Ardonagh

-

The MGA has also appointed Probitas alumnus Kiran Wignall.

-

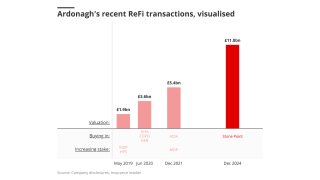

The deal, revealed by this publication in December, values the firm at $14bn.

-

Reported income for the year rose 24% to $1.98bn.

-

The insurer has participated on McGill and Price Forbes facilities, as well as Amwins.

-

Ian Donaldson and Craig Ball will rejoin Ardonagh in new roles focused on AI.

-

The strong deal multiple underscores the view of London as a “gateway to the world” for brokers.

-

Insurance Insider revealed yesterday Stone Point will join Madison Dearborn and HPS as shareholders.

-

It is understood that Lectio is now at ~$160mn of premium and could rise to $270mn next year.

-

Paul Nolan is expected to join Globe in July 2025.

-

-

Geo Europe CEO Walter Craft will remain with the financial lines business.

-

The downstream market is expected to soften in the second half of the year.

-

The broker has spent the bulk of his career handling major accounts.

-

The broker will become director of marine at the Ardonagh subsidiary.

-

Dan Walsh has led Aon Client Treaty for the past six years.

-

Capital is looking for opportunities to build international specialty businesses out of EC3.

-

The Ardonagh brand hired several casualty brokers from Miller last summer.

-

Current Bermuda CEO Chris Bonard will become president of the unit.

-

The acquisition brings international M&A opportunities and a pipeline of London wholesale business.

-

Paragon co-CEOs James Kalbassi and Tara Falk will become Ardonagh shareholders.

-

The buyer intends to fund the transaction with approximately 50% equity and 50% debt.

-

The broker had been vying with Marsh McLennan and AJ Gallagher.

-

Pro-forma income hit $1.9bn for the year, alongside pro-forma Ebitda of $695mn.

-

The talks are advanced, and the process is likely to move rapidly.

-

The broker aimed to secure better terms and borrow more from public lenders.

-

The pair hail from Miller and Aon respectively.

-

The challenger broker is continuing to build out its presence on the island.

-

The broker has used Whitespace since 2019.

-

Rance’s remit will include credit, marine, cyber, parametrics and motor.

-

The former Accredited CEO spent most of his career at Aon Reinsurance.

-

Investors are still keen on UK broking – but they may expect more for their money.

-

Price Forbes will become the dominant brand, while international CEO Ferguson will exit the business.

-

The transaction will reduce the firm’s reliance on private debt deals.

-

The regulator is calling for comments on the deal by 13 February.

-

The senior upstream energy broker departed Marsh last autumn.

-

The executive will lead for the EMEA region in its strategy and development business segment.

-

Price Forbes has been hiring across specialty lines, and recently appointed Howden’s cargo head Jonathan Eaton.

-

Woolley joined Aon in 2019 as an associate director and has previously worked as head of broker distribution for First Title Insurance.

-

Anthony Erotocritou is now group chief commercial officer, as Andrew Wallin takes the specialty helm.

-

The downstream brokers will join Price Forbes alongside former colleague Dan Nicholls, who left Miller last month.

-

Brokerslink has appointed Antony Erotocritou as a board director representing Ardonagh Specialty.

-

-

The $10bn broking firm is progressing in its pivot towards specialty and international business, and an asset management model.

-

The intermediary business booked 9.5% organic growth in P&C and 14.9% growth in specialty in the first nine months of 2023.

-

The senior retro/specialty broker spent 26 years at Willis Re, which was acquired by Gallagher in 2021.

-

The Swiss business controls around $1.3bn in premium.

-

Mark Shumway joins from Howden Capital Markets, where he has been managing director since 2020.

-

ESG targets and the growth trajectory of renewables is attracting capacity to the class of business.

-

The personal lines strategy mirrors the buy, build and sell playbook you would see from a sponsor.

-

The deal will provide the group with significant additional funds to support M&A in its international and specialty segments.

-

The deal values Ardonagh’s UK personal lines business at around £1.2bn and creates a business with millions of customers.

-

The exec is reunited with former LSM colleague Mark Stephenson, who joined the broker earlier this year following a 12-year stint at the carrier.

-

Sources said Baron is joining Price Forbes after nearly seven years at Aon, where he was managing director based in South Florida.

-

The recruitment continues a period of expansive hiring for the intermediary.

-

Dave Cahill and Adam Power have resigned, as Miller managed to shore up remaining members of its casualty team.

-

They are the latest additions to the Ardonagh team, which has been on a major hiring push.

-

Nine mariners from the former Ed Broking brand have resigned from Ardonagh, as the broker continues its brand consolidation.

-

The business development and market relationships head will join the Ron Hayes-led unit, focusing on specialty.

-

Roger Smith will be building a UK A&H and life team, while Steve Rance looks to develop a global mortgage and credit unit.

-

Group head of M&A Andy Wallin will take over reinsurance and capital on an interim basis.

-

The moves follow a pattern of prolific hiring in which 200 production staff were added across the group’s London business in 2022.

-

The deal would create a consumer distribution behemoth with more than £200mn of Ebitda.

-

Leather, who is set to join in summer, will report to group finance officer Nick Moss.

-

The acquisition comes less than a week after Ardonagh agreed to acquire Dutch specialist commercial lines broker Klap.

-

The acquisition comes after Ardonagh entered the Netherlands market in October 2022 through the purchase of Léons Group.

-

The fast-growing group – which did not exist when the UK voted to leave the EU – is now close to $500mn of adjusted Ebitda.

-

The specialty business – which includes Price Forbes and Bishopsgate – reported 16% organic growth in an integration year.

-

The intermediary has named leaders for each line of business within the two divisions.

-

Morgan Stanley has reached out to sponsors in recent weeks after initial attempts to source a US strategic tie-up.

-

Alun Thomas will report to Bermuda CEO Chris Bonard.

-

The pair will depart as Ron Hayes arrives to drive an acceleration of the specialty unit’s placement strategy.

-

The marine expert worked for Ed for five years, after a career working with Marsh, Miller and Aon.