Lancashire

-

Heyburn joins from Brit, where he was A&H class underwriter.

-

Top line grew across all carriers even as pre-tax profits dipped.

-

Rachel Sabbarton has been promoted to CEO at Lancashire Syndicates.

-

CEO Alex Maloney said Lancashire’s growth was “more measured” amid softening.

-

The carrier said most lines remained well priced despite increased competition.

-

Plus the latest people moves and all the top news of the week.

-

The managing agency is offering 62p per £1 for 2026 YoA capacity.

-

Beazley, Hiscox and Lancashire all grew in Q1 despite widespread rate decreases.

-

Plus, the latest people moves and all the top news of the week.

-

The CUO described the pricing dynamics in the line as “strong and good”.

-

The carrier estimated its California wildfire loss at $145mn-$165mn.

-

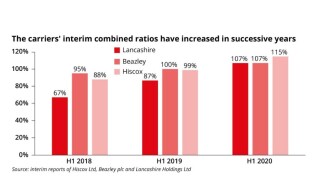

Hiscox, Beazley and Lancashire all reported top line growth, but ROEs dipped in an active wind season.

-

Plus, the latest people moves and all the top news of the week.

-

CEO Alex Maloney said the LA fires might prompt some carriers to go more “risk-off”.

-

The carrier reported an undiscounted combined ratio of 89.1%.

-

Lloyd’s CEO pay is lowest compared to major LSE-traded specialty insurers by a considerable margin.

-

The carrier is “extremely well capitalised” to achieve its strategic ambitions.

-

James Irvine will report to Cathal Carr, CEO and active underwriter of Oak syndicate 2843.

-

-

Staff movement in the class of business is high as new carriers launch into the space.

-

The CEO said the property market was in a “super-good place”, and increased competition was inevitable.

-

Rob Lusardi and Michael Dawson are to step down after eight years as directors.

-

The carrier increased insurance revenue by 16.8% to $1.3bn year on year.

-

Plus the latest people moves and all the top news of the week.

-

The CEO said the carrier’s hurricane exposure has remained static in the last few years.

-

CEO Alex Maloney hailed the results as the “best ever half-year performance” for the carrier.

-

The CEO said the carrier had identified several areas in its portfolio as having room to grow.

-

-

The carrier said it remains on track to hit a mid-80s combined ratio at the end of FY 2024.

-

The short-term disruption of relisting may be justified by the long-term benefits.

-

The unit has hired Everest’s Chris Curtin and Axa XL’s Brian Quinn.

-

Hiscox, Beazley and Lancashire all delivered one-off capital returns while swerving casualty issues.

-

In August 2023, Lancashire announced it was planning to launch in the US.

-

The carrier reported an undiscounted combined ratio of 82.6% in 2023.

-

Operating entity Lancashire Insurance Company Limited, based in Bermuda and the US, has a long-term ICR of a+ while parent company Lancashire Holdings Limited has a long-term ICR of bbb+.

-

Ratings could be lowered by one notch depending on regulatory restrictions on cash flow from Bermuda operating entities to non-operating holding companies, the ratings agency said.

-

Cat losses were within budgets despite high levels of minor events.

-

The CEO was speaking on the back of the carrier’s Q3 results, where it confirmed it would be returning $169mn to investors by way of a $119mn special dividend and offering up to $50mn in buybacks.

-

The carrier attributed the growth to significant rate rises in property (re)insurance and growth across other specialty lines.

-

Matthew Narbett will continue in his role as active underwriter of Syndicate 2010, while Colette Murphy has been promoted from deputy head of D&F.

-

His role change — following that of LCM leader Darren Redhead in 2021 — raises questions over the firm’s future ILS strategy.

-

London’s major carriers have projected bullish messages on a prolonged hard market for property, while acknowledging other classes are in very different cycles.

-

Lancashire group CUO Paul Gregory added that Q2 2023 marks the 22nd consecutive quarter of positive rating momentum.

-

The carrier’s insurance GWP increased by 35.1%, while reinsurance GWP grew by 19.9%.

-

Beazley and Lancashire’s plans to launch US units exemplify wider competitive challenges that the market must overcome to thrive.

-

The business is likely to target energy casualty, property D&F and inland marine in its first year.

-

She will join the team headed up by Stella Tomlin, who launched the Lancashire marine liability book in 2021.

-

Wood spent most of his near-19-year stint at Lancashire as head of property D&F for Lancashire’s Lloyd’s Syndicate 2010.

-

Most carriers were keen to talk about how they are taking on the ongoing hard market in Q1, but some complexities partly offset their good news.

-

Reforms to the UK listing regime may enhance prospects of an insurance firm opting to IPO in London in future, but several broader problems, including liquidity issues, will also affect such a decision, according to industry sources.

-

Montgomery Aviation and Rise Aviation Limited, along with EOS Aviation, have launched fresh legal battles against Convex and Lancashire.

-

Lancashire said positive rate momentum in the market was benefitting nearly all of its business lines, including its reinsurance portfolio.

-

Simon Fraser stepped down from Lancashire’s board after nine years of service.

-

The carrier recorded an unrealised investment gain of 1.5% compared with a loss of 2.3% in the same quarter last year.

-

Alison Gaudette will report to group chief risk officer Louise Wells.

-

The collapse of Silicon Valley Bank is creating investor fear across the global financial services sector.

-

CEO Alex Maloney is predicting more growth for Lancashire in 2023 considering the strong cat market and improving rate conditions across the carrier’s book.

-

The carrier increased its Ukraine reserves to $65.8mn while reporting a combined ratio of 97.7%.

-

Moves to push down London broker commissions highlights the options open to write reinsurance platforms in other markets.

-

Considering Hurricane Ian's impact, rate hardening will only accelerate, CEO Alex Maloney said.

-

Robert Lusardi is taking over the role from Simon Fraser, who is stepping down after nearly nine years as a senior independent director at Lancashire.

-

Gross written premium grew across all business lines, with P&C reinsurance reporting a 37.5% increase.

-

Lancashire 2010 has had its syndicate business forecast approved, but it may be revised in the wake of Hurricane Ian.

-

Lancashire has appointed Francis Lobo as head of engineering, Nicola Nairn as group head of reward and confirmed the appointment of Angus Roberts as head of airline.

-

Alex Maloney also reiterated that the company, which reported H1 results earlier today, is still “committed” to the cat game.

-

The latest addition to the board is a veteran of Axis and Ace.

-

The carrier said its ultimate net losses in Ukraine since the start of the conflict were towards the lower end of its initial range, at $22mn.

-

Angus Roberts joins from Chubb, where he has been a senior aviation underwriter since June 2019.

-

Barnes, Flude, Narbett and Thomas are all to be promoted in a reshuffle.

-

The executive will take up the role of global head of marine at AIG.

-

Swiss Re goes against the tide in expanding in cat, while specialty rates appear to be holding up better than expected.

-

Plus this week’s Q1 results and all the top news of the week.

-

CEO Alex Maloney acknowledged the company has exposure to losses in Russia, “although they have not yet materialised”.

-

Growth was driven by the P&C reinsurance segment, which increased GWP by 39.1% to $310.1mn.

-

In the event of a $2bn aviation-industry loss, Lancashire would face a $40mn loss on its aviation book, as well as a $10mn loss on other lines due to the Ukraine conflict, analysts said.

-

Lancashire has direct exposure to Ukraine through aviation, marine and political risk lines, according to a Jefferies report that said the carrier will likely incur “immaterial losses” from the conflict in its aviation war business.

-

The withdrawal of the major lead market will substantially reduce available capacity at 1 April renewals.

-

The CEO said, in very heavy cat years, “if you write a substantial amount of cat business as we do, there's going to be an inherent volatility to your business, which we accept”.

-

Despite heavy cat losses, its combined ratio improved by 0.5 pts, due to an improved expense ratio of 17.2%, compared with 24% in 2021.

-

Over the last 12 months, three of the four London-listed companies have drastically underperformed their US-listed and Continental European peers.

-

The new Sydney-based platform will initially focus on direct and facultative (D&F) commercial property in the Australian and New Zealand markets.

-

The carrier has previously announced an intention to buy up to one million of its common shares.

-

The executive also noted that the carrier expects to maintain its cat footprint for 2022, despite recent losses.

-

The biggest increases in GWP came from the carrier’s P&C reinsurance and P&C insurance segments.

-

The hire comes after the intermediary agreed to buy Bermudian business Foram.

-

The carrier said the claims stemmed from Hurricane Ida and storms in Europe.

-

Despite a somewhat mixed outlook, UK listed carriers London players say they are still leaning into growth.

-

The CEO said investors would be "scratching their heads" if hurricanes dragged insurers to a loss.

-

CEO Alex Maloney said the carrier was starting to ‘reap the benefit’ of three years of rate growth.

-

Analysts believe 2021 will be a “transition year” for Hiscox, Beazley and Lancashire.

-

The carrier has been rebuilding its team after Alasdair Butler and Lee Aspinall left to launch an MGA.

-

Plus the lowdown on CFC’s syndicate capacity and all the top news from the week.

-

Rates are beginning to taper in cargo as new capacity enters and staff displacement continues to be high.

-

The analyst says Hiscox must convince investors of a retail bounce-back, while Lancashire’s attritional loss ratio is key to better trading.

-

The resignation comes amid an uptick of competition in the class after four years of positive rate development.

-

David Chalk and Richard Ogoe have cumulatively spent around 16 years at WR Berkley.

-

Lancashire’s upstream income was broadly stable in 2020 as the carrier registered modest rate increases.

-

Aon-Willis, CFC's new Lloyd's syndicate, Talbot's contingency retreat and more.

-

The CEO said the carrier was turning aside more business than it wrote, yet had “sufficient headroom” to grow.

-

CEO Alex Maloney says the group’s highest-ever Q1 GWP was driven by market conditions.

-

The former global energy CUO takes on the newly created role effective immediately.

-

The carrier predicts $40mn to $60mn of GWP this year from new lines of business.

-

The goods-focused pact includes a joint declaration on financial services, though crunch issues have yet to be resolved.

-

Major consolidation laid the ground for current new launches, the Conduit chairman suggested.

-

“It is very hard to think about the future if you can’t make money today,” the Lancashire CEO said during (Re)Connect.

-

Commentary from Beazley and Lancashire also flags challenges on volumes, interest rates and recessionary claims.

-

The CEO said people were getting “ahead of themselves” to say it was the best market conditions in recent memory.

-

Analysts had expected the carrier to make a first-half profit, but reserve deterioration and higher Covid-19 claims impacted results.