volante launched Syndicate 1699 in 2021.

-

Inigo CEO Richard Watson said the team is ready for its “second album”.

-

What’s driving the wave of shifting ownership structures in the Lloyd’s market?

-

The upcoming Lloyd’s Lab cohort 16 will include a dedicated Irish theme.

-

Several airlines are understood to have come to market early.

-

Legacy reinsurance deals will be reviewed by the Legacy Review Panel.

-

The Lloyd’s investment business has cut expenses by 54% over the past six months.

-

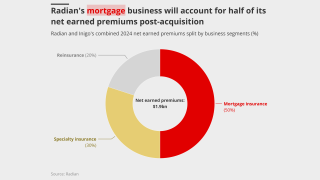

The deal will be watched closely by Radian’s handful of similar peers.

-

The pair hail from Dale Underwriting and Axa XL, respectively.

-

Plus, the latest people moves and all the top news of the week.

-

Small modular reactors are increasingly viewed as a means of meeting surging energy demand.

-

The veteran underwriter said market conditions are still ‘robust’.

-

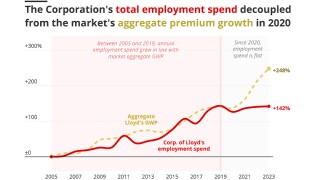

The Corporation’s chair reiterated its aim to reduce the cost of doing business.

-

The Corporation’s chair laid out plans to make Lloyd’s a preeminent market in the long term.

-

How does Lloyd’s plan to secure its future as a leading global marketplace?

-

Losing senior women creates a knock-on effect as juniors lose role models.

-

The mortgage insurer said Inigo will continue to operate as a standalone business.

-

The CEO said the lack of portfolio crossover was highly attractive to Inigo.

-

The US mortgage insurer announced its $1.7bn acquisition of Inigo earlier today.

-

The deal becomes part of a wave of carrier dealmaking.

-

Organisations were challenged to address systemic DEI failure rather than play “word salad” with labels.

-

Inigo executives told Insurance Insider last year they were weighing up the casualty treaty market.

-

The carrier plans to reduce 623’s stamp by around 10% next year.

-

Property remains the dominant line, accounting for nearly 30% of total London premiums.

-

The business has ramped up its underwriting volume since launching in Lloyd’s last July.

-

Plus, the latest people moves and all the top news of the week.

-

This will be the 15th cohort of companies to go through the Lloyd’s Lab.

-

There are concerns that repeated delays could lead to market disengagement with the process.

-

Lloyd’s has pursued a Big Game Hunting strategy to lure major insurers into the market.

-

The syndicate will be targeting approximately $50mn of GWP in its first year.

-

Apollo most recently received in-principle approval for Syndicate 1972.

-

The insurer’s plans for the syndicate were revealed by this publication earlier this year.

-

The reinsurer is moving all its non-cat business to the new syndicate, leaving 1910 focussed on peak cat.

-

Ryan Alternative Capital Re was launched in partnership with Axis Capital.

-

Mark ‘Ollie’ Hollingworth has held his current role at Atrium since 2017.

-

Paul Sandi, head of reinsurance, will serve as active underwriter for the new syndicate.

-

Maintaining underwriting discipline was central to the Corporation's messaging.

-

It was announced this week that the business had agreed to be acquired by Skyward Specialty.

-

Skyward’s acquisition of Apollo will provide access to the London Bridge framework.

-

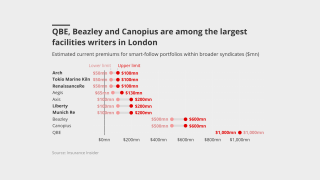

Rachel Turk said product-line facilities had been “under-scrutinised”.

-

Rönesans covers lines including aviation, energy, engineering and liability.

-

The carrier said the decision reflected its commitment to portfolio discipline.

-

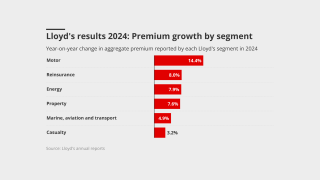

Lloyd’s reported reinsurance GWP increased 10.6% to £13.2mn.

-

The cycle-turn M&A story continues with strategic buyers to the fore.

-

Lloyd’s will keep heritage systems operationally resilient until at least 2030.

-

Syndicate 1440 was approved to assume business incepting January 2026.

-

Apollo executives David Ibeson and James Slaughter are committed to the future as a combined entity.

-

The LPPC will offer limits of $127.5mn EAR and DSU coverage in the US and Canada.

-

In June, this publication revealed that Apollo had appointed Evercore and Howden to run a process.

-

A notable uptick in attendance underpins the value still placed on the iconic trading centre.

-

What happens when a global broker network decides to fill a gap in the London market itself?

-

The news comes after the announcement of CEO Graham Evans’ departure.

-

The carbon-credit insurer has appointed James Morrell head of credit underwriting.

-

Plus, the latest people moves and all the top news of the week.

-

As rate reductions present headwinds, firms are expected to moderate expansion.

-

Simon Clegg will leave Syndicate 609 after 25 years.

-

The London carrier missed consensus on gross and net premiums for H1.

-

Part of the syndicate’s premium for clinical-trial-funding cover will move to Syndicate 1902.

-

The company has recently made several senior changes to its UK and Lloyd’s leadership.

-

The syndicate now predicts a return on capacity for 2021 of between -5% and 5%.

-

Market leaders Atradius and Coface have both received in-principle approvals for a Lloyd’s syndicate.

-

The Lloyd’s carrier is expected to try to claim multiple times under the policy.

-

The family-owned group is embarking on a major international expansion.

-

What does it take to turn a family-run insurance group into a global powerhouse?

-

The carrier reported an increase of 82% in pre-tax income.

-

Duc Tu and Lucy Howard have resigned from Atrium.

-

The carrier also announced an increased share-buyback programme.

-

A limited number of broking staff are also leaving the business, including downstream head Dan Nicholls.

-

Stephane Flaquet replaces George Marcotte, who has been interim COO since September 2024.

-

The LMA head also praised Velonetic for transparency on Blueprint 2.

-

The leadership transition at the syndicate was announced earlier this year.

-

The underwriter was head of financial institutions at LSM for six years.

-

Sources have identified facilities as a different source of rising commissions.

-

The search for a successor to lead Syndicate 1200 is underway.

-

Demian Smith joins from Guy Carpenter.

-

Surveys show diversity and inclusivity foster a sense of belonging and increase productivity.

-

Group CEO Tavaziva Madzinga said it might explore Lloyd’s Names backing in the future.

-

Some 185 credit claims were reported in the market, totalling over $400mn.

-

The Asta-managed syndicate aims to commence underwriting later this year.

-

The exit is by mutual agreement, according to the association.

-

The former Lloyd’s CEO is also eligible for a target $5mn annual equity award.

-

Atradius Syndicate 1864 is expected to begin underwriting next year.

-

Lloyd’s has confirmed the departure of two senior leaders.

-

Plus, the latest people moves and all the top news of the week.

-

Coface Lloyd’s Syndicate 2546 is expected to commence underwriting in 2025.

-

The former Lloyd’s CEO will not make his planned move to Aon.

-

The strategy is a 10-year plan to drive growth in UK financial services.

-

The MGA has secured Lloyd’s paper to write crypto theft insurance.

-

A second syndicate is being explored for “big and bold” new lines

-

Claims chiefs are caught between technological advancement and waiting for phase two

-

Plus, the latest people moves and all the top news of the week.

-

The executive said there was an ‘active cross-sell culture’ across The Fidelis Partnership.

-

How is The Fidelis Partnership choosing to launch into new insurance classes as it rapidly expands?

-

Syndicate 1947 is gearing up to expand its marine reinsurance portfolio.

-

The Cathal Carr-led carrier has been building its team since launching this year.

-

The new roles will oversee property, specialty and credit.

-

The business is one of the first to sell in this round of Lloyd’s M&A.

-

It was announced earlier today that the US wholesaler had agreed to acquire Atrium.

-

Sixth Street and Cornell also bid for the wholesaler.

-

The PRA, FCA and Society of Lloyd’s have agreed to the changes.

-

The deal comes amidst an expected spell of M&A on Lime Street.

-

Plus the latest people moves and all the top news of the week.

-

The Lloyd’s syndicate was one of just a couple of reinsurance start-ups in the current hard market.

-

Gallagher, Marsh and Aon also faced sizeable outstanding premium payments as at Q4 2024.

-

The new chair said the market must adapt for 2030 and beyond.

-

The FCA is reviewing how it can simplify regulation for commercial insurers.

-

Lloyd’s executives have suggested ceded reinsurance syndicates could help London compete in treaty.

-

The managing agency is offering 62p per £1 for 2026 YoA capacity.

-

The international casualty director has worked at Axa XL, Ive and Ardonagh.

-

The business currently works with Hamilton Managing Agency.

-

It has been a volatile week for the marine war market in a period of geopolitical turmoil.

-

Insight into the state of the insurance M&A market, powered by this publication's deal database.

-

Lloyd’s chair said attractive returns were the “essential bedrock” of performance.

-

The investment comes amid expectations of a new cycle of deals.

-

The start-up has hired four people to join the division.

-

Some segments are moving faster than anticipated, but overall, it remains a mixed bag.

-

The Lloyd’s business secured a $90mn investment from Alchemy in 2021.

-

The managing agent for Syndicate 609 has been involved in an M&A process this year.

-

Peter Montanaro retired from his role as market oversight director at Lloyd’s in May.

-

Is the huge growth experienced by the MGA sector run out of steam?

-

The former Volante chief is in initial talks with several parties.

-

Who will buy the swathe of PE-backed Lloyd’s firms coming to market over 2025-26?

-

The firm's near-term global strategy includes operations in the UK, US, parts of Europe and Asia.

-

The LMA urges use of AI for enhanced decision making but concerns remain.

-

Plus, the latest people moves and all the top news of the week.

-

The new Lloyd’s chief of market performance also outlined target growth areas.

-

The modeller said the insurance market could be exposed to unexpected aggregations.

-

Jim Meakins is the latest in a slew of talent to exit from the syndicate.

-

Robert Vetch joined the Lloyd’s business as CFO in 2019.

-

Corporates buying Lloyd’s syndicates face the culture/integration trade-off.

-

The campaign will run throughout June.

-

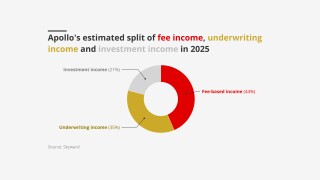

Analysts were interested in the potential for fee income from the retail division.

-

Tiernan’s former role of chief of markets will be split into two new exec team positions.

-

The driver of growth has shifted from rate to volume, as pricing increases tail off.

-

The executive set out his vision for the Corporation after assuming leadership.

-

The outgoing CEO said the market had been restored as a leader during his tenure.

-

Frustration is growing around a promised independent operating model and staff reward.

-

Plus, the latest people moves and all the top news of the week.

-

Lloyd’s maverick syndicate produces impressive results, but questions remain over succession.

-

The investment vehicle will publish its full results on 2 June.

-

The changes are aimed at improving underwriting and operational performance.

-

The Corporation is poised to accelerate its investments in start-ups.

-

LA wildfire losses are impacting the 2024 years of account, Argenta noted.

-

Cincinnati Global entered the cargo market this year.

-

Plus, the latest people moves and all the top news of the week.

-

Trade credit rivals Coface and Awbury are also entering the market.

-

The majority of the savings are expected to be realised in the retail division.

-

Alex Cullen left Atrium last month.

-

The Lord Mayor told the CRO Summit to stop treating risk as a dirty word.

-

Broker facilities and increased US domestic appetite are accelerating the softening.

-

The executive will be global reinsurance CEO and climate solutions chair.

-

The syndicate-in-a-box is the first Lloyd’s syndicate to operate outside London.

-

The CEO transition is already visible in messaging on growth as rate change picks up.

-

Lloyd’s CUO said established broker facilities were “big enough”.

-

The platform could help reduce claims-cash holding times by 10 weeks.

-

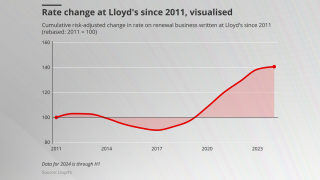

The CUO noted that market-wide rate change in Q1 was down 3.3%, coming in below plan.

-

The executive has spent 10 years in a range of roles at the Corporation.

-

Plus, the latest people moves and all the top news of the week.

-

Pushing through technological change and maintaining underwriting results are top of agenda.

-

Patrick Tiernan was announced as the new Lloyd’s CEO earlier today.

-

The underwriter was part of Probitas’ founding team.

-

The CEO-designate will commence his tenure on 1 June.

-

Jacqui Ferrier speaks with Insurance Insider in her first interview since taking the reins.

-

Chance Gilliland spent a decade at Chubb underwriting property binders.

-

Plus, the latest people moves and all the top news of the week.

-

What does it take to stay profitable as the insurance cycle shifts — and why is leadership diversity still lagging in the London market?

-

The new Lloyd’s chair has issued a commencement letter on his first day.

-

Lloyd’s chair Bruce Carnegie-Brown officially hands over to Charles Roxburgh today.

-

The underwriter is taking on a role with Cipriani and Werner.

-

Full Vanguard testing is expected to compete by the end of the year.

-

Co-founder and CUO Jacqui Ferrier has been appointed his successor.

-

As the next generation of Names comes to the fore, advisers urge simplification.

-

Managing director Nick Bacon will also exit this summer.

-

The underwriter is to run a new fine art and specie operation.

-

Fridays in the office will be the toughest nut to crack.

-

Why have reinsurance start-ups remained so rare in recent years, even as underwriting conditions have improved?

-

Delaney has spent the last 14 years at TMK.

-

Trevor Oates will be responsible for ceded reinsurance purchasing.

-

Plus, the latest people moves and all the top news of the week.

-

TMK is the largest insurer of aviation risks at Lloyd’s by gross written premium.

-

The carrier launched with the aim of writing $300mn of business this year.

-

Aegis 1225 jumped from fifth place last year to become the most profitable syndicate of the last decade.

-

ASR launched Syndicate 2454 at Lloyd’s last year.

-

Trade credit and marine are among the lines facing direct impacts amid a broader inflationary challenge.

-

The ratings agency said underwriting-cycle management would be key going forward.

-

Modified freehold gives syndicates and investors clarity around exit plans.

-

Elizabeth Wooliston said the immediate concern would be managing ‘value at risk’.

-

Plus, the latest people moves and all the top news of the week.

-

Growth was driven by Lloyd’s Syndicate 1274 and Antares Re.

-

Lloyd’s has been likened to a “toothless tiger” in its crackdown efforts.

-

Ex-Hannover CEO Jean-Jacques Henchoz exited from the reinsurer at the end of March.

-

Recent transactions on the platform include cat bonds from Flood Re and Brit.

-

Plus, the latest people moves and all the top news of the week.

-

The first quartile contracted on the back of Beazley 2623’s GWP reduction.

-

Technological delays erode credibility, but the market remains strong.

-

Alexandra Cliff will take a base pay of £425,000 per annum, compared with Keese’s £550,000.

-

Last year, nearly two-thirds of Lloyd’s syndicates reported a deterioration in combined ratio.

-

The announcement comes after similar launches with Inigo and Atrium.

-

CEOs have been told to stand down resources as wider testing won’t start until October.

-

Insurer appetite for facilities is not just about top line, it is also a hedge against disruption.

-

GWP increased 24% year on year at the Asta-managed syndicate.

-

The combined ratio improved by 3.2 points, from 80.9% in 2023 to 77.7% in 2024.

-

In the first part of this series, we explore how smart-followers are mixing up their strategies.

-

The company booked profit for the year of £247mn, up 20% on the prior year.

-

The syndicate’s claims ratio worsened due to an “exceptionally active” hurricane season.

-

The syndicate expects £5.8mn-£8.6mn in California wildfire claims.

-

Reinsurance made up 12% of the syndicate’s 2024 GWP.

-

Cat losses from Helene, Milton and the Oklahoma tornadoes will fall within expectations.

-

The market took a higher share of hurricane losses and couldn’t cut its acquisition costs.

-

Standfirst: The syndicate reported a strong turnaround despite exposure to major claims.

-

Plus, the latest people moves and all the top news of the week.

-

The syndicate achieved a profit despite a “relatively heavy” catastrophe year.

-

Ki cut its top line by 8.7%, while Beazley’s smart-tracker expanded to $481mn.

-

Results were impacted by prior year reserving and an unwind of intragroup reinsurance recoveries.

-

Most of the market’s largest syndicates kept their CoRs below 90% as prices remained adequate.

-

The executive said the market would be updated on progress in late April.

-

MAP’s Christopher Smelt said impact on nationwide programmes will cause risk aversion.

-

Reinsurance and property remained the primary drivers of premium growth.

-

The MGA’s GWP hit $4.6bn as the CEO labelled aviation all-risks rates “woefully inadequate”.

-

The Corporation’s CFO hailed profitable growth but warned syndicates to maintain discipline.

-

Syndicate 1984 is set to begin underwriting next month.

-

Stuart Cheers-Berry was delegated underwriting authority controller at PoloWorks.

-

The binder will provide capacity for international fac property, power and onshore energy.

-

The proportion of women in lead underwriting roles still trails other leadership positions.

-

Syndicate 1984 will be backed by Names under a modified freehold arrangement.

-

Plus, the latest people moves and all the top news of the week.

-

Lloyd’s hopes to protect healthy pricing, but focus is on broader structural market shifts.

-

The Corporation said pricing within aviation was “almost certainly inadequate”.

-

CUO Rachel Turk said some syndicates were showing a “mismatch” in ambition and strategy.

-

The syndicate reported an undiscounted net combined operating ratio of 77.9%.

-

The Corporation saw improvements across all three leadership levels.

-

Opportunities for insurance in transition-related activity “incredible”.

-

The market improved on attritional losses in 2024 – but slowing rate growth raises queries over top-line momentum.

-

While market underwriting profit slipped 10%, the underlying combined ratio was under 80%.

-

-

Followers will automatically support primary or excess Inigo quotes.

-

The executive spent a brief period at Wakam in a capital and reinsurance role.

-

The executive said the firm had to focus time and investment on the most meaningful projects.

-

The transition will take place immediately, with Anthony Baldwin set to leave next month.

-

North America is likely to be the most financially impacted by the scenario, Lloyd’s said.

-

Ascot Underwriting CEO Ian Thompson, who took the helm last summer, discussed emerging headwinds.

-

The result is 1.1 points ahead of the midrange of a 6.4%-16.4% forecast.

-

Returns on capacity reduced, forecast at 4.4%-14.4%, have settled at 4.6%.

-

The insurer has participated on McGill and Price Forbes facilities, as well as Amwins.

-

Plus, the latest people moves and all the top news of the week.

-

The niche auto underwriting cell was the first to launch on the MGA platform.

-

Lloyd’s CEO pay is lowest compared to major LSE-traded specialty insurers by a considerable margin.

-

Montanaro will remain at Lloyd’s as an adviser until the end of May.

-

Lloyd’s entry is a modest start for the London heavyweight but could be the beginning of something bigger.

-

Hickman has previously held roles at RSA, LV and Axa.

-

Last year, Patrick Tiernan issued a warning to syndicates to properly manage their DA portfolios.

-

Financial details will not be revealed until the publication of Avolon’s full-year results.

-

-

Conclusions on possible options will be shared at the end of Q1.

-

With Atrium marking another case of potential bifurcation, where is the natural home of risk?

-

The process will be led by Tom Hicks, consultant, UK head of insurance at Russell Reynolds.

-

These businesses are expecting more premium growth than the wider market this year.

-

The Lloyd’s carrier is considering options to bring an investor into only the agency side of the business.

-

Plus, the latest people moves and all the top news of the week.

-

Keese is also investing in the company alongside its existing partners.

-

John Neal said Burkhard Keese had guided Lloyd’s to some of its best financial results.

-

Capacity will be available to 11 open-market lines of business.

-

The long-planned move is part of a choreographed handover to the former Direct Line executive.

-

The French credit insurer has Apollo lined up as its managing agent.

-

Gavin Jackson assumes responsibilities previously held by David Pigot, who retired recently.

-

Syndicate 1200 CEO Graham Evans says growth will likely slow in 2025 as the market reaches inflection point.

-

The vehicle has $2.55bn in capital committed by institutional investors.

-

The members’ agent said 2024 will still be a profitable year for Lloyd’s.

-

Sheila Cameron urged “calm and caution” on the implications of a Trump presidency.

-

Losses are likely to fall within syndicates’ loss budgets, it said.

-

Underwriting oversight is top of the agenda for some, whilst others prioritise progress on tech and operations.

-

Syndicate 609 will cede net loss reserves of approximately $196mn.

-

High-net-worth binders and treaty exposures will bring significant claims to Lloyd’s writers.

-

The flagship project to digitise the market has been beset by delays and mounting costs.

-

The broker partnered with Ukrainian carrier ARX and Lloyd’s Lab InsurTech FortuneGuard.

-

The CEO’s accelerated exit could cost momentum, and shortens Tiernan’s odds of succeeding.

-

It is understood that supporters include Munich Re and Brit.

-

We explore the strands of the Lloyd's leader's six-year tenure, moving from remediation to growth mode.

-

The Corporation’s CEO will run Aon Reinsurance Solutions.

-

The move means Lloyd’s will have a new chairman and a new CEO in the same year.

-

Christa Schwimmer has joined the leadership team alongside Stefan Golling.

-

The move marks a return to underwriting for Michelle Boyd, who worked at Axa XL and HDI.

-

The move comes amid a restructure of Axa XL’s specialty leadership.

-

As 2024 draws to a close, we reflect on the events of the year for the London market.

-

The reduction in capacity reflects “strategic adjustments”.

-

David Hughes has a line size of A$10mn with a global mandate.

-

Rates are turning negative, and the balance of power is shifting towards the brokers.

-

The carrier has used Lloyd’s London Bridge 2 structure for the launch.

-

Reducing duplication of reporting is key, the association said.

-

The Corporation is undertaking research into global systemic risks.

-

First-quartile 2023 performers will contract capacity by 5% in aggregate next year, according to our survey analysis.

-

Higher cat losses and more casualty reserving could bring profits below 2023 high-point.

-

Syndicate 3705 will begin underwriting on 1 January 2025.

-

The company has exited some transactional liability and commercial D&O business.

-

Lower inflation and a softer market outlook tempered aggregate growth expectations.

-

The index is a three-year strategic project to track social inflation by analysing personal injury awards.

-

The carrier is seen as a likely target of Lloyd’s ‘Big Game Hunting’ strategy.

-

The Lloyd’s (re)insurer is looking to execute a five-year plan to double GWP to $3bn.

-

The broker facility is led by Beazley’s Smart Tracker Syndicate.

-

The Corporation is set to monitor commission structures and facility participation.

-

Lloyd’s has taken around 6% of aggregate US hurricane losses in recent years, and disclosed estimated net losses from Helene and Milton of $1.8bn to $3.4bn.

-

The Lloyd’s market chief stressed the need to grow into new classes and took aim at DA management.

-

Cyber is more in the one- or two-year loss development camp, the Lloyd’s CUO said.

-

The market’s dearth of third-party managing agents is a source of tension among young syndicates.

-

Large syndicates outside top performer quartiles have been afforded significant room to grow.

-

Oak Re confirmed Bain as an investor, with further capital through Hampden clients and Alpha.

-

Overall, syndicates have slightly improved 2022 forecast returns, with 2023 projections closer to stable.

-

Other capacity supporting the syndicate is mostly individual Names, sources have said.

-

The investment banker said the scarcity of attractive assets made the MGA market “red hot”.

-

Syndicate 1947 is understood to have served notice to Hamilton in recent weeks.

-

It is targeting $25mn GWP this year and $50mn GWP in 2025.

-

In a decade this market could grow from $5bn to $60bn.

-

The underwriter has spent his career so far with Talbot.

-

Harriet James was previously head of sustainability at RenaissanceRe

-

The syndicate will transition to a coverholder for Greenlight Re in 2025.

-

A new report put enhanced underwriting at 7% of Lloyd’s GWP with potential for fast growth.

-

The recruitment comes amid a spate of hiring for Westfield.

-

The company’s net asset value per share is expected to hit £2.06.

-

The number of Corporation roles potentially impacted remains unknown.

-

Good leaders and embracing data are key, panellists said.

-

Oak Re is being spearheaded by former RenaissanceRe executive Cathal Carr.

-

Panellists at Insurance Insider’s LMC also noted a lack of C-suite engagement in renewables.

-

Panellists said the industry must work collectively to grow the London market pie profitably.

-

Envelop Underwriting will bring all the firm’s underwriting into one framework.

-

Growth vs discipline, smart follow and M&A mean 2025 will be a mixed bag for London.

-

Fidelis 3123 and NormanMax 3939 were the first syndicates to adopt modifications.

-

Their new guide sets out the factors (re)insurers should consider when defining a major cyber event.

-

Chris Terry is joining from Apollo to run the cargo book, and TMK’s Louis Robertson will build the specie account.

-

Antares recently announced a restructure of its international entities including the launch of a UK company platform.

-

The chief of markets began sick leave in late August.

-

The MGA said there was a “notable imbalance” between supply and risk exposure in the D&O space.

-

The vehicle will leverage global reinsurance market capacity in the event of a natural disaster.

-

Robert Rechtern has spent the last two years at Lockton as head of A&H, sport & contingency.

-

The syndicate will continue to diversify its portfolio but growth will be “more conservative” in 2025.

-

Capital diversity can only be achieved when there are more options for third-party providers to access.

-

MIC Global will become Lloyd’s coverholder of Greenlight Re’s Syndicate 3456 for 2025

-

The Lloyd’s spread vehicle failed to meet fundraising deadlines.

-

There has been some strategic withdrawal of capital for younger syndicates.

-

With the storm’s losses looking more favourable, questions over rates and gross/net strategies will arise.

-

A more residential-skewed loss would impact Lloyd’s carriers in treaty where market share is lower.

-

Setting aside the storm’s greater potential insured loss scale, the flood risk implies greater exposure.

-

Geopolitical conflict could expose the global economy to $14.5tn in losses.

-

Increased interest follows ratings agency upgrades of Lloyd’s paper.

-

The market organisation has commissioned Oxbow Partners to discuss implications of the burgeoning segment.

-

ASR’s UK-based division will be underwriting on behalf of ASR Syndicate 2454.

-

The CUO said the market must not try to recreate the conditions of 20 years ago.

-

Better performance data and clarity around entry are key, report says.

-

The partnership aims to increase investment in developing countries.

-

This is the first major update to the misconduct framework since enforcement powers were introduced in 2005.

-

After a strong run, the market needs a chair that will uphold underwriting discipline and delivery on modernisation.

-

The Corporation’s CUO said managing agents must ensure they manage the future differently to the past.

-

Sir Charles Roxburgh was identified as a short-listed candidate for the role by this publication in July.

-

Sir Charles Roxburgh was identified as a short-listed candidate for the role by this publication in July.

-

The move follows current COO Bob James taking on leadership at Velonetic.

-

After the £3bn premium threshold, a smaller central fund charge will apply.

-

Treaty premiums have risen, while casualty premiums remain restrained.

-

The executive explained the Corporation’s ‘elephant hunting’ expansion strategy.

-

Lloyd's of London is the world's oldest and most famous insurance marketplace, but how does it remain relevant to the 21st century economy?

-

The consultation includes methods for tackling bullying and harassment.

-

Carbon will recruit 30 new staff including 15 underwriters to support growth.

-

The US election is not a particular concern for the executive and the company.

-

In 2023, the market’s reinsurance premiums grew by 12.8%, driven by material growth in property and specialty lines.

-

The business is aiming to launch at 1 January, focusing on non-cat delegated authority business.

-

A start-up would mark a return to Lloyd’s for the Australian carrier after a chequered past on Lime Street.

-

The CEO said standardising wordings to drive syndicated distribution could help Lloyd’s grow.

-

Oak Re Syndicate 2843 will commence underwriting from 1 January 2025.

-

The market remains concerned about managing the pricing slowdown, but a “super cycle” continues.

-

The executive said that the market was in a protracted period of stable underwriting and capital.

-

Overall, Lloyd’s H1 market underwriting profit came to £3.1bn, as the CoR improved by 1.5 points to 83.7%.

-

The CFO said defending profitability is the Corporation’s “utmost goal”.

-

GWP was up 6.5% to £30.6bn, a notable slowdown from the 21.9% growth posted in the same period a year ago.

-

Incoming CEO James promises transparency as digital development accelerates outside Lloyd’s.

-

The Blueprint Two build is due to be completed in January 2025.

-

The consortium backing the MGA is led by Axa XL Syndicate 2003.

-

However, some syndicates are planning more significant growth following hires or strategic shifts.

-

The executive is likely to be out for a couple of months while he recovers from surgery.

-

One of the key issues identified was that employees did not feel able to speak up, sources said.

-

The CEO said the carrier’s hurricane exposure has remained static in the last few years.

-

CEO Alex Maloney hailed the results as the “best ever half-year performance” for the carrier.

-

-

Market-wide testing is not expected to start until late Q4 this year or Q1 2025.

-

The shift to private market fundraising should be a meaningful boost to this and other initiatives.

-

The executive also said there had been a “step change” on culture in the market.

-

Plus the latest people moves and all the top news of the week.

-

Morant will be CEO, with Jardine chairman and Reith on the board, it is understood.

-

The upside for brokers of a larger Lloyd’s is not necessarily clear.

-

Giancarlo D’Alessandro joins from QBE, where he was portfolio manager for Australia and New Zealand.

-

The City grandee has experience on the Catlin, Convex and Miller boards.

-

Lloyd’s capital has several attractions to the MGA segment if it can manage the operational hurdles.

-

The executive has had a 40-year career at AIG, Berkshire Hathaway and Lloyd’s.

-

The syndicate will focus on writing non-cat delegated authority business.

-

The approval allows Davies to extend its UK broker incubation platform in Europe through Brussels.

-

Expectations of what “walking the walk” means for leaders have risen.

-

A selection of the top stories from the week.

-

The new appointee will need to help juggle competing demands.

-

Sources also named Mark Cloutier as a long-shot potential candidate for the position.

-

The new hire spent two years as head of member services at Lloyd’s.

-

A roundup of all the news you need today, including Lloyd’s chairman candidates.

-

Resulting lowered expenses could feed into Lloyd’s ambitions of building a £100bn premium market.

-

K2 plans to put $10mn-$20mn into the new syndicate, with third-party investors teeing up to fund the rest.

-

A round-up of all the news you need today, including the departure of the heads of FL and PI at Westfield.

-

Arch, Axa XL, Beazley, Chubb, Hiscox, Howden, MS Amlin and TMK are participating.

-

Listen in as Luis Prato, president of the UK and MENA for Liberty Specialty Markets, discusses the role of London within Liberty’s global business, the future strategy of the carrier, and the art of risk selection as a driver for performance.

-

John Neal’s expansion plan now has a five-year horizon, but deft execution will be needed.

-

The survey found 87% of respondents believe their organisation is committed to diversity.

-

The Oxbow report found that AI use cases span the entire (re)insurance capability model.

-

The Corporation is seeking a ‘market-connected member’ for the board.

-

Syndicate 3123’s opening is “the largest-ever launch of a Names-sponsored syndicate in Lloyd’s”.

-

The Lloyd’s vehicle also announced Chambers as an independent non-executive director.

-

The lineslip will be available alongside the MGA’s existing capacity.

-

Evercore is leading the capital raise process and Aon is assisting with the Lloyd’s application process.

-

Chaucer’s Richard Milner, Atrium’s John Fowle, MS Amlin’s Clare Constable and Nephila’s Adam Beatty will join the board.

-

A new cutover date will only be decided once key activities are completed or near completion.

-

Léger will work as chair and Neal as vice-chair of the reinsurance advisory board.

-

A standalone syndicate could offer capital, trading, and licensing advantages.

-

Reinsurers “weren’t getting paid” before 2023’s hardening, the Lloyd’s executive argued.

-

Beazley CEO Adrian Cox said that the carrier’s growth rate would slow as market conditions shift.

-

The MGA will focus on deals in infrastructure, technology, logistics, healthcare and financial services.

-

The Cut-over Review Committee will review the readiness of the London market.

-

Self-insurance has taken $25bn more premium out of the market than five years ago.

-

The Lloyd’s vehicle will focus on its existing spread portfolio.

-

In this episode, Hiscox London Market CEO Kate Markham discusses the carrier's AI lead underwriting project with Google Cloud, and the opportunity the insurer sees underwriting energy transition business in the Lloyd's marketplace.

-

New business is arriving, but the captives market is not a priority target.

-

Latin America and the Caribbean accounted for 4.6% of GWP for Lloyd's in 2023.

-

The terrorism product, led by Chaucer, will offer an initial line size of $100mn.

-

Initial testing ahead of the switch to a cloud-based system is around a month behind.

-

Captive Syndicate 1100, launched in partnership with a “major global client”, will be managed by Apollo.

-

Sources said London should dodge the worst deterioration on US liability, but might not escape unscathed.

-

The memorandum of understanding will see the two entities share international expertise.

-

The move follows work to create a capacity rental venture with members’ agent Argenta.

-

The syndicate has appointed former Munich Re active underwriter Stuart Newcombe.

-

LMG's latest London Matters report reveals that UK capital has lost ground to the US and Bermuda in some lines.

-

The executive said that the Corporation had received net exposure figures for the loss from all syndicates.

-

Proposals will be put to the Lloyd’s Council over the coming weeks to take effect from 2025.

-

The Lloyd’s chief of markets said he was generally comfortable with market fundamentals.

-

The carrier has ambitious growth plans for its rebranded Munich Re Specialty segment.

-

The updated framework from the Corporation provides less “scope creep”, said CUO Rachel Turk.

-

The insurer said its Lloyd’s presence underscores its London market commitment.

-

CEO Luke Tanzer talked about the expansion drive as the legacy firm reported a 14.3% RoE for 2023.

-

Approximately 1.2 million units are vacant throughout the state.

-

Lloyd’s and Velonetic are still exploring three options for the latter stages of cutover.

-

The Lloyd's CUO warned against "calling victory too early".

-

The market also outperformed various indices including the MSCI World.

-

Rokstone has taken box 335 on gallery three and will write several specialty lines from the box.

-

The Corporation also appointed Marc Lipman as president of Lloyd’s Americas.

-

This year’s analysis of profitability and volatility also includes an alternate view over five years.

-

In a departure from 2022 trends, fourth-quartile firms grew the slowest of all syndicates in 2023 at 8.1%.

-

-

-

Ariel and Blenheim were among eight syndicates moving into top underwriting quartile in 2023.

-

The syndicate’s total recognized gains were up to £61mn, from £28mn in 2022.

-

Growth in property income was offset by a reduced share of finpro business.

-

The syndicate's GWP increased from £51.6mn in 2022 to £141.9mn.

-

The syndicate posted a combined ratio of 84.6% and GWP of more than £1.2bn.

-

Work is still to be done on the investor proposition, expenses, and navigating a waning pricing cycle.

-

CFC noted that growth moderated amid increased competition in cyber.

-

The syndicate reported profit up 44.7% to $153mn for the year.

-

Lloyd’s gains leadership, and The Fidelis Partnership gets capital diversification.

-

The executive said Aviva and Fidelis had endorsed the market’s turnaround.

-

-

Atrium reserved £264.5mn for potential claims resulting from leased aircraft in Russia.

-

Active underwriter Smelt said competitors’ ‘blanket’ approaches are creating opportunity.

-

Combined ratios have improved as prices rise and investments return to profit.

-

The syndicate’s GWP reached £1.44bn in 2023, a 7% increase on 2022.

-

Primary casualty, aviation and motor classes were outliers in a bumper year for the market.

-

Hear the latest from the marine market as it weighs up the implications of the bridge collapse in Baltimore. Early indications are the claim could eclipse losses from Costa Concordia, stretching into the billions.

-

The new target go-live date is October, but a milestone plan will be confirmed in April.

-

The Lloyd’s CFO said returns needed to remain high due to investor fatigue.

-

Processing and product innovation companies are also in the cohort.

-

The injection will be sufficient to take the platform through its next stage of major development.

-

Sources believe Lloyd’s may be veering away from central DA systems.

-

The narrative of competition between the two hubs can hold space for benefits.

-

The syndicate-in-a-box will target £34.1mn in gross premium for 2024.

-

If you only read a handful of stories this week, make it the selection below.

-

Insurance Insider editor in chief Catrin Shi helps unpack Lloyd’s preliminary 2023 results, and offers her perspective on Aviva’s acquisition of Probitas.

-

The initiative will focus on fostering innovation through the Lloyd’s Lab.

-

For the 2022 year of account, the updated forecast remains unchanged.

-

Small scale cyber attacks are set to increase in the near term.

-

The Corporation is walking a tightrope between encouraging further growth whilst maintaining discipline.

-

There has been a 21% increase on a gross basis and a 62% increase on a one-in-200 final net basis for non-peak perils

-

The Lloyd’s chief of markets argued that unmet demand and latent risk will keep rates increasing.

-

The pension fund was one of the first investors to use London Bridge.

-

CFO said rate discipline needed to remain to offset prior-year losses.

-

Syndicate 6104 closed its 2021 year of account with a profit of 4.1%.

-

DDM is due to be removed as a core central service on 13 September.

-

As a drip-drip of exits have continued amid a harder cat market, broader questions arise.

-

The target was initially set in 2020, with a deadline of December 2023.

-

Aviva will need to manage the talent base deftly to get the most from the deal.

-

The LMG chair also discussed the need for tailored regulations.

-

Welcome to the first episode of Behind the Headlines, a fortnightly podcast hosted by Insurance Insider's senior reporter Sam Casey.

-

Exposures to property are growing materially in the riskier geographies.

-

Velonetic said the transition would not go ahead if questions over readiness remained.

-

Slipstream will be available to marine, cargo and logistics UK clients.

-

Attention is fixed on how competition will impact pricing in H2.

-

Plus all the latest executive moves and the top news of the week.

-

CEO John Neal has ambitions to pull in more major insurers, E&S players and captives.

-

She stepped into the role on an interim basis in August 2023.

-

LatAm represents $1.3bn in premiums, the Caribbean $1bn and Bermuda $700mn.

-

The MGA is looking to take advantage of trading in person.

-

The Lloyd’s chair warned that clients, capital and talent “will not wait”.

-

A minority stake has been taken in the two Lloyd’s Lab alumni.

-

Asta-managed Syndicate 1966 will target £75mn GWP for 2024.

-

The group has been exploring options to enter the market since 2021.

-

Envelop SPA 1925 was launched at the start of the year with Chris Baddeley as active underwriter, based in London.

-

The syndicate is expected to complete an RITC process by late 2025.

-

The Corporation is cracking down on LOC exposure following the Vesttoo scandal.

-

Nearly 80% of transportation companies surveyed cited a lack of access to insurance solutions and a lack of data to understand supply-chain risks.

-

The broker said there was a “record level of dry powder” waiting to be deployed.

-

Kevin Leach was formerly The Hanover Insurance Group’s financial institutions leader and VP.

-

Roughly $750mn of securities across 13 cells are available to institutional investors via London Bridge vehicles.

-

In the second part of our themes for 2024 outlook, we explore how fear of missing out in cat reinsurance is still contrasting with an upstreaming of risk that is creating fallout for primary insurers, while momentum in facilitisation and ESG continues.

-

In the first section of our two-part outlook for 2024, we explore why macro-economic concerns are taking a step back, though casualty pricing micro-cycles highlight ongoing caution.

-

We look at data trends that shed light on the past year, ranging from growth plans at Lloyd’s to personnel planning, uncertain IPO prospects and the unexpected trends from Florida losses.

-

Informal conversations to scope out candidates have already been conducted, with an executive search firm expected to be appointed as early as January.

-

The Corporation plans energy efficiency measures and refurbishment of the upper galleries.

-

The agreement gives the Corporation the option to stay until 2040.

-

The fund will be the second private asset product to be launched on the Lloyd’s investment platform after the private impact fund.

-

The rating is the market’s highest ever from S&P.

-

The executive had been appealing a misconduct hearing that initially upheld some charges against him.

-

Any firms that struggle to communicate on the new platform will be charged “translation fees” in the long term.

-

Yesterday, this publication reported that James Mackay was set to depart from his previous role at Aon Reinsurance Solutions.

-

The new syndicate will write cover for African Specialty Risks’ existing lines of business, with plans to enter new markets later.

-

The delayed introduction of phase two changes was at the request of the LMA, to allow more time for phase one implementation.

-

James Davidson will become CFO, and general counsel Benoit Waltregny will assume the additional role of deputy CFO.

-

Phase one of the launch is still slated to go ahead on 1 July 2024.

-

Risk Capital SA is a Luxembourg-based carrier with backing from Henry Junior Chalhoub, a member of the Chalhoub insurance dynasty.

-

Head of Lloyd’s relationships James Mackay joined Aon in 2019 after a 25-year stint at Argenta.

-

Other early users include Amwins, Aon, BMS Group, Consilium and Costero.

-

The question is whether the inherent value in CFC was in fact concentrated in departing executives David Walsh and Graeme Newman, or if the business can trade forward as it did.

-

The follow-only algorithmic syndicate has stamp capacity of $925mn for next year.

-

The executive said that work was underway to make sure the energy transition is “led by Lloyd’s”.

-

Political violence and terrorism will also be a focus class for the Corporation, amidst geopolitical turmoil.

-

Growth opportunities at Lloyd’s no longer limited to top underwriting performers, Insurance Insider’s survey shows.

-

Growth slows from last year’s 20%, while QBE and TMK close the gap on Brit and Beazley.

-

The product is led by Canopius and IQUW, with support from three other Lloyd’s insurance company markets.

-

The roadmap sets out planned oversight processes and regulatory expectations on climate-related risk management, capital and reserving as well as transition planning.

-

The box is expected to be manned by Pen's team of specialist marine underwriters.

-

Phase one of Blueprint Two will see Lloyd’s market participants move to Velonetic’s new digital service portal.

-

Blueprint Two should help reduce the claims-process timeline, according to a panel at Insurance Insider’s London Market Conference.

-

London’s insurance market is booming in some ways yet still has multiple challenges to address.

-

The new contract will include annual rent increases of 3%-5%.

-

Unity will provide $50mn of coverage supporting the export of grain and other commodities.

-

LIIBA's chief executive Croft has described the delegated authority process as being "ripe for modernisation and improvement”.

-

The venture received “insufficient commitments” for its insurance vehicle London Innovation Underwriters.

-

The Corporation’s head of culture Mark Lomas said: “We know we can’t undo the past, but we can do something about the inequalities we see today.”

-

The move comes after Neal was effectively confirmed in post until at least mid-2026, ushering in the Second Act of his tenure as CEO.

-

The number of female CEOs, CUOs, CFOs, MDs or board members has hardly changed in the past 12 months.

-

With plans to support three different types of Lloyd’s syndicates, the vehicle intends to trade under the new name London Innovation Underwriters by 15 November.

-

Axa’s Sean McGovern was also elected as a corporate external member of the Council after running unopposed.

-

Political violence and risk underwriters have heavily cut back in the region, which remains an important source of premium for marine insurers.

-

The not-for-profit placement platform generated a surplus after tax of £1.48mn for 2022, a substantial drop from an £8.83mn surplus in 2021.

-

Speakers at the Guy Carpenter Baden-Baden symposium said the industry must improve its prospects as an investment opportunity.

-

Sources said a move towards facilities was the latest evidence of market softening in the D&O class.

-

The US could be exposed to economic losses of $1.1tn in the event of a cyberattack, the highest of any country.

-

The business was launched earlier this year with $7mn of seed funding from Aquiline.

-

The company said Ki is the first algorithmic underwriter to offer capacity from multiple syndicates.

-

The top five insurers on the continent maintained their ‘clear dominance’ in terms of scale.

-

The proposals, published in July, would have placed additional reporting burdens on large UK firms.

-

Extreme weather events leading to food and water shortages are largely uninsured, the Corporation warns.

-

The three new capital vehicles fundraising for a Lloyd’s play, coupled with some of the best underwriting conditions seen for years, have raised the prospect of a new age of investment in the market – but questions remain around execution.

-

Strong words from Patrick Tiernan have caused a stir in the market as pricing continues to fall off fast.

-

Axa XL, represented by Sean McGovern, and Marcus Johnson are standing unopposed for the corporate and individual external member positions.

-

The playbook provides managing agents with a “view of what, when and how action should be undertaken” when implementing Blueprint Two.

-

The Corporation made the comments as part of revised guidance on Tier 2 capital limits.

-

Coverys placed its syndicate into run-off at the end of 2022, as it looked to switch its London underwriting to the company market.

-

Insurance Insider has analysed premium growth trends across Lloyd's and the company market for 2022.

-

The Corporation has also increased tax services and corporate real estate charges as a result of inflation, the first rise since 2018.

-

Lloyd's has set out what London market firms will need to do to transition from decades-old systems to new central services in July next year, in a crucial step of several modernisation milestones to come in 2024.

-

Insurance Insider has compiled a digest of a complex web of regulatory reforms that will take shape during the next 18 months.

-

The fac-focused underwriter launched in South Florida earlier this year, providing general liability and PV coverage in Latin American markets.

-

Johnson could replace the incumbent council member Jeffery Barratt.

-

The Corporation’s chairman said that Names and other third-party capital are essential to maintaining the market’s unique nature.

-

The model will focus on Fiji and the Pacific Islands before it is replicated in Asia and parts of Africa.

-

The pressure is on Lloyds to deliver benefits as other players build up their domestic E&S platforms.

-

The Corporation used its latest market message to call out what it saw as an “underwhelming” approach from specialty insurers to changing conditions and “moronic” D&O underwriting.

-

The Corporation’s chairman said Lloyd’s has “earned the right to grow” and wants to drive competitive progress on ESG goals.

-

The two-month refurbishment project included a reallocation of ground floor box space and IT upgrades.

-

This CVC investment has come hot on the heels of an H1 result which showed performance plus growth, and should be interpreted as vindication of the work done at Lloyd’s.

-

A Reverse Mentoring programme from the people behind the Dive In festival aims to give new generations in insurance a chance to ensure their voices are heard.

-

Former Brit CEO Matthew Wilson will take on a role of special adviser to the Lloyd's Council later this year, Insurance Insider understands.

-

The Corporation will collaborate with Moody’s Analytics to develop a solution to quantify greenhouse gas emissions across managing agents’ underwriting and investment portfolios.

-

Nicholas Lyons plans to champion the London market's expertise on cyber and climate risk, and discuss ideas for a consolidated systemic risk pool.

-

Insurance Insider explores how insurers can manage the dual, polar-opposite pressures of a litigious anti-ESG movement and net-zero climate activism.

-

Plus this week’s executive moves and all the latest exclusives of the week.

-

An 85% combined ratio and 22% top-line growth are a deserved boost for Lloyd’s – the question is what comes next.

-

Lloyd’s achieved GWP growth of more than 20% in H1, whilst posting an 85.2% combined ratio.

-

All underwriting segments in the Lloyd’s market produced an underwriting profit in the first half.

-

Gross written premium increased by 22% to £29.3bn, and investments returned to profit.

-

There were 150 application for the most recent Lloyd’s Lab cohort, with just 12 firms making the cut for the 11th cohort.

-

The group is expanding its remit beyond the black community to focus on more underrepresented groups in financial services.

-

Elizabeth Jenkin will take up her role on 9 October and report to the organisation’s CEO, Sheila Cameron.

-

After Apollo announced a collaboration marking the latest milestone for algorithmic underwriting-led follow capacity in the London market, Insurance Insider explores how such partnerships can proliferate.

-

The collaboration will involve the algorithmic underwriting of risks with a human in the loop for decision verification and portfolio steering.

-

The Room has undergone refurbishment over the summer, and the ground floor will have a new layout.

-

The independent brokerage, founded in 2019, will now be able to sell reinsurance risks from across Latin America directly to London underwriters.

-

The auctions will take place in October-November this year.

-

Plus all the latest executive moves and the top news from the week.

-

Ongoing rate rises in property are expected to be offset by decreases in specialty lines and casualty.

-

PPL has set out how it is resolving various functionality problems raised by sources to Insurance Insider.

-

Head of legal Claire Schrader will assume the general counsel role on an interim basis.

-

And all the other big moves of the week.

-

Beazley and Lancashire’s plans to launch US units exemplify wider competitive challenges that the market must overcome to thrive.