WTW

-

Despite 2025 losses, carriers have not secured desired rate increases.

-

Plus, the latest people moves and all the top news of the week.

-

Guy Carpenter continues to pursue Willis Re and individuals in court.

-

Senior Willis Re recruit Jim Summers denied Kevin Fisher had a role at the start-up.

-

The sector also faces a potential $700mn loss from a fatal Indonesian mining catastrophe.

-

GC accused Willis, Lucy Clarke, Jim Summers and John Fletcher of unlawful recruitment.

-

Loss activity in the upstream market remains benign, adding to softening.

-

The executive said the market will be revolutionised by digital technology.

-

James Kelly joins from Besso, having held senior positions at JLT, Lockton and Gallagher.

-

Ed Louth will join Liberty next year after serving out his contractual duties at Willis.

-

The broker’s hiring to date has focused on the specialty segment.

-

Plus, the latest people moves and all the top news of the week.

-

The broker is monitoring whether the economic environment will limit discretionary spending.

-

The broker said it was on track to hit its financial goals despite macro uncertainty.

-

The move comes as Michael Creighton is made credit and political-risk director for Africa.

-

Willis Re kicked off its talent acquisition with mass hiring from Guy Carpenter over the summer.

-

The broker said WTW hasn’t shown it was irreparably harmed by the defection.

-

Willis claims at least two $1mn accounts were also unfairly lost to Howden.

-

Property underwriters are ‘competing fiercely’ to access mining risks.

-

Chris Eaton and Bill Moret gave their notice last week without specifying their destination.

-

Ex-Western Europe CRB head Alberto Gallego and colleagues left for a Marsh joint venture.

-

Plus, the latest people moves and all the top news of the week.

-

Former head of construction Bill Creedon will assume the role of chairman.

-

The broker’s joint venture with Bain Capital still lacks a CEO.

-

The pair were offered contracts by Willis Re in July.

-

The broker announced the launch of its cross-class facility this week.

-

Placement head Delchar said Gemini will be available across its global book of in-scope risks.

-

The broker has been on an aggressive hiring spree overseen by Lucy Clarke.

-

The airline has exercised a break clause to renew its cover six months earlier.

-

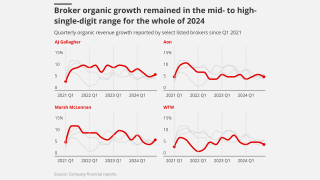

However, group organic growth among public brokers has slowed to pre-pandemic levels.

-

AIG leads the all-risks cover and Axa XL is the hull war lead.

-

Verita leadership and staff will remain intact and “seamlessly functional”.

-

WTW is “particularly interested” in growing markets like wealth management with bolt-on M&A.

-

-

The claim could add pressure to the hull war market after a recent High Court ruling.

-

The broker has recruited from its rival as it looks to launch Willis Re 2.0.

-

The latest hires follow Rob Hale’s move to Willis.

-

The broker made several senior energy hires from Marsh last year.

-

Renewable energy premium written in London and international markets amounts to $2bn.

-

Willis has been adding brokers to its aviation unit in Europe and the US.

-

Willis’ continued reinsurance build-out has targeted London and Bermuda marine and retro specialists.

-

The Atrium-led cover renews after the multi-billion-dollar High Court ruling.

-

Air India has a multi-year insurance arrangement in place.

-

Sources told this publication the hull of the aircraft is valued at $80mn.

-

Brokers across London and Bermuda have handed in their notice to join the start-up reinsurance broker.

-

The Bermuda-based team is led by John Fletcher.

-

The broker is launching a reinsurance arm in partnership with Bain Capital.

-

Saul Nagus is the latest from Marsh’s aviation unit to join WTW.

-

Willis has made a series of aviation hires on both sides of the Atlantic in recent weeks.

-

Plus the latest people moves and all the top news of the week.

-

-

The Willis-brokered coverage also includes the Willis CyXS facility.

-

Plus, the latest people moves and all the top news of the week.

-

The carrier beat QBE to the punch to secure the lead position.

-

The pair add to the roster of aviation-focussed hires at WTW.

-

The hires form part of WTW’s build-out of its US aviation practice.

-

Lucy Clarke said the broking business was resilient in the face of macro challenges.

-

Organic growth was flat on the prior year and in line with Q4 2024 figures.

-

A positive outcome could significantly curb insurers’ exposure to the loss.

-

Softening in the upstream market has also accelerated beyond expectations.

-

The facility now includes CyXS Plus and CyXS Company.

-

Willis said rising energy demand is creating a revival in the nuclear industry.

-

Larger companies ranked regulatory breach as their top risk.

-

The hire is part of a wider expansion across Willis’s specialty business.

-

Of the 178 passengers and crew on board, no serious injuries have been reported.

-

The broker said the list of perceived obstacles was “fairly damning” for insurers.

-

Q2 renewals will likely signal changes in the reinsurance market, the broker said.

-

The broker has made several recent hires within its marine division.

-

Claims in recent months have brought a period of benign loss activity to an end in the class.

-

Plus, the latest people moves and all the top news of the week.

-

Single-digit organic growth, robust casualty pricing and tapering margins were all key trends.

-

The arrival of Marsh’s Donnelly will "accelerate" US specialty growth, the CEO said.

-

CEO Carl Hess said WTW is entering 2025 with “considerable momentum”.

-

Clarke and Delchar, who were instrumental in building Marsh Fast Track, will lead the launch.

-

The executive will link up again with former colleague Lucy Clarke in Q2.

-

Starr-leads the WTW-placed all-risks cover for American Airlines.

-

Bradley was construction team leader for US casualty at WTW.

-

Heritage and history matter in people businesses, and the storied brand carries real equity.

-

The Willis name, which dates back to 1828, will be used with clients and markets.

-

Simon Delchar will become global head of placement.

-

Tony Simm will report to Garret Gaughan, global head of direct and facultative.

-

Jon Thacker has been at WTW for 20 years, specialising in construction.

-

Adam Garrard will cover his responsibilities on an interim basis.

-

WTW will hold a significant minority stake in the start-up with an option to acquire complete ownership over time.

-

WTW sold Willis Re to Gallagher in 2021 for $3.5bn.

-

The global market is stabilising and softening, and casualty and specialty lines are generally stable, the CEO said.

-

The broker posted a net loss of $1.67bn including pre-tax non-cash losses.

-

Benign claims activity and increased capacity are contributing to “competitive pressures”.

-

The WTW president of risk and broking is the first woman to hold the role in the institute’s history.

-

The broker will take a charge of $1.6bn-$2.1bn relating to the sale.

-

Baudouin is transitioning to a chairman position in Mexico.

-

Construction rates remain stable with some talk of potential softening.

-

The account is among a handful of airlines that have swapped out their brokers this year.

-

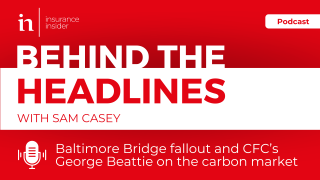

CFC developed and employed the lenders carbon-credit insurance policy with Standard Chartered Bank.

-

Glyn Thoms will be stepping into a newly formed role with a focus on cyber strategy formulation and management.

-

Colin Dutkiewicz has held senior roles at Aon and Swiss Re.

-

The choice to build a reinsurance unit at arm’s length alleviates some financial strain.

-

The two parties are targeting a launch by the end of the year, with scope for WTW to buy the start-up at maturity.

-

It will offer additional capacity to WTW US property clients with a limit up to $25mn.

-

Gavin Hamilton joins from Miller, where he served as European wholesale and South African property lead.

-

A quick roundup of the week’s main stories.

-

The new broking president added that hundreds of Marsh staff would not show up tomorrow at WTW.

-

He joins the firm following the departure of Edward Morgan and Guy Tyler, who have launched an MGA.

-

The broker said achieving profitability “remains challenging” for insurers.

-

CRB NA growth was driven by specialty lines, including natural resources, construction and real estate.

-

WTW has also recruited Marsh’s Thomas Burrows and Rupert Mackenzie recently.

-

The broker raised the low end of its 2024 target ranges for adjusted operating margin and adjusted EPS.

-

Alongside the appointment, Adam Garrard will take on the new role of chairman of risk and broking.

-

Camilla Chiatti and Parry Herbert will also join the team.

-

The moves are the latest in a period of personnel upheaval in the energy market.

-

The executive was head of wholesale and specialty at Aon’s Global Broking Centre.

-

The flurry of London market PVT hiring continues.

-

Darren Howlett was a member of Marsh’s relationship management executive leadership.

-

Burrows is the latest former JLT energy broker to join the team at WTW.

-

The business will be supported by up to $200mn of Lloyd’s and London underwriting capacity.

-

Since 1 January, the market’s potential descent into freefall has been closely watched.

-

Proving war-on-land coverage has been challenging, given the lack of reinsurance cover available.

-

WTW is looking to strategically hire across its business, having rebuilt its team following the failed Aon merger.

-

Cyber physical damage cover has also been added to the facility.

-

Prior to joining WTW, Morrison has held senior roles at Canopius, and AIG.

-

The executive said expansion was driven by retention and new business.

-

CEO Carl Hess hailed a “solid” first quarter of results.

-

High cash-burn, the dearth of available leaders, and weaker market conditions all point to shelving.

-

The US regulator faces litigation from both sides of the climate issue.

-

Dussuyer has also been appointed head of corporate risk and broking France.

-

WTW predicted that ‘meaningful softening’ could creep into energy markets during the year.

-

Increased reinsurance retentions left some insurers with their worst net results in a decade.

-

In his new role, Harrison will report directly to Adam Garrard, global head of risk & broking.

-

Graham Knight will become chairman of natural resources.

-

There were 166 deals over $100mn and 34 deals over $1bn in the first quarter of the year.

-

Hear the latest from the marine market as it weighs up the implications of the bridge collapse in Baltimore. Early indications are the claim could eclipse losses from Costa Concordia, stretching into the billions.

-

WTW said the rise of the risk from health and safety was “surprising”.

-

-

The executive said that adequate rates were encouraging insurers to grow.

-

Welcome to the first episode of Behind the Headlines, a fortnightly podcast hosted by Insurance Insider's senior reporter Sam Casey.

-

WTW and Tysers collaborated with PPL to design and implement the pilot.

-

The facility offers a range of $25mn-$50mn in excess capacity.

-

The facility is backed by a host of Lloyd’s syndicates.

-

The CEO said winning back clients “validated” the broker’s approach.

-

Risk and broking was driven by new business, client retention and rates.

-

The executive will work to grow the broker’s affinity proposition in the UK.

-

Storm Ciarán incurred insured losses of EUR1.9bn, according to WTW’s natural catastrophe report for July to December.

-

Michael Creighton joined WTW in 2019 as an executive director within the financial solutions team.

-

In October 2023, it was announced that Powell was leaving Marsh to join WTW as the broker’s global chief claims officer.

-

Nearly 80% of transportation companies surveyed cited a lack of access to insurance solutions and a lack of data to understand supply-chain risks.

-

The broker said there was a “record level of dry powder” waiting to be deployed.

-

He replaces Mark Stephenson, who is leaving Liberty to join Ardonagh.

-

AIG leads the placement, WTW is the lead broker, with Marsh support, on the JAL account.

-

The broker is hiring in energy following the departure of several downstream brokers for Price Forbes.

-

The brokers will work in the contingency team headed up by Ian Tomlin.

-

The broker said reinsurance capacity has contracted over the past 18 months, and the once-diamond-hard aviation war market has started to soften.

-

WTW also said private equity will continue to dominate the M&A landscape in 2024, with firms sitting on “over $2tn in dry powder” which is ready to deploy.

-

The broker said it anticipated new entrants in the downstream class following a profitable 2023.

-

The senior broker said it will take time for clients to return to the market.

-

The executive joined family-owned Lockton in 2020, as director of energy within the South Florida-based Latin America and Caribbean team.

-

SEC filings show that, in Q3, the activist shareholder liquidated its remaining 508,880 shares in WTW — worth around $120mn at the end of Q2.

-

A-Star offers up to $80mn in additional capacity for D&O liability insurance.

-

WTW conducted a snap poll at the broker's European Insurance Leaders’ Forum in Brussels, canvassing 75 insurance industry leaders from more than 45 companies.

-

The broking executive had a key role in the launch of Marsh’s Fast Track facility.

-

Work is at an exploratory stage, with efforts focused on London specialty and US P&C mid-market expertise.

-

The broker’s Q3 organic growth was driven by specialty lines, including fac financial solutions, natural resources, surety, construction and aviation.

-

WTW said that new staff were ramping up revenue production, following a period of investment in talent.

-

The exercise is understood to involve mainly junior and non-broking staff.

-

The executive was Marsh McLennan’s global chief claims officer and will join WTW early next year.

-

Despite an upswing in deal activity, large deals have continued to see a steady decline in volume that began in 2021.

-

Survey participants said "much work remains post-implementation".

-

Besides reinsurance broking, MGAs and MGUs, affinity is another segment where WTW can scale its operations, the executive noted.

-

WTW has highlighted that global climate change-related litigation cases have doubled to more than 2,000 since 2015.

-

Coffin will be succeeded by Stuart Ashworth as head of broking & market engagement.

-

The carrier is looking to increase its presence in the marine market segment.

-

And all the other big moves of the week.

-

WTW exploring reinsurance exec recruitment comes at a time of competitive tension in the market.

-

WTW is quietly sounding out market executives for a potential relaunch into reinsurance once its two-year non-compete agreement with Gallagher Re ends in December, this publication can reveal.

-

The broker said that key hires – including Lucy Clarke – would pay off in improved results.

-

The broker said it experienced headwinds from prior-year book sales, inflation and investment costs.

-

Areas of focus should include hiring external talent, securing capital for M&A, speeding up US growth, and answering the reinsurance question.

-

Pat Donnelly has succeeded Lucy Clarke at Marsh, and Adam Garrard at WTW has moved into a chairman role.

-

The report states that in the first months of 2023 as many as 1.5 million person-days were expended on cost-of-living protests in the 10 countries hardest hit.

-

Group head of M&A Andy Wallin will take over reinsurance and capital on an interim basis.

-

Syndicates which began investing early in digital benefit by a 6-point combined ratio outperformance.

-

The scale of the loss has yet to become clear following the blaze on Friday, although the fire is under control.

-

Douglas spent the last decade of his 23-year tenure as head of WTW’s climate and resilience hub.

-

A report from WTW and the Institute of International Finance has found little correlation between companies’ operation emissions intensity and their climate transition value-at-risk.

-

Three months ago, Starboard trimmed its stake by almost 14% to 1,925,491 shares valued at over $470mn from 2,232,209 shares at the end of Q3.

-

The broker described Neuron as an end-to-end trading solution that connects multiple broker and insurer systems together, enabling risks to flow at scale and with common data standards.

-

The broker spent much of his career serving multinational clients.

-

Shares were trading down 6% following the publication of the broker’s Q1 results.

-

The broker reported new business and increased retention in aerospace, financial solutions and natural resources.

-

The WTW D&O liability 2023 survey canvassed directors and risk managers in 40 countries around the world.

-

The move marks a return to growth in fac for the broker after heavy talent attrition during Aon’s attempted takeover.

-

The number of global firms surveyed in WTW’s report that purchased political risk cover surged to 68% in 2022 from 25% in 2019, as the Ukraine war changed the geopolitical outlook.

-

Based in London, Artunduaga has served as Aon’s LatAm network leader. In addition, Chile-based Jose Necochea, Victor Padilla and Andres Claro will move to WTW.

-

The offshore construction market was identified by the broker as being “inherently unprofitable”.

-

Hardening has recommenced in the market, although conditions vary depending on client, according to WTW.

-

WTW’s survey cites regulatory risk, health and safety precautions and bribery and corruption on the list of top D&O risks.

-

WTW said driver shortages continue to force contractors to use younger, often less experienced drivers, potentially putting upward pressure on losses.

-

WTW only gained majority ownership of the India operation last year, meaning it did not transfer in the wider Gallagher acquisition.

-

With brokers shifting to new providers to place certain classes, and competition among e-trading firms intensifying, the placement platform landscape has reached a crucial turning point.

-

The executive spent 19 years as head of Willis Germany and Austria.

-

As Adidas terminated its partnership with Kanye West following his antisemitic tweets, it projected a loss that signalled why insurers should be pushing the need for brand reputation insurance.

-

The executive said the broker stopped receiving client proposals whilst it was set to be taken over.

-

The broker has experienced a resurgence in growth under new leadership and strategy.

-

Plus all the top news and latest people moves of the week.

-

WTW has appointed Pieter Van Ede as global head of trade credit, in a move the broker said demonstrated its commitment to growth in the class of business.

-

According to WTW’s report, countries are “de-aligning” from the West due to the declining influence of the US and its allies.

-

It is understood that Axis and Canopius lead the facility, which considers clients from any industry sector in providing excess capacity.

-

Despite improving returns, inflation and the availability of economically priced nat cat capacity remain the biggest challenges facing the sector.

-

Simon Weaver will be responsible for driving business growth throughout the newly integrated region.

-

Tom Haddrill joins from Lloyd’s, where he spent 11 years, most recently as CEO for Lloyd’s Asia and country manager for Singapore.

-

WTW has been on a hiring spree in the wake of the failed Aon merger, and said France was one of its “most important” markets.

-

The broker has been re-stocking its talent base following staff departures linked to the failed Aon merger.

-

Only D&O and workers’ compensation clients experienced price decreases during Q3, according to WTW.

-

Evan Freely will head up a team of 130 staff specializing in credit and political risk.

-

Mahoney joins from Aon, where he was team leader for US general casualty and energy in London.

-

The Corporate Risk and Broking head of global lines of business said staff and client attrition has been reversed – and cast doubt on predictions of further specialty market hardening.

-

Announcements and interviews at the UN conference have shed light on the tools emerging to help carriers decarbonise their underwriting portfolios.

-

The platform will automate a range of processes across risk submission, risk appetite evaluation, underwriting and pricing for quotation, using a lead algorithm.

-

The product will provide $100mn in cover across eight countries at high risk of tropical cyclones.

-

The project, funded by Agence Française de Développement, was revealed during the G20 Leaders’ Summit in Bali.

-

The broker warned that more insurers will restrict or drop oil and gas business in the coming years.

-

Growth is accelerating at the broker in the wake of a challenging period following the collapse of the Aon merger.

-

The acceleration defied wider sector trends, which has led to slowing growth at other brokers.

-

-

Terry Rolfe joins from Epic Insurance Brokers & Consultants, where she served as aviation practice leader.

-

The executive’s career includes periods at WTW and Marsh.

-

Archie Horne is also joined by his former team: Florence Crowhurst, Harry Findlay and Ben Roe.

-

The brokers are working on finalizing the terms in a written settlement agreement, which could be filed within two weeks.

-

The broker also hired Will Fremlin-Key as global head of mining and metals, and appointed Ahmed Abdel-Gawad as head of natural resources for the CEEMEA region.

-

The broker said the fallout from the Russia-Ukraine conflict was increasing competition for business.

-

Kiran Nayee will be responsible for complex casualty placements for WTW’s D&F clients.

-

New capacity has also entered the wider market over the period, with WTW adding that more is likely to follow in Q3.

-

The unit sits within the broker’s climate and resilience hub.

-

The move represents a return to WTW, where the broker spent the beginning of his career.

-

The CEO said that WTW was making good progress under its strategy but acknowledged there is more to do.

-

Growth was slower than rival brokers, but CEO Carl Hess said investments would bear fruit in H2.

-

Scott Morrison, who has more than 25 years' experience, was co-head of the trade credit excess-of-loss team at Canopius.

-

The news comes after this publication revealed Kerrigan Read is also set for WTW.

-

Luis Maurette, current head of Latin America and head of global sales and client management, will retire on December 31, 2022.

-

Laurent Belhout will become head of France, while André Lavallée takes up the newly created role of head of corporate risk and broking in France.

-

Peru’s state-owned firm Petroperu has said that the broker designated to run its account was chosen as a result of a “technical evaluation”, following local media and Inside P&C reports that WTW had won with the highest bid in the process.

-

Before his appointment, the executive served multiple senior leadership roles within the division across Germany and Northern and Central Europe.

-

Sudhir Modhvadia will be based in London and report to head of facultative Alex Shepherd.

-

Fabien Conderanne most recently held the role of head of financial solutions for Asia Pacific.

-

Victor De Jager will be based in Amsterdam and report to Garret Gaughan, head of D&F, and Anne Pullum, head of Europe and CRB, Europe.

-

Insurers have expressed concerns about hitting the 2023 deadline for the regime.

-

Of the companies surveyed, only 2% did not consider their reputation a standalone risk.

-

It is understood that the account includes oil platforms, crude barrels and 12 vessels, and is one of the largest accounts in the South American country.

-

As momentum builds for greater transparency on ESG and net-zero transitions across the insurance ecosystem, brokers are entering an evolution.

-

The buybacks will be in addition to the $1.3bn remaining on the broker’s current open-ended repurchase program.

-

Wendy Peters’ decision comes in the wake of several senior changes within the WTW PV and terror team.

-

The account consists of 16 airlines and has a total fleet value of $29.7bn.

-

Henry Keville will be responsible for leading WTW’s financial lines programmes for banks, insurance companies, asset managers and other firms in the financial sector.

-

The appointment of Will Jones comes during a time of change for the WTW terrorism and political violence team.

-

Plus this week’s Q1 results and all the top news of the week.

-

The loss of the carrier’s Russian operations is set to create “modest margin headwinds” for the business.

-

The company posted adjusted diluted earnings per share of $2.66, ahead of analyst consensus of $2.50.

-

Thomas Olaynig from Marsh and Aon’s Kilian Manz are replacing Mathias Pahl and Peter Philipp.

-

DM Insurance Broker specialises in bond insurance and surety bonds across a variety of industries.

-

The brokers asked the judge to delay some pre-trial conferences by two weeks as they could obstruct the settlement negotiations.

-

The broker said there was still a “big unknown” around the potential global economic impact of the conflict.

-

WTW forecasts that cyber rates could increase by 100% to 200% for heavily exposed industries.

-

WTW has appointed Aon’s Ed Day to work as head of international property in the broker’s D&F team, which is led by Garret Gaughan.

-

The intermediary said capacity for downstream energy has now returned to 2017 levels.

-

The potential for major deterioration on a 2019 loss could yet prove “devastating” for the market.