-

The chief of market performance urged underwriters not to follow the herd.

-

The developments this week thrust culture issues up the agenda for new leadership.

-

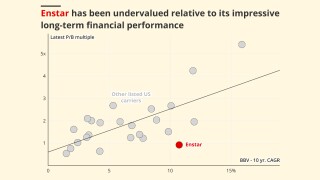

The sector’s recent achievements have flown below the radar, despite huge value creation.

-

Specialised service providers like CDK can pose more frequency risk than global operators.

-

Everest’s AIG deal meaningfully cuts its primary exposure.

-

The buy-in can be seen as a “flip” bet on a rebound in appetite for carrier M&A.

-

Without flexible mechanisms the Corporation risks suppressing transactions.

-

The protection gap must be closed before a public cyber reinsurance scheme is possible.

-

The market turn may give some staff pause for thought, but reward remains high.

-

The broker’s joint venture with Bain Capital still lacks a CEO.

-

Aspen would give Sompo more reinsurance scale, more US premium and a Lloyd’s presence.

-

US retailers have various levers to pull to put pressure on potential new competitors.

-

In trying to solve multiple needs, specialty reinsurance opens up complexities.

-

Aviation reinsurance reserving issues will also be a broader focus for the market.

-

Surveys show diversity and inclusivity foster a sense of belonging and increase productivity.

-

The broker’s planned US talent raid is in keeping with its audacious history.

-

There is a growing disconnect between risk and pricing in the class.

-

SRCC exposures are being studied more closely but fixing aggregation issues is a challenge.

-

There is the prospect of fragmented appeals and uncertainties around reinsurance recoveries.

-

The LMA urges use of AI for enhanced decision making but concerns remain.

-

Corporates buying Lloyd’s syndicates face the culture/integration trade-off.

-

While M&S had a cyber policy in place, Co-op and Harrods did not, Insurance Insider revealed.

-

The Lord Mayor told the CRO Summit to stop treating risk as a dirty word.

-

The CEO transition is already visible in messaging on growth as rate change picks up.

-

Pushing through technological change and maintaining underwriting results are top of agenda.

-

Lloyd’s chair Bruce Carnegie-Brown officially hands over to Charles Roxburgh today.

-

The retailer’s partners are looking to join forces to secure better deals.

-

Combating depressed trading on the LSE and a delayed hard market shift has held back the firm.

-

From where to prioritise investing to managing slower growth, there are tough balancing acts ahead.

-

The investment recovery will be welcome but Chinese tariffs will contribute to loss-cost inflation.

-

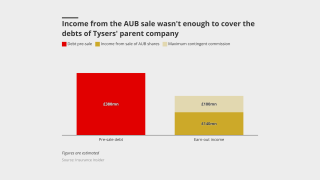

The IGH closure is bitter for employee investors left with nothing – but such investments are inherently risky.

-

Lloyd’s has been likened to a “toothless tiger” in its crackdown efforts.

-

An issue has emerged in diligence, and Howden has a complex consortium to align.

-

Technological delays erode credibility, but the market remains strong.

-

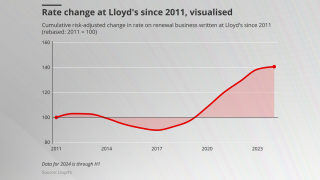

Lloyd’s hopes to protect healthy pricing, but focus is on broader structural market shifts.

-

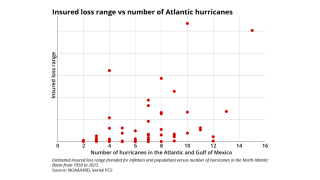

Island appetite remains stable, but early 2025 loss activity has injected fresh uncertainty.

-

Navigating its path to global specialty growth will require operational dexterity.

-

PIB’s broadened sale process is symptomatic of wider investor sentiment around brokers.

-

Lloyd’s entry is a modest start for the London heavyweight but could be the beginning of something bigger.

-

Aviation premiums have been described as “woefully inadequate” considering rising liability losses.

-

WTW’s ownership of Miller may offer a cautionary tale for the US retail-London wholesale group structure.

-

Heritage and history matter in people businesses, and the storied brand carries real equity.

-

It has been a “good” bad renewal for cat reinsurers, with attachments likely to endure in the medium term.

-

The CEO’s accelerated exit could cost momentum, and shortens Tiernan’s odds of succeeding.

-

The strong deal multiple underscores the view of London as a “gateway to the world” for brokers.

-

Rates are turning negative, and the balance of power is shifting towards the brokers.

-

The business will test the market from a position of strength after impressive early profits and robust growth.

-

Surging capacity suggests broker facilities are now refined enough to be a long-term feature.

-

The broker’s US retail foray will throw the cards in the air. Where might they land?

-

Greco will likely remain in place in the medium-term, which could mean major M&A and a Lloyd’s platform.

-

In a decade this market could grow from $5bn to $60bn.

-

The market reacted to the $2.4bn charge in a positive light.

-

London market carriers may be getting competitive, but that is not in itself a bad thing.

-

Signposting the opportunity is one place to start.

-

In line with Milton’s moderate forecast loss, the ILS market reaction will be less influential in post-event dynamics.

-

Capital diversity can only be achieved when there are more options for third-party providers to access.

-

It will take more carriers to rein in income expectations to halt the soft market spiral.

-

With the storm’s losses looking more favourable, questions over rates and gross/net strategies will arise.

-

Brokers will only get more vocal on aggregate or secondary peril if Helene remains a retained loss event.

-

DEI has faced a backlash in the US where companies have pulled back from targets and initiatives.

-

After a strong run, the market needs a chair that will uphold underwriting discipline and delivery on modernisation.

-

The new CEO has owned past challenges and charted a better course, but will need to be relentless in driving change.

-

The market remains concerned about managing the pricing slowdown, but a “super cycle” continues.

-

-

The peril is posing an increased risk of loss for the sector.

-

Property underwriters warn of complacency in how quickly margins can erode.

-

Incoming CEO James promises transparency as digital development accelerates outside Lloyd’s.

-

The shift to private market fundraising should be a meaningful boost to this and other initiatives.

-

The firm escapes public market distractions and long-term undervaluation, but the low mark will hurt peer companies.

-

Expectations of what “walking the walk” means for leaders have risen.

-

The new appointee will need to help juggle competing demands.

-

Work to revitalise the French reinsurer just got harder as problems in its life book crashed the share price.

-

Many have argued war exclusions have detracted from discussions of systemic risk in the cyber market.

-

Conditions are coalescing for an uptick in carrier M&A after many subdued years.

-

With topco liquidation looming, there are questions for R&Q and the wider market.

-

The Corporation of Lloyd’s risks its credibility if it doesn't own its mistakes soon.

-

The global nature of cyber means a UK ransomware pay license would have "no material impact" locally.

-

Reinsurers are much better placed to absorb cat losses; insurers are carrying more risk.

-

Capital is looking for opportunities to build international specialty businesses out of EC3.

-

Recent contingency losses reflect a willingness of the market to go looking for premiums.

-

Insurers must take their responsibilities seriously.

-

The hard market has not burst the MGA bubble – and now interest is on the rise again.

-

Since 1 January, the market’s potential descent into freefall has been closely watched.

-

Last week, UNEP launched a multistakeholder forum building on the experience gained from the NZIA.

-

From here on out, insurers will likely have to rely on the strength of their individual stories.

-

The short-term disruption of relisting may be justified by the long-term benefits.

-

A fresh investor will be needed to put meaningful cash on the table for a US retail deal.

-

High cash-burn, the dearth of available leaders, and weaker market conditions all point to shelving.

-

The agreement from Fleming to honour original terms still leaves it open to long-term damage.

-

The new CEO needs to fix the underwriting, but should also ask the bigger questions.

-

Lloyd’s gains leadership, and The Fidelis Partnership gets capital diversification.

-

However, it doesn't prove a mutual is a wrong concept for the cyber market.

-

Long-term confidence in the market depends on the details of the new tax rule.

-

Sources believe Lloyd’s may be veering away from central DA systems.

-

The narrative of competition between the two hubs can hold space for benefits.

-

Reinsurers are reporting stellar 2023 results – what they do with the earnings will be crucial.

-

Impressive results in 2023 will mean big payouts.

-

The Corporation is walking a tightrope between encouraging further growth whilst maintaining discipline.

-

As a drip-drip of exits have continued amid a harder cat market, broader questions arise.

-

Aviva will need to manage the talent base deftly to get the most from the deal.

-

Brokers face pressure on margins as the market’s firming phase slows

-

A minority view gaining currency is that 2016-19 will not be the only problem.

-

Rising legal costs show the risk of Howden’s growth-hungry approach.

-

Changing work practices do not overshadow basic precepts of good employment.

-

A hard cat market in 2023 means cedants must consider the alternatives.

-

Putting together two “show me” stories risks investor skepticism.

-

The depth of the retro market recovery will be an influential factor in the pace of the cat market slowdown from here.

-

The company has improved performance and brought in new top management – but its direction under Covéa remains to be seen.

-

The segment has bounced back from its mid-2022 nadir, but its current zenith is not that much to shout home about.

-

The flight of reinsurers to mid- and upper layers of programmes is influenced by recent experience but softening at this level can be seen as a risky move.

-

Lloyd’s may be wary of making disciplinary hearings more public, but it could at least make processes more transparent.

-

The move points to a longer spell of independence for Miller – but possible bearishness on external interest in UK broking.

-

The question is whether the inherent value in CFC was in fact concentrated in departing executives David Walsh and Graeme Newman, or if the business can trade forward as it did.

-

The 200-year-old firm is not the only one to be caught up in watchdogs’ investigations into corruption and bribery controls.

-

Does one party – the carrier or the cedant – have to lose out for the other to succeed?

-

London’s insurance market is booming in some ways yet still has multiple challenges to address.

-

Lloyd’s has been trying to simplify its story for external investors, but it has more work to do, judging by the outcome of the London SPAC that was planning a syndicate investment launch.

-

Trading at just 0.6x book, the firm is a cheap option for an insurer which is looking to enter E&S, or is underweight in the sector.

-

Variations between the casualty and cat markets mean 2024 cat outcomes may be far less uniform than they were this year.

-

At a point when cyber rates are falling and capacity is plentiful in high excess layers, the mutual plans have the wider cyber market somewhat perplexed.

-

The 3x3 plan takes the things about the firm over the last decade that have been distinctive and intensifies them.

-

With new leadership at some of the largest continentals, there will be close attention to how their tactics in changing lines of business will evolve.

-

Halfway through a complex restructuring is not the time for a CEO (and CFO) change.

-

As the algorithmic syndicate has diversified its capital base, the risk-modelling world provides a parallel with regard to how these initiatives could develop.

-

Investors are beginning to push insurers harder to deliver on diversity and inclusion, but the culture around speaking out and recruiting talent suggests new ideas or broader execution is needed.

-

The lopsidedness of the ILS recovery means more confidence around prolonged hard market rates but also raises the bar on competing for third-party capital.

-

Strong words from Patrick Tiernan have caused a stir in the market as pricing continues to fall off fast.

-

Insurance Insider has compiled a digest of a complex web of regulatory reforms that will take shape during the next 18 months.

-

The pressure is on Lloyds to deliver benefits as other players build up their domestic E&S platforms.

-

The personal lines strategy mirrors the buy, build and sell playbook you would see from a sponsor.

-

This CVC investment has come hot on the heels of an H1 result which showed performance plus growth, and should be interpreted as vindication of the work done at Lloyd’s.

-

The psychological wounds of the past were serious, and the sector’s redemption arc with capital will take time to play out.

-

The paradox of “the best reinsurance market in years” is that there are still question marks over who wants a piece of it.

-

However minor an irritant these losses are for global carriers, their impact is likely to have an outsized influence on the narrative heading into the 1 January renewals.

-

Prior-year legacy deals and higher reinsurance costs are just some of the issues that brokers, MGAs and other cedants are confronting in clearing up after the debacle over allegations regarding faked letters of credit.

-

Beazley and Lancashire’s plans to launch US units exemplify wider competitive challenges that the market must overcome to thrive.

-

WTW exploring reinsurance exec recruitment comes at a time of competitive tension in the market.

-

Areas of focus should include hiring external talent, securing capital for M&A, speeding up US growth, and answering the reinsurance question.

-

The fallout from Coutts’ cancellation of Nigel Farage as a client provides useful lessons as companies adopt bolder stances around issues such as social justice and climate change.

-

The issues have put a spotlight on partial collateralisation, the leverage of the fronts, and the challenges of assigning responsibility.

-

The Corporation has had to navigate challenging trade-offs around its succession planning.

-

It didn’t take long after the Validus-RenRe deal for the next possible reinsurance consolidation target to emerge.

-

Cancellations of music events due to performers’ mental health conditions is one of the issues, alongside strikes and the energy crisis, which are challenging contingency underwriters.

-

The reaction to capital raising this year signals that investor belief in risk-takers is reinvigorated.