-

Clear Blue originally filed the suit in late 2023, alleging reckless conduct and misrepresentation.

-

White will join from Allianz trade, and Summers from Talbot.

-

The reinsurer plans to grow its US business at a higher rate than its non-US business.

-

Carriers are rethinking the traditional renewal-rights model.

-

Moretti has relocated to California from London.

-

Willis claims at least two $1mn accounts were also unfairly lost to Howden.

-

The broker is understood to manage Brown & Brown’s account at Howden.

-

Incumbent Jane Warren will retire at the end of the year.

-

The carrier has hired José David Jiménez García as managing director for Germany.

-

Scott was most recently head of claims at MGA Geo Underwriting.

-

Without flexible mechanisms the Corporation risks suppressing transactions.

-

The insurer of last resort currently has $2.15bn of cat bond protection on risk.

-

Jonathan Rinderknecht was arrested Tuesday on destruction of property charges.

-

The Ryan Specialty renewables MGA launched an international arm last year.

-

Pryor-White founded Tarian Underwriting, which was sold to Corvus in 2022.

-

In July, he took the role on interim basis from Laure Forgeron.

-

Property underwriters are ‘competing fiercely’ to access mining risks.

-

The recruits will join from Nephila, Aon and Malaysian Re.

-

Declared events totalling just under A$2bn ($1.3bn) included one cyclone and two floods.

-

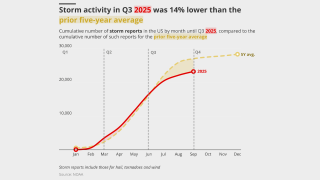

Despite a rocky H1, 2025 insured losses from nat cat events may not surpass 2024 levels.

-

The specialty insurer was recently acquired by Korean carrier DB Insurance.

-

The carrier is planning a limited relaunch into the UK D&O market.

-

-

The class offers affirmative coverage for gaps in traditional insurance policies.

-

As both carriers and reinsurers deal with softening markets, all eyes are on hurricane-prone areas.

-

Alliant is in the process of moving the ~$1bn of business it places with Howden to other wholesalers.

-

It comes as the MGA expects to write more than $1bn of premium in 2026.

-

The underwriter has worked for Markel in Singapore since 2020.

-

The carrier has renewed and extended its capacity arrangement with the MGA.

-

Samir Hemsi was CUO at Westfield Syndicate and sat on the firm’s board of directors.

-

Joel Hodges will run the international business as managing director.

-

Panellists at Insider Progress shared fixes for bias, confidence and culture.

-

The newly united company has set out ambitions to double in size by 2030.

-

Sources said Marsh Specialty UK growth leader Lizzy Howe will lead the operation.

-

The former civil servant joined the Corporation in October 2021.

-

Seller White Mountains will retain a roughly 15% fully diluted equity stake.

-

Jo Smart has worked for Torus and Aegis during his two decades in the market.

-

West Hill Capital is the main investor in the capital raise.

-

The aviation market has experienced a run of large losses this year.

-

The business has been ~70% owned by White Mountains since January 2024.

-

Plus, the latest people moves and all the top news of the week.

-

Julia Graham played a key role in the UK's introduction of captive-friendly regulation.

-

Inigo CEO Richard Watson said the team is ready for its “second album”.

-

What’s driving the wave of shifting ownership structures in the Lloyd’s market?

-

The ratings agency cited a reduction in exposure to nat cat risk as a reason for the change.

-

The executive has worked at Aon for almost two decades.

-

The executive was most recently serving as CRO – insurance.

-

Landa was part of the team lift led by Michael Parrish, who is CEO of the US retail arm.

-

Stephan Simon left BMS in June 2024 after almost three years in the role.

-

High capacity is adding to competition in the upstream energy space.

-

The protection gap must be closed before a public cyber reinsurance scheme is possible.

-

She previously served as Hub’s North American casualty practice leader.

-

The Bermuda-based executive joined the Ardonagh Group’s reinsurance broking arm in March 2023.

-

Spectrum joins investors ForgePoint, Hudson and MTech.

-

Stephen Ridgers is leaving his current role as head of construction midcorp at Allianz Commercial.

-

The pair have expanded remits overseeing property and specialty.

-

The MGA secured a “significant strategic investment” from Zurich earlier this year.

-

Continental composite carriers aim to smooth volatility with new initiatives.

-

Kantara now holds a majority stake in the MGA, with the rest held by employees.

-

Winds have strengthened to 80 mph, and the hurricane is expected to intensify further over the next 48 hours.

-

Current backer JC Flowers will retain its holding and the cash will fund a Bermuda acquisition.

-

New sources of capacity lack the expertise to service rapidly developing clients.

-

Abbas Juma has spent more than seven years at Howden M&A in various senior roles.

-

The upcoming Lloyd’s Lab cohort 16 will include a dedicated Irish theme.

-

Several airlines are understood to have come to market early.

-

The company will continue its capacity partnership with the MGA until 2030.

-

Susan Langley will look to strengthen global business ties and promote UK growth.

-

According to McKinsey, the projected spending on data centers is expected to hit $6.7tn by 2030.

-

The BP Marsh-backed MGA launched earlier this year, led by Adam Kembrooke.

-

The underwriter has worked at Hiscox, Lloyd’s, Chubb and Zurich.

-

Marlon Williams will focus on the placement of reinsurance and retro business.

-

Tom Potter was global casualty underwriting manager for UK & Lloyd’s at Axa XL.

-

The Lloyd’s investment business has cut expenses by 54% over the past six months.

-

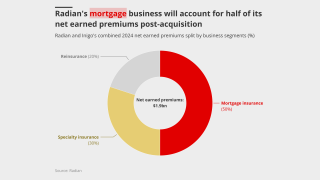

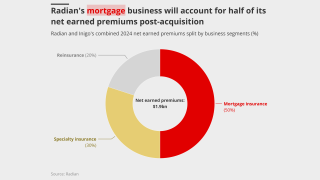

The deal will be watched closely by Radian’s handful of similar peers.

-

Sean McGovern will step down from the role in December.

-

The hire comes as Guy Carpenter fills the void created by the Willis Re raid earlier this year.

-

The pair hail from Dale Underwriting and Axa XL, respectively.

-

The tropical cyclone is expected to be named Imelda.

-

Plus, the latest people moves and all the top news of the week.

-

Small modular reactors are increasingly viewed as a means of meeting surging energy demand.

-

The transaction marks the largest US market entry by a Korean non-life insurer.

-

Georges De Macedo will remain within the group as a board member.

-

The executive has been with ASG since it was formed in 2016.

-

Aon’s Enrico Vanin will lead the platform as CEO.

-

After losing in the High Court, insurers pin their hopes on the Court of Appeal.

-

The veteran underwriter said market conditions are still ‘robust’.

-

This will be Fidelis’ first office in North America and will be led by former Navigators Re head Ivan Vega.

-

The Corporation’s chair reiterated its aim to reduce the cost of doing business.

-

The London broker has also recently hired Michael Lohan from Lockton.

-

Global pricing is now 22% below the mid-2022 peak.

-

MGA Amiga Specialty launched in May, with backing from investor BP Marsh.

-

Equivalent to a Category 5 hurricane, Ragasa is the world's strongest storm this year.

-

The market turn may give some staff pause for thought, but reward remains high.

-

He will spearhead the division’s launch slated for 2026, which will be the first product launch for ICW Group’s specialty unit.

-

The report highlighted the gap between insured and uninsured attacks is widening.

-

The broker’s headline Ebitda was $20mn, up from $5.6mn in 2023.

-

The toll of risk losses sustained by the PVT market this year is mounting.

-

IAG completed its takeover of RACQ last month.

-

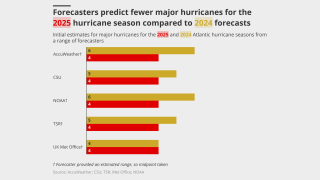

Despite formation of Gabrielle, there is "a very high probability" of a below-average season.

-

The executive met with UK colleagues to discuss plans for the US business.

-

Dale Underwriting recently pulled out of standalone offshore energy business.

-

The major storm is set to move on to mainland China later in the week.

-

The economic loss from the event was around EUR7.6bn.

-

Part four looks at how the talent landscape will shift in response to AI introduction.

-

The move comes as the broker rebuilds its Bermuda team.

-

The low degree of overlap between the combining portfolios benefits both parties.

-

Lockton Re has predicted major growth in the global cyber insurance market.

-

The Bermuda reinsurer has been active in ILS since launching in 2007.

-

Plus, the latest people moves and all the top news of the week.

-

The Corporation’s chair laid out plans to make Lloyd’s a preeminent market in the long term.

-

Louis Tucker established and later sold Barbican Insurance to Arch in 2019.

-

How does Lloyd’s plan to secure its future as a leading global marketplace?

-

Losing senior women creates a knock-on effect as juniors lose role models.

-

The mortgage insurer said Inigo will continue to operate as a standalone business.

-

The acquisition furthers Howden’s expansion into the US retail space.

-

The CEO said the lack of portfolio crossover was highly attractive to Inigo.

-

More general issues at recruitment level include drawing from too narrow a pool.

-

The US mortgage insurer announced its $1.7bn acquisition of Inigo earlier today.

-

Alessa Quane will report to Sompo P&C CEO James Shea.

-

The deal becomes part of a wave of carrier dealmaking.

-

The 2024-25 period has been the worst on record for claims, with costs of $775mn+.

-

Organisations were challenged to address systemic DEI failure rather than play “word salad” with labels.

-

The broker said insurers were facing increasing pressure to improve financial performance in claims.

-

It said the loss did not reflect the underlying economic performance of the business.

-

This publication revealed in February the incident was expected to lead to a major claim.

-

The ILS manager has $6.8bn in assets and will be led by MariaGiovanna Guatteri.

-

The recent Iumi conference highlighted the impact of waning globalisation and tariffs.

-

A decision in relation to who bears which legal costs will be reached at a later date.

-

The measures also seek to encourage greater wildfire mitigation efforts.

-

The combined casualty treaty team has also made a number of hires.

-

Age has not been addressed as much as other areas of diversity, the panel said.

-

There will also be a renewed focus on organic growth, both in P&C and across US and international operations.

-

The sidecar will support five programs providing specialty frequency coverages.

-

Chris Eaton and Bill Moret gave their notice last week without specifying their destination.

-

Property remains the dominant line, accounting for nearly 30% of total London premiums.

-

Her predecessor will become head of US excess casualty and operations.

-

Reinsurer executives stressed that the industry worked hard on setting the right structure.

-

The executive joins from MSIG USA.

-

The assistant treasurer is also due to review the Australian cyclone pool.

-

Ariel Berman joined the company as head of specialty in 2023.

-

Insurance Insider reported earlier today of the asset manager’s foray into the MGA space.

-

The business said it was experiencing strong momentum on the Island.

-

Ex-Western Europe CRB head Alberto Gallego and colleagues left for a Marsh joint venture.

-

The deal represents a first entry into the US MGA market for the $1.1tn asset manager.

-

Plaintiffs allege that manufacturers and retailers have broken environmental laws.

-

The Berkshire subsidiary is seeking coverage for a $22mn antitrust loss.

-

The affirmations reflect Everest’s strong underwriting diversification.

-

The carrier started writing construction in Lloyd’s following the acquisition of Probitas.

-

Plus, the latest people moves and all the top news of the week.

-

Giles has spent more than five years at Themis Underwriting.

-

Losses were primarily driven by personal property lines.

-

From aviation claims to retention challenges, underlying dynamics will take time to play out.

-

He was appointed CUO of casualty, Americas, in July last year.

-

This will be the 15th cohort of companies to go through the Lloyd’s Lab.

-

The tech firm is building a joint stock company with insurers and investors.

-

The new recruit will report to group CUO Ian Houston.

-

The new division will be led by Terry Fitzgerald, who has previously led the finpro portfolio.

-

Chilton founded Capsicum Re, which was acquired by Gallagher in 2020.

-

There are concerns that repeated delays could lead to market disengagement with the process.

-

Models anticipate a busier second half, particularly in the next few weeks.

-

The carrier’s US and Europe claims teams will report to Clayden.

-

The relationship between growth and capital is “symbiotic”, the broker said.

-

Mark Connellan is the latest addition to Bassel Matta’s team.

-

The deal is expected to result in $700mn in combined GWP in Florida upon completion.

-

Lenders include Morgan Stanley, Permira and Bridgepoint.

-

The carrier’s chief buyer urged a partnership approach from reinsurers.

-

Blackstone-style capital seeking to get closer to source is a net negative for reinsurers.

-

Cedants target methods of reducing pressure on earnings as reinsurers chase growth.

-

Former head of construction Bill Creedon will assume the role of chairman.

-

Bazan Group’s refinery near Haifa was badly damaged by Iranian bombardment in June.

-

Lloyd’s has pursued a Big Game Hunting strategy to lure major insurers into the market.

-

New capacity continues to flow into the hull market, despite rating pressure.

-

Bill Bouvier has spent more than three years at the legacy firm in this role.

-

An M&A senior analyst and M&A underwriter for emerging markets are also set to depart.

-

The syndicate will be targeting approximately $50mn of GWP in its first year.

-

Scale is increasingly becoming a differentiator for reinsurance carriers, the broker noted.

-

Geopolitical turbulence brings new challenges that primary specialty lines carriers urgently need to address.

-

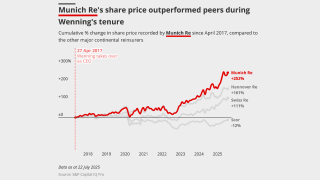

Being conservative and stable is the name of the reinsurer’s game.

-

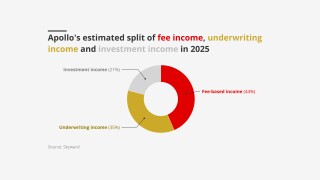

Apollo most recently received in-principle approval for Syndicate 1972.

-

The aviation market may prove an outlier following a disastrous year of loss activity.

-

The broker’s joint venture with Bain Capital still lacks a CEO.

-

The private ILS segment took losses from LA wildfires and Mid-West severe convective storms in H1 2025.

-

Fleming’s attempt follows those of other legacy carriers that have had recent successes raising capital.

-

The insurer’s plans for the syndicate were revealed by this publication earlier this year.

-

Despite high profile losses, there’s ample capacity in marine and aviation, while PV has seen healthy profits.

-

The MGA has set a "new market benchmark" for non-US primary tax risk, it said.

-

Litigation funders are promoting “aggressive” tactics in the UK, Holland and Israel.

-

Reinsurers and their cedants are feeling their books are in better shape, although the market is still uneven.

-

The company, however, sets a high bar on making a move.

-

Hannover Re Capital Partners is in talks with two investors for 1 January launch.

-

The pair were offered contracts by Willis Re in July.

-

The former Hannover Re CEO said reinsurers must use alternative capital and tech.

-

Pine Walk has grown substantially and is on course to write $1.2bn of premium this year.

-

Earnings covers do not need to equal aggregate reinsurance deals, the broker said.

-

Anticipation, motivation and inspiration are central to effective implementation.

-

Reinsurers are ready to draw a line under a worsening claim outlook across the casualty market.

-

The carrier M&A cycle has started and reinsurance is a segment where acquisitions work better.

-

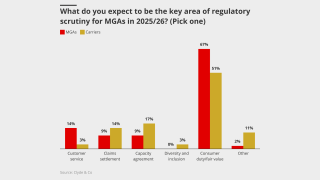

A survey from PwC described the sector as “stable”, “evolving” and “dynamic”.

-

Paul Campbell details how the most profitable insurers act during a soft versus hard market.

-

The reinsurer is moving all its non-cat business to the new syndicate, leaving 1910 focussed on peak cat.

-

The Argenta-backed MGA is already active in the cargo and property classes of business.

-

Rafael Diaz, Tiara Elward and Felipe Murcia will join BMS’s LatAm and Caribbean unit.

-

The post-disaster reinsurance start-up model is changing.

-

Excess capacity will sustain softer rates, as organic growth challenges lead to more M&A chatter.

-

Reinsurance CEO Wakefield said reinsurance structures may evolve for prolonged growth.

-

Agency reactions ranged from Fitch revising down its sector outlook to AM Best keeping a positive outlook.

-

Terms are expected to hold, underpinning the stronger recent performance of reinsurers.

-

The CEO said the AHJ acquisition brought a ‘step change’ to Miller’s reinsurance growth.

-

The reinsurer’s new CEO said he sees no need for a radical shift in strategy.

-

The carrier notified California regulators that it would stop renewing plans starting last month.

-

The departure follows an investigation into an “offensive” email sent by Rouse.

-

It is understood that CyberCube has been considering a sale of the business.

-

Rates will remain elevated in a period of structurally higher risk premia.

-

Supply for property outstrips demand, but the casualty market is “bifurcated”.

-

Mark ‘Ollie’ Hollingworth has held his current role at Atrium since 2017.

-

Tim Barber joins from QBE Re, where he was head of North America.

-

Paul Sandi, head of reinsurance, will serve as active underwriter for the new syndicate.

-

What’s next for the reinsurance market as Monte Carlo approaches?

-

The insurer has been under review with positive implications since March.

-

It was announced this week that the business had agreed to be acquired by Skyward Specialty.

-

Skyward’s acquisition of Apollo will provide access to the London Bridge framework.

-

The treaty underwriter is set to run an MGA within the group.

-

The executive stepped down from Oneglobal in July after five years leading the firm.

-

The Swiss carrier appointed a new global energy head earlier this week.

-

Heyburn joins from Brit, where he was A&H class underwriter.

-

Rachel Turk said product-line facilities had been “under-scrutinised”.

-

Former Hannover Re CEO Jean-Jacques Henchoz received the Lifetime Achievement award.

-

Lloyd’s reported reinsurance GWP increased 10.6% to £13.2mn.

-

The cycle-turn M&A story continues with strategic buyers to the fore.

-

Gross written premium was up 6% year on year.

-

Lloyd’s will keep heritage systems operationally resilient until at least 2030.

-

Growth in the SME sector could help stabilize the market, however.

-

Apollo executives David Ibeson and James Slaughter are committed to the future as a combined entity.

-

Despite rate reductions accelerating, the sector-wide combined ratio is set to remain below 90% through 2027.

-

The US specialty carrier announced Tuesday that it was buying the Lloyd's business for $555mn.

-

The executive most recently served as head of North American treaty reinsurance.

-

The LPPC will offer limits of $127.5mn EAR and DSU coverage in the US and Canada.

-

Aon acquired NFP from Madison Dearborn in April last year in a $13.4bn deal.

-

Jane Poole will succeed Michael Grist, who exits after nearly 16 years.

-

Cyber reinsurance supply has continued to outstrip demand during 2025.

-

In June, this publication revealed that Apollo had appointed Evercore and Howden to run a process.

-

The executive said claims can be a differentiator in a softening market.

-

The action follows Sompo’s $3.5bn all-cash acquisition of Aspen Insurance.

-

Farnworth will also chair the carrier’s audit committee.

-

The ratings agency warned negative PYD on US casualty will likely continue.

-

Signs of discipline indicate a “break” from past boom/bust market cycles.

-

Some 32% of survey respondents expect property cat rates to fall by more than 7.5%.

-

The ratings agency was presenting its outlook ahead of the Monte Carlo Rendez-Vous.

-

The deal is part of Gallagher’s ongoing Asia-Pacific investment strategy.

-

Strong CoRs and investment returns supported profitability in H1 2025.

-

Sébastien Bardy joins from Allianz to lead the firm’s financial scale-up.

-

The Japanese carrier faces integration challenges to make a success of the deal.

-

The underwriter has over 20 years' experience in the construction insurance sector.

-

The deal ends Livingbridge’s two-year attempt to sell the UK broking/MGA platform.

-

The carrier is looking to take a lead position in energy-transition risks.

-

Henrietta Butcher leaves Tysers after decades with the broker.

-

City firms have introduced perks of extending working from home periods and half days in summer.

-

Ratings agency said the Sompo deal could have positive financial and operational benefits for the Bermudian.

-

James River said the court was right to dismiss the fraud case.

-

Company said defendant ‘distraction’ can’t make up for flimsy arguments.

-

The violations included not using propertly appointed adjusters and failing to pay claims.

-

Sources said the team is led by Martin Soto Quintus and is mostly based in Chile.

-

The broker is in hiring mode in specialty after numerous brokers departed for Willis Re.

-

Group CEO Mikio Okumura cited “solutions that have not been fulfilled”.

-

Plus, the latest people moves and all the top news of the week.

-

Insight into the state of the insurance M&A market, powered by this publication's deal database.

-

Sources see Aspen as the right fit for Sompo, with Apollo getting a full cash exit.

-

After spending 20 years at Aon, Goodman will start a senior executive position with Guy Carpenter.

-

The reinsurance veteran joined Aon nearly 20 years ago from Cooper Gay.

-

The executive will buy reinsurance for HDI and Talanx’s corporate unit.

-

The broker has a longstanding trading relationship with US retailer Alliant.

-

The firm has also updated the loss-calculation engines of existing Jeannie tools.

-

Angus Hampton, meanwhile, has been promoted to head of casualty in place of Mario Binetti.

-

Sources said that the NY-based TL underwriter has retained Piper Sandler to run the process.

-

The lawsuit has been filed as sales talks with Sompo yielded a deal.

-

The Japanese company announced the $3.5bn deal today, three months after the Bermudian completed its IPO.

-

The Japanese carrier has agreed to buy Aspen for a realization of $3.5bn.

-

The all-cash deal values the Bermudian’s stock at a 36% premium.

-

This publication first reported deal talks last week.

-

Last year marked the second consecutive year in which carriers made a positive return.

-

Paul Jeroen van de Grampel drove Aon's M&A and litigation solutions proposition.

-

Submission volume is up 10%-20%, according to sources.

-

The ILS play will make the business more capital efficient under new owner Sixth Street.

-

Hagood will stay on as sole CEO of Nephila Holdings, with Taylor continuing as president.

-

-

The broker said it was achievable to place a $2bn vertical limit in the London market.

-

Lawmakers are seeking input on risk evaluation, limits and other concerns.

-

The group claims the White House is undermining disaster preparedness.

-

He succeeds Felix Cassau, who is joining Hannover Re.

-

A notable uptick in attendance underpins the value still placed on the iconic trading centre.

-

The division reported revenue up 13.3% at A$465.9mn.

-

Equidad earlier sold its soccer team to group of US investors that includes actor Ryan Reynolds.

-

Parrish, now Howden US CEO, and his colleagues said they didn’t violate contracts.

-

The Bermudian reiterated its pledge to improve performance.

-

The broker announced the launch of its cross-class facility this week.

-

Plus, the latest people moves and all the top news of the week.

-

Assurex’s global independent broker network pumps $4bn of premium into the London market.

-

Patton Kline succeeds Glod as US aviation and space practice leader.

-

The US has been lucky over recent decades to avoid a $100bn insured hurricane event.

-

The broker said 2026 will bring a “cautious but deliberate” aviation reinsurance environment.

-

Aspen would give Sompo more reinsurance scale, more US premium and a Lloyd’s presence.

-

This publication revealed yesterday that the two were in detailed takeover talks.

-

This publication revealed yesterday that Sompo is currently in negotiations with Aspen.

-

The news comes after the announcement of CEO Graham Evans’ departure.

-

A key hearing in the poaching case is set for 4 September in New York.

-

Worsening trading conditions in the D&O market are leading to staff cutbacks.

-

-

She was most recently claims manager at QBE France.

-

US retailers have various levers to pull to put pressure on potential new competitors.

-

Sources said that detailed discussions have taken place, with a clear path to a deal.

-

Bartlett is the latest in a series of talent moves in the construction market.

-

The deal comes amid heightened interest in German distribution assets.

-

The combined ratio worsened slightly by 0.5 points to 91.6%.

-

The mid-year renewals point to mounting pressure on reinsurance pricing.

-

The deal was announced last month.

-

The update will enable structured data capture early in the placing process.

-

Claude Wade is to step down from his role to address ongoing health issues.

-

Placement head Delchar said Gemini will be available across its global book of in-scope risks.

-

The broker approved a grant of $316mn in equity awards payable in staggered amounts over the coming five years.

-

There has already been an influx of new capacity from MGAs into the power market.

-

The carbon-credit insurer has appointed James Morrell head of credit underwriting.

-

Candy Wong spent 30 years at Aon Re China before a stint at Guy Carpenter.

-

Part III of our series looks at where AI is being integrated into underwriting departments.

-

This is the first rate filing to use the recently approved Verisk model.

-

The company was hit with a data breach on July 16.

-

Signature of the exit plan is needed for cutover in 2026.

-

Plus, the latest people moves and all the top news of the week.

-

Top line grew across all carriers even as pre-tax profits dipped.

-

Besides Russia-Ukraine losses, the Air India crash losses totaled $26mn.

-

The broker has been on an aggressive hiring spree overseen by Lucy Clarke.

-

Peter Vogt will act as a strategic advisor at Axis until the end of 2026.

-

Matthew Budd has over 30 years’ claims experience and previously worked for Talbot and XL.

-

The CEO said the carrier will prioritise margin over top-line growth.

-

The lawsuit is the latest development in the multi-billion dollar reinsurance scandal.

-

Nat-cat events triggered A$1.36bn of losses during the year.

-

The overseas division booked a combined ratio of 94% for the quarter.

-

As rate reductions present headwinds, firms are expected to moderate expansion.

-

Beth MacGregor and Adam Vulliamy are also set to join from Axis Capital.

-

The carrier also reported a slightly improved combined ratio of 94.6%.

-

Net adverse development for the quarter increased 30% year on year to $89.2mn.

-

The insurer has substantially expanded its marine team in recent years.

-

Simon Clegg will leave Syndicate 609 after 25 years.

-

The London carrier missed consensus on gross and net premiums for H1.

-

Property MGA Arden Insurance Services specialises in multi-family habitations.

-

The carrier’s profit grew 34% for the year to A$1.35bn.

-

The carrier booked top-line growth of 2% in H1.

-

Rates were down 3.9% across its portfolio in the first half of 2025.

-

Layla O’Reilly and Mark Edwards are among the brokers leaving the firm.

-

The airline has exercised a break clause to renew its cover six months earlier.

-

The estimate covers property and vehicle claims.

-

Part of the syndicate’s premium for clinical-trial-funding cover will move to Syndicate 1902.

-

The executive has worked for JLT Re, Lockton Re, Willis Re and US Re.

-

The Hannover Re CEO said rate adequacy remains “attractive” overall.

-

Steven Crabb will become deputy chairman on the insurance solutions division.

-

The company has recently made several senior changes to its UK and Lloyd’s leadership.

-

Ex-Tysers chairperson Dan Lott heads the consultancy as CEO.

-

In trying to solve multiple needs, specialty reinsurance opens up complexities.

-

California wildfires were the reinsurer’s largest H1 loss, at EUR615.1mn.

-

This publication revealed two years ago that EQT could lodge a $1bn claim.

-

Rachel Sabbarton has been promoted to CEO at Lancashire Syndicates.

-

A number of staff will be leaving the D&O team as a result of the restructuring.

-

The syndicate now predicts a return on capacity for 2021 of between -5% and 5%.

-

Robert James is set to join the Bassel Matta-led team.

-

He joins from MS Amlin, where he was lead underwriter for US casualty.

-

Market leaders Atradius and Coface have both received in-principle approvals for a Lloyd’s syndicate.

-

Both organisations still predict an above-average hurricane season.

-

Tom Hester joined the broker in 2018 as SVP.

-

Philip Dalton succeeds partner Colin Hasler, who has retired after a 42-year career.

-

The carrier cited elevated cat and large-loss activity, including the LA wildfires.

-

The reinsurer chair said the frequency of losses today “will prevent prices from slipping too much.

-

California wildfire losses were partially offset by improved underlying underwriting.

-

Plus, the latest people moves and all the top news of the week.

-

The P&C re segment’s combined ratio improved by 12.7 points to 61.0%.

-

The company bolstered casualty reserves by $18mn, mostly from discontinued lines.

-

The transaction is expected to close later this year.

-

The carrier reported an increase of 82% in pre-tax income.

-

The forecast has increased since the early July update due to several additional factors.

-

The underwriter left Navium Marine last year and before that worked at Atrium.

-

The move will impact around $50mn of gross written premiums in total.

-

Tokio Marine HCC was below plan on income as the carrier prioritised bottom line.

-

The carrier’s overall P&C combined ratio improved 1.8 points to 91.2%.

-

However, group organic growth among public brokers has slowed to pre-pandemic levels.

-

The Swiss carrier improved its P&C combined ratio by 1.2 points to 92.4%.

-

More investment in early stage firms is an indicator of bullish market, says Gallagher’s Johnston.

-

Cat losses of $1.5mn, net of reinsurance, were primarily due to severe convective storms.

-

Price decreases became lower throughout Q2, however, averaging 3% in April, 2.3% in May and 1.6% in June.

-

Written premium increased by 31% to $2.41bn as top-line growth brought expense ratios down.

-

Duc Tu and Lucy Howard have resigned from Atrium.

-

This publication reported yesterday that Talanx was closing in on the sale.

-

AIG leads the all-risks cover and Axa XL is the hull war lead.

-

CEO Alex Maloney said Lancashire’s growth was “more measured” amid softening.

-

Natural catastrophe claims remained consistent compared with the prior year.

-

The carrier posted its H1 results earlier today, beating analyst consensus.

-

The loss was driven by nat cats and reserve adjustments in US casualty.

-

California wildfires account for $40bn of the insured loss tally in H1.

-

The carrier also announced an increased share-buyback programme.

-

Emerging lawsuits and expanding loss triggers are giving rise to potential claims under a range of policies.

-

The carrier said most lines remained well priced despite increased competition.

-

Prior-year reserve development moved to a $6.3mn charge in Q2 from a $19.3mn release a year ago.

-

With roughly 200 employees, the South American operations generated over EUR130mn in 2024 GWP.

-

The company also purchased $15mn of SCS parametric coverage.

-

The specialty reinsurer also saw several bad investments hit the books.

-

The broker said that there could be a flattening of rate decreases in the hull market in 2026.

-

Stephane Flaquet replaces George Marcotte, who has been interim COO since September 2024.

-

The executive has spent more than three decades in insurance.

-

The LMA head also praised Velonetic for transparency on Blueprint 2.

-

The company has also expanded its relationships with US and UK MGAs.

-

The plaintiffs seek a declaration that part of Marsh recruits’ restrictive covenants are unenforceable.

-

CEO David Howden accused rivals of “restricting choice for their own clients”.

-

Group CEO David Howden says: ‘Our doors are open’.

-

Verita leadership and staff will remain intact and “seamlessly functional”.

-

The leadership transition at the syndicate was announced earlier this year.

-

-

The newly created role consolidates leadership across UK entities.

-

The carrier also benefitted from favourable reserve development in property and A&H.

-

The new team will be headed by Brown & Brown’s Ed Byrns.

-

The underwriter was head of financial institutions at LSM for six years.

-

Matthew Doherty joined the reinsurer in 2018 as SVP, property portfolio manager.

-

Cat portfolios generally grew, but casualty approaches varied.

-

The reinsurance CoR decreased 2.3 points to 79.5% while the primary CoR rose 4.7 points to 98.7%.

-

The suit asserts the raid will cause “incalculable harm” to the broker.

-

The executive joined Navigators in 2010 after eight years at White Mountains Capital.

-

The Canadian insurer saw property rates dip across its global divisions.

-

Nadia Beckert was promoted to Bermuda CUO in March.

-

The MGA will initially focus on credit, energy and construction.

-

The business posted a 95.2% undiscounted combined ratio.

-

Alistair Lester joins from Aon, where he has worked for the past eight years.

-

Plus, the latest people moves and all the top news of the week.

-

The transaction is expected to have a price-to-earnings multiple of 11x.

-

Aviation reinsurance reserving issues will also be a broader focus for the market.

-

AJ Gallagher has responded to a request for additional information under the HSR filing.

-

The French carrier’s first-half revenues were driven by 6% growth in P&C.

-

The model becomes the second in the state to get approval to affect ratemaking applications.

-

A majority of staff not offered jobs at Ryan Re will remain at Markel to manage the run-off.

-

The Miami-based executive assumes the role left vacant by April McLaughlin.

-

DB reiterated that no final decisions have been made regarding a potential deal.

-

The executive was previously head of excess casualty, North America.

-

WTW is “particularly interested” in growing markets like wealth management with bolt-on M&A.

-

Specialty casualty now accounts for around 22.2% of its insurance business mix.

-

In May, we revealed that Lockton's James Campbell is leaving for a role in HWF’s real estate team.

-

Director of competition Graeme Reynolds will cover role until a replacement is found.

-

Joanne Barry and Robert Fox also left the business earlier this year.

-

-

Andrew Laing succeeds Rupert Moore, who will become reinsurance CEO for Asia Pacific.

-

Nicolau Daudt will become global specialty CEO, as previously announced.

-

The claim could add pressure to the hull war market after a recent High Court ruling.

-

Scor's CEO said the P&C market had experienced a “competitive” first half.

-

The firm will target mid-market risks with TIVs of $25mn-$1bn.

-

Nationwide will delegate management of the policies to Ryan Specialty.

-

Sources have identified facilities as a different source of rising commissions.

-

The P&C segment posted an 82.5% combined ratio for the quarter.

-

Everest booked $98mn of aviation losses related to the war, which contributed 2.5 points to the consolidated CoR.

-

The Bermudian said its pursuit of SMEs through M&A will provide sustainable improvements to its bottom line.

-

The broker is looking to move as much of the book away from its adversary as possible.

-

The company provides management workflow for residential contractors.

-

Pricing was “virtually flat” in the second quarter.

-

The CEO said business remains adequately priced in most classes.

-

The carrier is reducing its exposure to quota shares and shifting to XoL.

-

Millions are evacuating after one of the strongest earthquakes in modern history.

-

In part II of our series, we look at where AI is being integrated into claims departments.

-

The carrier said market dynamics were shifting due to increased capacity.

-

Mercury’s recovery from the guaranteed percentage of losses is $47mn.

-

The loss ratio rose 1.9 points to 53.1%, while the expense ratio ticked up 0.6 points to 28.1%.

-

The carrier had $20mn in reserve releases in the quarter, compared to nil in Q2 2024.

-

This brings the carrier’s total limit on the program to $1.8bn.

-

The lawsuit claims more than 100 employees left with Parrish and his three reports.

-

Matthew Flynn joins from RenaissanceRe.

-

The firm has quadrupled its Ebitda since 2022.

-

Insured losses produced the second highest first-half tally since records began in 1980.

-

Insight into the state of the insurance M&A market, powered by this publication's deal database.

-

The carrier agreed to acquire Liberty Mutual’s P&C firms in Thailand and Vietnam in March.

-

The facility was previously for commercial risk clients.

-

The UK carrier will write business that falls in the scope of the FSCS.

-

The broker has recruited from its rival as it looks to launch Willis Re 2.0.

-

The search for a successor to lead Syndicate 1200 is underway.

-

The reduced fine reflected the PRA view that the breaches weren’t deliberate.

-

North American carriers completed the most transactions in the first half of 2025.

-

Goldman Sachs and Cinven have also participated in the German broker’s sale process.

-

Demian Smith joins from Guy Carpenter.

-

The fronting insurer will be able to support MGAs across the 27 EU states.

-

Surveys show diversity and inclusivity foster a sense of belonging and increase productivity.

-

The figure updates an April estimate of EUR696mn.

-

The NFP acquisition was a “tailwind for organic growth, not a key driver”, said CFO Edmund Reese.

-

Staff targeted include producers that channel business through Howden’s London wholesale arm.

-

PE owner Livingbridge brought the broker to market two years ago.

-

The firm is currently working with 13 MGAs, including QMetric and Eaton Gate.

-

The broker’s EPS beat consensus at $3.49 for the quarter.

-

Plus, the latest people moves and all the top news of the week.

-

The former Everest executive has more than 30 years of A&H experience.

-

Wind season remains an important variable, but also might not change current dynamics significantly.

-

Jill Beggs was most recently COO for reinsurance.

-

The reinsurance unit’s combined ratio for the quarter was 94.2%.

-

Doan Nguyen-Huu also succeeds Claudia Valencia Lascar as unit head.

-

The company has also opened a fac office in Singapore.

-

Jim Franson joins from Validus Re, where he was US president.

-

Lucy Fraser has held roles at the ABI, and the City of London Corporation.

-

Dart succeeds Andrew Carrier, who will retire at the end of the year.

-

Improved book value, a healthy CoR and disciplined underwriting mark the CEO’s time at the helm.

-

The property segment reported a CoR of 27.4% for the quarter, down 26.5 points year on year.

-

Weatherbys Hamilton provides private client, bloodstock and farm coverage.

-

Bridges joins from QBE, where he spent over 17 years.

-

CFO Christoph Jurecka will succeed as management board chair.

-

Some 185 credit claims were reported in the market, totalling over $400mn.

-

Frank Masteling will lead the new business as head of trade credit.

-

The Asta-managed syndicate aims to commence underwriting later this year.

-

The broker’s planned US talent raid is in keeping with its audacious history.

-

The insurer denies it is responsible for the actor’s legal fees.

-

The carrier’s top line grew to $890m in the first half of 2025.

-

The broker has nearly 20 years of experience in the reinsurance and retro markets.

-

Sources said MarshBerry is advising the underwriter.

-

Incumbent Oskar Buchauer is stepping down after 27 years.

-

Liberty Mutual, Allianz and Aviva previously had their appeals dismissed.

-

The exit is by mutual agreement, according to the association.

-

The impact on the (re)insurance market has been muted due to its strong capital position.

-

The carrier reported preliminary profits of EUR2.1bn, driven by “very low” major-loss expenditure in P&C re.

-

Underscoring a more competitive market, the structure includes an escalating premium.

-

The expansive European broker is targeting Mike Parrish’s team and former McGriff staff.

-

Lloyd’s has confirmed the departure of two senior leaders.

-

The carrier has also hired Imogen Wright as underwriter marine and energy treaty.

-

Alcor has also opened an Atlanta office, broadening operations in the US market.

-

A look into how the insurance industry is using AI and where practical gains are arising.

-

Tokio Marine GX was launched in May to offer coverage for companies looking to decarbonise.

-

BI claims are notoriously difficult to manage and some insurers believe binary coverage can help.

-

Laure Forgeron has worked at the Swiss carrier since 2009 in numerous senior positions.

-

Fidelis, Liberty and Hive are among the insurers with the greatest exposure.

-

The medical professional liability firm is targeting further healthcare opportunities.

-

Plus, the latest people moves and all the top news of the week.

-

Claims were concentrated in the US, with a significant increase in D&O class actions.

-

The broker said the appointments are designed to drive growth.

-

Despite steep rate hikes, premium volume has held steady as players such as SpaceX self-insure.

-

-

The technology will help analyse growing and emerging risks, especially climate change.

-

The carrier has appointed Roberts Proskovics as renewable energy risk management head.

-

The losses were below May’s $777mn, but almost 3x higher than for June 2024.

-

The medical liability carrier said the deal marks a strategic shift.

-

Total revenues grew 12% due to the contribution from acquisitions.

-

SiriusPoint will provide 100% capacity for Pen’s international PI portfolio.

-

Kathleen Durling joins from Simply Business.

-

Questions remain over regulatory touch, capital requirements and tax benefits

-

The suit claims billions of dollars are being illegally withheld.

-

In March 2024, Cowen was appointed to lead Chubb’s new international transactional liability platform.

-

The latest hires follow Rob Hale’s move to Willis.

-

Peter Cordell will join Syndicate 1729 in January.

-

John Neal was due to start at Aon as global reinsurance CEO in September.

-

Airmic has been lobbying the government to introduce a captives framework for years.

-

The former Lloyd’s CEO will not make his planned move to Aon.

-

Dual’s Luke Browne will join Consilium Risk Solutions.

-

Ian Roberts joined the law firm in 2013.

-

The broker made several senior energy hires from Marsh last year.

-

The strategy is a 10-year plan to drive growth in UK financial services.

-

The US accounted for 92% of all global insured losses for the period.

-

Continued Apax and Carlyle support will give PIB time to differentiate its business.

-

The PRA will also have to report on turnaround time for new approvals against 10-day and six-week targets.

-

US events accounted for more than 90% of global insured losses.

-

The government is consulting on reforms to the existing regulations.

-

The outcome of the consultation includes a detailed timetable for delivery.

-

The MGA has also appointed Probitas alumnus Kiran Wignall.

-

The MGA has recently added casualty and specialty reinsurance divisions.

-

The MGA has secured Lloyd’s paper to write crypto theft insurance.

-

A second syndicate is being explored for “big and bold” new lines

-

State legislation has led to major strides in rate adequacy.

-

The company launched into the contingency market in the wake of the Covid-19 pandemic.

-

The trade body sent an open letter to the UK Chancellor ahead of her Mansion House speech.

-

Category 4 and 5 storms could become more common and hit further north.

-

The executive has spent 13 years in the broker’s marine division.

-

Claims chiefs are caught between technological advancement and waiting for phase two

-

Last year, the firm obtained a Class 4 license in Bermuda.

-

A representative from the carrier said Nexus is responding “with urgency”.

-

Patel has run the MGA platform since its launch in 2017.

-

Dan Prince said the firm will work with brokers’ existing relationships.

-

Plus, the latest people moves and all the top news of the week.

-

How is The Fidelis Partnership choosing to launch into new insurance classes as it rapidly expands?

-

BP Marsh announced its backing of Amiga, which is led by Adam Kembrooke, last month.

-

The MGA is expected to launch a product-recall portfolio in September.

-

Claire Janaway is leaving the carrier after 19 years.

-

Apax and Carlyle will continue to back the broker consolidator.

-

The insurer has hired Coface’s Hélène Martin to support its expansion.

-

In the US, the index fell 6.7% year on year.

-

Emilie Hungenberg joins the carrier from Aspen.

-

Cultural transformation, education, and leadership are also essential to creating safe workplaces.

-

Despite predicting fewer hurricanes, the numbers are still above average.

-

The MGA will write natural resources professional liability business.

-

Andrew Creed has been promoted to group president in addition to his role as group CFO.

-

Luke Tanzer is set to retire after 16 years at the helm of the run-off carrier.

-

Volante joins capacity providers Allianz and Tokio Marine Kiln.

-

Renewable energy premium written in London and international markets amounts to $2bn.

-

Syndicate 1947 is gearing up to expand its marine reinsurance portfolio.

-

The Cathal Carr-led carrier has been building its team since launching this year.

-

Ondine Bourrut Lacouture succeeds Simon Williams, who had been in the role since 2019.

-

The new roles will oversee property, specialty and credit.

-

The business is one of the first to sell in this round of Lloyd’s M&A.

-

Demand and growth opportunities remain ample despite competitive pressures.

-

Parent Aventum said co-CEO Paul Richards remains with the business.

-

The executive previously held roles at Capgemini, The Hartford and AIG.

-

The weather-modelling agency is predicting a below-normal season.

-

-

He will succeed incumbent president Kadidja Sinz.

-

Arturo Pelaez will continue in his managing director role at Brookfield Asset Management.

-

Sources said the downstream energy market is unlikely to turn a profit in 2025.

-

Partner Neo Combarro announced his departure on LinkedIn in May.

-

It was announced earlier today that the US wholesaler had agreed to acquire Atrium.

-

Marsh’s property book saw an average decline of 9% in Q1, a trend that appears to have continued through Q2.

-

Sixth Street and Cornell also bid for the wholesaler.

-

The PRA, FCA and Society of Lloyd’s have agreed to the changes.

-

The deal comes amidst an expected spell of M&A on Lime Street.

-

Willis has been adding brokers to its aviation unit in Europe and the US.

-

The availability of capacity remains the market’s key driver, the broker said.

-

Bridges had been at QBE for 17 years.

-

The challenge now is balancing top-line growth with underwriting discipline amid falling rates.

-

The claims specialist spent 30 years at Amlin before joining TFP.

-

The former Hiscox Re & ILS specialty underwriter starts on 7 July.

-

Rates continue to drop as capacity is ample, the broker said.

-

Plus the latest people moves and all the top news of the week.

-

The Lloyd’s syndicate was one of just a couple of reinsurance start-ups in the current hard market.

-

The cyber business will continue to operate as a standalone entity.

-

Gallagher, Marsh and Aon also faced sizeable outstanding premium payments as at Q4 2024.

-

The executive was CEO at PartnerRe until he retired last year.

-

The three months to June included a cluster of Guy Carpenter exits.

-

The carrier has entered several new classes recently, including specie and reinsurance.

-

The MGA has been through a remedial exercise under Acrisure’s ownership.

-

The unit will include both ocean and inland marine coverage.

-

The carriers remain in takeover negotiations but have not reached a decision around valuation.

-

The late March storm caused extensive damage in southern Quebec and Ontario.

-

The take-private deal was announced in July 2024.

-

The broker’s fac reinsurance division will encompass around 70 staff, it is understood.

-

The claim hits the downstream market following a loss-hit start to the year.

-

It is the second deliverable of the FIT Transition Plan Project.

-

The expansive broker now employs over 450 people in Japan, after launching there in 2024.

-

The new chair said the market must adapt for 2030 and beyond.

-

The FCA is reviewing how it can simplify regulation for commercial insurers.

-

The Australian carrier’s nat cat losses are A$200mn lower than its annual allowance.

-

The $2.6bn deal provides Ergo with an entry point to the US SME market.

-

Ex-Tropical Cyclone Alfred has been the costliest event, with A$1.36bn in losses.

-

The changes affect operations in Switzerland, Bermuda and the US.

-

Separately, Caribbean market head Janine Seifert is leaving the reinsurer for BMS Re.

-

Lloyd’s executives have suggested ceded reinsurance syndicates could help London compete in treaty.

-

The international casualty director has worked at Axa XL, Ive and Ardonagh.

-

He was most recently Marsh’s US manufacturing and automotive practice head.

-

The executive brings more than 25 years of insurance experience.

-

The broker has expanded the number of global industry verticals to seven from four.

-

The soft market continued through H1 2025, especially on shared programs.

-

The company resumed work on a public offering in September.

-

The business currently works with Hamilton Managing Agency.

-

The LA wildfires accounted for 59% of loss activity over Q1.

-

Gallagher Re’s Lara Mowery said mid-year renewals marked the “beginnings of capacity” emerging.

-

Cedants were able to “challenge the status quo” with aggregates back on the table, the broker said.

-

The executive told this publication he will have more time “to propel” embedded auto MGA In The Car.

-

The company said the reduction was due to years of steady improvements.

-

Premium rose across the top 15 P&C risks in 2024.

-

Richardson has been with the firm since 2015 and was most recently vice chair and chair of international.

-

The programme’s total limit this year is down $594mn to $1.36bn.

-

The broker noted a “significant variation” in renewal outcomes.

-

The deal, revealed by this publication in December, values the firm at $14bn.

-

Niala Butt joins from CNA Hardy, where she was casualty claims manager.

-

The measure could have landed insurers with extra tax on US business.

-

The aerospace, energy and marine markets all sustained multiple significant losses in H1.

-

The deal puts an equity value of £275mn on the broking firm.

-

The ruling comes as insurers face growing legal pressures following the January blazes.

-

There are now 14 new companies writing homeowners’ policies in the state.

-

The broker built out Lockton Re’s US casualty and professional lines treaty book.

-

Andrew Pryde succeeds Andreas Kull, who will stay on until September.

-

There has been an uptick in UK retail firms buying cyber after a string of attacks.

-

Green hushing is on the rise as Trump rows back on climate initiatives.

-

Is the ransomware threat really getting worse – or just more visible?

-

Property rates are coming under further pressure, while liability is being buoyed by ongoing challenging loss trends.

-

Shuker was CEO of A-Plan when Howden acquired the firm in 2021.

-

The event was co-hosted by The Fidelis Partnership and IDA Ireland.

-

The awards will be held on 3 September at The Brewery in London.

-

There is a growing disconnect between risk and pricing in the class.

-

Last month, Combarro announced his exit on LinkedIn after 17 years at Lockton.

-

Insight into the state of the insurance M&A market, powered by this publication's deal database.

-

The new unit – Ceded Re – will operate under the leadership of Guy Van Hecke.

-

The Atrium-led cover renews after the multi-billion-dollar High Court ruling.

-

The carrier is expanding its appetite for sustainable construction of large commercial buildings.

-

Goldman will join Ascot next month to take on the newly created role.

-

In North America, the median W&I claim payment in 2024 was $5.5mn, the highest on record.

-

David Turner previously spent more than 30 years at Amlin.

-

Errors and omissions claims made up 55% of all notifications, continuing a five-year trend.

-

MillerBoost is the latest broker facility to launch in London.

-

Although US pricing is improving there is pressure in other geographies.

-

The cost comes in at $530.6bn, roughly $20mn lower than budgeted.

-

Sources said NY-based Lee Equity is seeking to extend its investment in the TPA heavyweight.

-

CFO Jane Pool will also leave the company as Aviva takes over.

-

The underwriter has worked for RiverStone, Advent, Lloyd’s and AIG.

-

The platform will capture and standardise data from all submissions, the broker said.

-

The firm believes UK support for policyholders is under-served compared with the US.

-

SRCC exposures are being studied more closely but fixing aggregation issues is a challenge.

-

R&Q Gamma’s outstanding liabilities predominantly relate to the UK P&I Club.

-

Air India has a multi-year insurance arrangement in place.

-

Plus, the latest people moves and all the top news of the week.

-

This publication revealed his exit from MS Re last month.

-

-

The appointments are pending regulatory approval.

-

The carrier’s president Andrew McMellin is aiming to double London market share in the next five years.

-

The carrier said the cuts will help it to become a “simpler, digital-led business”.

-

The executive previously spent 15 years in a variety of roles at Zurich.

-

Allstate attributed the bulk of its losses to three major wind and hail events.

-

Jim Williamson said litigation funding had evolved into an investment class.

-

There has been significant talent displacement in the specialty reinsurance market.

-

The Beazley CUO said geopolitics would determine cyber market pricing.

-

Miller recently strengthened its reinsurance proposition with the acquisition of AHJ.

-

Henk Bijl joins from Aon, where he has worked for the last 25 years.

-

The investment comes amid expectations of a new cycle of deals.

-

The carrier is launching a dedicated auto-follow unit within its DA practice.

-

Coverage has broadened while limits have increased, the broker said.

-

The company has also promoted Alex Baker and Tim Duffin.

-

Western insurers do not insure Iranian risks, with the country subject to sanctions.

-

The start-up has hired four people to join the division.

-

The £3.7bn deal was announced in December.

-

This is up from last year’s $1bn protection for its Florida treaty.

-

Some segments are moving faster than anticipated, but overall, it remains a mixed bag.

-

Holschneider co-founded the firm and is currently executive chairman.

-

The executive was formerly the head of cyber solutions, North America.

-

The reinsurance division booked 29% growth for the fiscal year to 30 April 2025.

-

The Lloyd’s business secured a $90mn investment from Alchemy in 2021.

-

There is the prospect of fragmented appeals and uncertainties around reinsurance recoveries.

-

The broking CEO was honoured for services to the insurance industry.

-

The managing agent for Syndicate 609 has been involved in an M&A process this year.

-

Peter Montanaro retired from his role as market oversight director at Lloyd’s in May.

-

Nick Line has spent 28 years at Markel, where he has been CUO since 2018.

-

Phil Furlong has been made head of underwriting and oversight, a newly created role.

-

CEO Caroline Wagstaff called for a “tailored and proportionate” approach to regulation.

-

The executive brings nearly 30 years of liability experience to the role.

-

The pair is looking to provide investment and strategic advice to early-stage firms.

-

Logue replaces Richard Barke, who is moving to a senior leadership role at Asta owner Davies.

-

Sources told this publication the hull of the aircraft is valued at $80mn.

-

Rachel Bardon will also join the board of Compre's Bermuda-based reinsurer Pallas Re.

-

Neil Nimmo was CEO and chairman at Lockton International for more than 16 years.

-

The protection gap is calling into question the relevance of the insurance industry.

-

In April, the loss modeller pegged losses at A$2.57bn.

-

Brokers across London and Bermuda have handed in their notice to join the start-up reinsurance broker.

-

Howden recently expanded in South America with the takeover of Contacto and Innova Re.

-

The carrier said it is disappointed with the English High Court’s decision.

-

The former Volante chief is in initial talks with several parties.

-

The UK High Court has ruled in favour of lessors in the multi-billion-dollar dispute.

-

The deal marks SFMI’s third investment in the group since 2019.

-

Who will buy the swathe of PE-backed Lloyd’s firms coming to market over 2025-26?

-

The documents figure in a potential criminal case against a CCB employee.

-

The Bermuda-based team is led by John Fletcher.

-

The trend is expected to be most pronounced in the Middle East, the survey found.

-

The broker is targeting run-rate synergies of $150mn by the end of 2028.

-

The appointment follows B&B’s acquisition of Accession.

-

The deal multiple is understood to be around 15x adjusted Ebitda.

-

The executive’s career includes a stint as head of cat for CorSo.

-

The association said privacy should be a key consideration in new requirements.

-

The LMA urges use of AI for enhanced decision making but concerns remain.

-

The investor reported a total shareholder return of £101.2mn for 2024.

-

Case added that recently acquired broker NFP has “exceeded” expectations.

-

The broker is launching a reinsurance arm in partnership with Bain Capital.

-

The reinsurer has also appointed Mehdi Benleulmi as global head of credit.

-

Tovah Grosscurth replaces Sonya Bryson, who has left the commercial lines business.

-

Future claims handlers could be "bionic adjusters” empowered by technology.

-

The London market is not expected to shoulder the bulk of the eventual loss.

-

She replaces Matthew Sheppard, who has become deputy CUO in London.

-

The man is alleged to have conspired with others to falsify LOCs and collateral letters.

-

Plus, the latest people moves and all the top news of the week.

-

The loss has decreased by 0.3% since the company’s third assessment.

-

The new Lloyd’s chief of market performance also outlined target growth areas.

-

The merger is on track to close in H2 2025, CEO Pat Gallagher said.

-

The number has expanded by around 40% from an earlier update, sources said.

-

Saul Nagus is the latest from Marsh’s aviation unit to join WTW.

-

The modeller said the insurance market could be exposed to unexpected aggregations.

-

The latest update brings the agency’s combined estimate for Milton and Helene to $32.4bn.

-

The increased tariff on China trade could drive up the loss quantum on the SharkNinja recall and others.

-

Jim Meakins is the latest in a slew of talent to exit from the syndicate.

-

Robert Vetch joined the Lloyd’s business as CFO in 2019.

-

BP Marsh has subscribed for a 49% shareholding in the start-up MGA.

-

The PE firm’s Aaron Cohen said full integration of broking assets is crucial.

-

Ed Short was previously VP, digital partners, at Arch.

-

Corporates buying Lloyd’s syndicates face the culture/integration trade-off.

-

Eric Seyfried and Glen Manjos are also departing Axis’ cyber and tech unit.

-

The MGA has built out a suite of products, including a planned launch into political violence.

-

The broker has been building out its Bermuda reinsurance presence.

-

William Soares moves from casualty and specialty CUO to president.

-

The campaign will run throughout June.

-

Analysts were interested in the potential for fee income from the retail division.

-

HCI secured three towers with $3.5bn in XoL coverage.

-

Muñoz was also Aon Re chairman for the Latin American region.

-

The purchase aims to bolster Markel’s marine product line in the Asia-Pacific region and EU.

-

David Baldwin joins from EIRS where he was a senior reinsurance consultant.

-

The executive will remain CEO of reinsurance until 1 September.

-

Chris Jones told this publication his plans for the first six months of his tenure.

-

Tiernan’s former role of chief of markets will be split into two new exec team positions.

-

Jack Kenneally will take on the role of class underwriter at the MGA.

-

This year is predicted to be an above-average season, like 2024.

-

The executive set out his vision for the Corporation after assuming leadership.

-

The $2.59bn renewal is up 45% from last year.

-

Up to nine million acres of US land are considered likely to burn.

-

The outgoing CEO said the market had been restored as a leader during his tenure.

-

The reinsurer confirmed Andrew Phelan’s exit, as of 15 May.

-

Frustration is growing around a promised independent operating model and staff reward.

-

Lee Mooney will replace Neil Galjaard, subject to regulatory approval.

-

The Floridian also secured $352mn of multi-year coverage extending to 2027.

-

Last week, TSR updated its forecast and is now predicting above-average storm activity.

-

The total cost excluding a 15% quota share was $201.85mn, with rates down 12.2% from last year.

-

Plus, the latest people moves and all the top news of the week.

-

Most of the losses are attributable to a supercell storm in Texas.

-

Eckert said the reinsurance market is still at historically well priced levels.

-

The executive replaces Mike Warwicker, who left the firm earlier this year.

-

A 20% increase in FHCF retention levels sent cedants to the private market.

-

Lloyd’s maverick syndicate produces impressive results, but questions remain over succession.

-

The investment vehicle will publish its full results on 2 June.

-

-

Bredahl has been appointed CEO and Bonneau as chairman.

-

The changes are aimed at improving underwriting and operational performance.

-

The dropped process is JC Flowers’ second attempt to sell the international broker.

-

Starr and Axon also are among those exposed to the Marsh USA-placed $40mn line.

-

The Corporation is poised to accelerate its investments in start-ups.

-

The Peak Re subsidiary mainly writes US motor and casualty reinsurance.

-

Burford’s CEO said Chubb is inappropriately using its corporate power.

-

There have been several personnel moves in the fast-growing tax insurance space recently.

-

Kestrel stock will begin trading on Nasdaq tomorrow under the symbol KG.

-

Politically related exposures are growing for the marine market.

-

LA wildfire losses are impacting the 2024 years of account, Argenta noted.

-

He will also invest in the company.

-

Markel is prominent in the growing smart-follow market.

-

Philip Enan joins following 11 years at Chubb.

-

Almost 50,000 people have been forced to evacuate.

-

Insight into the state of the insurance M&A market, powered by this publication's deal database.

-

The change reflects the company’s growing profile within the MS&AD group.

-

It previously predicted activity slightly below the 1995-2024 average.

-

New capacity is fuelling competition for talent in the class of business.

-

The executive will also continue as MD overseeing Caribbean fac.

-

SCS can no longer be considered a "secondary" peril for the US insurance market, Steve Bowen said.

-

Plus, the latest people moves and all the top news of the week.

-

Trade credit rivals Coface and Awbury are also entering the market.

-

The agency forecasts up to five major hurricanes and 19 named storms.

-

Last week Neo Combarro, Lockton’s head of TL announced his exit on LinkedIn.

-

Spicer will transition to a global specialty executive chairman role.

-

The majority of the savings are expected to be realised in the retail division.

-

She will continue to work with the executive team on key projects and initiatives.

-

The broker called on carriers to expand coverage into new specialisms.

-

In January, 32 Acquinex employees resigned, with 22 moving to Howden’s underwriting arm.

-

The aircraft lessor has booked $654mn in settlements from insurers over the past year.

-

New entrants to the line of business have heightened competition for talent.

-

The carrier’s combined ratio improved by 0.7 points YoY to 91.1%.

-

Two large storms hit the Midwest and Ohio Valley regions on 14-17 May and 18-20 May.

-

The Lord Mayor told the CRO Summit to stop treating risk as a dirty word.

-

The group reported an 89.7% combined ratio for the quarter.

-

Willis has made a series of aviation hires on both sides of the Atlantic in recent weeks.

-

The executive will take the global role alongside his existing US responsibilities.

-

M&S, which still faces disruption from the attacks, had coverage lead by Allianz.

-

The underwriter joined Catlin in 2006.

-

Markel International has also hired senior underwriter Keely Madden.

-

Chris Jones is the latest in a series of talent moves in the construction line.

-

The underwriter has held positions at The Hanover, Liberty Mutual and Zurich.

-

Broker facilities and increased US domestic appetite are accelerating the softening.

-

Vincent Hermenier joined Hannover Re in 2004.

-

The hire is the latest in the newly formed carrier’s buildout.

-

As with 2024, pricing pressure has been most acute on top layers.

-

The reinsurer reported EUR2.1bn GWP for the year.

-

The executive will be global reinsurance CEO and climate solutions chair.

-

The Japanese carrier noted the impact of increasing natural disasters.

-

Holmes, Froideval and Cheak will head up the units for London, Europe and Asia.

-

The company’s parent MS&AD reported group profit of 691bn yen for the year.

-

The carrier benefited from top-line growth and lower adverse PYD.

-

P&C combined ratios were higher than Q1 2024, and wildfires impacted Hannover Re most.

-

The syndicate-in-a-box is the first Lloyd’s syndicate to operate outside London.

-

Tornadoes have killed at least 32 people in three states.

-

The targeted uplift comes after Mercury ceded nearly $1.3bn of wildfire losses to reinsurers in Q1.

-

The broker replaces Louise Nevill, who is joining Axa XL as CUO for specialty.

-

The CEO transition is already visible in messaging on growth as rate change picks up.

-

Greg Branagan joined Mosaic in 2023 as AVP, tax underwriter, within TL.

-

Andrew Kane has spent eight years at QBE.

-

The reinsurer’s CFO cited a 1.5% net price reduction year to date.

-

Delegates welcomed the FCA’s red-tape cut, but said more is yet to come.

-

Lloyd’s CUO said established broker facilities were “big enough”.

-

Large natural catastrophe losses totalled $570mn in Q1, driven by the LA wildfires.

-

Sources said MarshBerry was retained earlier this year to run the sale.

-

Are intermediaries facing tougher times as the broking supercycle winds down?

-

Michael Brooks, SVP, head of transactional liability, will be taking over temporarily.

-

The programme will succeed the previous buyback launched in 2023.

-

The platform could help reduce claims-cash holding times by 10 weeks.

-

The CUO noted that market-wide rate change in Q1 was down 3.3%, coming in below plan.

-

The company has settled, or is in the settlement stage, for 80% of the exposure.

-

The executive has spent 10 years in a range of roles at the Corporation.

-

Competition is high in specialty reinsurance as new capacity enters the market.

-

Specialty reinsurance has experienced high competition for talent.

-

The carrier’s overall P&C combined ratio improved 0.1 points to 91.8%.

-

The undiscounted combined operating ratio worsened slightly to 96.6%.

-

The Bermudian's first quarter cat losses totalled $333.3mn, compared to $103mn a year ago.

-

The revision is significantly lower than the $4.5bn October estimate.

-

Their next destination remains unknown.

-

The exec will lead key initiatives including Aon United, and work closely with NFP.

-

The new CEO said recent purchases were designed to protect earnings volatility.

-

Sources suggested that the multiple could be as low as the 13x range as valuations reset.

-

Insurance Insider revealed earlier this week that the underwriter had resigned from Allianz.

-

The consultation is a “welcome change of approach” from the regulator.