Marsh McLennan

-

He will join Gallagher as chief broking officer for EMEA transaction solutions.

-

This publication revealed the GC trio were set to join the start-up broker in June.

-

Fears relating to an economic downturn continue to dominate concerns.

-

Marsh has accused its former execs of flouting a preliminary injunction.

-

Marsh is also seeking expedited discovery in a related talent poaching case.

-

The lawsuit alleges that Marsh misnamed the insured party on the policy.

-

Parties will now brief on a request for a preliminary injunction on an expedited timeline.

-

Liberty recently restructured its UK and MENA underwriting leadership.

-

Chris Lay will retire from the business in Q1 2026.

-

A motion by defendants to dismiss the case was also denied.

-

Tim Wakeman joined Marsh in 2021 and previously worked at Elseco.

-

The move comes after the withdrawal of a complaint in the Delaware court.

-

A New Jersey judge also refused to grant WTW’s request for a restraining order.

-

The Marsh-placed account renews its all-risks cover on 16 November.

-

Marsh is also suing a second tier of former Florida leaders.

-

The move comes as Michael Creighton is made credit and political-risk director for Africa.

-

Willis Re kicked off its talent acquisition with mass hiring from Guy Carpenter over the summer.

-

The broker said WTW hasn’t shown it was irreparably harmed by the defection.

-

Property pricing fell by 8%, while casualty rate increases tapered to 3%.

-

Plus, the latest people moves and all the top news of the week.

-

Property, cyber and workers’ comp rates were all down mid-single digits, offsetting casualty hardening.

-

The broker’s new business and client services division is targeting $400mn of savings.

-

Earlier this week, the broking house announced a rebrand to Marsh.

-

Guy Carpenter will rebrand as Marsh Re, as a new central tech/operations unit is created.

-

Plus, the latest people moves and all the top news of the week.

-

Willis claims at least two $1mn accounts were also unfairly lost to Howden.

-

Sources said Marsh Specialty UK growth leader Lizzy Howe will lead the operation.

-

The aviation market has experienced a run of large losses this year.

-

According to McKinsey, the projected spending on data centers is expected to hit $6.7tn by 2030.

-

Ex-Western Europe CRB head Alberto Gallego and colleagues left for a Marsh joint venture.

-

Company said defendant ‘distraction’ can’t make up for flimsy arguments.

-

After spending 20 years at Aon, Goodman will start a senior executive position with Guy Carpenter.

-

Parrish, now Howden US CEO, and his colleagues said they didn’t violate contracts.

-

Patton Kline succeeds Glod as US aviation and space practice leader.

-

A key hearing in the poaching case is set for 4 September in New York.

-

US retailers have various levers to pull to put pressure on potential new competitors.

-

The broker has been on an aggressive hiring spree overseen by Lucy Clarke.

-

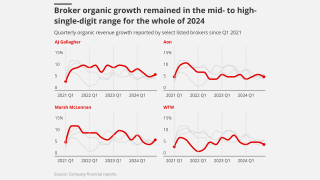

However, group organic growth among public brokers has slowed to pre-pandemic levels.

-

The plaintiffs seek a declaration that part of Marsh recruits’ restrictive covenants are unenforceable.

-

The suit asserts the raid will cause “incalculable harm” to the broker.

-

Plus, the latest people moves and all the top news of the week.

-

The broker is looking to move as much of the book away from its adversary as possible.

-

The lawsuit claims more than 100 employees left with Parrish and his three reports.

-

Staff targeted include producers that channel business through Howden’s London wholesale arm.

-

Property rates declined by 7% globally in the second quarter.

-

The expansive European broker is targeting Mike Parrish’s team and former McGriff staff.

-

Claims were concentrated in the US, with a significant increase in D&O class actions.

-

The technology will help analyse growing and emerging risks, especially climate change.

-

Total revenues grew 12% due to the contribution from acquisitions.

-

The latest hires follow Rob Hale’s move to Willis.

-

The broker made several senior energy hires from Marsh last year.

-

Marsh’s property book saw an average decline of 9% in Q1, a trend that appears to have continued through Q2.

-

Willis has been adding brokers to its aviation unit in Europe and the US.

-

Clients are increasingly using captives because of uncertainty around long-term capacity commitments.

-

Gallagher, Marsh and Aon also faced sizeable outstanding premium payments as at Q4 2024.

-

The claim hits the downstream market following a loss-hit start to the year.

-

He was most recently Marsh’s US manufacturing and automotive practice head.

-

Premium rose across the top 15 P&C risks in 2024.

-

The facility, backed by six global cyber insurers, offers limits of as much as EUR5mn.

-

Brokers across London and Bermuda have handed in their notice to join the start-up reinsurance broker.

-

Saul Nagus is the latest from Marsh’s aviation unit to join WTW.

-

Marsh McLennan canvassed finance directors and sales leaders across a range of sectors.

-

Willis has made a series of aviation hires on both sides of the Atlantic in recent weeks.

-

The broker replaces Louise Nevill, who is joining Axa XL as CUO for specialty.

-

The broker has also held positions at JLT, Towergate and THB.

-

Ransomware threat actors are continuing to attempt ‘smash and grab’ attacks.

-

The executive led Ferma for 10 years.

-

Christian Kitchen had been at Travelers since October 2022.

-

The pair add to the roster of aviation-focussed hires at WTW.

-

The hires form part of WTW’s build-out of its US aviation practice.

-

The only major product line to see rate increases was casualty.

-

Marsh alleges Aon also went after its clients as well as its employees.

-

California wildfires had ‘little or no impact’ on property cat pricing at April 1, Dean Klisura said.

-

Guy Carpenter president Dean Klisura added that Q1 was a record cat bond issuance quarter.

-

The growth figure represents a 5-point deceleration on the 9% reported in Q4 2024.

-

The UK broker is still in talks with Mubadala about a standalone investment in the business.

-

It is understood that Marsh brokered the tower, which is exposed to claims from a 2024 breach.

-

-

Willis said rising energy demand is creating a revival in the nuclear industry.

-

The broker has recently unified its global financial lines practice.

-

Adam Russell most recently held the role of head of strategy for global placement.

-

The broker has also named Andrew Herring chair of the division from next year.

-

The broker has launched a company market section of the facility called Encore.

-

Andrew George will report to president and CEO of Marsh Martin South.

-

Nevill has extensive experience in underwriting at Talbot, WR Berkley and Markel.

-

Fast Track is led by QBE and backed by Canopius, Arch and Beazley.

-

The crash is the latest of several losses for aviation insurers in recent months.

-

Claims in recent months have brought a period of benign loss activity to an end in the class.

-

Plus, the latest people moves and all the top news of the week.

-

Single-digit organic growth, robust casualty pricing and tapering margins were all key trends.

-

The Pacific region led the quarter’s price decline at -8%.

-

The executive will link up again with former colleague Lucy Clarke in Q2.

-

Guy Carp CEO Dean Klisura said LA wildfires could slow rate reductions at 1 April.

-

Organic growth in broking segment Marsh accelerated during the reporting period.

-

Panellists discussed the softening market, and what would flip the switch on rates.

-

Rivera will succeed current CEO Carlos Rivera, effective 1 January.

-

Samer Ahmad was with Marsh for more than seven years.

-

The Indonesian flag carrier moves during the busy Q4 airline renewals.

-

The long-serving Aon broker specialises in the placement of cruise portfolios and Norwegian accounts.

-

Alistair Brighton will succeed Alistair Fraser as CEO for corporate and commercial in the UK.

-

The facility is backed by Sompo, Brit and Talbot, and benefits from We2Sure’s tech offering.

-

The promotion is effective as of January 1.

-

DeWitt was recently VP of financial planning and analysis and head of investor relations at Marsh.

-

Prior to the event, clients were expecting a “very competitive market environment”.

-

Organic growth fell by 1 point quarter on quarter and was down by 5 points from Q3 2023.

-

Elaine Casaprima will serve as CEO of the combined entity.

-

The broker confirmed Darren Jones and Ian Curtin were also joining the firm.

-

The transaction will be one of the largest involving two strategics in broking history.

-

The vehicle provides coverage for non-physical damage BI.

-

The account is among a handful of airlines that have swapped out their brokers this year.

-

Kristof De Bremme will relocate from London to Brussels, reporting to Europe CEO Christos Adamantiadis.

-

The brokers called on the industry to “catalyse” the country’ growth by removing blanket exclusions.

-

A whitepaper published by the two companies set out measures that could create cyber insurance capacity.

-

Sources said that the business will be marketed off adjusted Ebitda of ~$500mn, including a title broking asset.

-

Will Curran is moving into broking after a career in underwriting, mostly at Tokio Marine Kiln.

-

The duo will be reunited with former colleague Tim Martin.

-

The facility automatically follows the lead market which offers the lowest quote.

-

The facility launch comes after Marsh launched its Slipstream marine facility.

-

The quarter was the first period where prices didn’t increase since the third quarter of 2017.

-

The executive said challenging loss cost trends were contributing to rate rises.

-

Earnings per share were up 10%, while the margin expanded by 1.3 points.

-

Steadfast, AUB and BMS have joined the top 20.

-

The moves are the latest in a period of personnel upheaval in the energy market.

-

Seven members of the construction team have resigned, including construction practice leader Patrick Baker.

-

-

Loss assessment is ongoing but the event looks likely to be a total loss.

-

Darren Howlett was a member of Marsh’s relationship management executive leadership.

-

Renewable energy assets have been plagued by severe weather losses.

-

Cyber insurance rates for UK clients dropped 12% on average, Marsh said.

-

He will report to Cynthia Beveridge, global chief broking officer for commercial risk.

-

Since 1 January, the market’s potential descent into freefall has been closely watched.

-

WTW is looking to strategically hire across its business, having rebuilt its team following the failed Aon merger.

-

The broker had been vying with Marsh McLennan and AJ Gallagher.

-

The broker said the $125mn excess cyber vehicle is now the largest of its kind.

-

The practice aligns existing capabilities from Marsh Specialty and others.

-

Global commercial insurance rates rose 1% in Q1, down from a 2% increase in Q4 2023.

-

The US casualty market was “challenging”, the executive said.

-

The Q1 figure represents a 2-point acceleration on the 7% reported in Q4 2023.

-

Graham Knight will become chairman of natural resources.

-

Rates continue to trend downwards in the D&O class of business.

-

The move comes as rates continue to decrease in the D&O class.

-

-

The talks are advanced, and the process is likely to move rapidly.

-

The move reunites Van Leuven with former colleague Kristof De Bremme.

-

Marsh Specialty has released its Political Risk Report 2024.

-

The marine hull market is looking to retain rating robustness in 2024.

-

The facility was launched in November for grain shipments.

-

Brokers face pressure on margins as the market’s firming phase slows

-

Slipstream will be available to marine, cargo and logistics UK clients.

-

The broker had approached underwriters to consult on additional brokerage of 0.5%.

-

Insurance Insider reported last year that the facility was relaunching.

-

Trading on a data-first approach marks a 'new era of innovation', execs said.

-

Shannan Fort was a partner in McGill’s FI and cyber team.

-

-

The broker also announced Rob Geraghty as her successor.

-

Falling rates in finpro and increased competition in property drove the trend.

-

The CEO flagged a trend towards mega settlements and said there was concern around the direction of loss costs.

-

Property rate increases decelerated to 6% in Q4, compared to slowdowns of 7% in Q3 and 10% in Q2 2023.

-

The broker’s growth was down 3 points on the 10% reported in Q3 and level with the 7% posted in Q4 2022.

-

The executive has headed up Marsh’s Pacific region for the last four years, having joined via the acquisition of JLT.

-

The senior upstream energy broker departed Marsh last autumn.

-

In October 2023, it was announced that Powell was leaving Marsh to join WTW as the broker’s global chief claims officer.

-

Discussions include insuring military risks in the field of air and business travel to Ukraine.

-

The 737 Max fleet was previously grounded in 2019 following the fatal crashes of Lion Air Flight 610 and Ethiopian Airlines Flight 302, when Boeing had a $500mn sub-limit on such claims.

-

The Global Risks Report 2024, made in partnership with Marsh and Zurich, shows that extreme weather events, misinformation and disinformation are top risk severity concerns.

-

AIG leads the placement, WTW is the lead broker, with Marsh support, on the JAL account.

-

The Hartford, Canopius, Newline, QBE, CNA Hardy, Travelers, Hamilton and Volante are participating in the facility.

-

The broker, who has worked at Marsh since 1989, will report to John Donnelly and Chris Lay.

-

Gamze Konyar has been promoted from her prior role as head of Marsh’s cyber practice for the Central and Eastern Europe and Eastern Mediterranean regions.

-

The broker’s global marine team services global premiums of $3.9bn across marine classes.

-

Canopius will write a 2.5% line on the multi-class facility, while Axa XL will write 1%.

-

Unity will provide $50mn of coverage supporting the export of grain and other commodities.

-

Donnelly will take up the role on 1 January 2024 and will be responsible for Marsh’s retail and wholesale broking activities.

-

This publication confirmed the move in September

-

The broking executive had a key role in the launch of Marsh’s Fast Track facility.

-

Commercial insurance pricing remained flat, increasing by 3% globally over the period, the same as the prior quarter.

-

Marsh cites its primary listing on the NYSE, along with the costs and administrative burdens of listing on LSE, as reasons for delisting.

-

Current cyber brokerage leader for the US and Canada, Meredith Schnur, will succeed Reagan as cyber practice leader, US and Canada.

-

Hema Mistry returns to the UK to run the finpro division, following a stint at the broker in San Francisco.

-

Plus, all the latest company results, executive moves and top news from the week.

-

Last week, this publication revealed that Howden agreed to pay Guy Carpenter in excess of £50mn ($61mn) to settle the poaching suit related to Massimo Reina and a defecting European team.

-

Concern around prior-year loss development and social inflation is impacting the market.

-

Adjusted earnings per share increased by 33% and the group also reported margin expansion.

-

Sources said a move towards facilities was the latest evidence of market softening in the D&O class.

-

The executive was Marsh McLennan’s global chief claims officer and will join WTW early next year.

-

Pat Tomlinson will also step into the role of president and CEO of Mercer and vice chair of Marsh McLennan when his predecessor, Martine Ferland, retires in March 2024.

-

Upstream energy broker David Patten has also left Marsh.

-

Jay Payne has been with Marsh since 2019 and was head of retail and cargo sales leader.

-

-

On completion, Honan CEO Fluitsma will report to Marsh Pacific CEO Nick Harris.

-

The broker argued that it was not “reasonable” to overstep its position as broker to Greensill, the failed supply chain finance firm, and provide certain information to White Oak.

-

Guy Carpenter has succeeded in bringing Ronda into the suit, while Baotic and Nicosia will not be added.

-

Robson has been named global chairman of credit specialties, both reporting to Donnelly.

-

The US and Europe have shown concerns over Lloyd’s of London war exclusion wording, the report shows.

-

Outgoing CEO Brian Hanuschak was named chairman and will remain as a strategic advisor to the MGU.

-

Areas of focus should include hiring external talent, securing capital for M&A, speeding up US growth, and answering the reinsurance question.

-

Pat Donnelly has succeeded Lucy Clarke at Marsh, and Adam Garrard at WTW has moved into a chairman role.

-

Global property cat rates were up 30% during the quarter.

-

Global property cat reinsurance posted the most notable risk-adjusted rate increases, spiking about 30% on average, with loss-impacted clients seeing higher pricing.

-

The results represent a return to double-digit expansion following three quarters of single-digit growth.

-

Kelly Butler will be responsible for the strategic development and delivery of Marsh UK cyber insurance and placement capabilities.

-

The executive will report to international segment co-heads Adam Clifford and Jason Keen.

-

The insurance industry is looking to play a part in supporting the rebuild of the war-torn country.

-

The supply-chain finance firm dramatically collapsed in 2021 after its trade credit insurance was pulled.

-

There are more examples in the market of more experienced entrepreneurs going out to get capital to start up and "do it themselves”, according to CIO Dan Topping.

-

The executive was previously co-CEO of First Republic Bank.

-

Lloyd's chief of markets Patrick Tiernan set out some of the reasons why Lloyd's controversial approach to cyber war segregations could have had a "softer landing".

-

Miller has made a string of senior hires in its marine team in the past few months.

-

Chris McTear joined Aon in 2018 and has previously worked as part of the Airmic Insurance Steering Group.

-

The endorsement allows for broader coverage, as it includes a writeback on collateral impacts arising from a cyber operation that is carried out as part of a war.

-

The broker is targeting to double its revenues to £400mn by 2025.

-

The broker has hired Tom Summers and Tyler Walsh from Marsh and Adam Carr from Howden.

-

The first risks have already been bound under the facility, with work to place a further 5% ongoing.

-

Most lines continued to record price increases, with global rates being propelled largely by rising rates in property insurance.

-

The broker said pricing reductions might decelerate throughout the year if carriers perceive increased risk.

-

Plus the latest executive moves and all the top news of the week.

-

The broker expects the restructure to result in savings of $300mn by 2024.

-

Primary insurance rate increases were 10% for property in Q1 compared to 7% in Q4.

-

The broker said US property cat reinsurance rates increased by 40% to 60% in April for clean renewals.

-

The increased growth from Q4 halts a trend of gradual deceleration experienced through 2022.

-

The cross-line facility launch – in a generally firm market – suggests that the tech-driven era of facilitisation is continuing to gain pace.

-

The facility will be the largest to launch since Aon Client Treaty in 2016.

-

The new facility will provide coverage for all major lines, except motor, and is backed by several A-rated Lloyd’s insurers.

-

The loss hits a market grappling with social and economic inflation, plus increased reinsurance costs.

-

Political instability, economic retrenchment, competition for strategic resources and supply-chain diversification are contributing to increasing risk.

-

The executives bring diverse management experience from energy, motor, publishing and agriculture.

-

With brokers shifting to new providers to place certain classes, and competition among e-trading firms intensifying, the placement platform landscape has reached a crucial turning point.

-

The broker’s London market specialty unit is on the brink of closing a deal with Whitespace to place North American casualty risks on the e-placement platform.