-

This was the second issuance completed by Farmers via its Bermuda reinsurance vehicle Topanga Re.

-

The facility provides solvency support via a fresh equity injection under various scenarios.

-

The finance committee discussed shifting market dynamics as tort reform takes effect.

-

PoleStar Re Ltd 2026-1 includes three sub-layers, which run for a three-year term.

-

The CEO conceded some might see Swiss Re’s dividend targets for 2026 as “underwhelming”.

-

The Japanese P&C carrier agreed a deal to buy 15% of WR Berkley shares in March.

-

Fontana 2.0 will encompass a more flexible investment strategy than the 2022 vehicle.

-

The carrier is looking to latch onto emerging economic trends where it can add expertise.

-

The business is pursuing growth in Bermuda in captives, cyber ILS and alternative risks.

-

CFO Vogt added that the vehicle’s impact from earned premiums should ramp up from 2026 through 2029.

-

The sidecar was launched today by the Bermudian reinsurer and investment firm Carlyle.

-

The capital will provide retro cover for life-focused reinsurer Fortitude Re.

-

Improved performance and growing investment returns played a role in the upgrade.

-

The Bermuda reinsurer has been active in ILS since launching in 2007.

-

The ILS manager has $6.8bn in assets and will be led by MariaGiovanna Guatteri.

-

The measures also seek to encourage greater wildfire mitigation efforts.

-

The sidecar will support five programs providing specialty frequency coverages.

-

The syndicate is targeting capital allocation for 1 January, the company confirmed.

-

Cat bonds have outperformed private ILS strategies in the YTD, according to ILS Advisers.

-

Sources said that the carrier has held preliminary talks with private debt investors.

-

The private ILS segment took losses from LA wildfires and Mid-West severe convective storms in H1 2025.

-

Fleming’s attempt follows those of other legacy carriers that have had recent successes raising capital.

-

Hannover Re Capital Partners is in talks with two investors for 1 January launch.

-

Ryan Alternative Capital Re was launched in partnership with Axis Capital.

-

The Japanese carrier has agreed to buy Aspen for a realization of $3.5bn.

-

The ILS play will make the business more capital efficient under new owner Sixth Street.

-

The lawsuit is the latest development in the multi-billion dollar reinsurance scandal.

-

Cat portfolios generally grew, but casualty approaches varied.

-

The vehicle will support Ascot’s casualty business in the US and Bermuda.

-

The broker has nearly 20 years of experience in the reinsurance and retro markets.

-

The PRA will also have to report on turnaround time for new approvals against 10-day and six-week targets.

-

How is The Fidelis Partnership choosing to launch into new insurance classes as it rapidly expands?

-

The man is alleged to have conspired with others to falsify LOCs and collateral letters.

-

The latest update brings the agency’s combined estimate for Milton and Helene to $32.4bn.

-

The programme will succeed the previous buyback launched in 2023.

-

Gallagher Re said rates had softened in 2025 versus the prior two years.

-

Sentiment at the ILS Connect event hosted by Insurance Insider ILS was generally positive.

-

We assess the Bermudian’s standing amid waning investor sentiment and economic uncertainty.

-

The state insurer of last resort is set to purchase $2.89bn of reinsurance this year.

-

Its 2025 programme exhausts at $9.5bn excess $1bn.

-

The firm acted as the front for Trouvaille Re, the E&S property sidecar for MGA AmRisc.

-

Being the “new kid” has created interest in the market, Mereo CEO Croom-Johnson added.

-

The industry loss data provider also increased its estimate for Hurricane Helene to $15.3bn.

-

The broker has also hired fellow Aon broker Barry Gordon in a role trading ILWs.

-

The business will still look at large non-life deals in particular in-the-money ADCs.

-

The investment recovery will be welcome but Chinese tariffs will contribute to loss-cost inflation.

-

European reinsurers, London market carriers and composites all enjoyed healthy trading.

-

Erik Manning is joining the business from BMS as head of ceded reinsurance.

-

The announcement spurred a quick spike in stock market valuations.

-

Trade credit and marine are among the lines facing direct impacts amid a broader inflationary challenge.

-

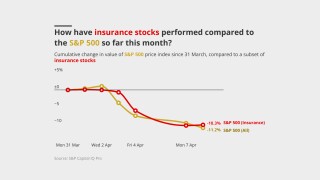

Swiss Re and Talanx led the gains among listed European carriers.

-

The asset manager has hired Rom Aviv as head of ILS.

-

Markets have taken a battering across the globe following the “Liberation Day” announcement.

-

Elizabeth Wooliston said the immediate concern would be managing ‘value at risk’.

-

Trouvaille II raised $580mn for 2025, compared to $325mn in 2024.

-

Insurance share prices were resilient amid today’s market meltdown.

-

Total reinsurer capital grew by $45bn in 2024 to $715bn.

-

Recent transactions on the platform include cat bonds from Flood Re and Brit.

-

The firm also promoted Devin Inskeep to an expanded role as SVP, head of ratings and advisory.

-

This year’s coverage will involve $2.94bn of new risk transfer.

-

Some $4.8bn of reinsurance and cat bond limit will come up for renewal in 2025.

-

The role will focus on international treaty, specialty lines and strategic advisory.

-

Jana holds around 109,000 shares and 69,000 call options, at a $307mn total value.

-

Bolding will focus on aligning Gallagher Securities with Gallagher Re.

-

The carrier’s Eaton Fire loss would be a retained net loss hit.

-

Somers Re is valued at ~$1.3bn, according to disclosures made in Arch’s Q3 2024 SEC filings.

-

Theo Norris joins from Gallagher Re, which brokered one of the first 144A cyber cat bonds.

-

The company’s stock price has plummeted in the wake of the LA wildfires.

-

The state insurer is budgeting for an extra 43% of overall coverage in 2025-26.

-

The 2025 target would be ~25% larger than the $3.56bn it placed for 2024.

-

Fema's traditional reinsurance programme will attach at losses of $7bn and above.

-

CEO Adrian Cox said Beazley’s recent $290mn ILW purchase was not driven by “capital flexibility in and of itself”.

-

The reinsurer is planning to drop its cession rate from 40% to 30%-35%.

-

The firm has helped underwriting businesses secure $3.5bn in capital.

-

The loss tally is considerably lower than estimates issued by model vendors.

-

In line with Milton’s moderate forecast loss, the ILS market reaction will be less influential in post-event dynamics.

-

The raise includes minority investments from Nationwide, Enstar and others.

-

Changes to the categorisation and oversight of managing agents seek to reduce duplication and thereby cut costs.

-

Cat bond funds have been attracting inflows while confidence is patchier across collateralised re.

-

The company increased its full year 2024 adjusted net income guidance.

-

The proposals include increasing either statutory or CRTF funds.

-

Aspen said reduced reinsurance appetite made it a good time to seek alternative capacity.

-

A hard cat market in 2023 means cedants must consider the alternatives.

-

-

A more consistent trading rhythm returned to the property market, with capacity deployment outside of frequency-exposed layers and more heavily loss-impacted segments bouncing back.

-

The lawsuit, filed Thursday on behalf of Clear Blue and its subsidiaries, alleges that Aon conducted insufficient due diligence on the ILS InsurTech.

-

The Bermudian firm said it expects the acquisition could drive more growth than the prior forecast of $2.7bn incremental premium.

-

The lopsidedness of the ILS recovery means more confidence around prolonged hard market rates but also raises the bar on competing for third-party capital.

-

The sidecar has been launched alongside partner Stone Point Credit Adviser.

-

The APRA intends to review reinsurance settings in the Australian prudential framework over the course of 2023 and the first half of 2024.

-

The company’s targeted Vescor cat bond would have provided collateral to meet auto and other obligations, but there were multiple structural points of risk for investors.

-

The firm’s statement followed allegations in Israeli tech media of missing collateral linked to deals it was concerned in.

-

In a discussion at Trading Risk’s London ILS 2023 conference, panellists compared the current cyber ILS market to the cat market in the 1990s.

-

Hard-market conditions have been beneficial but more improvements are needed, the panel said.

-

At Trading Risk’s London ILS 2023 conference, the PRA’s head of division for London markets, Andrew Dyer, explained how the PRA is executing its plans to bolster the UK ILS market.

-

Structures have been developed that would avoid “excessive capital trapping”.

-

The company will use the funds to expand its global presence, enhance its marketplace platform and widen its offering.

-

How much capacity is available to meet rising cat reinsurance demands was a key theme throughout this year’s Rendez-Vous.

-

Gupta moves from Axis Capital where he served for four years in the New York team.

-

There are still some hurdles preventing widespread ILS adoption of cyber risk, but momentum should increase.

-

The ratings agency said a high degree of uncertainty around ultimate exposure is likely to be long-lasting and will fuel rate strengthening in affected lines.

-

The first-of-its-kind deal blends bank financing with ILS funding.

-

Political violence and aviation coverages had been thrown into marine composites as the market softened.

-

Courts in Bermuda and the US approved the move, which had earlier been subject to investor litigation.

-

The reinsurer said it was anticipating increased volume for catastrophe bonds and collateralised reinsurance this year.

-

Cornell Fox joins as head of investor relations and business development, while Masa Kitade has been enlisted as head of business development for Asia.

-

Plus booming broker growth; GRP, Covea UK and James River sales; and all the top news of the week.

-

Many ILS firms opened 2022 with reduced assets under management, in a bearish signal for the mid-year renewals.

-

The team will not offer an ILS product but plans to invest in insurer capital-relief instruments as part of a new asset management play.

-

The former MS Amlin head of reinsurance takes up the CUO role next week.

-

Negotiations were dragged out by decisions being referred for sign-off at senior levels.

-

Reinsurers have held the line more strongly than last year but rising risks may offset gains.

-

CyberCube also forecast that fresh capital will start to flow into the cyber insurance market next year.

-

The interconnected challenges of performance and the collateralized structure make it tough to land a strategic pivot.

-

The carrier has ramped up fundraising activities this summer as it seeks to broaden its platform.

-

If you only read a handful of stories this week, make it the selection below.

-

The Canadian pension plan Ontario Teachers’ will support three Lloyd’s syndicates – CFC, Beazley and Beat – via its initial deal.

-

The Dutch firm had given the AIG-owned platform a mandate that could range from EUR500mn to EUR1bn, covering US cat reinsurance.

-

The new London Bridge framework is less useful to the bulk of specialist ILS asset managers than it is end investors.

-

The manager said last year it wanted to deploy $100mn to $200mn in casualty ILS

-

Discussions with industry and in-country partners have so far foregrounded parametric solutions.

-

Markel will provide approximately $150mn to facilitate the buyout of the retrocessional segregated accounts of the funds, as well as tail-risk cover to release $100mn of trapped collateral.

-

Ongoing high claims from risks such as winter storm, wildfire or convective storm are playing into the climate-change debate over whether and to what extent cat reinsurers are mispricing their business.

-

Carriers will not necessarily accept smaller returns in exchange for high ESG scoring vehicles and risks must be properly priced, according to Dirk Lohmann, chairman of Schroders Capital ILS.

-

Managers such as Schroders and Fermat capitalised on investors looking for liquid, remote-risk strategies to grow their asset base in H1.

-

The Canadian pension fund and the ILS fund provide Funds at Lloyd’s capital alongside traditional reinsurers.

-

A rampaging cat bond market should lead more cedants to consider its long-term advantages.

-

He worked for eight years at the French firm, where he oversaw the strategic direction of its ILS business.

-

With ILS and pension fund money now confirmed for Syndicate 1988, there are further observations for the vehicle launch.

-

Reinsurers from Bermuda, the Cayman Islands and Japan have also provided capital to the syndicate for its 1 July launch.

-

The ILS vehicle has support from four key providers and will be launched alongside a broader offering including K&R, fine art and other specialty risks.

-

The experience of the past few years has made cedants much more concerned about managing tail risk than they are credit risk.