Scor

-

The facility provides solvency support via a fresh equity injection under various scenarios.

-

The underwriter has spent 30 years in fine art insurance.

-

Plus, the latest people moves and all the top news of the week.

-

Carriers posted weaker top-line results but delivered improved combined ratios.

-

Citi and Berenberg believe the carrier is more resilient than in the past.

-

Plus, the latest people moves and all the top news of the week.

-

Opportunities for profitable growth in cat will be hard to predict, the executive said.

-

The French reinsurer improved its P&C combined ratio by 7.4 points to 80.9%.

-

Continental composite carriers aim to smooth volatility with new initiatives.

-

CEO Thierry Léger also stressed his intention to repair the carrier’s relations with Covea.

-

The mid-year renewals point to mounting pressure on reinsurance pricing.

-

Covea had requested a stay in the proceedings.

-

The underwriter left Navium Marine last year and before that worked at Atrium.

-

Scor's CEO said the P&C market had experienced a “competitive” first half.

-

The P&C segment posted an 82.5% combined ratio for the quarter.

-

Hannover Re’s CEO is lowest paid among peers, despite their pay growing 77% since 2015.

-

P&C combined ratios were higher than Q1 2024, and wildfires impacted Hannover Re most.

-

Plus, the latest people moves and all the top news of the week.

-

The CEO expects overall P&C pricing to be “stable” through 2025.

-

The carrier booked LA wildfire losses of EUR148mn.

-

The carrier announced a major writedown in its L&H book last year.

-

London-based US excess casualty writers are increasingly looking to attach lower in the tower.

-

The reinsurer said the probe concerns the alleged involvement of its former chairman.

-

Chapman exited from Scor following a 13-year tenure with the carrier.

-

Plus, the latest people moves and all the top news of the week.

-

Sources warned some property XoL books are already running 50% loss ratios.

-

Some of the Big Four are slowing growth as the market softens.

-

Tim Chapman also holds the role of EMEA head of construction at Scor.

-

Plus, the latest people moves and all the top news of the week.

-

The reinsurer pegged the market loss at $40bn.

-

The carrier pegged its LA wildfire losses at EUR140mn.

-

EGPI growth at the carrier’s Alternative Solutions unit jumped 29.6%.

-

Arta Nasradini joins from AIG, where she led the DACH aerospace team.

-

The reinsurer has made improvements to its life and health segment, it said.

-

The executive has also been made Syndicate 2015 active underwriter.

-

The political violence market is in a competitive stage thanks to an influx of capacity.

-

Julia Willberg joins from Hannover Re, where she has held several senior roles.

-

Adrian Poxon also had oversight of engineering, aviation and space at Scor.

-

The carrier said its P&C and L&H reserves have been confirmed by independent reviewers.

-

Nat cat pricing is expected to be more or less flat, with rises on loss-affected programmes.

-

The carrier has also completed a review of its L&H unit.

-

The denial followed this publication’s report that Covéa had renewed its intentions to buy the reinsurer.

-

This publication reported earlier that French mutual Covéa has engaged Scor in M&A talks.

-

The mutual’s approach comes as Scor continues efforts to fight back from performance issues including a flare-up in L&H.

-

CEO Thierry Léger claims the “insurability” of global risk is becoming “challenged”.

-

Scor is also limiting its exposure in political risk and cyber.

-

Plus the latest people moves and all the top news of the week.

-

Scor disclosed L&H troubles while Swiss Re continued reserving for US casualty.

-

Léger confirmed that his move to lead the L&H unit will not be permanent.

-

The P&C segment posted an 86.9% combined ratio for the quarter.

-

Scor guided to a EUR400mn insurance result loss earlier this month.

-

A selection of the top stories from the week.

-

A roundup of all the news you need today, including Enstar EU’s new CEO.

-

Work to revitalise the French reinsurer just got harder as problems in its life book crashed the share price.

-

A roundup of all the news you need today, including Lloyd’s chairman candidates.

-

The negative L&H result was driven by reserve updates.

-

The negative L&H result was driven by reserve updates.

-

Riots erupted in the Pacific Island territory last month over electoral reforms.

-

Léger will work as chair and Neal as vice-chair of the reinsurance advisory board.

-

Combined ratios improved all around thanks to better pricing and a benign cat quarter.

-

The CEO said Scor is still on track to hit a full-year 87% combined ratio.

-

The carrier reported 1 April price increases of 3.2%.

-

The executive will also serve as a member of Scor’s executive committee.

-

Hard-won profitability has given carriers room to salt away reserves.

-

Five regional leaders have been appointed for P&C and life and health.

-

The firm reallocated from short-tail lines amid social inflation concerns.

-

The company proposed a dividend of EUR1.8 per share for 2023.

-

Dejung spent 13 years at Scor, most recently as cyber CUO.

-

-

Opportunities for profitable growth remain in 2024, the agency said.

-

The executive has over two decades’ experience in the market.

-

The carrier also set out detail on its alternative solutions offering.

-

EGPI growth at the firm’s Alternative Solutions unit soared 191%.

-

Scor partnered with Acrisure Re to build the consortium.

-

Anderson first joined Scor in 2017 as a senior cyber and technology underwriter.

-

The segment has bounced back from its mid-2022 nadir, but its current zenith is not that much to shout home about.

-

Tokio Marine HCC restructured its marine, energy and renewables division earlier this year.

-

Cat losses were within budgets despite high levels of minor events.

-

Global P&C CEO Jean-Paul Conoscente, acknowledging a "heavy" quarter for attritional losses, said the carrier had taken action that should lead to ratio improvements over time.

-

The French carrier's operating result was EUR257mn, an increase of more than 130% on the prior-year period.

-

With new leadership at some of the largest continentals, there will be close attention to how their tactics in changing lines of business will evolve.

-

Speakers at the Guy Carpenter Baden-Baden symposium said the industry must improve its prospects as an investment opportunity.

-

The transaction was a partial exercise of an agreement signed by the companies in June 2021.

-

Our virtual roundtable polled industry leaders on critical questions for the reinsurance market. Today, we explore how the industry can collaborate on net-zero objectives after insurers exited the Net-Zero Insurance Alliance (NZIA) in droves.

-

The reinsurer’s new CEO said demand is to outstrip supply as cedants grow and exposures expand.

-

Our virtual roundtable polled senior industry figures on the biggest questions facing the reinsurance industry. Today, we look ahead to the influences steering M&A market conditions.

-

The French reinsurer said continued price increases, particularly on cat and US casualty, remain necessary.

-

The reinsurer has announced a detailed plan to diversify its P&C reinsurance book as part of a new strategic plan.

-

This is the first multi-year plan led by the new CEO.

-

Downstream underwriters have been pushing for rate this year following high claims activity in 2022.

-

Swiss, Munich, Hannover and Scor all delivered optimistic messages on pricing for next year.

-

The new CEO said the carrier must remain focused on pricing for geopolitical uncertainty.

-

The carrier also reported 9% rate increases at the summer renewals.

-

The underwriter has worked at Swiss Re, Ironshore and Alize during his insurance career.

-

After three years as a company director, Brégier received a unanimous recommendation from the nomination committee.

-

The executive has worked for the French carrier for almost four decades in various roles in Toronto, Paris and Milan.

-

The underwriter joined Scor in 2020 having previously led the cargo and specie operation at Starstone.

-

The long-serving executive turned around the fortunes of the French reinsurer in a two-decade stint as leader.

-

Varenne was previously interim CEO and group COO of Scor.

-

After founder members Axa and Allianz dealt a potentially terminal blow to the Net-Zero Insurance Alliance by withdrawing, the NZIA is exploring limited options to continue.

-

The reinsurer is the fifth major player to leave the organisation, following Swiss Re, Munich Re, Zurich and Hannover Re.

-

Most carriers were keen to talk about how they are taking on the ongoing hard market in Q1, but some complexities partly offset their good news.

-

The global P&C CEO said the carrier will deploy roughly the same capacity in the state as last year.

-

The carrier continued to rebalance its portfolio towards specialty at 1.1 and 1.4.

-

The reinsurer achieved rate increases of 7% across its portfolio.

-

Scor’s P&C reinsurance business is expecting insurance revenue growth of up to 2% in 2023.

-

Analysts find carriers have few investments in bank debt after Credit Suisse rescue.

-

Kayley Stewart joins from Fidelis, and Yvonne Ledger and Kate Carrett are joining the environmental liability team.

-

S&P Global Ratings has affirmed Scor’s financial strength ratings (FSR) at A+, while the French carrier’s outlook remained stable.

-

The release of Swiss Re, Munich Re, Hannover Re and Scor’s year-end reports provides an update on market conditions.

-

The rating downgrades reflect the deterioration in Scor’s operating performance.

-

CFO Ian Kelly said the EUR0.40 reduction reflects 2022 as a loss-making year.

-

Analysts question a 24% Q4 earnings miss as the company cuts its dividend.

-

It is understood that industry veteran James Grieve will retire this summer after over 16 years at the French reinsurer.

-

The carrier is confident the positive cycle will continue as it prepares for April, June and July renewals.

-

The ratings agency said the weakening of the group’s performance in the first part of the year continued into the third quarter.

-

Plus all the top news and latest people moves of the week.

-

The French carrier has replaced Laurent Rousseau with Swiss Re’s Thierry Léger - midway through a remedial journey. Can a third CEO in two years resolve the carrier’s issues?

-

The decisive move to replace Laurent Rousseau early in his CEO tenure was about “timely decisions”, the Scor chairman said.

-

The deal protects the carrier’s capital in the event of large nat-cat or mortality losses.

-

The agency has also cut the carrier’s long-term issuer default rating to A-.

-

In response, Scor said it is taking all possible steps to improve its profitability.

-

Carriers reassured analysts that unrealised investment losses will not seriously affect solvency while sounding a bullish note on renewals.

-

The underwriter will be based in London and report to Marie Biggas and Daniel Carreras.

-

The French reinsurer’s Q3 update details its extensive remedial efforts – but with the impact yet to be felt, it is still vulnerable to takeover.

-

The French carrier has vowed to continue its “selective” reinsurance underwriting strategy.

-

Martine Gerow’s mandate will last for the remainder of Kory Sorenson’s term, which comes to a close at the end of the general meeting in 2023.

-

The group vows to continue remedial work to restore profitability.

-

Inflation, heightened cat activity and years of poor reinsurance returns are fuelling demands for wholesale change in the European market.

-

David Guest’s appointment comes shortly after Christianna Vandoorne, head of terrorism and PV, left the syndicate.

-

Christianna Vandoorne has been head of terrorism and PV at the syndicate since June 2020.

-

Further rating action is likely if underlying performance does not improve in the short to medium term.

-

The scheme aims to fill the gap left when private sector carriers exited the market following the Grenfell disaster.

-

This publication’s review of H1 disclosures shows how listed (re)insurers’ nat cat losses have tallied with aggregate projections.

-

Insurance Insider selects 10 exclusive news stories reported by our team on the frontline at Monte Carlo Rendez-Vous.

-

In their messages at the Rendez-vous de Septembre, Munich Re, Hannover Re, Swiss Re and Scor signalled a ripe environment to hike prices and adjust terms.

-

Chris Beazley stepped down from his CEO position at MS Amlin’s reinsurance arm at the end of August.

-

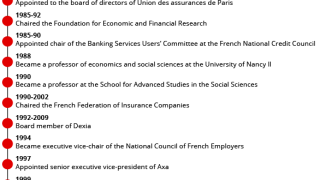

Generali France chairman Claude Tendil has served for 13 years.

-

The CEO likened reinsurance market conditions to those seen in large commercial primary lines post-HIM.

-

The carrier said the move will accelerate deal-making in its early-stage investment arm.

-

Swiss Re, Munich Re, Hannover Re and Scor have set out their strategies on inflation, pricing and Ukraine.

-

The carrier’s management emphasised further underwriting actions.

-

The carrier cut its GWP by 9.8% during the summer renewals, including a 24% reduction in exposure to the US.

-

After serving as a director on Scor’s board for many years, Kory Sorenson has decided to resign due to personal reasons.

-

Adrian Poxon will take on the role of aviation CUO following Sommerlad’s retirement on 1 September.

-

Colleagues William Campbell and David Barr have also handed in their notice, although their destination is not yet known.

-

The reinsurer named climate change as a key driver of the increase in the frequency and severity of droughts.

-

Regulatory burdens mean that restarting the Freeport refinery could take longer than first hoped.

-

The scheme, due to be officially launched in September, will run for five years.

-

The French reinsurer faces a number of hurdles as it looks to set its new corporate strategy. We outline the challenges ahead.

-

The outgoing reinsurance CEO will be succeeded by Stuart McMurdo, current CEO of Scor UK, the Scor syndicate and regional CEO of EMEA.

-

The company will also double its coverage for low-carbon energies by 2025.

-

Ukraine uncertainties remain despite some loss estimates emerging in Q1 earnings across the Big Four European carriers, while inflation looms on the horizon.

-

The agency affirmed the carrier’s Insurer Financial Strength rating at AA-.

-

The carrier also took heavy Covid-19 losses in its L&H division, leading to an operating loss at group level.

-

The carrier said lines including political risk, credit and surety and aviation were facing claims.

-

The executive said the Ukraine conflict was an example of how the industry had come to over-optimise models.

-

The incoming active underwriter and CUO was deputy active underwriter at Arch Syndicate 2012 and head of terrorism, aviation, war and space for Arch Insurance International.

-

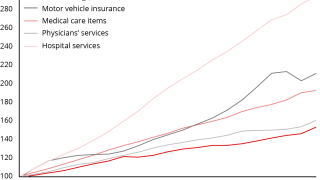

A 1% increase in inflation could lead to a five-point increase in combined ratio for a longer-tail risk such as medical professional liability, the Scor chairman said.

-

Scor’s Malcolm Newman, Axa XL’s Sean McGovern and Aon’s Richard Dudley gave evidence to the Lords committee on regulation.

-

The day, originally planned for 29 March, will be moved to the end of July.

-

The syndicate has doubled its underwriting profit and improved its combined ratio as its turnaround work bears fruit.

-

Earnings reports from Swiss Re, Munich Re and Scor have revealed increased cat budgets and highlighted continued shifts away from frequency coverage.

-

Future large catastrophe events and new Covid-19 variants remain risk factors for 2022’s earnings.

-

CEO Laurent Rousseau told employees face-to-face contact is “essential” to the business.

-

The carrier booked EUR838mn of cat losses for 2021, equal to 12.8% of premium.

-

Scor’s renewals update denotes a continued push to control volatility while Hannover Re is focused on growth.

-

The carrier also said its new retro purchase will provide first-dollar protection.

-

The ratings company said it considered Scor's earnings performance, which has been below the agency's expectations for the past five years.

-

The carrier said InsurTech investment was driven by specialty and commercial solutions during the year.

-

Yves Cormier brings more than 15 years' experience in the insurance sector across capital markets transactions, M&A, investor analytics and balance-sheet management to the role.

-

The executive replaces Kade Spears in the role.

-

The likes of Swiss Re and Scor are supporting the sector-specific methodology linked to broader decarbonisation efforts.

-

The reinsurer said joining the alliance further strengthened its commitment to the preservation of biodiversity.

-

Swiss Re, Munich Re, Hannover Re and Scor have set out divergent strategies on cat as volatility increases and the retro market seizes up.

-

Scor is to shift its portfolio to increase the proportion of P&C to 60% and reduce life and health (L&H) to 40%, according to CEO Laurent Rousseau.

-

Plus the latest impact of cat activity on reinsurer results and all the top news from the week.

-

The carrier has also exited US MGAs exposed to North Atlantic cat risk.

-

The carrier launched a share buyback and announced portfolio rebalancing actions.

-

People movement is picking up in the sector, which is experiencing broadly stable rating thanks to ample capacity.