The economic risks are huge. International Monetary Fund data shows that, since the early 2010s, Taiwan’s GDP has grown at a faster rate than the global economy. According to the World Trade Organization, Taiwan was the 16th-largest exporter and 17th-largest importer of merchandise in 2021.

The country is also the world’s top contract manufacturer of semiconductor chips, which are used in most electronics.

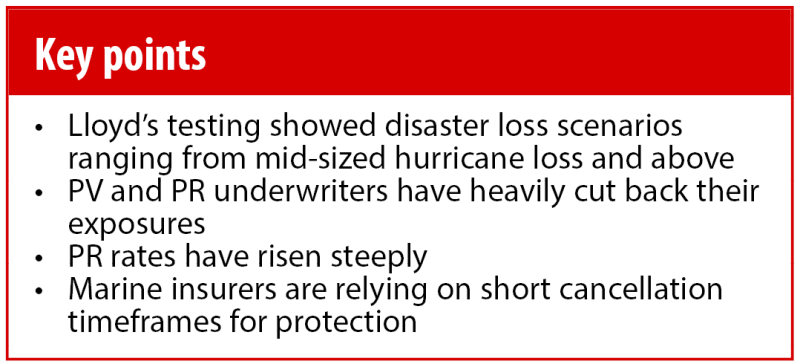

The more recent outbreak of conflict in Israel has heightened concerns over geopolitical instability. Amid this volatility, political risk (PR) and political violence (PV) insurers have heavily cut back in the region in recent years, hiking prices and limiting coverage to more geographically specific products.

Meanwhile, marine war carriers are relying on safeguards built into the products allowing them to cancel coverage after a week to mitigate their exposure.

However, Lloyd's stress-test plans show the exposure for the industry could still resemble the hit from a hurricane – suggesting that forward-planning to manage any event is still crucial.

Political risk demand rising but little supply on offer

PR underwriters have “drastically” changed their viewpoint on Taiwan in the past few years after previously seeing it as “benign territory”, with many carriers now completely off risk in the region, sources said.

Sources canvassed by this publication varied on the extent to which escalation of conflict between China and Taiwan is a pressing concern for them at present, although all sources agreed it is a geopolitical situation that is being closely monitored by the market.

The inquiry flow to carriers, and demand in the region, have increased significantly, but many carriers are looking to strip back or at least not increase their exposure to China or Taiwan.

Although it is understood that many insurers have reduced exposure to China and Taiwan, another source explained that some carriers are more comfortable in taking on the risk if the client is willing to pay a premium that reflects the risk. In this situation, the carrier might consider a line on a particular risk that is more isolated.

Where China and Taiwan may have previously been brought under multi-country or broader Asia policies in the past, coverage in the region now is much likelier to come under a single-country policy.

"And as a result of that, you're seeing pricing increase, policy binding and more elevated pricing levels, because there's less capacity [and] less interest in writing it,” the source continued. “There has been a big impact in our market and demand for business both in terms of number of inquiries, because corporates and banks are more worried, the pricing is being driven upwards."

One underwriting source said that pricing for coverage in China and Taiwan has more than quadrupled.

Roughly two years ago before tensions flared up, pricing was 0.35% on a 15-year risk in the region, "now you're looking at 1.75%-2% per annum for a one-year risk," another source outlined.

Another example of massively increased pricing came from a broking source who explained that, when recently renewing coverage for a client with no claims, discussions started with a 50% increase in pricing, which they described as "huge".

Tension between China and Taiwan has increased distinctly after the-then US House of Representatives speaker Nancy Pelosi visited Taiwan in August 2022.

While China sees “reunification” with Taiwan as something that “must be fulfilled,” according to president Xi Jinping, Taiwan believes it is distinct from the Chinese mainland and has its own constitution and leaders who were elected democratically.

Market participants agreed that the recent escalation of conflict between Russia and Ukraine has had a significant impact on the way in which both clients and carriers approached coverage in China and Taiwan.

Seeing Russia go from a very active member of the global economy to being almost entirely cut off from the West has allowed companies to envision escalation of tensions in Taiwan as a situation “that could actually happen,” a source explained.

“Whereas before many thought 'yeah, that can happen to Myanmar', but most companies would have said that's not something that can happen that quick. It's just that realisation that escalation is potentially a real thing."

Marine insurers hopeful on speed of Taiwan shipping routes

The war in Ukraine was a painful reminder to the marine market of the claims potential for blocking and trapping, with insurers typically paying out for total losses on ships if they are detained in war zones for over a year.

The mass detention of ships in Ukrainian ports following Vladimir Putin’s invasion resulted in a sizeable claims bill for marine war underwriters, and prompted an increased focus on global exposures and aggregations.

Far higher volumes of maritime trade pass through the Taiwan Strait than through the Black Sea. However, mariners are hopeful that the speedy passage of ships through the area, and the structural advantages of marine war contracts that allow them to charge additional premiums in quick order after the outbreak of hostilities, will mitigate their exposure.

Typically, once an area is deemed a high war risk, underwriters can issue a seven-day notice of cancellation, then begin charging additional premiums for ships operating in the affected seas.

The topic was a talking point at the International Union of Marine Insurance (Iumi) conference in Edinburgh this September.

Iumi president Frédéric Denèfle noted there is “mounting tension” between China and Taiwan, but quantifying blocking and trapping exposures is highly challenging.

“We do not have a full maximum loss scenario available for that type of situation, and this is a matter of concern for a lot of stakeholders in the industry,” he said.

Maritime insurance data platform Insurwave noted that the Taiwan Strait handles 50% of the world’s container fleet and is a “geographic bottleneck”.

“To put things in perspective, 12% of global trade passes through the Suez Canal, one of the world's most heavily used shipping lanes, which for a time had a significant impact on world trade when it was disrupted in 2021,” said Insurwave’s commercial director Mark Costin.

“In comparison, estimates of the volume of trade carried through the South China Sea range from 20% to 33%. This equates to thousands of vessels and huge exposure to the global marine industry.”

The Ukraine war has also generated a seismic shift in reinsurance costs, deductibles and coverage, meaning most marine underwriters are shouldering far higher risk on a net basis.

In some quarters, this has prompted a reduction in appetite to write war business.

However, it is not possible to draw direct comparisons between the situation in Ukraine and modelled scenarios in Taiwan.

One point raised by sources was that the turnover time at ports is far shorter in and around Taiwan than in Ukraine, meaning shipowners would be able to respond more promptly to a conflict.

And while the marine war market exposures may be huge, the unique and nimble structure of the market allows it to respond rapidly to loss situations.

A situation in which Taiwanese or Chinese waters became at-risk areas, attracting additional premiums, would likely lead to a substantial income stream for the market.

PV segment has low standalone Taiwan exposure

While other sectors of the market are concerned about the looming threat of a conflict between China and Taiwan, PV underwriters are quietly confident they won’t see many significant losses.

Market sources canvassed by this publication said there are very few standalone Taiwanese risks in the London market, with the risks that do make their way in often forming part of large portfolios.

One source said they could “count the number of standalone risks on one hand”.

Despite this, there is some concern in the market that electronics supply chains, including microchips for consumer electronics, aircraft and supercomputers, could be disrupted, or there may be a large-scale cyberattack, which would likely fall to the terror market.

However, if there were an attack on electronics supply chains, there would likely be a contingent BI claim and, as always, where the loss falls in the market is entirely dependent on the loss trigger.

PV underwriters have been systemically cutting back exposure in Taiwan for the last few years, resulting in a low level of exposure were a conflict to erupt.

Given the history of the tensions between China and Taiwan, there is also very little strikes, riots and civil commotion (SRCC) coverage in the London market.

Sources said this is largely because Taiwan has been getting excluded from coverage more and more regularly as fears over the potential for conflict escalated.

Sources also said the cutbacks were as a result of reinsurers continually asking questions about underwriters’ exposure in Taiwan.

As we saw at the last January renewals, reinsurers have become increasingly stringent when it comes to geographical exclusions, higher retentions and tighter restrictions for cedants.

However, this has not stopped reinsurers from consistently asking underwriters about how much Taiwanese exposure they have on their books, with one source noting that it is always one of the first questions they ask when discussing the upcoming renewal.

Lloyd’s tests suggest mid-sized hurricane size losses possible from region

Rising tensions in the region recently saw Lloyd’s undertake an ad-hoc review of the market’s exposure for several event scenarios in the South China Sea, including the occupation of outlying islands, such as Taiwan.

Despite the relaxed sentiment of some segment underwriters over their exposure, the outcomes suggest that, combined, the market cannot be complacent over the risks.

The Taiwan Strait scenarios were designed by a third party to consider implications across a wide array of classes including: aviation, cyber, marine, PR, PV and SRCC, and property including contingent BI. Lloyd’s did not express any view on the likelihood or geopolitics of any of the scenarios.

In his Q3 market message, chief of markets Patrick Tiernan explained that the first two scenarios of a blockade and outlying island activity project final net losses which were roughly in line with mid-sized US hurricanes.

The third scenario was more extreme than the others, but in terms of final net loss, lower than a repeat of the KRW storms of 2005 on today’s portfolio.

“As a market, we can absorb any of the scenarios, but the issue that we need to focus on is the accumulation of exposure from a relatively small premium base,” Tiernan said at the time.

He urged syndicates to “plan and rate for the geopolitical risks ahead of us rather than focusing on rate increases gleaned from recent events”.