The reinsurance industry is riding high as it gathers in Monte Carlo for the annual Rendez-Vous. With the hurricane season only half-spent, however, the outcomes of the 2025 renewal are still to be decided.

Ahead of last year’s event, this publication said the reinsurance “redemption arc” was not yet complete. A further year into the post-2022 hard market, reinsurers are now enjoying that arc’s zenith.

Having collected average returns on equity in the high teens to early 20s and in some cases still higher in 2023, H1 returns are also looking strong (see our chart of the day, p11, for more on RoEs).

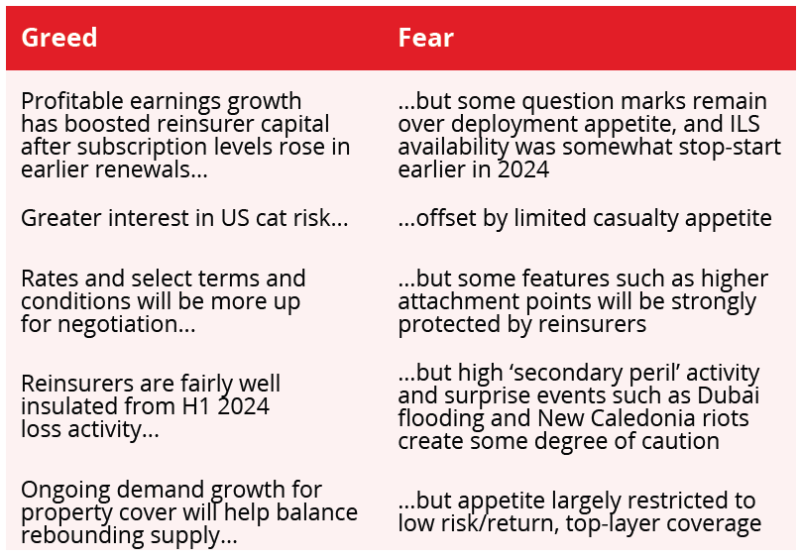

However, as the market progresses past its peak, reinsurers must balance their appetite to grow and their fear of undoing the hard work of the past five years through an unwinding of underwriting discipline.

The continual rising frequency of secondary peril losses – most of which are now retained by insurers – is still front and centre of reinsurers’ minds.

Sources identified severe convective storm (SCS) losses – the single largest driver of insured cat losses over H1 2024 – as one peril in particular that is driving reinsurer discipline.

The way reinsurers walk this line between greed and fear will determine the outcomes of the 2025 renewal season.

Growth appetite versus demand

Throughout the year so far, reinsurers’ desire to grow has been evident, as carriers look to fill their portfolios with profitable business.

The lack of start-ups in reinsurance – unlike the plethora of new businesses launched in the 2002 and 2006 hard markets – also cut down potential competition for incumbent reinsurers, allowing them greater sway over pricing and terms in the market turn.

However, this year’s renewals have highlighted a shifting balance of power between reinsurers and brokers, as reinsurers’ desire to keep growing starts to drive renewed competitive tension.

“Reinsurers are buying lunch again for the brokers,” one source said, indicating carriers’ eagerness for US reinsurance premium.

That appetite, however, is not without a degree of caution. Reinsurers have been badly burned in the past decade and are looking to insulate themselves from the growing threat of secondary perils, with cat growth targeted at business that hits their required parameters.

For most, this means maintaining high attachment points and refusing aggregate deals to reduce their exposure to mid-sized events.

Hiscox Re & ILS CEO Kathleen Reardon added that cedants have had the time to make improvements to their underlying portfolios, which will also smooth reinsurance renewal discussions and allow reinsurers to present cedants with more options, within certain parameters.

“These are conversations that we haven’t had in easily five years because we’ve been on the battlefield,” she said.

Even if reinsurers will not supply their clients with the low-level, earnings volatility coverage they would like, sources said inflation and pent-up demand will likely drive purchases of additional vertical limit this year. This new demand will sop up strong supply from retained earnings growth, providing an offsetting stability to renewed reinsurer competitiveness.

One source suggested that, globally, cedants would look to buy an additional $35bn-$40bn at 1 January this year.

Gallagher Re CEO Tom Wakefield estimated cat limits may continue to grow by about 4% or $20bn in 2025, in comments made as part of our ‘Big Questions’ virtual roundtable (see p12 for more of the outlook from top industry executives).

Guy Carpenter chairman David Priebe said he did not expect the supply/demand situation to change much, with retained earnings growth offset by new demand.

This could include clients looking for additional aggregate cover, but for tail or severity aggregation of losses, not the frequency level deals previously seen.

In casualty, meanwhile, the picture remains complex.

Many of the largest reinsurers have been taking targeted portfolio actions around some casualty treaty exposures as they move away from classes where they have experienced significant losses in recent years.

Swiss Re, for instance, reduced its US casualty premium at mid-year this year as did Munich Re.

The impact of social inflation on prior-year losses has also driven a more cautious approach to both casualty reserving and pricing since the ‘bad years’ of 2015-2019, and firming – albeit more gradual than in property – of casualty reinsurance business.

As a result, sources expect continued price increases on excess-of-loss treaties.

Across P&C overall, the impression so far is of a market equilibrium that is still finely balanced. The level of oversubscriptions for well-priced top-layer property business in 2024 renewals demonstrates reinsurers’ desire to grow – and pricing pressure in this area is likely to accelerate after showing signs of modest softening in 2023 renewals.

At the same time, investors are still nervous – the withdrawal of ILS investment earlier this year on the back of the hurricane season forecast is testament to that anxiety.

Sources believe reinsurers have proven to their investors that operating profitably is possible. “Now they have to prove it’s sustainable”, as one source put it.

Preparing for the downturn

Although reinsurers have enjoyed a period of rate adequacy, all have noted the slowing of increases, if not softening in some regions, within the cat market. As this progresses, reinsurers must now aim for the right moment to put a brake on growth.

Some sources are more optimistic about the length of the current market conditions than others. One said the favourable environment will stretch out for at least the next two years before reaching the “inflexion point” at which reinsurers must curb their supply and pivot to repaying investors.

At present, there is an expectation that reinsurers will compete to an extent on price on desirable business, but will place more emphasis on competing via terms and conditions.

“There will be posturing from reinsurers around the added value that they bring,” a source said, “but nobody is saying ‘go and put my capital to work at any price.’”

On the flipside, sources said buyers are “resigned” to the hard-market conditions but have a little more flexibility than last year to be selective around their reinsurance panels.

Guy Carpenter's Priebe said cedants are still mindful of the need to diversify their reinsurance panels after the experience of 1 January 2023, with many more turning to ILS solutions as a result.

However, he also suggested they will be looking for reinsurers offering “holistic” relationships across programmes.

Competitive tension will likely drive more differentiation among cedants, he forecast. “Reinsurers will have to work harder to get signings,” he said, adding that the conversations will be “less about a market discussion and more about individual relationships”.

A spur toward M&A?

As competition between reinsurers increases, the quest for growth becomes ever more difficult, particularly as prices plateau or slip.

This, sources said, could spur some carriers on towards M&A activity, after a relative dearth of deal-making in the past few years.

At the same time, reinsurance M&A has been slow in recent years because of a lack of investor interest in the business, driven by poor returns. There have been only two large-scale deals in the past five years: RenRe's acquisition of Validus, and Covea’s buying of PartnerRe. The reversal of reinsurers’ fortunes since 2022 could make reinsurance a more attractive acquisition opportunity.

In particular, sources pointed to the reinsurance segments of hybrid carriers as potential targets for acquisition by companies keen to enter reinsurance quickly. This would also provide an opportunity for hybrid carriers burned by poor reinsurance results to exit their positions.

“We don’t expect a wave of consolidation but some of these unloved stepchildren might find new homes in the next two or three years,” they said.