Munich Re

-

The group aims for earnings per share growth of more than 8%.

-

The carrier said it will leverage its strong position in the ongoing favourable environment.

-

Colette Buckley joins Steven Ridgers, who became Axis head of erection all risks in October.

-

The argument for buyers to purchase cyber has never been stronger, yet growth is still lagging.

-

Plus, the latest people moves and all the top news of the week.

-

Carriers posted weaker top-line results but delivered improved combined ratios.

-

Insurers must avoid being a “blocker” in development and financing decisions.

-

Plus, the latest people moves and all the top news of the week.

-

Property growth plans are cooling, but favourable loss trends will increase surplus capacity.

-

The shuttering of Munich Re Ventures reflected a focus on the reinsurer’s “core offering”.

-

The carrier attributed the results to a significant fall in major-loss expenditure.

-

The carrier is consolidating its venture capital activity into asset manager MEAG.

-

Munich Re is among the insurers with a stake in the German carrier.

-

The reinsurer stressed it “did not shy” from cat business in 2023.

-

The carrier has hired José David Jiménez García as managing director for Germany.

-

Continental composite carriers aim to smooth volatility with new initiatives.

-

Being conservative and stable is the name of the reinsurer’s game.

-

Stefan Golling also said Munich Re’s appetite for agg covers was unchanged.

-

The insurer has been under review with positive implications since March.

-

The mid-year renewals point to mounting pressure on reinsurance pricing.

-

The reinsurer chair said the frequency of losses today “will prevent prices from slipping too much.

-

The P&C re segment’s combined ratio improved by 12.7 points to 61.0%.

-

Insured losses produced the second highest first-half tally since records began in 1980.

-

Plus, the latest people moves and all the top news of the week.

-

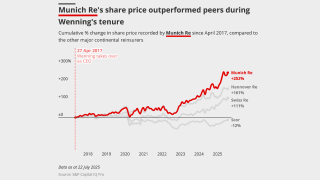

Improved book value, a healthy CoR and disciplined underwriting mark the CEO’s time at the helm.

-

CFO Christoph Jurecka will succeed as management board chair.

-

The carrier reported preliminary profits of EUR2.1bn, driven by “very low” major-loss expenditure in P&C re.

-

The $2.6bn deal provides Ergo with an entry point to the US SME market.

-

Hannover Re’s CEO is lowest paid among peers, despite their pay growing 77% since 2015.

-

New entrants to the line of business have heightened competition for talent.

-

P&C combined ratios were higher than Q1 2024, and wildfires impacted Hannover Re most.

-

Plus the latest people moves and all the top news of the week.

-

The carrier’s share price dropped 3.6% on its Q1 results.

-

The executive said secular heightened risk trends would fuel the carrier’s primary expansion.

-

The carrier booked EUR800mn in LA losses in the P&C segment.

-

Simon Horton spent 10 years at Marsh before joining AIG last year.

-

It is understood that Marsh brokered the tower, which is exposed to claims from a 2024 breach.

-

Several insurers and MGAs have launched into the class of business over the past year.

-

The executive has managed both casualty and personal lines reinsurance books.

-

Reinsurance made up 12% of the syndicate’s 2024 GWP.

-

Plus, the latest people moves and all the top news of the week.

-

Ahead of the deal, Ergo owned a 29% stake in Next, which generated top line of $548mn last year.

-

Some of the Big Four are slowing growth as the market softens.

-

Navigating its path to global specialty growth will require operational dexterity.

-

Plus, the latest people moves and all the top news of the week.

-

The carrier will look to grow business outside North America.

-

The carrier expects the market loss to land at $35bn-$40bn.

-

The carrier pegged its claims expenditure for the LA wildfires at EUR1.2bn.

-

The portfolio tracker facility is led by Canopius.

-

Hurricane Milton resulted in the largest insured loss of the year at $25bn.

-

Christa Schwimmer has joined the leadership team alongside Stefan Golling.

-

The P&C re unit will aim for a 79% combined ratio next year.

-

The carrier attributed the intensification of storms this season to climate change.

-

The underwriter has spent his career so far with Talbot.

-

The carrier said it expected its Milton losses to fall below its EUR500mn ($537mn) Helene loss.

-

Major-loss expenditure doubled to EUR1.6bn for the quarter

-

Assuming Munich Re takes roughly a 3% market share of hurricane losses suggests a ~$20bn industry loss for Helene.

-

The reinsurer said three Canadian loss events in the quarter will lead to similar claim expenditure as Hurricane Helene.

-

The new product adds to its existing portfolio of upstream energy and marine and energy liability business.

-

The carrier is looking to grow its specialty offering across Europe and APAC.

-

How is the market positioned to withstand Hurricane Milton?

-

The Madrid branch will look to begin underwriting primary specialty insurance in 2025.

-

The executive joins Munich Re from Amwins Global Risks.

-

Patrice Michellon, who has spent more than eight years with the reinsurer, will report to Clarisse Kopff.

-

Munich Re's core message this year is that its risk appetite is “quite stable”.

-

Plus the latest people moves and all the top news of the week.

-

Scor disclosed L&H troubles while Swiss Re continued reserving for US casualty.

-

Plus the latest people moves and all the top news of the week.

-

The reinsurer also said it expected no significant impact from the CrowdStrike losses.

-

Its combined ratio stayed under 80%, which may give it room to outperform on annual targets.

-

Over 75% of insured losses attributable to severe thunderstorms, flooding and forest fires.

-

The ratings agency said Munich Re demonstrated its ability to optimise its market-leading position.

-

Combined ratios improved all around thanks to better pricing and a benign cat quarter.

-

The carrier has ambitious growth plans for its rebranded Munich Re Specialty segment.

-

CFO Christoph Jurecka declined to give a loss estimate for the Baltimore Bridge loss.

-

The carrier reported a P&C re net result up 44% to EUR1.8bn.

-

The carrier’s Q1 P&C re combined ratio is around 75%.

-

Hitesh Kotak has been appointed CEO for Japan, India, Korea and South East Asia.

-

The syndicate posted a combined ratio of 84.6% and GWP of more than £1.2bn.

-

Last summer’s hail loss has crept significantly for many Italian cedants.

-

The carrier is partnering with Munich Re Syndicate and Tokio Marine HCC.

-

Hard-won profitability has given carriers room to salt away reserves.

-

Opportunities for profitable growth remain in 2024, the agency said.

-

It also highlighted loss deterioration on its 2015-2018 casualty books.

-

The carrier announced a capital repatriation plan of EUR3.5bn.

-

The segment has bounced back from its mid-2022 nadir, but its current zenith is not that much to shout home about.

-

The uptake on war exclusions, which was followed by other reinsurers, could signal the end of "endless" discussions on the topic.

-

The binder has a line size of $2mn and will enable the MGA to write international property risks in a number of international territories.

-

The primary insurance subsidiary buys around EUR700mn of property cat protection from the wider market.

-

Charlotte Macey started her career at CNA Hardy in 2008 and was most recently class manager for property D&F.

-

CFO Christoph Jurecka said losses for 2023 were in line with its expectations, but he added that the events producing the losses differed from those of years previous.

-

The (re)insurer also predicted its return on investment would improve “noticeably” next year, to more than 2.8%.

-

Cat losses were within budgets despite high levels of minor events.

-

The carrier reported EUR770mn of losses in Q3, and the Maui wildfires were the costliest event, with losses amounting to EUR200mn.

-

The carrier reported major losses for the quarter of EUR770mn, a significant reduction on the EUR2.1bn reported in the same quarter last year.

-

The carrier has raised its projection for the year to EUR4.5bn, up from EUR4bn.

-

Executives said geopolitical uncertainty, economic stagnation, cyber, cat events and inflation will drive demand on the Continent.

-

The incoming president succeeds Christian Lay, CEO at Marsh McLennan UK.

-

Our virtual roundtable polled industry leaders on critical questions for the reinsurance market. Today, we explore how the industry can collaborate on net-zero objectives after insurers exited the Net-Zero Insurance Alliance (NZIA) in droves.

-

Executives said the cyber market would be “dead” if it does not control accumulations.

-

AM Best said market hardening was likely to continue through 2024, given global market conditions.

-

The ratings agency believes Munich Re will defend its “excellent” competitive position and conservative capital management over the next two years

-

Swiss, Munich, Hannover and Scor all delivered optimistic messages on pricing for next year.

-

The executive also lambasted the growing tide of corporate regulation in Germany and the EU.

-

Flooding in Italy during the second quarter cost the German reinsurer around EUR200mn.

-

The carrier announced the launch of the green solutions portfolio in May as it looks to become a market leader for sustainable risks.

-

Lucas Beckmann has spent just over 15 years at Munich Re in several senior roles.

-

The quota share cyber reinsurance market is finely poised, with good appetite for strong cyber writers, but reinsurers are cautious of new writers or fronted MGAs.

-

After founder members Axa and Allianz dealt a potentially terminal blow to the Net-Zero Insurance Alliance by withdrawing, the NZIA is exploring limited options to continue.

-

The executive first joined the group via Munich Reinsurance America.

-

The ongoing debate raging in London on the nuances of cyber war wordings threatens to wreak more reputational damage on the industry if a consensus is not found.

-

Most carriers were keen to talk about how they are taking on the ongoing hard market in Q1, but some complexities partly offset their good news.

-

A memo from the reinsurer raises concerns for cyber insurers over whether they could face a coverage gap after renewals.

-

The reinsurer has cat capacity available at 1.6 and 1.7 where pricing meets its margin targets.

-

The result was impacted partly by EUR600mn of losses caused by the earthquake in Turkey in February.

-

The news follows months of speculation in the energy market about James Grainger’s plans after his resignation from Munich Re.

-

The executive said surging demand for coverage would address the supply-demand mismatch in the renewables space.

-

The business is looking to become a lead presence in green risks in London, following Syndicate 457’s exit from oil and gas business.

-

Overall the group’s net result is likely to exceed consensus at EUR1.3bn.

-

Ransomware will remain the primary loss driver in 2023 in terms of threats for businesses and individuals.

-

The market veteran left Aegis London, where he was CEO from 2015, in June last year.

-

Beneva has signed up to net-zero targets as a member of the NZIA, following a period of turbulence in which Munich Re, Zurich and Hannover Re have left the alliance.

-

Aviva has said it is committed to the Net-Zero Insurance Alliance, in the wake of withdrawals from the group by Zurich, Munich Re and Hannover Re.

-

Hannover Re has followed Zurich and Munich Re in announcing its departure from the Net Zero Insurance Alliance, though it offered no explanation for its decision.

-

Capitola operates as a digital market that connects brokers with carriers using AI for risk-appetite matching.

-

Industry climate alliances have received allegations from conservative politicians and regulators in the US that such commitments are illegal group activities that violate antitrust laws.

-

Monica Tigleanu will be succeeded by Simone Hardy, who has been appointed senior underwriter, joining from The Channel Syndicate.

-

The executive will stand for election at RenRe’s AGM in May.

-

The longstanding Chaucer underwriter left when the carrier exited the FI market last year.

-

The collapse of Silicon Valley Bank is creating investor fear across the global financial services sector.

-

The release of Swiss Re, Munich Re, Hannover Re and Scor’s year-end reports provides an update on market conditions.

-

Highlander has $300mn of insurance coverage, placed by Ed Broking and led by Munich Re Syndicate.

-

The reinsurer’s retro programme was renewed at a smaller size for 2023.

-

The P&C segment also booked 2.3% risk-adjusted price increases at the 1 January renewal.

-

The shares will be bought back for a maximum total value of EUR1bn, following a proposed dividend announced by the firm for voting at its AGM.

-

Michael Kerner, who joined Munich Re in 2018, has been appointed to lead the operation.

-

The carrier is predicting its insurance revenues to reach around EUR58bn, while ROI will be at least 2.2%.

-

The year 2005, which featured the devastating Hurricane Katrina, remains the most expensive storm season.

-

Carriers reassured analysts that unrealised investment losses will not seriously affect solvency while sounding a bullish note on renewals.

-

Personnel movement in the contingency market has been elevated following Covid-19 upheaval.

-

The carrier has reduced its full-year projected consolidated result for reinsurance and expects a worse P&C combined ratio.

-

The reinsurer said it will be “significantly more challenging” to hit EUR3.3bn 2022 profit target.

-

Thomas Blunck has been appointed to succeed Torsten Jeworrek as chair of the board of management’s reinsurance committee, effective 1 January 2023.

-

The reinsurer is working to find the right inflation indicators for individual client portfolios.

-

Munich Re board member Thomas Blunck warned inflation will remain high in 2023, driving up loss costs.

-

Overcapacity in upstream energy means the immediate impact of the move will be limited.

-

The carrier will no longer invest or insure contracts and projects directly relating to new oil and gas fields, new midstream oil infrastructure and new oil-fired power plants.

-

The syndicate will now pivot “in a very robust and determined fashion” into renewables and green tech, according to CUO Dominick Hoare.

-

The underwriter is one of the most respected in the market and leads a substantial amount of Gulf of Mexico business.

-

This publication’s review of H1 disclosures shows how listed (re)insurers’ nat cat losses have tallied with aggregate projections.

-

Staff movement is high in the cargo space as carriers look to expand in an improved rate environment.

-

In their messages at the Rendez-vous de Septembre, Munich Re, Hannover Re, Swiss Re and Scor signalled a ripe environment to hike prices and adjust terms.

-

The German carrier telegraphed continued pricing discipline into 2023 as carriers grapple with reduced available capital.

-

The move is the latest in a series of personnel changes in the construction space.

-

Bernd Luckey’s appointment comes amid a number of senior moves within the construction market.

-

Swiss Re, Munich Re, Hannover Re and Scor have set out their strategies on inflation, pricing and Ukraine.

-

The carrier said pricing on property quota share, particularly in the US, was not keeping pace with inflation.

-

The carrier reported EUR90mn of Ukraine losses for the second quarter, bringing the H1 total to EUR200mn.

-

US severe thunderstorms caused insured losses of $17bn during the first half.

-

The loss comes hard on the heels of a large BI claim stemming from the Freeport LNG refinery.

-

Plus the latest company results, people moves and all the top news of the week.

-

Ukraine uncertainties remain despite some loss estimates emerging in Q1 earnings across the Big Four European carriers, while inflation looms on the horizon.

-

The carrier’s CFO emphasised that any future loss predictions from the ongoing conflict would be “highly speculative”.

-

The unit recorded EUR100mn in Ukraine losses on specialty lines during the quarter, while the group suffered a heavy investment impact from the war.

-

CEO Joachim Wenning highlighted exposure in specialty lines.

-

The InsurTech also recently announced a partnership with Munich Re to launch an insurance product for digital-asset insurance.

-

The carrier is also expected to book Q1 losses from recent European storms.

-

The firm has previously said it will not renew existing contracts in Russia and Belarus, while new business in the countries has been suspended.

-

The move comes in a period of heightened people-move activity in the construction and engineering class.

-

The second of Insurance Insider’s deep-dive analysis pieces on innovation examines the internal structures and opportunities that can accelerate innovation.

-

The first of a two-part series on innovation examines the barriers blocking product innovation in the P&C market.

-

The reinsurer will make exceptions if the suspension of business negatively affects persons or companies that need protection.

-

Earnings reports from Swiss Re, Munich Re and Scor have revealed increased cat budgets and highlighted continued shifts away from frequency coverage.

-

The reinsurer said nat-cat business is one of its most profitable lines but emphasised that it will also chase growth in life and health and Ergo to reduce long-term volatility.

-

Munich Re’s P&C re unit reported a Q4 consolidated result of EUR648mn ($735mn), a sixfold increase year on year, as the carrier announced 14.5% premium growth at the 1 January renewals.

-

The carrier proposes to increase the dividend by EUR1.20 on last year’s payment.

-

Dual’s crisis management team joined from Swiss Re in July 2021.

-

The former Marsh broker was initially slated to join Lockton Re’s cyber reinsurance practice.

-

It is understood that Ascent is currently in negotiations with a number of new potential lead markets.

-

The new coverage marks the first time that sovereign debt repayments have been protected by a parametric catastrophe clause.

-

Swiss Re, Munich Re, Hannover Re and Scor have set out divergent strategies on cat as volatility increases and the retro market seizes up.

-

Executives said they were surprised that underwriters had staged more of a return than brokers.

-

Munich Re CFO Christoph Jurecka reaffirmed the carrier’s commitment to cat business and revealed an expectation of further price increases in 2022.

-

The reinsurer revised its full-year P&C CoR to 100% after third-quarter storms.

-

Everest Insurance head of specialty casualty will transition to the reinsurance division, reporting to Beggs.

-

The sale represents a 4% stake in the UK motor insurer, according to Jefferies.

-

Alan Norris’s colleague Ian Ritchie has joined Munich Re Syndicate after Talbot exited contingency following heavy pandemic losses.

-

The preliminary result was achieved despite EUR600mn losses from Bernd damages, as well as EUR1.2bn losses from Hurricane Ida.

-

The carrier also cited increasing continental cyber losses as a factor in continued market hardening.

-

Munich Re’s venture capital arm Munich Re Ventures has closed a $500mn Munich Re Fund II to invest in early-stage companies.

-

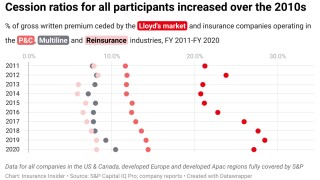

Analysis of financial data shows that the last decade has seen a marked increase in the proportion of premiums ceded by carriers in all sectors.

-

In his new role, Michael Cusition will report to David Sankey, head of Marine at Atrium.