-

The broker will join Ron Borys’ financial lines team.

-

Property pricing fell by 8%, while casualty rate increases tapered to 3%.

-

The Jay Rittberg-led program manager kicked off a strategic process in August.

-

The broker will report to Howden US CEO Mike Parrish.

-

A Lloyd’s consortium led by Beat Syndicate 4242 backs the MGA.

-

The carrier is planning a limited relaunch into the UK D&O market.

-

The BP Marsh-backed MGA launched earlier this year, led by Adam Kembrooke.

-

Ariel Berman joined the company as head of specialty in 2023.

-

Plaintiffs allege that manufacturers and retailers have broken environmental laws.

-

The new division will be led by Terry Fitzgerald, who has previously led the finpro portfolio.

-

Plus, the latest people moves and all the top news of the week.

-

Rates are bottoming out, but ample capacity is still preventing a hardening market.

-

Assurex’s global independent broker network pumps $4bn of premium into the London market.

-

Worsening trading conditions in the D&O market are leading to staff cutbacks.

-

The broker has been on an aggressive hiring spree overseen by Lucy Clarke.

-

Company alum David Murie will lead the new business unit.

-

A number of staff will be leaving the D&O team as a result of the restructuring.

-

The move will impact around $50mn of gross written premiums in total.

-

Price decreases became lower throughout Q2, however, averaging 3% in April, 2.3% in May and 1.6% in June.

-

Emerging lawsuits and expanding loss triggers are giving rise to potential claims under a range of policies.

-

The underwriter was head of financial institutions at LSM for six years.

-

The company has struggled in reinsurance, while large claims dragged down D&O results in Q2.

-

The broker has noted that double-digit reductions are increasingly available in property.

-

The insurer denies it is responsible for the actor’s legal fees.

-

Claims were concentrated in the US, with a significant increase in D&O class actions.

-

SiriusPoint will provide 100% capacity for Pen’s international PI portfolio.

-

The MGA has also appointed Probitas alumnus Kiran Wignall.

-

The executive previously held roles at Capgemini, The Hartford and AIG.

-

Rates continue to drop as capacity is ample, the broker said.

-

Property rates are coming under further pressure, while liability is being buoyed by ongoing challenging loss trends.

-

Errors and omissions claims made up 55% of all notifications, continuing a five-year trend.

-

The MGA has built out a suite of products, including a planned launch into political violence.

-

The reinsurer confirmed Andrew Phelan’s exit, as of 15 May.

-

The carrier will focus on mid-market business outside of Lloyd’s.

-

The MGA is building out its product base from its latent defects and surety offering.

-

The reinsurer said the market was unprofitable and pricing needed to increase immediately.

-

The only major product line to see rate increases was casualty.

-

He will oversee Ascot’s US and Bermuda insurance and reinsurance companies.

-

The move was influenced by fierce competition in the domestic US D&O market.

-

The specialty MGA has been pursuing an M&A strategy in recent months.

-

PartnerRe's $5mn commitment will enable the MGA to expand its D&O line size.

-

The broker has recently unified its global financial lines practice.

-

The combined ratio improved by 3.2 points, from 80.9% in 2023 to 77.7% in 2024.

-

Larger companies ranked regulatory breach as their top risk.

-

The London wholesaler rebranded from GAWS of London in March last year.

-

Andrew Johnson, Edwina Charlton and Rupert Newman join from Paragon.

-

Underwriting conditions in the financial lines market have deteriorated after major hardening.

-

The broker also spent five years at JLT.

-

The broker said clients could expect to see double-digit rate decreases this year.

-

The facility is backed by a $10mn Lloyd’s binder.

-

The carrier’s US platform will continue to be led by long-time executive Sal Pollaro.

-

The average change for primary policies with the same limit and deductible was a 3.5% decrease.

-

The offering will provide D&O, professional indemnity/errors and omissions, crime and cyber cover.

-

Parker has worked at Ardonagh-owned Paragon since 2012.

-

The MGA and 49% owner SiriusPoint could bring in a new investor.

-

McGill was recently included in Warburg Pincus’s multi-asset continuation vehicle.

-

The pair will lead crisis management and financial lines, respectively.

-

Gabriel Ewing has held senior roles at WTW in the transactional risks team and at Marsh.

-

The company has exited some transactional liability and commercial D&O business.

-

Plus the latest people moves and all the top news of the week.

-

Chris Nixon has been promoted to underwriting manager, executive & professional lines, UK.

-

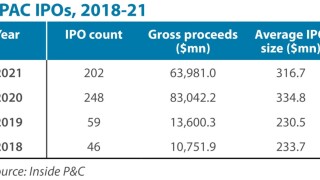

A resurgence in IPO activity may help provide new business for underwriters and reduce competition.

-

The underwriter will manage and develop the MGA’s professional indemnity portfolio.

-

The business will trade via London, the US and Canada.

-

It is understood the increase is mainly due to a new professional lines team.

-

Former PWC partner Tom Brown has been named interim CFO.

-

The MGA said there was a “notable imbalance” between supply and risk exposure in the D&O space.

-

Overall, insurance rates fell by 1%, led by competition in property.

-

Uncertainty around court outcomes is almost forcing carriers to settle claims.

-

The Flex consortium will offer up to EUR/$50mn limit.

-

The carrier will only continue to offer lead capacity to some existing accounts.

-

It will take more carriers to rein in income expectations to halt the soft market spiral.

-

The D&O class has experienced huge rating volatility over the past four years.

-

The firm will specialise in professional liability insurance for SMEs.

-

Polo Managing Agency is to act as turnkey to the new venture.

-

This publication revealed last month that some of Westfield’s financial lines team had resigned.

-

The deal is the D&O MGA’s first acquisition since launching in 2021.

-

Securities class actions are a perennial source of claims for D&O insurers.

-

Q2 was the ninth consecutive quarter of year-over-year price decreases.

-

The development follows news that Kentro Capital CEO Colin Thompson has resigned.

-

Professional indemnity is the largest class of business for the syndicate.

-

The business specialises in hard-to-place risks.

-

The broker has worked for WTW, Lockton and AJ Gallagher.

-

Hopper joined Starr in 2019 and previously worked at Marsh and Zurich.

-

Underwriters fear that misleading statements about AI capabilities could result in claims.

-

Prior to joining WTW, Morrison has held senior roles at Canopius, and AIG.

-

Casper was launched last year by Argenta deputy active underwriter Bradley Knight.

-

Prices for programs that renewed in both Q1 2023 and Q1 2024 decreased 15%.

-

The US regulator faces litigation from both sides of the climate issue.

-

Rates continue to trend downwards in the D&O class of business.

-

The move comes as rates continue to decrease in the D&O class.

-

A total of 30 carriers entered the US public company D&O space in 2023.

-

The team of brokers worked for the recently acquired Protean Risk.

-

There is frustration in the market that remediation work has been squandered.

-

WTW said the rise of the risk from health and safety was “surprising”.

-

-

The findings have implications for businesses and D&O.

-

Head of FI Samantha Shean is leaving Axis to join Aviva.

-

Insurance Insider reported last year that the facility was relaunching.

-

The broker has been adding to its capabilities in the region.

-

The pace of price decreases has eased since Q2 last year.

-

The carrier has been growing its financial institutions team and recently appointed Mark Warrilow from Price Forbes.

-

The broker grew by 35% in 2023 and is looking to reach gross written premiums of $1.4bn by 2026.

-

This publication recently noted that ongoing rate declines and questions about past accident years are leading to calls for D&O price discipline.

-

The professional risks portfolio is underpinned with Bridgehaven capacity.

-

The Hartford, Canopius, Newline, QBE, CNA Hardy, Travelers, Hamilton and Volante are participating in the facility.

-

The casualty-focused MGA was launched in March by Argenta deputy active underwriter and head of casualty Bradley Knight.

-

Sources said that there was still rating adequacy in the market, but that further pricing falls would be unsustainable.

-

The D&O market continues to soften, following several years of substantial rate increases.

-

A-Star offers up to $80mn in additional capacity for D&O liability insurance.

-

There is an increasing focus in the casualty reinsurance space on social inflation and litigation funding trends.

-

The decline marked the sixth consecutive quarter of double-digit pricing declines.

-

Hema Mistry returns to the UK to run the finpro division, following a stint at the broker in San Francisco.

-

Sources said a move towards facilities was the latest evidence of market softening in the D&O class.

-

Lockton is hiring in financial institutions following the departure of several staff to join Bishopsgate.

-

Plus this week’s people moves and all the top news from this week.

-

Strong words from Patrick Tiernan have caused a stir in the market as pricing continues to fall off fast.

-

The carrier is rebuilding its financial lines team following a number of staff exits from the division.

-

The Corporation used its latest market message to call out what it saw as an “underwhelming” approach from specialty insurers to changing conditions and “moronic” D&O underwriting.

-

Berman will replace Ramesh Singh, who is leaving the business to head up financial lines at Aviva.

-

She joins the D&O team in London following the exit of senior underwriter Tim Carpenter, who is joining BHSI.

-

The MGA platform was launched by former Barbican executives in late 2021.

-

Average renewal premiums decreased 20% to 30% over the previous year’s price, with some public companies posting premium falls of 50% to 60% in the past 18 months.

-

Aviva has seen a number of staff exits from its D&O team, with senior personnel leaving to launch a book at Westfield Specialty.

-

The hammering of hailstorm losses that US homeowners’ carriers reported for H1 will drive positive change in property markets.

-

BHSI grew to be one of the largest writers of D&O in London during the hard market of 2020 and 2021.

-

Aon report marks the fifth consecutive quarter of year-over-year pricing decreases in the D&O space.

-

Double-digit rate decreases are common in the class of business despite macroeconomic headwinds.

-

The business will offer products including commercial financial lines, financial institutions and investment management insurance.

-

The underwriter has previously worked at AIG, Chubb and Markel.

-

Cyber GWP could exceed $50bn by 2030, the broker predicts.

-

The executive will work as director of underwriting for the specialty casualty division.

-

The executive oversaw lines of business including management liability, financial institutions and healthcare.

-

It emerged earlier this month that Westfield Specialty was launching a D&O book through Syndicate 1200.

-

The consultancy has outlined the financial guarantees needed from governments and availability of data from Ukraine that will enable insurers to provide risk capacity for the country's recovery.

-

The class is attracting increasing scrutiny from executives and within Lloyd’s, as a descent in pricing persists.

-

The broker said clients could save money, increase limits and buy extra coverage.

-

Syndicate 1200 exited London D&O in 2020 when it was under the ownership of Argo.

-

D&O insurers have long warned that economic conditions could push up insolvencies and associated claims.

-

The MGA will now offer employment practices liability, pension trustee liability, and commercial crime cover.

-

Prices are continuing to decline in the D&O market following significant hardening.

-

The scale of reductions is increasing as the class of business experiences its fourth consecutive quarter of rate falls.

-

The broker said pricing reductions might decelerate throughout the year if carriers perceive increased risk.

-

The ratings agency cited an increased risk of asset-quality deterioration.

-

The WTW D&O liability 2023 survey canvassed directors and risk managers in 40 countries around the world.

-

High capacity and an ongoing faith in the financial system have mitigated against instant action from insurers.

-

The hire comes as Miller continues to expand its UK team under the leadership of Tim Norman.

-

AIG’s head of commercial D&O in the UK, Christopher Magee, is leaving the business to take up a role with Starr in the US, Insurance Insider can reveal.

-

The binder will offer £5mn in primary capacity for companies in technology, media and marketing.

-

WTW’s survey cites regulatory risk, health and safety precautions and bribery and corruption on the list of top D&O risks.

-

The MGA provides coverage to SMEs in the food, hospitality, leisure and hotel sectors.

-

Prior to joining BHSI in 2020, Ben Ruddlesdin worked as an underwriter for The Hartford.

-

A group of lenders have provided uninsured deposits of $30bn to support the ailing bank.

-

The longstanding Chaucer underwriter left when the carrier exited the FI market last year.

-

The demise of the lender underlines concerns about global economic conditions and high interest rates.

-

Not only could raising venture debt become increasingly difficult for the sector, but InsurTech companies could also struggle to access their credit lines.

-

D&O underwriters, as well as financial institution insurers supporting startups and venture capitalists, could have faced “financial distress” without government intervention.

-

Costs of defending and settling lawsuits are likely to fall on the bank’s D&O insurers.

-

The market has undergone substantial multi-year hardening after a surge of painful loss activity.

-

Reinsurance renewals were more orderly than feared and business plan resubmissions have a positive weighting.

-

The MGA’s international platform hopes to bring in MGA underwriters looking for US expansion.

-

CEO Nick Tye told this publication earlier this month that the company was planning a financial lines launch.

-

The broker said that rates were falling but remained well above soft market levels.

-

Argenta will be a cornerstone capacity provider to new MGA Casper, which will write $100mn in year one.

-

The product launch comes soon after the MGA started a new professional indemnity binder.

-

There has been no let-up in rate reductions so far this year, as fears mount about the profitability of the class.

-

The market has quickly moved away from dramatic hardening in 2020 and 2021 following an influx of capacity.

-

Slowing primary pricing, the looming threat of inflation and increased cat retentions were key themes from this reporting round.

-

Rokstone’s new PI facility is for UK and EU risks with a £2mn primary and a £5mn excess of loss limit.

-

The MGA has grown its fintech book by 100% in the last year and the new team will be led by Hannah Durrant.

-

The business marks the latest launch into a financial lines market that has attracted substantial amounts of capacity.

-

Companies will also face claims relating to cyber security and problems with ESG disclosures.

-

Alex Burton Brown’s appointment comes at a time of elevated personnel movement in the financial institutions space.

-

The broker said a dearth of IPOs had created a “buoyant environment”, with both start-ups and incumbents competing.

-

The underwriter joined the company in 2020 amid hard market conditions.

-

While competition is picking up, a likely rise in claims during a recession is likely to prevent a return to a soft market.

-

There has been a recent uptick in personnel movement in the financial institutions space.

-

Prices are falling in the London D&O market amid competition to secure business from incumbents and new entrants.

-

Jodie Major worked for Chaucer’s financial institutions team, and the carrier has recently exited the market.

-

Convex joined the financial lines space at the height of a hard market, when capacity was scarce.

-

Plus the latest executive moves and all the top stories of the week.

-

The carrier has also exited the downstream energy and financial institutions markets in recent weeks.

-

Some multi-national cedants are using US addresses to source cover from US carriers, risking issues in the event of claims, amid a desperation for growth on both sides of the Atlantic.

-

The move is the second recent class-of-business exit, with the business also having withdrawn from downstream energy.

-

In Q3, 46% of primary policies renewing with the same limit and deductible received a price decrease, while 16% received a price increase, according to Aon.

-

The declining number of IPOs has reduced demand for public D&O cover and created competition, but current rates may not adequately price the risk, the executive said.

-

Consilium’s financial lines operation specialises in professional and executive risks as well as cyber.

-

The scheme aims to fill the gap left when private sector carriers exited the market following the Grenfell disaster.

-

The hire of Ben Phillips comes amid a recent uptick in personnel movement in financial lines after a period of stability.

-

The appointment comes following the departure of Renette Pretorius, who is joining Berkshire Hathaway Specialty Insurance.

-

Sources said that some entities were exhibiting “sheer desperation” to hit 2022 plans, driving down prices.

-

The executive has worked at the carrier for over nine years, initially within the accident and health team.

-

The appointments come following the exit of underwriter Matthew Howard-Coombe to Starr.

-

The broker said clients could achieve broader terms and higher limits in D&O, although there was frustration over pricing fluctuation.

-

The rapid cooling of the US SPAC and de-SPAC market could also prove fertile ground for the plaintiff bar.

-

The underwriter joined CNA Hardy last year amid a flurry of people movement in the D&O market.

-

Are we set for the shortest softening D&O market ever?

-

Accredited Insurance will be the fronting partner for Nexus Frontier.

-

The policy, which Beazley claims to be the first of its kind in London and the US, will offer $10mn of capacity.

-

A Howden report on the D&O market shows that clients “heavily penalised” for Covid-19 exposures have seen “meaningful rate reductions”.

-

With pricing surpassing a previous peak in 2002, new entrants and established carriers vied to secure business.

-

Plus this week’s Q1 results and all the top news of the week.

-

Conditions for SPAC D&O are likely to remain turbulent, amid the heightened SEC scrutiny and uncertainty concerning claims resolution.

-

The appointment comes after the carrier promoted Janine McGriskin to lead FI in the UK.

-

The impact of the war in Ukraine has led to a drop-off in IPO activity, which many carriers were relying on for growth.

-

The broker has also appointed Rebecca Harvey from Besso to focus on North American production in D&O.

-

The hire follows the appointment of Keith Mather to head up financial lines for the international business.

-

Linda Daly will join the company’s D&O division led by Michael Chu.

-

The start-up said its survey shows that SPAC and de-SPAC claims would drive increasing litigation throughout 2022.

-

Underwriters are navigating tricky territory as they look to hit growth targets while maintaining discipline on pricing.

-

The appointment comes after Allison Wilkinson departed Chubb to join Convex.

-

Prior to her promotion, Janine McGriskin held the role of senior underwriter, UK financial institutions, at the carrier.

-

The broker has reported successive slowdowns since price increases climbed to a peak in Q1 2020.

-

The MGA can now offer limits of up to £10mn on either primary or excess layers for UK PI business.

-

Secretary of state Michael Gove claimed the market is “failing some leaseholders”.

-

For the SPAC market, sources said that prices should continue to harden, while D&O rates are expected to stabilize amid a capacity flush.

-

Michael Morgan will take over as head of professional liability in the latest management change at the finpro practice.

-

The unwinding of the pandemic, inflation and specialty pricing are set to be some of the areas of focus for the market.

-

The appointment comes after Sarah McGurk resigned to join Aviva.

-

Increased competition is shifting market dynamics after a transformation in rating conditions.

-

The new recruit will join Julian Samengo-Turner’s Middle East and Africa team.

-

Staff movement in the line of business has remained high amid firm market conditions coming into 2022.

-

The executive has more than 25 years’ experience working in banking and asset management.

-

New markets have reset the balance between supply and demand in the market.

-

The hire follows the addition of former Berkshire Hathaway executive Michael Densham to expand the MGA’s Canadian operations.

-

The carrier has been rebuilding its D&O team after a number of staff left to launch new books of business.

-

In his new role at the specialist D&O MGA, Densham will report to Banyan founder and CEO Tim Usher-Jones.

-

Plus, the latest executive moves in the sector and all the top news of the week.

-

The market was divided about the outlook for 2022, with some predicting a substantial reduction in rates.

-

Insolvencies are a key source of claims but have been prevented by government support measures during the pandemic.

-

Competition for staff remains fierce in the D&O market, where there has been substantial rating remediation.

-

Spring Partners said the new underwriting capacity and product launch were part of its London market growth plans.

-

The broker has announced several senior leadership changes since John Doyle was promoted to group president and COO.

-

The carrier has been rebuilding its team after losing key underwriting staff earlier in 2021.

-

The carrier has faced a string of resignations amid a battle for talent in the D&O market.

-

Chris Warrior will take on additional responsibility for professional indemnity, cyber and transactional liability.

-

The start-up carrier launched in FI over the summer with ex-Pembroke and Hamilton underwriters.

-

The broker has reported successive slowdowns since rate increases hit a high in Q1 o 2020.

-

Plus the latest in aviation broking account wins and all the top news from this week.

-

The carrier has seen an exodus of financial lines staff amid a battle for top talent in the line of business.

-

SPAC coverage has attracted favourable pricing, but underwriters are scrutinising claims trend following a boom in blank cheque activity.

-

Experienced underwriters Patrick Comerford and Clive Moore left Pioneer after it failed to secure PL paper for 2020.

-

Wesley Richards will report to Dylan Hughes, managing director of Brunel Professions.

-

The MGA is one of the start-ups to have joined the D&O market since the dramatic change of conditions in 2020.

-

The business will write casualty lines including PI, D&O, medmal and cyber.

-

Elizabeth Grima will run the new wholesale unit with Tom Malcolm.

-

The broker expects a slowdown in price rises to continue for the rest of the year.

-

The underwriter, who used to head up D&O at Starr and Barbican, will lead an expansion into the class at the professional indemnity MGA.

-

Increased disclosures being released by companies heighten the risk of inaccurate or misleading statements.

-

Staff movement is high in the D&O market as carriers look to capitalise on buoyant market conditions.

-

The nature of the hire demonstrates the level of competition for top talent in the sector.

-

Staff movement in the D&O market remains high as carriers battle to secure top talent in a hard market.

-

The start-up carrier has already appointed several Hiscox staff to build out its financial lines operation.

-

Convex has been building out its FI team, which is headed up by Allison Hollern.

-

The ratings agency warned that underlying loss activity remained high and new threats are emerging.

-

The carrier said it was experiencing the hardest financial lines market for 35 years.

-

Staff displacement in the D&O market is high following a tumultuous period of rating adjustment in 2020.

-

Adjusted for large renewals and IPOs, the pricing index rose 7.7% in the second quarter.

-

The broker said CUOs insisting underwriters renew with price increases risked losing quality business.

-

A number of employees have recently resigned from the carrier as high staff displacement continues in the D&O space.

-

The underwriter will be based in Barcelona and focus on professional indemnity business.

-

The SiriusPoint-backed business will focus on complex risks, such as IPOs, life science and SPACs.

-

The business will be headed up by Tim Usher-Jones, a former Chubb D&O executive in the Canadian market.

-

Tegron is one of several new entrants to the market, easing pressure on capacity in the D&O sector.

-

The carrier said the appointments will help the insurer "grow its presence within the UK broking market”.

-

Staff displacement has been high in the D&O market after a period of dramatic rating adjustment in 2020.

-

The specialty insurer’s new division will underwrite global liability risks from its London office.

-

New entrants have eased the capacity constraints that played a large part in last year’s huge rating changes.

-

The carriers insuring VW’s D&O policies have agreed to pay out claims due to damage inflicted by previous executives in the emissions scandal.

-

The expansive syndicate was one of several players to join the D&O market after dramatic rate rises last year.

-

Falcon Risk Holdings will initially focus on financial and cyber lines in the US.

-

Investors in London-based insurer include specialist InsurTech backer Mundi

-

The aspiring carrier is already providing risk-transfer deals for carbon offset buyers but plans for its initial underwriting to be focussed in more traditional areas.

-

Rob Green transfers from AGCS London while Rick Hornby joins from NFP.

-

The underwriting executive will oversee lines including cyber, D&O and casualty.

-

The Gallagher MGA said current market conditions made it an ‘ideal time’ to invest in D&O.

-

Two former Axa XL financial lines underwriters join the start-up.

-

Double-digit rate rises are still expected in the class, but not at the same scale as seen in 2020.

-

Hiscox, a lead market for D&O in London, takes its peer’s head of London market financial lines.

-

Tegron Capital will launch in July and focus on excess-of-loss cover for publicly traded companies.

-

The broker warns directors could face legal bills running into the millions of pounds.

-

Underwriters and brokers are competing for talent amid hard market conditions in the class of business.

-

Founders Philippe Gouraud and Yoel Brightman bring on board their former colleague.

-

New York-based executive risk underwriter Jim Rizzo will lead the new product suite.

-

The carrier is one of a number of players to have entered the D&O market as pricing continues to grow.

-

Rising Edge will provide D&O cover for companies ranging from US-listed entities to private entities.

-

Market sources report an uptick in competition to secure accounts as clients sought optimum deals in a challenging market.

-

The continued expansion comes amid tough competition for talent in the hard D&O marketplace.

-

The broker said that the carrier’s decision had forced some clients to rebuild policies from scratch.

-

Market sources said that ongoing economic disruption is likely to keep pricing in the market high.

-

The appointment follows the departure of two Talbot PI underwriters last year, who left to join Faraday.

-

The law firm said underinsurance was common in the sector, despite rising risks.

-

Insider Hannah Tindal will move from Chicago to London to take the role of D&O head within the London regional unit and Nordic team.

-

The Aquiline-backed motor syndicate is hiring a team to lead a build-out in specialty lines.

-

Conditions remain favourable for underwriters but uncertainty remains on whether the recession will lead to a flood of claims.

-

The appointments follow Axa XL’s exit from management liability business in London last year.

-

The start-up makes its first appointment directly from Hiscox, where Inigo founder Richard Watson worked as CUO.

-

The management liability market underwent huge hardening last year as major carriers withdrew.

-

The appointment confirms the carrier’s prospective involvement in the rapidly hardening market.

-

The return to the office and perceived slow business recovery could also lead to claims.

-

The appointment reflects a diversification push at the carrier.

-

The broker will add a Belgian office alongside its London operation for post-Brexit trading.

-

Soaring rates in the D&O market have prompted a string of underwriting people moves in London.

-

The insurer said that stripping out the effects of Covid-19 from counterfactuals would over-indemnify policyholders.

-

The insurer has a strategy of becoming a leading management liability insurer in the UK.

-

Mike Newson will lead the division as PI and financial lines manager.

-

The new capacity will be welcomed by brokers and clients as conditions continue to harden.

-

Bermudian’s Lloyd’s platform to begin underwriting class by early 2021.

-

Watford is liable for a $18.6mn fee if the Arch deal is terminated.

-

The decision follows an earlier move to shrink the book and the departure of CUO of international financial lines Tim Powell.

-

The Allianz unit says the experience of the Sars epidemic suggests general liability claims are likely to remain benign.

-

The additional capacity will go a small way to relieving a shortfall in the class, which has triggered rate rises of as much as 400%.

-

As rating soars and income dries up, clients are forced to cut limits and take on higher deductibles.

-

A memo circulated to brokers indicates the extent of the hardening underway in the London D&O market.

-

Olivier Hamon and Alice Batchili will write executive and professional lines products from the carrier’s Paris office.

-

The group remains committed to the class in Bermuda and the US.

-

It will be led by senior M&A lawyer Rob Faasen.

-

The broker’s Clips survey also recorded a significant acceleration in property prices.

-

The ex-Neon underwriter joins after a brief period heading up financial lines at Barents Re.

-

Michael Lock is the latest appointment to the team led by Niraj Perera, who joined from AJ Gallagher in April.

-

The trade body says unpaid premiums and excesses risk making policies unsustainable.

-

The carrier will be actively targeting excess lines on US-listed placements, where capacity has been shrinking.

-

Massachusetts-based Surround will provide a variety of coverages in one combined policy with a flat price.

-

The broker notes that Covid-19 will have a long-term impact on classes of business including D&O.

-

Frank Amandi moves to the new post in Cologne after more than six years with the Allianz unit.

-

The directors’ and officers’ (D&O) insurance market is bracing for a total loss of around $600mn for claims against American-Israeli drug manufacturer Teva Pharmaceuticals.

-

Wirecard collapse threatens huge loss; Apollo and Argo deals revealed; inside the AGCS turnaround.

-

The pull back of a key lead market comes at a time of significant hardening in the D&O space.

-

He replaces Chris Mauduit, who has retired after leading the team for the previous five years.

-

The latest damaging D&O loss comes as the market hardening continues to accelerate.

-

Hardening in the financial lines market has been exacerbated by fears over Covid-19.

-

The prospect of a fourth consecutive year of underwriting losses and Covid-19 uncertainty has spurred additional rate momentum since January.

-

In court documents, the defence company says Aon failed to provide sufficient claims notification advice.

-

Umbrella covers and commercial property "hardening at fastest pace since 9/11”.

-

The use of exclusions could leave the personal assets of directors at risk in the event of legal action.

-

John Collier rejoins former colleague David Purdy at the broker.

-

Average price growth accelerated to the fastest pace since the recovery began at the end of 2017.

-

Global pricing for financial business risks rose by 26 percent in the quarter, according to the broker’s survey.

-

Businesses expected to suffer disproportionately in the post-coronavirus economy are seeing rises of up to 400 percent.

-

Covid-19 has led to a surge in potential exposure in what was already a challenged market.

-

Tesla says it has not renewed D&O cover for the 2019-20 policy period because of the cost of premiums.

-

The commercial lines insurer first entered the country in 2015.

-

As the Covid-19 crisis continues to deepen, this week signs of strain became increasingly evident in certain lines of business.

-

An increase in the severity of securities class actions has seen D&O insurers present a united front against rising litigation, but divisions between carriers remain, writes John Hewitt Jones.

-

The syndicate reported a £25mn profit for 2019 as it delivered strong investment returns.

-

Antonio Bellanca will lead the PI line, working alongside three former Neon colleagues.

-

Axa XL’s UK financial institutions head Eve Richards and Clyde & Co partner Angus Duncan join the broker.

-

A round-up of InsurTech news from 13 March to 20 March.

-

The case is likely the first over alleged misrepresentations to investors about the virus.

-

WTW’s former executive director of financial and executive risks will lead the division.

-

Chloë Cox comes from Marsh JLT Specialty and Alex Atkinson was previously at Alesco.

-

The analyst said claims development in the sector usually takes three to five years.

-

Jarrod Schlesinger said insurers should engage with industry groups on the issue.

-

Recent rate rises have been partially offset by rising defence and cost containment expenses.

-

Fitch placed ProAssurance ratings on negative watch following the announcement of the acquisition, noting concerns about the medical professional liability space.

-

Pre-adverse development cover, the carrier saw impact from directors’ and officers’ and mergers and acquisitions-related business.

-

Zurich is understood to lead the aerospace company’s D&O programme, brokered by Aon.

-

The broker has experience placing business for offshore law firms and trust companies.

-

When looking at rate trends for large directors’ and officers’ (D&O) accounts, one could call the situation a tale of two markets.

-

Inside P&C questions whether emerging pressures in medmal are receiving enough attention.

-

The tussle over the financial lines broker comes amid rising competition for talent between rival insurance intermediaries.

-

The downgrade comes following the carrier’s disclosure of impacts from a worsening tort environment.

-

Shares of Travelers also fell by about 5 percent after the carrier reported its fourth quarter results on Thursday.

-

The carrier expects to book a Q4 P&C loss ratio of between 134 percent and 148 percent.

-

In its 2020 manifesto the association demands action to get the market segment moving.

-

However, there's more to re-underwriting an excess book than price alone, Inside P&C analysts noted.

-

Rate hikes imposed on three large corporate accounts had a major impact on the broker’s quarterly index.

-

North American PL, international financial products and environmental liability latest shut-downs.

-

Former Generali UK manager and head of financial lines hired.

-

The Insurance Insider looks back to some of the standout pieces of the last 12 months.

-

1 January renewal runs late as brinksmanship from cedants meets determination from reinsurers.

-

The Hollywood mogul is said to have reached a settlement for the civil cases filed against him.

-

Data from the Q3 CIAB pricing survey provides solid evidence the market today is well beyond anything seen since the turn of the decade.

-

The new business segment will target premiums of about $50mn-$100mn over the next five years.

-

Steven Moore will become lead underwriter for PI as Russell Newell moves to head up MGA Collegiate.

-

The rate rises followed a slew of high profile class actions and derivative lawsuits against US public firms.

-

The InsurTech, formerly named Verifly, sells short-term liability insurance for freelancers and small businesses.

-

Both senior brokers work in professional liability, with Jones also operating in the cyber market.

-

The senior underwriter joins from Abu Dhabi National Insurance Company.

-

The class action comes amid concerns over an uptick in environmental-related D&O claims.

-

The purchase of healthcare liability renewal business comes amid a retreat by SRCS from some specialty classes.

-

Sources said the new clauses would limit future opioid-related claims.

-

Ratings agency AM Best has affirmed the Birmingham, Alabama-based carrier's financial strength rating (FSR) of A+ while revising the outlook.

-

Fitch said AIG’s reduction in appetite has exerted a “strong influence” on the class of liability business.

-

The report suggests a continuation of upward D&O pricing momentum recorded in the first quarter.

-

US commercial insurance pricing increased by 4 percent in the second quarter, according to the broker.

-

The portfolio holds almost $200mn in net reserves.

-

The two executives join from JLT Re and are specialists in binding authority and open market general and professional liability.

-

The rise of technology has made our lives exponentially easier. The iPhone I carry around with me means I can be contacted at any time of day on all manner of platforms – calls, text, emails, WhatsApp, Slack, WeChat and more.

-

Derivative actions and social inflation have created a significant uptick in claims activity.

-

Daly has joined a new broking and investment banking platform recently launched by Cobbs Allen.

-

Ariel Duris said heavy regulation means the industry submits fewer claims than other sectors.

-

The changes come as regulators target more individual directors with enforcement action.

-

Sompo GRS mid-market leader Matt Burns will oversee the small business team.

-

The second quarter rate uptick compares to low single digit increases achieved in the prior year period.

-

The underperforming division is working to reduce annual gross premiums written by $900mn.

-

Axa XL has named Simona Fumagalli as head of financial lines for Europe.

-

Professional lines underwriter Lillies joins from Everest Re.

-

The Citibank-run sale process attracted interest from The Hanover.

-

Lloyd’s underwriters, Arch and Lexington will need to reach a new accord with victims of Allen Stanford’s $5bn investment fraud.

-

The group will start by underwriting property, casualty, executive and professional lines.

-

A New Jersey federal judge rejected insurers’ request to throw out key counts in the lawsuit.

-

Despite performance improvement, the segment still faces challenges, the ratings agency noted.

-

Bill Sullivan will retire after six years leading Berkshire’s casualty construction team.

-

Sector posts profit in 2018 but mounting concerns mean challenges are on the horizon.

-

“Distressed” D&O market pushes for correction as professional indemnity notches up double-digit rate increases.

-

EC3 execs described low-to-mid single-digit increases on average, with aviation, property D&F and PI rates pushing higher.

-

Mark Wood, Sarah Hughes and Adam Codrington will all join the David Howden-led firm.

-

Arguments were held Monday before the US Supreme Court in a case that could open the door to more lawsuits and D&O claims.

-

Jonathan Kennett will lead the operation following the fusion of the UK and Ireland and Chubb Global Markets teams.

-

The planned disposal would be the latest in a series of run-off sales at the global insurer.

-

The executive replaces Steve Redding, who left Antares to join Volante.

-

The increase to £350,000 per claim and the widening of the pool of those eligible for compensation could push up the cost of professional indemnity insurance.

-

The Australian Royal Commission into financial services misconduct has led to withdrawal of local capacity

-

Howard Friedman will leave his leadership role but will continue working at ProAssurance.

-

Aside from the noise around elevated catastrophes and lacklustre renewals, Q4 underlying loss ratios continued to rise.

-

Report shows insurers are increasing scrutiny of sexual harassment risk.

-

Carriers are reluctant to expand their appetite in areas like cryptocurrency before D&O prices rise.

-

An increase in securities litigation is expected to lead to greater D&O losses in 2019.

-

Casualty lines paint mixed rating picture going into 2019.

-

Five roles are under consultation as a result of the market withdrawals.

-

Philippe Aerni has helmed the segment’s financial and professional lines unit since 2014.

-

Philippe Aerni will lead both casualty and financial and professional lines.

-

Underwriting manager Richard Whelan will relocate to Liberty Specialty Market’s London headquarters.

-

Tom Grandmaison has led AIG’s construction practice for four years, focusing on clients in the US and Canada region.

-

The Lloyd’s carrier will provide paper for the insurer’s property, liability and professional indemnity lines from 1 January.

-

Axa anticipates claims could arise from regulatory changes as Brexit takes hold.

-

Professional lines and casualty leader roles also change with the departure of Steve McGill.

-

Channel Syndicate has exited professional liability, A&H, hull and cargo to gain 2019 approval.

-

The syndicate joins a growing list of carriers to exit the challenged line of business.

-

Next’s offering expands its coverage into general and professional liability insurance for general contractors.

-

The offering combines D&O, outside directorship, E&O and employment practices liability coverage

-

The WR Berkley CEO highlighted areas for concern in professional liability lines.

-

She worked at Liberty Mutual, BP and Siemens before joining AGCS.

-

Data from the Florida state insurance supervisor gives Universal an 8.3 percent market share in the counties lying in the path of the hurricane.

-

Sam Adamson has been promoted while Pavittar Bansel and Joe Dearsley join.

-

In theory doing insurance for big business should be very similar to selling reinsurance.

-

Levine was formerly a professional risks specialist at the rival broker.

-

The decline comes as almost one in five W&I policies attract a claim.

-

The executive joins from Marsh.

-

Liberty’s Global Transaction group will function as a stand-alone business unit.

-

Workplace harassment took center stage last year with the outcry over celebrities such as movie producer Harvey Weinstein and the number of people ousted from positions of power seems only to grow amid the continuing fallout.

-

The Primark store was reportedly undergoing a $38mn refurbishment and expansion at the time of the blaze.

-

The former investment bank executive joins the broker as the financial institutions team becomes part of the broker's global specialties arm.

-

Lloyd’s presentation slides from July obtained by The Insurance Insider throw a harsh spotlight on non-US professional indemnity business.

-

The medical liability insurer’s earnings surged over 21 percent from last year’s Q2.

-

Property, financial and professional lines recorded the largest rate increases in the period.

-

But the medical liability insurer’s combined ratio deteriorates to 99 percent.

-

This publication understands Aspen will either look to strike renewal rights deals on the aviation, marine hull and international professional indemnity books, or put them into run-off.

-

The start-up will initially focus on management liability lines in the UK and Ireland.

-

The seller’s board has also refused to grant exclusivity to the investment firm as hopes of a 1 August deal fade.

-

Senior underwriter Fergus Fergusson will take over following the departure of Donnacha Smyth to XL Catlin.

-

Aspen has lost more underwriters as members of its Bermuda FinPro team jump ship.

-

The Bermudian lost six underwriters and a claims specialist last week.

-

California, Florida, Texas and New York account for more than three quarters of premiums, which rise over 9 percent.

-

The team will be led by David Doe, formerly a director at the London market broker.

-

Ed Beckwith has held the role since August 2015.

-

Survey shows 80 percent identify breaches as top concern.

-

Axis was most recently professional lines unit leader for that nation at Axis.

-

The consortium has £10mn of primary capacity.

-

Diane Link becomes head of E&S lines casualty for North America while Allen Kwan will run sales for the west of the US.

-

Proprietary data bolster CEO Greenberg’s call for legal system reforms.

-

David Mercer’s professional indemnity-focused underwriting cell is one of nine in the pipeline for Volante.

-

He has been CEO of the broker's international finex business for 16 years.

-

Financial institutions underwriters John Dexter and Janine McGriskin have resigned, sources said.

-

The Japanese-owned Lloyd's business claims $25mn in IP capacity.

-

Greg Roberts is the latest underwriter to leave the company.

-

The firm’s Bradford says a market awash in capital may never harden again.

-

There is a stronger belief that commercial insurance rates with be at or above the three-year average.

-

Weinstein says his insurers are acting in bad faith by refusing to cover suits against him.

-

Earthquake capacity continues to grow and is now at an all-time high, seeing the same ugly pricing as elsewhere in the property sector, according to AmWins.

-

The (re)insurer’s expansion will provide warranties and indemnities coverage for M&A.

-

The Liberty Mutual unit has added ex-bankers and lawyers to Swan’s new M&A team.

-

Bowmark Capital has also bid for a slice of the high-net-worth broker.

-

The launch follows the hire of Neil Beaton in November

-

Open-market property and marine are the worst-performing areas.

-

Commercial auto segment leads the way with another near double-digit increase in Q1.

-

Appeals court says ambiguous language is construed in favour of the insured.

-

Buyer Allianz would probably offer shares for its Swiss peer, the analysts say.

-

The carrier will stop underwriting open market PI and FI business from London.

-

Bluefin Underwriting and other Schinnerer Group entities will adopt the new brand over the next year.

-

The former Zurich and AIG executive will be president of the alternative markets business.

-

An appeals panel returns case to trial court citing error on California law.

-

The insurer will extend its global capacity in the line by 20 percent.

-

The property picture improves but a casualty pricing deterioration accelerates.

-

Carriers ordered to pay $40mn for Verizon's defence costs from a 2006 spin-off related securities claim.

-

Weinstein sues Chubb for denying legal expense cover tied to alleged sexual assaults.

-

SRCS plans to enhance E&S platform with financial and professional lines.

-

The step by the US unit of Jardine Lloyd Thompson pushes the firm further into new markets following the addition of International Risk Consultants in February.

-

Initiative targets financial, executive and professional large accounts for insurers.

-

Executives share their views on pricing across primary and reinsurance lines in Q1.

-

The appointment is the third major hire since management closed a Centerbridge-backed $952mn buyout from Sompo.

-

US Risk Underwriters, a unit of P&C wholesaler US Risk, has set up a risk purchasing group to underwrite lawyers' professional liability coverage

-

Marsh has appointed Paul Denny as UK financial and professional (Finpro) practice leader.

-

Higher loss experience and increasing levels of litigation have led to restricted capacity for US directors' and officers' risks.

-

Claims frequency involving directors-and-officers (D&O) liability coverage rose in 2017, but that trend has not led to firming prices, according to AM Best.

-

The price per $1mn of directors' and officers' coverage fell 8.3 percent last year, according to Aon Risk Solutions.

-

Global commercial cyber liability premium is set to hit $6.2bn by 2020, with the services sector likely to be the biggest buyer of the standalone product in that timeframe, according to a report by data analytics firm Verisk.

-

JLT Specialty has hired Leon Steenkamp as head of tax insurance within its M&A insurance practice.

-

Pricing for directors' and officers' (D&O) insurance is getting firmer, albeit slowly and in distinct areas, while industry executives are heartened that market leaders are walking away from business if they have to.

-

Insurers that provided $130mn of D&O cover to Patriot National could face total losses on the policies unless a US bankruptcy court forces mediation of covered legal claims and temporarily halts related litigation, according to recent court filings.

-

Expansive MGA Nexus has made its fifth acquisition in 12 months with an agreement to buy professional lines coverholder Apsley Specialty.

-

Arch Insurance and US Specialty Insurance Company are seeking a judgment from the court of New Jersey to confirm they do not have to pay out for historic multi-million-dollar shareholder actions against pharmaceutical giant Pfizer.

-

Ryan Specialty Group has opened the doors at its first Latin America-focused managing general underwriter, Capital Bay Underwriting, in Miami.

-

Gail Cook has joined Lockton from Zurich, where she was head of financial lines.

-

Beazley has recruited a trio of financial lines underwriters, as the Lloyd's insurer continues to expand its presence in mainland Europe.

-

Arch Underwriting has appointed Alison Percival as regional manager for financial lines at its Australian business

-

WR Berkley has consolidated two professional liability units run from Chicago, combining Monitor Liability Managers with the Berkley Select operation there under the leadership of Joseph Shores, who had already been leading both organisations as president.

-

Canopius has hired William Kelly as a senior vice president in its US management and professional lines team.

-

MS Amlin has hired ArgoGlobal's Tim Finch as lead underwriter for financial lines to replace Andy Pecover, who resigned last September

-

Insurance broker and consultancy Qdos Group has appointed EY to handle a sale of the business, The Insurance Insider understands

-

CNA has purchased a new quota share cover to support growth of its financial institutions (FI) and management liability portfolio that carries a ceding commission of just 28 percent, The Insurance Insider can reveal.

-

The bulk of Ironshore’s representations and warranties M&A team for the Americas has quit the Liberty Mutual-owned insurer to join Ascot’s MGA start-up Ethos, The Insurance Insider can reveal.

-

Willis Towers Watson North America (WTWNA) has consolidated a number of Finex offerings in the US into a single panel on its recently launched Connected Broking platform, The Insurance Insider can reveal

-

The price of directors' and officers' (D&O) coverage fell for the 17th quarter in a row in Q3 despite the threat posed by near-record levels of legal activity, which could increase claims

-

UK businesses have a blind spot for boardroom risks, CNA Hardy has warned, as research shows corporations are more focused on the threat of technology failure and cyber attacks.

-

Pioneer Underwriting has promoted Kate McCluskey from underwriter to head of professional indemnity (PI) international and US excess.

-

Former Dual CEO Talbir Bains is set to return at 1 January with a start-up MGA known as Volante that will look to commence underwriting operations across four continents, The Insurance Insider can reveal.

-

Newline Group has hired Andy Pecover, MS Amlin's class underwriter for financial lines, to lead its directors' and officers' (D&O) team, The Insurance Insider understands

-

Medical professional liability carrier Coverys plans to expand its reach in Florida by acquiring A-rated Global Insurance Management Company (GIMC) and its Healthcare Underwriters Group subsidiary.

-

Almost three months after the devastating fire at Grenfell Tower, professional indemnity (PI) underwriters and their advisers are reviewing their policy wording and demanding more information on proposal forms to weed out areas that could leave their firms exposed.

-

David Nayler, Aon UK's former head of financial and professional services, has agreed to move to Marsh to lead its UK financial institutions industry practice, the broker announced today.

-

The price for each $1mn of directors and officers coverage fell by an average of 7 percent in the second quarter according to a report from Aon.

-

Navigators Group plucked Jim Rhyner from the senior ranks of Chubb to run its Navigators Pro division from an office in New Jersey.

-

Brit has recruited Tom Bongi from XL Catlin as executive vice president for professional lines at its US platform.

-

Global P&C carrier Chubb has promoted Chris Savvas to head of its professional indemnity operation in the UK and Ireland

-

Directors' and officers' (D&O) liability insurance rates fell again in the US during the first quarter, with Aon's quarterly price index tumbling to its lowest value in the 15 years since it was created

-

Berkshire Hathaway Specialty Insurance has entered the professional indemnity, cyber and financial lines markets in Southern Europe, the carrier announced today.