-

Industry-wide initiatives continue to target expanded youth access to the sector.

-

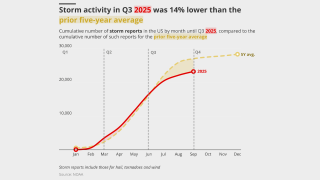

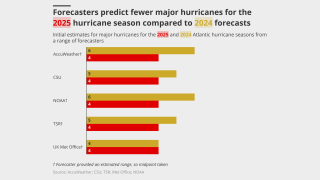

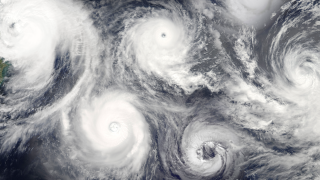

Lack of major cat events could add further pressure on 1 January pricing.

-

Insight into the state of the insurance M&A market, powered by Insurance Insider’s comprehensive deal database.

-

The deal confers a high multiple on Convex and gives AIG re/specialty exposure.

-

Starr’s reinsurance ambitions and embrace of Lloyd’s will be watched closely.

-

Brokers may encourage clients to capitalise on falling rates by boosting coverage.

-

Private capital providers are being signed down as two strong years have piqued interest.

-

Reinsurers are willing to concede on pricing, while cyber interest is on the rise.

-

Part five in our series looks at how AI can empower brokers to add value as well as speed.

-

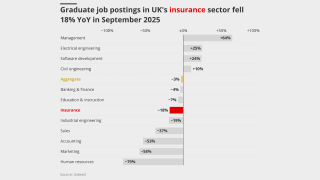

Insurance grad vacancies were down 18% year-on-year in the UK, ahead of a 3% nationwide drop.

-

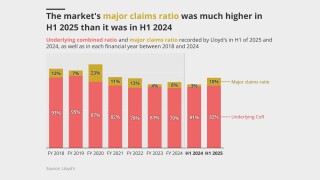

Differentiating Lloyd’s claims performance could help drive business to the market.

-

Carriers are rethinking the traditional renewal-rights model.

-

Despite a rocky H1, 2025 insured losses from nat cat events may not surpass 2024 levels.

-

The class offers affirmative coverage for gaps in traditional insurance policies.

-

Continental composite carriers aim to smooth volatility with new initiatives.

-

Several airlines are understood to have come to market early.

-

According to McKinsey, the projected spending on data centers is expected to hit $6.7tn by 2030.

-

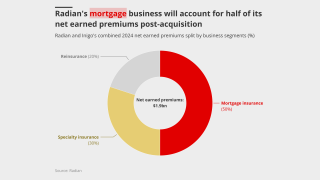

The deal will be watched closely by Radian’s handful of similar peers.

-

Small modular reactors are increasingly viewed as a means of meeting surging energy demand.

-

After losing in the High Court, insurers pin their hopes on the Court of Appeal.

-

Despite formation of Gabrielle, there is "a very high probability" of a below-average season.

-

Part four looks at how the talent landscape will shift in response to AI introduction.

-

The low degree of overlap between the combining portfolios benefits both parties.

-

Organisations were challenged to address systemic DEI failure rather than play “word salad” with labels.

-

Property remains the dominant line, accounting for nearly 30% of total London premiums.

-

Plaintiffs allege that manufacturers and retailers have broken environmental laws.

-

From aviation claims to retention challenges, underlying dynamics will take time to play out.

-

There are concerns that repeated delays could lead to market disengagement with the process.

-

Blackstone-style capital seeking to get closer to source is a net negative for reinsurers.

-

Cedants target methods of reducing pressure on earnings as reinsurers chase growth.

-

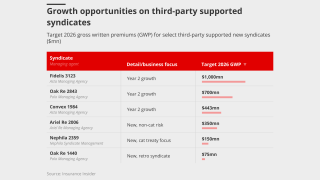

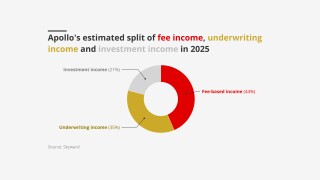

Apollo most recently received in-principle approval for Syndicate 1972.

-

The aviation market may prove an outlier following a disastrous year of loss activity.

-

The private ILS segment took losses from LA wildfires and Mid-West severe convective storms in H1 2025.

-

Reinsurers and their cedants are feeling their books are in better shape, although the market is still uneven.

-

The carrier M&A cycle has started and reinsurance is a segment where acquisitions work better.

-

The post-disaster reinsurance start-up model is changing.

-

Terms are expected to hold, underpinning the stronger recent performance of reinsurers.

-

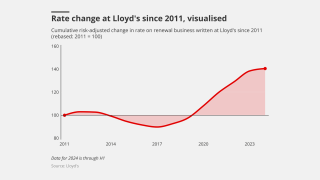

Maintaining underwriting discipline was central to the Corporation's messaging.

-

The cycle-turn M&A story continues with strategic buyers to the fore.

-

Cyber reinsurance supply has continued to outstrip demand during 2025.

-

The Japanese carrier faces integration challenges to make a success of the deal.

-

City firms have introduced perks of extending working from home periods and half days in summer.

-

Insight into the state of the insurance M&A market, powered by this publication's deal database.

-

Rates are bottoming out, but ample capacity is still preventing a hardening market.

-

The Japanese company announced the $3.5bn deal today, three months after the Bermudian completed its IPO.

-

Submission volume is up 10%-20%, according to sources.

-

A notable uptick in attendance underpins the value still placed on the iconic trading centre.

-

The mid-year renewals point to mounting pressure on reinsurance pricing.

-

Part III of our series looks at where AI is being integrated into underwriting departments.

-

Top line grew across all carriers even as pre-tax profits dipped.

-

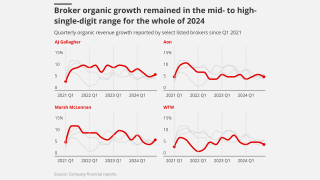

As rate reductions present headwinds, firms are expected to moderate expansion.

-

Brokers turn to harder classes, innovation, commissions and tech to soften the blow.

-

Market leaders Atradius and Coface have both received in-principle approvals for a Lloyd’s syndicate.

-

However, group organic growth among public brokers has slowed to pre-pandemic levels.

-

Emerging lawsuits and expanding loss triggers are giving rise to potential claims under a range of policies.

-

Cat portfolios generally grew, but casualty approaches varied.

-

In part II of our series, we look at where AI is being integrated into claims departments.

-

Insight into the state of the insurance M&A market, powered by this publication's deal database.

-

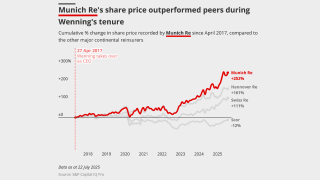

Improved book value, a healthy CoR and disciplined underwriting mark the CEO’s time at the helm.

-

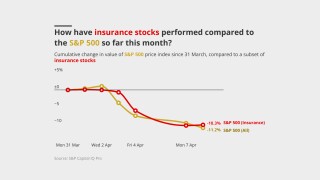

The impact on the (re)insurance market has been muted due to its strong capital position.

-

A look into how the insurance industry is using AI and where practical gains are arising.

-

Despite steep rate hikes, premium volume has held steady as players such as SpaceX self-insure.

-

Questions remain over regulatory touch, capital requirements and tax benefits

-

Continued Apax and Carlyle support will give PIB time to differentiate its business.

-

The business is one of the first to sell in this round of Lloyd’s M&A.

-

Sources said the downstream energy market is unlikely to turn a profit in 2025.

-

The challenge now is balancing top-line growth with underwriting discipline amid falling rates.

-

The three months to June included a cluster of Guy Carpenter exits.

-

The aerospace, energy and marine markets all sustained multiple significant losses in H1.

-

Green hushing is on the rise as Trump rows back on climate initiatives.

-

Insight into the state of the insurance M&A market, powered by this publication's deal database.

-

Although US pricing is improving there is pressure in other geographies.

-

Hannover Re’s CEO is lowest paid among peers, despite their pay growing 77% since 2015.

-

The investment comes amid expectations of a new cycle of deals.

-

Some segments are moving faster than anticipated, but overall, it remains a mixed bag.

-

Working out ROI on sponsorship deals is difficult, but the sport is beloved by insurance brands.

-

The protection gap is calling into question the relevance of the insurance industry.

-

Who will buy the swathe of PE-backed Lloyd’s firms coming to market over 2025-26?

-

Future claims handlers could be "bionic adjusters” empowered by technology.

-

The increased tariff on China trade could drive up the loss quantum on the SharkNinja recall and others.

-

Analysts were interested in the potential for fee income from the retail division.

-

This year is predicted to be an above-average season, like 2024.

-

Lloyd’s maverick syndicate produces impressive results, but questions remain over succession.

-

Insight into the state of the insurance M&A market, powered by this publication's deal database.

-

Broker facilities and increased US domestic appetite are accelerating the softening.

-

As with 2024, pricing pressure has been most acute on top layers.

-

P&C combined ratios were higher than Q1 2024, and wildfires impacted Hannover Re most.

-

Delegates welcomed the FCA’s red-tape cut, but said more is yet to come.

-

Soft conditions have led to “less acute" underwriting discipline, sources said.

-

More players are looking to the class in a bid for top-line growth.

-

Sentiment at the ILS Connect event hosted by Insurance Insider ILS was generally positive.

-

Beazley, Hiscox and Lancashire all grew in Q1 despite widespread rate decreases.

-

We assess the Bermudian’s standing amid waning investor sentiment and economic uncertainty.

-

Insight into the state of the insurance M&A market, powered by Insurance Insider’s comprehensive deal database.

-

Risk managers at last week’s Axco summit said interconnected global risks require flexibility.

-

As the next generation of Names comes to the fore, advisers urge simplification.

-

Insolvencies caused by the tariffs could also cause increased losses

-

Fridays in the office will be the toughest nut to crack.

-

Sources expect it to be a couple billion-dollar insurable market.

-

Due diligence is essential to make sure incubators are backing winners.

-

Aegis 1225 jumped from fifth place last year to become the most profitable syndicate of the last decade.

-

Trade credit and marine are among the lines facing direct impacts amid a broader inflationary challenge.

-

Despite a softening market, carriers still have belief in their profitability, sources said.

-

Insight into the state of the insurance M&A market, powered by Insurance Insider’s comprehensive deal database.

-

Sources said extending coverage to Gen AI may be difficult and unnecessary.

-

The first quartile contracted on the back of Beazley 2623’s GWP reduction.

-

Reinsurers fended off 20% cuts, but wildfires pleas failed to hold pricing flat.

-

Last year, nearly two-thirds of Lloyd’s syndicates reported a deterioration in combined ratio.

-

Insurer appetite for facilities is not just about top line, it is also a hedge against disruption.

-

In the first part of this series, we explore how smart-followers are mixing up their strategies.

-

The market took a higher share of hurricane losses and couldn’t cut its acquisition costs.

-

Sources warned some property XoL books are already running 50% loss ratios.

-

The proportion of women in lead underwriting roles still trails other leadership positions.

-

Some of the Big Four are slowing growth as the market softens.

-

The market improved on attritional losses in 2024 – but slowing rate growth raises queries over top-line momentum.

-

Hiscox, Beazley and Lancashire all reported top line growth, but ROEs dipped in an active wind season.

-

Sources warned of the erosion of underwriting margins after a string of strong years.

-

Two major claims have prompted underwriters to question the sustainability of double-digit rate decreases.

-

Some firms are broadening their M&A net in light of PE firms showing more restrained appetite for intermediaries.

-

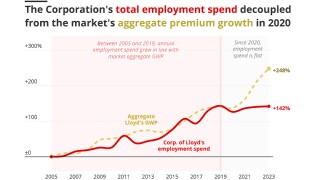

Lloyd’s CEO pay is lowest compared to major LSE-traded specialty insurers by a considerable margin.

-

The transactional liability class faces a string of potential losses, especially in the contingent segment.

-

Cedants could choose to retain more as cross-share sell-offs boost their capital.

-

Social inflation and larger vessels are making multi-billion losses more likely.

-

A higher loss quantum will put a greater burden on retro programmes.

-

With another year of underwriting profits banked, the ‘Golden Age’ isn’t over yet.

-

Deteriorating CoRs, GWP growth and fears over wildfire impacts were common themes.

-

Settlements could reduce seized aircraft quantum to the mid-single billions of dollars.

-

Newer swing products offer an alternative way to deal with escalating awards.

-

Underinsurance, total loss claims, and high property values have impacted loss estimates.

-

As the market turns, balance sheet M&A is becoming a more appealing option.

-

Single-digit organic growth, robust casualty pricing and tapering margins were all key trends.

-

With Atrium marking another case of potential bifurcation, where is the natural home of risk?

-

These businesses are expecting more premium growth than the wider market this year.

-

Secondary perils accounted for 65% of global insured losses in 2024.

-

A combination of mandated days and soft pressure is driving up EC3 attendance.

-

The California fires will test post-2018 treaty revisions – and reinsurers’ nerves.

-

Loss assessment is at an early stage, but senior sources suggested the claim could surpass $1bn.

-

In the food and beverage market, rates are falling by an average of 3%-4%.

-

Market softening means exploiting hardening niches is the name of the game.

-

Underwriting oversight is top of the agenda for some, whilst others prioritise progress on tech and operations.

-

High-net-worth binders and treaty exposures will bring significant claims to Lloyd’s writers.

-

We explore the strands of the Lloyd's leader's six-year tenure, moving from remediation to growth mode.

-

Carriers rushing headlong into gen AI without considering its ESG implications could face costly complications down the road.

-

The path to Howden’s new era is steep – but the opportunity is vast.

-

In part two of our 2025 outlook, we explore the drivers of carrier M&A and recreating the ESG agenda.

-

Certain new and old themes will re-emerge this year as the balance of power shifts.

-

Reinsurer appetite largely outweighed demand at 1 January.

-

As 2024 draws to a close, we reflect on the events of the year for the London market.

-

Concern over rate adequacy remains, but reinsurers are delving deeper into data rather than walking away.

-

As 2024 draws to a close, we reflect on the events of the year for the London market.

-

High deductibles, tighter underwriting and lack of flood cover meant lower claims figures.

-

Insight into the insurance M&A market, powered by Insurance Insider’s deal database.

-

Reinsurer appetite for aggregates begins to creep back in.

-

Overall, reinsurers accepted that rate cuts were still leaving them with strong margins.

-

Annual growth in demand for tax insurance ranged between 25% to 40%, sources said.

-

First-quartile 2023 performers will contract capacity by 5% in aggregate next year, according to our survey analysis.

-

Lower inflation and a softer market outlook tempered aggregate growth expectations.

-

Marine and energy were the busiest lines, driven by high competition for talent.

-

A resurgence in IPO activity may help provide new business for underwriters and reduce competition.

-

Lloyd’s has taken around 6% of aggregate US hurricane losses in recent years, and disclosed estimated net losses from Helene and Milton of $1.8bn to $3.4bn.

-

The 2024 hurricane season stayed within predictions for high activity but lacked market-moving events.

-

The market’s dearth of third-party managing agents is a source of tension among young syndicates.

-

Sources agreed that to achieve growth, the focus is shifting from the US to SMEs in Europe.

-

Helene losses were spread wider than initially suggested, in contrast to Milton claims.

-

The 2024 event saw 80 speakers address an audience of over 350.

-

Growth vs discipline, smart follow and M&A mean 2025 will be a mixed bag for London.

-

-

Fidelis 3123 and NormanMax 3939 were the first syndicates to adopt modifications.

-

The D&F market now expects 2025 renewals to be flat to down 5%

-

The A&H market had improved performance between 2020 and 2023.

-

The loss of premium income from Glencore is expected to add to competitive pressures running up to 1 January.

-

Credit insurers may need to adapt their business mix, client base and types of deals underwritten to stay relevant.

-

Achieving profitability is increasingly challenging in the volatile but historically lucrative market.

-

Risk managers are increasingly concerned about insurability.

-

Some reinsurers are considering frequency protection products.

-

Assuming Munich Re takes roughly a 3% market share of hurricane losses suggests a ~$20bn industry loss for Helene.

-

A canvassing of the market showed some bifurcation on the necessity of a government backstop.

-

There has been some strategic withdrawal of capital for younger syndicates.

-

A more residential-skewed loss would impact Lloyd’s carriers in treaty where market share is lower.

-

Milton made landfall south of Tampa Bay at Category 3 on Wednesday night.

-

Setting aside the storm’s greater potential insured loss scale, the flood risk implies greater exposure.

-

Increased interest follows ratings agency upgrades of Lloyd’s paper.

-

Most sources noted expectations of a $50bn+ event, but the range of outcomes is huge.

-

Space insurers are running at a near-200% loss ratio after booking losses of over $1bn in 2023.

-

Many insurers have cut back lines in Lebanon, although larger insured sums are at stake in Israel.

-

Sources expect significant loss amplification in the claims that will come from Georgia, the Carolinas and Tennessee.

-

The Category 4 event will highlight the impact of recent market hardening.

-

Loss-free accounts are expected to be oversubscribed by as much as 140%.

-

This is the first major update to the misconduct framework since enforcement powers were introduced in 2005.

-

M&A levels have increased 23% year-to-date compared to 2023, according to Gallagher Specialty.

-

Construction rates remain stable with some talk of potential softening.

-

The marine market is challenged by global warfare, supply chain breakdown and the complicated energy transition.

-

Treaty premiums have risen, while casualty premiums remain restrained.

-

Legal trends, the primary pricing micro-cycle and other factors all play into an opaque outlook.

-

Sources said that for reinsurers to meet this demand, they will need to get comfortable analysing and evaluating systemic and aggregate risk.

-

Negotiations are getting tougher, but overall market capacity is stable.

-

Swiss Re, Munich Re, Hannover and Scor each have challenges that will influence their renewal behaviour.

-

The choice to build a reinsurance unit at arm’s length alleviates some financial strain.

-

Reinsurers are high on their ‘redemption arc’. The question is – how long will it last?

-

Smart-follow is creating a third tier of provider – the “lead follower” – but broader efficiencies must be achieved.

-

Scor disclosed L&H troubles while Swiss Re continued reserving for US casualty.

-

Only 14% of board seats are filled by women, but directors at brokers tend to be younger than at managing agents.

-

The James River-Long Tail Re deal is the latest example of deal-specific investor capital.

-

However, some syndicates are planning more significant growth following hires or strategic shifts.

-

The regulator is considering changes that could penalise some international players.

-

The FCA’s aim is to reduce regulatory costs and increase the competitiveness of the commercial insurance market.

-

Hail remains the primary sub-peril dominating insured loss costs.

-

Lancashire was the only carrier to see double-digit growth in insurance revenue for H1.

-

A canvass of sources suggests that a $3bn-$5bn loss could tip the cyber market into unprofitable territory.

-

The market is warned to think about overall ecosystem interactions rather than “digitalising by stealth”.

-

Everest Re bucked a more general trend to keep cat exposure stable.

-

New capacity and increased competition is bringing rating levels under pressure.

-

The upside for brokers of a larger Lloyd’s is not necessarily clear.

-

US-listed brokers and carriers have generally continued to produce strong growth even in a transitioning market.

-

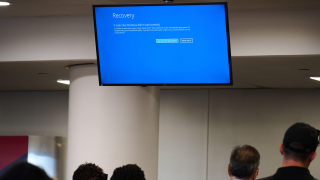

The cyber market should use the latest outage to start decisively taking action on managing cat aggregates.

-

Lloyd’s capital has several attractions to the MGA segment if it can manage the operational hurdles.

-

Market sources suggest that this will be a manageable loss, although at this early stage there are multiple uncertainties.

-

Resulting lowered expenses could feed into Lloyd’s ambitions of building a £100bn premium market.

-

Regulators are mulling reforms that could open the door to international independent brokers.

-

With Hiscox’s founders no longer at the helm, deal-making may be more achievable.

-

Two-thirds of insurance firms have been challenged about their resilience plans by the regulator.

-

John Neal’s expansion plan now has a five-year horizon, but deft execution will be needed.

-

Analysis of directors’ ages shows a shortage when it comes to the next generation of leaders.

-

Although talent movement in Q1 2024 was above Q1 2023 levels, personnel movement slowed in Q2 2024.

-

Quota share commissions are under pressure amid changing buying patterns.

-

Re-marketing of large fleets can result in double-digit rate decreases as carriers chase income.

-

Some 39% of respondents expect deal volumes to increase in the next 12 months.

-

Reinsurance sources say the pool targets the wrong aspects of Australian cat losses.

-

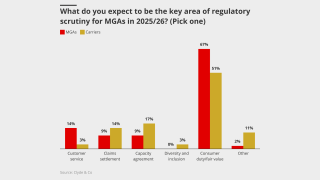

MGAs are looking hard at capacity arrangements for fear of regulatory action.

-

SCS caused global insured losses worth at least $8bn in the first quarter of 2024.

-

New business is arriving, but the captives market is not a priority target.

-

Underwriters fear that misleading statements about AI capabilities could result in claims.

-

The track record of smart-follow vehicles is still young, but the segment is gaining traction.

-

Sources said London should dodge the worst deterioration on US liability, but might not escape unscathed.

-

Forecasters have warned that a number of meteorological factors could make this year the most active on record.

-

Concerning hurricane forecasts are among the factors driving tighter reinsurer capacity.

-

The average risk adjusted rate increase is hovering at about 2% for clean business.

-

Combined ratios improved all around thanks to better pricing and a benign cat quarter.

-

The acquisition brings international M&A opportunities and a pipeline of London wholesale business.

-

Competition and broker pressure on rates is ramping up as London goes for growth.

-

The funding practice has led to a dramatic increase in claims amount, which in turn pushes up rates.

-

Property rates remain adequate, although price increases are tailing off.

-

Israel exposure has thrown inwards-outwards PV coverage mismatches to the fore again.

-

The market has advanced in sophistication but must tackle talent, tax and diversification issues.

-

A thriving competitive intermediary market is what keeps London fresh.

-

Sources approve of Labour’s plans around regulatory accountability.

-

Some firms are outsourcing their recruitment to tailor for a younger generation.

-

The US regulator faces litigation from both sides of the climate issue.

-

Recurring loss patterns have led to squeezed coverage, leaving clients exposed.

-

We explore the first stages of incorporation of GenAI into insurance, alongside the longer-term potential.

-

The recent Italian hail and Bernd losses show some companies are relying on outdated models.

-

This year’s analysis of profitability and volatility also includes an alternate view over five years.

-

Underwriters said there was some cause for concern around reinsurance coverage.

-

Transatlantic competition, rising valuations and price undercutting set a challenging scene.

-

In a departure from 2022 trends, fourth-quartile firms grew the slowest of all syndicates in 2023 at 8.1%.

-

-

We take a look at the outgoing CEO’s performance as he prepares to handover to CorSo CEO Andreas Berger.

-

Ariel and Blenheim were among eight syndicates moving into top underwriting quartile in 2023.

-

Work is still to be done on the investor proposition, expenses, and navigating a waning pricing cycle.

-

A claim on that scale would test the market in ways it has never seen.

-

AI was the hot topic throughout the InsurTech Insights event.

-

There is frustration in the market that remediation work has been squandered.

-

Hard-won profitability has given carriers room to salt away reserves.

-

Sources cited numerous issues with how collateral protection insurance was designed.