-

Industry-wide initiatives continue to target expanded youth access to the sector.

-

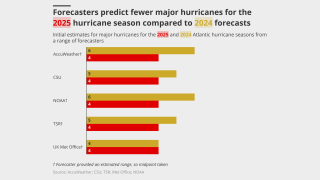

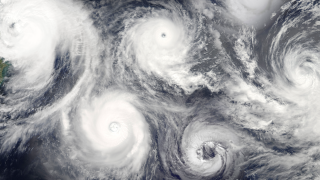

Lack of major cat events could add further pressure on 1 January pricing.

-

Insight into the state of the insurance M&A market, powered by Insurance Insider’s comprehensive deal database.

-

The deal confers a high multiple on Convex and gives AIG re/specialty exposure.

-

Starr’s reinsurance ambitions and embrace of Lloyd’s will be watched closely.

-

Brokers may encourage clients to capitalise on falling rates by boosting coverage.

-

Private capital providers are being signed down as two strong years have piqued interest.

-

Reinsurers are willing to concede on pricing, while cyber interest is on the rise.

-

Part five in our series looks at how AI can empower brokers to add value as well as speed.

-

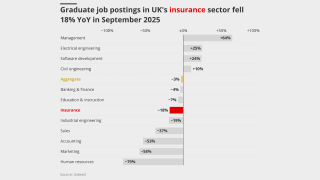

Insurance grad vacancies were down 18% year-on-year in the UK, ahead of a 3% nationwide drop.

-

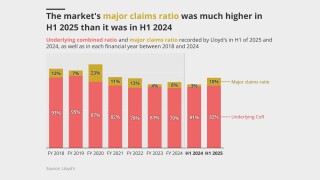

Differentiating Lloyd’s claims performance could help drive business to the market.

-

Carriers are rethinking the traditional renewal-rights model.

-

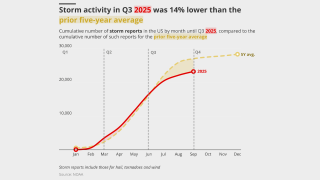

Despite a rocky H1, 2025 insured losses from nat cat events may not surpass 2024 levels.

-

The class offers affirmative coverage for gaps in traditional insurance policies.

-

Continental composite carriers aim to smooth volatility with new initiatives.

-

Several airlines are understood to have come to market early.

-

According to McKinsey, the projected spending on data centers is expected to hit $6.7tn by 2030.

-

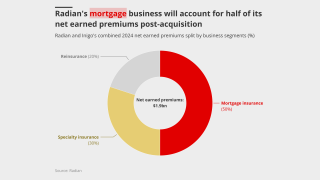

The deal will be watched closely by Radian’s handful of similar peers.

-

Small modular reactors are increasingly viewed as a means of meeting surging energy demand.

-

After losing in the High Court, insurers pin their hopes on the Court of Appeal.

-

Despite formation of Gabrielle, there is "a very high probability" of a below-average season.

-

Part four looks at how the talent landscape will shift in response to AI introduction.

-

The low degree of overlap between the combining portfolios benefits both parties.

-

Organisations were challenged to address systemic DEI failure rather than play “word salad” with labels.

-

Property remains the dominant line, accounting for nearly 30% of total London premiums.

-

Plaintiffs allege that manufacturers and retailers have broken environmental laws.

-

From aviation claims to retention challenges, underlying dynamics will take time to play out.

-

There are concerns that repeated delays could lead to market disengagement with the process.

-

Blackstone-style capital seeking to get closer to source is a net negative for reinsurers.

-

Cedants target methods of reducing pressure on earnings as reinsurers chase growth.

-

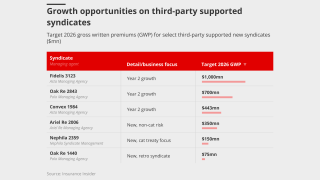

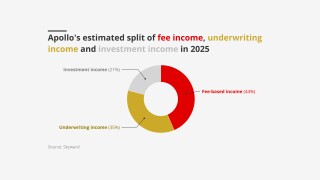

Apollo most recently received in-principle approval for Syndicate 1972.

-

The aviation market may prove an outlier following a disastrous year of loss activity.

-

The private ILS segment took losses from LA wildfires and Mid-West severe convective storms in H1 2025.

-

Reinsurers and their cedants are feeling their books are in better shape, although the market is still uneven.

-

The carrier M&A cycle has started and reinsurance is a segment where acquisitions work better.

-

The post-disaster reinsurance start-up model is changing.

-

Terms are expected to hold, underpinning the stronger recent performance of reinsurers.

-

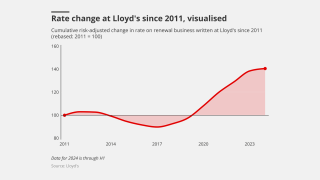

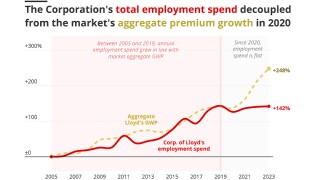

Maintaining underwriting discipline was central to the Corporation's messaging.

-

The cycle-turn M&A story continues with strategic buyers to the fore.

-

Cyber reinsurance supply has continued to outstrip demand during 2025.

-

The Japanese carrier faces integration challenges to make a success of the deal.

-

City firms have introduced perks of extending working from home periods and half days in summer.

-

Insight into the state of the insurance M&A market, powered by this publication's deal database.

-

Rates are bottoming out, but ample capacity is still preventing a hardening market.

-

The Japanese company announced the $3.5bn deal today, three months after the Bermudian completed its IPO.

-

Submission volume is up 10%-20%, according to sources.

-

A notable uptick in attendance underpins the value still placed on the iconic trading centre.

-

The mid-year renewals point to mounting pressure on reinsurance pricing.

-

Part III of our series looks at where AI is being integrated into underwriting departments.

-

Top line grew across all carriers even as pre-tax profits dipped.

-

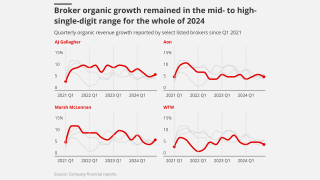

As rate reductions present headwinds, firms are expected to moderate expansion.

-

Brokers turn to harder classes, innovation, commissions and tech to soften the blow.

-

Market leaders Atradius and Coface have both received in-principle approvals for a Lloyd’s syndicate.

-

However, group organic growth among public brokers has slowed to pre-pandemic levels.

-

Emerging lawsuits and expanding loss triggers are giving rise to potential claims under a range of policies.

-

Cat portfolios generally grew, but casualty approaches varied.

-

In part II of our series, we look at where AI is being integrated into claims departments.

-

Insight into the state of the insurance M&A market, powered by this publication's deal database.

-

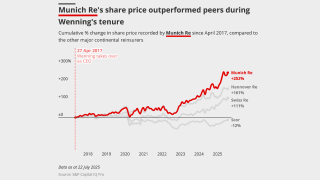

Improved book value, a healthy CoR and disciplined underwriting mark the CEO’s time at the helm.

-

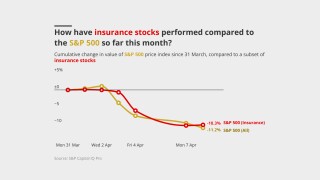

The impact on the (re)insurance market has been muted due to its strong capital position.

-

A look into how the insurance industry is using AI and where practical gains are arising.

-

Despite steep rate hikes, premium volume has held steady as players such as SpaceX self-insure.

-

Questions remain over regulatory touch, capital requirements and tax benefits

-

Continued Apax and Carlyle support will give PIB time to differentiate its business.

-

The business is one of the first to sell in this round of Lloyd’s M&A.

-

Sources said the downstream energy market is unlikely to turn a profit in 2025.

-

The challenge now is balancing top-line growth with underwriting discipline amid falling rates.

-

The three months to June included a cluster of Guy Carpenter exits.

-

The aerospace, energy and marine markets all sustained multiple significant losses in H1.

-

Green hushing is on the rise as Trump rows back on climate initiatives.

-

Insight into the state of the insurance M&A market, powered by this publication's deal database.

-

Although US pricing is improving there is pressure in other geographies.

-

Hannover Re’s CEO is lowest paid among peers, despite their pay growing 77% since 2015.

-

The investment comes amid expectations of a new cycle of deals.

-

Some segments are moving faster than anticipated, but overall, it remains a mixed bag.

-

Working out ROI on sponsorship deals is difficult, but the sport is beloved by insurance brands.

-

The protection gap is calling into question the relevance of the insurance industry.

-

Who will buy the swathe of PE-backed Lloyd’s firms coming to market over 2025-26?

-

Future claims handlers could be "bionic adjusters” empowered by technology.

-

The increased tariff on China trade could drive up the loss quantum on the SharkNinja recall and others.

-

Analysts were interested in the potential for fee income from the retail division.

-

This year is predicted to be an above-average season, like 2024.

-

Lloyd’s maverick syndicate produces impressive results, but questions remain over succession.

-

Insight into the state of the insurance M&A market, powered by this publication's deal database.

-

Broker facilities and increased US domestic appetite are accelerating the softening.

-

As with 2024, pricing pressure has been most acute on top layers.

-

P&C combined ratios were higher than Q1 2024, and wildfires impacted Hannover Re most.

-

Delegates welcomed the FCA’s red-tape cut, but said more is yet to come.

-

Soft conditions have led to “less acute" underwriting discipline, sources said.

-

More players are looking to the class in a bid for top-line growth.

-

Sentiment at the ILS Connect event hosted by Insurance Insider ILS was generally positive.

-

Beazley, Hiscox and Lancashire all grew in Q1 despite widespread rate decreases.

-

We assess the Bermudian’s standing amid waning investor sentiment and economic uncertainty.

-

Insight into the state of the insurance M&A market, powered by Insurance Insider’s comprehensive deal database.

-

Risk managers at last week’s Axco summit said interconnected global risks require flexibility.

-

As the next generation of Names comes to the fore, advisers urge simplification.

-

Insolvencies caused by the tariffs could also cause increased losses

-

Fridays in the office will be the toughest nut to crack.

-

Sources expect it to be a couple billion-dollar insurable market.

-

Due diligence is essential to make sure incubators are backing winners.

-

Aegis 1225 jumped from fifth place last year to become the most profitable syndicate of the last decade.

-

Trade credit and marine are among the lines facing direct impacts amid a broader inflationary challenge.

-

Despite a softening market, carriers still have belief in their profitability, sources said.

-

Insight into the state of the insurance M&A market, powered by Insurance Insider’s comprehensive deal database.

-

Sources said extending coverage to Gen AI may be difficult and unnecessary.

-

The first quartile contracted on the back of Beazley 2623’s GWP reduction.

-

Reinsurers fended off 20% cuts, but wildfires pleas failed to hold pricing flat.

-

Last year, nearly two-thirds of Lloyd’s syndicates reported a deterioration in combined ratio.

-

Insurer appetite for facilities is not just about top line, it is also a hedge against disruption.

-

In the first part of this series, we explore how smart-followers are mixing up their strategies.

-

The market took a higher share of hurricane losses and couldn’t cut its acquisition costs.

-

Sources warned some property XoL books are already running 50% loss ratios.

-

The proportion of women in lead underwriting roles still trails other leadership positions.

-

Some of the Big Four are slowing growth as the market softens.

-

The market improved on attritional losses in 2024 – but slowing rate growth raises queries over top-line momentum.

-

Hiscox, Beazley and Lancashire all reported top line growth, but ROEs dipped in an active wind season.

-

Sources warned of the erosion of underwriting margins after a string of strong years.

-

Two major claims have prompted underwriters to question the sustainability of double-digit rate decreases.

-

Some firms are broadening their M&A net in light of PE firms showing more restrained appetite for intermediaries.

-

Lloyd’s CEO pay is lowest compared to major LSE-traded specialty insurers by a considerable margin.

-

The transactional liability class faces a string of potential losses, especially in the contingent segment.

-

Cedants could choose to retain more as cross-share sell-offs boost their capital.

-

Social inflation and larger vessels are making multi-billion losses more likely.

-

A higher loss quantum will put a greater burden on retro programmes.

-

With another year of underwriting profits banked, the ‘Golden Age’ isn’t over yet.

-

Deteriorating CoRs, GWP growth and fears over wildfire impacts were common themes.

-

Settlements could reduce seized aircraft quantum to the mid-single billions of dollars.

-

Newer swing products offer an alternative way to deal with escalating awards.

-

Underinsurance, total loss claims, and high property values have impacted loss estimates.

-

As the market turns, balance sheet M&A is becoming a more appealing option.

-

Single-digit organic growth, robust casualty pricing and tapering margins were all key trends.

-

With Atrium marking another case of potential bifurcation, where is the natural home of risk?

-

These businesses are expecting more premium growth than the wider market this year.

-

Secondary perils accounted for 65% of global insured losses in 2024.

-

A combination of mandated days and soft pressure is driving up EC3 attendance.

-

The California fires will test post-2018 treaty revisions – and reinsurers’ nerves.

-

Loss assessment is at an early stage, but senior sources suggested the claim could surpass $1bn.

-

In the food and beverage market, rates are falling by an average of 3%-4%.

-

Market softening means exploiting hardening niches is the name of the game.

-

Underwriting oversight is top of the agenda for some, whilst others prioritise progress on tech and operations.

-

High-net-worth binders and treaty exposures will bring significant claims to Lloyd’s writers.

-

We explore the strands of the Lloyd's leader's six-year tenure, moving from remediation to growth mode.

-

Carriers rushing headlong into gen AI without considering its ESG implications could face costly complications down the road.

-

The path to Howden’s new era is steep – but the opportunity is vast.

-

In part two of our 2025 outlook, we explore the drivers of carrier M&A and recreating the ESG agenda.

-

Certain new and old themes will re-emerge this year as the balance of power shifts.

-

Reinsurer appetite largely outweighed demand at 1 January.

-

As 2024 draws to a close, we reflect on the events of the year for the London market.

-

Concern over rate adequacy remains, but reinsurers are delving deeper into data rather than walking away.

-

As 2024 draws to a close, we reflect on the events of the year for the London market.

-

High deductibles, tighter underwriting and lack of flood cover meant lower claims figures.

-

Insight into the insurance M&A market, powered by Insurance Insider’s deal database.

-

Reinsurer appetite for aggregates begins to creep back in.

-

Overall, reinsurers accepted that rate cuts were still leaving them with strong margins.

-

Annual growth in demand for tax insurance ranged between 25% to 40%, sources said.

-

First-quartile 2023 performers will contract capacity by 5% in aggregate next year, according to our survey analysis.

-

Lower inflation and a softer market outlook tempered aggregate growth expectations.

-

Marine and energy were the busiest lines, driven by high competition for talent.

-

A resurgence in IPO activity may help provide new business for underwriters and reduce competition.

-

Lloyd’s has taken around 6% of aggregate US hurricane losses in recent years, and disclosed estimated net losses from Helene and Milton of $1.8bn to $3.4bn.

-

The 2024 hurricane season stayed within predictions for high activity but lacked market-moving events.

-

The market’s dearth of third-party managing agents is a source of tension among young syndicates.

-

Sources agreed that to achieve growth, the focus is shifting from the US to SMEs in Europe.

-

Helene losses were spread wider than initially suggested, in contrast to Milton claims.

-

The 2024 event saw 80 speakers address an audience of over 350.

-

Growth vs discipline, smart follow and M&A mean 2025 will be a mixed bag for London.

-

-

Fidelis 3123 and NormanMax 3939 were the first syndicates to adopt modifications.

-

The D&F market now expects 2025 renewals to be flat to down 5%

-

The A&H market had improved performance between 2020 and 2023.

-

The loss of premium income from Glencore is expected to add to competitive pressures running up to 1 January.

-

Credit insurers may need to adapt their business mix, client base and types of deals underwritten to stay relevant.

-

Achieving profitability is increasingly challenging in the volatile but historically lucrative market.

-

Risk managers are increasingly concerned about insurability.

-

Some reinsurers are considering frequency protection products.

-

Assuming Munich Re takes roughly a 3% market share of hurricane losses suggests a ~$20bn industry loss for Helene.

-

A canvassing of the market showed some bifurcation on the necessity of a government backstop.

-

There has been some strategic withdrawal of capital for younger syndicates.

-

A more residential-skewed loss would impact Lloyd’s carriers in treaty where market share is lower.

-

Milton made landfall south of Tampa Bay at Category 3 on Wednesday night.

-

Setting aside the storm’s greater potential insured loss scale, the flood risk implies greater exposure.

-

Increased interest follows ratings agency upgrades of Lloyd’s paper.

-

Most sources noted expectations of a $50bn+ event, but the range of outcomes is huge.

-

Space insurers are running at a near-200% loss ratio after booking losses of over $1bn in 2023.

-

Many insurers have cut back lines in Lebanon, although larger insured sums are at stake in Israel.

-

Sources expect significant loss amplification in the claims that will come from Georgia, the Carolinas and Tennessee.

-

The Category 4 event will highlight the impact of recent market hardening.

-

Loss-free accounts are expected to be oversubscribed by as much as 140%.

-

This is the first major update to the misconduct framework since enforcement powers were introduced in 2005.

-

M&A levels have increased 23% year-to-date compared to 2023, according to Gallagher Specialty.

-

Construction rates remain stable with some talk of potential softening.

-

The marine market is challenged by global warfare, supply chain breakdown and the complicated energy transition.

-

Treaty premiums have risen, while casualty premiums remain restrained.

-

Legal trends, the primary pricing micro-cycle and other factors all play into an opaque outlook.

-

Sources said that for reinsurers to meet this demand, they will need to get comfortable analysing and evaluating systemic and aggregate risk.

-

Negotiations are getting tougher, but overall market capacity is stable.

-

Swiss Re, Munich Re, Hannover and Scor each have challenges that will influence their renewal behaviour.

-

The choice to build a reinsurance unit at arm’s length alleviates some financial strain.

-

Reinsurers are high on their ‘redemption arc’. The question is – how long will it last?

-

Smart-follow is creating a third tier of provider – the “lead follower” – but broader efficiencies must be achieved.

-

Scor disclosed L&H troubles while Swiss Re continued reserving for US casualty.

-

Only 14% of board seats are filled by women, but directors at brokers tend to be younger than at managing agents.

-

The James River-Long Tail Re deal is the latest example of deal-specific investor capital.

-

However, some syndicates are planning more significant growth following hires or strategic shifts.

-

The regulator is considering changes that could penalise some international players.

-

The FCA’s aim is to reduce regulatory costs and increase the competitiveness of the commercial insurance market.

-

Hail remains the primary sub-peril dominating insured loss costs.

-

Lancashire was the only carrier to see double-digit growth in insurance revenue for H1.

-

A canvass of sources suggests that a $3bn-$5bn loss could tip the cyber market into unprofitable territory.

-

The market is warned to think about overall ecosystem interactions rather than “digitalising by stealth”.

-

Everest Re bucked a more general trend to keep cat exposure stable.

-

New capacity and increased competition is bringing rating levels under pressure.

-

The upside for brokers of a larger Lloyd’s is not necessarily clear.

-

US-listed brokers and carriers have generally continued to produce strong growth even in a transitioning market.

-

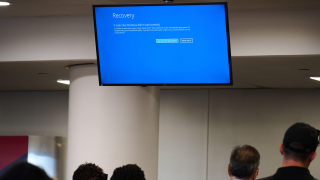

The cyber market should use the latest outage to start decisively taking action on managing cat aggregates.

-

Lloyd’s capital has several attractions to the MGA segment if it can manage the operational hurdles.

-

Market sources suggest that this will be a manageable loss, although at this early stage there are multiple uncertainties.

-

Resulting lowered expenses could feed into Lloyd’s ambitions of building a £100bn premium market.

-

Regulators are mulling reforms that could open the door to international independent brokers.

-

With Hiscox’s founders no longer at the helm, deal-making may be more achievable.

-

Two-thirds of insurance firms have been challenged about their resilience plans by the regulator.

-

John Neal’s expansion plan now has a five-year horizon, but deft execution will be needed.

-

Analysis of directors’ ages shows a shortage when it comes to the next generation of leaders.

-

Although talent movement in Q1 2024 was above Q1 2023 levels, personnel movement slowed in Q2 2024.

-

Quota share commissions are under pressure amid changing buying patterns.

-

Re-marketing of large fleets can result in double-digit rate decreases as carriers chase income.

-

Some 39% of respondents expect deal volumes to increase in the next 12 months.

-

Reinsurance sources say the pool targets the wrong aspects of Australian cat losses.

-

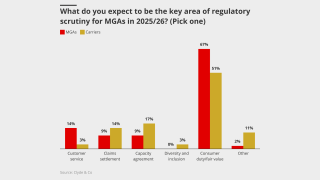

MGAs are looking hard at capacity arrangements for fear of regulatory action.

-

SCS caused global insured losses worth at least $8bn in the first quarter of 2024.

-

New business is arriving, but the captives market is not a priority target.

-

Underwriters fear that misleading statements about AI capabilities could result in claims.

-

The track record of smart-follow vehicles is still young, but the segment is gaining traction.

-

Sources said London should dodge the worst deterioration on US liability, but might not escape unscathed.

-

Forecasters have warned that a number of meteorological factors could make this year the most active on record.

-

Concerning hurricane forecasts are among the factors driving tighter reinsurer capacity.

-

The average risk adjusted rate increase is hovering at about 2% for clean business.

-

Combined ratios improved all around thanks to better pricing and a benign cat quarter.

-

The acquisition brings international M&A opportunities and a pipeline of London wholesale business.

-

Competition and broker pressure on rates is ramping up as London goes for growth.

-

The funding practice has led to a dramatic increase in claims amount, which in turn pushes up rates.

-

Property rates remain adequate, although price increases are tailing off.

-

Israel exposure has thrown inwards-outwards PV coverage mismatches to the fore again.

-

The market has advanced in sophistication but must tackle talent, tax and diversification issues.

-

A thriving competitive intermediary market is what keeps London fresh.

-

Sources approve of Labour’s plans around regulatory accountability.

-

Some firms are outsourcing their recruitment to tailor for a younger generation.

-

The US regulator faces litigation from both sides of the climate issue.

-

Recurring loss patterns have led to squeezed coverage, leaving clients exposed.

-

We explore the first stages of incorporation of GenAI into insurance, alongside the longer-term potential.

-

The recent Italian hail and Bernd losses show some companies are relying on outdated models.

-

This year’s analysis of profitability and volatility also includes an alternate view over five years.

-

Underwriters said there was some cause for concern around reinsurance coverage.

-

Transatlantic competition, rising valuations and price undercutting set a challenging scene.

-

In a departure from 2022 trends, fourth-quartile firms grew the slowest of all syndicates in 2023 at 8.1%.

-

-

We take a look at the outgoing CEO’s performance as he prepares to handover to CorSo CEO Andreas Berger.

-

Ariel and Blenheim were among eight syndicates moving into top underwriting quartile in 2023.

-

Work is still to be done on the investor proposition, expenses, and navigating a waning pricing cycle.

-

A claim on that scale would test the market in ways it has never seen.

-

AI was the hot topic throughout the InsurTech Insights event.

-

There is frustration in the market that remediation work has been squandered.

-

Hard-won profitability has given carriers room to salt away reserves.

-

Sources cited numerous issues with how collateral protection insurance was designed.

-

Hiscox, Beazley and Lancashire all delivered one-off capital returns while swerving casualty issues.

-

DDM is due to be removed as a core central service on 13 September.

-

On average, risks are being placed in a range of flat to up 5%.

-

Attention is fixed on how competition will impact pricing in H2.

-

CEO John Neal has ambitions to pull in more major insurers, E&S players and captives.

-

Rate increases have accelerated further after major losses in 2023.

-

Underwriters are pushing for rate rises, but competition is increasing.

-

Strong reinsurance results have absorbed long-tail reserve charges.

-

Investors are still keen on UK broking – but they may expect more for their money.

-

Fragile supply chains are driving up costs.

-

Being underweight US casualty gives the firm more room than peers to manoeuvre.

-

Convective storms cost more than ever, but activity was not exceptional.

-

Rates have fallen on the back of reduced deal flow in 2023.

-

After HannoverRe announced a 2025 CEO transition, here is our last review on the company's successes and challenges ahead

-

Sources said that the market was not sufficiently profitable to concede ground on pricing.

-

The 1 January renewals featured a significant shift away from mainstay quota share and aggregate coverage, with examples including Axis and Brit dropping specific stop-loss covers.

-

Key market participants hailed the narrowing of the gap between PV insurance and reinsurance, however said that more still needs to be done to fix the market.

-

Prices are surging as a result of heightened risk but coverage remains readily available for shipowners.

-

In the second part of our themes for 2024 outlook, we explore how fear of missing out in cat reinsurance is still contrasting with an upstreaming of risk that is creating fallout for primary insurers, while momentum in facilitisation and ESG continues.

-

In the first section of our two-part outlook for 2024, we explore why macro-economic concerns are taking a step back, though casualty pricing micro-cycles highlight ongoing caution.

-

Reinsurers are making some adjustments to secure target signings but appetite to grow is finely balanced.

-

Well-priced top layer cat risk is in demand, leaving reinsurers watching the market carefully for any signs of decline.

-

The lack of momentum reflects on a general belief that underlying casualty business is well-priced for current years.

-

The PV market is facing yet another battle with reinsurers as they continue to restrict coverage, tighten definitions and exclude geographies.