Beazley

-

The London carrier has explored how businesses are navigating an era of accelerating risk.

-

Beazley, Hiscox and Lancashire executives spoke 12k words on average in 2025 earnings calls.

-

The argument for buyers to purchase cyber has never been stronger, yet growth is still lagging.

-

Several Lloyd’s syndicates are also now providing cover for the federal insurer.

-

Plus, the latest people moves and all the top news of the week.

-

The carrier is looking to latch onto emerging economic trends where it can add expertise.

-

Most segments have grown premiums so far this year, but only three have observed increased rates.

-

The business is pursuing growth in Bermuda in captives, cyber ILS and alternative risks.

-

In mid-morning training, the share price had fallen by 12%.

-

The venture will launch in early 2026 and include captives, ART, cyber ILS and specialty (re)insurance elements.

-

The carrier plans to invest $500mn in capital to establish a presence in Bermuda.

-

Beazley is one of the key leaders in the London marine marketplace.

-

Stephan Simon left BMS in June 2024 after almost three years in the role.

-

The carrier plans to reduce 623’s stamp by around 10% next year.

-

-

Plus, the latest people moves and all the top news of the week.

-

Top line grew across all carriers even as pre-tax profits dipped.

-

The London carrier missed consensus on gross and net premiums for H1.

-

The carrier booked top-line growth of 2% in H1.

-

Rates were down 3.9% across its portfolio in the first half of 2025.

-

The Beazley CUO said geopolitics would determine cyber market pricing.

-

The executive’s career includes a stint as head of cat for CorSo.

-

Beazley, Hiscox and Lancashire all grew in Q1 despite widespread rate decreases.

-

Plus, the latest people moves and all the top news of the week.

-

CEO Adrian Cox said the market could turn on “unexpected events”.

-

Cyber and property experienced the largest price reductions.

-

It is understood that Marsh brokered the tower, which is exposed to claims from a 2024 breach.

-

Ki cut its top line by 8.7%, while Beazley’s smart-tracker expanded to $481mn.

-

The transactional liability-focused MGA's Lloyd’s line is up from £37.5mn to £40mn.

-

Hiscox, Beazley and Lancashire all reported top line growth, but ROEs dipped in an active wind season.

-

Plus, the latest people moves and all the top news of the week.

-

He said that “everyone’s looking for growth”, as the firm has moderated its top line projections.

-

Predicting underwriting conditions for the remainder of the year is ‘challenging’.

-

The London carrier posted an undiscounted combined ratio of 79%, up from 74% in 2023.

-

Lloyd’s CEO pay is lowest compared to major LSE-traded specialty insurers by a considerable margin.

-

Sara Foucher has held roles at RSA, Swiss Re and XL Catlin.

-

Fast Track is led by QBE and backed by Canopius, Arch and Beazley.

-

The executive has also worked for AIG and Ace.

-

The underwriter will report to group CUO Paul Bantick.

-

A spree of new entrants in the cargo market has resulted in recent talent turmoil.

-

CEO Adrian Cox said Beazley’s recent $290mn ILW purchase was not driven by “capital flexibility in and of itself”.

-

Some US and European cedants will likely see "specific adjustments" to their programmes.

-

The carrier said an active hurricane season and a global cyber event had not altered its full-year guidance.

-

The Flex consortium will offer up to EUR/$50mn limit.

-

The deal has reduced the carrier’s one-in-250-year cyber loss scenario from $651mn to $461mn.

-

Paul Bantick will continue to oversee the cyber risks division during the search for his successor.

-

Sources said that for reinsurers to meet this demand, they will need to get comfortable analysing and evaluating systemic and aggregate risk.

-

The carbon market is viewed as a potential growth class for insurers.

-

The carrier launched into the political violence market at the beginning of the year.

-

Lancashire was the only carrier to see double-digit growth in insurance revenue for H1.

-

Plus the latest people moves and all the top news of the week.

-

The CEO said he expects cyber rates to start flattening post-loss.

-

The executive argued that Beazley’s performance is the ultimate driver of the insurer’s valuation.

-

Growth was driven by active risk selection, as rating environment begins to moderate, said CEO Cox.

-

In messaging to the market, the cyber insurer described the rating environment as “stable and sustainable”.

-

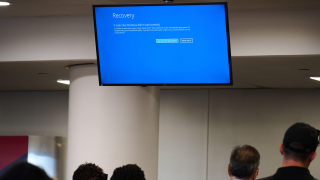

The cyber market should use the latest outage to start decisively taking action on managing cat aggregates.

-

The carrier’s cyber hours clauses and sub-limits will limit exposure, according to the analyst.

-

The current guidance is that Beazley will publish an undiscounted CoR in the low-80s at full year.

-

The incident highlights the aggregation risk around cloud service reliance.

-

A roundup of all the news you need today, including the FCA’s new listing rules.

-

Arch, Axa XL, Beazley, Chubb, Hiscox, Howden, MS Amlin and TMK are participating.

-

Sam Franks will also maintain his current role as head of partner engagement for the region.

-

Lucien Mounier has served for six years as Beazley’s head of Asia Pacific

-

This publication reported in April that Alexandra Barnes had resigned from Beazley.

-

Beazley has two days to amend its complaint, correcting jurisdictional deficiencies.

-

The carrier has also hired Victoria Burnell from Tokio Marine Kiln to join the energy team.

-

Beazley CEO Adrian Cox said that the carrier’s growth rate would slow as market conditions shift.

-

The track record of smart-follow vehicles is still young, but the segment is gaining traction.

-

-

The carrier confirmed a combined-ratio guidance in the “low 80s” for the year.

-

Staff turnover has been elevated in the energy market this year.

-

The short-term disruption of relisting may be justified by the long-term benefits.

-

Christine LaSala will step back from her board membership at the end of this month.

-

The partnership will add more capacity on the platform from April.

-

For the 2022 year of account, the updated forecast remains unchanged.

-

Hiscox, Beazley and Lancashire all delivered one-off capital returns while swerving casualty issues.

-

The carrier reported $1.2bn profit and 71% CoR for 2023.

-

Beazley was one of the first four cyber cat bond sponsors.

-

Beazley also confirmed the appointment of CFO Barbara Plucnar Jensen.

-

Slipstream will be available to marine, cargo and logistics UK clients.

-

Beazley is expected to announce its year-end results on 7 March.

-

-

The MGA previously hired Sara Valentine from Brit to launch in energy.

-

Koscondy will set the global production and distribution strategy of all of Beazley’s cyber business sub-$250mn.

-

Aidan Flynn said that although different markets are expected to move at different speeds, the underlying trend is clear.

-

Growth opportunities at Lloyd’s no longer limited to top underwriting performers, Insurance Insider’s survey shows.

-

Cat losses were within budgets despite high levels of minor events.

-

CEO Adrian Cox said the market has continued to soften more than Beazley initially anticipated.

-

The carrier attributed growth in the division to "exceptional" conditions in the property market throughout the year.

-

Brenna Westinghouse joined Beazley in 2017 after 14 years at Marsh.

-

The rating reflects “the entity’s role and strategic importance to Beazley as an excess and surplus writer in the United States”, AM Best said.

-

The proposals, published in July, would have placed additional reporting burdens on large UK firms.

-

The carrier is looking to grow its direct underwriting capabilities, focussing on the offshore wind market.

-

Panellists at the Dive In Festival explored the link between innovation and inclusion and why it's important to them as leaders in their respective fields.

-

The attack came from a hacking group known as Scattered Spider, an affiliate of the ALPHV/BlackCat ransomware gang.

-

The carrier increased gross written premiums by 13% to $2.92bn, while the combined ratio deteriorated by 13 points from a prior-year figure of 71%.

-

London’s major carriers have projected bullish messages on a prolonged hard market for property, while acknowledging other classes are in very different cycles.

-

Sally Lake has spent 18 years at the carrier, including the last five as CFO.

-

Beazley and Lancashire’s plans to launch US units exemplify wider competitive challenges that the market must overcome to thrive.

-

The carrier’s before-tax profit leapt by $356mn to $547mn under the new IFRS 17 reporting standards.

-

The carrier warned that if members do not back its proposals, it will continue with plans for a US E&S carrier without compensation.

-

This came after the firm said it had begun the process of moving its US E&S business off its Lloyd’s paper as it sets up a new E&S carrier.

-

The CEO said the business shift would be structurally simpler, as he said Beazley was “very confident” on its reinsurance cover despite exposure to Vesttoo.

-

The carrier reported a 66% increase in GWP for its property business.

-

The London market businesses face potential fallout as Vesttoo investigates collateral inconsistencies.

-

The revision reflects AM Best’s expectation that Beazley will maintain its risk-adjusted capitalisation "comfortably at the strongest level”.

-

Staffing turmoil is ongoing in the marine market as companies vie to secure talent.

-

Beazley’s Smart Tracker Syndicate was granted full syndicate status from the start of this year.

-

Amplify will initially cover property before moving into other lines, such as financial and professional liability and cargo.

-

The underwriter headed one of the largest hull and war books in the London market.

-

Despite leaving the alliance, Beazley said it “remains fully committed” to its transition to net-zero.

-

Guy Carpenter was the sole placing broker sourcing capacity for the tie-up.

-

Most carriers were keen to talk about how they are taking on the ongoing hard market in Q1, but some complexities partly offset their good news.

-

Beazley CEO Adrian Cox told investors the carrier's cyber expectations remained “unchanged” for the year, despite predicting a slowing of growth into Q2.

-

The carrier attributed its growth to a 56% increase in its property risks and 24% increase in its cyber business in the first quarter of the year.

-

Reforms to the UK listing regime may enhance prospects of an insurance firm opting to IPO in London in future, but several broader problems, including liquidity issues, will also affect such a decision, according to industry sources.

-

The cybersecurity professional has more than 20 years’ experience.

-

The resolutions received 60.76% and 60.85% of votes, respectively, falling short of the 75% threshold needed to pass.

-

A recent rise in ransomware incidents – along with pricing deceleration, attracting capital, and the Lloyd’s cyber war exclusions – were among the hot topics at Zywave’s cyber conference in London.

-

The cross-line facility launch – in a generally firm market – suggests that the tech-driven era of facilitisation is continuing to gain pace.

-

Details on Beazley’s cyber war product are yet to come to light, but there are questions outstanding on event definition, wordings and whether the market will follow.

-

The new product is being developed to meet client demand for the coverage as the Lloyd’s market prepares to exclude cyber war as a peril from 31 March.

-

The collapse of Silicon Valley Bank is creating investor fear across the global financial services sector.

-

CEO Adrian Cox and CFO Sally Lake are set to lose more than £100k each in long-term share awards after the accounting error.

-

Beazley executives spoke of further growth prospects in the class, after its results revealed a 79% combined ratio for its cyber division in 2022.

-

With the new war exclusions starting to take effect from Q4 last year, the executive expects a disorderly few months before the market reaches equilibrium.

-

The carrier said an investment loss of $179.7mn largely offset 14% GWP growth over the period.

-

As Adidas terminated its partnership with Kanye West following his antisemitic tweets, it projected a loss that signalled why insurers should be pushing the need for brand reputation insurance.

-

The executive is set to replace David Roberts as chair.

-

Fred Kleiterp will leave his current role as CEO for EMEA at Swiss Re Corporate Solutions to join Beazley in June.

-

Beazley’s $45mn first-time cyber cat bond offered all-perils coverage, though some expected early deals to start with limited scope.

-

The cat bond will pay out to Beazley if total claims arising from a cyber attack on its clients surpass $300mn.