-

According to the Civil Unrest Index, protest activity has soared over the past two years.

-

The reinsurer is offering pricing incentives to members to reintegrate cover.

-

IGI’s premium income has almost doubled since it listed in 2020, but how can growth still be achieved in a soft market?

-

Plus, the latest people moves and all the top news of the week.

-

The class offers affirmative coverage for gaps in traditional insurance policies.

-

West Hill Capital is the main investor in the capital raise.

-

Continental composite carriers aim to smooth volatility with new initiatives.

-

Plus, the latest people moves and all the top news of the week.

-

The toll of risk losses sustained by the PVT market this year is mounting.

-

Bazan Group’s refinery near Haifa was badly damaged by Iranian bombardment in June.

-

The start-up aims to bind its first risk in Q4 2025.

-

Plus, the latest people moves and all the top news of the week.

-

The underwriter has worked for RiverStone, Advent, Lloyd’s and AIG.

-

SRCC exposures are being studied more closely but fixing aggregation issues is a challenge.

-

Plus, the latest people moves and all the top news of the week.

-

The carrier’s president Andrew McMellin is aiming to double London market share in the next five years.

-

Western insurers do not insure Iranian risks, with the country subject to sanctions.

-

The new Lloyd’s chief of market performance also outlined target growth areas.

-

The modeller said the insurance market could be exposed to unexpected aggregations.

-

The product protects insureds outside of warzones from conflict-related cyberattacks.

-

A survey from the carrier looked at the political risk and violence concerns of companies.

-

Several insurers and MGAs have launched into the class of business over the past year.

-

Personnel movement has been high in the PVT class as new capacity enters the market.

-

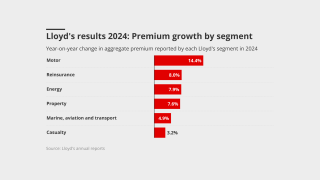

Reinsurance and property remained the primary drivers of premium growth.

-

The terrorism pool has shifted its programme from facultative to an XoL arrangement.

-

Probitas is set to grow by around 40% this year.

-

The political violence market is in a competitive stage thanks to an influx of capacity.

-

It is understood that supporters include Munich Re and Brit.

-

As 2024 draws to a close, we reflect on the events of the year for the London market.

-

Swiss Re has retreated from its “escalation clause” for the Middle East.

-

Jelle Ouwehand joined Arch from Marsh, where he was a senior terrorism, PV and war broker.

-

A significant amount of new capacity has flowed into the political violence and terror market in recent months.

-

Chris Cane and Jaime Hunwicks join from Talbot, Jonathan Bint from Chaucer and Molly Ashcroft from Axis.

-

The political violence market has seen a flurry of new entrants in recent months.

-

Contrary to expectations that US casualty would dominate the conversations, Milton took the spotlight.

-

Geopolitical conflict could expose the global economy to $14.5tn in losses.

-

Many insurers have cut back lines in Lebanon, although larger insured sums are at stake in Israel.

-

The business recently hired former Occam PVT underwriter Nicholas Stevens.

-

The underwriter has spent a decade at Chaucer.

-

PVT business has been attracting new capacity after recent rate increases.

-

Plus the latest people moves and all the top news of the week.

-

The PVT market has seen a recent spike in staff movements, as new capacity enters the space.

-

The peril is posing an increased risk of loss for the sector.

-

The carrier launched into the political violence market at the beginning of the year.

-

The short-tail buildout will feature lines including political violence and marine.

-

QBE has “effectively stopped writing new business” in response to its New Caledonia loss.

-

Police and civil authorities will likely pick up most costs.

-

New capacity and increased competition is bringing rating levels under pressure.

-

Riots erupted in the Pacific Island territory last month over electoral reforms.

-

Dominic Kirby’s departure follows that of PV head Henry Gillingham and casualty treaty head Stuart Dale.

-

The flurry of London market PVT hiring continues.

-

The PVT team will be part of a new crisis management unit under Luke Powis.

-

The underwriter has been with Westfield since November 2020.

-

The underwriting head has worked in the London market for 25 years.

-

The broker has also placed a new cyber facility.

-

Israel exposure has thrown inwards-outwards PV coverage mismatches to the fore again.

-

Both Schlesinger and Sandford will report to Matt Humphries, head of crisis management.

-

She joined the carrier as an underwriting assistant over 11 years ago.

-

Swiss Re is among reinsurers to have the right to limit coverage if conflict widened.

-

The broker said there was a ‘disparity’ in market response to war in the Middle East.

-

Environmental activism and terrorist activity are also set to rise.

-

Insured losses from civil unrest have risen over the last decade to total $7bn in 2020-23.

-

Competition among insurers is rising as new carriers enter the market.

-

Providing coverage will remain “very tricky” in the near term.

-

Talbot has lost a trio of PV underwriters to Ark in recent months.

-

Alexander Baker was a senior PV, war and terrorism underwriter at Axa XL.

-

Talbot is rebuilding its PV team after a December Ark and Chaucer raid.

-

Mosaic has also added CNA Hardy’s Emily Humphreys to its PV team as part of the deal.

-

Clayton will join the carrier’s global credit and political risks team, reporting to James Wilson, head of credit and political risks.

-

Key market participants hailed the narrowing of the gap between PV insurance and reinsurance, however said that more still needs to be done to fix the market.

-

Insurance competition remains vibrant in some of the segments that remain most exposed to persistent risks highlighted by the flagship World Economic Forum report.

-

The PV market is facing yet another battle with reinsurers as they continue to restrict coverage, tighten definitions and exclude geographies.

-

Highlighting regions where the demand for SRCC products is increasing, stakeholders can tailor offerings more effectively, the PCS said.

-

The carrier has hired Ed Atkin, Piers Harding and George Wallace from Talbot and Callum Bennett from Chaucer to run the new book.

-

Sources said that with heightened geopolitical risks, pricing is already "much higher" than at any point in the last five years.

-

The MGA was without backing since March 2023, after Markel and Chaucer pulled their PVT paper.

-

Woodhouse will be based in London and report to Ed Winter, director of terrorism.

-

The latest class of business entry forms part of the carrier’s ongoing international insurance expansion.

-

The political violence market failed to ‘look in the rearview mirror’ amid growing geopolitical tensions.

-

The contingency market is monitoring the war between Israel and Hamas for potential loss activity, as well as keeping track on whether it has wider global implications for events, sources told this publication.

-

Sources said the insurer will not be taking on any new business or renewals as the PV class continues to be threatened by potential losses.

-

A cancelled Bruno Mars concert in Tel Aviv is among the losses to hit the segment.

-

Political violence and risk underwriters have heavily cut back in the region, which remains an important source of premium for marine insurers.

-

Reinsurers are also determined to secure structural changes and payback from Italian, Slovenian and Turkish cedants at 1 January 2024.