-

The sidecar was launched today by the Bermudian reinsurer and investment firm Carlyle.

-

The capital will provide retro cover for life-focused reinsurer Fortitude Re.

-

Improved performance and growing investment returns played a role in the upgrade.

-

The Bermuda reinsurer has been active in ILS since launching in 2007.

-

The ILS manager has $6.8bn in assets and will be led by MariaGiovanna Guatteri.

-

The measures also seek to encourage greater wildfire mitigation efforts.

-

The sidecar will support five programs providing specialty frequency coverages.

-

The syndicate is targeting capital allocation for 1 January, the company confirmed.

-

Cat bonds have outperformed private ILS strategies in the YTD, according to ILS Advisers.

-

Sources said that the carrier has held preliminary talks with private debt investors.

-

The private ILS segment took losses from LA wildfires and Mid-West severe convective storms in H1 2025.

-

Fleming’s attempt follows those of other legacy carriers that have had recent successes raising capital.

-

Hannover Re Capital Partners is in talks with two investors for 1 January launch.

-

Ryan Alternative Capital Re was launched in partnership with Axis Capital.

-

The Japanese carrier has agreed to buy Aspen for a realization of $3.5bn.

-

The ILS play will make the business more capital efficient under new owner Sixth Street.

-

The lawsuit is the latest development in the multi-billion dollar reinsurance scandal.

-

Cat portfolios generally grew, but casualty approaches varied.

-

The vehicle will support Ascot’s casualty business in the US and Bermuda.

-

The broker has nearly 20 years of experience in the reinsurance and retro markets.

-

The PRA will also have to report on turnaround time for new approvals against 10-day and six-week targets.

-

How is The Fidelis Partnership choosing to launch into new insurance classes as it rapidly expands?

-

The man is alleged to have conspired with others to falsify LOCs and collateral letters.

-

The latest update brings the agency’s combined estimate for Milton and Helene to $32.4bn.

-

The programme will succeed the previous buyback launched in 2023.

-

Gallagher Re said rates had softened in 2025 versus the prior two years.

-

Sentiment at the ILS Connect event hosted by Insurance Insider ILS was generally positive.

-

We assess the Bermudian’s standing amid waning investor sentiment and economic uncertainty.

-

The state insurer of last resort is set to purchase $2.89bn of reinsurance this year.

-

Its 2025 programme exhausts at $9.5bn excess $1bn.

-

The firm acted as the front for Trouvaille Re, the E&S property sidecar for MGA AmRisc.

-

Being the “new kid” has created interest in the market, Mereo CEO Croom-Johnson added.

-

The industry loss data provider also increased its estimate for Hurricane Helene to $15.3bn.

-

The broker has also hired fellow Aon broker Barry Gordon in a role trading ILWs.

-

The business will still look at large non-life deals in particular in-the-money ADCs.

-

The investment recovery will be welcome but Chinese tariffs will contribute to loss-cost inflation.

-

European reinsurers, London market carriers and composites all enjoyed healthy trading.

-

Erik Manning is joining the business from BMS as head of ceded reinsurance.

-

The announcement spurred a quick spike in stock market valuations.

-

Trade credit and marine are among the lines facing direct impacts amid a broader inflationary challenge.

-

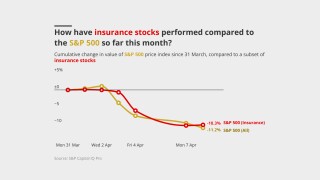

Swiss Re and Talanx led the gains among listed European carriers.

-

The asset manager has hired Rom Aviv as head of ILS.

-

Markets have taken a battering across the globe following the “Liberation Day” announcement.

-

Elizabeth Wooliston said the immediate concern would be managing ‘value at risk’.

-

Trouvaille II raised $580mn for 2025, compared to $325mn in 2024.

-

Insurance share prices were resilient amid today’s market meltdown.

-

Total reinsurer capital grew by $45bn in 2024 to $715bn.

-

Recent transactions on the platform include cat bonds from Flood Re and Brit.

-

The firm also promoted Devin Inskeep to an expanded role as SVP, head of ratings and advisory.

-

This year’s coverage will involve $2.94bn of new risk transfer.

-

Some $4.8bn of reinsurance and cat bond limit will come up for renewal in 2025.

-

The role will focus on international treaty, specialty lines and strategic advisory.

-

Jana holds around 109,000 shares and 69,000 call options, at a $307mn total value.

-

Bolding will focus on aligning Gallagher Securities with Gallagher Re.

-

The carrier’s Eaton Fire loss would be a retained net loss hit.

-

Somers Re is valued at ~$1.3bn, according to disclosures made in Arch’s Q3 2024 SEC filings.

-

Theo Norris joins from Gallagher Re, which brokered one of the first 144A cyber cat bonds.

-

The company’s stock price has plummeted in the wake of the LA wildfires.

-

The state insurer is budgeting for an extra 43% of overall coverage in 2025-26.

-

The 2025 target would be ~25% larger than the $3.56bn it placed for 2024.

-

Fema's traditional reinsurance programme will attach at losses of $7bn and above.

-

CEO Adrian Cox said Beazley’s recent $290mn ILW purchase was not driven by “capital flexibility in and of itself”.

-

The reinsurer is planning to drop its cession rate from 40% to 30%-35%.

-

The firm has helped underwriting businesses secure $3.5bn in capital.

-

The loss tally is considerably lower than estimates issued by model vendors.

-

In line with Milton’s moderate forecast loss, the ILS market reaction will be less influential in post-event dynamics.

-

The raise includes minority investments from Nationwide, Enstar and others.

-

Changes to the categorisation and oversight of managing agents seek to reduce duplication and thereby cut costs.

-

Cat bond funds have been attracting inflows while confidence is patchier across collateralised re.

-

The company increased its full year 2024 adjusted net income guidance.

-

The proposals include increasing either statutory or CRTF funds.

-

Aspen said reduced reinsurance appetite made it a good time to seek alternative capacity.

-

A hard cat market in 2023 means cedants must consider the alternatives.

-

-

A more consistent trading rhythm returned to the property market, with capacity deployment outside of frequency-exposed layers and more heavily loss-impacted segments bouncing back.

-

The lawsuit, filed Thursday on behalf of Clear Blue and its subsidiaries, alleges that Aon conducted insufficient due diligence on the ILS InsurTech.

-

The Bermudian firm said it expects the acquisition could drive more growth than the prior forecast of $2.7bn incremental premium.

-

The lopsidedness of the ILS recovery means more confidence around prolonged hard market rates but also raises the bar on competing for third-party capital.

-

The sidecar has been launched alongside partner Stone Point Credit Adviser.

-

The APRA intends to review reinsurance settings in the Australian prudential framework over the course of 2023 and the first half of 2024.

-

The company’s targeted Vescor cat bond would have provided collateral to meet auto and other obligations, but there were multiple structural points of risk for investors.

-

The firm’s statement followed allegations in Israeli tech media of missing collateral linked to deals it was concerned in.

-

In a discussion at Trading Risk’s London ILS 2023 conference, panellists compared the current cyber ILS market to the cat market in the 1990s.

-

Hard-market conditions have been beneficial but more improvements are needed, the panel said.

-

At Trading Risk’s London ILS 2023 conference, the PRA’s head of division for London markets, Andrew Dyer, explained how the PRA is executing its plans to bolster the UK ILS market.

-

Structures have been developed that would avoid “excessive capital trapping”.

-

The company will use the funds to expand its global presence, enhance its marketplace platform and widen its offering.

-

How much capacity is available to meet rising cat reinsurance demands was a key theme throughout this year’s Rendez-Vous.

-

Gupta moves from Axis Capital where he served for four years in the New York team.

-

There are still some hurdles preventing widespread ILS adoption of cyber risk, but momentum should increase.

-

The ratings agency said a high degree of uncertainty around ultimate exposure is likely to be long-lasting and will fuel rate strengthening in affected lines.

-

The first-of-its-kind deal blends bank financing with ILS funding.

-

Political violence and aviation coverages had been thrown into marine composites as the market softened.

-

Courts in Bermuda and the US approved the move, which had earlier been subject to investor litigation.

-

The reinsurer said it was anticipating increased volume for catastrophe bonds and collateralised reinsurance this year.

-

Cornell Fox joins as head of investor relations and business development, while Masa Kitade has been enlisted as head of business development for Asia.

-

Plus booming broker growth; GRP, Covea UK and James River sales; and all the top news of the week.

-

Many ILS firms opened 2022 with reduced assets under management, in a bearish signal for the mid-year renewals.

-

The team will not offer an ILS product but plans to invest in insurer capital-relief instruments as part of a new asset management play.

-

The former MS Amlin head of reinsurance takes up the CUO role next week.

-

Negotiations were dragged out by decisions being referred for sign-off at senior levels.

-

Reinsurers have held the line more strongly than last year but rising risks may offset gains.

-

CyberCube also forecast that fresh capital will start to flow into the cyber insurance market next year.

-

The interconnected challenges of performance and the collateralized structure make it tough to land a strategic pivot.

-

The carrier has ramped up fundraising activities this summer as it seeks to broaden its platform.

-

If you only read a handful of stories this week, make it the selection below.

-

The Canadian pension plan Ontario Teachers’ will support three Lloyd’s syndicates – CFC, Beazley and Beat – via its initial deal.

-

The Dutch firm had given the AIG-owned platform a mandate that could range from EUR500mn to EUR1bn, covering US cat reinsurance.

-

The new London Bridge framework is less useful to the bulk of specialist ILS asset managers than it is end investors.

-

The manager said last year it wanted to deploy $100mn to $200mn in casualty ILS

-

Discussions with industry and in-country partners have so far foregrounded parametric solutions.

-

Markel will provide approximately $150mn to facilitate the buyout of the retrocessional segregated accounts of the funds, as well as tail-risk cover to release $100mn of trapped collateral.

-

Ongoing high claims from risks such as winter storm, wildfire or convective storm are playing into the climate-change debate over whether and to what extent cat reinsurers are mispricing their business.

-

Carriers will not necessarily accept smaller returns in exchange for high ESG scoring vehicles and risks must be properly priced, according to Dirk Lohmann, chairman of Schroders Capital ILS.

-

Managers such as Schroders and Fermat capitalised on investors looking for liquid, remote-risk strategies to grow their asset base in H1.

-

The Canadian pension fund and the ILS fund provide Funds at Lloyd’s capital alongside traditional reinsurers.

-

A rampaging cat bond market should lead more cedants to consider its long-term advantages.

-

He worked for eight years at the French firm, where he oversaw the strategic direction of its ILS business.

-

With ILS and pension fund money now confirmed for Syndicate 1988, there are further observations for the vehicle launch.

-

Reinsurers from Bermuda, the Cayman Islands and Japan have also provided capital to the syndicate for its 1 July launch.

-

The ILS vehicle has support from four key providers and will be launched alongside a broader offering including K&R, fine art and other specialty risks.

-

The experience of the past few years has made cedants much more concerned about managing tail risk than they are credit risk.

-

The platform will be managed by Horseshoe with Leadenhall’s head of non-life, Ben Adolph, acting as head of underwriting.

-

Syndicates and managing agents who want third-party capital support need to deliver on profit and transparency.

-

Mary Margaret von Herberstein will work on relationships with quota-share capacity providers.

-

The broker’s international chairman noted shifting attachment points on wind deals and reshaped aggregate covers.

-

The investor will focus on late seed and Series A funding rounds as it widens its geographical remit.

-

Former Aon broker Charlie Simpson will lead the broker’s platform in Bermuda.

-

The hedge fund reinsurer reports an underwriting loss of $1.1mn for the quarter, a fraction of the typhoon-driven deficit of a year earlier.

-

The Floridian insurer aims to renew just over a third of its private reinsurance placement in cat bond cover.

-

Whether the Texas Deep Freeze ends as a $12.5bn, $15bn or $20bn insured loss, it will be a medium-sized cat event that will deal an earnings hit to carriers with exposure to the affected states.

-

Hannover Re and Fidelis provided significant capacity on the Munich Re-led programme.

-

The merged entity will also look to focus on higher margin lines and invest in InsurTech.

-

The Insurance Capital Fund combines US wind cat bonds with subordinated debt issued by European insurers.

-

The company also lowered the attachment points on its per-occurrence and aggregate property catastrophe treaties after shrinking its portfolio.

-

The EU’s chief insurance supervisor advocates adding on pandemic to existing national schemes.

-

The European (re)insurance supervisor said correlation to financial market risk made the idea a challenging one while reinsurance appetite is also very limited.

-

The move follows Fidelis’ decision to hand back $275mn it had raised for a retro vehicle.

-

The total increase to the Bermudian firm’s AuM will be “tempered” at the start of the year due to timing of allocations, cat losses and side pocketing.

-

-

Former Securis' executive Neil Strong joins arrivals including Lancashire’s Chris Wilkinson as a second head of specialty and Talbot PV specialist Dan Callow.

-

RenRe said it had “ample dry powder” even after fully deploying its $1.1bn 2020 capital raise.

-

The CEO said the French reinsurer will avoid court cases where possible in pandemic coverage disputes.

-

Alternative capital providers have benefited alongside the “class of 2020” with post-pandemic growth, as specialist ILS assets grew 3.7% in the half year to 1 January.

-

The retro and specialty vehicle launch comes as PartnerRe expands in retro and ILS.

-

Ascot will provide the reinsurance support for the index-based crop products.

-

The new capacity for the sidecar first launched in 2019 will be invested solely in EBRD bonds.

-

The CFO said the new access point for investors would not be used to inflate Lloyd’s capacity and dampen returns in the market.

-

The emerging markets specialist aims to raise around $860mn of additional funds by 2025.

-

This publication looks at 10 issues that will shape the industry in the year ahead, from rate sustainability to start-up progress to the post-Covid recovery.

-

The vehicle is the first sidecar launched in Singapore and will cover regional risks.

-

The insurer will begin ceding risk to Lifson from January 1 next year.

-

The companies said they will pursue a “controlled exit” as the affiliated ILS manager continues to draw back following a reduction in assets.

-

If the fundraise closes, the business will operate as a “permanent capital” monoline retrocessionaire.

-

The former Pioneer underwriting chief will lead the programs team within Brit Global Specialty USA from Georgia.

-

By setting up an asset manager, the reinsurer is competing with ILS firms on their turf.

-

The company has expanded its sidecar in recent years but this will allow it to tap into a different investor base.

-

The Syndicate 6131 team will also start writing business on ILS Capital’s US rated balance sheet.

-

Direct investment has propped up the reinsurer ILS platforms, but further evolution will be needed.

-

The Nephila CEO said ILS capital backing sidecars that are a "trade not a relationship" will charge a higher cost of capital.

-

The executive has begun sounding out investors about a retro offering.

-

The expansive ILS firm is likely to look for debt funding to remain staff-owned.

-

Post-Covid fundraising may not be on the same scale as the post-Irma reload, but similar narrative themes are a risk to monitor.

-

The ILS manager is in the process of applying for a corporate member, sources said.

-

Nicholas Hughes will become retro head, while Guy Hengesbaugh and Aaron Coates join as underwriters.

-

We round up the biggest themes from our five-day virtual conference, which welcomed 2,600 delegates this week.

-

The international chairman says poor investment returns will drive push for rate adequacy.

-

The Bermudian manager is looking to broaden its platform.

-

Total equity and debt raised this year if the $300mn target is reached would approach $1.5bn.

-

Alternatives to the buffer loss table are coming to the fore, as the sector searches for answers on trapped capital.

-

Lohmann will move into the newly created role of chairman.

-

Ghosh will work closely with CEO Ken Pierce to develop the two-year-old platform.

-

Buyers are looking to protect against a mid-sized loss, although trades are not believed to have taken place yet.

-

The Australian carrier exhausted its Orchard Re cat bond.

-

In an environment of global financial volatility, the coronavirus has brought both opportunities and challenges to the ILS market, writes Fiona Robertson.

-

The departure comes after a 21% contraction in GWP at the unit in H1.

-

Ex-Novae deputy CUO to become active underwriter at Syndicate 2358.

-

The January agreement remains subject to regulatory approval.

-

Cat programmes have been completed this year, but a heavy hurricane season could shake up the market, the broker said.

-

The former RenRe third-party capital chief joins the Bermudian ILS firm.

-

Two ILS leaders are working on a new launch with strategic broker and reinsurer alliances in place, sister title Trading Risk revealed.

-

The two-tranche deal will provide US storm and Canadian quake cover.

-

Syndicate 2358 will write specialty risks, an expansion from the Markel-owned platform's historic focus on property catastrophe.

-

The launch will mark the third follow-only syndicate in the works within the Lloyd’s market.

-

This comes after Everest Re previously let a mid-year renewal lapse, with ILS capacity scarce.

-

ADIA, Crestview and CVC back a fundraise equivalent to 45 percent of pre-transaction equity.

-

The London market veteran holds several advisory positions and assists the UK government.

-

The carrier retained more risk in the first layer of its programme.

-

The impact of the pandemic on the mortgage insurance market has been muted thus far.

-

The platform said a narrowing spread between buy and sell offers on ILWs suggests more trades will clear.

-

The London Matters report finds EC3 lost reinsurance market share between 2015 and 2018.

-

The carrier will only issue the smaller of its two planned deals.

-

Private equity is looking for opportunities to capitalise on the Covid-19 dislocation.

-

Minimum standards will include full communicable diseases and wildfire exclusions, the ILS fund has said.

-

The institution will make a net gain of $60mn on the transaction.

-

Property reinsurers seem to be preparing to draw the battle lines on Covid-19 claims around T&Cs.

-

The purchase follows the 2019 launch of the Lion Rock Re sidecar.

-

The ILS market is seeking to avoid further high levels of collateral lock-up should a string of events similar to those in 2017-2018 happen again, writes Lucy Jones.

-

The collaboration takes over from Vario's previous work with Guy Carpenter.

-

The carrier failed to secure sufficient investor interest for the transaction.

-

The Bermudian platform sources casualty reinsurance deals for hedge funds.

-

The ILS fund manager’s parents makes hundreds of millions of dollars of capacity available.

-

It is hoped the capital platform will be live in Q4 for investors to support 2021 capacity.

-

Kara Owens said investors’ understanding of cyber insurance has evolved.

-

The scheme’s main retrocession programme, the world’s biggest terrorism reinsurance placement, will likely increase from last year’s £2.3bn.

-

The MGA is backed by (re)insurance capacity from Markel, through the carrier’s Nephila insurance-linked securities fund.

-

The new funds raised at 1 January are dedicated to its retro-focused Upsilon fund and its Medici cat bond strategy.

-

The figures reflect expectations that sponsors will return to the ILS market to seek cover as rates stabilise.

-

Nephila raised its $100mn target from the Stratosphere Re bond, which covers both personal and commercial property business.

-

The World Bank's pandemic insurance bond covers the virus, and is designed to trigger if deaths impact multiple nations.

-

The cutbacks could have withdrawn close to $1.5bn of limit from the market.

-

This publication looks at the 10 most prevalent industry trends for the year ahead.

-

The carrier’s CFO pledges tighter risk selection following December’s profit warning, but no major pullbacks.

-

The reinsurance partnership would support the expansion of Beazley’s fast-growing affirmative cyber book.

-

Ali will take charge of Hamilton’s future cat bond placements, having been involved in the recent renewal of its sidecar Turing Re.

-

Leo Re sits alongside Munich Re's more broadly distributed Eden Re, which contributed $300mn in 2019.

-

A striking feature of this year’s 1 January renewal has been the changing approach to aggregate retrocession covers.

-

Willis Re report shows reinsurers reacting to Boeing incidents and ILS lock-up.

-

A shift towards rated paper and occurrence structures helped the market clear with some deals remaining outstanding.

-

The Insurance Insider looks back to some of the standout pieces of the last 12 months.

-

Losses arise from four events plus reserve re-estimates.

-

For the most part, aggregate retro covers got hammered in 2017-2018 – but what isn’t as often discussed as these headline losses is the fact that one pocket of such capacity actually got away largely intact.

-

The auction platform expects an active renewal season with an additional $1bn of limit committed from traditional treaty and facultative reinsurance programmes.

-

The carrier has dropped some layers from its ILW-based ILS transaction.

-

The Sussex Specialty Insurance Fund will allow institutional investors to access Lloyd’s risks through Syndicate 2988.

-

A-grade students lose momentum, world-class soccer teams have bad runs and every ship must occasionally navigate through stormy weather.

-

Cat bonds sponsored by the California Earthquake Authority and the Philippines government both achieved their target size while pricing in the upper range of coupon guidance.

-

CFO John Dacey says the new alternative capital partners unit will enhance its flexibility.

-

The country's ministry of finance has agreed a deal with 56 insurers to insure public buildings against natural disasters.

-

The costliest event, Typhoon Hagibis, will generate a near-$60mn hit across two classes of shares.

-

Randolph Re will target ILS deals above $25mn.

-

The product is the first non-US cat bond issued in the past nine months.

-

“Trapital” is once again throwing out renewal schedules in the ILS market after recent typhoon losses have complicated the run-up to 1 January.

-

The business will become part of Artex Risk Solutions, a unit that focuses on captive management and alternative risk transfer.

-

The latest Galileo cat bond has five tranches and will cover various natural catastrophe risks in the US, Canada, Puerto Rico and the US Virgin Islands, Europe and Australia.

-

The sector will see a slight dip in capital at the upcoming renewals, but growth prospects are strong, panellists at an S&P conference predict.

-

AIG’s AlphaCat-managed ILS funds grew AuM by $200mn in Q3, while assets at Nephila, Hiscox ILS and Mt Logan dipped in the quarter.

-

The autumn season of reinsurance industry conferences usually runs like a well-oiled machine.

-

The reinsurance broker says interest in sidecars has picked up, though investors’ criteria is stringent.

-

Failing to expand could lead to the market stalling, suggested speakers at Trading Risk’s New York conference.

-

Trapped capital – or “trapital” as we dubbed it in the newsroom one day – remains a key theme in discussions in the run-up to 1 January renewals.

-

The demise of Neil Woodford and his funds empire will have wide reverberations for many months.

-

The founding executive will hand over to present COO Paschal Brooks.

-

Bernina Re will become the flagship underwriting unit for Credit Suisse's ILS funds.

-

There are questions on whether the four European reinsurers will continue to expand their top line as conditions improve

-

Speaking at a B3i launch event CEO John Carolin said that there was “momentum” behind distributed ledger technology.

-

The RenRe CEO raised the concern in light of the way catastrophe losses have risen from initial estimates in recent years.

-

Geography matters in reinsurance. Bermuda's isolation means that every carrier knows its neighbour's business.

-

The Aquilo reinsurance strategy was part of Markel Catco's operations.

-

Investors may be able to part collateralise ILS investments with other assets, effectively adding an ILS overlay to an existing mandate, says Rick Pagnani, head of the firm’s ILS business.

-

Management of the acquired business will report to Artex Risk Solutions CEO Peter Mullen.

-

Hyeji Kang was formerly head of actuarial function and replaces Bernhard Arbogast, who retires after 25 years with the carrier.

-

The ILS manager would be following LGT and Credit Suisse, which have also set up their own rated vehicles.

-

Sources had already estimated that capacity in the £2bn market could fall by 20 percent for 2020.

-

The industry can offer cover on climate risks but should also look at resilient investments, the Bank of England governor said.

-

The expanded entity will develop common products and funds, according to Coriolis CEO Diego Wauters.

-

The launch follows the carrier’s decision earlier this year to put CatCo into run-off.

-

The MS Amlin-owned ILS fund is speaking to Lloyd’s about new entry routes to the Corporation for open-ended ILS funds.

-

Peter Mills teams up with Tim Griffiths to launch London-based Pyrrhic Re.

-

The reinsurer also reiterates optimism about the 1.1 renewals.

-

The Insurance Insider takes a look at reinsurance market dynamics after “near-miss” Dorian.

-

The reinsurer is considering creating a separate balance sheet that could write risks on behalf of third-party investors, akin to the Vermeer Re vehicle managed by RenaissanceRe.

-

The launch comes after six years of Nephila using Asta's turnkey services.

-

In Monte Carlo presentation, the ratings agency also predicts a "flight to quality" among ILS investors.

-

Andrew Barnard will serve as CEO of new ILS platform Lodgepine with two colleagues taking on investment management roles.

-

"Signs of fatigue" are showing in the market as pricing hardens slightly.

-

The executive’s move into the new role of deputy head comes two months after Schroders scooped up the outstanding shares in the ILS fund manager.

-

Rates for $40bn live cat trades have risen as the market has grown more wary of a significant loss, sources said.

-

The investor supplies more than £40mn ($49mn) of growth capital following the telematics company’s acquisition of IMS last year.

-

Whoever thought it was a good idea to taunt the weather gods in this way?

-

The company has created a new management committee as it refocuses on disciplined underwriting.

-

Fears of meaningful industry losses mount as storm intensifies and track shifts.

-

Despite shrinkage of the overall pool, new capital providers have entered the market in recent months, the ratings agency said.

-

The carrier’s current total of $2.1bn has grown from $300mn at the start of 2015 and is up $100mn since the start of the year.

-

AIG took a $1mn investment loss from its $124mn holding in AlphaCat, whereas Pillar provided $3.3mn of investment income for Alleghany.

-

The Reinsurance Opportunities Fund has started a buy-back process after shareholders voted in favour of a run-off.

-

Australian carrier says spring events have also eaten into its calendar-year aggregate deductible.

-

Will Roscoe is taking on the newly created role, having been with the firm since 2011.

-

The latest quarter was the second-lowest Q2 for issuance volume in the past eight years.

-

The executive promises a broader managed funds vehicle, whose strategies will also differ from those of Nephila.

-

Kinesis deployed 50 percent more limit year on year while RenaissanceRe grew its DaVinci sidecar.

-

Last week, Markel said it was placing its retro fund manager Markel Catco into run-off, as part of a restructure that will see a fresh retro play brought to market for 1 January 2020.

-

CEO Michael McGuire says the decision reflects the stock's valuation.

-

The company is also placing its Markel Catco reinsurance fund into run-off.

-

I’ve been writing about (re)insurance for almost a decade now, initially for another London-based industry title, my memories of which are increasingly patchy.

-

AuM as measured by Trading Risk was almost flat at $103bn, up fractionally on 1 January.

-

It’s no surprise that the topic of bonuses and remuneration gets people talking. Recently my colleague Gavin Davis hit a nerve among our readers over an editorial he wrote essentially arguing that the reinsurance industry did not make anywhere near enough use of properly designed performance-based remuneration structures. Underwriting executives had insufficient skin in the game, he argued.

-

After an almost two-year absence, Brad Livingston is rejoining the broker to focus on ILS business.

-

The ILS platform’s COO had helped drive growth to $1.5bn assets under management.

-

Dirk Lohmann (pictured) will remain at the helm of the ILS manager.

-

The firm’s 2015 Atlas cat bond has triggered, following loss creep from the 2017 hurricanes.

-

The company has reached a settlement with Alissa Fredricks and agreed to binding arbitration with Tony Belisle.

-

The NFIP will bear the brunt of losses from Hurricane Barry, according to industry analysts.

-

The series of storms caused economic losses of $2bn, figures from Aon show.

-

The City Council is working with RMS to improve the quality of its protection.

-

Axis and Swiss Re were able to top up on ILW cover at the lower end of their targeted costs.

-

The deal follows recent ILS fund manager investments by White Mountain and Scor.

-

The mid-year renewal included $135mn from a Bermuda-listed placement, which shrank from $278mn after the insurer revised the covered portfolio.

-

Reinsurance rates are rising, especially in Florida and retro, but primary market changes are still outstripping the significance of these improvements.

-

Participation by DE Shaw for the first time since 2015 drove an overall increase in ILS use by the Floridian insurer for its 2019-20 programme.

-

Capital is returning to the ILS industry after the past two years of losses, Paul Schultz, CEO of Aon Securities, said at the firm’s 2019 ILS event last week.

-

Third Point Re and White Mountains have also given financial support to the start-up.

-

The reinsurer has secured $60mn of protection against named storms and earthquakes in the US from the capital markets.

-

New deals have brought total year-to-date ILS volumes to $2.9bn, pointing to a shrinking of the market.

-

Reinsurers are now in a competitive position in the ILS market, having narrowed a major market share deficit in the past five years through some large M&A deals and a few instances of significant organic growth.

-

The Toronto-based firm will continue to be managed by its current team.

-

Congresswoman Maxine Waters has proposed the new law to end lapses in National Flood Insurance Program coverage.

-

Further M&A activity in the ILS market points to the likelihood that no single ownership model will prevail.

-

The buyer spends $55mn on a 30 percent stake in the Chicago ILS fund manager.

-

The ILS market faces a test to recover position as it loses market share to traditional players.

-

With more than $4bn of assets under management, Elementum was the third-largest independent ILS firm left in the market.

-

Scor chairman and CEO Denis Kessler said the Coriolis acquisition would help its ILS platform move into the top tier of the market.

-

American Integrity Insurance and Safepoint have looked to tap the ILS market this week.

-

The deal would bolster the reinsurer’s ILS assets under management by more than 60 percent to $2.1bn.

-

The Akibare Re bond will pay out to Mitsui Sumitomo, sister publication Trading Risk revealed.

-

Arch Capital backed hedge fund carrier’s outlook graded “stable”.

-

The issuances from United Insurance Holdings (UPC), American Integrity Insurance Company and Safepoint point to a slight hardening of the market.

-

Nephila has also stopped buying ILW cover as the market of buyers shrinks.

-

Investors remain committed to the insurance-linked securities market even if first-quarter issuance has dropped dramatically.

-

Allianz, Swiss Re or, let’s be honest – Convex – would have been better for John Neal. But Samsung Fire & Marine’s decision to buy into Lloyd’s business Canopius represents a highly positive codicil to last week’s strategy announcement.

-

The insurer expects to complete its Florida placement later this quarter.

-

Loss-hit issuances from Nationwide Mutual, Heritage and USAA all traded close to zero this month, among a recent flurry of activity on the secondary market.

-

Initial guidance on the latest Residential Re transaction points to a spread well above comparable deals.

-

The insurer predicted catastrophe claims of $381mn for March.

-

AM Best has put the AmTrust subsidiary's financial strength rating under review with positive implications following the sale announcement.

-

Early paying of premiums could draw in capital, panellists told a Trading Risk event.

-

Traditional equity capital fell 5 percent to $488bn while ILS capital rose by 9 percent to reach $97bn.

-

Review by outside counsel finds no bad faith in “exercising business judgment”

-

The moves follow years of market malaise in the property sector.

-

The collateralised capacity from Turing Re will support the reinsurer’s property treaty reinsurance portfolio.

-

ILS Capital’s Libassi claims the end of the reinsurer’s fronting business will create a leaner ILS market.

-

The executive took an advisory role when Axa XL bought out minority investors in the funds platform last year.

-

The Latin America-focused syndicate avoided most of last year’s biggest catastrophes.

-

The combined ratio improved to 104.1 percent.

-

The carrier, led by chairman and CEO Bertrand Labilloy, says 157 Re paves the way for a Paris ILS market.

-

The plan for Catco Reinsurance Opportunities garners near-unanimous investor approval.

-

At today’s pricing, most property cat is still a good write for a vast pool of non-insurance capital.

-

The forecast compares with Raymond James' estimate of rate increases of up to 15 percent on loss-affected business.

-

StarStone leads the hydroelectric claim, which follows last year's Ituango Dam disaster.

-

LGT led the way with its rated start-up Lumen Re.

-

The insurer has grown ILS revenues from zero to $92mn in five years.

-

In a comparison that you should only attempt if you have a French accent, Scor chairman and CEO Denis Kessler once quipped that traditional reinsurance was the wife of the insurance world, while ILS was the mistress.

-

Countering the increased demand for public reinsurance, Demotech is seeking to require more overall coverage.

-

CEO Paresh Patel said the carrier is already buying cover for a greater than one-in-100 return period.

-

The new executive board member fills a vacancy left by the late Jürgen Gräber.

-

The sidecar Reinsurance Risk Premium Interval Fund gave investors around a quarter of the sums requested.

-

The partner’s pricey, scaled-down reserves deal leaves questions about the impact on Maiden’s capital unanswered.

-

The executive expects AlphaCat to become an increasingly compelling part of the Validus purchase.

-

The move will be put to shareholders of the London-listed Catco Reinsurance Opportunities fund later this month.

-

A lower catastrophe loss burden helps offset a $76.2mn reserves hit.

-

The $54mn ILS issue follows the city state’s introduction of a grant scheme for the securities a year ago.

-

Julian Enoizi, who was instrumental in bringing the £75mn Baltic Re terrorism cat bond to market, said using ILS for an exotic risk was “a long journey”.

-

Adverse development and a withdrawal of capacity are expected to lead to increased pricing for loss-affected Latin American accounts.

-

CEO Masojada calls the London market business, with a combined ratio of 89.3 percent, the "standout performer".

-

The Eurekahedge ILS Advisers index posted its worst December performance on record.

-

Baltic Re will provide coverage for Pool Re’s losses between £500mn and £700mn.

-

Andy Corton will join the carrier’s marine operation.

-

A highlight of last week’s packed Insider London conference came when former Catlin COO Paul Jardine was asked a question from the floor about whether he felt his erstwhile colleagues (taken to mean Stephen Catlin and Paul Brand) were “crazy” to be capital-raising for a major new (re)insurance venture in today’s market.

-

Rates softened slightly as buyers returned to the market.

-

After listening to the Markel earnings call, I feel prompted to again ask the question: is this the end for Markel Catco?

-

Reinsurers did not adequately adjust pricing to account for 2018 losses and 2017 creep, the ratings agency says.

-

The internet grocer previously warned the fire would hamper sales growth.

-

The insurer will benefit from reduced incentive expenses owed to former executives in the Bermudian firm.

-

The former majority shareholder will continue to provide services and support to the ILS fund manager.

-

Why should Leadenhall be hived off into the Mitsui’s asset management division?

-

Disclosures filed by the utility in bankruptcy court show the company paid just $26.8mn for its $200mn catastrophe bond.

-

A shift to lower volatility classes propels underwriting profit.

-

MS Amlin’s ownership of the London-based firm will now transfer to the Japanese corporation directly.

-

Few of the Bermuda and London staff at Tokio Millennium Re will be retained after the takeover.

-

A four-month fundraising round culminates in a deal with Avantis.

-

There will be a reduction in the amount of third party capital in the industry this year, O’Donnell told analysts.

-

Director Graham Coutts foresees a “flight back to quality” from cedants.

-

Conditions may be improving for some investors after wider ILS appetite has dampened, according to the broker.

-

ILS capital rose by 6 percent despite the “noise” in Q4, the broker said.

-

Swiss Re Capital Markets Europe SA will ensure trading continuity for the arm after Brexit

-

The island has seen life registrations grow amid a desire to broaden beyond non-life (re)insurance.

-

-

Pimco has hired former Mt Logan Re CEO Rick Pagnani to front its move into the space.

-

The organisation said the president and CEO of the eponymous modelling company was a “game changer” for the reinsurance industry, and a driving force behind the cat bond market.

-

The North Carolina Insurance Underwriting Association is seeking $250mn for reinsurance cover through a new cat bond, Cape Lookout Re.

-

Ramlal joined the joint venture between Chubb and BlackRock back in November.

-

This may be the year investors call pricing models for alternative capital into question.

-

The deal will flexibly expand in line with cessions from an MGA.

-

Brokers forecast an average of $9.4bn in cat bond volumes for the year.

-

The London Stock Exchanged-listed Catco Reinsurance Opportunities pledges to "keep investment management arrangements under review".

-

Arguably the defining feature of the last seven years of the reinsurance market has been the inexorable increase in the amount of ILS capital in the system, from roughly $40bn in 2012 to $90bn in H1 2018.

-

The InsurTech has built a digital marketplace for cyber risks.

-

The complaint on behalf of Markel investors follows the disclosure of regulatory probes into the accounting of loss reserves.

-

The changing dynamics of the reinsurance and ILS markets will be laid bare in forthcoming key renewal dates.

-

The reinsurance broker has pointed to several new initiatives designed to bring more capital to the market.

-

Deal volumes for the full-year 2018 hit $10.1bn.

-

CEO Julian Enoizi prepares the ILS market’s first terrorism cat bond in more than 15 years.

-

If you have to turn to me for your dose of optimism, then things have probably taken a slightly strange turn.

-

Reduced traditional reinsurance capital was partially offset by continued alternative capital growth.

-

Like UK bakery chain Greggs’ feted vegan sausage roll, Swiss Re’s European parametric water-level cover helps plug a gaping market chasm.

-

The insurer has nearly $700mn overall in sidecar support including previous transactions.

-

The Willis Re executive said 2019 could be a challenging year for some ILS managers, as some products have performed poorly.

-

Reduced ILS capacity is impacting the sidecar and retro market in particular.

-

ILS showed reinsurers the New World, but reinsurers have now learned to live in it.

-

The vehicle’s size is $5mn up on last year.

-

The ILS market is in a bit of a pickle as it heads into the New Year.

-

UPC said the coverages and terms within the quota share remain unchanged.

-

Rates in the insurance linked securities sector have increased by 10 to 20 percent in 2018's fourth quarter, according to Lane Financial.

-

A new report from the Bermuda Monetary Authority shows Bermuda financial services firms have $51.9B in alternative capital.

-

Trapped collateral after recent catastrophes could buttress pricing, the analysts say.

-

The asset manager said there was “significant opportunity” within the reinsurance and retrocession market.

-

Could 1.1 be a flat cat reinsurance renewal in the US?

-

Firm retro market in prospect ahead of 1.1 as deployable ILS capital narrows.

-

The Hong Kong-based sidecar was originally expected to generate $50mn of commitment from international investors.

-

Insurers of all sizes have been hit with claims from the record breaking Camp and Woolsey wildfires.

-

In the journey to create a new asset class, there are many staging posts that have to be passed.

-

Daljitt Barn follows recent arrival Paul Jardine onto the advisory board of the start-up.

-

The initial estimate pegs Camp at $9.8bn and Woolsey at $4bn

-

Lion Rock Re has secured commitments of $75mn from third-party investors.

-

The deal had provided the ILS manager with domestic US paper to access insurance business.

-

The insurer's stock plummeted Friday after the company announced probe into ILS funds.

-

The exit comes ahead of Lloyd’s closure of Special Purpose Arrangement 6129.

-

Just how important is Markel Catco to the catastrophe reinsurance market?

-

News of a steep decline in Catco Reinsurance Opportunities’ net asset value comes after the fund manager’s parent confirmed regulatory investigations.

-

The investigation is looking into accounting for loss reserves for 2017 and 2018.

-

Jo Kendall joins from Willis Re, where she led the London specialty cat modelling team.

-

The $15bn-$20bn wildfire losses have caused the ILS-dominated retro market to seize up.

-

Mt Logan will not be the only reinsurer vehicle impacted by Stone Ridge’s retractions, but has emerged as the first such example.

-

The Californian earthquake bond priced at the upper end of guidance.

-

A lot has changed since InsurTech first barged into the collective (re)insurance vocabulary back in the heady days of 2016.

-

The French parent lifts its synergies target from the XL purchase by $100mn.

-

Secondary market pricing indications show that investors are expecting another $227mn of losses

-

Grace Hanson will join the company as his successor.

-

The storms will reduce the net asset value of securities in the Catco Reinsurance Opportunities Fund by as much as 9.8 percent.

-

This ain’t nothing like a hard market, but that is very much a good thing for everyone.

-

Aggregate loss activity will trap retro capital for a second year running, as disappointing returns set up expectations for reduced capacity.

-

The California State Compensation Insurance Fund returned to the cat bond market as USAA’s ResRe multi-peril deal raised $200mn.

-

In London last week, I heard Lloyd’s chairman Bruce Carnegie-Brown give a talk detailing some of the challenges facing the Lime Street market – a particularly pertinent topic given the trials and tribulations experienced by some syndicates in recent months in getting their 2019 business plans signed off.

-

Move is a sign of Axa XL’s commitment to the ILS space.

-

The deficit marks an improvement on the prior-year period net loss of $179mn.

-

The new offering will work alongside its existing ILS operations.

-

This appointment is one of three new moves at the business.

-

The initial estimate suggests an ultimate outcome broadly in line with market expectations.

-

The ILS manager will continue to operate largely independently following the completion of the deal.

-

Irma and Florence impacted Florida insurers’ Q3 earnings as disparity emerged around Michael losses.

-

Following new investment, Akinova has brought in the experienced Paul Jardine.

-

The possibility of a relationship between the two events puts the utility’s $200mn wildfire cat bond under the spotlight.

-

The UK-based sidecar writes a quota share of the carrier’s treaty and D&F books.

-

It is understood the Florida insurer clawed back $10mn of capital that had previously been freed.

-

The company said losses from Hurricane Michael will be larger

-

The Scor executive called on regulators to trim capital requirements.

-

I remember having a conversation with a (re)insurance executive when they had hired a team to enter a horribly priced line of business.

-

Before Florence and Michael, rate reductions had looked set to resume.

-

The executive was responsible for a ceded reinsurance portfolio of more than $4bn

-

The all-cash purchase price fell slightly below initial expectations of a $1bn-plus valuation for the Bermudian manager.

-

The London-based asset manager has raised more than $600mn for life ILS strategies since July.

-

The Bermudian firm’s management team is praised for its ‘excellent job’ in growing its AuM.

-

The commercial pool will bring together traditional and ILS capacity, it was announced.

-

The ILS fund manager had received approval to operate the SPA next year, though the Corporation rejected an application to convert the vehicle into a full syndicate.

-

Former Marsh broker Richard Green becomes regional head.

-

The figure has crept by 6 percent since June.

-

Climate change is climbing up the (re)insurance agenda.

-

This is the third time Arch has sought cover for its mortgage book via an ILS deal in 2018.

-

The resort town of Mazatlan is among the areas under threat.

-

Reinsurers now have fresh impetus to argue for flat renewals at 1 January.

-

Jebi is said to have hit third layers of some occurrence covers while Trami has eaten through back-up protections.

-

Reinsurers must be prepared for how much work is required to be an asset manager, said the Hiscox Re & ILS COO.

-

The over-estimation of losses by modellers led the ILS market to raise capital amid anticipation of higher rates.

-

The London-based ILS manager still needs to find a managing agent to sponsor the sidecar syndicate for 2019.

-

Aurous Risk Partners will work to match risk to various forms of capacity, including alternative capital via fronting carriers.

-

Liz Breeze replaces Yuval Abraham and will be based in Bermuda.

-

More involvement on co-investment and co-participation will be key for reinsurers in the future, says AXA XL’s Daniel Brookman.

-

The relatively sparsely populated location of Hurricane Michael’s landfall suppresses demand for top-up cover.

-

The Allianz unit carves out a specialist ILS business to be led by Richard Boyd, who is now CUO of the alternative risk transfer business.

-

Cedants seeking to recall collateral that had been released and commuted are demonstrating “unrealistic” behaviour, Horseshoe Group CEO Andre Perez said.

-

Amundi Pioneer has allocated at least $15mn to the new issuance across several of its funds.

-

The storm is on track to hit the northern tip of Japan's Honshu island and the south of Hokkaido island.

-

The just-launched platform will connect holders of long-tail insurance risks with investment funds.

-

About $24.8bn of ILS outstanding emanated from the North Atlantic island as of March, according to the Bermuda Monetary Authority.

-

Some contracts may also require the reinsurer to re-capitalise any shortfall in anticipated claims.

-

The combined Markel-Nephila entity will manage almost $30bn of capital.

-

The US will be the MGA’s expansion focal point, with two teams likely to be added annually.

-

The industry’s ranks are being thinned by inexorable forces of change, Arch CEO says.

-

Andrew Dolphin will remain in London and report to Hiscox Re & ILS CEO Mike Krefta.

-

The ILS manager’s estimate included around $2.1bn of wind damage claims.

-

The outgoing CFO says the Corporation is winning a clampdown on the use of letters of credit as he delays his exit from the Corporation.

-

Nothing is ever as short-tail as it seems.

-

The XL president said it was imperative that the market condenses the value chain and brings capital closer to risk.

-

Allianz's interest in a deal with Nephila may fuel speculation that major insurers will start to acquire ILS managers.

-

The Swiss Re CEO refutes the suggestion that financial-sector newcomers can deploy capital more efficiently than traditional reinsurers.

-

Reinsurers chasing ILS capital may find it difficult to get buy-in from third-party capital for a “me too” strategy, but there are still opportunities out there.

-

The executive was one of Bermuda ILS manager's first employees.

-

Limited loss development from HIM hurricanes has dampened rate hikes, the broker said.

-

The Aon Reinsurance Solutions CEO commented on recent deals that saw carriers broaden their product offering and skill set.

-

A quest for scale, diversification and tax changes add fuel to the M&A fire.

-

Ten years ago, I walked into The Insurance Insider office for the first time, flagrantly breaking the first commandment of insurance journalism: never start a new job the week before Monte Carlo.

-

The issue would be the ILS market’s first terrorism cat bond since the 2003 Golden Goal transaction.

-

Buyers say lower prices will help them purchase more reinsurance cover next year.

-

Cat bond expansion drives the growth.

-

The executive was previously an actuarial analyst at the broker.

-

RMS’ Paul Wilson and former MS Amlin executive Adam Tidball have joined the firm.

-

With Markel as its new parent, the fund manager can diversify further away from its traditional mainstay of property cat reinsurance.

-

The business has continued to diversify into fee-driven firms through M&A.

-

Several independent managers remain but ILS entrepreneurs have already largely cashed out.

-

Citrus cat bond losses are now expected to total $324mn

-

Dual’s planned syndicate start-up and Beat Capital’s acquisition of Syndicate 4242 point to a Lloyd’s future where the underwriting is distanced from the capital it serves.

-

The deal, which will give Markel a 20 percent share of the ILS market, could be the industry's first true convergence play.

-

The ILS manager will continue to use Allianz as a fronting partner after ownership change.

-

Markel will gain a dominant ILS position and an enhanced business profile, AM Best said, while Moody's noted strategic benefits and enlarged asset base.

-

The sale will accelerate the fund manager's expansion into the primary insurance markets.

-

The hire reflects Brit's effort to build out its third-party capabilities and follows the January launch of Sussex Capital.

-

The organisation is set to replace the $250mn Ursa Re 2015-1 Class B notes which will expire in September.

-

The executive joined the Hiscox Re and ILS team as a Bermuda-based underwriter in 2012.

-

The creator of alternative reinsurance securities aims to raise up to $20mn as it expands.

-

Elementum, Fermat and Credit Suisse make their debut on the cover at the state-backed catastrophe fund.

-

For the first time in six years, cat bond pricing in relation to assumed risk has started to increase, an S&P report showed.

-

The ILS manager said it had extracted a 43 percent rate increase from buyers of the retro product and expected rates to hold stable in 2019.

-

A shift in legislation would reduce the current US-listed companies' reporting requirements.

-

The Cal Phoenix Re cat bond was the first cat bond to cover wildfire on a standalone peril, as well as the first third-party liability issuance.

-

The intermediary noted that it was the third-highest sum for a second quarter.

-

As the industry looks to shorten the value chain, could MGAs benefit from lower-cost capital providers?

-

Everest Re sidecar Mt Logan Re has reached $1.1bn of assets under management.

-

The UK-based insurer now sources 9 percent of its £300mn aggregate reinsurance from the collateralised market.

-

The proceeds will be used in part to repurchase up to 1 million Class A shares.

-

The Federal Emergency Management Agency engaged Hannover Re for the 3-year issue.

-

Other similar types of platform in the Bermudian (re)insurer’s portfolio have also grown.

-

The reshuffle follows the resignation of CUO and active underwriter Nicky Payne from the Credit Suisse-backed ILS syndicate.

-

Former CEO Rick Welsh has left the company as it prepares for a rebrand.

-

Paper providers are demanding greater transparency from MGAs as the need to streamline costs puts renewed pressure on the distribution model.

-

Nephila helped the top 10 ILS managers expand their asset bases to $67bn in H1 2018.

-

Watson spent three years at Markel Catco, having joined the company in 2015.

-

The nationwide giant cited pricing as a reason for the shift.

-

Barbican Managing Agency underwriting director David Booth steps into the role on an interim basis.

-

Richard Slater joins from XL Catlin as underwriting director, while Adam Champion leaves MS Amlin to take the role of senior vice president, portfolio manager and operations.

-

Completion of the first major deal under CEO Duperreault hands the buyer businesses including Validus Re, ILS manager AlphaCat and Lloyd’s platform Talbot.

-

Cal Phoenix Re has an initial target size of $200mn.

-

Even with the most in-depth data, those attempting to estimate the insured or economic loss from a major hurricane are always bound to be off by some degree, especially when it comes to complex events such as hurricanes hitting densely populated areas.

-

The target size is said to be $200mn with Tokio Millennium as fronting reinsurer.

-

Reinsurers may hold less risk in the long term as they look to cut costs and originate risk for other investors, Nephila co-founder Greg Hagood forecast.

-

The Brazilian investment bank has acquired start-up ILS manager Lutece Investment Management after seeding its funds.

-

The insurer increases coverage by 41 percent to $445mn with ‘mid-single digit’ rate cuts.

-

The former specialy lines head left the French reinsurer earlier this year, as sister publication Trading Risk revealed.

-

Pricing has dropped by 6 percent on the single-tranche Northshore Re II 2018-1 transaction.

-

ILS participation may well be approaching saturation point in the catastrophe market.

-

The Esser-backed broker ventures into workplace dispute risk

-

Division will focus on MGAs and programs as well as InsurTech and alternative risks.

-

Sources said that Evercore has been retained to advise Nephila management, who holds the majority of the business.

-

The Bermuda-based firm had $500mn of ILS under management in 2017.

-

The latest issuance includes European windstorm, as well as US wind and quake.

-

The total for the year stands at $798.56mn.

-

The financial services company may look to gain a credit rating for the Bermuda-based vehicle.

-

The residual carrier obtained rates that came in better than anticipated.

-

The alliance with the insurer comes a month after the carrier closed its Lloyd's India branch.

-

The move could be a bid to emulate the success of the reinsurance funds run by rival mutual fund managers Stone Ridge and Pioneer.

-

Many cat bonds were pricing below their guidance range earlier in the second quarter.

-

The increase reflects the assignment-of-benefits crisis in the southern part of the state.

-

The reinsurer had originally been expected to hold an IPO late last year.

-

The carrier is working with brokers and members' agents to source the additional capital.

-

The giant marine reinsurance mutual picks its brokers after a lengthy tender.

-

The cat loss modeller says 20,000 residential buildings were damaged.

-

The reinsurer has raised $530.5mn of Sector Re debt since December.

-

Only two Florida-specific bonds hit the market in the period.

-

The insurance industry veteran was recognised for his services to the government and the economy.

-

ILS and Lloyd's syndicates are understood to be on risk for the Lottoland loss.

-

Hail, strong winds and flash floods blamed for losses across central and eastern US.

-

Anna Sweeney of the Prudential Regulation Authority has warned that firms “may be taking false comfort” from losses that turned out to be largely manageable.

-

Reinsurance sector capital is set to reach record levels by 1 July this year.

-

Brent Slade will join the new operation from Horseshoe Group.

-

The reinsurance group will no longer offer investors actively managed vehcles.

-

The former Goldman Sachs executive will report to Guy Carpenter vice chairman David Priebe.

-

Socium Re will reinsure a share of Fidelis' excess of loss portfolio.

-

The Lloyd's broker hires a director of specialty from data specialist Geospatial to support the initiative.

-

The 1.6 renewals have further highlighted the inelasticity of cat reinsurance pricing.

-

Founder of Everest unit will spend months in transition working with now president Whiting.

-

The transaction provides cover for named storms and severe thunderstorms in Texas on an indemnity, annual aggregate basis.

-

The vehicle has already completed a $100mn issuance that was listed on the Bermuda Stock Exchange in February

-

The new ILS manager is using a fund-of-funds approach to target institutional investors.

-

The two vehicles will provide cover for named US storms and earthquakes as well as European windstorms.

-

The state reinsurer is considering lowering the attachment point on its programme.

-

The mega-trend towards passive investing has been powerful and pervasive.

-

The promotion follows the departure of segment head Peter Mullen last month.

-

Over the past five years, vehicles that outsource underwriting to other companies have formed one of the fastest-growing segments of the ILS market, from a standing start.

-

The retro writer said its 2017 portfolio loss would rise to 41 percent of net asset value.

-

Given how much of its asset base was locked up if not lost, the fact that it pulled off the feat of bringing in more than $2.3bn to enable it to renew its portfolio for 2018 was impressive.

-

Sompo International CFO Mike McGuire has pledged support for the firm's asset management platform.

-

Shareholders to vote on run-off resolution for London-listed fund.

-

State-backed carrier is authorised to spend up to $92mn to acquire catastrophe coverage.

-

The US insurer has returned to the cat bond market to renew a $300mn cover.

-

Final pricing on the $450mn Caelus Re comes in at the low end of a revised target range.

-

The retro manager’s 2017 losses have jumped to more than 41 percent of net asset value from a previously predicted 28 percent.

-

Prices at 1.6 look likely to remain depressed by competition.

-

Willis Re deputy chairman Mark Hvidsten will manage ILS chief Bill Dubinsky after the reshuffle.

-

The reinsurer is the latest in a stream of first-time users of the cat bond market.

-

The Lloyd's insurer launched its UK-based sidecar NCM Re with $72mn of capital in January.

-

While the exposures are vast, silent cyber could bring new premium to the $4bn cyber market.

-

A 41.5 point increase in the combined ratio was driven by losses from Hurricane Irma.

-

The operation would allow the fund manager to maintain access to the market after its joint venture with Axis ends.

-

The broker believes traditional reinsurance pricing will be on "life support" as ILS capacity remains abundant.

-

New cat bond issuances from Everest Re and Aspen Bermuda expanded by at least 50 percent over the course of marketing, as investor appetite remained strong.

-

Underlying profitability at global reinsurers has deteriorated by more than 5 points on the combined ratio since 2005.

-

Trapped ILS capital may turn out to be lost capital as claims from last year develop, according to QBE Re chief underwriting officer Jonathan Parry.

-

Aon Securities CEO Paul Schultz has said the ILS market may receive a boost from increased M&A activity due to an uptick in reinsurance buying.

-

Cat bond launches are showing no sign of slowing down, with a further three deals with an initial combined size of $675mn being launched in the past week.

-

While 2017 was a challenging year for the ILS market, it may not have been the year of "the great test", according to Leadenhall CEO Luca Albertini.

-

Vegard Nilsen has been named CEO of London-based ILS manager Securis Investment Partners amid a restructuring as firm co-founder Rob Procter gave up the job to focus on his role as chief investment officer .

-

Global reinsurance capital continued to rise in 2017 as alternative capital funds reloaded, according to Aon Benfield.

-

Arch Capital’s mortgage insurance unit has closed another reinsurance deal with Bellemeade Re, the reinsurance structure it acquired from AIG with United Guaranty at the start of last year.

-

Axis has given notice on the Securis SPA, The Insurance Insider has learned.

-

Tumbling cat bond prices continue to exert pressure on the wider reinsurance market and are likely to curb rate increases at the upcoming Florida renewal.

-

USAA has launched the $175mn Residential Re 2018-1 cat bond, which will provide US multi-peril cover, sister publication Trading Risk reported.

-

PCS has increased its loss number for Hurricane Harvey to $17.1bn from $15.7bn, according to Trading Risk sources.

-

Securis-backed Special Purpose Arrangement (SPA) 6129 made a loss of £31.4mn ($44.2mn) in 2017 following the year's major catastrophe losses, as its combined ratio spiked to 180.4 percent.

-

Aspen Bermuda has returned to the cat bond market for the first time since the 2008 financial crisis, as it seeks to raise $150mn to cover US and European catastrophe risk, sister publication Trading Risk has reported.

-

The Prudential Regulation Authority (PRA) has hired an insurance-linked securities specialist from interdealer broker Tullett Prebon to work in the fledgling UK sector, sister publication Trading Risk reported

-

Liberty Syndicate 4472 fell to a $118.7mn loss last year amid a high volume of major losses from three major North Atlantic hurricanes, California wildfires and the Adnoc refinery explosion.

-

The US Federal Emergency Management Agency plans to turn to the insurance-linked securities market to bolster its flood cover through a July placement.

-

Markel Catco's London-listed Reinsurance Opportunities Fund reported only a 0.35 percent gain to net asset value in February for its ordinary shareholders exposed to last year's catastrophe losses.

-

The Incubex venture of former Brit CEO Neil Eckert is aiming to raise up to $5mn of additional equity, as it looks at trading opportunities in the reinsurance markets.

-

The Lloyd's syndicates of insurance-linked securities managers all made a loss in 2017 in the wakes of hurricanes Harvey, Irma and Maria.

-

Enstar and Stone Point have drafted in Evercore for advice after they received takeover approaches for live businesses StarStone and Atrium, The Insurance Insider can reveal.

-

Personal lines and small business insurance broker Goosehead Insurance plans to raise $100mn through an initial public offering, according to a regulatory filing.

-

The insurance-linked securities market has expressed "strong interest" in insuring the Lloyd's Central Fund, according to Lloyd's chief financial officer John Parry.

-

Lloyd's is looking at bringing in ILS capital next year to back the Corporation's Central Fund, following the introduction of the UK's new ILS framework.

-

Weather-related catastrophe exposures and potential claims on liability policies stemming from climate change pose significant risks to P&C (re)insurers, according to Moody's Investors Service.

-

Several Floridian insurers are looking to lower their reliance on the state-backed reinsurance fund in 2018, bringing a small amount of new demand into the market, sister publication Trading Risk reported.

-

Retro writer Markel Catco said that 2017 returns for its London-listed fund could drop by a further 8 percent if industry loss estimates for last year's hurricanes and wildfires increase by 20 percent.

-

Retro writer Markel Catco said that 2017 returns for its London-listed fund could drop by a further 8 percent if industry loss estimates for last year's hurricanes and wildfires increase by 20 percent.

-

Trade credit insurer Atradius has reported profits after tax of EUR186.2mn ($229.6mn) for 2017, down by 12.1 percent on the previous year.

-

Hiscox Re has launched the first ever cyber industry loss warranty in a bid to address the uncertainty around cyber tail risk.

-

Florida homeowners' carrier Anchor Insurance Holdings has bolstered the surplus of its operating subsidiaries, raising at least $17.14mn in the last four months, The Insurance Insider can reveal.

-

Word out of the Association of Insurance and Financial Analysts (AIFA) conference in Naples, Florida, last week was that there was an "undercurrent of ebullience", as one analyst dispatch put it, because of the full valuation XL Group attracted from acquirer Axa.

-

Markel Catco's London-listed Reinsurance Opportunities Fund had to put two-thirds of its year-end 2017 asset base into side pockets, much higher than the typical 5-15 percent that it puts on hold each year, sister publication Trading Risk reported.

-

The Florida Hurricane Catastrophe Fund said its losses from Hurricane Irma were expected to reach $2.04bn, less than half its previous estimate of $5bn.

-

Simon Arnott has joined insurance-linked securities manager Securis Investment Partners as head of origination for Bermuda and the US, based in Bermuda, sources told sister title Trading Risk.

-

Simon Arnott has joined insurance-linked securities manager Securis Investment Partners as head of origination for Bermuda and the US, based in Bermuda, sources told sister title Trading Risk.

-

UK terrorism reinsurer Pool Re is considering tapping the newly minted UK insurance-linked securities market through an issuance worth at least $100mn, sister publication Trading Risk reported.

-

P&C insurer Assurant has launched the sale of $250mn of convertible preferred stock to help finance its $1.9bn acquisition of The Warranty Group.

-

InsurTech start-up Extraordinary Re has signed a deal with exchange operator Nasdaq to use its technology to run a new insurance-linked securities (ILS) trading platform.

-

InsurTech start-up Extraordinary Re has signed a deal with exchange operator Nasdaq to use its technology to run a new insurance-linked securities trading platform.

-

Leadenhall Capital Partners has confirmed the launch of a new fund at the January renewals which covers remote risk, sister publication Trading Risk has reported.

-

On Monday Axa surprised markets with a $15.3bn deal to purchase Bermudian (re)insurer XL, with the $57.60 a share offer representing a 33 percent premium to the target's closing share price on 2 March.