Aspen

-

Innovation emerged as the critical target for attracting new business to London.

-

Aspen's GWP increased 0.9% to $1.13bn, as it focuses on “robust cycle management”.

-

The Aspen exec highlighted the London market’s long-standing reputation for innovation.

-

The insurer paid tribute to the executive’s lasting contributions to the firm.

-

What’s next for the reinsurance market as Monte Carlo approaches?

-

The action follows Sompo’s $3.5bn all-cash acquisition of Aspen Insurance.

-

The Japanese carrier faces integration challenges to make a success of the deal.

-

Ratings agency said the Sompo deal could have positive financial and operational benefits for the Bermudian.

-

Group CEO Mikio Okumura cited “solutions that have not been fulfilled”.

-

Plus, the latest people moves and all the top news of the week.

-

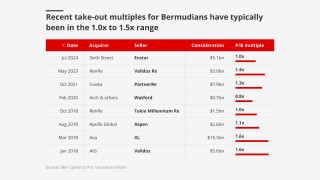

Insight into the state of the insurance M&A market, powered by this publication's deal database.

-

Sources see Aspen as the right fit for Sompo, with Apollo getting a full cash exit.

-

The lawsuit has been filed as sales talks with Sompo yielded a deal.

-

The Japanese company announced the $3.5bn deal today, three months after the Bermudian completed its IPO.

-

The Japanese carrier has agreed to buy Aspen for a realization of $3.5bn.

-

The all-cash deal values the Bermudian’s stock at a 36% premium.

-

This publication first reported deal talks last week.

-

Plus, the latest people moves and all the top news of the week.

-

Aspen would give Sompo more reinsurance scale, more US premium and a Lloyd’s presence.

-

This publication revealed yesterday that the two were in detailed takeover talks.

-

Sources said that detailed discussions have taken place, with a clear path to a deal.

-

The newly created role consolidates leadership across UK entities.

-

-

Last year, the firm obtained a Class 4 license in Bermuda.

-

Emilie Hungenberg joins the carrier from Aspen.

-

The executive replaces Mike Warwicker, who left the firm earlier this year.

-

The underwriter has held positions at The Hanover, Liberty Mutual and Zurich.

-

Plus, the latest people moves and all the top news of the week.

-

The company’s upsized public offering priced at $30 per ordinary share.

-

The IPO was announced at the end of April, targeting ~$2.6bn-$2.9bn.

-

The specialty carrier is braving volatile macroeconomic conditions in a second effort to list.

-

We assess the Bermudian’s standing amid waning investor sentiment and economic uncertainty.

-

The carrier is targeting an IPO valuation between $2.6bn and $2.9bn.

-

The carrier is offering shares priced at $29-$31.

-

The syndicate expects £5.8mn-£8.6mn in California wildfire claims.

-

Changes in business mix towards specialty and improved reserve development offset higher Q4 cat losses.

-

In October, this publication revealed that the carrier had resumed IPO preparations.

-

Cat losses in reinsurance rose 11.1% year over year to $45.1mn, driven by Hurricane Helene.

-

He joins from R&Q Insurance Holdings, where he has been chief accounting officer.

-

The business put up strong H1 numbers, and has named Christian Dunleavy group president.

-

Coalition Re to offer active cyber reinsurance via two products supported by Aspen-led capacity.

-

The reinsurance segment reported cat losses of $43.2mn versus $15.2mn in Q2 2023.

-

The new leadership structure is designed to create more accountable executive roles responsive to Aspen’s strategy.

-

The City grandee has experience on the Catlin, Convex and Miller boards.

-

The carrier will reassess the market in the fourth quarter, or early in 2025.

-

Aspen said reduced reinsurance appetite made it a good time to seek alternative capacity.

-

The group-level CoR worsened 4.7-points in the quarter, coming in at 89.4%.

-

Karlsson was previously head of credit and structured risks.

-

The deal adds to Aspen’s existing support of the InsurTech in the UK and Canada.

-

Dan Osman will take over as active underwriter for Syndicate 4711.

-

Putting together two “show me” stories risks investor skepticism.

-

It was announced earlier today that former Aspen UK CEO Richard Milner was set to join Chaucer as group CEO.

-

The company also confirmed earlier reports from this publication that Goldman Sachs would be a leading bookrunner, along with Citigroup, Jefferies and Apollo Global Securities for its ~$4bn H1 2024 IPO in New York.

-

The announcement comes almost two months after this publication revealed that the carrier had lined up Goldman Sachs, Citibank and Jefferies to run its $4bn H1 IPO in New York.

-

The follow-only algorithmic syndicate has stamp capacity of $925mn for next year.

-

CEO Mark Cloutier attributed the performance to increased investment income, driven by a higher rate environment, as well as increased fee income from Aspen Capital Markets, which “enhanced” the quality of earnings.

-

Ratings could be lowered by one notch depending on regulatory restrictions on cash flow from Bermuda operating entities to non-operating holding companies, the ratings agency said.

-

Edward Hart joined Aspen in February and has previously held roles at Brit and Barbican.

-

Tim Mardon will become CUO at Aspen Bermuda Limited and a member of Aspen Re’s leadership team.

-

Ki announced a new multi-year partnership with Aspen and Travelers this morning.

-

The company said Ki is the first algorithmic underwriter to offer capacity from multiple syndicates.

-

Bianconi joined Aspen in 2016 and has held a number of roles including, most recently, as head of US cyber.

-

The move to gear up for a listing follows a non-deal roadshow held over the summer.

-

Andrew Dyer joins from the Prudential Regulation Authority, where he has been head of the insurance supervision division for the past six years.

-

Insurance's GWP decline was driven by a couple of programs that were underperforming, while reinsurance's deceleration was driven by a deliberate slowdown in the mortgage book.

-

Net income increased to $219mn over the period, up from $48mn in the same period last year, while underwriting income increased by 33% to $208mn.

-

In her expanded role, she will work with trading partners to represent Aspen in the US for all business segments and build out existing distribution strategies.

-

The executive joins from Crum and Forster, with 20 years’ cyber experience.

-

John Welch left his role as CEO of domestic markets at Axa XL Re last year in a leadership reshuffle.

-

Trium cyber is the first monoline cyber vehicle to be approved by Lloyd’s, and began writing business in January.

-

Aspen’s global head of casualty and head of international reinsurance Beatrice Morley is set to relocate to London as of 1 August.

-

The company did not provide prior-year period figures as it usually discloses its results on a semiannual basis.

-

Mark Cloutier set out Aspen’s plans for top-line 2023 growth in the range of 10%, and a continued strategy of pursuing rate rather than exposure growth in property cat.

-

The Bermudian carrier reported GWP of just over $4.3bn in 2022, a 10% increase on the year prior.

-

The syndicate also reported an overall profit of £35.1mn for the year, up from a £34.3mn loss in 2021.

-

David Altmaier previously served as the commissioner of insurance for the state of Florida, leading the office of insurance regulation for more than six years.

-

The number of global, non-life run-off deals dropped to 48 over 2022, compared with 54 in 2021, according to a report from PwC.

-

The former Canopius CEO will chair the company’s nominations and governance committees.

-

Based in Bermuda, the executive will oversee the firm’s investments in technology and support its growth initiatives.

-

Nick Acker joins from Arch Insurance group, where he spent 10 years, most recently as a vice president in its wholesale and distribution management team.

-

The new carrier will be backed by Ariel Re owner Pelican Ventures and aims to write $50mn GWP in 2023.

-

The firm’s leadership said a pattern of strong results is needed before triggering an IPO process.

-

The carrier also reported GWP of just over $2.3bn for the first half of the year.

-

The carrier’s withdrawal from certain specialty lines comes as remediation feeds through into improved results.

-

The carrier’s former accountant KPMG will now have to respond to EY’s enquiries.

-

The carrier has also announced a brace of promotions in its first-party and specialty teams.

-

The existing $770mn adverse development cover between the two parties has been absorbed as part of the deal.

-

A substantial rise in the value of liabilities transacted during Q1 to $4.2bn was driven largely by Aspen’s $3.6bn LPT with Enstar.

-

The business performance is on track for an eventual flotation, but the date will depend on stock market conditions, the CEO said.

-

The reinsurance segment swung back to underwriting profits as its CoR declined 8.5 points to 93.6% and its LR improved 11.4 points to 63%.

-

The carrier strengthened reserves by $41mn due to uncertainty around financial and professional lines claims development.

-

Under the terms of the deal, Aspen will provide paper across multiple geographies with three programs in the US and four in Europe.

-

Project Leaf will see environmental, social and governance (ESG) information issues woven into Aspen’s decision making for its credit and political risk portfolio.

-

The deal is the largest in Enstar’s history and sets Aspen up either for a sale to a strategic buyer or a return to the public markets.

-

Ashley Bowell was found guilty of defrauding his former employer, and its insurer Aspen, after falsely claiming to have been injured at work.

-

The carrier said the move reinforces the importance of Lloyd’s as a platform.

-

In a raft of promotions, Andrew Rippert will become reinsurance CUO and Beatrice Morley head of international reinsurance.

-

The executive will join the business in early January, replacing Mike Cain.

-

The significant pre-emption is predominantly driven by the transfer of a reinsurance book from the carrier’s UK platform to Lloyd’s.

-

Kevin Chidwick, group CFO at Aspen Insurance Holdings, is to retire by year end and will be succeeded by Christopher Coleman.

-

“If we hit ’21, as I expect, based on most recent forecasts, and in ‘22 we get close to our plan, I think a possibility for this business would be a potential IPO in early ’23,” Cloutier told this publication on Tuesday.

-

The carrier has non-renewed around $800mn of business in the past 18 months.

-

Aspen said Mike Cain will still remain with the company through Q1 2022.

-

Aileen Mathieson, who will start on 15 November, will also join Aspen’s group executive committee.

-

Philip Hough leaves Singapore to focus on his role as global head of property, based in Zurich.

-

The industry veteran is credited with having built Arch’s well-respected mortgage credit business.

-

Plus the implications of the X-Press Pearl sinking and all the top news from this week.

-

The company is accused of “brazenly cheating” Andrew Kudera of his own money and of owed compensation, the lawsuit states.

-

The newcomer replaces Andrew Kudera, who was hired in January last year but has now left to pursue other opportunities.

-

The new logo and slogan follow a year of progress in the carrier’s turnaround plan.

-

She joins Axa XL executive Kelly Lyles and ex-Zurich Insurance exec Thomas Huerlimann.

-

Aspen’s outwards reinsurance team now also joins the carrier’s capital markets unit.

-

The ratings agency also affirms the carrier’s financial strength rating of A.

-

The executive says the carrier made strides last year in its underwriting and is well positioned for growth.

-

Catastrophe losses more than doubled to $360.8mn, which included $181.2mn of Covid-19 losses.

-

The appointment reflects a diversification push at the carrier.

-

Bermudian’s Lloyd’s platform to begin underwriting class by early 2021.

-

The move caps 18 months of turnaround efforts at the Bermuda reinsurer.

-

The former GL leader takes up a New York and Connecticut role.

-

The carrier showed improvement in the underlying profitability of the carrier as the turnaround continues.