Hannover Re

-

Several Lloyd’s syndicates are also now providing cover for the federal insurer.

-

Plus, the latest people moves and all the top news of the week.

-

Carriers posted weaker top-line results but delivered improved combined ratios.

-

Plus, the latest people moves and all the top news of the week.

-

Property growth plans are cooling, but favourable loss trends will increase surplus capacity.

-

The (re)insurer has a higher-than-average Jamaican market share.

-

The group raised its full-year net income guidance to EUR2.6bn.

-

The reinsurer plans to grow its US business at a higher rate than its non-US business.

-

The carrier will pay special dividends only in exceptional circumstances.

-

Continental composite carriers aim to smooth volatility with new initiatives.

-

The former Hannover Re CEO said reinsurers must use alternative capital and tech.

-

The reinsurer’s new CEO said he sees no need for a radical shift in strategy.

-

The mid-year renewals point to mounting pressure on reinsurance pricing.

-

Plus, the latest people moves and all the top news of the week.

-

The Hannover Re CEO said rate adequacy remains “attractive” overall.

-

California wildfires were the reinsurer’s largest H1 loss, at EUR615.1mn.

-

Hannover Re’s CEO is lowest paid among peers, despite their pay growing 77% since 2015.

-

Vincent Hermenier joined Hannover Re in 2004.

-

P&C combined ratios were higher than Q1 2024, and wildfires impacted Hannover Re most.

-

The reinsurer said the LA wildfires would have a “dampening effect” on mid-year renewals.

-

The reinsurer's group operating income fell by 14% to EUR480.5mn.

-

The business, which has ~EUR300mn of book value, is expected to launch a process.

-

Plus, the latest people moves and all the top news of the week.

-

Sources warned some property XoL books are already running 50% loss ratios.

-

Some of the Big Four are slowing growth as the market softens.

-

For the prior-year quarter, the carrier reported a EUR9mn loss.

-

The carrier is likely to exceed its Q1 large-loss budget due to the California wildfires.

-

The carrier reported cat price reductions of 5.4% at the January renewals.

-

Julia Willberg joins from Hannover Re, where she has held several senior roles.

-

Hannover Re’s CEO said the market had been disciplined.

-

-

The reinsurer’s large losses tallied up to EUR1.3bn for the nine-month period to 30 September.

-

He succeeds Christian Hermelingmeier, who is set to become Hannover Re’s new CFO.

-

The outgoing CEO will leave the company at the end of March 2025.

-

The reinsurer is planning to drop its cession rate from 40% to 30%-35%.

-

The carrier’s EUR6bn structured reinsurance team is set to grow.

-

Plus the latest people moves and all the top news of the week.

-

Scor disclosed L&H troubles while Swiss Re continued reserving for US casualty.

-

Clemens Jungsthöfel said Hannover Re was sticking with its first-quarter approach.

-

German floods were the carrier’s largest H1 loss, at EUR120mn.

-

Combined ratios improved all around thanks to better pricing and a benign cat quarter.

-

After an unexpected charge in Q4 last year, the carrier feels “very comfortable” with its reserving position.

-

At group level, Hannover Re's operating income grew by 15% to EUR558.1mn.

-

Stefan Sperlich will lead the new division as managing director.

-

Hard-won profitability has given carriers room to salt away reserves.

-

The reinsurer’s solvency ratio currently stands at 269%.

-

The recruit will run E+S Rück and part of European reinsurance.

-

The carrier has also recruited Swiss Re’s Thorsten Steinmann.

-

Opportunities for profitable growth remain in 2024, the agency said.

-

Being underweight US casualty gives the firm more room than peers to manoeuvre.

-

The carrier said a tax windfall and better profits made bolstering possible.

-

The carrier increased premium volume by 6.9% at 1 January.

-

The carrier faced "significant impact" from a P&C reserve charge on its earnings.

-

After HannoverRe announced a 2025 CEO transition, here is our last review on the company's successes and challenges ahead

-

The segment has bounced back from its mid-2022 nadir, but its current zenith is not that much to shout home about.

-

The carrier also laid out its financial strategy through to 2026 in an investor-day disclosure.

-

Cat losses were within budgets despite high levels of minor events.

-

Hannover Re said it was in discussions with retro partners about buying less in 2024.

-

The firm’s insurance revenue result was pulled down by currency effects among other factors.

-

As the curtain comes down on the millionth Monte Carlo Rendez-Vous, and the prices in the cafes and restaurants are presumably reset to their customary levels, the conference has again done its main job.

-

Our virtual roundtable polled industry leaders on critical questions for the reinsurance market. Today, we explore how the industry can collaborate on net-zero objectives after insurers exited the Net-Zero Insurance Alliance (NZIA) in droves.

-

Chairman and CEO Jean-Jacques Henchoz sees affordability of insurance becoming a politicised issue, while discussions on preventive measures remain on the sidelines.

-

CEO Jean-Jacques Henchoz said it was “difficult to find a positive trend” in the global risk outlook.

-

Our virtual roundtable polled senior industry figures on the biggest questions facing the reinsurance industry. Today, we look ahead to the influences steering M&A market conditions.

-

Swiss, Munich, Hannover and Scor all delivered optimistic messages on pricing for next year.

-

The (re)insurer’s CEO Jean Jacques Henchoz said that Hannover Re remains on track for its full-year combined ratio target of 91-92%.

-

The carrier’s largest loss in H1 arose from the earthquake in Turkey and Syria, resulting in a EUR257mn charge.

-

After founder members Axa and Allianz dealt a potentially terminal blow to the Net-Zero Insurance Alliance by withdrawing, the NZIA is exploring limited options to continue.

-

Most carriers were keen to talk about how they are taking on the ongoing hard market in Q1, but some complexities partly offset their good news.

-

The reinsurer said its P&C re division is on track to contribute at least EUR1.6bn to its full-year operating result at year-end.

-

Beneva has signed up to net-zero targets as a member of the NZIA, following a period of turbulence in which Munich Re, Zurich and Hannover Re have left the alliance.

-

Aviva has said it is committed to the Net-Zero Insurance Alliance, in the wake of withdrawals from the group by Zurich, Munich Re and Hannover Re.

-

Hannover Re has followed Zurich and Munich Re in announcing its departure from the Net Zero Insurance Alliance, though it offered no explanation for its decision.

-

The release of Swiss Re, Munich Re, Hannover Re and Scor’s year-end reports provides an update on market conditions.

-

The P&C Re segment recorded large losses above expectations for the sixth consecutive year in 2022.

-

The carrier has increased its retro capacity by 56% to EUR1.34bn.

-

The carrier said it achieved average risk-adjusted price increases of 30% on cat business.

-

Analysts expressed surprise at the “underwhelming” profit and RoE projections.

-

The carrier said GWP was up 12.7% to EUR33.3bn.

-

In a brief update, the (re)insurer said reinsurance revenue is expected to grow by at least 5% at constant exchange rates.

-

Exclusions and coverage changes absolutely make sense as a goal, but some wordings have thrown up additional risks.

-

The transaction is the first proportional deal for cyber risk in the capital markets.

-

Cedants are grappling with rising rates while coverage narrows.

-

Carriers reassured analysts that unrealised investment losses will not seriously affect solvency while sounding a bullish note on renewals.

-

The carrier also offered assurances on the strength of its reserving to combat inflation.

-

The carrier booked a Hurricane Ian loss of EUR276mn.

-

The firm said inflation and modelling changes had driven the need for bigger limits.

-

Winter storms in the first half of 2022 are expected to result in claims totalling EUR1.4bn.

-

This publication’s review of H1 disclosures shows how listed (re)insurers’ nat cat losses have tallied with aggregate projections.

-

In their messages at the Rendez-vous de Septembre, Munich Re, Hannover Re, Swiss Re and Scor signalled a ripe environment to hike prices and adjust terms.

-

The company’s executives forecast further price increases and improvements in conditions across the board for 1.1 treaty renewals.

-

Swiss Re, Munich Re, Hannover Re and Scor have set out their strategies on inflation, pricing and Ukraine.

-

The reinsurer so far has made no claims on its retro protections for war-related impacts.

-

Sharon Ooi joins Swiss Re’s executive board and will be based largely in Hong Kong.

-

The carrier booked EUR316mn in reserves for Ukraine during the first half.

-

Ukraine uncertainties remain despite some loss estimates emerging in Q1 earnings across the Big Four European carriers, while inflation looms on the horizon.

-

The carrier decided against booking a precautionary aviation charge due to a “lack of clarity”.

-

The carrier also took heavier-than-budgeted major losses of EUR336mn.

-

On its earnings call, the company also announced it is buying reinsurance and retro cover on an all risk and war basis.

-

The unit profited despite large losses over 2021 of EUR1.1bn.

-

The reinsurer said it was anticipating increased volume for catastrophe bonds and collateralised reinsurance this year.

-

Scor’s renewals update denotes a continued push to control volatility while Hannover Re is focused on growth.

-

The carrier also trimmed its retro programme in “challenging” buying conditions.

-

The carrier expanded premium by 8.3% at the January renewal.

-

Swiss Re, Munich Re, Hannover Re and Scor have set out divergent strategies on cat as volatility increases and the retro market seizes up.

-

The transaction will free up capital for Hannover’s reinsurance growth.

-

Hurricane Ida will also hit the K-Cession sidecar but not the XoL cover, board member Sven Althoff said.

-

The P&C unit’s combined ratio deteriorated to 101.5% after triple-digit Ida and Bernd losses.

-

The executive said “every reinsurance buyer” underestimated the impact of the flooding.

-

The reinsurer aims to become carbon-neutral in operations by 2030, whilst its reinsurance target date is 2050.

-

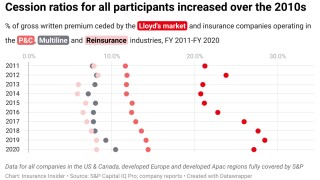

Analysis of financial data shows that the last decade has seen a marked increase in the proportion of premiums ceded by carriers in all sectors.

-

In its renewal season update, the carrier said Bernd, Ida, Uri and the pandemic would force up pricing across lines and regions.

-

The Hannover Re CEO said that the issue of mitigation had become “totally dominant” in discussions about the climate crisis.

-

Despite some rate tapering, the two German reinsurers are expanding premium, as all four carriers enjoyed North American rate increases.

-

The carrier also estimated its own loss from the flooding as EUR200mn-EUR250mn.

-

Hannover Re’s P&C re unit reported Q2 operating profit of EUR466mn ($528mn) compared to a loss of EUR14.9mn last year, as the segment benefited from a significant reduction in large losses.

-

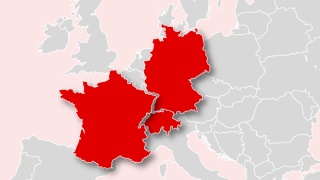

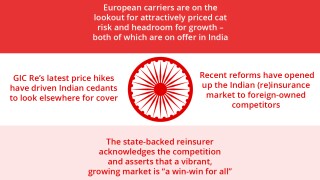

State-backed carrier GIC Re faces competition as the European Big Four press into the subcontinent.

-

Casualty insurance head Bradley Knight will work alongside fellow deputy Barney Smythe.

-

Rate increases are tailing off, but the carriers’ reports reveal divergent growth strategies.

-

The carrier expects rate increases on US and Australian accounts to be smaller than those at 1.1 and 1.4.