-

The Indian state-backed reinsurer has taken action to improve underwriting performance.

-

The intermediary also warned that inflation headwinds could affect the future cost of claims.

-

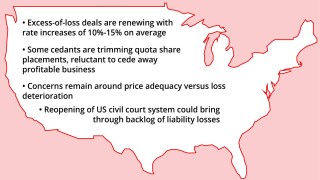

Reinsurers are clamouring for proportional business, while maintaining excess-of-loss rate rises at 1 January levels.

-

Double-digit rate rises are still expected in the class, but not at the same scale as seen in 2020.

-

The start-up carrier still plans to write more excess-of-loss business overall.

-

Pockets of the distressed Florida market are still expected to face a challenging renewal, but much of the remediation was carried out last year.

-

Rate increases are tailing off, but the carriers’ reports reveal divergent growth strategies.

-

Hiscox’s London market rate rises decelerated from 20% in 2020 to 13% in Q1.

-

Sources said pandemic rate inflation and increases in exposure could lead to rates tapering off after years of increases.

-

Underwriters voiced a cautious optimism about the outlook for 2020, but warned that the class was moving from a low point.

-

The French carrier grew its top line by 14.3% at the April renewals.

-

The broker’s latest report points to big opportunities in cyber re and retro.