-

Interim CUO Nick Pritchard turned in his notice in August of this year.

-

Widespread underinsurance and low exposures will limit losses.

-

Many commercial risks will have London coverage, but insured values are relatively low.

-

Rates pulling back will rein in some of the excess margin obtained over the past three years, he said.

-

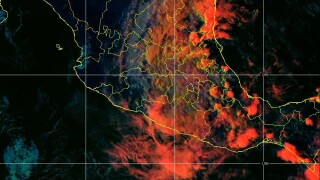

Hurricane warnings are in place for Guantanamo, Holguin and Las Tunas.

-

Economic losses from the Cat 5 storm could run to 30%-250% of the country’s GDP.

-

A US landfall is not expected, but the storm could hit the Bahamas by Friday.

-

The storm could bring flooding to Jamaica, Cuba and Haiti.

-

APIP is one of the world’s largest property programs.

-

Property pricing fell by 8%, while casualty rate increases tapered to 3%.

-

Total pre-tax favorable prior period development in the quarter was $361mn, up nearly 48% YoY.

-

Property, cyber and workers’ comp rates were all down mid-single digits, offsetting casualty hardening.

-

Though wildfire losses are up, total losses are the lowest since 2015.

-

Brian Church has spent 20 years at Chubb.

-

Willis claims at least two $1mn accounts were also unfairly lost to Howden.

-

Declared events totalling just under A$2bn ($1.3bn) included one cyclone and two floods.

-

Julia Graham played a key role in the UK's introduction of captive-friendly regulation.

-

The Bermuda-based executive joined the Ardonagh Group’s reinsurance broking arm in March 2023.

-

The pair have expanded remits overseeing property and specialty.

-

According to McKinsey, the projected spending on data centers is expected to hit $6.7tn by 2030.

-

The underwriter has worked at Hiscox, Lloyd’s, Chubb and Zurich.

-

Marlon Williams will focus on the placement of reinsurance and retro business.

-

The hire comes as Guy Carpenter fills the void created by the Willis Re raid earlier this year.

-

Equivalent to a Category 5 hurricane, Ragasa is the world's strongest storm this year.

-

The executive met with UK colleagues to discuss plans for the US business.

-

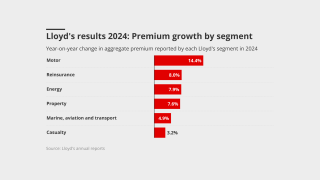

Property remains the dominant line, accounting for nearly 30% of total London premiums.

-

Reinsurer executives stressed that the industry worked hard on setting the right structure.

-

The affirmations reflect Everest’s strong underwriting diversification.

-

Models anticipate a busier second half, particularly in the next few weeks.

-

The platform aims to “bend the loss curve”.

-

The sector recorded total premiums written in London of £11.9bn in 2024

-

The carrier notified California regulators that it would stop renewing plans starting last month.

-

Supply for property outstrips demand, but the casualty market is “bifurcated”.

-

Mark ‘Ollie’ Hollingworth has held his current role at Atrium since 2017.

-

Syndicate 1440 was approved to assume business incepting January 2026.

-

Despite rate reductions accelerating, the sector-wide combined ratio is set to remain below 90% through 2027.

-

The executive most recently served as head of North American treaty reinsurance.

-

The data modeling firm said losses previously averaged $132bn annually.

-

Lawmakers are seeking input on risk evaluation, limits and other concerns.

-

A notable uptick in attendance underpins the value still placed on the iconic trading centre.

-

The combined ratio worsened slightly by 0.5 points to 91.6%.

-

The mid-year renewals point to mounting pressure on reinsurance pricing.

-

Top line grew across all carriers even as pre-tax profits dipped.

-

Nat-cat events triggered A$1.36bn of losses during the year.

-

Company alum David Murie will lead the new business unit.

-

The carrier’s profit grew 34% for the year to A$1.35bn.

-

Layla O’Reilly and Mark Edwards are among the brokers leaving the firm.

-

The estimate covers property and vehicle claims.

-

The Hannover Re CEO said rate adequacy remains “attractive” overall.

-

California wildfires were the reinsurer’s largest H1 loss, at EUR615.1mn.

-

Both organisations still predict an above-average hurricane season.

-

The carrier cited elevated cat and large-loss activity, including the LA wildfires.

-

The reinsurer chair said the frequency of losses today “will prevent prices from slipping too much.

-

The P&C re segment’s combined ratio improved by 12.7 points to 61.0%.

-

The Swiss carrier improved its P&C combined ratio by 1.2 points to 92.4%.

-

More investment in early stage firms is an indicator of bullish market, says Gallagher’s Johnston.

-

CEO Alex Maloney said Lancashire’s growth was “more measured” amid softening.

-

Natural catastrophe claims remained consistent compared with the prior year.

-

California wildfires account for $40bn of the insured loss tally in H1.

-

The company has also expanded its relationships with US and UK MGAs.

-

Matthew Doherty joined the reinsurer in 2018 as SVP, property portfolio manager.

-

The Canadian insurer saw property rates dip across its global divisions.

-

The business posted a 95.2% undiscounted combined ratio.

-

Scor's CEO said the P&C market had experienced a “competitive” first half.

-

The firm will target mid-market risks with TIVs of $25mn-$1bn.

-

The P&C segment posted an 82.5% combined ratio for the quarter.

-

Millions are evacuating after one of the strongest earthquakes in modern history.

-

The broker has noted that double-digit reductions are increasingly available in property.

-

Insured losses produced the second highest first-half tally since records began in 1980.

-

Wind season remains an important variable, but also might not change current dynamics significantly.

-

Group CEO Tavaziva Madzinga said it might explore Lloyd’s Names backing in the future.

-

Property rates declined by 7% globally in the second quarter.

-

The property segment reported a CoR of 27.4% for the quarter, down 26.5 points year on year.

-

Liberty Mutual, Allianz and Aviva previously had their appeals dismissed.

-

The carrier reported preliminary profits of EUR2.1bn, driven by “very low” major-loss expenditure in P&C re.

-

Alcor has also opened an Atlanta office, broadening operations in the US market.

-

The losses were below May’s $777mn, but almost 3x higher than for June 2024.

-

US events accounted for more than 90% of global insured losses.

-

Category 4 and 5 storms could become more common and hit further north.

-

The start-up aims to bind its first risk in Q4 2025.

-

In the US, the index fell 6.7% year on year.

-

Emilie Hungenberg joins the carrier from Aspen.

-

Despite predicting fewer hurricanes, the numbers are still above average.

-

Marsh’s property book saw an average decline of 9% in Q1, a trend that appears to have continued through Q2.

-

Rates continue to drop as capacity is ample, the broker said.

-

-

The late March storm caused extensive damage in southern Quebec and Ontario.

-

The Australian carrier’s nat cat losses are A$200mn lower than its annual allowance.

-

Ex-Tropical Cyclone Alfred has been the costliest event, with A$1.36bn in losses.

-

The managing agency is offering 62p per £1 for 2026 YoA capacity.

-

The soft market continued through H1 2025, especially on shared programs.

-

The LA wildfires accounted for 59% of loss activity over Q1.

-

Premium rose across the top 15 P&C risks in 2024.

-

Property rates are coming under further pressure, while liability is being buoyed by ongoing challenging loss trends.

-

MillerBoost is the latest broker facility to launch in London.

-

The cost comes in at $530.6bn, roughly $20mn lower than budgeted.

-

The platform will capture and standardise data from all submissions, the broker said.

-

The carrier’s president Andrew McMellin is aiming to double London market share in the next five years.

-

The executive previously spent 15 years in a variety of roles at Zurich.

-

This is up from last year’s $1bn protection for its Florida treaty.

-

Some segments are moving faster than anticipated, but overall, it remains a mixed bag.

-

CEO Caroline Wagstaff called for a “tailored and proportionate” approach to regulation.

-

The executive’s career includes a stint as head of cat for CorSo.

-

The loss has decreased by 0.3% since the company’s third assessment.

-

The new Lloyd’s chief of market performance also outlined target growth areas.

-

The driver of growth has shifted from rate to volume, as pricing increases tail off.

-

Almost 50,000 people have been forced to evacuate.

-

Plus, the latest people moves and all the top news of the week.

-

Broker facilities and increased US domestic appetite are accelerating the softening.

-

P&C combined ratios were higher than Q1 2024, and wildfires impacted Hannover Re most.

-

Motion Specialty will initially focus on high value home and flood insurance in the US.

-

The revision is significantly lower than the $4.5bn October estimate.

-

The reinsurer said the LA wildfires would have a “dampening effect” on mid-year renewals.

-

The reinsurer's group operating income fell by 14% to EUR480.5mn.

-

New broker vehicles are setting up amid accelerated softening in D&F.

-

The facility provides follow capacity to US and international placements.

-

Cat losses included $17.5mn from the CA wildfires and other events.

-

Beazley, Hiscox and Lancashire all grew in Q1 despite widespread rate decreases.

-

The carrier estimated its California wildfire loss at $145mn-$165mn.

-

Co-founder and CUO Jacqui Ferrier has been appointed his successor.

-

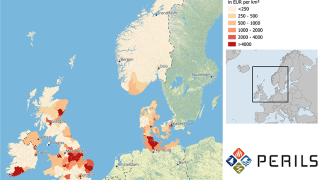

Six weeks after the storm, Perils released its first industry-loss estimate at EUR619mn.

-

The only major product line to see rate increases was casualty.

-

In a post on LinkedIn, Steve Arora said investor appetite “just wasn’t there”.

-

The firm now reports on insurance exposures to natural perils for 21 countries.

-

Despite wildfires, reinsurers are “well positioned to maintain strong profitability in 2025”.

-

Trouvaille II raised $580mn for 2025, compared to $325mn in 2024.

-

Losses stemmed from ex-Tropical Cyclone Alfred and North Queensland flooding.

-

Overall market capacity increased by 5.3% year-on-year, the broker reported.

-

The announcement comes after similar launches with Inigo and Atrium.

-

The company booked profit for the year of £247mn, up 20% on the prior year.

-

The syndicate expects £5.8mn-£8.6mn in California wildfire claims.

-

Reinsurance made up 12% of the syndicate’s 2024 GWP.

-

Reinsurance and property remained the primary drivers of premium growth.

-

Most of the industry losses occurred in Austria, the Czech Republic and Poland.

-

The business offers parametric windstorm coverage.

-

The property and specialty insurer reported underwriting profits of $131mn ($170mn).

-

The Italian carrier posted a record group profit of EUR7.3bn.

-

For the prior-year quarter, the carrier reported a EUR9mn loss.

-

Both carriers have extensive reinsurance coverage.

-

Plus, the latest people moves and all the top news of the week.

-

Followers will automatically support primary or excess Inigo quotes.

-

Sources warned of the erosion of underwriting margins after a string of strong years.

-

The London D&F market will shoulder most of the losses.

-

Predicting underwriting conditions for the remainder of the year is ‘challenging’.

-

Several underwriters left Hiscox’s property D&F team last year to join MGA Velocity.

-

North America is likely to be the most financially impacted by the scenario, Lloyd’s said.

-

The London carrier posted an undiscounted combined ratio of 79%, up from 74% in 2023.

-

The estimate is based on industry losses in the range of $35bn-$45bn.

-

Westfield has seen a number of senior underwriters depart the business in recent weeks.

-

The firm projects losses from the fires at between $160mn-$190mn.

-

Sara Foucher has held roles at RSA, Swiss Re and XL Catlin.

-

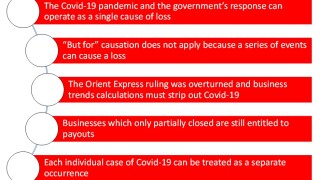

The appeals court has ruled that composite policies provide multiple limits.

-

Retention levels for reinsurance fell across the different geographies the carrier operates in.

-

The ratings agency has revised Mercury’s outlook from stable to negative.

-

The group includes James Cooke and Angus Ovens.

-

The estimate is net of its per-occurrence reinsurance program and gross of tax.

-

More than 33,000 claims had been filed as of 5 February.

-

The estimate covers property and vehicle claims.

-

Genna Biddell will report to Brad Melvin, president and CEO, BMS Re US.

-

The carrier is “extremely well capitalised” to achieve its strategic ambitions.

-

Its post-tax estimate of $1.3bn is net of reinsurance recoveries.

-

Underinsurance, total loss claims, and high property values have impacted loss estimates.

-

The annual claims totalled £5.7bn, the largest amount paid out in any year.

-

The storm is likely to be one of the costliest weather events in Canadian history.

-

The carrier disclosed it will book $1.1bn in net losses from the California fires.

-

The carrier’s Eaton Fire loss would be a retained net loss hit.

-

The event now includes a casualty portion and has officially been re-branded as the Property and Casualty Symposium.

-

The MGA and 49% owner SiriusPoint could bring in a new investor.

-

Compared with its initial figure, CatIQ’s latest estimate has increased by 40%.

-

Guy Carpenter said personal-lines exposure would account for 85% of the aggregate loss.

-

The total includes fire and smoke damage plus living expenses for evacuees.

-

The fire started Wednesday morning and is currently 0% contained.

-

Losses from the larger fire will amount to $20bn-$25bn, the modeller said.

-

The broker said disaster data can attract more risk capital.

-

The pool services a number of public authorities in California.

-

Severe convective storms accounted for 41% of last year’s insured loss load.

-

The estimate has reduced slightly since the modeler’s last update in October.

-

Sources said that the new paper is replacing PartnerRe capacity that was backing the MGA.

-

CEO Cerio highlighted changes that allowed the insurer of last resort to combine commercial, coastal and personal lines.

-

Daniel Moruzzi joins from Ascot and Matthew Cope joins from Aon.

-

The Palisades fire is estimated at $9bn-$12bn, while Eaton is $6bn-$8bn.

-

Investigators are homing in on the likely causes of the incidents.

-

It has been a “good” bad renewal for cat reinsurers, with attachments likely to endure in the medium term.

-

Moody’s also expects losses in the billions of dollars.

-

Six wildfires are now burning in SoCal, with the Palisades fire being the largest.

-

It is understood that supporters include Munich Re and Brit.

-

Hurricane Milton resulted in the largest insured loss of the year at $25bn.

-

More than 4,000 acres are burning as thousands evacuate.

-

In part two of our 2025 outlook, we explore the drivers of carrier M&A and recreating the ESG agenda.

-

Certain new and old themes will re-emerge this year as the balance of power shifts.

-

The largest non-US event in 2024 was the catastrophic flooding in Valencia.

-

Supply generally exceeded demand and trading relationships were ‘strong’, CEO Tom Wakefield said.

-

The storms struck Victoria, New South Wales and Queensland.

-

Most of the industry losses occurred in Austria, the Czech Republic and Poland.

-

The scheme has been pushed back by three months to 31 March 2025.

-

TSR anticipates that next year will see an ACE value of 129 compared with the 30-year norm of 122.

-

James Drinkwater is to serve as vice chair and executive chairman at Amwins Global Risks.

-

James Irvine will report to Cathal Carr, CEO and active underwriter of Oak syndicate 2843.

-

The movers include former line underwriter for major property D&F, James Robertson.

-

The carrier attributed the intensification of storms this season to climate change.

-

CEO Mario Greco said his future retirement had nothing to do with bringing the plan forward.

-

The company is on track to exceed its targets for 2023-25 one year ahead of schedule.

-

Claims at 9M were 15% higher than the same period in 2023.

-

The floods add to an already historic loss tally for Canada in 2024.

-

Helene losses were spread wider than initially suggested, in contrast to Milton claims.

-

Hannover Re’s CEO said the market had been disciplined.

-

The reinsurer’s large losses tallied up to EUR1.3bn for the nine-month period to 30 September.

-

Paul Keaveney leaves Zurich after nearly a decade with the carrier.

-

Kevin Stokes has been with Pillar for nearly four years.

-

Rates are continuing to soften in D&O and cyber, according to CFO Paul Cooper.

-

The D&F market now expects 2025 renewals to be flat to down 5%

-

The CEO said the property market was in a “super-good place”, and increased competition was inevitable.

-

Some US and European cedants will likely see "specific adjustments" to their programmes.

-

The carrier said activity across smaller and mid-sized natural catastrophe and risk events had been “elevated”.

-

The carrier increased insurance revenue by 16.8% to $1.3bn year on year.

-

Most of the losses derive from France.

-

The firm is also integrating changes to its process to allow it to cover wider ground.

-

The estimate implies a roughly $15bn homeowners’ industry loss from the hurricane.

-

Andrade flagged expected 5% to 10% increases in the US and Europe.

-

Flash flooding in Spain has killed at least 64 people, leaving thousands of homes without power.

-

Although the worst of the rainfall has passed, the “devastating episode” may not be over, Spanish prime minister Pedro Sánchez warned.

-

The investor has paid in an extra £12.5mn for an additional 5% holding.

-

The Goldman Sachs-backed broker will buy out BP Marsh’s stake.

-

Over the period, the Spanish carrier’s reinsurance segment expanded profit by almost 10% year on year.

-

Insured losses for 9M 2024 have hit $102bn, according to a report.

-

Beazley leads the first $100mn layer of the programme, while Tokio Marine HCC leads the second on the Alesco-placed cover.

-

Overall, insurance rates fell by 1%, led by competition in property.

-

The three-year deal is expected to generate $200mn in GWP over the period.

-

As a result of mostly flooding, £495mn ($644mn) of losses occurred in the UK.

-

Cedants and brokers called for long-term relationships as reinsurers addressed loss creep.

-

The company said $13bn-$22bn will come from wind damage.

-

With the storm’s losses looking more favourable, questions over rates and gross/net strategies will arise.

-

Milton made landfall near Siesta Key yesterday, leaving 2.7 million homes without power.

-

A more residential-skewed loss would impact Lloyd’s carriers in treaty where market share is lower.

-

The cost to the NFIP is likely to be a “mid to high single-digit-billion impact”.

-

The hurricane has destroyed hundreds of homes and left more than 2.7 million homes without power in Florida.

-

Milton’s center is projected to make landfall near or just south of Tampa Bay.

-

Contrary to expectations that US casualty would dominate the conversations, Milton took the spotlight.

-

Geopolitical conflict could expose the global economy to $14.5tn in losses.

-

The NHC is predicting storm surge, exacerbated by the tide, as high as 15ft for Tampa Bay.

-

A hurricane warning has been issued for the east coast of Florida.

-

Hurricane Milton strengthened from a tropical storm on Sunday to a Category 5 storm yesterday.

-

The figure does not include NFIP losses.

-

Most of the estimated insured losses will be retained by insurers.

-

Sources expect significant loss amplification in the claims that will come from Georgia, the Carolinas and Tennessee.

-

The numbers will be refined further to arrive at an industry loss estimate.

-

Tallahassee avoided a major hit – but flood and storm-surge losses remain unknown.

-

Plus the latest people moves and all the top news of the week.

-

Property underwriters warn of complacency in how quickly margins can erode.

-

Will Curran joined the Lloyd's syndicate earlier this year.

-

Taiwan’s strongest earthquake in 25 years caused damage to facilities for chipmaker TSMC.

-

The facility automatically follows the lead market which offers the lowest quote.

-

InsurX has grown its capacity beyond £100mn after adding D&F to its existing contingency business.

-

The average risk adjusted rate increase is hovering at about 2% for clean business.

-

Transatlantic competition, rising valuations and price undercutting set a challenging scene.

-

The value of the bridge is estimated at $1.2bn.

-

On average, risks are being placed in a range of flat to up 5%.

-

The carrier confirmed the appointments of Barrett and Tinworth to the property team.

-

InsurX launched into the D&F market earlier this month and plans to facilitate the placement of around $30mn of property D&F business.

-

The LatAm telecoms company buys a sizeable protection triggered by windspeeds.

-

The platform has signed up brokers such as Miller and Gallagher and carriers such as Beazley and Atrium ahead of its market launch.

-

Charlotte Macey started her career at CNA Hardy in 2008 and was most recently class manager for property D&F.

-

The syndicate exited the class in 2021 at a time when the Lloyd’s market was in the thick of its performance drive and Decile 10 exercise.

-

Deans joins from CNA Hardy, where she was a property underwriter since 2010.

-

Aon-owned Mexican cat modeler ERN estimated Otis insured wind losses, excluding auto and infrastructure, at $1.2bn-$1.8bn.

-

The CEO was speaking on the back of the carrier’s Q3 results, where it confirmed it would be returning $169mn to investors by way of a $119mn special dividend and offering up to $50mn in buybacks.

-

The carrier has been in hiring mode in recent months after staff exits earlier this year.

-

Reinsurers are also determined to secure structural changes and payback from Italian, Slovenian and Turkish cedants at 1 January 2024.

-

Matthew Narbett will continue in his role as active underwriter of Syndicate 2010, while Colette Murphy has been promoted from deputy head of D&F.

-

Sompo International said it saw growing demand for expertise and capacity in the region.

-

The CEO said Chubb has ‘never seen better pricing’ on primary property.

-

The underwriter spent more than two decades at Ascot, holding several roles in the property, political violence and marine hull teams.

-

Plus the latest executive moves and all the top news of the week.

-

London D&F underwriters are seeing rate rises of 15% on average on clean business, while loss-affected accounts are seeing their rates double.

-

Wyatt is reunited with former IQUW and Agora colleague, James Blackwell in her new role.

-

The duo will head up the D&F and DA teams, and report to active underwriter Steven Tebbutt.

-

The firm is led by the former executive team of MGA Medici Facultative, headed by Henrik Webster.

-

London D&F underwriters are seeing rate rises of 20% on average amid surging in-flows of new US business ahead of the key 1 April renewals.

-

The MGA’s international platform hopes to bring in MGA underwriters looking for US expansion.

-

The association allowed managing agents to select the most suitable candidates in this election cycle.

-

Neil Cryer joins from CNA, where he spent nearly seven years as head of property D&F.

-

Charles Tinworth and Abigail Paterson are set to join the property team as senior underwriter and underwriter, respectively.

-

The loss is expected to be absorbed by the domestic Canadian and London markets, with Lloyd’s taking a relatively heavy share of the placement.

-

Victor De Jager will be based in Amsterdam and report to Garret Gaughan, head of D&F, and Anne Pullum, head of Europe and CRB, Europe.

-

Sources in the market estimated the average risk-adjusted rate increase at the 1 June renewal at around 5%, with a similar trajectory expected for 1 July accounts.

-

The carrier has also promoted Srdjan Todorovic to lead its global political violence operation.

-

The carrier has bolstered its property team following several staff exits earlier this year.

-

Mark Herget joined Fidelis in April 2020 as an underwriter before being transferred to its Bermudan operation in November of the same year.

-

WTW has appointed Aon’s Ed Day to work as head of international property in the broker’s D&F team, which is led by Garret Gaughan.

-

Cat de-risking and asset revaluations have also been key features of this renewal.

-

There are early signs of bifurcation between rates on cat-exposed or loss affected business, and clean accounts.

-

The senior underwriter has worked at Sirius, Novae, Mitsui Sumitomo and Chaucer.

-

Sources described the deal as a collegiate agreement, and long term the carrier is still understood to be committed to the US property market.

-

Former head of D&F at Geo Specialty David Leathem and his colleagues first joined the Ardonagh-backed MGA in 2017 to establish its international property book.

-

Head of property John Roberts-West and senior commercial property underwriter Katie Hunter have both left the business, with Hunter set to join Beazley at the end of the month.

-

Head of Continental Europe facultative Nicola Fraccalvieri will lead the combined team.

-

The prospect of higher reinsurance costs, an inflationary environment and concerns over cat pricing are fuelling the underwriter argument for more rate in 2022.

-

The notification comes after a $100mn filing from Tulane University reported by this publication earlier this month.

-

John Brown will be joining former colleague Simon Jackson at the ERS-owned syndicate.

-

Experienced brokers Matthew Sinclair and David Pratt-Sinclair are to head up the new division.

-

The exit in London comes at a time of wider market discussion around the adequacy of cat pricing.

-

The rebrand follows a last-minute acquisition of the firm by Aquiline-owned Lloyd’s syndicate ERS, in December of last year.

-

The fairly late notification and the size of the claim have prompted some to question whether further substantial Uri claims could be in the pipeline.

-

Plus the lowdown on CFC’s syndicate capacity and all the top news from the week.

-

The mid-year renewals are seeing a continued slowdown in rate rises for the property D&F market.

-

HDI is looking to streamline its Talanx operations in Germany and bring together 7,650 staff under one new company.

-

Outside the US, two Indian cyclones are expected to have caused more than $4.5bn of economic losses.

-

Beazley is one of the leading players in property D&F business in London, writing a global book with a US focus.

-

The appointment follows the hire of MS Amlin reinsurance underwriter Dominic Peters as CUO.

-

Rates are up an average of around 10%, half the magnitude of a year ago.

-

The Week in 90 Seconds: Biometric data and cyber; Greensill collapse; Guy Carpenter’s Priebe on pandemic risk; Texas storm; Marsh McLennan’s Glaser

-

The claim from the TASB Risk Management Fund is one of the first pieces of loss information to come to light following the Texas deep freeze.

-

Nat cat and extreme weather claims have become more frequent and severe with hail, heavy rain and wildfires leading to significant losses.

-

IGI is set to launch into the contingency market and has appointed underwriter Emily Clapham to lead the entry into the class, Insurance Insider can reveal.

-

The carrier has admitted to errors in select cases but stressed that its $475mn loss figure remains unchanged.

-

Simon Moore has joined Lockton Re as a senior broker in the company’s non-marine retro and property specialty team, based in London.

-

The segment returned to underwriting profit despite the group reporting a significant pre-tax loss.

-

Some had argued that the definition of occurrence used by judges could make it harder for insurers to aggregate treaty claims.

-

The carrier revealed 10.9% premium volume growth at 1.1.

-

The Lloyd’s chairman tells the House of Lords the development will enable modelling of potential losses.

-

Allianz, IAG, Chubb and Swiss Re Corporate Solutions have filed pleadings in the Federal Court.

-

Some pointed to low average costs to fix burst pipe claims, while others warned that BI could drive up losses.

-

The vast majority of the losses come from BI, with other losses stemming from life, travel and event cancellation.

-

Market sources report an uptick in competition to secure accounts as clients sought optimum deals in a challenging market.

-

Plus an update on European (re)insurer results and all this week’s top news.

-

The carrier reported “significant claims provisions” following the judgement in the FCA BI test case.

-

The CEO lays part of the blame for the UK’s Covid-19 BI woes at brokers’ door.

-

The EU’s chief insurance supervisor advocates adding on pandemic to existing national schemes.

-

A Lloyd’s report warns that increasing digitisation makes key infrastructure assets more vulnerable.

-

An underwriting loss at the international segment eclipses a profitable performance from MENA personal lines.

-

The agreement will initially focus on political risk and trade credit, energy and property business, with up to $25mn of capacity per risk.

-

The European (re)insurance supervisor said correlation to financial market risk made the idea a challenging one while reinsurance appetite is also very limited.

-

The CEO said pricing was going up by 10%-30% and that terms were being tightened globally.

-

The body said that government-backed insurance schemes are not always the answer and are complex to establish.

-

The pandemic and natural disasters impacted the result by $178mn.

-

The reinsurance unit of the Spanish group takes a near-EUR80mn full-year hit on the pandemic.

-

The newcomer most recently led Marsh’s property team in Asia, and has also worked at Newline and Cooper Gay.

-

The Australian carrier has also modestly increased its reserves for Covid-19 BI claims.

-

Futureset aims to bring together specialists to promote risk awareness and resilience.

-

The CEO also discussed Beazley’s approach to re-underwriting cyber risks.

-

Bryte has also granted an underwriting binder for its entire corporate property book to Sapphire Risk Transfer.

-

The analyst predicts the insurance sector could experience its best performance in nearly a decade.

-

The ratings agency foresees no “material effect” on the capital or earnings of UK commercial property insurers following the Supreme Court ruling.

-

Fenchurch Law partner suggests "aggressive" initial claims adjustments will be unwound and the reinsurance context will need specific consideration.

-

William Alderton becomes head of the new worldwide unit.

-

The regulator plans to publish data on the size of claims settlements and scale of reserving.

-

After a management meeting, the analysts rule the carrier well placed to capitalise on the hardening market.

-

The bank trims earnings estimates and says consensus expectations are too high.

-

Some markets on the programme have pushed back on the inclusion of event cancellation exposures.

-

Fourth-quarter lockdown measures will push Covid-related P&C Re and CorSo losses up $400mn to $2.7bn for 2020, the analysts say.

-

The underwriter will work alongside George Stratts to build a book of business.

-

Pandemic outbreak jumps 15 places to become the joint-second perceived risk.

-

Deployed capacity is recovering and claims were below expectations but ending government support could negatively hit the market.

-

The analyst says the judgment removes an overhang that had weighed on the carrier’s stock.

-

Typical cat loss events trigger XoL reinsurance recoveries. It is not certain that this will.

-

The carrier's 2020 net loss estimate remains intact after the buffer for potential Australian BI losses.

-

The carrier still expects net losses from Covid-19 to cost about £62mn.

-

The ruling broadens the coverage available and alters the operation of trends clauses.

-

Shares in the carrier recover from initial losses following a ruling by the Supreme Court that came down largely in favour of insureds.

-

Judges dismiss insurers’ appeals and overturn the famous Orient Express ruling.

-

The upcoming Supreme Court ruling could result in increased losses for the carrier.

-

The mixed ruling delivered by the High Court meant insurers escaped from worst-case loss scenarios.

-

The finding could have a material impact on the scale of BI losses stemming from the pandemic.

-

The year was marked by record North Atlantic storms, which put the loss tally more than 40% ahead of mild 2019 experience.

-

The missive adds to the patchwork of arrangements emerging for existing policies across the 27-nation EU.

-

Loss-free accounts are repricing by high single digits but the real battle is over terms.

-

The new recruit will run SI’s UK and international property team.

-

The GDV trade association reports below-average losses thanks to a quiet winter storm season.

-

Major consolidation laid the ground for current new launches, the Conduit chairman suggested.

-

Guardrisk argued that its policy did not respond to a general government response to the pandemic.

-

The underwriting room will be open on Wednesdays only for all classes.

-

The coronavirus pandemic prompted huge change in a sector already dealing with systemic challenges.

-

The consultancy said losses were expected to keep mounting following Q4 disclosures.

-

The joint venture will focus on mid-market global property business, primarily in the US.

-

Losses were relatively evenly divided between the two events.

-

The insurer said its reserving was still adequate after the court supported its overall approach, but said biosecurity exclusions were not sufficient to decline claims.

-

The regulator says that the insurance sector had remained resilient this year but faced ongoing threats.

-

The highest court dashes lingering hopes of pre-Christmas certainty in the BI debacle.

-

The new Syndicate 1796 is the conduit for the initiative and is backed by 14 global (re)insurers.

-

The executive was an EVP at the Innovisk-hosted MGA, which will enter run-off for 2021.

-

PI underwriter Dean Kiernan joins from RSA and property specialist Donna Stroulger from Mapfre.

-

The local Organising Committee expects to receive around 50bn yen ($481mn) for the initial delay.

-

Occurrence retro rates are among the segments where rate pressure is abating, although the outlook remains somewhat opaque in a late renewal.

-

The regulator says it wants a clear position on the issue as soon as possible after the Supreme Court ruling on the BI test case.

-

Rates for listed companies continue to rise between 200%-400% amid hard market conditions.

-

But the ratings agency warns that pandemic exclusions, along with legal disputes, are damaging the industry’s reputation.

-

The reinsurer was placed under review in March amid turmoil in its management.

-

Carriers have raised $19bn so far this year, with another $3bn in the pipeline, the broker says.

-

The outcome of the appeal and a planned new BI test case will be significant for reinsurers.

-

One top-tier broking source claimed that across the market, claims were being settled in two-thirds of the usual time.

-

Based in Zurich, the former Schroders executive will become senior property underwriter for France, Benelux, Iberia and Africa.

-

The regulator ordered potential rebates in June after deciding lockdown measures meant some contracts offered little value for money.

-

The German carrier pegs the full-year impact of the pandemic on its reinsurance operations at EUR3.4bn.

-

Disagreement over cyber wordings in named-perils cover joins the list of issues creating friction ahead of 1.1.

-

The club reported a combined ratio of 102.2% for the first half of 2020, and an underwriting deficit of $2.2mn.

-

One Lime Street will be open to all classes of business on Tuesdays, Wednesdays and Thursdays from 2 December.

-

Joint research finds that remote working has challenged the London market’s ability to innovate commercially.

-

At a Reuters event, Willis’ Aubert agrees that assuming older employees would find the transition hardest was a mistake.

-

The carrier seeks to address potential BI liabilities following a court ruling.

-

Plus Aon's new cat XoL facility under the spotlight.

-

-

The Australian carrier takes a A$865mn provision for BI losses following the unfavourable court ruling.

-

Both Suncorp and QBE said multiple tests applied to trigger BI coverage, with QBE saying aggregate reinsurance should mitigate net exposure.

-

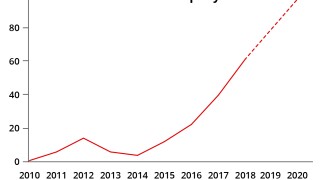

The report said that the volume of cyber insurance claims had gone up more than nine times in the past five years.

-

The regulator said in the Supreme Court appeal that carriers ran the risk of a large accumulation of losses when they sold their BI policies.

-

Court rules policy exclusions referring to outdated law not valid.

-

Counsel representing carriers argued it was not reasonable to find cover in respect of a national pandemic on the first day of the FCA BI test case appeal.

-

Australian carrier ups coronavirus BI provision to A$195mn.

-

The branch will write US property, casualty and specialty reinsurance on behalf of its Irish subsidiary.

-

The fundamental issue of causation, as well as trends clauses and the Orient Express judgment, will be under scrutiny.

-

The carrier expects its total losses to reach EUR700mn-EUR900mn, as Covid claims reports begin to flow to reinsurers.

-

The carrier has fully eroded the retention on its group aggregate cover, limiting Q4 cat exposure.

-

The sector is trying to find ways to rebuild its client base following the devastation caused by the Covid-19 pandemic.

-

Wording construction, the use of counterfactuals and the notorious Orient Express ruling will all be under the spotlight.

-

The venture is led by Guillermo Eslava, a former Swiss Re and Brit underwriter who briefly joined Argo in 2019 as head of LatAm casualty.

-

Government shift to immediate priorities and the complexity of the issues prompt a pause.

-

The top general insurance supervisor also warns the market against declaring an early victory on underwriting remediation.

-

Covid’s “slow, prolonged and symmetric” nature contrasts with a cyber attack or supplier outage, operations expert Nick Strange notes.

-

The Treasury had raised concerns that insurers were paring the value of state support from claims payouts.

-

Mini-MDLs will be established for some lawsuits brought against Arch, United Specialty and Society Insurance.

-

The carrier said it did not intervene earlier so that it didn’t “clutter up the procedure”.

-

The pandemic has shown that acting ahead of a major event and ensuring wordings clarity are key.

-

The case was launched after thousands of businesses attempted to claim on their insurance for Covid-19 related BI.

-

The case started in Sydney today, with the Insurance Council of Australia arguing that the intention of pandemic exclusions in commercial property policies is clear.

-

Insurers argue that the judgment shows that downturns prior to the occurrence of the insured peril can be accounted for.

-

The regulator, the Hiscox Action Group and seven carriers will seek leave on Friday to appeal the High Court judgment directly to the Supreme Court.

-

Applications have been filed for a 2 October hearing.

-

The president and CEO urges wordings precision to avoid cyber-related litigation.

-

The appointments follow the arrival of former Axis head of global international property Stuart Heath to lead delegated property.

-

The Bronek Masojada-led carrier says it has yet to decide whether to challenge the High Court ruling.

-

A group of 12 insurers have volunteered not to factor in the grants in any claims.

-

The executive was previously Willis’ London North American property head.

-

Hiscox Action Group lawyers demand the regulator uses powers to speed up interim payments.

-

A trade body and broker said payouts would be the “ethical approach” to support financially stressed businesses.

-

The two biggest reinsurers are said to be taking up a leadership role as the market starts to address the T&Cs challenge.

-

The carrier probably won’t be the last to flag additional losses from events cancellation.

-

Speaking on Tuesday, John Neal reiterated the market’s commitment to customers in the Americas.

-

The law firm claims the widely used “resilience” wording should respond to government-ordered lockdowns.

-

The regulator orders carriers to consider how they can “progress claims” now, irrespective of an appeals process due to kick off on 2 October.

-

The carrier claims the Paris court decision runs counter to judgments in Toulouse and Bourg-en-Bresse.

-

The executive says he is optimistic about the prospects for Bermuda.

-

Financial Services Director General John Berrigan wants to establish a new working group which will report back with proposals in the first quarter.

-

The latest estimate is marginally below a previously disclosed $75mn UK BI claims cap.

-

The likelihood of a heavy loss rises, but some elements including requirements around mandatory shutdowns are a silver lining.

-

The Swiss carrier says any increase in P&C claims arising from the ruling won’t materially impact its earlier assessment of $750mn in Covid-19 claims.

-

The verdict has been hailed as a victory for the regulator and policyholders but many individual decisions on wordings favour insurers.

-

The insurer could have total gross losses of more than EUR500mn, according to a French publication.

-

Lloyd's welcomes the ruling, while the ABI claims it "divides equally" between policyholders and insureds.

-

Reinsurance recoveries and a drop in overall claims will offset the BI loss hike.

-

In a major blow to insurers the court found that the pandemic and the government’s response could be treated as a single cause of loss.

-

The carrier predicts fewer than one third of its 34,000 UK BI policies could be impacted by the judgment.

-

Tomorrow’s decision, including the important precedents it sets, will be appealed.

-

CEO John Neal gave the estimate ahead of the FCA test case judgment next week.

-

The hotly anticipated judgment will be a milestone in the ongoing dispute about how carriers respond to Covid lockdown-related losses.

-

A New South Wales Supreme Court judge gives the go-ahead for the hearing to start on 2 October.