Chaucer

-

Jo Smart has worked for Torus and Aegis during his two decades in the market.

-

The Miami-based executive assumes the role left vacant by April McLaughlin.

-

The insurer is weighing up options including entering new geographies and M&A.

-

Chance Gilliland spent a decade at Chubb underwriting property binders.

-

The executive will oversee Howden Re’s treaty and fac business in Miami.

-

The announcement comes after similar launches with Inigo and Atrium.

-

Alex Nelson will work as head of power and renewable energy at the carrier.

-

The carrier has appointed Ivan Sit to head up the operation.

-

A significant amount of new capacity has flowed into the political violence and terror market in recent months.

-

The executive will take up her role on 1 January 2025.

-

Chris Cane and Jaime Hunwicks join from Talbot, Jonathan Bint from Chaucer and Molly Ashcroft from Axis.

-

The underwriter has spent a decade at Chaucer.

-

The executive worked with Artificial Labs on Chaucer’s underwriting platform.

-

The executive will join the company next month, reporting to CUO Nicola Stacey.

-

The executive will replace David Bendle on his retirement at the end of 2024.

-

The terrorism product, led by Chaucer, will offer an initial line size of $100mn.

-

Casper was launched last year by Argenta deputy active underwriter Bradley Knight.

-

-

Combined ratios have improved as prices rise and investments return to profit.

-

The launch is Chaucer’s first foray into the class.

-

Alexander Baker was a senior PV, war and terrorism underwriter at Axa XL.

-

She replaces Mark Walker, who moved last year to become head of national business for the UK.

-

Milner was appointed CEO of Aspen UK in 2020 and has held a number of senior roles within the market.

-

Prior to his resignation, Stubbs held the role of deputy class underwriter at Chaucer Group.

-

The carrier said the decision was the culmination of a “series of strategic portfolio adjustments”.

-

Mallen previously spent over 10 years at Chaucer, most recently as a US casualty reinsurance underwriter.

-

The carrier is looking to grow its direct underwriting capabilities, focussing on the offshore wind market.

-

Insurance Insider explores how insurers can manage the dual, polar-opposite pressures of a litigious anti-ESG movement and net-zero climate activism.

-

The hires come as part of a restructure of the marine and energy segment of the business.

-

The carrier is hiring in its energy team following the resignation of natural resources head James Brown.

-

The London market businesses face potential fallout as Vesttoo investigates collateral inconsistencies.

-

The underwriter has worked at the carrier for almost 20 years and has a background in specialty reinsurance.

-

Chaucer joins RSA, Liberty and Axa in the quota share arrangement.

-

There is stiff competition in the renewables space as carriers look to establish positions in a growth market.

-

He steps into the role vacated by Richard Harries, who will retire at the end of the month after more than 26 years at the carrier.

-

Group CFO Rob Callan will take on the role of group interim CEO while Chaucer looks for a successor.

-

Andrew Pearce joins following a 16-year tenure at the consulting firm.

-

Simon Tighe is taking on the group ESG position in addition to his role as group head of investments and treasury at Chaucer.

-

Signatories of the UN’s PSI must abide by four key principles, including embedding insurance-related ESG issues into decision-making.

-

The underwriter will work out his notice period at Chaucer, which remains active in the natural resources class.

-

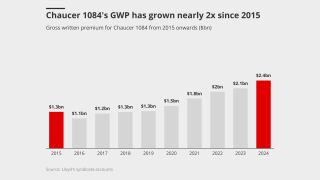

Syndicate 1084 reported an overall profit of $16.6mn compared to $129mn in 2021, as net incurred losses increased by just over $227mn.

-

The longstanding Chaucer underwriter left when the carrier exited the FI market last year.

-

Intellectual property coverage is seen as a growth market for traditional insurers.

-

The products are designed to protect against instances of purchased carbon credits failing to materialise.

-

Announcements and interviews at the UN conference have shed light on the tools emerging to help carriers decarbonise their underwriting portfolios.

-

Jodie Major worked for Chaucer’s financial institutions team, and the carrier has recently exited the market.

-

The carrier has also exited the downstream energy and financial institutions markets in recent weeks.

-

The move is the second recent class-of-business exit, with the business also having withdrawn from downstream energy.

-

Chaucer CEO John Fowle also set out to Insurance Insider the rationale for the carrier’s new ESG scorecard comprising 158 data points.

-

There has recently been a string of major claims in the downstream market, making underwriters question rating trajectory.

-

Chaucer’s global head of marine Philip Graham also chairs the influential facts and figures committee of the International Union of Marine Insurance.

-

The incoming cyber head will step into the role left by Laura Hunt, who joined AIG last month.

-

The commitment includes achieving greenhouse gas neutrality across its global underwriting and investment portfolios.

-

The carrier launched a dedicated renewable power offering at the start of 2022, led by Lyndsey Picton.

-

With the Lloyd’s Lab in its fourth year and poised to welcome cohort eight to its incubator, Insurance Insider examines its impact so far.

-

The syndicate also increased gross written premiums by 17.6% to $1.7bn, amid favourable market conditions in most classes.

-

The scorecard will assess a company’s ESG profile, taking areas such as water management, air pollution, D&I, and local infrastructure into account.

-

The energy division at Chaucer will now be split into two teams: renewable power and natural resources.

-

In his new role, Raj Nanra will be responsible for the leadership, strategic delivery and financial result of SLE Holdings (SLE Worldwide Australia).

-

Joe Murphy has left his senior underwriter post to join the Ryan Specialty Group-owned MGA.

-

The promotions precede the retirement of both Ed Lines, active underwriter of Syndicate 1084 and Colin Clulow, head of property division, at the end of 2021.

-

The upgrade seeks to reflect the strength of Chaucer Insurance Company and its parent company China Re’s balance sheets, S&P said.

-

The appointment follows the departure of underwriter Alex Harris, who has joined Antares.

-

The respected underwriter, who has worked at the business for more than two decades, will be replaced by Harriet Sharp.

-

The marine specialty unit will include marine PI and transport logistics and freight forwarder business.

-

Demand is growing for insurance capacity to cover less carbon-intensive energy sources.

-

Political risks and contract frustration coverage will now be available alongside the original political violence offering.

-

Specialty (re)insurer Chaucer has appointed Xamira Groves as its new head of insurance, where she will work closely with the group’s syndicates to expand global market share across multiple P&C lines.

-

Markel, Beazley, Hiscox, Chaucer, Brit and Liberty Specialty Markets are all participants in the product development.

-

The consortium, created with China Re, will later expand to include other lines of business.

-

The marine, energy and aviation chief will work as deputy active underwriter until the end of the year.

-

The Chaucer CEO on international expansion, casualty reserving and the long road to price adequacy.

-

The insurer is to occupy three floors in the tower, taking up 44,000 square feet of office space.

-

The local underwriting head steps up to run the Irish operation.

-

Ben Goldsmith was a political violence underwriter for just over two years and before was a vice president at Bowring Marsh.

-

Insider Deborah Wyatt takes his place, while Neil Edwards assumes the deputy head role.

-

April McLaughlin will manage and expand its multi-line reinsurance offering within the region.

-

Protest losses, which were covered under its property programme, came to around $100mn, leading some carriers to exclude the cover.

-

The Irish entity created for Brexit seeks authorisation on the island.

-

The former XL Catlin COO replaces Chris Stooke, who has spent almost a decade at the carrier.

-

The team had already expanded in December with hires from MS Amlin and Syndicate 2525.

-

Chaucer leads the standalone cover, bought after the Chilean retailer’s property policy excluded the risk.

-

The NAIC has given authorisation for Chaucer to write the lines of business through its Irish subsidiary from 1 January.

-

Senior hires join from Chubb, Brit and Liberty Specialty Markets.

-

Thomas Beasley joins from MS Amlin and Rob Neil from Syndicate 2525.

-

The product features fixed payment for a terrorism event within the insured’s post code, irrespective of physical damage.

-

An accelerated share buyback and a special dividend will complete the deployment of the $850mn generated through the China Re deal.

-

Head of specialty Peter Glanfield and head of professional indemnity David Cable are among those under consultation.

-

Colm Sheedy will work alongside senior class underwrtier Joe Murphy to expand the book.

-

The merger with Syndicate 2088 and a 2020 pre-emption brings the number of £1bn-plus syndicates at Lloyd’s to 11.

-

The rating outlook is stable.

-

Craig Curtiss and Callum Bennett will join a team run by Andrew Bauckham.

-

CEO John Fowle will relinquish the underwriting role on the arrival of Nicola Stacey.

-

Noufal Manzil joins from Talbot, which recently closed its Lloyd’s Dubai platform.

-

Jonathan Sutcliffe will become head of underwriting at Chaucer Dublin but remain active underwriter at Syndicate 2088 until the end of the year.

-

The platform offers on-demand insurance to commercial drone pilots.

-

The international GL specialist departs after nine years.

-

The disposals mark the completion of the US carrier’s $865mn sale of Chaucer to China Re.

-

The executive takes on management responsibility for aviation and marine .

-

The syndicate remained in the red in 2018.

-

The casualty specialist calls time after more than a decade at the carrier.

-

Richard Taylor joins the MGA from CMS.

-

David Bruce has been appointed CEO of the new subsidiary.

-

The regulatory investigation relates to coverage provided under a group insurance policy issued to the NRA.

-

Settle in for The Insurance Insider’s 12 days of Insurancemas.

-

The Brussels competition regulator sees no cause for concern arising from “horizontal overlaps” between the two entities.

-

Stamp movements show the aftermath of this year’s tough planning season.

-

The UK-based sidecar writes a quota share of the carrier’s treaty and D&F books.

-

The US carrier says buybacks will be a ‘meaningful component’ of its strategy as it rules out major M&A.

-

Market observers may well look back on the China Re-Chaucer acquisition as a turning point for the involvement of Asian money in Lloyd’s.

-

The deal values the London market carrier at 1.66x tangible equity as of 30 June this year.

-

The German insurer joins The Hanover in support of Bascule Underwriting.

-

The Insider 50 contracted marginally last week as most companies in the index stagnated

-

The parties are waiting for an indication from the Chinese authorities on whether a deal would receive approval.

-

Carriers with a cornerstone position in one market have much to gain from operating on Lime Street.

-

In the newly created role, he will also collaborate with the cyber team of Chaucer.

-

The Chinese state-owned reinsurer is the high bidder by a substantial margin.

-

Bruce Carman’s new venture has named Will Gaunt as class underwriter.

-

Conservatism in The Hanover board could yet delay the outflow of Chinese money into the insurance sector.

-

Final round bids for The Hanover’s Lloyd’s business are due 29 June.