-

The appointments are aimed at offering a clearer team structure.

-

Property pricing fell by 8%, while casualty rate increases tapered to 3%.

-

The protection covers the US insurance book for the 2024 and prior accident years.

-

Property, cyber and workers’ comp rates were all down mid-single digits, offsetting casualty hardening.

-

Brian Church has spent 20 years at Chubb.

-

In July, he took the role on interim basis from Laure Forgeron.

-

West Hill Capital is the main investor in the capital raise.

-

She previously served as Hub’s North American casualty practice leader.

-

Tom Potter was global casualty underwriting manager for UK & Lloyd’s at Axa XL.

-

He will spearhead the division’s launch slated for 2026, which will be the first product launch for ICW Group’s specialty unit.

-

The executive met with UK colleagues to discuss plans for the US business.

-

The combined casualty treaty team has also made a number of hires.

-

There will also be a renewed focus on organic growth, both in P&C and across US and international operations.

-

Her predecessor will become head of US excess casualty and operations.

-

Plaintiffs allege that manufacturers and retailers have broken environmental laws.

-

The Berkshire subsidiary is seeking coverage for a $22mn antitrust loss.

-

The affirmations reflect Everest’s strong underwriting diversification.

-

He was appointed CUO of casualty, Americas, in July last year.

-

The platform aims to “bend the loss curve”.

-

The executive most recently served as head of North American treaty reinsurance.

-

Signs of discipline indicate a “break” from past boom/bust market cycles.

-

After spending 20 years at Aon, Goodman will start a senior executive position with Guy Carpenter.

-

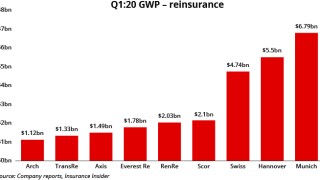

Top line grew across all carriers even as pre-tax profits dipped.

-

He joins from MS Amlin, where he was lead underwriter for US casualty.

-

The reinsurer chair said the frequency of losses today “will prevent prices from slipping too much.

-

The Swiss carrier improved its P&C combined ratio by 1.2 points to 92.4%.

-

Emerging lawsuits and expanding loss triggers are giving rise to potential claims under a range of policies.

-

The newly created role consolidates leadership across UK entities.

-

The Canadian insurer saw property rates dip across its global divisions.

-

The executive was previously head of excess casualty, North America.

-

Specialty casualty now accounts for around 22.2% of its insurance business mix.

-

Scor's CEO said the P&C market had experienced a “competitive” first half.

-

The P&C segment posted an 82.5% combined ratio for the quarter.

-

The broker has noted that double-digit reductions are increasingly available in property.

-

The legacy player is working to secure its first deal, and could look to expand to US E&S.

-

Wind season remains an important variable, but also might not change current dynamics significantly.

-

Group CEO Tavaziva Madzinga said it might explore Lloyd’s Names backing in the future.

-

Property rates declined by 7% globally in the second quarter.

-

The property segment reported a CoR of 27.4% for the quarter, down 26.5 points year on year.

-

The carrier reported preliminary profits of EUR2.1bn, driven by “very low” major-loss expenditure in P&C re.

-

Laure Forgeron has worked at the Swiss carrier since 2009 in numerous senior positions.

-

Peter Cordell will join Syndicate 1729 in January.

-

Dual’s Luke Browne will join Consilium Risk Solutions.

-

Last year, the firm obtained a Class 4 license in Bermuda.

-

The executive previously held roles at Capgemini, The Hartford and AIG.

-

The international casualty director has worked at Axa XL, Ive and Ardonagh.

-

The LA wildfires accounted for 59% of loss activity over Q1.

-

Niala Butt joins from CNA Hardy, where she was casualty claims manager.

-

Although US pricing is improving there is pressure in other geographies.

-

Some segments are moving faster than anticipated, but overall, it remains a mixed bag.

-

The executive brings nearly 30 years of liability experience to the role.

-

Jim Meakins is the latest in a slew of talent to exit from the syndicate.

-

The executive replaces Mike Warwicker, who left the firm earlier this year.

-

Sam Wylie has been appointed portfolio manager.

-

This will allow Ark to write business on surplus line paper and Lloyd’s business.

-

The underwriter joined Catlin in 2006.

-

The underwriter was part of Probitas’ founding team.

-

Both Chubb and Zurich will underwrite the risks, with Nico as the sleeping partner.

-

The facility provides up to $100mn in claims-made excess casualty coverage.

-

The remediation process is on track for completion in the fourth quarter.

-

The CUO described the pricing dynamics in the line as “strong and good”.

-

Co-founder and CUO Jacqui Ferrier has been appointed his successor.

-

In a post on LinkedIn, Steve Arora said investor appetite “just wasn’t there”.

-

The Kelso and Arch-backed run-off player has retained Evercore to advise.

-

Delaney has spent the last 14 years at TMK.

-

London-based US excess casualty writers are increasingly looking to attach lower in the tower.

-

He will oversee Ascot’s US and Bermuda insurance and reinsurance companies.

-

Despite wildfires, reinsurers are “well positioned to maintain strong profitability in 2025”.

-

Chris Jones, Will Shepherd-Barron and David Clark will join the start-up.

-

CEO Rinku Patel said the move marked a “clear step change” in Pine Walk’s MGA strategy.

-

Instead, the reinsurer plans to write more casualty business through its innovations book.

-

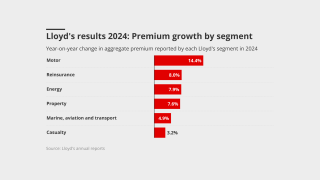

Reinsurance and property remained the primary drivers of premium growth.

-

The Italian carrier posted a record group profit of EUR7.3bn.

-

For the prior-year quarter, the carrier reported a EUR9mn loss.

-

In the absence of interim action, the segment could face an “availability crisis”.

-

Genna Biddell will report to Brad Melvin, president and CEO, BMS Re US.

-

Newer swing products offer an alternative way to deal with escalating awards.

-

The underwriter has worked at Axis for a decade.

-

The Pacific region led the quarter’s price decline at -8%.

-

The event now includes a casualty portion and has officially been re-branded as the Property and Casualty Symposium.

-

The MGA and 49% owner SiriusPoint could bring in a new investor.

-

Claims related to California wildfires are "fairly insubstantial" to date, executives said.

-

CEO Jim Williamson said social inflation was a “growing barrier” to a vibrant economy.

-

The (re)insurer recorded a reserve charge of nearly $1.3bn within its casualty insurance book.

-

Robin Hamilton has been appointed head of energy and marine liability.

-

The carrier tapped the run-off market in Q4 for a US casualty insurance-focused portfolio.

-

Supply generally exceeded demand and trading relationships were ‘strong’, CEO Tom Wakefield said.

-

Reinsurer appetite largely outweighed demand at 1 January.

-

It is understood that Lectio is now at ~$160mn of premium and could rise to $270mn next year.

-

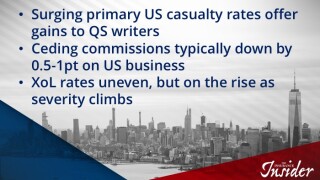

Ceding commissions remain elevated, but primary rates are improving reinsurer margins.

-

Growth vs discipline, smart follow and M&A mean 2025 will be a mixed bag for London.

-

Hannover Re’s CEO said the market had been disciplined.

-

The reinsurer’s large losses tallied up to EUR1.3bn for the nine-month period to 30 September.

-

The broker said the casualty segment is approaching an “inflexion point”.

-

The investor has paid in an extra £12.5mn for an additional 5% holding.

-

Aon executive Daniele de Bosini said reinforced infrastructure had mitigated the impact of recent disaster events.

-

Craig Miller most recently held the role of UK commercial director at Dual Oliva.

-

Sweeney was most recently VP at Vantage Risk, as part of a team responsible for the US financial lines business.

-

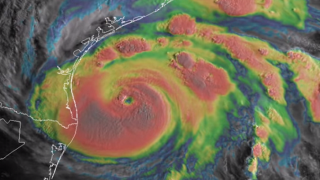

The magnitude of the hurricane may impact reinsurers’ capacity deployment.

-

Third-party litigation funding has been linked to rising casualty insurance prices.

-

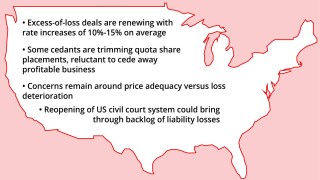

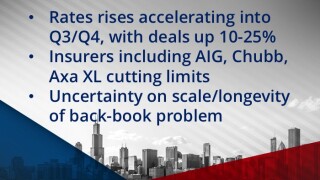

Reinsurers will likely push for double-digit US premium rate increases.

-

A roundup of the breaking news, C-suite interviews and exclusive insights.

-

The company is currently “underweight” in that line of business, he added.

-

CEO Thierry Léger claims the “insurability” of global risk is becoming “challenged”.

-

The reinsurer constructed a “social inflation index” for a new study.

-

Scor is also limiting its exposure in political risk and cyber.

-

The transaction complements its previous acquisition of RMS in 2021.

-

-

The property market remains “one of the most favourable... I've seen in my career", he said.

-

The mean nuclear verdict for 2013-2022 was $89mn, versus $76mn in 2010-2019.

-

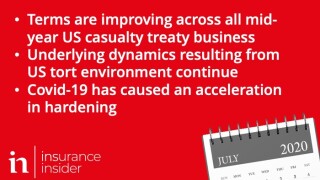

Fears around social inflation have maintained upwards pressure on US liability reinsurance pricing.

-

The broker noted a shift towards alternative risk solutions in the MENA region.

-

Recent contingency losses reflect a willingness of the market to go looking for premiums.

-

Jessica Cullen is relocating to London from New York to take up the new role.

-

The Lloyd’s chief of markets said he was generally comfortable with market fundamentals.

-

Verdicts awarding more than $100mn hit a new high of 27 last year, study finds.

-

Joy had previously set up the casualty practice at Global Indemnity.

-

Based in New York, the executive will report to global head of casualty Josh Everdell.

-

A minority view gaining currency is that 2016-19 will not be the only problem.

-

The Bermudian’s reserves will be on watch when its Japanese parent reports earnings.

-

The broker’s report also hailed the best risk-adjusted margins for ILS investors in a decade.

-

Property cat and casualty pricing remain steady following chaotic 2023 renewal, with global cat rates rising 3%.

-

As risks continue to become more interconnected, (re)insurers face increased pressure to manage aggregation.

-

Social inflation continues to prove challenging in the casualty space and is rebounding post-Covid.

-

With US third-quarter reporting season being well underway, the results so far highlight further runway for the hard property E&S market.

-

Reinsurers are also determined to secure structural changes and payback from Italian, Slovenian and Turkish cedants at 1 January 2024.

-

With new leadership at some of the largest continentals, there will be close attention to how their tactics in changing lines of business will evolve.

-

AI development is creating new risks for insurers to assess as multiple key trends suggest it will evolve into a standalone insurance product like cyber-risk.

-

He joins from Hoerbiger Holding, where he was head of corporate risk and insurance management.

-

The Corporation used its latest market message to call out what it saw as an “underwhelming” approach from specialty insurers to changing conditions and “moronic” D&O underwriting.

-

The French reinsurer said continued price increases, particularly on cat and US casualty, remain necessary.

-

The company’s Monday statement is the latest development in a debacle that could potentially lead to a major loss event for the utility company’s casualty insurers.

-

Dave Cahill and Adam Power have resigned, as Miller managed to shore up remaining members of its casualty team.

-

The company’s targeted Vescor cat bond would have provided collateral to meet auto and other obligations, but there were multiple structural points of risk for investors.

-

If you only read a handful of articles this week, make it the selection below.

-

Despite reinsurers’ concerns over social inflation and loss trends, capacity remains abundant in both quota share and XoL deals, sources say.

-

The underwriter has worked at various Axa entities for 13 years, holding a string of increasingly senior positions.

-

While panelists agreed that tort reform is needed, they also noted that it couldn’t be achieved by force from the insurance industry alone.

-

DLG’s outlook has been downgraded to ‘negative’ following a 24% tumble in share price since last week, as severe weather and investment-portfolio pressure tank profitability.

-

Inflation will define priorities such as a focus on safeguarding clauses and pricing transparency, as well as line of business challenges, for underwriters and actuaries in the year ahead.

-

The MGA writes management liability, professional indemnity, crime and cyber risk.

-

The new lead underwriter has almost 30 years’ experience including stints at Chubb, Faraday and Howden.

-

The reinsurer added $280mn in casualty pro rata premium in Q4, a 60% jump, while growing casualty XoL writings by 37%, or about $84mn in new premium.

-

The carrier continues to write the class from other global hubs.

-

Kevin O’Donnell also said 1.5-point rises in ceding commissions for long-tail line treaties were an “acceptable” increase in acquisition costs, given improved underlying profitability.

-

The new division is structured into three business units: a chief underwriting office led by Rasmus Nygård, business transformation led by Jörg Hipp and global MidCorp, headed up by Ole Ohlmeyer.

-

The SPA was launched in 2019 and generated a combined ratio of 88.8% last year.

-

Ress will lead Axa XL’s underwriting strategy for general liability, motor and environmental insurance in Europe and the APAC region.

-

Australian insurers are now pursuing a second test case for further clarity on BI policy wording.

-

The newly acquired carrier has confirmed a payout of £80mn for UK Covid-19 claims so far.

-

The carrier will mobilise 3,000 general agents plus distribution partners to make offers on an “unprecedented scale”.

-

The underwriting executive will oversee lines including cyber, D&O and casualty.

-

Reinsurers are clamouring for proportional business, while maintaining excess-of-loss rate rises at 1 January levels.

-

Ascot Group named Matthew Lillegard to its newly created post of group chief actuary on Wednesday, the latest in a flurry of hires.

-

Mathias Neumann was chief underwriter of casualty and specialty at the Japanese company.

-

Insiders Mark Appleton and Thomas Stamm take new roles as the carrier expands management of the line beyond Hanover.

-

The CFO said that commercial lines business was improving faster than retail, reversing previous trends.

-

The hire reflects Ascot’s push to build capabilities on the island.

-

Ben Wallace will lead the team as the syndicate continues to expand in the casualty space.

-

The start-up adds Angus Hampton as head of international casualty and reports a quota-share focus during the renewals.

-

The broker previously held positions at Guy Carpenter, JLT Re and HSBC Insurance Brokers.

-

The insurer is also said to have scaled back its cession percentage to between 25%-30%, with final signings still being determined.

-

Ceding commissions are not falling as reinsurers look to capitalise on insurers' re-underwriting.

-

Brokers are navigating a market where new capacity from underwriters who have waited out the soft market may help dampen price rises.

-

The ruling will follow a final, uncontested court hearing on Wednesday.

-

The insurer was ordered to pay out for policies by the Western Cape High Court earlier this week.

-

The reinsurance CEO says Swiss Re will cut back its US casualty share.

-

Liability account move is latest development in ongoing reinsurance buying overhaul.

-

The Allianz unit says the experience of the Sars epidemic suggests general liability claims are likely to remain benign.

-

Since Covid-19 began to spread in areas with high insurance penetration, the situation has been in constant evolution.

-

The executive’s departure from the Willis Towers Watson merger partner follows that of other casualty reinsurance colleagues.

-

The changes are part of the carrier’s move to a more regional operating model.

-

The transaction covers casualty reserves for the 2009 to 2017 years of account.

-

The deal covers subject premium of around $2bn and will run for 18 months.

-

His anticipated move to Guy Carpenter follows that of Francis Paszylk to TigerRisk.

-

The appointments follow an expansion in the carrier’s European casualty offering earlier in the year.

-

The Accredited program partner has plans to expand into new lines of business.

-

The executive joined the company last year from Swiss Re and has also worked at AIG and Willis.

-

Meanwhile, US GL underwriters fear the impact of Covid-19 litigation.

-

Project is in its early stages, with a round of meetings held to stress test it with PE firms.

-

The insider replaces Detlef Offenhau, who has recently retired from the role.

-

A $49mn marine liability policy held by supply ship operator Rodi Marine is expected to be one of the first in the market to receive a Covid-19-related claim.

-

Insurance lawyers are anticipating a massive surge in PTSD-related claims in the aftermath of the Covid-19 outbreak, amid a wider uptick in liability claims triggered by the pandemic.

-

Insurers for BW Offshore’s Sendje Berge FPSO may have dodged a bullet following a pirate attack on the vessel, but the ordeal may only be beginning for the nine crew members kidnapped in the raid.

-

It will have a maximum line of over $20mn and allow members to adjust lines on a risk-by-risk basis.

-

He replaces Chris Mauduit, who has retired after leading the team for the previous five years.

-

The veteran broker will help diversify the firm’s product offering.

-

The new hire comes amid fierce competition for talent in the broking space.

-

Reinsurers demand exclusions and rate rises in all classes amid pandemic uncertainty.

-

The equity research firm names Beazley as most exposed to the price growth within casualty because of its US hospitals business.

-

Concerns over crew liability claims have led carriers to change wordings and tighten underwriting criteria.

-

At least 20 states in the US have so far moved to limit the liability of care home operators.

-

Aviation and marine experts Dominic Toogood and Gary Moore join the firm from Prospect Insurance Brokers.

-

Florian Beerli, Angela Ives, Jae Park and Alex Marti join the carrier from Chubb.

-

The Chubb CEO calls on Congress to shield corporate America from Covid-19-related litigation as the US begins to re-open.

-

The carrier is looking to grow its business share in the international liability market.

-

The executive was head of casualty for North America and London for Axis Reinsurance.

-

An increase in the severity of securities class actions has seen D&O insurers present a united front against rising litigation, but divisions between carriers remain, writes John Hewitt Jones.

-

Active underwriter says pricing, retro conditions and casualty crisis will play out in MAP 2791’s favour.

-

Carriers are retracting quotes as they balk at taking on further risk amid the Covid-19 pandemic, according to market sources.

-

Remedial actions start to bear fruit in primary property.

-

The analyst predicted that rate hardening will continue, albeit with reduced premium levels.

-

Jonah Pfeffer was previously president of reinsurance at OneBeacon.

-

The book of occupational disease liability is highly volatile and payouts can be significant.

-

Underwriting income for the industry climbed $4.9bn from the previous year, driven by growth in net premiums earned, according to AM Best.

-

His arrival comes as rates surge across the excess casualty market, driven by social inflation in the US.

-

The Japanese-owned carrier installs the fifth and final divisional head following a business overhaul.

-

The liability cover is the second product to stem from the Lloyd’s innovation facility.

-

Global P&C CEO Conoscente offers reassurance on US casualty exposure.

-

The move follows S&P and Fitch putting ProAssurance’s ratings under review.

-

The executive said syndicates would struggle to grow market share as casualty rates rise.

-

The ratings agency said its outlook on the carrier remains unchanged following the announcement of its acquisition of Norcal.

-

Fitch placed ProAssurance ratings on negative watch following the announcement of the acquisition, noting concerns about the medical professional liability space.

-

Colm Lyons, Lee Ackerman, James Perrott and Tom Graham join Syndicate 1969.

-

Analysts remain unconvinced that the US casualty reserving crisis is behind the carrier.

-

The former underwriter left Barbican following the company’s acquisition by Arch.

-

Carriers led by Axa XL are accused of “not acting in good faith” and acting “miserly”.

-

Pre-adverse development cover, the carrier saw impact from directors’ and officers’ and mergers and acquisitions-related business.

-

The CEO explained the reasoning for the carrier's recent reserve increase during a call with analysts on Wednesday.

-

According to sources, AIG underwriters globally have been told not to write new construction risks in Latin America.

-

Berkshire Hathaway-owned MedPro provides medical malpractice insurance in the US.

-

The comments came as Chubb shares rose more than 6.3 percent following the release of fourth quarter results.

-

General liability, professional liability and personal lines were key growth areas for the carrier.

-

The broker has experience placing business for offshore law firms and trust companies.

-

The move by a senior claims executive to the underwriting side comes amid mounting casualty claims due to social inflation.

-

The carrier's first full-year results as a listed entity will include $28mn of unfavourable development.

-

SVP Tom Jurgens told The Insurance Insider that he expects the book to grow at least 15 percent this year.

-

Disruption in P&C markets is expected to boost demand for captive services.

-

If early reporters Travelers and RLI are reliable cross-industry bellwethers, it looks like significantly lower overall catastrophe losses last year will flatter carriers’ Q4 and 2019 results and offset much of the damage from spiralling casualty claims.

-

The appointment follows the closing of Gallagher’s acquisition of Capsicum Re.

-

The former Navigators executive has set up a consultancy called G58 to work with private equity and insurance clients.

-

This publication looks at the 10 most prevalent industry trends for the year ahead.

-

The Australia CEO becomes regional chair and will lead international liability.

-

Since December we have been stressing that the major fourth-quarter results story is likely to be reserve charges taken by carriers that write US casualty books.

-

Sources said carriers will likely need OFAC approval to make liability payments to Iranian families.

-

Reserve calculations are changing as a result of escalating social inflation, the analyst noted.

-

Former Vibe CUO Bradley Knight and casualty colleagues including five class underwriters move from the shuttered Syndicate 5678.

-

The case exemplifies the complications historic opioid claims are causing in the market.

-

The executive will work to develop a new stream of diversified business for the broker.

-

Jeremy Shallow becomes head of international specialty, while Ross MacDonald takes on the post of head of non-US international casualty.

-

The experienced legal and claims executive will underwrite and service a variety of accounts.

-

LMA and Lloyd’s say the exercise will begin around March or April this year.

-

An oil rig off the coast of Norway may seem an unlikely victim of social inflation. But the phenomenon that has created misery for USA Inc and shaped the outcome of the casualty reinsurance renewals is being felt far from the pharmaceuticals companies, the hospitals, the religious institutions – and insurers thereof – perceived to stand well ahead in the firing line.

-

Greenspan was more optimistic about Arch, switching her opinion to ‘overweight’ from ‘equal weight’.

-

Losses in the wider casualty market are affecting relatively loss-free pockets of the energy sector.

-

Broker says alternative capital retracted by 7% as investors exercise caution.

-

Broker’s 1.1 report notes uptick in rates for property cat and non-marine retro.

-

The Insurance Insider looks back to some of the standout pieces of the last 12 months.

-

The Willis Re International chairman says some carriers consider primary rate increases inadequate.

-

The broker highlights increasingly discerning reinsurers pushing for rate.

-

Rate growth fails to meet early expectations but the market is clearly tightening in aggregate.

-

Price growth defies modest expectations as carriers including Liberty Mutual, MS Amlin and R+V Re retrench.

-

Hilary Brown most recently served as head of casualty, international for AIG.

-

1 January renewal runs late as brinksmanship from cedants meets determination from reinsurers.

-

Third-party liability, product liability and pollution liability are the main affected lines in the cut back.

-

Yesterday we broke the news that Liberty Specialty Markets had pulled out of UK motor treaty, as signs gather that 1 January will reveal this to be a hard pocket of the market.

-

Strong balance-sheet growth, marginal operating performance, favourable business profile and appropriate enterprise risk management were factors in the outlook.

-

Carrier seeks to mitigate regulatory risk around motor and is likely to cut US med-mal exposure.

-

The mutual would provide capacity to a network of managing general agents, in order to increase options available for cannabis businesses.

-

The MGA was unable to secure capacity for the three classes for 2020.

-

Two professionals win the underwriter rankings and RKH Specialty’s Jason Rose climbs to the top of the broker podium.

-

The US casualty market looks to have a major reserving problem as claims inflation picks up.

-

Casualty has “a definite trend towards improving terms”, the head of casualty underwriting for the US and Canada said.

-

The incident has prompted the filing of lawsuits over allegations that people were exposed to high levels of Butadiene.

-

Nic Wood, who headed the team, is expected to join Canopius.

-

The executive has held casualty positions at AIG, Ironshore and Endurance.

-

Adam Lantrip, Sam Levine and Laura Burke have joined the new division.

-

Colm Sheedy will work alongside senior class underwrtier Joe Murphy to expand the book.

-

Analyst Philip Kett says the carrier has already recognised a large amount of required reserving linked to its US casualty book.

-

At the end of this week, my daughter will turn 20.

-

The Miami-based group will initially focus on developing property and casualty, employee benefits and corporate business.

-

Sheri Wilbanks was at AIG for more than 14 years, most recently as its global innovation lead for its Client Risk Solutions division.

-

This publication highlights five key areas of the unit’s turnaround plan from Swiss Re’s investor day.

-

Loss deterioration, interest rates and capacity reduction lend weight to reinsurers’ case for rate rises.

-

Mia Finsness will assume new global responsibilities for the insurer’s casualty portfolio.

-

CFO John Dacey says the new alternative capital partners unit will enhance its flexibility.

-

Gregory Schilz, Grant Nichols and Brian Lu join the broker from Marsh JLT.

-

Broker makes several key hires after Canadian pension fund and private equity deal.

-

The executive focused on casualty classes, including motor, liability and professional indemnity.

-

Any carrier troubled in recent months by large losses, be they property or casualty, will have noted Zurich CEO Mario Greco’s claim last week that his company has neutralised the threat.

-

The carrier’s withdrawal comes amid general concerns over pricing and reserving.

-

The move follows an exodus of casualty underwriters from Swiss Re’s primary business over 2019.

-

Aon and Willis Re will place the global XoL, with Guy Carp placing international.

-

The "Hundreds" product will have a $100mn limit excess of $100mn, and cover 100 named perils.

-

Executives who have been upfront about the need to batten down the hatches ahead of the impending casualty storm must be feeling a little put upon.

-

Casualty rates and T&Cs should improve for 24-36 months, the executive said.

-

Aon's Robert Johnston takes the Bermuda chairman role, with incumbent John Fletcher moving to the regional CEO post.

-

The ratings firm’s analysis suggests that rising claims costs and thin margins present an “earnings risk” to the industry.

-

Speaking on an analyst call CFO Christoph Jurecka said that the reinsurer had been revising its US casualty books since 2017.

-

Convex CEO warns "big bang" market-wide reserving remediation could be "fatal" for some.

-

A benign period for cats, sustained by improved investment income and a doubling of non-insurance revenue, helped the company boost operating earnings

-

A more litigious environment in the country has pushed up claims frequency and severity.

-

The AIG subsidiary achieved rate rises of 30 percent across commercial D&O while also reducing its portfolio loss exposure.

-

Paul Rivett said social inflation, interest rates and tightening capacity at Lloyd’s had heightened pressure on underwriters.

-

It’s Halloween and the (re)insurance industry is running scared. But the ghastly sounds are not the groans of ghouls or the shrieks of spectres. Instead, it is the moaning and wailing of underwriters astonished at the latest vast liability award.

-

The conference in Boston also flagged anxiety about a third year of wildfire losses from California.

-

The new business segment will target premiums of about $50mn-$100mn over the next five years.

-

The executive was talking to analysts during a call to discuss Markel’s third-quarter 2019 results.

-

The Bermudian company wrote 70 percent more casualty and specialty premium year on year.

-

Olivier Antiphon and Anne-Sophie Bonifay will join as head of construction and head of casualty, respectively.

-

Great American replaces Axa-XL as a paper provider for the AJ Gallagher-owned marine managing general agent.

-

Reinsurers look set to largely ride on the coat-tails of insurers on rate rises, with ceding commissions relatively steady.

-

The carrier’s results deteriorated this quarter after reserve strengthening in liability lines.

-

Limit control, emerging risks and cat losses have all contributed to rapidly changing conditions.

-

A report finds that the overall US P&C market has moved out of the red and into break-even underwriting profitability.

-

Asbestos payments in 2018 declined by 14 percent to $2.1bn, according to the ratings agency.

-

David LeBlanc takes over for Douglas Nelson who has vacated the role to become chairman.

-

The end is in sight. After six weeks of back-to-back-to-back-to-back conferences, there is a light at the end of the tunnel.

-

The InsurTech, formerly named Verifly, sells short-term liability insurance for freelancers and small businesses.

-

The class action comes amid concerns over an uptick in environmental-related D&O claims.

-

The Bermudian’s estimated loss range follows a similar disclosure by Arch earlier this week.

-

Sources said the new clauses would limit future opioid-related claims.

-

The broker said outsized claims experience for the 2019/20 period had left some mutuals struggling.

-

The supplier to carriers including Liberty Mutual and John Hancock has raised $110mn in total.

-

Insurers are facing up to a total loss on MGM Resorts’ $751mn tower after the hotel and casino company agreed an $800mn settlement with survivors.

-

The transaction has now received regulatory approval and has closed.

-

Wilson’s role will focus on building out the Bermudian’s casualty and specialty reinsurance footprint in the US.

-

The restructuring also entails the creation of a new specialty insurance business through the merger of marine and international P&C.

-

Jeff Lynn joins from Everest Re to lead the new business segment.

-

The rating agency cited the reinsurer’s balance sheet strength and parental support in its decision.

-

The company at the center of the opioid crisis is now struggling to renew casualty cover expiring 1 October.

-

The Corporation predicts £7bn in new business will be written this year.

-

Property swings back into the black while the market overall moves to an underwriting loss.

-

The Insurance Insider gives you a run-down of everything you need to know from the reinsurance conference.

-

Supply chain sub-contracting agreements are watering down liability cover, according to some insurance executives.

-

The company filed for bankruptcy after a fire tore through a Philadelphia refinery on 21 June.

-

State officials advised carriers to settle claims swiftly or face "disciplinary action".

-

More than 20 other carriers are still pursuing the case, including Markel, Chubb and Munich Re.

-

DropIn founder Louis Ziskin explains how his InsurTech can slash claims costs and curb fraud.

-

The proposal would provide less than half of what insurers are seeking.

-

The Bermuda (re)insurer exits management liability, along with marine hull, power and product recall.

-

The current litigation environment is worse than Travelers expected, the executive said at a conference.

-

The portfolio holds almost $200mn in net reserves.

-

The executive said the carrier is moving towards “balance between underwriting and investment”.

-

William Berkley said a continued uptick in jury awards would apply sustained pressure on the casualty and PI markets.

-

Clare Constable and Will Morris join the business as director of claims and director of underwriting for delegated authority.

-

August has been in no way tranquil for P&C stocks.

-

The P&C program specialist is led by co-founders Erik Matson and David Paulsson.

-

The drugs and consumer goods giant must pay $572mn in damages, but is appealing the judgment.

-

The two will report to David Perez, EVP and general manager of national insurance specialty.

-

Average cost per claim hits £4,791 according to latest research.

-

One way to think about the ambitious build-out of start-up (re)insurer Convex is an interesting test of the franchise values of specialty (re)insurers.

-

The carrier hires a former Aon director as it enters the $650mn market.

-

The underwriter will join the casualty team, led by Dan Curran.

-

The New York State court system has designated 45 judges to deal with a deluge of lawsuits expected to be filed as the law takes effect.

-

Rey Haliti and Auberson Eustache have joined the Bermudian (re)insurer’s New York office.

-

The insurer says it shouldn’t have to cover the university’s settlement because the policy contained an abuse and molestation exclusion.

-

The move follows regulatory scrutiny in other states over the offering of Carry Guard policies.

-

More than half of attorneys surveyed by the carrier said litigation finance has prolonged the time it takes to settle losses.

-

Investment income increases, while the group’s non-life run-off operations and Lloyd’s business Atrium post an improved performance.

-

Swiss Re’s medmal exit comes after ProAssurance’s warning last quarter of companies being “swept away by the tide”.

-

The buyer says purchase reflects growing regional demand for warranty and indemnity insurance.

-

The Pennsylvania-based grocer has been named in multiple lawsuits by plaintiffs seeking to recover billions of dollars over opioids.

-

The recently created specialty outfit taps AmTrust at Lloyd’s and Nuclear Risk Insurers for talent.

-

The judge said that the punitive damages were higher than constitutional limits set by the US Supreme Court.

-

The Chubb CEO hit out at the wave of litigation which often follows acquisitions.

-

The new venture streamlines underwriting by scraping data on liquor license violations.

-

The move comes after a reserve strengthening and commercial liability moratorium imposed during the first quarter of this year.

-

It’s clear that pricing is improving. But how widespread is the pain that’s driving it? (It’s not just AIG & Lloyd’s)

-

A five-strong team will work under Peter Boardman and Guy Robinson.

-

The insurance company is opposing the Scouts’ bid to move the case to a local county court.

-

The new hire will replace Convex recruit Pagram in a US casualty role.

-

Garick Zillgitt and Justin Magee will be vice presidents of primary general liability and excess casualty respectively.

-

Professional lines underwriter Lillies joins from Everest Re.

-

If you don’t fancy hurriedly retraining as a techie to ensure you are gainfully employed in the (re)insurance sector 10, 20 or 30 years from now, consider becoming a climate change specialist.

-

The Citibank-run sale process attracted interest from The Hanover.

-

Willis Re’s latest renewal report highlights how the casualty reinsurance pricing is improving while the market contends with some of the reserving sins of the past.

-

If the insurance market could be imagined as a fairground, cyber risk would be the frantic Whack-a-Mole game.

-

The casino giant says it is at risk of “losing valuable witnesses and attorneys” in legal battles with more than 4,000 claimants.

-

Improvement in underwriting profitability in 2019 will be followed by “modest deterioration” over the next four years, according to a new report.

-

New bodily injury litigation is an underwriting opportunity for the liability market, Shah said.

-

Joe Sweeting will be based in London and work as head of Lloyd's casualty.

-

Chubb’s report comes amid growing outcry among D&O insurance providers over event-driven securities lawsuits.

-

The appointment of Clive Archer follows the departure of Tim Mackenzie last month.

-

The building on Manhattan’s Seventh Avenue is home to financial services firms and law firm Willkie Farr & Gallagher.

-

The group will start by underwriting property, casualty, executive and professional lines.

-

“Green shoots” of rate firming spur hopes of further gains.

-

A New Jersey federal judge rejected insurers’ request to throw out key counts in the lawsuit.

-

Insurers posted a net underwriting income of $4.2bn in the first three months of 2019, up 24% from the same period a year prior.

-

A settlement over the October 2017 mass shooting could reach as high as $800mn, the casino firm said.

-

The organisation results results of a survey which showed an average rate increase of 3.5 percent.

-

The Q1 pricing report provides further evidence that carriers are pushing for rate and attempting to manage exposures as loss-cost trends bite.

-

The verdict is the third and largest against the chemical company over claims that Roundup causes cancer.

-

The life sciences team will target small and mid-market organisations.

-

The third-largest P&C underwriter in the US reported 20.4 percent top-line growth and a 7.6 percent renewal rate increase in specialty lines.

-

Everest Re executives were relatively optimistic about P&C (re)insurance pricing.

-

EC3 execs described low-to-mid single-digit increases on average, with aviation, property D&F and PI rates pushing higher.

-

Renewal pricing in each of the company’s specialty property casualty sub-segments exceeded expectations.

-

The hires will bring FM Global’s total boiler and machinery staff to more than 250.

-

The executive becomes UK and Ireland leader for P&C and life within the broker’s insurance consulting and technology operation.

-

Current Faraday CEO Andrew D’Arcy will take on a new role as head of all P&C business outside North America.

-

Start-up hires Pagram as part of talent acquisition spree.

-

The asset class appeals to writers of short-tail business, according to GSAM.

-

London-based D&O writers have “woken up” to the threat of creeping claims frequency and severity, sources said.

-

Arguments were held Monday before the US Supreme Court in a case that could open the door to more lawsuits and D&O claims.

-

A firming D&O market is making insurers think twice about granting activism-related coverage extensions.

-

Steve Harwood joins from Pembroke to lead the new operation.

-

Carmella Capitano will serve as head of primary general casualty-risk management and lead Starr’s excess casualty team.

-

The funds will make this the company’s sixth, seventh and eight investment vehicles.

-

Richard Porter will assume the role of head of financial lines after serving as general counsel for Chubb Bermuda.

-

Arch Capital Group’ chairman Dinos Iordanou will leave the firm in September.

-

A judge agreed to seal excess-of-loss reinsurance documents in a dispute between Everest Re and insurer Penn National.

-

Benchimol hopeful of mid-year correction after disappointing 1 January renewal.

-

The carriers argue the historic allegations are not covered by the diocesan general liability policies.

-

The company will no longer offer excess casualty and lead umbrella coverage to most clients whose revenue exceeds $10bn.

-

The Australian Royal Commission into financial services misconduct has led to withdrawal of local capacity

-

A Washington state regulator hit Illinois Union with a cease and desist order against underwriting the policies.

-

That figure accounts for the bulk of AIG’s $445mn unfavourable reserve development, pre-adverse development cover.

-

The cyber market is on edge, waiting for changes that will impact pricing.

-

Report shows insurers are increasing scrutiny of sexual harassment risk.

-

Carriers are reluctant to expand their appetite in areas like cryptocurrency before D&O prices rise.

-

The coverholder will have delegated authority for all types of business offered at the carrier’s syndicate at Lloyd’s.

-

Berkshire is currently obtaining state regulatory approvals for the product.

-

Paolo Pitton joins from Chubb to lead the initiative.

-

D&O pricing has lagged behind claims activity for the better part of a decade, market experts say.

-

Sexual harassment allegations against corporate executives are starting to spawn securities lawsuits.

-

Predecessor David Jordan moves to head Berkley wholesale broker Breckenridge.

-

Current active underwriter Tom Corfield continues as CUO of Scor UK.

-

The EMCI bidder says it will only consider options in which it acquires all its target's outstanding stock.

-

The Lloyd’s carrier’s casualty book drags on parent AFG’s results.

-

Some top-tier commercial auto carriers stand to see market improvement, JLT says.

-

The carrier's president and CEO tells analysts property and auto are “getting rate”, while casualty has been patchier.

-

The impact of AIG and Lloyd's pulling back means there will likely be a lot of opportunity this yearDo problems at AIG and Lloyd’s create a big opportunity for the market?

-

The casualty specialist calls time after more than a decade at the carrier.

-

The executive’s remit includes southern European and Mediterranean casualty.

-

The Chapter 11 procedure adds a new dimension to carriers’ legal action against the utility related to losses incurred from the Camp Fire.

-

Commercial lines and brokers are expected to lead the way after a tough fourth quarter.

-

The claimants say more accounts are required from the carrier to reach a figure for final damages.

-

The agreement will expand the carrier’s financial lines reach in Asia.

-

Commissions on QS deals fall and excess of loss rates show modest improvement in the US.

-

The reinsurer has absorbed almost $500mn of losses from its sister company in less than two years.

-

Noblr co-founder Gary Tolman resigned from the White Mountains board to avoid a conflict of interest.

-

I’m sure you’ve heard the classic apocryphal comic tale of the building worker’s sick note, long since immortalised into Irish folk music by The Dubliners as ‘The Reason Why Paddy’s Not at Work Today’.

-

The deal follows the purchase of intermediaries Symmetry, Title & Covenant and Honour Point.

-

Reinsurers hit by a heavy cat year are unlikely to see significant rate rises as retro rates increase.

-

The team in London was led by Graeme McGeachie.

-

The insurer named a new president of primary casualty and head of excess casualty.

-

Casualty lines paint mixed rating picture going into 2019.

-

The West of England is imposing a general increase on members at the 20 February renewal, the first time in three years an International Group club will do so.

-

Rate reductions have already started to ‘decelerate’, one industry expert said.

-

More than half of primary D&O policies saw a price increase in the third quarter.

-

The platform will be led by Mike Kerner, formerly of Everest Re.

-

The organisation reports strong uptake across risk classes.

-

Market premium is also projected to shrink 5 percent as a result of performance drive

-

Insurers of all sizes have been hit with claims from the record breaking Camp and Woolsey wildfires.

-

The ratings agency credited risk-adjusted capitalisation and workers’ comp profits as contributing to the segment’s stability.

-

Philippe Aerni has helmed the segment’s financial and professional lines unit since 2014.

-

Philippe Aerni will lead both casualty and financial and professional lines.

-

Improved pricing and strong industry capital have led to Fitch to revise its outlook on the US P&C sector to stable.

-

The carrier has put the construction team under consultation.

-

AM Best warned that without strengthening, reserves for asbestos and environmental exposures are on track to be exhausted in seven years.

-

Casualty reinsurers looking to continue positive pricing movements seen in 2018 renewals.

-

Demand for larger limits is also increasing, with a race among brokers to place $1bn in limit.

-

Butcher, d’Alessandro and Hunt have left the business.

-

The Sirius-backed MGA is growing rapidly in $53bn market.

-

The French insurer will pay EUR584mn for the Chinese carrier.

-

The planned cover follows a decision by the car insurer pool’s member companies to shoulder the risk collectively.

-

The Wisconsin-based P&C insurer currently has an financial strength rating of A.

-

The Civil Liability Bill sets a new framework for determining the discount rate for personal injury compensation.

-

The carrier splits out admitted from non-admitted casualty business.

-

Loss estimates for California wildfires crystallising around $10bn-$15bn range.

-

PG&E could face $10bn in claims from 2017, with a similar scenario to potentially play out after this year’s fires

-

The company reported a combined ratio of 96.4 percent.

-

The executive joins from Liberty Mutual-owned specialty (re)insurer Ironshore.

-

The Lloyd’s carrier will provide paper for the insurer’s property, liability and professional indemnity lines from 1 January.

-

The meeting included stockholders of record as of 10 October.

-

A judge found USAIG acted negligently and in bad faith by failing to settle a claim promptly.

-

Deal will represent key test of market’s belief in global insurer’s turnaround story.

-

Harrell replaces Ed Beckwith at Syndicate 4711 as he adds to existing roles of head of international insurance and global head of marine.

-

Axa anticipates claims could arise from regulatory changes as Brexit takes hold.

-

The insurer is adding new executives to its management committee as its chief risk officer steps down.

-

Maiden Holdings' recent struggles continued with its third quarter results highlighting yet further losses.

-

The 2018 conference season has finally come to a close in North America, with the Property Casualty Insurers Association of America’s event in Miami last week bringing the curtain down on this year’s major industry gatherings.

-

The syndicate will increase capacity for specialty, marine reinsurance and energy.

-

Cat losses and a reserve charge pushed the carrier to a combined ratio of 105.3 percent for Q3.

-

The results were underscored by partly by growth in Assurant’s mobile and multifamily housing units

-

The Floridian’s combined ratio fell 166.2 points

-

The medical liability specialist reported operating earnings of $0.42 per share, narrowly beating Wall Street expectations.

-

The platform will reinsure Silicon Valley motor liability risks underwritten by Apollo 1969.

-

Executives faced pointed questions about workers’ compensation claims trends and casualty pricing during Q3 conference calls.

-

Casualty pricing and demand overshadow property catastrophe, while RenRe arrives just too late to steal the show.

-

Chairman and CEO Robusto lays claim to the best quarter since 2010.

-

Professional lines and casualty leader roles also change with the departure of Steve McGill.

-

New business in core casualty lines will be sourced from wholesalers only as of the first quarter of 2019.

-

Billions of dollars of additional quota-share cover will also be purchased.

-

Before Florence and Michael, rate reductions had looked set to resume.

-

The earnings fell short of consensus estimates partly due to lower investment returns

-

The carrier posted a loss as a rise in net earned premiums failed to offset cat losses

-

The insurer said that one good quarter was not enough to “declare victory” in its turnaround effort

-

But some predictions of a disastrous quarter proved overdone.

-

The company reported operating earnings per share of $2.19, beating Wall Street consensus estimates of $1.87.

-

He joined the Dallas, Texas-based holding company last week to focus on the program insurance sector.

-

The 737 Max 8 has an insured hull value of $60.1mn and the policy is led by Global Aerospace.

-

The insurer reported net income of $37.4mn for the quarter, a jump of 275 percent year over year.

-

The syndicate has repositioned its portfolio over the course of the past 12 months.

-

AIG leads the aviation policy, which is brokered by Lockton.

-

Deal could dwarf even new AIG casualty deal if cedant pulls trigger next year.

-

Casualty quota share is biggest new deal brought to market in years.

-

The Jonathan Ranger-led business will initially target the growing cyber market ahead of rolling out its marine offering.

-

The CEO of the Bermudian P&C (re)insurer earmarks Novae’s marine, liability, political and credit risk and cyber businesses for praise.

-

Former Munich Re Syndicate Singapore chief establishes rare Singapore MGA.

-

AIG Europe Ltd will divide into two separate entities as the UK negotiates its exit from the European Union.

-

The WR Berkley CEO highlighted areas for concern in professional liability lines.

-

Nichols will serve as chairman and interim CEO of Protective following the resignation of Randall Birchfield.

-

WR Berkley beat Wall Street consensus estimates, with results benefiting from higher income from investment funds.

-

Chubb beat Street EPS estimates and reported an operating RoE of 8.7 percent, with earnings benefiting from its ceded reinsurance strategy

-

The regional carrier has a $35mn retention, which could be partially reduced by additional reinsurance recoveries from supplemental Non-Florida reinsurance program.

-

Some will interpret the planned disposal as a positive sign the continental European legacy market is opening up.

-

The current deputy CEO will lead the specialty broker after Rugge-Price steps down.

-

The portfolio for sale holds EUR90mn of Irish public liability and employers' liability exposures.

-

The Hartford’s $2.1bn acquisition of Navigators was announced on 22 August.

-

Shulman will oversee operations in the United States and Canada as part of organizational restructuring.

-

The reinsurer was hit with estimated Q3 cat claims of $240mn from losses including Florence, California wildfires and typhoons in Japan.

-

The majority of losses come from Typhoons Jebi and Trami in Japan.

-

A new study from the Workers Compensation Research Institute shows medical payments per claim falling or holding steady in several US states.

-

The MGA plans to write builders' risk, general liability and surety business.

-

The executive will take on the role in addition to leading Everest's commercial casualty operation.

-

The firm’s underwriting results improved versus the cat-hit Q3 2017, but saw reserve releases down from $14.9mn to $7.8mn.

-

The ratings have a stable outlook.

-

Judy Gonsalves will succeed Joseph Clabby, who has been named chairman of Chubb Bermuda.

-

Valerie Butt will lead the carrier’s casualty division with responsibility for new and renewal business.

-

Atrium is understood to be the lead insurer on the main contractual-protection insurance placement.

-

The acquisition is to strengthen AFG’s specialty casualty offer.

-

The Chicago-based firm said this was the second-highest total through the first three quarters of the year, just short of 2017.

-

The Bermudian carrier has hired David Adams, previously of Maiden Re, to lead the new unit.

-

Lessman will run transactional liability while Meade will head FI.

-

The just-launched platform will connect holders of long-tail insurance risks with investment funds.

-

David Robotham and Paul Devido will join early next year.

-

The German investment bank says a Covea/Scor combination "makes no sense".

-

In theory doing insurance for big business should be very similar to selling reinsurance.

-

Ex-Scottsdale president Mike Miller’s Ategrity is backed by Stuart Zimmer.

-

North American arm of the Hyperion-owned MGA will distribute and underwrite environmental cover for the Bermuda company.

-

Lou Levinson will assume the job on 24 September and report to David McElroy.

-

Michael Owen and Rob Barron have joined the London operation.

-

The international (re)insurance player has also decided to shrink its property D&F book.

-

Outgoing CEO Inga Beale reports a marginal improvement in underwriting results, buoyed by reserve releases.

-

Concern about losses hitting ‘other liability’ policies rises year-on-year.

-

The Bronek Masojada-led carrier will reduce its capacity by 12.5 percent next year after a 39 percent increase in 2018.

-

He leaves AGCS after almost 10 years at the insurer.

-

The segment is characterized by greater volatility than standard lines markets.

-

The executive joins from Marsh.

-

The move reflects a new era of more enthusiastic - and strategic - reinsurance buying at the US carrier.

-

The class of business reported a combined ratio of 130.3 percent for the year.

-

The run-off book is said to hold around $500mn in reserves.

-

The Cincinnati-based insurer has given Reith and the management team permission to explore an MBO.

-

TigerRisk has been appointed to advise on the disposal of the Irish public liability and employers' liability book.

-

Workplace harassment took center stage last year with the outcry over celebrities such as movie producer Harvey Weinstein and the number of people ousted from positions of power seems only to grow amid the continuing fallout.

-

The executive takes up the newly created position today, joining from Munich Re.

-

The executive will change roles within the brokerage at the end of the year.

-

A recommended 13.4 percent rate cut for workers’ compensation cover in Florida shouldn’t lead anyone to assume that an expected spike in carriers’ claims-related legal costs has failed to emerge.

-

The hire reflects a global expansion push in the line.

-

The provider of workers’ compensation insurance has agreed to a new acquisition deal.

-

The executive was North American A&H leader for eight years.

-

As M&A deals go in the insurance industry this year, Allstate’s decision to buy InfoArmor for $525mn in cash won’t go down as a bellwether deal.

-

The rollback reflects frequency declines but not a ruling that ended 2003 fee caps.

-

Allied World Re has promoted Yeo Meng Wong from an underwriting role to senior vice president and general manager.

-

One analyst believes buying the provider of employee identity protection will help the auto insurer diversify.

-

The creator of alternative reinsurance securities aims to raise up to $20mn as it expands.

-

Lane’s downpours puts commercial property, auto and homeowners carriers at risk.

-

Lloyd’s presentation slides from July obtained by The Insurance Insider throw a harsh spotlight on non-US professional indemnity business.

-

The carrier has confirmed its Corporate Solutions arm is one of the insurers for Autostrade per l’Italia.

-

Goebbels joins from Integro, where he was a director for UK and Europe.

-

The Cal Phoenix Re cat bond was the first cat bond to cover wildfire on a standalone peril, as well as the first third-party liability issuance.

-

Casualty underwriters told this publication they were assessing their talc exposures after the Johnson & Johnson verdict but were not overly concerned.

-

The consortium will offer A$50mn ($36mn) in capacity for middle-market risks that are normally written in the local markets.

-

Giles Allen and James Glover are among five recent exits from the A&H team at Axis.

-

The Golden State’s insurance commissioner has led efforts to close cannabis coverage gaps.

-

Property, financial and professional lines recorded the largest rate increases in the period.

-

Suzanne Black will take up the new role of head of liability.

-

Carriers and MGAs are seeing increased demand for intellectual property (IP) cover as awareness grows around the inherent value in intangible assets

-

The largest segment of the commercial lines market has had a sub-100 percent combined ratio three straight years.

-

Property cat reinsurance rate rises still lag behind those of primary insurance, executives said during Q2 conference calls.

-

The Hartford, Travelers and Chubb were questioned about talc exposures this earnings season following a court ruling against Johnson & Johnson.

-

Only 7 percent of those surveyed buy insurance for intellectual property litigation risk now but one-third would do so in the future, the broker found.

-

The companies estimate the tie-up will be worth an initial $30mn in gross written premiums a year.

-

Chance Warmack’s loss-of-value policy was triggered by his low Philadelphia contract.

-

Legal costs tied to intellectual property can be large yet risks are often excluded.

-

Dana Hendricks moves into the group role from a senior position at the Podiatry Insurance unit.

-

Senior underwriter Fergus Fergusson will take over following the departure of Donnacha Smyth to XL Catlin.

-

Aspen has lost more underwriters as members of its Bermuda FinPro team jump ship.

-

For now, motor insurers can sleep a little easier.

-

Odyssey Re CEO Brian Young says the segment “is not priced to perform”.

-

The Bermudian lost six underwriters and a claims specialist last week.

-

The ex-Greenlight Re underwriter is the new head of office at the Caymans firm.

-

Ed Beckwith has held the role since August 2015.

-

Lloyd’s third-party administrator ARM has a focus on trucking and cargo claims.

-

The carrier creates two new London market casualty positions.

-

MGM lawsuit against shooting victims asserts exemption under anti-terror act.

-

The delay is not expected to affect accompanying changes to the Ogden discount rate.

-

The ratings firm said the survival ratio last year improved slightly to 7.8x.

-

If Catalina signs the deal, it will be the third UK employers' liability book it has acquired in just over two years.

-

Stefan Homberger named international casualty head as Arielle Moody moves to team lead.

-

The insurer increases coverage by 41 percent to $445mn with ‘mid-single digit’ rate cuts.

-

A court of appeal in the state has said assignment of benefit rights can be split between multiple parties.

-

The Japanese-owned Lloyd's business claims $25mn in IP capacity.

-

Insurers told they should “pass along” any federal tax savings as rate cuts.

-

Mark Richards was most recently Navigators’ president of primary casualty.

-

Joe Savarese has been named president of the US specialty primary casualty division, while William Vaughn becomes CUO.

-

-

The firm’s Bradford says a market awash in capital may never harden again.

-

A combined trade body would represent more than 60 percent of the US P&C market.

-

The merged operations of SpareBank and DNB will create Norway’s third-largest P&C insurer.

-

Earthquake capacity continues to grow and is now at an all-time high, seeing the same ugly pricing as elsewhere in the property sector, according to AmWins.

-

Michael Bender will head up the P&C division

-

Berkshire Hathaway is understood to have shown early interest in the UK employers' liability book.

-

Everest taps the industry veteran’s long experience in excess and surplus lines.

-

Waters named national specialty senior vice president and CUO to lead energy and construction.

-

Steven Goldman will replace Timothy O'Donnell following his promotion.

-

Open-market property and marine are the worst-performing areas.

-

The Corporation has warned syndicates to address unprofitable business or face closure.

-

The new US business will target companies with more than $25mn in revenue.

-

CalFire pins blame for 12 Wine Country fires on trees falling into PG&E power lines.

-

Appeals court says ambiguous language is construed in favour of the insured.

-

The Chubb CEO says “hit and run” litigation dominates D&O cover.

-

Berkley and other P&C CEOs feel loss trends will become more important.

-

Studies show costs dropping aided by declines in opioid use by injured workers.

-

Bluefin Underwriting and other Schinnerer Group entities will adopt the new brand over the next year.

-

Property losses in 2017 spurred premium rate gains that could be short-lived.

-

The insurer will separate its short-tail cyber portfolio from longer-tail casualty risks.

-

The insurer now has reinsurance for up to $3bn of losses from a Florida hurricane.

-

Founder of Everest unit will spend months in transition working with now president Whiting.

-

The insurer is to take more out of premium pools, potentially leaving less for charity.

-

The first named storm of 2018 has killed at least two people amid heavy rain.

-

Lynn Halper will leave the carrier at the end of June.

-

Bizet will help JLT Re’s drive to expand in the Caribbean and Latin American markets.

-

CEO Emmanuel Clarke says higher interest rates dealt a short-term blow to earnings.

-

The company reveals it is involved in six lawsuits relating to the proposed $2.7bn take-private deal.

-

A multitude of factors led to the aggregate 94.8 percent combined ratio reached in Q1.

-

RenRe’s capital infusion is expected to fuel growth by the expansive broker.

-

The executive will rejoin former colleague Graeme Scott.

-

The MS Amlin Insurance SE CEO and global managing director of MS Amlin’s P&C business will pursue opportunities outside the firm, according to an internal memo.

-

The ratings agency still retains a negative outlook on the sector, however.

-

UBS puts a buy rating on the insurer and sets a price target at $65.00.

-

The French reinsurer has expanded its business solutions unit into six lines split across three main regions.

-

The Dublin hub will allow the company to continue its EU business post-Brexit.

-

The sector’s investment gains came at the same time cat losses caused a decline in net income.

-

The gun owners organisation claims the state is trying to stop insurers from working with it.

-

Property lines specifically rose 3.4 percent in Q1, highest among three straight quarters of increasing premiums

-

Snow and hail cause $1.2bn of insured losses in Europe, Impact Forecasting says.

-

Stuart Hawes leaves Markel International after nine years, this publication has learned.

-

National General advances its bid for independence as the Karfunkels' third attempt at a public insurance company.

-

Two warranty and indemnity underwriters leave the Lloyd's carrier.

-

State-backed carrier is authorised to spend up to $92mn to acquire catastrophe coverage.

-

Patricia Mills of Chaucer soars to third place in the second edition of The Insurance Insider's survey

-

Surging Geico profit and the US tax cut help produce insurance earnings of $407mn.

-

The executive resigns from the carrier after joining as global head of M&A in June 2016.

-

SRCS plans to enhance E&S platform with financial and professional lines.

-

Broker collected $12mn from other NRA policy sales since 2000, New York DFS says.

-

The insurer met earnings expectations, helped by a rate hike on a key commercial auto policy.

-

The Bermuda-based carrier being acquired by AIG also suffered from rising expenses.

-

Street-beating earnings of $1.69 a share driven by mortgage segment gains.

-

The policy registry enabled by the distributed-ledger technology aims to shorten the time it takes for carriers to respond to communities in crisis.

-

A federal judge has demanded details of the defendants’ insurance coverage by 30 April in an attempt to bypass years of litigation.

-

Executives share their views on pricing across primary and reinsurance lines in Q1.

-

Carrier cites gain in non-standard auto as P&C swings to profit.

-

The syndicate would focus on both North American MGAs and treaty business across property and casualty.

-

The appointment is the third major hire since management closed a Centerbridge-backed $952mn buyout from Sompo.

-

The executive will become senior cyber underwriter at Syndicate 1967.

-

Axa has raised $3.2bn to put toward the $15.3bn XL deal through internal financial moves by subsidiaries, including the repayment of loans to Axa Equitable Holdings and the unit's purchase of Alliance Bernstein units previously owned by Axa SA and affiliates.